Maple Finance (SYRUP) is hovering around the $0.2700 USD mark at the time of recording on Friday, as buying pressure persistently protects the S1 Pivot support zone at $0.2497 USD. The steady price maintenance indicates that market sentiment is gradually stabilizing after recent fluctuations.

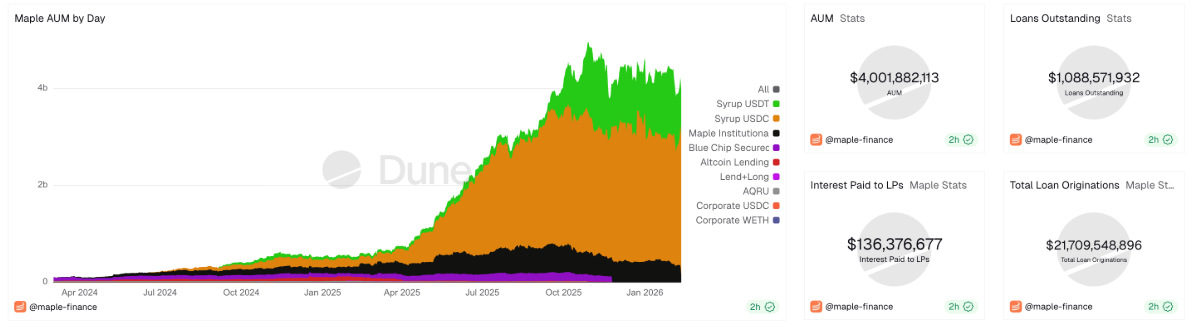

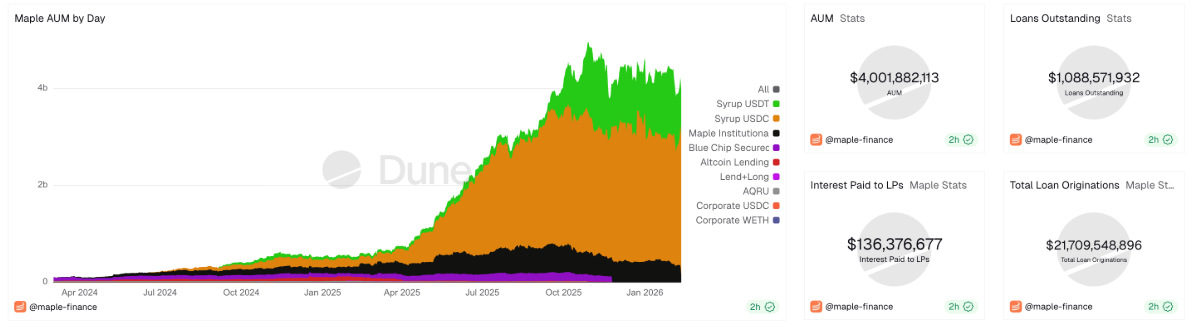

From an on-chain data perspective, demand for this DeFi protocol remains positive. Total Assets Under Management (AUM) has surpassed $4 billion USD, while revenue continues to hold steady after reaching a record high in January — a sign reinforcing investor confidence in the platform.

On the technical side, SYRUP is signaling a potential recovery as selling pressure appears to weaken, opening room for a new upward move if demand continues to be sustained.

