Trove only refunds KOLs, not retail investors! $450,000 transferred to a new wallet as evidence exposed

Perp DEX Trove quietly refunded participating KOLs in the presale, while other participants suffered heavy losses. Monitoring wallets associated with the TROVE token deployer revealed that, one day after the token collapse, USDC worth $100,000 and USDT worth $350,000 were transferred to newly funded wallets.

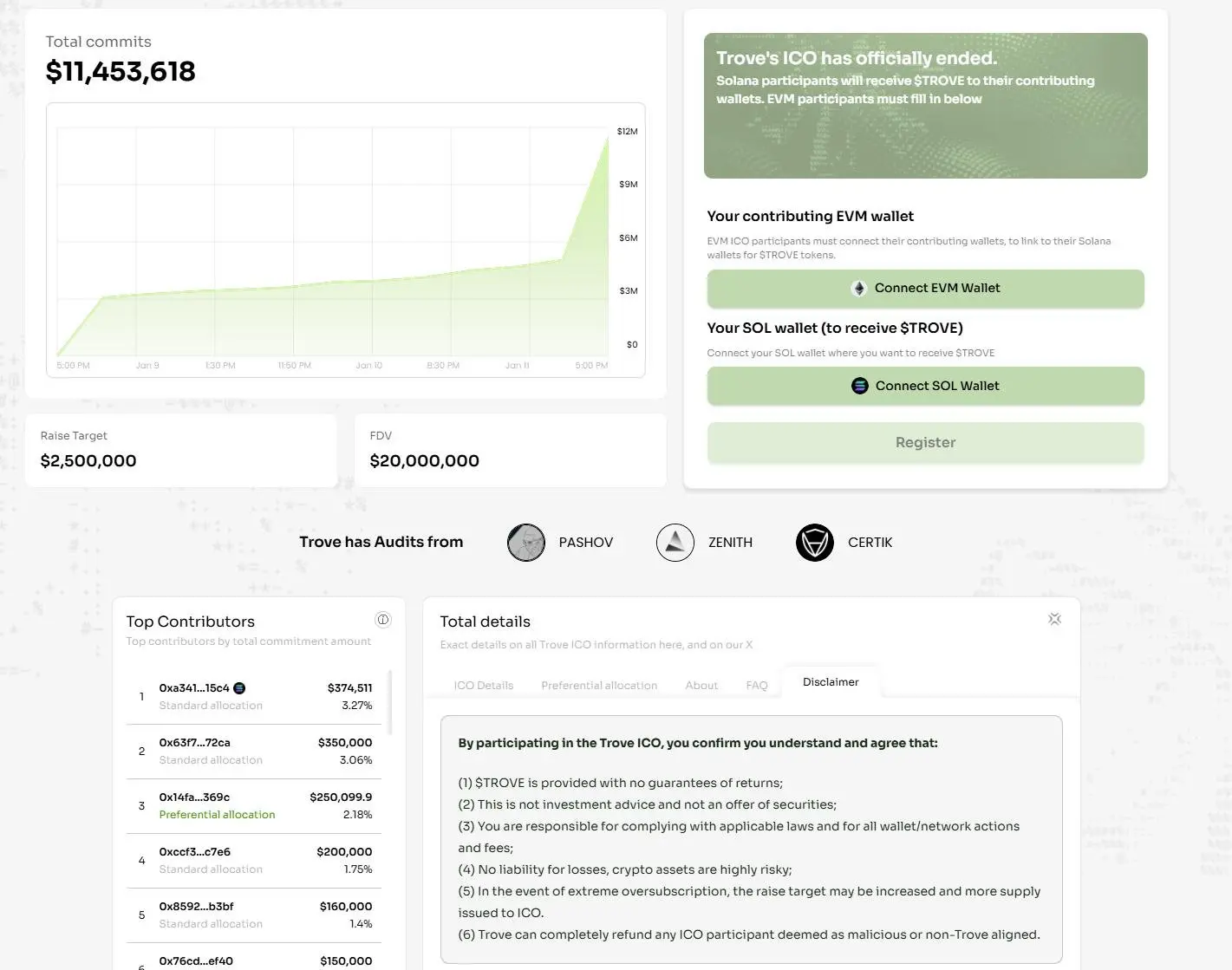

$4.5 Million Transfer: The Trove Selective Refund Scandal

(Source: Trove)

Bubblemaps disclosed on February 12 that Perp DEX Trove had secretly refunded KOLs involved in the presale, while other investors faced severe losses. By tracking wallets linked to the TROVE token deployer, it was found that one day after the token crash, USDC valued at $100,000 and USDT valued at $350,000 were transferred to newly funded wallets. On-chain evidence and leaked chat logs have been obtained, proving that the project team engaged in unfair treatment of investors.

