The sideways market casts a shadow over Solana's recovery prospects

Solana (SOL) is trading around $79 at the time of writing on Friday, after experiencing a correction of over 9% this week. This movement reflects increased short-term profit-taking pressure. Meanwhile, on-chain indicators and data from the derivatives market send mixed signals about investor sentiment, indicating a clear tug-of-war between bulls and bears — a factor currently restraining the price’s recovery.

Diverging Indicators Hampering Solana’s Recovery

Institutional demand for Solana has returned this week, fueling hopes for a new rebound. Data from SoSoValue shows that Solana (SOL) spot ETF funds recorded inflows of $11.6 million as of Thursday, ending a two-week outflow streak. If this capital inflow continues and expands, SOL’s price could regain upward momentum in the coming sessions.

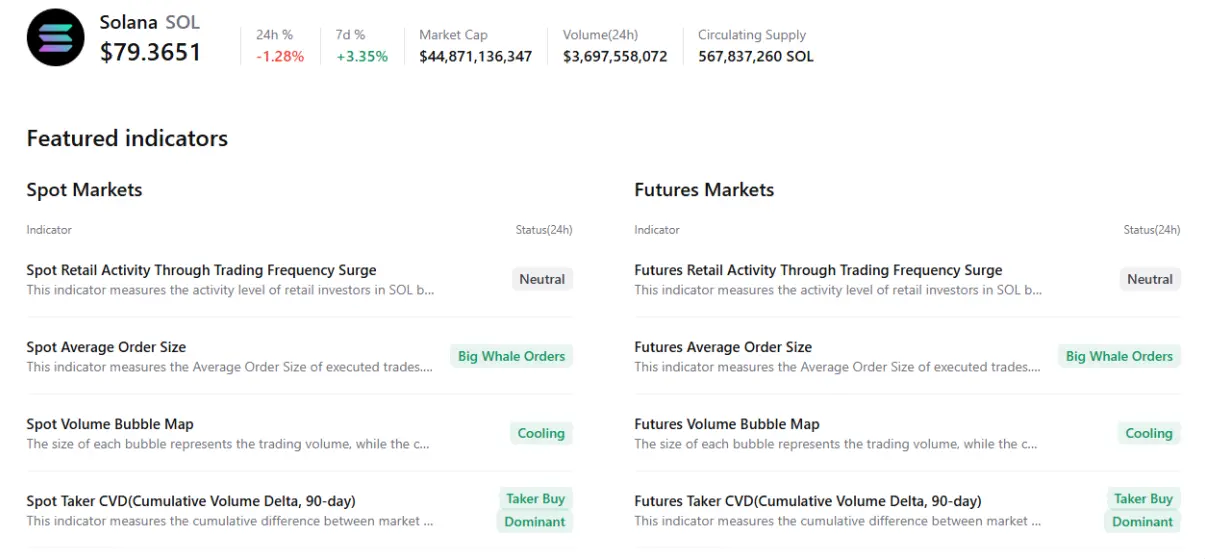

Weekly net fund flow chart of SOL spot ETFs | Source: SoSoValueAlongside positive signals from capital flows, aggregated data from CryptoQuant also reinforce a favorable outlook despite the weak price action. Both the spot market and futures contracts for SOL show large buy orders from “whale” groups. Market liquidity has cooled, while buyers are gradually gaining dominance, suggesting the formation of a base and short-term recovery potential.

Weekly net fund flow chart of SOL spot ETFs | Source: SoSoValueAlongside positive signals from capital flows, aggregated data from CryptoQuant also reinforce a favorable outlook despite the weak price action. Both the spot market and futures contracts for SOL show large buy orders from “whale” groups. Market liquidity has cooled, while buyers are gradually gaining dominance, suggesting the formation of a base and short-term recovery potential.

However, the derivatives picture sends a cautious message. According to CoinGlass, SOL’s funding rate turned negative at -0.0014% on Friday, indicating that short positions are paying fees to long positions — a sign reflecting market sentiment leaning toward a bearish scenario.

