Uniswap Token (UNI) continues to break out along with the overall recovery of the cryptocurrency market, trading around $3.44 at the time of writing on Saturday. The 7% daily increase of this decentralized exchange (DEX) token indicates a clear improvement in investor sentiment following the release of the January Consumer Price Index (CPI) report by the Bureau of Labor Statistics.

Specifically, the January CPI rose only 0.2% month-over-month (MoM)—lower than the forecast of 0.3%, while the 2.4% increase year-over-year (YoY) was also below the market expectation of 2.5%. Core CPI, which excludes volatile components such as food and energy, recorded a 2.5% YoY increase, in line with expectations.

These signals of easing inflation have injected positive momentum into risk assets, including cryptocurrencies. In this context, investors are increasingly confident that the Federal Reserve may implement at least two interest rate cuts in 2026, further supporting the market’s upward trend.

Uniswap Gains Momentum Amid Cautious Retail Investors

Market interest in Uniswap has surged this week, fueled by a notable move from BlackRock when they launched a tokenized US Treasury bond product—BUILD fund—on Uniswap’s DEX platform.

According to Robert Mitchnick, Head of Global Digital Assets at BlackRock, integrating BUIDL into UniswapX “marks a significant step forward in the interoperability between tokenized USD yield funds and the stablecoin ecosystem.”

