Could Brad Garlinghouse's participation in the CFTC conference change the direction of XRP?

In recent days, XRP’s price has struggled to recover, raising concerns about the possibility of repeating the prolonged bear market scenario from 2021 to 2022. However, a new development involving Ripple CEO Brad Garlinghouse could be a game-changer.

XRP May Not Follow Past Patterns

Brad Garlinghouse has joined the Advisory Committee on Innovation of the U.S. Commodity Futures Trading Commission (CFTC). This is a significant milestone not only for Ripple but for the entire XRP ecosystem. This is especially meaningful as the legal environment that previously posed challenges for Ripple over the past five years is now seeking input from industry stakeholders.

For the XRP community, this move signals positive progress, indicating a normalization of regulatory processes. Collaborating with the CFTC could enhance Ripple’s credibility in U.S. policy discussions. Constructive dialogue with this regulatory agency may reduce uncertainties and alleviate some of the long-standing legal barriers that have weighed on XRP’s value.

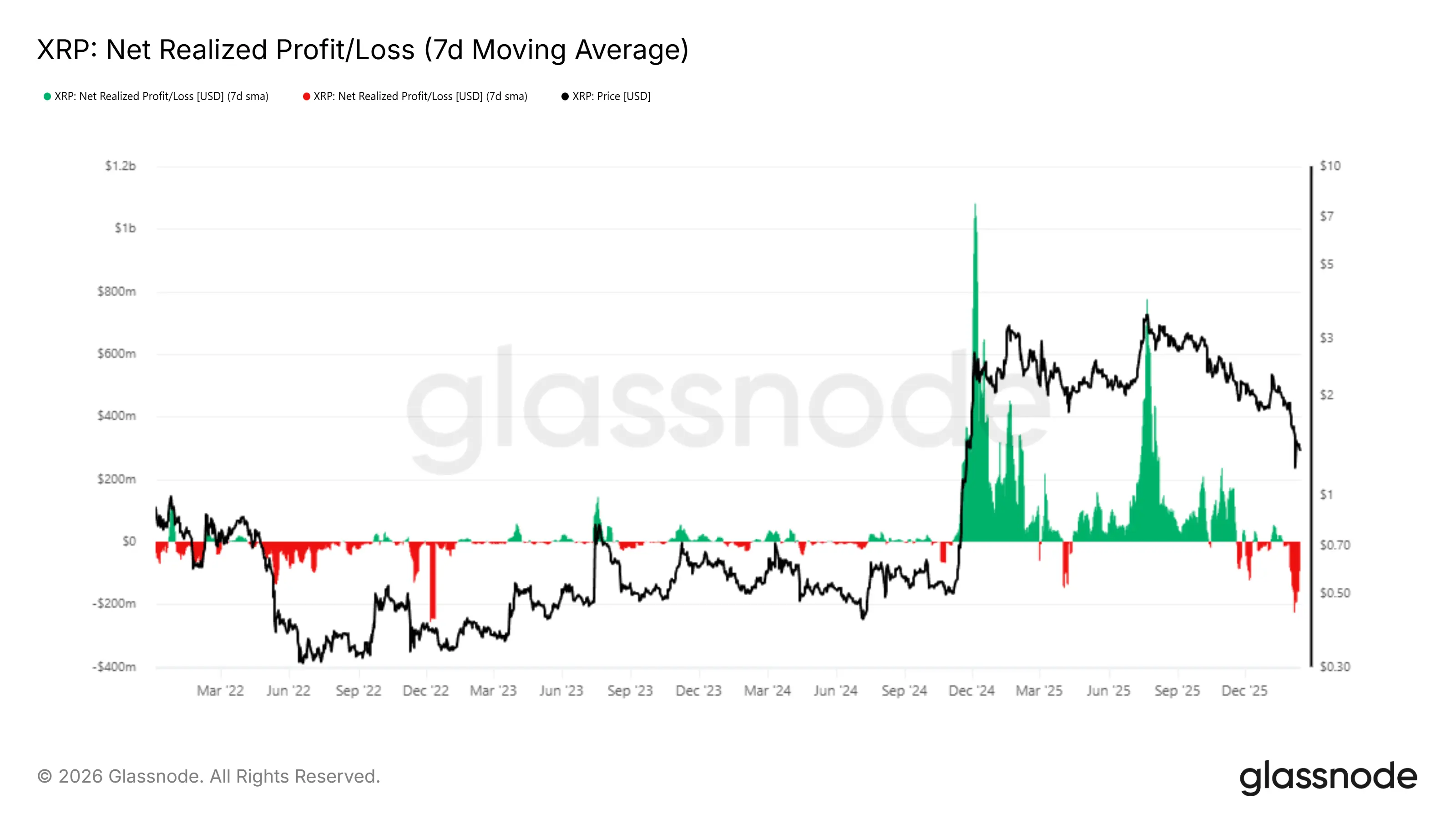

Realized Profit/Loss of XRP | Source: Glassnode

Although recent data on profits and losses show an increase in selling activity, some analysts have compared this situation to early signals before the 2022 bear market. However, it’s important to note that in 2022, selling pressure lasted nearly four months, whereas the current sell-off shows no signs of such duration or intensity. This reduces the likelihood of a prolonged downturn for XRP.

Realized Profit/Loss of XRP | Source: Glassnode

Although recent data on profits and losses show an increase in selling activity, some analysts have compared this situation to early signals before the 2022 bear market. However, it’s important to note that in 2022, selling pressure lasted nearly four months, whereas the current sell-off shows no signs of such duration or intensity. This reduces the likelihood of a prolonged downturn for XRP.

