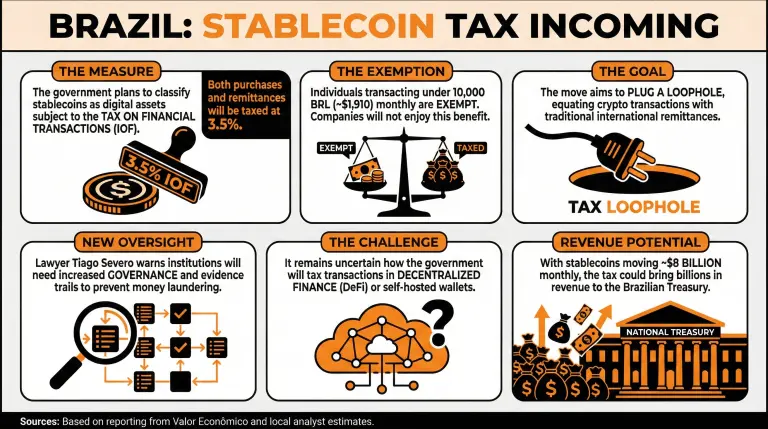

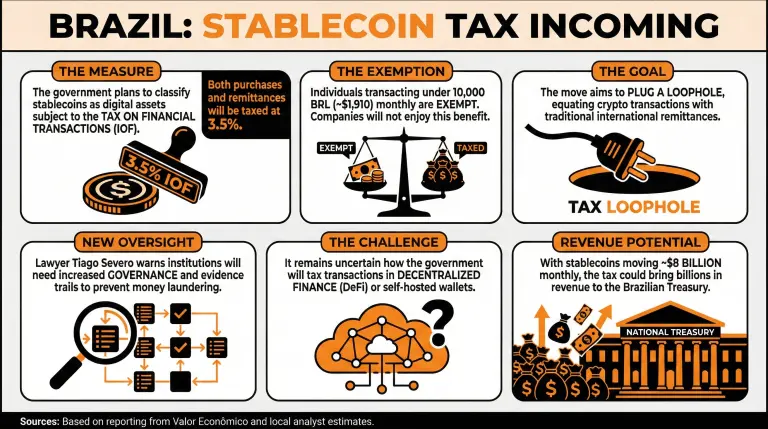

The measure, described last week, would be submitted by Brazil’s Revenue Service for public consultation and would impose a 3.5% tax on both stablecoin purchases and remittances, treating them as foreign currency exchanges subject to the existing Tax on Financial Transactions (IOF).

Brazil Prepares For Issuing Decree Taxing Stablecoin Purchases and Remittances

The Brazilian crypto industry is on the verge of changing due to a new tax measure expected to be presented in the next few days.

According to Valor Econômico, the Brazilian government is preparing to close what many considered a gray area by classifying stablecoins as digital assets subject to taxation (IOF). The proposal will come from the Federal Revenue Service (Receita Federal), which will specify that both stablecoin purchases and remittances will be taxed with 3.5% on their operations.

Nonetheless, individuals will be exempt from paying this percentage if they don’t transact over 10,000 Brazilian reais (nearly $1,910) monthly. Companies leveraging stablecoins will not enjoy this benefit.

This move would equate cryptocurrency transactions and traditional remittances, plugging a loophole that allowed both individuals and companies to sidestep taxation in these operations.

Local analysts explain that the proposal will also include a new level of oversight on institutions handling stablecoins. Tiago Severo, a crypto-specialized lawyer, highlighted that anyone who operates crypto for payments or international remittances “will need to raise governance, evidence trails, and controls to prevent money laundering to a level closer to the regulated exchange rate.”

Nonetheless, the measure is expected to face significant opposition from the crypto industry, as it will surely affect their operations as customers abandon these local businesses for decentralized finance alternatives.

It is uncertain how or even if the government plans to apply this tax to transactions outside the centralized exchange sector, as Brazilians will also be able to manage stablecoins through decentralized finance options and move them using self-hosted wallets.

According to estimates, if applied, the tax would bring billions in revenue to the Brazilian Treasury, as stablecoins move up to $8 billion each month in the country.

FAQ

- What significant tax measure is Brazil expected to introduce for the crypto industry?

The Brazilian government plans to classify stablecoins as digital assets, subjecting them to a 3.5% Tax on Financial Transactions (IOF).

- How will this tax affect individual and corporate stablecoin transactions?

Individuals will be exempt from the tax if their transactions do not exceed 10,000 Brazilian reais monthly, while companies will not receive this exemption.

- What additional regulations are expected alongside this tax proposal?

The proposal will introduce increased oversight on institutions handling stablecoins, requiring enhanced governance and control measures to combat money laundering.

