The probability of Japan raising interest rates is 80%, an implicit signal influencing Bitcoin

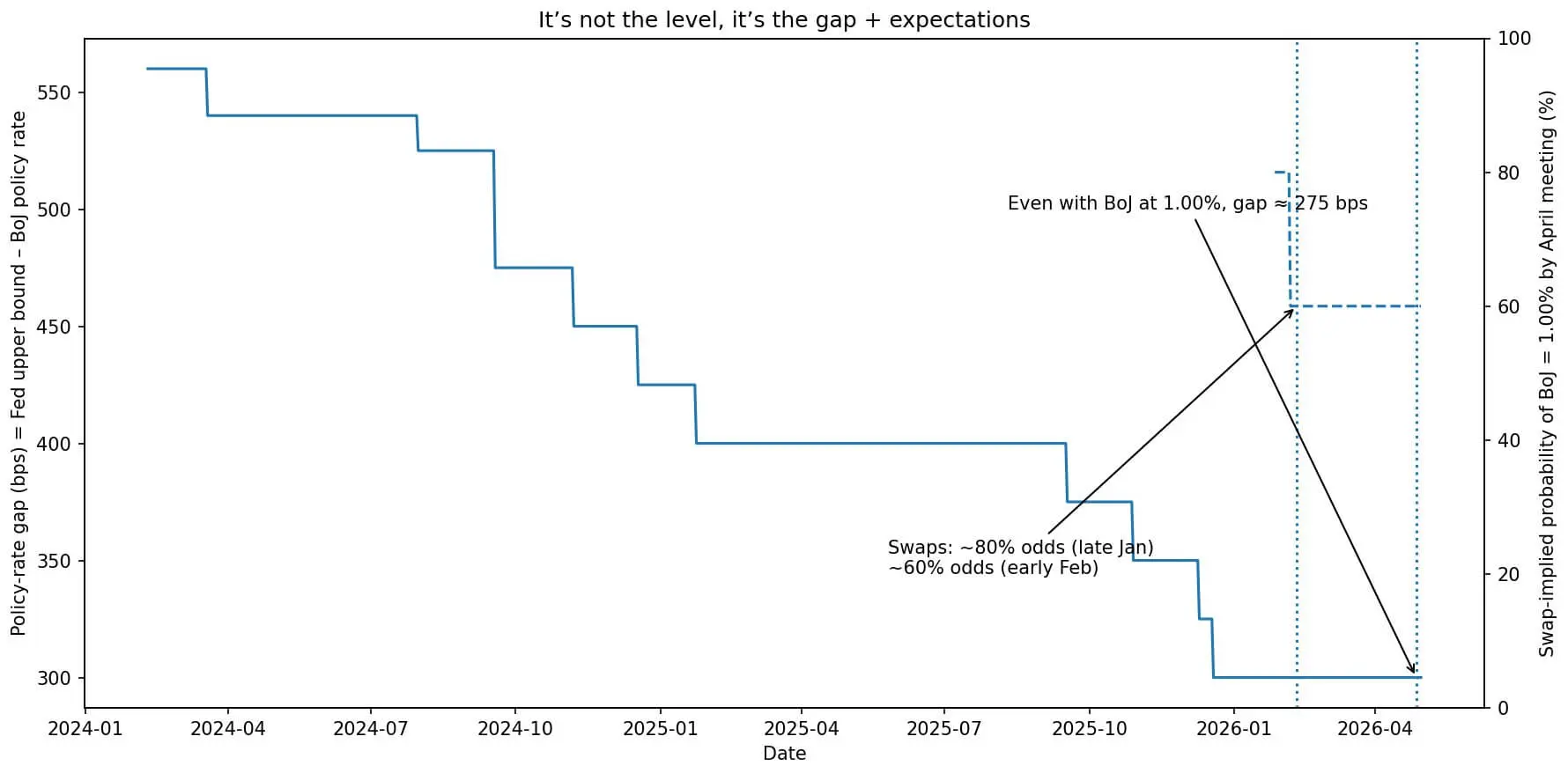

Bank of America Securities forecasts that the Bank of Japan (BoJ) will raise its policy interest rate from 0.75% to 1.0% at the April 27–28 meeting. According to swap data cited in BoJ’s recent meeting minutes, the market is currently pricing in about an 80% probability of this scenario occurring.

A 25 basis point increase may seem modest at first glance, but the debate surrounding it is much deeper: whether returning to a 1% interest rate — last seen in the mid-1990s — will trigger a wave of global carry trade reversals, forcing risky assets, including Bitcoin, to deleverage?

