Gate Daily (February 12): BlackRock announces purchase of UNI tokens; MicroStrategy to issue more perpetual preferred shares

Bitcoin (BTC) has once again weakened and declined, currently around $67,570 as of February 12. U.S. non-farm payrolls added 130,000 jobs in January, exceeding expectations, which suppressed expectations for rate cuts. BlackRock will purchase an undisclosed amount of Uniswap token UNI. MicroStrategy CEO stated that the company will issue more perpetual preferred shares to alleviate investor concerns over stock price volatility.

Macro Events & Crypto Highlights

-

According to the latest data from the U.S. Department of Labor, non-farm employment increased by 130,000 in January, well above the expected 66,000. The unemployment rate decreased from 4.4% in December 2025 to 4.3%. Strong non-farm payroll data prompted the market to readjust expectations for rate cuts. Due to a resilient labor market and inflation trends largely in line with expectations, investors reduced bets on rate cuts and bought bonds, pushing U.S. Treasury yields higher. The rise in U.S. Treasury yields is unfavorable for gold. The 10-year U.S. Treasury yield rose nearly 3 basis points to 4.168%.

-

According to Fortune, the world’s largest asset management firm BlackRock announced that it will list its tokenized U.S. Treasury-backed fund BUIDL on the decentralized exchange Uniswap. As part of the partnership, BlackRock will also purchase an undisclosed amount of Uniswap tokens UNI. The collaboration is facilitated by asset tokenization firm Securitize and will initially be open only to qualified institutional investors via a whitelist, requiring at least $5 million in assets.

-

According to Bloomberg, MicroStrategy CEO Phong Le stated in an interview that the company will issue more perpetual preferred shares to ease investor concerns over its stock’s sharp volatility. Le said the company offers a product called “Stretch,” a perpetual preferred stock providing investors with “digital capital exposure while avoiding volatility.” The dividend rate resets monthly, currently at 11.25%, aiming to keep its trading price near a $100 face value. So far, preferred shares constitute a small part of MicroStrategy’s financing. The company has sold about $370 million in common stock and $7 million in perpetual preferred shares to fund recent Bitcoin purchases over the past three weeks.

News Highlights

-

Elon Musk: X Money external beta to launch within 1-2 months

-

Cryptocurrency platform Paxful fined $4 million; US authorities say it profited from facilitating money transfers for criminals

-

CME-supported crypto lending platform BlockFills suspends withdrawals, says it is working to restore liquidity

-

Sonic Labs introduces “Vertical Integration Strategy,” abandoning traditional L1 subsidy models, building its own product matrix to empower S tokens

-

U.S. SEC Chair testifies on “relaxation of cryptocurrency regulation”

-

MicroStrategy CEO: The company will issue more perpetual preferred shares to ease investor concerns over stock volatility

-

Intercontinental Exchange launches Polymarket prediction market signals and sentiment data tools

-

Sui launches synthetic USD eSui Dollar in partnership with Ethena Labs

-

BlackRock will purchase an undisclosed amount of Uniswap token UNI

Market Overview

-

Latest Bitcoin news: BTC again weak and falling, currently around $67,570, with $194 million in liquidation over the past 24 hours, mostly long positions;

-

U.S. stock market on February 11 was volatile. It surged early on due to January non-farm payrolls beating expectations but later retreated amid expectations of delayed rate cuts and AI concerns. The S&P 500 and Nasdaq closed lower, while chip stocks showed resilience, with the Philadelphia Semiconductor Index rising 2.3%, leading gains. The Dow Jones Industrial fell 66.74 points, or 0.1%, to 50,121.40, ending a three-day winning streak. The S&P 500 dipped 0.34 points to close at 6,941.47. The Nasdaq Composite declined 36.01 points, or 0.2%, to 23,066.47.

