The post BlackRock Enters the UNI Ecosystem: Are Whales Betting on a Major Uniswap Price Reversal? appeared first on Coinpedia Fintech News

The post BlackRock Enters the UNI Ecosystem: Are Whales Betting on a Major Uniswap Price Reversal? appeared first on Coinpedia Fintech News

The Uniswap price chart just printed a sharp 15% intraday rise, and this time it’s not just retail noise. Infact, Whale transaction counts have spiked aggressively and the timing is hard to ignore. UNI recently tapped $2.35, a level closely aligned with late-2020 support zones. Now, heavy capital is stepping in post BlackRock news.

Is the rise from UNI’s lowest point in years a Coincidence? Maybe or Maybe not. let’s look closer for a much clearer perspective.

Why Whales Are Moving & Buying in Sync in Uniswap crypto

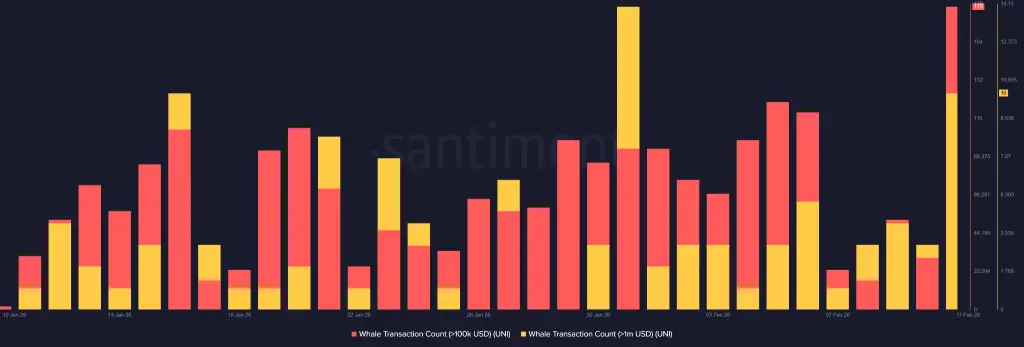

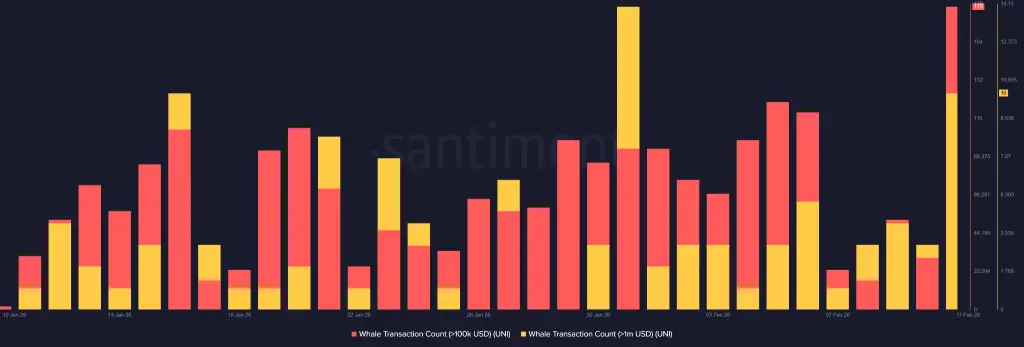

![]() Over the past 24 hours, based on Santiment onchain data, 10 addresses have executed transactions exceeding $1 million. At the same time, more than 175 addresses moved over $100K each, both are classified as whale transactions. That’s not random liquidity shuffling, infact that’s concentrated involvement.

Over the past 24 hours, based on Santiment onchain data, 10 addresses have executed transactions exceeding $1 million. At the same time, more than 175 addresses moved over $100K each, both are classified as whale transactions. That’s not random liquidity shuffling, infact that’s concentrated involvement.

Meanwhile, whale cohorts holding between 1,000 and 1 million UNI have increased their balances. In plain terms, larger players aren’t just trading the bounce they’re mass accumulating.