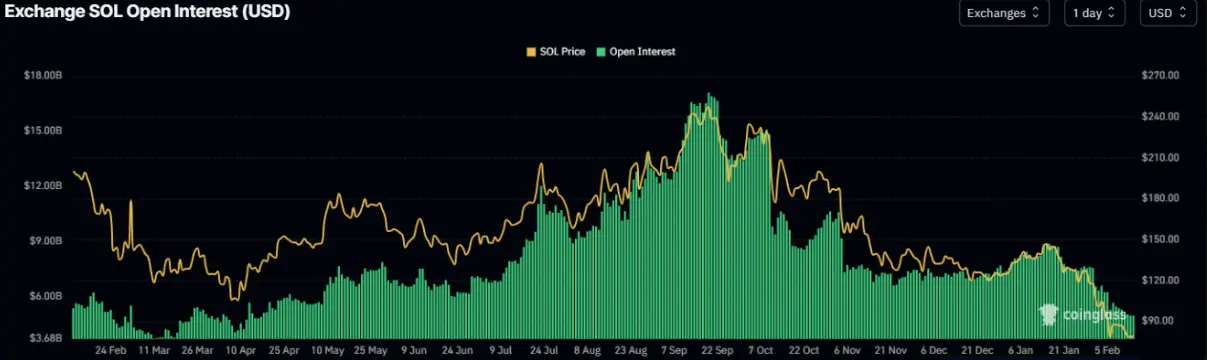

Solana funding rate chart | Source: CoinglassNotably, Solana’s open interest (OI) decreased to $4.96 billion on Friday, continuing a weakening trend since mid-January and falling to the lowest level since mid-April 2025. The narrowing of OI indicates declining market participation, reinforcing a cautious outlook.

Solana funding rate chart | Source: CoinglassNotably, Solana’s open interest (OI) decreased to $4.96 billion on Friday, continuing a weakening trend since mid-January and falling to the lowest level since mid-April 2025. The narrowing of OI indicates declining market participation, reinforcing a cautious outlook.

The conflicting signals between spot capital flows and the derivatives market reflect increasing indecision among traders, eroding confidence in a sustainable upward trend and potentially continuing to restrain Solana’s short-term recovery.

SOL OI | Source: Coinglass## Solana Price Forecast: Bears Target $60

SOL OI | Source: Coinglass## Solana Price Forecast: Bears Target $60

Solana (SOL) continues its correction this week, losing nearly 9% after an 8.62% decline last week. As of Friday, SOL is trading around $79.04, indicating that selling pressure still dominates the market.

Daily SOL/USDT chart | Source: TradingViewIn a negative scenario, if buying momentum does not pick up, Solana could slide toward the February 6 low at $67.50. Closing below this support level would open the door to a deeper decline, with the next psychological target at $60 — a zone that could trigger additional technical selling pressure.

Daily SOL/USDT chart | Source: TradingViewIn a negative scenario, if buying momentum does not pick up, Solana could slide toward the February 6 low at $67.50. Closing below this support level would open the door to a deeper decline, with the next psychological target at $60 — a zone that could trigger additional technical selling pressure.

Momentum indicators reinforce the bearish outlook. The daily RSI has dropped to 26, deep into oversold territory, reflecting strong downward momentum and panic selling. Additionally, MACD has formed a bearish crossover since January 19 and continues to signal negativity, with red histogram bars expanding below the neutral line.

However, if buying interest returns, SOL could rebound and test the psychological $80 level in the short term.

SN_Nour

Related Articles

Anchorage Digital, Kamino, and Solana Company have launched a tripartite custody model supporting institutional staking of SOL.

Bitcoin and Ethereum ETFs Record Outflows While Solana ETF Sees Inflows on Feb 13

3 Promising Altcoins to Accumulate in 2026 — SOL, AVAX, and LINK in Focus

The previously losing giant whale with a loss of over $6.88 million USD deposited $2 million USD into HyperLiquid and opened long positions on ETH and SOL.

Forward Industries Financial Report: Holds approximately 6,962,000 SOL as of the end of 2025