Selling Pressure Persists but Is Not Worrisome

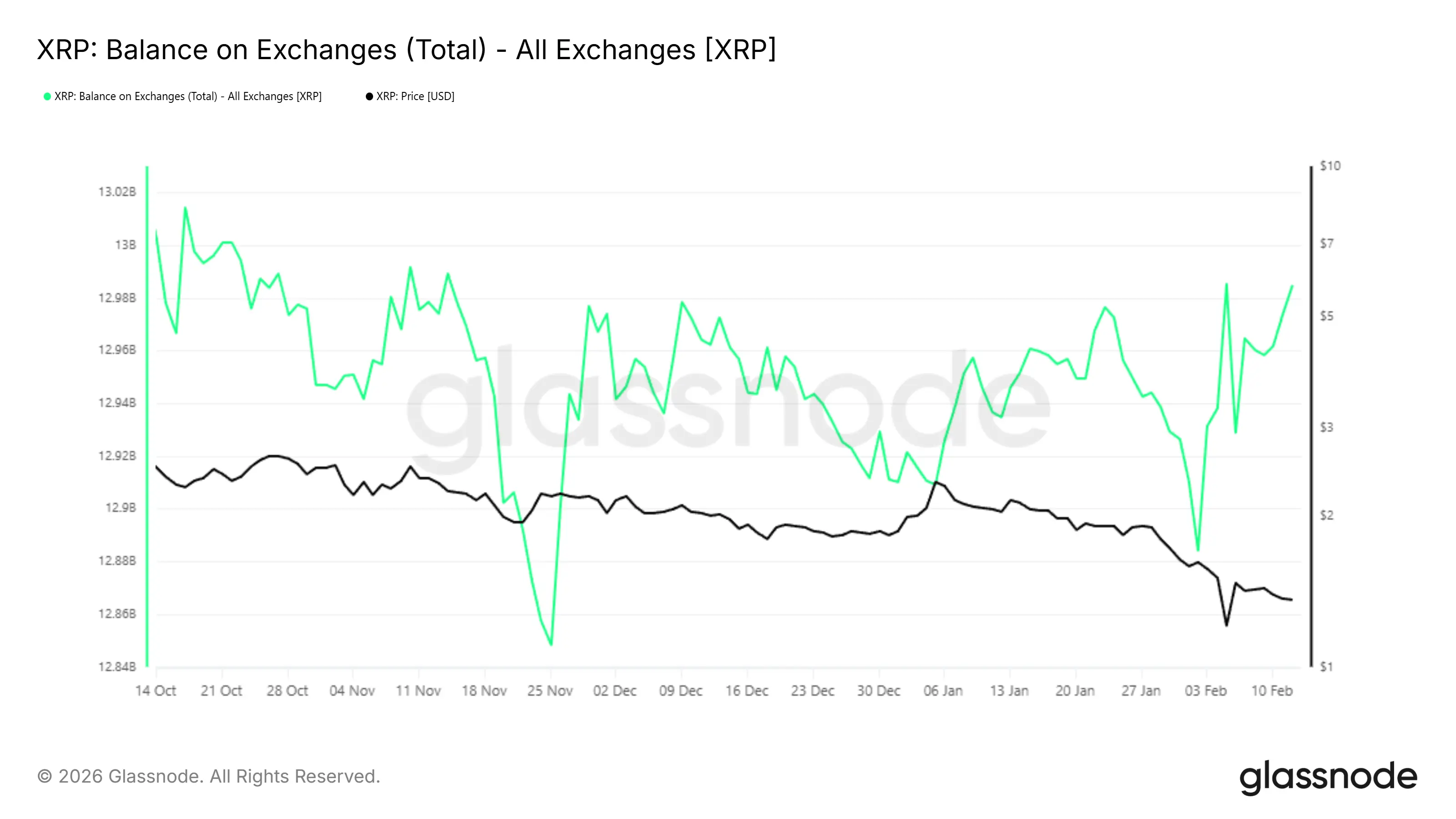

Data from exchanges indicate that current selling pressure remains moderate. Over the past 10 days, approximately 100 million XRP have been transferred to exchanges, worth about $130 million. While this is a notable figure, it’s not enough to trigger widespread panic.

By comparison, in November 2025, 130 million XRP were sold off within just 72 hours, reflecting a much more panic-driven sentiment. Compared to that event, current transactions appear more controlled and less urgent.

XRP Balance on Exchanges | Source: Glassnode

The combination of moderate selling pressure and positive legal developments could help stabilize market sentiment. If the selling rate does not spike significantly, the market may absorb the supply without experiencing a severe price decline. Investors are closely monitoring on-chain indicators for confirmation signals.

XRP Balance on Exchanges | Source: Glassnode

The combination of moderate selling pressure and positive legal developments could help stabilize market sentiment. If the selling rate does not spike significantly, the market may absorb the supply without experiencing a severe price decline. Investors are closely monitoring on-chain indicators for confirmation signals.

