XRP outperforms Bitcoin and Ethereum as prices hit bottom: Can it reverse?

Recently, the price of XRP has fallen below $1.50, marking a deeper correction and signaling a bottom that first appeared nearly two years ago. This decline has pushed XRP below its realized price—a key on-chain analysis indicator.

The panic sell-off occurred immediately afterward. However, some investor groups view this weakness as an accumulation opportunity. Nonetheless, historical data suggests that XRP is likely to enter a prolonged accumulation phase or establish a new value zone to gather holdings.

Increasing Selling Pressure: XRP Investors Gradually Withdraw

Pessimism is spreading as XRP’s price continues to struggle to recover significantly. Both retail and large investors are reducing their XRP holdings. The lack of sustainable growth momentum has weakened confidence and raised concerns about prolonged downside risk in the current crypto market cycle.

On-chain data shows addresses holding between 10,000 and 100,000 XRP have decreased their positions. Additionally, large wallets holding between 100 million and 1 billion XRP have also sold heavily. In total, these investor groups have distributed approximately 350 million XRP over the past five days.

Realized Price of XRP | Source: Glassnode

This sell-off amounts to over $483 million, indicating growing bearish sentiment among key investor communities. Notably, continuous selling by “whales” often negatively impacts market psychology, increasing short-term volatility and putting downward pressure on XRP’s price stability.

Realized Price of XRP | Source: Glassnode

This sell-off amounts to over $483 million, indicating growing bearish sentiment among key investor communities. Notably, continuous selling by “whales” often negatively impacts market psychology, increasing short-term volatility and putting downward pressure on XRP’s price stability.

Is XRP Forming a Bottom or Continuing Downtrend?

XRP’s long-term outlook currently revolves around the realized price—an indicator reflecting the average cost basis of all circulating XRP. This metric provides a clearer view of the overall investor position relative to the spot price.

Currently, XRP’s spot price is below its realized price.

When the spot price drops below the realized price, the market typically enters a loss phase. The last time this scenario occurred was in July 2024. Historical data suggests this could be a sign that the market is approaching a bottom.

However, recovery is not always immediate. In fact, after falling below the realized price in May 2022, XRP took nearly a year to accumulate before rebounding in March 2023. If history repeats, XRP may undergo a prolonged accumulation phase before resuming an uptrend.