Meanwhile, whale cohorts holding between 1,000 and 1 million UNI have increased their balances. In plain terms, larger players aren’t just trading the bounce they’re mass accumulating.

On the Uniswap price chart, this activity coincides with price stabilizing near long-term structural support. And while broader market sentiment remains fragile, this sort of synchronized whale behavior tends to precede volatility one way or another.

On the Uniswap price chart, this activity coincides with price stabilizing near long-term structural support. And while broader market sentiment remains fragile, this sort of synchronized whale behavior tends to precede volatility one way or another.

Network Activity Rebound Supports Bullish View For Uniswap price

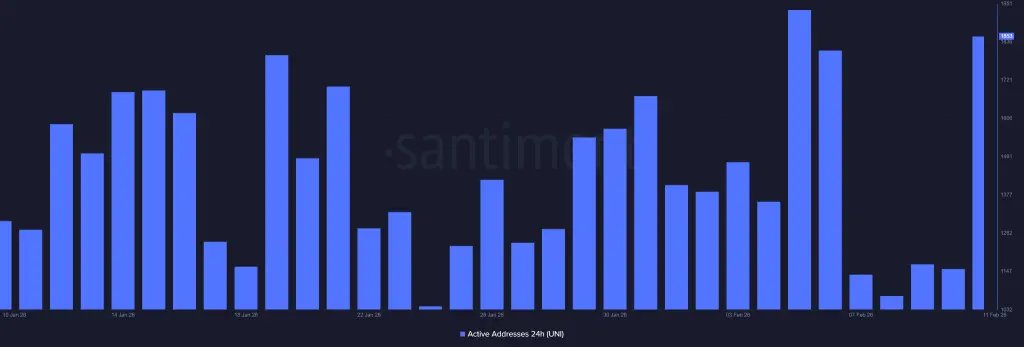

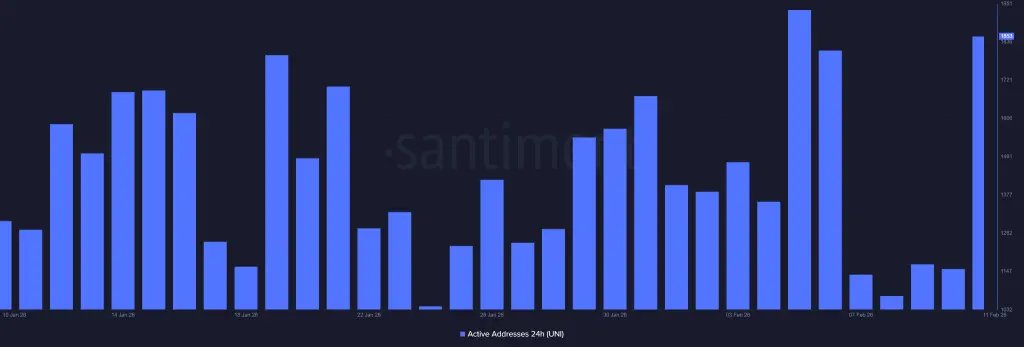

Now here’s where it gets interesting. Daily active addresses jumped to 1,853 from around 1,150 in prior days. That’s a material uptick in on-chain participation. Interest in Uniswap crypto isn’t just speculative but real users are interacting again and that’s the most positive thing happened.

At the same time, the 30-day MVRV ratio has improved. That metric essentially tracks whether recent buyers are underwater. With it recovering, traders from the past month are beginning to regain position strength. If momentum continues, short-term recovery pressure could build.

At the same time, the 30-day MVRV ratio has improved. That metric essentially tracks whether recent buyers are underwater. With it recovering, traders from the past month are beginning to regain position strength. If momentum continues, short-term recovery pressure could build.

Still, let’s be real. A bounce doesn’t automatically mean a trend shift.

Still, let’s be real. A bounce doesn’t automatically mean a trend shift.