Maple Finance Maintains Revenue, Attracts Whales

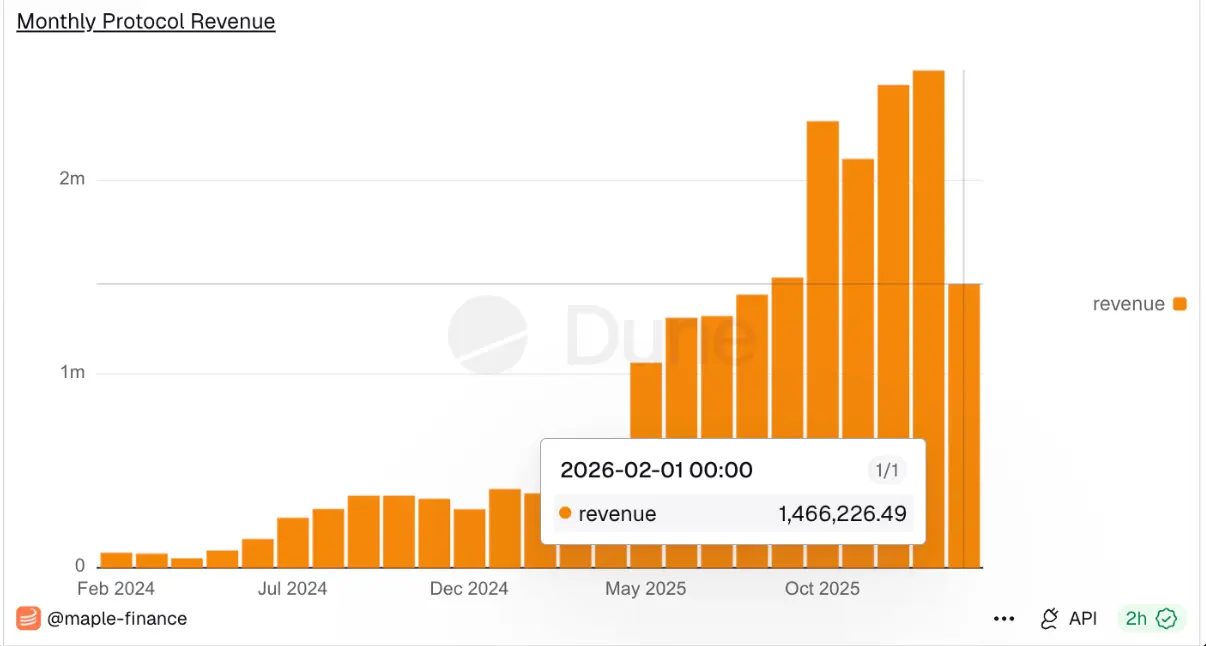

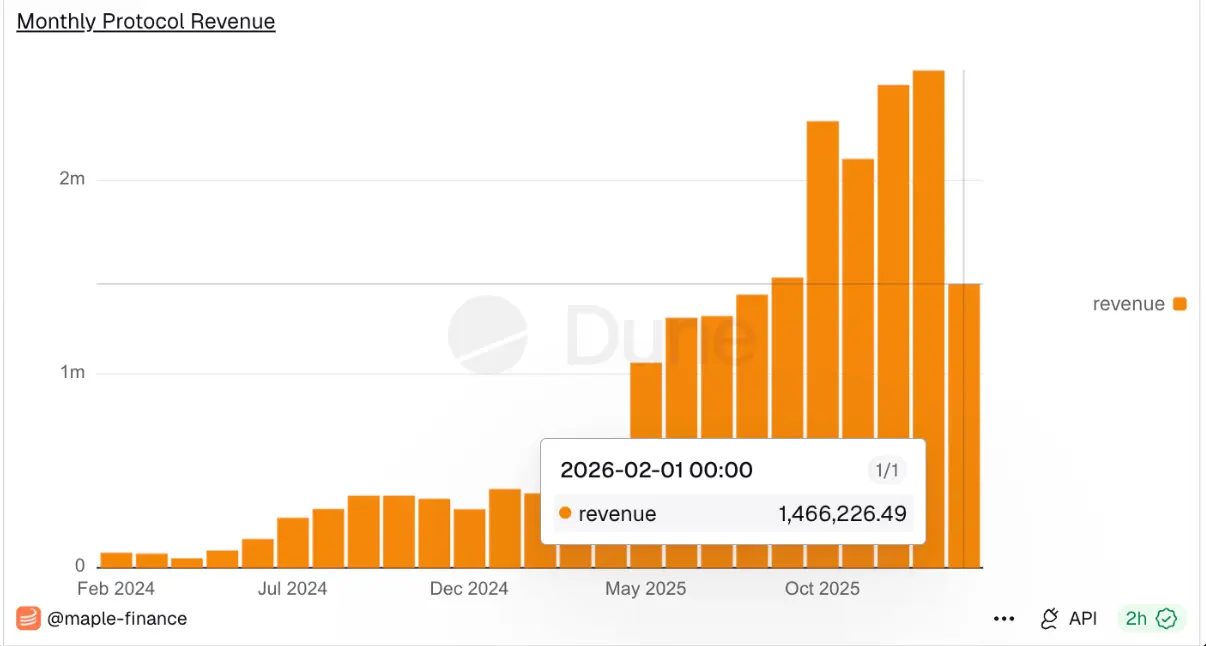

Data from Dune Analytics dashboards show that Maple Finance has generated $1.46 million USD in revenue so far this month, after hitting a record high of $2.57 million USD — mostly from lending activities and yield optimization strategies. This trend follows steady monthly growth, after the protocol recorded $2.49 million USD in December.

Monthly Revenue of Maple Finance | Source: Dune

Meanwhile, Maple Finance’s total assets under management (AUM) have exceeded $4 billion USD, with lending debt reaching $1.08 billion USD. The combination of stable revenue streams and expanding asset scale indicates that the protocol’s ecosystem is accelerating, benefiting from continuously rising market demand.

Monthly Revenue of Maple Finance | Source: Dune

Meanwhile, Maple Finance’s total assets under management (AUM) have exceeded $4 billion USD, with lending debt reaching $1.08 billion USD. The combination of stable revenue streams and expanding asset scale indicates that the protocol’s ecosystem is accelerating, benefiting from continuously rising market demand.