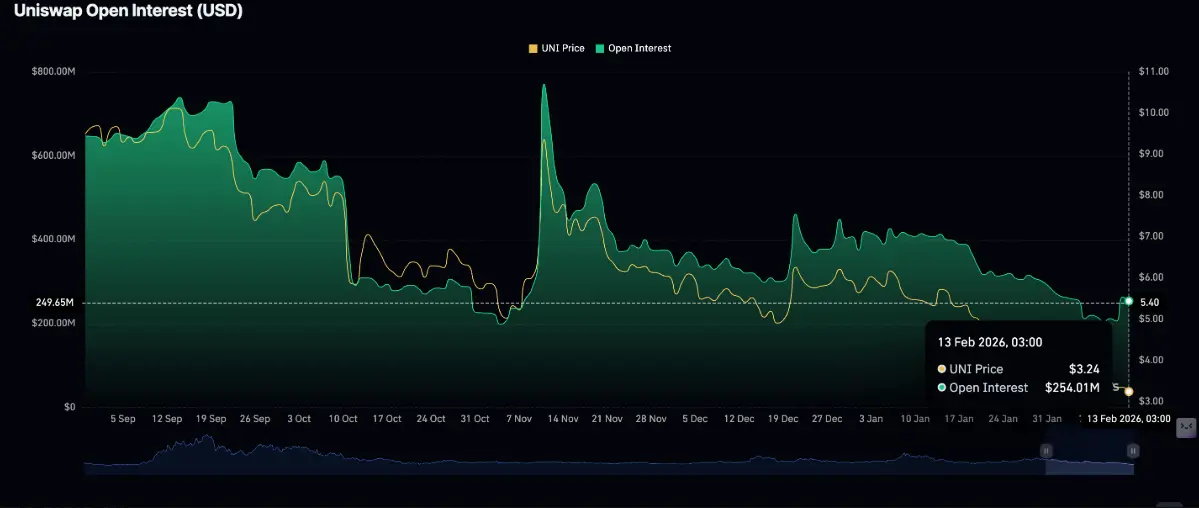

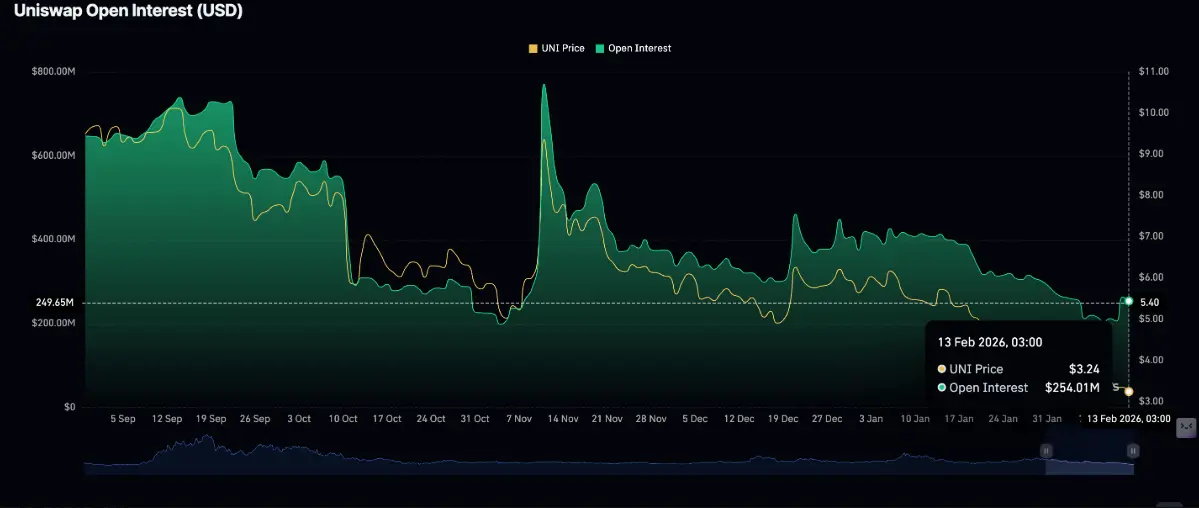

Beyond technological collaboration, BlackRock has quietly purchased an undisclosed amount of UNI tokens, fueling bullish sentiment in the market. As a result, derivatives activity has spiked, with open interest (OI) in UNI futures reaching a peak of $263 million on Tuesday before cooling to $253 million on Friday. The decline in OI indicates that investors remain cautious and have not fully committed to believing that UNI can sustain its short-term upward momentum.

Open Futures Contract Volume on Uniswap | Source: CoinGlass

Open Futures Contract Volume on Uniswap | Source: CoinGlass

Technical Outlook: Short-term Prospects for UNI

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

BlackRock "bets" on UNI: Breaking down the business logic of its partnership with Uniswap

BlackRock deploys a $2.2 billion tokenized government bond fund BUIDL on UniswapX for on-chain trading, marking its first direct exposure to DeFi governance tokens and signifying traditional financial institutions entering the decentralized finance space. This move not only enhances capital liquidity and improves settlement efficiency but also indicates BlackRock's intention to strengthen its influence in DeFi by purchasing UNI tokens, deepening collaboration with Uniswap, and promoting compliance standards, demonstrating the transformation of DeFi into infrastructure finance.

区块客5h ago

Uniswap Price News: UNI surges 40% in two hours then pulls back, BUIDL integration and ETF news fail to ease selling pressure

February 14 News, Uniswap's token UNI experienced a short-term surge after Securitize announced the integration of BlackRock's tokenized treasury product BUIDL into its protocol, while Bitwise's submitted spot ETF application also ignited market sentiment. After the announcement, UNI temporarily surged over 40% within two hours but then quickly retreated, showing clear signs of "profit-taking."

From a capital structure perspective, the surge in volume and price increase consumed bullish momentum, with bears concentrated on selling at high levels. As the price retreated, long positions were passively closed, and open interest decreased accordingly, indicating a lack of sustained buying support for the rally. Technically, UNI once again broke below the key moving average resistance at $4.2, with short-term momentum significantly weakening.

GateNewsBot9h ago

BlackRock "bets" on UNI: Breaking down the business logic of its partnership with Uniswap

BlackRock announced that it has deployed its $2.2 billion tokenized government bond fund BUIDL onto the UniswapX protocol and purchased an undisclosed amount of UNI tokens. This marks Wall Street's first foray into DeFi, enabling compliant institutional participation. The integration of BUIDL enhances asset liquidity and provides institutional investors with a gas-free trading environment. At the same time, the value of UNI tokens has increased due to the introduced fee-sharing mechanism, making it a productive asset. BlackRock's involvement indicates that DeFi is entering the infrastructure finance stage.

区块客02-13 12:20

BlackRock Brings $2.1B Tokenized Treasury Fund to Uniswap for DeFi

BlackRock has taken a significant step into the world of decentralized finance (DeFi) by bringing its $2.1 billion tokenized Treasury fund to Uniswap. This move marks the asset management giant’s first formal engagement with DeFi and offers institutions new avenues for on-chain investment. The

CryptoBreaking02-13 07:25

The "Shanzhai Air Force Leader" shorted over 20 tokens with a monthly profit of 6.7 million, continuing to take profits on PUMP and UNI short positions today.

According to Hyperinsight monitoring, the "Shanzhai Air Force Head" address reduced its PUMP short positions by approximately $1,302,800 on February 13. It currently holds $1,687,500 in short positions, with unrealized gains of $757,300 and a return rate of 448.76%. At the same time, this address took partial profits on UNI short positions. Additionally, the whale increased its LIT short positions, currently holding about $4,170,000, with unrealized gains of $3,280,000.

GateNewsBot02-13 07:16

BlackRock partners with Uniswap! Opens tokenized fund BUIDL for on-chain trading, UNI surges 20% at one point

BlackRock partners with Uniswap and Securitize to open up on-chain trading for its tokenized U.S. Treasury bond fund "BUIDL," marking the fund's first entry into DeFi and attracting market attention. UniswapX technology will support trading, with BUIDL asset management reaching $2.4 billion, making it a leading institutional-grade tokenized fund. This move caused the UNI token to surge over 20%.

CryptoCity02-13 04:06

Open Futures Contract Volume on Uniswap | Source: CoinGlass

Open Futures Contract Volume on Uniswap | Source: CoinGlass