BlackRock Catalyst

So why the sudden spark in what was otherwise a bearish atmosphere?

Uniswap Labs and Securitize announced a partnership with BlackRock to enhance DeFi liquidity for institutional investors via the USD Institutional Digital Liquidity Fund (BUIDL). The collaboration enables on-chain trading of BUIDL shares through UniswapX, an auction-driven protocol.

That headline alone was enough to jolt the UNI/USD pair higher.

Institutional bridges tend to shift perception fast. And perception, especially in crypto, often drives short-term price action harder than fundamentals.

UNI/USD Key Deciding Resistance Looms

Now comes the harder part, as the intraday spike loved by all and bullish speculation already jumped. But, the worries has not over yet, as immediate resistance range sits between $5.50 and $7.00

Clearing that band would suggest the Uniswap price is re-entering a broader bullish range. Failure to build above current momentum, however, could send UNUSD back into consolidation most likely under $4.00 again, until macro sentiment improves.

So, what’s next? For now, the Uniswap price analysis suggests that it is responding to whale accumulation, improving on-chain metrics, and an institutional headline. Whether this develops into a sustained move depends less on today’s spike and more on whether the broader market narrative decides to cooperate.

So, what’s next? For now, the Uniswap price analysis suggests that it is responding to whale accumulation, improving on-chain metrics, and an institutional headline. Whether this develops into a sustained move depends less on today’s spike and more on whether the broader market narrative decides to cooperate.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

BTC Spring Festival "Red Envelope Market," can it be recreated this year?

From 2015 to 2024, Bitcoin recorded positive returns during the Spring Festival for 10 consecutive years, with gains ranging from 0.8% to 19.5%. In 2025, the first decline occurred, with a drop of 4.8%. As the 2026 Spring Festival approaches, Bitcoin's price is around $67,000, and the market is watching to see whether the upward trend will continue or if there will be another decline.

PANews2m ago

The Triple Resonance at Bitcoin's Bottom: The Ultimate Direction of Macro, On-Chain, and Miner Economics

Author: FLAME LABS

Summary

This research report aims to comprehensively analyze the core question of the Bitcoin market in the first quarter of 2026: after experiencing a sharp retracement from the October 2025 all-time high (around $126,000) to the current range of approximately $60,000-$70,000, where exactly is the absolute bottom of this cycle? The current market is at a paradoxical crossroads: on one hand, the traditional "four-year halving cycle" theory suggests the market is still in a bear market relay, possibly requiring a cooling-off period of up to a year; on the other hand, the approval of spot ETFs, the Federal Reserve's shift in monetary policy (and the subsequent personnel changes bringing uncertainty), and the iteration of mining hardware are reshaping the underlying logic of the market.

This report abandons simple linear extrapolation and instead constructs a model that includes macro liquidity, miner survival costs (shutdown price), on-chain chips

PANews3m ago

Exodus reduced its holdings by 10 BTC and 11 ETH in January, while increasing its holdings by 1334 SOL.

Exodus Movement has updated its digital asset holdings as of January 31, 2026, holding 1,694 BTC and 1,887 ETH, down 10 and 11 respectively, and increasing its SOL holdings by 1,334 to 13,807.

GateNewsBot5m ago

10X Research: Bitcoin Retreats to Liquidity Trap Zone, Market May Reversal

10X Research CEO Markus Thielen stated that after the 2024 US election, Bitcoin could rapidly rise to $90,000, but then fall back to $87,000 due to a liquidity vacuum, facing negative options gamma at $75,000, which leads market makers to sell futures. The market situation could reverse at $60,000.

GateNewsBot12m ago

Tom Lee warns that gold may have peaked. Can Bitcoin become the next focus of capital?

February 12 News, Fundstrat co-founder Tom Lee recently stated that after a strong rally, gold prices are approaching a cyclical high, and the market may soon see a new round of capital rotation. He believes that if risk aversion cools and risk appetite increases, some capital may re-focus on Bitcoin, thereby reigniting the discussion of "which has more long-term value, gold or Bitcoin."