XRP Still Has Recovery Potential

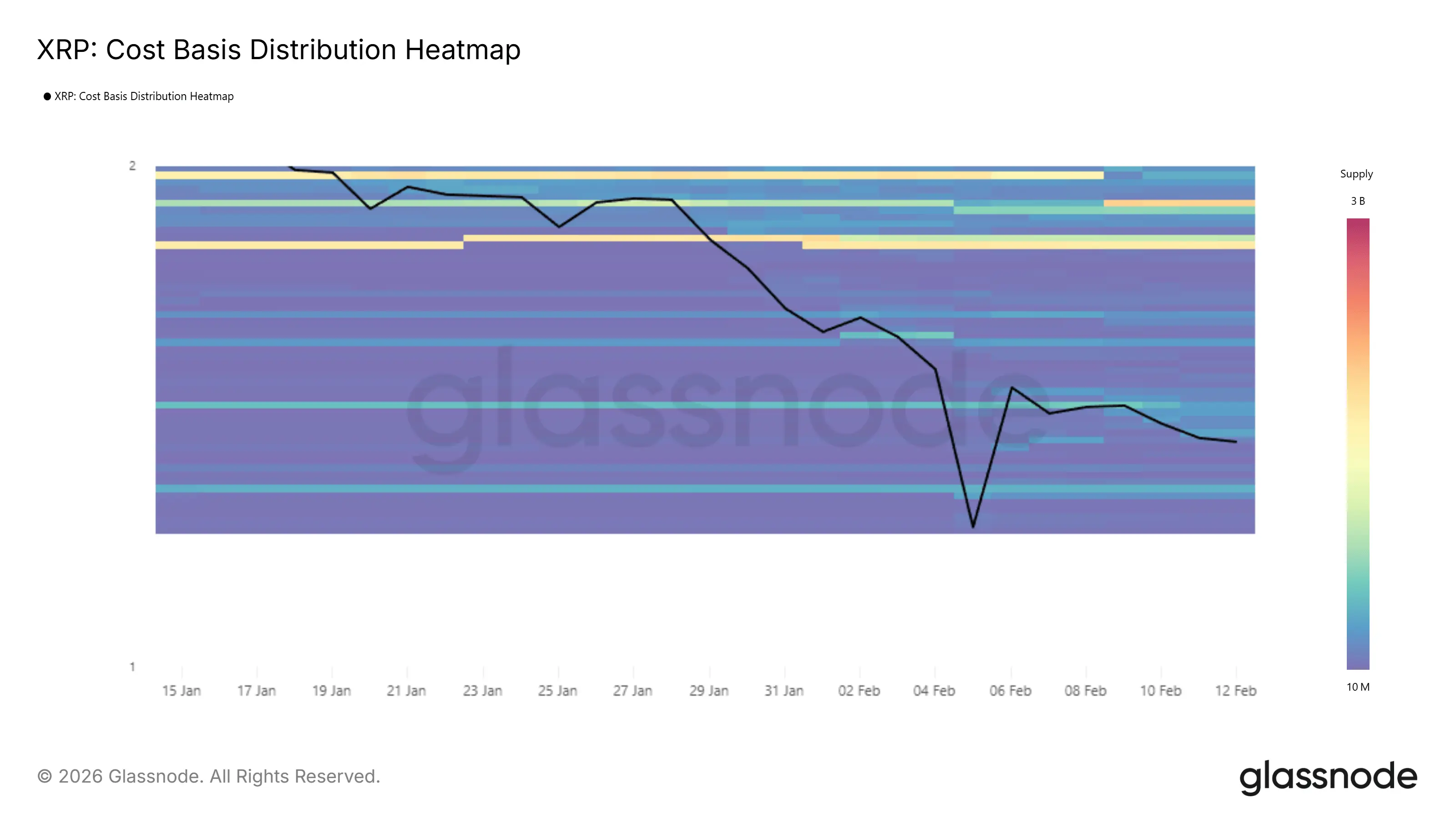

The liquidation heatmap currently shows few major obstacles to XRP’s recovery. The next key resistance zone lies between $1.78 and $1.80, considered a potential profit-taking area rather than a strong barrier.

The absence of dense liquidation clusters below the current price also reduces the risk of short-term cascading sell-offs. If bullish momentum improves, XRP could advance further before encountering significant supply from above. This flexible technical structure offers a positive outlook, though caution remains warranted.

XRP CBD Heatmap | Source: Glassnode

XRP CBD Heatmap | Source: Glassnode

XRP Price Must Recover to Maintain Uptrend

Currently, XRP is trading at $1.35 and trending below the critical support level of $1.36. The next support is identified at $1.27, corresponding to the 23.6% Fibonacci retracement. Although XRP faces downward pressure, macro factors suggest that risks are balanced.

Garlinghouse’s appointment to the CFTC Advisory Committee could boost investor confidence. If XRP can reclaim the $1.51 level, a strong recovery may develop. Maintaining strength above this level could push the price toward the $1.76 supply zone.

XRP Price Analysis | Source: TradingView