(Source: Gate)

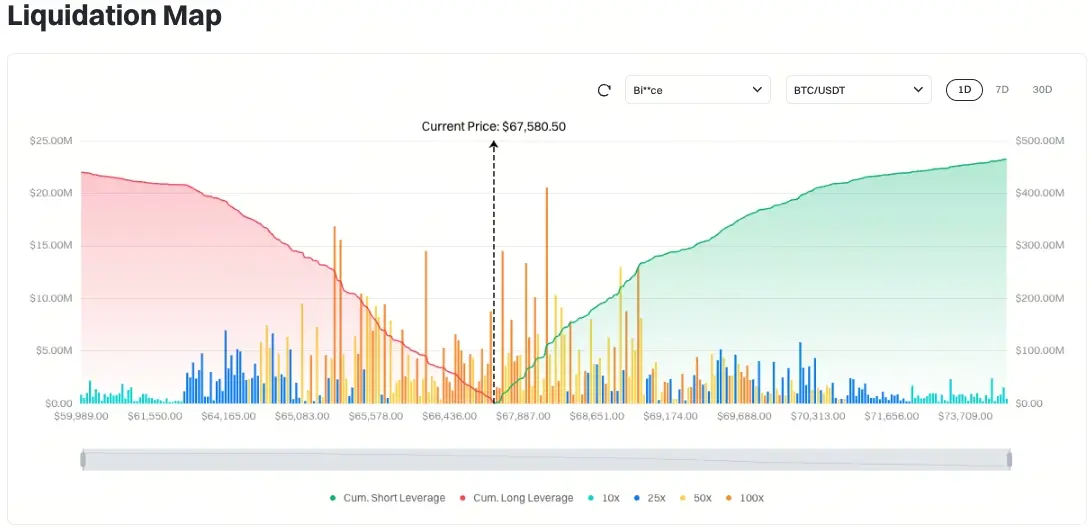

- According to Gate’s BTC/USDT liquidation map, with current price at $67,580.50, if the price drops to around $65,316, total long liquidation exceeds $251 million; if it rises to around $68,301, total short liquidation exceeds $109 million. Short liquidations are significantly lower than longs; traders should control leverage wisely to avoid large-scale liquidations during market swings.

(Source: Coinglass)

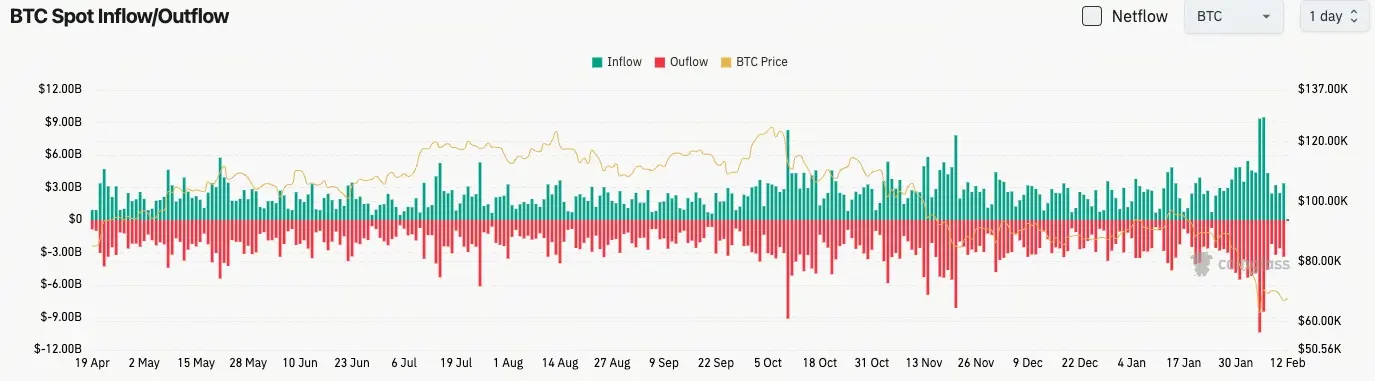

- In the past 24 hours, BTC spot inflow was $3.38 billion, outflow $3.39 billion, net outflow $0.1 billion.

(Source: Coinglass)