The transfer of $450,000 ($100,000 USDC + $350,000 USDT) occurred just one day after the token collapse, a highly sensitive timing. This indicates that the project team prioritized the interests of KOLs during the panic caused by the token price plummeting. Such selective refunds constitute a highly malicious and unfair act, violating the fundamental principle of “equal treatment of all investors.”

The existence of on-chain evidence makes it impossible for the Trove team to deny. Blockchain transparency allows all fund transfers to be tracked. By analyzing the flow of funds between wallets, Bubblemaps can identify which wallets are controlled by the project team and which transfers are refunds. When combined with leaked chat logs—possibly from insiders or affected KOLs—a complete chain of evidence is formed, leaving the project almost unable to deny wrongdoing.

Leaked chat logs may include discussions between the project team and KOLs regarding refund arrangements, such as “we will give you refunds but don’t tell retail investors.” Such explicit preferential treatment plans will put the Trove team at a significant legal disadvantage in future lawsuits. Victimized retail investors could sue on charges of fraud, breach of contract, unfair trading, and more.

From a business ethics perspective, this selective refund destroys Trove’s reputation. Even if the project has excellent technology and valuable products, this double standard in investor treatment erodes its moral foundation for continued development. No investor will trust a project proven to discriminate among different groups.

$11.5 Million ICO and Insider Trading on Polymarket

After raising $11.5 million via ICO in January, Trove claimed it would retain $9,397,403 (about $940,000) to continue building the Perp DEX on Solana. This statement itself raises questions: if they raised $11.5 million but only kept $940,000, where did the remaining $2.1 million go? The project team has not provided a clear explanation. Possible destinations include team salaries, marketing expenses, consulting fees, etc., but the lack of transparent financial disclosure makes the use of these funds suspicious.

This has sparked strong community dissatisfaction, with the token price dropping over 95%, and ICO participants suffering heavy losses, accusing the team of Rug Pull. The 95% price decline from ICO price to current value means investors have lost nearly all their principal. For example, a retail investor who invested $10,000 now only has $500, losing $9,500. This catastrophic investment outcome has triggered widespread anger and calls for accountability.

Community feedback indicates issues such as “paying KOLs for promotion and funds flowing into gambling platform deposit addresses.” On-chain detective ZachXBT revealed that Trove paid @TJRTrades up to $45,000 in marketing fees, directly deposited into the KOL’s gambling site deposit address. This discovery is explosive, showing that Trove’s promotional funds not only went to KOLs but also entered gambling platforms, implying a highly improper fund flow.

KOL @hrithikk stated that Trove’s team not only paid generous marketing fees but also privately offered ICO allocations valued as low as $8.5 million, with discounts up to 60%, plus large airdrop rewards. Trove is still selling shares at low prices and has approached him more than five times asking if he would invest. Retail ICO prices correspond to a $20 million valuation, while KOLs privately received allocations valued at $8.5 million at a 60% discount. Such a huge valuation gap is blatantly unfair.

Insider trading on Polymarket is a textbook example of market manipulation. Less than two hours before the ICO ended, the probability of “Trove ICO raising over $20 million” on Polymarket’s prediction market was nearly zero. The team suddenly announced a 5-day extension, and the “YES” option on Polymarket shot up from low levels to nearly 60%. It’s clear that insider funds had already moved, with on-chain data showing specific wallets placing precise bets before the announcement, then quickly cashing out after the price surged.