Looking back over the past year, the global financial environment has remained volatile, with geopolitical tensions and inflation pressures recurring, making gold the primary safe-haven choice. Data shows that gold has increased by as much as 73% this year, attracting significant institutional and retail investment. In contrast, Bitcoin has fallen about 29 during the same period, under pressure from regulatory uncertainties and profit-taking. This stark divergence has reshaped the global asset allocation landscape.

GateNewsBot14m ago

Bitcoin funds or a major migration? Barry Silbert predicts 5%-10% flowing into Zcash, as privacy coins face a revaluation window

On February 12, the founder of Digital Currency Group (DCG), Barry Silbert, stated at the Bitcoin Investor Week Conference in New York that in the next few years, approximately 5%–10% of Bitcoin funds may flow into privacy-focused crypto assets represented by Zcash. He believes that Bitcoin remains the core asset, but in terms of privacy and high growth potential, privacy coins may exhibit stronger "asymmetric return" characteristics.

Barry Silbert pointed out that as on-chain analysis tools become more sophisticated, the early narrative of Bitcoin as "anonymous cash" has been weakened, and transaction traceability has become a reality. He emphasized that unless there is a structural collapse of the dollar system, Bitcoin is unlikely to replicate the hundreds-fold growth potential, whereas projects focused on privacy protection and new encryption technologies could potentially offer 500x or even higher returns. He specifically mentioned Zcash and Bittensor, considering these assets more suitable for high-risk, high-reward strategic allocations.

GateNewsBot16m ago

The post BlackRock Enters the UNI Ecosystem: Are Whales Betting on a Major Uniswap Price Reversal? appeared first on Coinpedia Fintech News

The post BlackRock Enters the UNI Ecosystem: Are Whales Betting on a Major Uniswap Price Reversal? appeared first on Coinpedia Fintech News

Over the past 24 hours, based on Santiment onchain data, 10 addresses have executed transactions exceeding $1 million. At the same time, more than 175 addresses moved over $100K each, both are classified as whale transactions. That’s not random liquidity shuffling, infact that’s concentrated involvement.

Meanwhile, whale cohorts holding between 1,000 and 1 million UNI have increased their balances. In plain terms, larger players aren’t just trading the bounce they’re mass accumulating.

Meanwhile, whale cohorts holding between 1,000 and 1 million UNI have increased their balances. In plain terms, larger players aren’t just trading the bounce they’re mass accumulating. On the Uniswap price chart, this activity coincides with price stabilizing near long-term structural support. And while broader market sentiment remains fragile, this sort of synchronized whale behavior tends to precede volatility one way or another.

On the Uniswap price chart, this activity coincides with price stabilizing near long-term structural support. And while broader market sentiment remains fragile, this sort of synchronized whale behavior tends to precede volatility one way or another. At the same time, the 30-day MVRV ratio has improved. That metric essentially tracks whether recent buyers are underwater. With it recovering, traders from the past month are beginning to regain position strength. If momentum continues, short-term recovery pressure could build.

At the same time, the 30-day MVRV ratio has improved. That metric essentially tracks whether recent buyers are underwater. With it recovering, traders from the past month are beginning to regain position strength. If momentum continues, short-term recovery pressure could build. Still, let’s be real. A bounce doesn’t automatically mean a trend shift.

Still, let’s be real. A bounce doesn’t automatically mean a trend shift. So, what’s next? For now, the Uniswap price analysis suggests that it is responding to whale accumulation, improving on-chain metrics, and an institutional headline. Whether this develops into a sustained move depends less on today’s spike and more on whether the broader market narrative decides to cooperate.

So, what’s next? For now, the Uniswap price analysis suggests that it is responding to whale accumulation, improving on-chain metrics, and an institutional headline. Whether this develops into a sustained move depends less on today’s spike and more on whether the broader market narrative decides to cooperate.