Bitcoin Slides to 15-Month Low — Is This Key Support Setting Up a Rebound?

Key Takeaways

-

Bitcoin has dropped into the $69K–$74.5K support zone for the first time in ~15 months.

-

BTC is down 23% over 30 days, cooling off from the $126K high.

-

BTC/GOLD continues to respect a long-term ascending triangle.

-

The 200-week MA (~21.81 on BTC/GOLD) remains the key momentum trigger.

-

Holding $69K keeps rebound chances alive; losing it risks deeper consolidation.

Bitcoin has entered a critical phase, sliding into a price zone that hasn’t been meaningfully tested in nearly 15 months. After weeks of steady selling pressure, BTC has dropped back into the $69,000–$74,500 support range—an area that previously acted as a strong base during March 2025.

BTC Weekly Chart/Coinsprobe (Source: Tradingview)

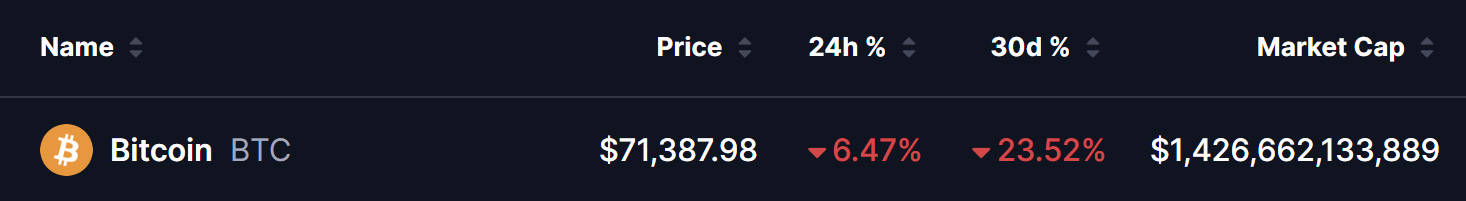

As of February 5, 2026, Bitcoin is trading near $71,387, down 6.47% in the last 24 hours. On a broader scale, BTC is now off more than 23% over the past 30 days, giving back a large portion of its explosive rally toward the $126K all-time high and pushing market sentiment firmly back into caution mode.

Source: Coinmarketcap

Still, from a technical perspective, Bitcoin is now sitting at a zone where rebounds have historically started.

Zooming out to the BTC/GOLD weekly chart, price action continues to respect a large ascending triangle structure—a pattern often associated with long-term trend reversals or bullish continuation.

This setup is defined by:

-

A rising trendline connecting higher lows all the way back to 2017

-

A horizontal resistance zone between 36.84 and 41.07, which has capped upside multiple times

During the recent gold-driven rotation, BTC/GOLD once again pulled back to test its long-term ascending support near 14.27—a level that has repeatedly acted as a major demand zone across multiple cycles.

BTC/XAU Weekly Chart/Coinsprobe (Source: Tradingview)

Rather than breaking down, price respected this trendline.

That’s an important detail.

It suggests the current move looks more like a rotation inside the triangle, not a structural failure of the long-term bullish setup.

200-Week Moving Average Remains the Key Pivot

At present, BTC/GOLD is trading below its 200-week moving average, sitting near 21.81. Historically, this level has acted as a momentum switch:

-

Below it → gold tends to outperform

-

Above it → Bitcoin usually takes the lead

A weekly or monthly reclaim of this moving average would be a strong signal that buyers are stepping back in and that Bitcoin may begin outperforming gold once again.

If that happens, momentum could accelerate quickly.

What’s Next for Bitcoin (BTC)?

Back on the BTC/USD weekly chart, price is now pressing directly into the $69K–$74.5K demand zone, while also interacting with the rising moving average.

If bulls manage to:

-

Hold this $69K–$74.5K support band, and

-

Stabilize price back above the weekly moving average,

Bitcoin could attempt a recovery toward:

-

$97,900 (first major resistance)

-

$126,200 (cycle high resistance)

This would mark a classic support defense → relief rally structure.

On the flip side, a clean weekly close below $69K would weaken the rebound thesis and open the door to deeper consolidation or another downside leg before any sustainable recovery.

Bottom Line

While traditional safe havens like gold are seeing sharp rotations, Bitcoin is quietly holding a major long-term support zone.

At the same time:

-

BTC/USD is testing a historical demand area

-

BTC/GOLD is respecting its ascending triangle

-

Momentum is stretched after a 23% monthly drawdown

This combination often precedes medium-term bounce attempts.

If support near $69K–$74.5K holds and BTC/GOLD reclaims its 200-week moving average, Bitcoin could be entering a phase where it begins to shine again—right as broader market fear peaks.

For now, BTC sits at a crossroads.

The next few weekly closes may decide whether this is just another correction… or the foundation for the next leg higher.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Bitcoin, Ether ETFs Rebound With Modest Friday Inflows

Bitcoin Is Down Bad, But Hasn't Yet Hit Its 'Ultimate Bear Market Bottom': Analysts