Maple Finance’s Total Assets Under Management (AUM) Data | Source: Dune

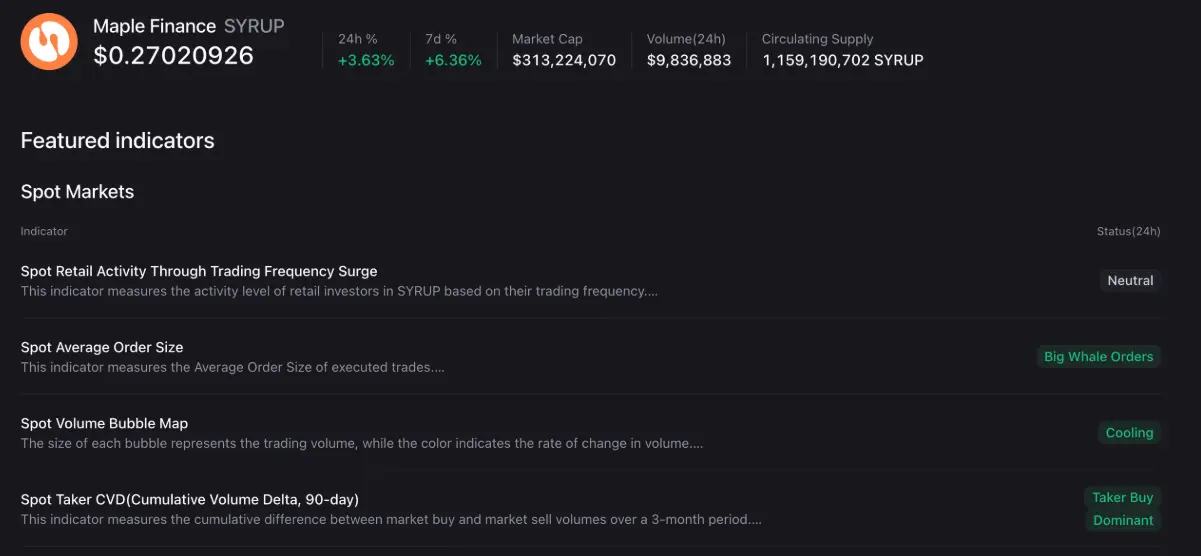

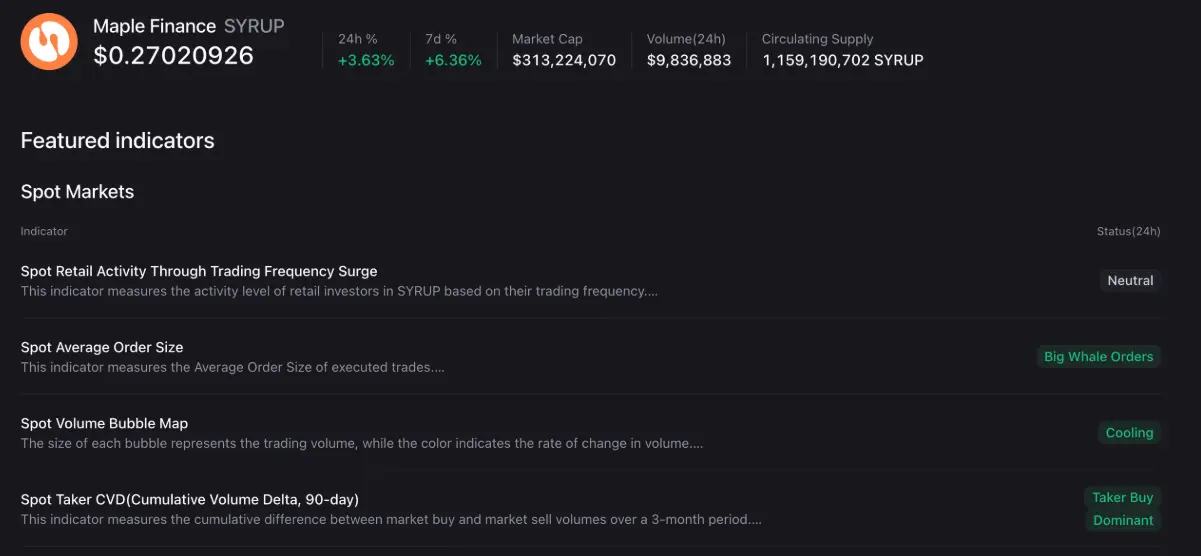

Further supporting this positive outlook, data from CryptoQuant shows stable interest from large investors — often called “whales” — as reflected by the average size of SYRUP orders in the spot market, indicating that significant capital is quietly accumulating.

Maple Finance’s Total Assets Under Management (AUM) Data | Source: Dune

Further supporting this positive outlook, data from CryptoQuant shows stable interest from large investors — often called “whales” — as reflected by the average size of SYRUP orders in the spot market, indicating that significant capital is quietly accumulating.

Spot Market Indicators for SYRUP | Source: CryptoQuant

Spot Market Indicators for SYRUP | Source: CryptoQuant

Technical Outlook: Can SYRUP Recover in a Downtrend Channel?

Maple Finance currently trades just above the S1 Pivot level at $0.2497 USD — a short-term support buffer formed after a 31-day decline that saw SYRUP lose about 35% of its value. This movement clearly reflects a downward trajectory within a larger descending channel pattern, established by two parallel trendlines on the daily timeframe.

Conversely, a technical rebound could see SYRUP testing the 50-day Exponential Moving Average (EMA) at $0.3176 USD, before aiming for the 200-day EMA at $0.3666 USD — an area coinciding with the upper boundary of the price channel and serving as a key resistance level.

Daily SYRUP/USDT Chart | Source: TradingView

Technical signals suggest selling pressure is gradually weakening. The RSI currently hovers around 36, remaining above the oversold zone and sideways after a deep decline, implying that selling momentum is no longer overwhelming. Additionally, the MACD line is approaching the signal line as the histogram’s negative side narrows, increasing the likelihood of a bullish crossover — a potential short-term reversal indicator.

Daily SYRUP/USDT Chart | Source: TradingView

Technical signals suggest selling pressure is gradually weakening. The RSI currently hovers around 36, remaining above the oversold zone and sideways after a deep decline, implying that selling momentum is no longer overwhelming. Additionally, the MACD line is approaching the signal line as the histogram’s negative side narrows, increasing the likelihood of a bullish crossover — a potential short-term reversal indicator.

