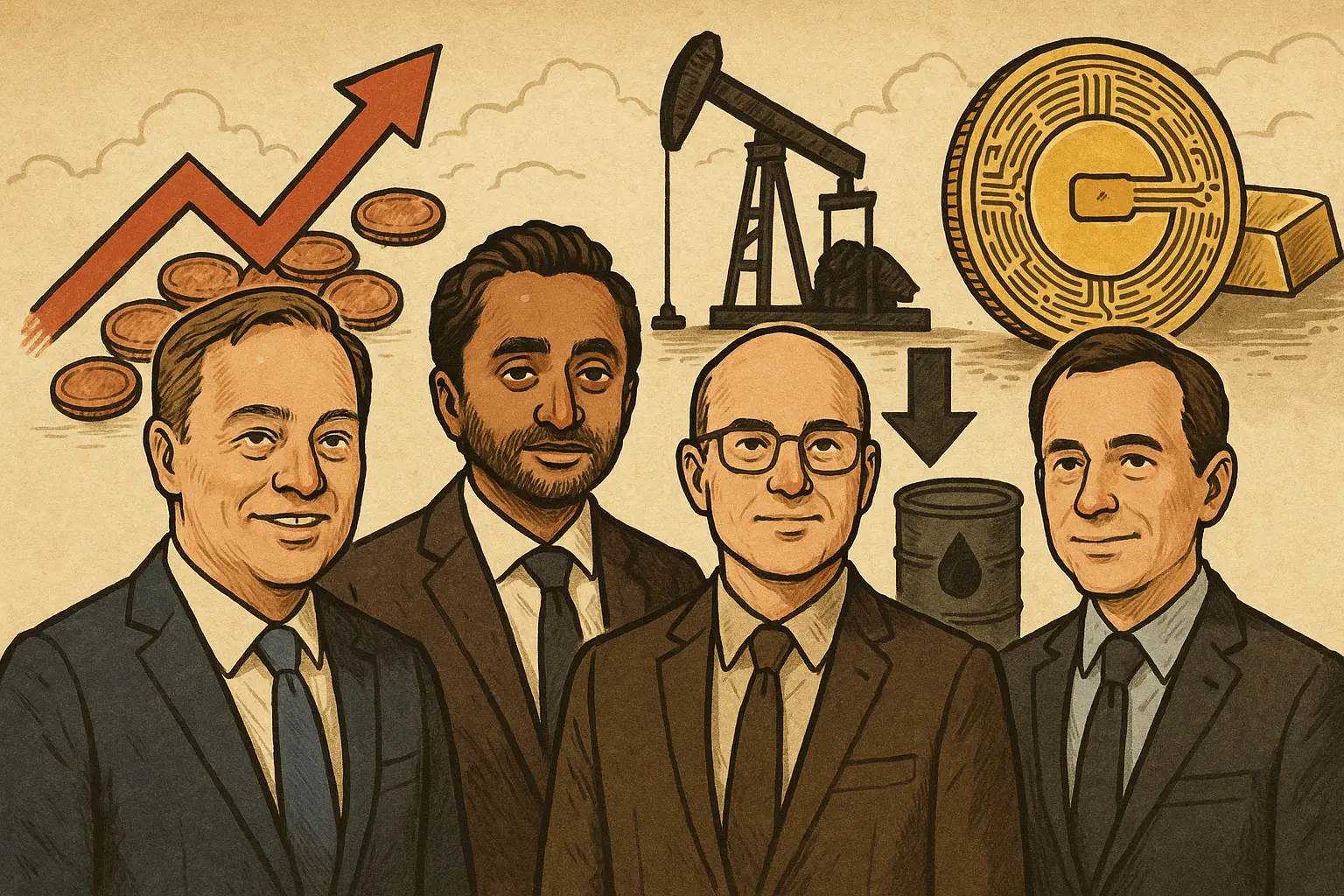

The four tech giants' 2026 investment bets: Copper rises, oil falls, new crypto paradigm replaces gold and Bitcoin

Four top tech billionaires Jason Calacanis, Chamath Palihapitiya, David Friedberg, and David Sacks release their 2026 investment script: go long on copper mines, short on oil with a forecasted drop to $45. Chamath predicts a paradigm shift by central banks replacing gold and Bitcoin, requiring resistance to quantum computing. Sacks bets on a boom in IPOs.

Chamath: Long Copper, 70% Shortage by 2040

Chamath: I’m choosing a basket of key metals. This aligns with my earlier logic about copper; under the backdrop of geopolitical tensions and supply chain reshaping, the demand for these foundational materials will be rigid. I select copper as the best-performing asset in 2026. In a world increasingly leaning toward unilateralism and emphasizing economic resilience, we are still severely underestimating the gap between global demand and supply for a few critical elements.

In this context, the asset most likely to “take off” is copper. It’s currently the most useful, cheapest, most scalable, and conductive material, found everywhere—from data centers to chips to weapon systems. At current rates, by 2040, global copper supply will face a shortfall of about 70%. This 70% figure is staggering, meaning even if all global copper mines operate at full capacity, production can only meet 30% of demand.