Trove Scam Timeline

January 6: Announces ICO, raises 4.6 times oversubscription, totaling $11.5 million

Two hours before ICO ends: Suddenly announces a 5-day extension, insider trading profits on Polymarket

A few hours later: Withdraws the extension, Polymarket profits again

January 17: Abruptly abandons Hyperliquid and shifts to Solana, selling off HYPE

After token collapse: Secretly refunds KOLs $450,000, retail investors lose 95%

Perhaps believing that liquidity on prediction markets is insufficient, amid widespread community questioning, Trove’s team played along with a “fire to burn the princes” tactic: they announced the withdrawal of the extension, ending the ICO as originally planned. Following this announcement, the corresponding order book was settled to zero. Data from Polymarket shows that wallets placed accurate bets before the news and continued to profit from the reversal. Such two precise bets in succession are almost impossible to be luck; they suggest insider information was involved.

From Hyperliquid to Solana: Strategic Betrayal and Bottom-Out

On January 17, Trove suddenly announced abandoning Hyperliquid and shifting to issuing tokens on Solana. For a project that had been raising funds based on the Hyperliquid ecosystem, this was a complete betrayal. Trove once had a compelling narrative: as a perpetual decentralized exchange (Perp DEX) targeting collectibles and real-world assets (RWA), Trove claimed it could turn illiquid “cultural assets”—such as Pokémon cards, CSGO skins, and luxury watches—into tradable financial assets, providing a hedge platform for collectors.

In late October last year, Trove founder @unwisecap strongly promoted “everything can be perpetual” in multiple articles and announced that Trove would be built based on HIP-3, which excited the community. Over the following month, Trove announced collaborations with Kalshi and CARDS (Collector_Crypt), receiving official endorsements from these well-known projects. (P.S. As of press time, Kalshi has already “cut ties,” removing its responses from Trove’s official account.)

In late December, Trove announced an investment of over $20 million to purchase 500,000 HYPE tokens to meet HIP-3 integration requirements. Soon after, a testnet staking plan was launched, and platform trading volume exceeded $1 million within two weeks. Everything seemed to be progressing as expected. But this was all a carefully crafted bait.

Meanwhile, on-chain detective MLM discovered that Trove’s team used timed sell functions to attempt to offload half of their HYPE tokens within 40 minutes. Choosing to dump billions worth of tokens on a weekend with the lowest liquidity in just 40 minutes, Trove’s team was clearly panicked. In response to questions, Trove’s explanation was unconvincing: “Investors felt nervous and decided to exit.” However, on-chain transaction records show these sell-offs occurred while the team publicly denied “selling tokens.” This behavior shattered the community’s trust.

MiCA Regulations and Iranian Identity: The Complex Legal Quagmire

The good news is that this scandal may not end with a simple “Soft Rug.” Trove claimed on its official website to comply with EU MiCA regulations. Now, facing false advertising and potential fraud allegations, angry investors have every reason to pursue civil claims under MiCA provisions. MiCA (Markets in Crypto-Assets) is the EU’s regulatory framework for crypto assets, imposing strict requirements on token issuance, marketing disclosures, and investor protection. If Trove indeed claimed compliance, it must bear corresponding legal responsibilities.

The bad news is that chat screenshots leaked by KOLs suggest team members may be based in Iran. This makes legal accountability extremely complicated. Iran is subject to strict US and EU sanctions, with the international financial system largely isolated from Iran. If Trove’s team is indeed in Iran, victims would find it difficult to enforce judgments or recover funds, as assets in Iran are beyond Western jurisdiction. They could simply ignore court rulings, making enforcement impossible.

This also explains why Trove’s team dares to blatantly commit fraud. Operating from a jurisdiction where they cannot be held accountable, they can freely deceive investors. This “offshore scam” model is common in crypto, exploiting blockchain’s anonymity and cross-border nature to harvest global investors in legal vacuums.

Hyperliquid’s ecosystem is known for strong community cohesion, but this trust also provides fertile ground for scams. Trove exploited the Hyperliquid community’s inherent trust in ecosystem projects, using HIP-3 integration as bait to successfully defraud investors’ funds. This case serves as a warning: not all projects claiming to build on Hyperliquid are trustworthy; investors must conduct independent due diligence.

For affected retail investors, the most practical actions now are: forming collective lawsuits with other victims, filing complaints and investigations with platforms like Polymarket and Hyperliquid, continuously exposing the scam on social media, and attempting to contact law enforcement agencies (though cross-border enforcement is difficult). Even if losses cannot be recovered, these steps can at least prevent more people from falling victim.