Positive Signals from Institutional Investors

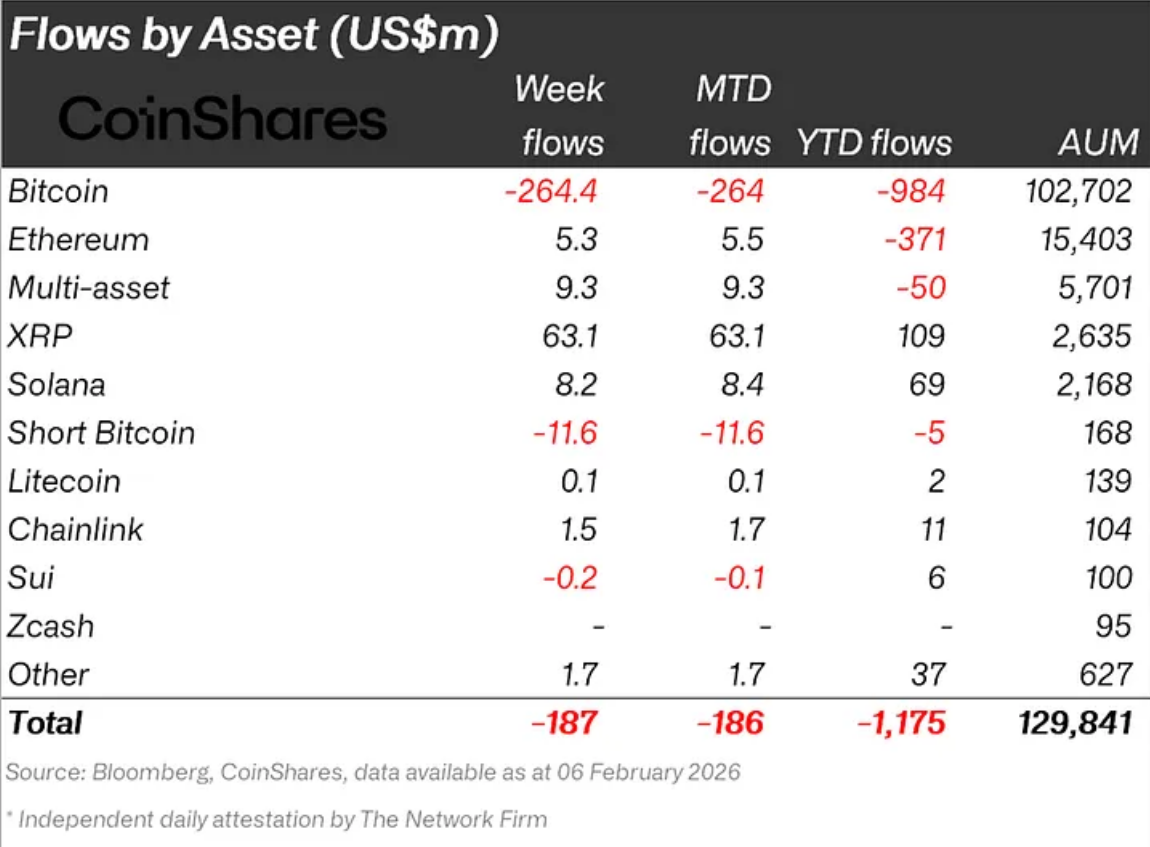

While retail investors remain cautious, major financial institutions continue to show significant interest in XRP. According to CoinShares data, XRP saw inflows of up to $63.1 million in the week ending February 6. This surpasses other large assets like Bitcoin, Ethereum, and Solana during the same period.

Institutional Investment Flows into XRP | Source: CoinShares

Since the beginning of the year, investment flows into XRP-related products have reached $109 million, while Bitcoin and Ethereum experienced net outflows. This divergence indicates that financial institutions are placing their trust in XRP’s utility, especially its role in cross-border payments.

Institutional Investment Flows into XRP | Source: CoinShares

Since the beginning of the year, investment flows into XRP-related products have reached $109 million, while Bitcoin and Ethereum experienced net outflows. This divergence indicates that financial institutions are placing their trust in XRP’s utility, especially its role in cross-border payments.

Institutional capital can serve as a “buffer” to support prices during market downturns. While it cannot eliminate volatility entirely, the involvement of large financial players may help limit deeper declines and prevent prolonged accumulation phases.

Can XRP Price Recover?

As of this writing, XRP is trading at $1.38, holding above the support level of $1.37. The short-term outlook is neutral, with mixed signals from investors. While selling pressure persists, institutional inflows and past bottom signals offer cautious hope for a recovery.

XRP’s immediate target is to regain $1.52 to establish a solid support level. If achieved, this price could become a psychological milestone, reducing selling pressure. As investor sentiment improves and buying interest returns, XRP could rise to $1.77 and even test the resistance at $2.00.

XRP Price Analysis | Source: TradingView

However, without sustainable growth momentum, downside risks increase. Breaking below the $1.37 support could push XRP down to $1.26. If this level cannot hold, the positive outlook would be invalidated, opening the possibility of further declines toward $1.12 if market weakness continues.

XRP Price Analysis | Source: TradingView

However, without sustainable growth momentum, downside risks increase. Breaking below the $1.37 support could push XRP down to $1.26. If this level cannot hold, the positive outlook would be invalidated, opening the possibility of further declines toward $1.12 if market weakness continues.

Although XRP faces many challenges, institutional capital may play a key role in limiting downside risks. Nonetheless, for a sustainable recovery, XRP needs to break through key resistance levels and regain investor confidence.

Related Articles

Data: Today, the US Bitcoin ETF experienced a net outflow of 3,711 BTC, and the Ethereum ETF experienced a net outflow of 27,535 ETH.

Binance’s CZ Pushes Back on Blame as BTC, ETH, and BNB Prices Slide

Data: If BTC drops below $64,893, the total long liquidation strength on major CEXs will reach $1.443 billion.

Standard Chartered Bank once again lowers its Bitcoin 2026 target price to $100,000, expecting it to dip to $50,000 before rebounding.

Strategy Expands Preferred Stock Sales to Fund Additional Bitcoin Purchases Amid Market Volatility