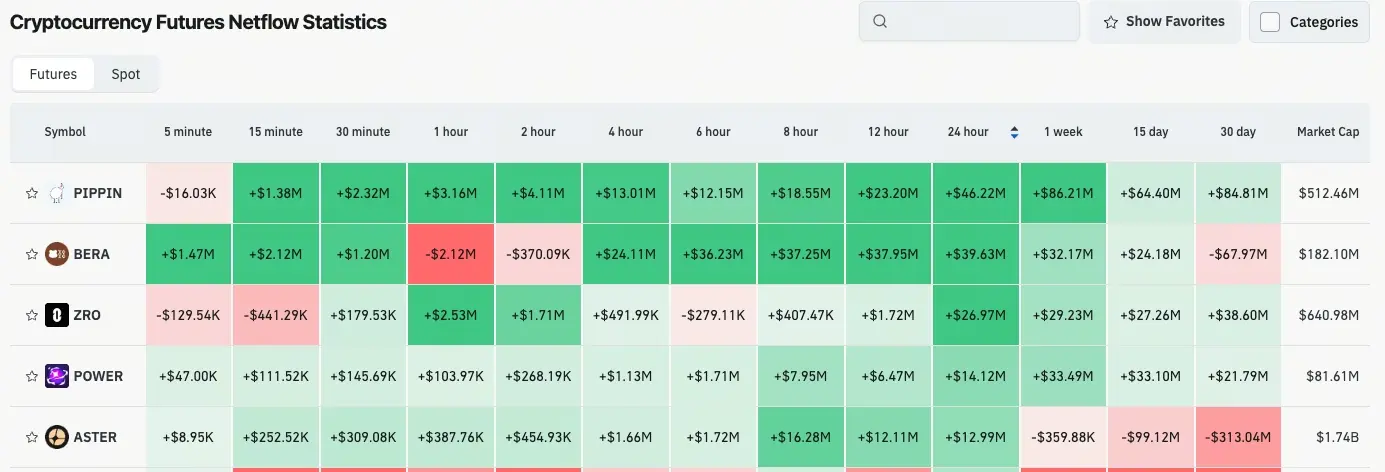

- In the past 24 hours, net outflows led by contracts such as $PIPPIN, $BERA, $ZRO, $POWER, $ASTER, indicating trading opportunities.

X KOL Selected Opinions

Phyrex Ni (@Phyrex_Ni): “Today’s market is also hard to analyze. The current market is polarized. Looking at the January non-farm payroll data, the economy is performing better than expected, which reduces the likelihood of the Fed cutting rates quickly, but also shows the resilience of the U.S. economy. It also distances the U.S. further from recession, but stocks are still showing signs of tug-of-war, probably because some investors believe rate cuts are far off.”

“From my personal perspective, the relationship between rate cuts and data isn’t very strong now. We’ve discussed this many times: since Trump asked Powell to take office, the main goal has been rate cuts. Good economic data justifies rate cuts; bad data also justifies rate cuts; falling inflation should lead to rate cuts; rising inflation, well, cut rates first and then see. That was Trump’s most direct demand.”

“So, how the Fed will speak and act after June is more important, and before that, the influence should be limited. So we see some slight fluctuations in the stock market, oscillating between gains and losses. Crypto is suffering. Bitcoin dropped below $66,000 again.”

“Looking at Bitcoin data, we’ve discussed a lot today. Although ETFs are showing buying, and both high-net-worth and retail investors are buying, the price of BTC is still falling, mainly due to sentiment and liquidity. It feels like the bear market is really coming. Dispersed buying can’t offset concentrated selling; in fact, data shows selling isn’t that heavy.”

“But most buying seems passive. For example, I myself have been accumulating around $60,000, not buying spot now. So, although I provide some weak buying power, it mainly slows down the decline rather than contributing to price increases. That might be why the data looks good, but the price still isn’t favorable.”

Today’s Outlook

-

China January M2 money supply (annual rate), previous 8.5%

-

UK Q4 GDP preliminary estimate (annual rate), previous 1.3%

-

UK Q4 GDP preliminary estimate (quarterly rate), previous 0.1%

-

UK December industrial output (annual rate), previous 2.3%

-

UK December goods trade balance (million GBP), previous -23,711

-

US weekly initial jobless claims (thousands) as of 0207, previous 231

-

US January existing home sales (annualized monthly rate), previous 5.1%

Related Articles

Asset management giant enters DeFi! BlackRock partners with Uniswap to enable BUIDL on-chain trading, UNI surges 20% on news

BlackRock Launches $180B BUIDL Token, Buys UNI in DeFi Push

BlackRock’s BUIDL Lands on Uniswap: A $2.2B Bridge Between TradFi and DeFi Sends UNI Soaring 25%

BlackRock Enters the UNI Ecosystem: Are Whales Betting on a Major Uniswap Price Reversal? - BTC Hunts

BlackRock Just Made Its Move on Uniswap (UNI) – This Could Change the Setup Fast