- What impact is this measure predicted to have on the Brazilian crypto industry?

Local analysts anticipate significant opposition from the crypto sector, as this tax may drive customers to decentralized finance alternatives and impact local business operations.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Ripple CEO Praises CFTC’s New “Olympics” Crypto Committee

CFTC named a 35-member Innovation Advisory Committee, including CEOs from Ripple, Coinbase, Uniswap, Solana Labs, and Chainlink Labs.

The committee also includes leaders from CME, Nasdaq, ICE, DTCC, DraftKings, FanDuel, and Polymarket, per the CFTC roster.

Ripple CEO Brad Garlinghouse has

CryptoNewsFlash2h ago

Cryptocurrency Market Rebounds Amid U.S. Government Shutdown: Bitcoin, Ethereum, XRP, and Solana Rise Simultaneously

February 14 News, the United States experienced a partial government shutdown due to the failure to pass the budget on time. However, against the backdrop of increasing political uncertainty, the cryptocurrency market defied the trend and rose. Mainstream assets such as Bitcoin, Ethereum, XRP, and Solana showed significant rebounds, driving the overall market capitalization to recover.

Market data shows that in the past 24 hours, the total market value of cryptocurrencies increased by nearly 5%, reaching approximately $2.38 trillion. The previous weeks of volatility and decline had kept many investors on the sidelines, but this round of rebound has injected new activity into the market. Although some analyses had predicted that the shutdown would increase selling pressure, the actual trend has contrasted with those expectations.

GateNewsBot7h ago

The Central Bank of Russia plans to study tying the ruble to stablecoins, seeking new payment tools to circumvent sanctions

February 14 News, the Central Bank of Russia recently announced that it will conduct in-depth research on the feasibility of pegging stablecoins to the ruble and assess their risks and potential benefits. On February 12, Vladimir Chistyukhin, First Deputy Governor of the Central Bank of Russia, revealed at the Alpha Dialogue Conference in Moscow that the research plan aims to explore how stablecoins can better integrate into Russia's financial system. This move comes at a critical moment when Russia, facing Western sanctions and global banking access restrictions, is seeking new payment tools.

For years, the Central Bank of Russia has opposed stablecoins, especially those pegged to fiat currencies, believing they could pose financial stability and regulatory risks. However, as cryptocurrencies gradually enter the international settlement space and the digital ruble project is launched, the stance of the Central Bank of Russia has changed. Previously, Russia allowed cryptocurrencies for some international settlements, and the digital ruble has entered the pilot phase. It is expected that stablecoins will be fully launched by the end of 2026.

GateNewsBot9h ago

Solana founder joins CFTC's core think tank, bringing a technical perspective to U.S. crypto policy

February 14 News, the U.S. cryptocurrency regulatory system is accelerating the integration of industry-leading technical talent. Anatoly Yakovenko, the founder of the high-speed blockchain Solana, was recently selected for the newly established Innovation Advisory Committee of the U.S. Commodity Futures Trading Commission (CFTC), becoming one of the few blockchain protocol designers directly involved in federal policy discussions. This appointment indicates that U.S. regulators are shifting from an “external review” approach to a new path of “collaborating with developers to set rules.”

The Innovation Advisory Committee is composed of 35 members, focusing on cutting-edge issues in blockchain infrastructure, artificial intelligence, and digital asset markets, and providing regulatory agencies with advice on technology and market trends. The committee is led by Michael S. Selig, with the goal of helping the U.S. market adapt more efficiently to the rapidly evolving fintech environment. Yakovenko’s practical experience in low-latency, high-throughput network architecture is seen as offering a realistic perspective for derivatives settlement, on-chain transparency, and system stability assessment.

GateNewsBot10h ago

For professional investors only! Hong Kong opens up crypto asset-backed financing and perpetual contracts

The Hong Kong Securities and Futures Commission has opened up virtual asset margin financing and perpetual contracts, limited to professional investors to enhance market liquidity and risk management. Measures include allowing Bitcoin and Ethereum as collateral, while establishing transparent design and information disclosure principles to assist investors in risk management. Affiliates can act as market makers to further increase liquidity.

CryptoCity14h ago

State Council: Fully introduce blockchain and other technologies to conduct end-to-end certification for green electricity production and related processes

ChainCatcher News, the General Office of the State Council issued the Implementation Opinions on Improving the National Unified Electricity Market System, which points out to improve the functions of the electricity market, accelerate the establishment of a green electricity consumption certification mechanism, and fully introduce technologies such as blockchain to conduct full-chain certification for green electricity production, consumption, and other links.

GateNewsBot15h ago