However, if the price breaks below $1.27, the market trend could turn negative. A breach of this support level would likely trigger panic selling, potentially driving the price down to $1.11, invalidating the bullish scenario and prolonging the current correction phase.

XRP Price Analysis | Source: TradingView

However, if the price breaks below $1.27, the market trend could turn negative. A breach of this support level would likely trigger panic selling, potentially driving the price down to $1.11, invalidating the bullish scenario and prolonging the current correction phase.

Despite current downward pressure, Garlinghouse’s involvement with the CFTC could usher in a more positive chapter for Ripple and the XRP ecosystem. To sustain recovery prospects, XRP needs to quickly regain key price levels and rebuild investor confidence.

Related Articles

XRP ETFs See Lowest Weekly Inflow Since Launch - U.Today

Fed Flags XRP as Core Asset in New Crypto Risk Framework

Analyst Who Correctly Projected XRP Run to $2.47 Shares Next Target to Watch

18 Months Ago They Said XRP Wouldn’t Hit $1 – Now $10 Is Next: Analyst

Cryptocurrency Market Rebounds Amid U.S. Government Shutdown: Bitcoin, Ethereum, XRP, and Solana Rise Simultaneously

European Compliance Channel Opens: XRP Accelerates Coverage of the EU Market After Scandinavia