However, a negative scenario should still be considered. If SYRUP closes below the $0.2497 USD level, selling pressure could intensify, pushing the price down toward the S2 Pivot at $0.1937 USD.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

BTC 15-minute increase of 0.93%: macro liquidity and institutional buying dominate the short-term rebound

2026-02-13 15:00 to 15:15 (UTC), BTC recorded a +0.93% return within a 15-minute window, with the price ranging between $67,184 and $67,803, showing a clear short-term upward trend. During this period, trading volume slightly increased, market attention grew, and overall volatility remained at an average level, reflecting a warming of investors' risk appetite.

The main drivers of this movement are sustained loose macro liquidity and increased institutional buying. Influenced by expectations of a Federal Reserve rate cut, the expansion of global M2 has driven a stronger willingness to allocate risk assets. Meanwhile, the US Bitcoin E

GateNewsBot15m ago

glassnode: BTC options indicate increased market defensive sentiment and a rise in downside protection demand

Recently, Bitcoin has been consolidating between $65,000 and $73,000. The options market shows defensive characteristics, with open interest increasing, implied volatility rising, and market expectations of greater future price fluctuations. The skew of put options is increasing, but the market liquidity structure is gradually balancing.

GateNewsBot38m ago

BTC Tests Resistance After 1,800-Point Swing Gain

_Bitcoin nears $67K after a 1,800-point swing from $65.2K, testing key resistance as traders target a fourth straight win._

Bitcoin approached $67,000 after a strong upward move of 1,800 points from a recent entry near $65,200.

The advance placed the asset at a local resistance zone, where tra

LiveBTCNews44m ago

Peter Brandt says Bitcoin may not have bottomed out yet; the "true bottom" is unlikely to appear before October; market predictions are increasingly divided.

Renowned trader Peter Brandt warns that the Bitcoin market may not have bottomed out yet, expecting a bottom by October 2026. In the short term, it may fluctuate upward but could fall back to $50,000. Ethereum will fluctuate until dollar liquidity improves, with current declines exceeding 40%. Market forecasts indicate a 41% probability that Bitcoin will fall below $60,000 by the end of February.

GateNewsBot1h ago

MVRV Indicator Suggests BTC May Be Near a Market Low

Bitcoin's MVRV ratio is currently at 1.10, suggesting it is approaching undervaluation. Historically, dips below 1 indicate potential market bottoms, presenting buying opportunities for long-term investors amid ongoing price corrections.

BlockChainReporter1h ago

After the CPI release, the crypto market experienced minor short-term fluctuations, with Bitcoin rising slightly by 0.24%.

BlockBeats News, February 13 — After the CPI data was released, the cryptocurrency market experienced minimal short-term fluctuations, with Bitcoin rising slightly by 0.24%, currently priced at $67,535.

Meanwhile, the US Dollar Index DXY dropped nearly 20 points in the short term, now at 96.87. Non-USD currencies generally gained, with the EUR/USD rising over 20 points in the short term, and the GBP/USD rising over 30 points in the short term.

GateNewsBot1h ago

Monthly Revenue of Maple Finance | Source: Dune

Meanwhile, Maple Finance’s total assets under management (AUM) have exceeded $4 billion USD, with lending debt reaching $1.08 billion USD. The combination of stable revenue streams and expanding asset scale indicates that the protocol’s ecosystem is accelerating, benefiting from continuously rising market demand.

Monthly Revenue of Maple Finance | Source: Dune

Meanwhile, Maple Finance’s total assets under management (AUM) have exceeded $4 billion USD, with lending debt reaching $1.08 billion USD. The combination of stable revenue streams and expanding asset scale indicates that the protocol’s ecosystem is accelerating, benefiting from continuously rising market demand.

Spot Market Indicators for SYRUP | Source: CryptoQuant

Spot Market Indicators for SYRUP | Source: CryptoQuant