Tom Lee says ETH is preparing for another V-shaped recovery.

Fundstrat Research Head Tom Lee expresses hope that Ethereum (ETH) will recover quickly after recent declines, emphasizing that this asset has experienced eight similar recoveries since 2018.

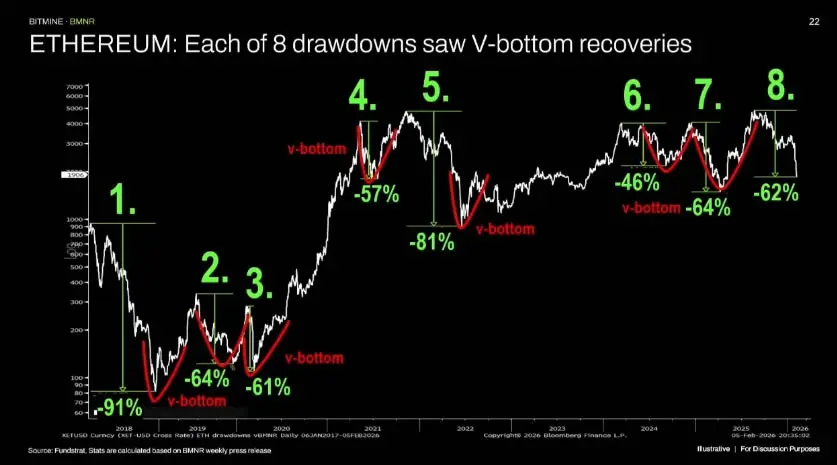

“I understand that many investors are feeling disappointed, but it’s important to remember that since 2018, ETH has fallen more than 50% eight times,” Tom Lee stated at a conference in Hong Kong on Wednesday.

He also pointed out that last year, ETH dropped as much as 64% from January to March.

Eight previous declines all saw ETH’s V-shaped recovery | Source: Fundstrat “However, in all eight cases, Ethereum formed a V-shaped bottom, meaning it fully recovered 100% at a pace nearly matching the decline,” Lee shared.

Eight previous declines all saw ETH’s V-shaped recovery | Source: Fundstrat “However, in all eight cases, Ethereum formed a V-shaped bottom, meaning it fully recovered 100% at a pace nearly matching the decline,” Lee shared.

According to him, there are no significant changes, and ETH is likely to continue experiencing a V-shaped bottom recovery pattern.

Tom Lee predicts ETH is approaching its bottom

BitMine market analyst Tom DeMark identified the $1,890 level as a potential bottom, but believes the price could test this level twice through a “dip below the threshold.” Tom Lee calls this a “perfect bottom” and further comments:

“We believe Ethereum is very close to the bottom. The current situation reminds me of the downturns in fall 2018, fall 2022, and April 2025. This is not the time to worry about the bottom anymore. If you’ve seen the correction, focus on opportunities rather than panic selling.”

According to TradingView data, ETH’s price dropped to $1,760 on February 6, just slightly above the 2025 bottom of around $1,400. Currently, Ether cannot sustain above $2,000, trading at $1,970 at the time of writing, after experiencing a 37% decline over the past 30 days.

Demand for ETH staking reaches all-time high

Although ETH has underperformed this year, data shows that demand for staking this asset remains very high.

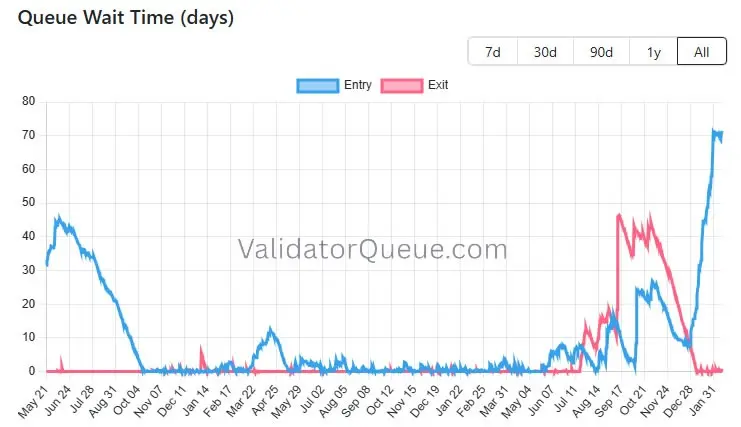

Currently, the staking wait time has reached an all-time high of 71 days, with a total of 4 million ETH in the validator queue, according to ValidatorQueue data. The staking supply rate also hit a record 30.3%, equivalent to 36.7 million ETH.

The clear consequence of this trend is a “significant supply constraint,” according to analyst “Milk Road” on Wednesday.

“Currently, one-third of the total ETH supply is locked, providing a modest yield of 2.83% APR,” the analyst commented. “While this isn’t an attractive yield by crypto market standards, many investors are still willing to wait.”

Ethereum staking registration queue during peak hours | Source: ValidatorQueue “When people lock up to $74 billion amid falling prices, it shows they’re not just speculating. They’re preparing for a long-term strategy.”

Ethereum staking registration queue during peak hours | Source: ValidatorQueue “When people lock up to $74 billion amid falling prices, it shows they’re not just speculating. They’re preparing for a long-term strategy.”

Related Articles

Polygon Joins Enterprise Ethereum Alliance to Advance Institutional Payment Rails

Ethereum Treasury Company ETHZilla Launches the First Tokenized Asset Supported by Aircraft Engines

Transak Brings Instant Fiat On-Ramps to MegaETH, Opening ETH Purchases to 10M Users