Why such a huge gap? First, the explosion of AI data centers. Each GPU server requires 5-10 times more copper wiring than traditional servers, and global data center construction is booming. Nvidia, Oracle, Amazon have announced hundreds of billions of dollars in data center expansion plans. Second, electric vehicles and charging infrastructure. An electric vehicle uses four times more copper than a traditional fuel car, and global EV penetration is rapidly increasing. Third, renewable energy facilities. Solar and wind power plants require大量 copper cables, and energy transition will continue for decades. Fourth, defense weapon systems. Amid geopolitical tensions, military build-ups are restarting, and modern weapon systems are heavy consumers of copper.

Why can’t supply keep up? Developing a new copper mine takes 10-15 years from exploration to production, with extremely strict environmental approvals, and billions of dollars in capital investment. Currently, global copper mining investment is severely lacking, with limited new capacity over the next 5-10 years. This widening supply-demand gap will push copper prices higher and higher, making Chamath’s logic very solid.

Chamath’s Contrarian Prediction: Central Banks Will Issue New Crypto to Replace Gold BTC

Chamath: I have two contrarian predictions. The second is: central banks will realize the limitations of gold and Bitcoin and seek a brand-new, controllable crypto paradigm. To safeguard sovereignty, they need a tradable, secure, and fully private asset that’s hard for other countries—whether allies or adversaries—to spy on. Technologically, it must withstand the potential threats posed by quantum computing within the next 5 to 10 years.

This prediction is highly disruptive. Gold has been a reserve asset for thousands of years, and Bitcoin is recognized as “digital gold” by some nations. However, Chamath believes both have fatal flaws. Gold’s issues are its uncontrollability and difficulty in rapid trading; when nations need to mobilize reserves urgently, physical properties become a barrier. Bitcoin’s problem is even more serious: while it can be traded quickly, its fully transparent blockchain exposes reserve sizes and transaction behaviors of countries.

What kind of new crypto asset do central banks need? Chamath proposes three standards. First is controllability: the asset must be issued and circulated under the control of a central bank or sovereign nation, not fully decentralized like Bitcoin. Second is privacy: transaction records must be completely private, preventing other countries from spying on reserve sizes and transactions. Third is quantum resistance: current elliptic curve cryptography is vulnerable to quantum computers, so new assets must adopt quantum-resistant cryptography.

What might this asset look like? Possibly a digital asset issued on a permissioned blockchain jointly by central banks, using zero-knowledge proofs to ensure privacy, and employing lattice or hash-based cryptography to resist quantum attacks. This asset could become the new standard for international settlement, gradually replacing some functions of gold and the US dollar. If Chamath’s prediction comes true, it will fundamentally reshape the global monetary system.

Sacks and Friedberg Bullish on Polymarket and AI Employment

Friedberg: I have two choices. First is Huawei; I believe Huawei’s deep collaboration with SMIC in chip manufacturing will outperform Western expectations this year. Second is Polymarket, which has evolved from a niche oddity into a platform providing real-time insights. I expect it to explode this year. After partnering with the NYSE, I foresee all major exchanges—including Robinhood, Coinbase, and even Nasdaq—taking action this year. Prediction markets will not only influence markets but also become news.

Sacks: My contrarian prediction is that AI will increase, not decrease, demand for knowledge workers. I cite the “Jevons Paradox”: when the cost of a resource drops, overall demand for it actually increases because more use cases emerge. For example, lower costs for code generation will lead society to produce vast amounts of software; cheaper radiology scans will make imaging widespread, increasing the need for radiologists to interpret and verify AI results. The “unemployment narrative” is not only wrong; we will actually see job growth.

Sacks believes 2026 will be a big year for IPOs, with many companies going public and creating trillions in new market value. Recently, there has been concern about shrinking public markets and privatization of many firms. 2026 will be a major reversal of that trend and part of the “Trump boom.” He predicts GDP growth of 5%, with 75 to 100 basis points of rate cuts by June, and large-scale tax refunds in April.

Jason believes Amazon will become the first “enterprise singularity,” where profits from robots surpass human contributions. Their autonomous driving company Zoox is progressing well, and they are massively replacing human workers with robots. Jason also predicts that in speculative and betting sectors—including Robinhood, Polymarket, Coinbase—2026 will be a beneficiary, as the economic boom and rate cuts leave people with extra cash to bet and speculate.

Related Articles

Cardano Developers Welcome Rosetta Java v2.0.0 Improving Sync Speed and ADA Market Dynamics

Crypto Market Sees Persistent Downturn Under ‘Extreme Fear’ Sentiment

Can altcoins rebound in Q1 2026? Data reveals the end of the sell-off and potential turning points

Solana Price Faces Bearish Pressure with $57 Fibonacci Extension in Sight

BTC Spring Festival "Red Envelope Market," can it be recreated this year?