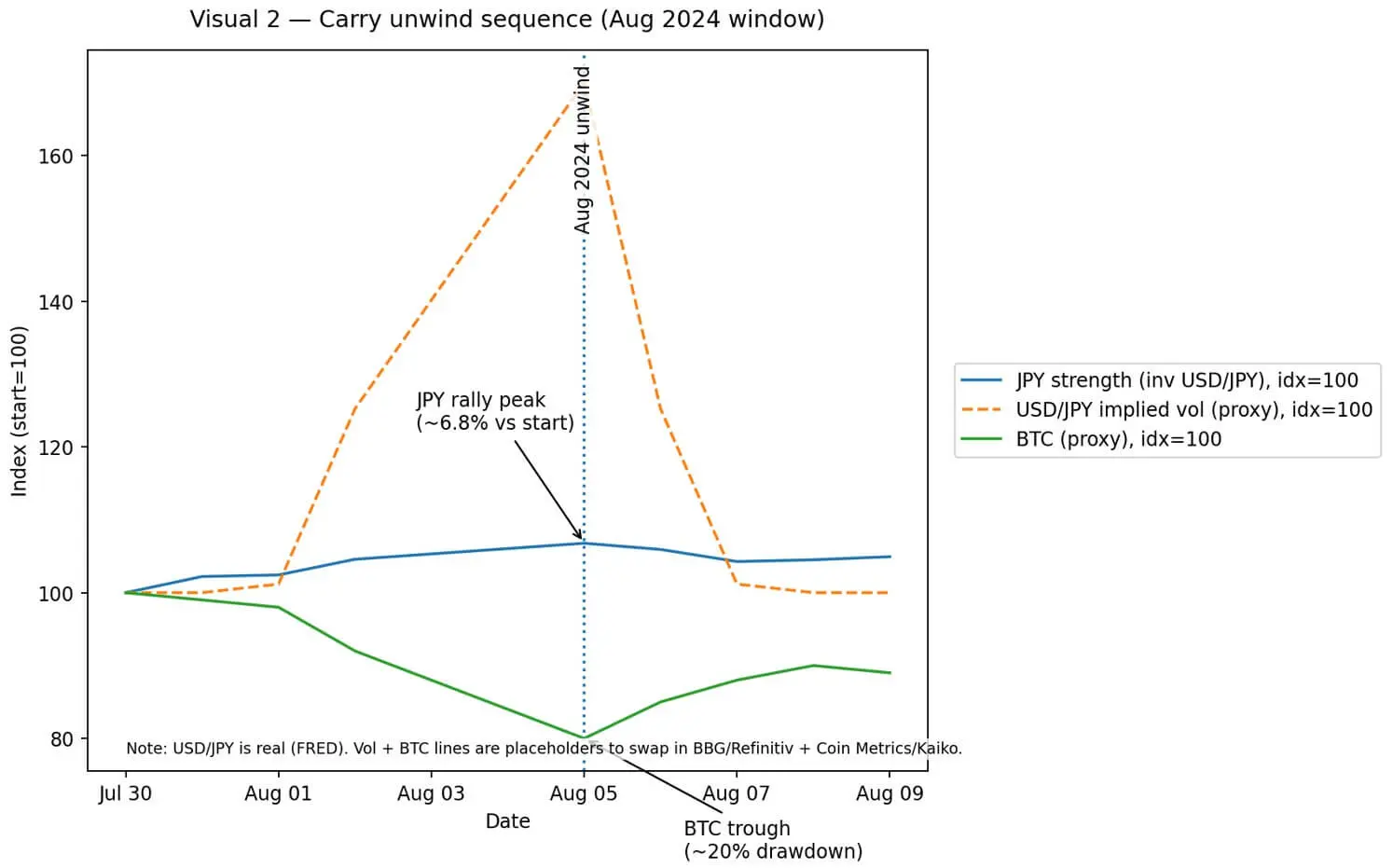

In August 2024, a sharp yen appreciation caused by carry trade unwinding led Bitcoin and ETH to plunge up to 20% within hours.

Subsequently, the Bank for International Settlements (BIS) described this event as a textbook example of forced deleveraging: margin calls spreading across futures, options, and collateralized structures, with crypto significantly impacted.

Therefore, when the market mentions “Japan at 1%” or “systemic risk,” the question is whether history repeats itself or if the current environment is different.

Comparing with 1995 and Key Differences

On April 14, 1995, the BoJ set the base discount rate at 1.00%. Just five days later, the USD dropped to 79.75 yen — a post-Plaza Accord low — forcing coordinated intervention by central banks.

Five months later, the BoJ cut rates to 0.50%, initiating decades of ultra-low interest rate policies.

That period also followed the “Great Bond Massacre” of 1994 — a global bond sell-off wiping out about $1.5 trillion in portfolios as US and European yields soared.

The combination of a strengthening yen, bond market volatility, and policy uncertainty created a highly volatile macro environment — often cited whenever Japan’s policy stance shifts.

However, the current mechanism is different. In 1995, the yen strengthened due to a surge in Japan’s current account surplus and capital outflows from USD-denominated assets. The rate adjustment was a reaction, not the primary cause.

Today, the US Federal Reserve maintains rates at 3.50–3.75%, which is 275 basis points higher than Japan’s 0.75%. This spread still underpins the carry trade structure: borrowing yen cheaply to invest in higher-yield assets in the US or emerging markets to profit from the differential.

A 25 basis point increase to 1% does not eliminate this gap. Instead, it may shift expectations about the future path — and expectations, rather than absolute rates, are what drive currency volatility.

The chart shows the narrowing of the Bank of Japan’s policy rate gap with the US Federal Reserve, while swap markets forecast decreasing odds of a 1% rate hike in April.## How carry trade reversals happen and why volatility is key

The chart shows the narrowing of the Bank of Japan’s policy rate gap with the US Federal Reserve, while swap markets forecast decreasing odds of a 1% rate hike in April.## How carry trade reversals happen and why volatility is key

Carry trade profits come from the interest rate differential minus the appreciation of the funding currency.

If you borrow yen at 0.75% and earn 3.5% in the US, your net is about 2.75%. But if the yen appreciates by 2.75%, all gains are wiped out. Leverage amplifies this effect.

With 10x leverage, a 1% yen appreciation reduces equity by 10%, enough to trigger a margin call and force asset sales.

The risk isn’t just the rate hike itself but the surprise element combined with crowded positions and thin liquidity. In August 2024, BoJ not only raised rates but also signaled a more hawkish stance than expected. The yen surged, volatility-strategic funds had to cut positions, derivatives were unwound, and cross-currency basis spreads widened.

Bitcoin — often viewed as a liquid collateral asset in leveraged structures — also declined sharply along with tech stocks and high-beta assets.

BIS notes that this chain of reactions shows Bitcoin, despite often being described as uncorrelated, still behaves as a “risk-on” asset when global liquidity tightens abruptly.

The chart illustrates the yen interest rate spread in August 2024 when Bitcoin fell 20%, driven by sharp USD/JPY volatility and a 6.8% yen appreciation.## Repatriation of capital and US bonds

The chart illustrates the yen interest rate spread in August 2024 when Bitcoin fell 20%, driven by sharp USD/JPY volatility and a 6.8% yen appreciation.## Repatriation of capital and US bonds

Japan currently holds about $1.2 trillion in US Treasury bonds, making it the largest foreign creditor to the US.

When BoJ raises rates, the yield gap between Japanese government bonds (JGBs) and US Treasuries narrows. Japanese pension funds, insurers, and banks must consider whether to continue holding US Treasuries with 4.0% yields but currency risk, or switch to JGBs near 1.5% with no FX risk.

This rebalancing process won’t happen overnight but could pressure US yields higher if capital flows back persist. Rising Treasury yields increase global borrowing costs, putting pressure on all risk assets, including Bitcoin.

An indirect but real effect: Bitcoin valuation partly depends on opportunity costs relative to risk-free assets. When opportunity costs rise, speculative demand weakens.

Three scenarios for April and their impact on Bitcoin

Scenario 1: BoJ raises rates to 1% but maintains a cautious tone, emphasizing “data dependence” and “gradual normalization.” The yen appreciates slightly, volatility remains controlled. Bitcoin’s response is limited or short-term.

Scenario 2: Rate hike with a clear hawkish stance or stronger-than-expected employment data. The yen surges 3–5% within a week, volatility increases, risk management strategies cut positions, margin calls spread. Bitcoin could decline 10–20%, similar to August 2024.

Scenario 3: BoJ keeps rates at 0.75% with a dovish tone. The yen weakens, carry trade resumes, risk appetite improves. Bitcoin benefits along with stocks and credit markets.

What to watch?

The question “Is a 1% BoJ rate hike a systemic risk?” depends on implementation and context.

A well-telegraphed, orderly move is likely neutral. Conversely, surprises in a thin-liquidity environment could trigger a cascade of volatility.

Investors should closely monitor statements and the April 27–28 Outlook Report, especially language about rate paths and inflation expectations. USD/JPY implied volatility is more telling than spot rates. CFTC positioning data showing extreme yen short positions are also noteworthy. Additionally, TIC capital flow data indicates US bond repatriation trends.

Bitcoin’s role in this environment is clear: it’s a liquid asset often used as collateral in leveraged macro funds engaging in yen carry trades. When these positions unwind suddenly, Bitcoin faces selling pressure. But if the process is gradual, Bitcoin’s correlation with traditional assets weakens, and it reverts to supply-demand dynamics and institutional acceptance.

A BoJ rate hike to 1% is plausible. The risk of carry trade reversal is real but conditional, not inevitable.

Most probabilities are already priced in. The remaining question is whether the post-1% path will be gradual or accelerate, and whether global liquidity can absorb this adjustment without breaking.

For Bitcoin, this may just be a volatility to watch — or a systemic shock to prepare for.

Vương Tiễn

Related Articles

Data: Today, the US Bitcoin ETF experienced a net outflow of 3,711 BTC, and the Ethereum ETF experienced a net outflow of 27,535 ETH.

Binance’s CZ Pushes Back on Blame as BTC, ETH, and BNB Prices Slide

Data: If BTC drops below $64,893, the total long liquidation strength on major CEXs will reach $1.443 billion.

Standard Chartered Bank once again lowers its Bitcoin 2026 target price to $100,000, expecting it to dip to $50,000 before rebounding.

Strategy Expands Preferred Stock Sales to Fund Additional Bitcoin Purchases Amid Market Volatility