Bitcoin ETF Outflows Signal Liquidity Squeeze as Risk-Off Sentiment Deepens

ETF outflows remove key liquidity support, increasing Bitcoin’s vulnerability to selling pressure.

Bitcoin opened the year under clear pressure as demand from investment products weakened sharply. As per onchain reports, capital that fueled much of the last two rallies is now retreating. And this drop, coupled with growing macro and geopolitical uncertainty, has triggered cautious sentiment.

Bitcoin Liquidity Contracts as ETF Momentum Reverses

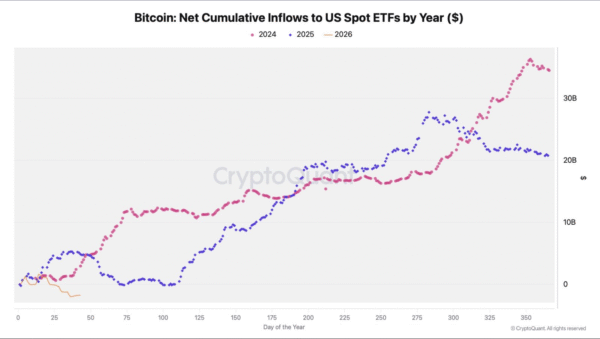

According to an analysis shared by Darkfost, cumulative spot Bitcoin ETF flows flipped to negative within weeks. Compared with previous years, BTC investment vehicles began 2026 with substantial investment losses.

The case was different in 2024 as cumulative inflows climbed throughout the year. More so, momentum accelerated in the final quarter, pushing BTC-tied funds to close above $30 billion. Liquidity flowed into the sector as demand for these products remained strong. Capital absorption helped support the OG coin’s price.

Momentum carried into the first half of last year, during which cumulative inflows peaked near the $27–28 billion range. Similar to the previous year, liquidity remained high, as the products continued to absorb supply from the spot market.

_Image Source: _X/Darkfost

However, these products showed early signs of fatigue towards the end of last year. As per data, cumulative inflows dropped from a peak of $27 billion to near $20 billion by year-end. Flow data flattened before trending lower in the second half. Unfortunately, the spotted weakness towards the end of last year now appears to be extending into 2026.

Current outflows remove a key marginal buyer from the market. Without steady ETF demand, spot liquidity tightens. Price action becomes more sensitive to selling pressure. Short-term volatility tends to rise under such conditions.

Liquidity Tightens as Crypto Funds Struggle to Regain Demand

Investors seem to be reassessing risk exposure, given that global uncertainty has triggered a risk-off outlook. Typically, reduced appetite for risk assets is first observed in crypto markets. In fact, flow data shows that many traders are staying out of the market for now.

The contrast between 2024–2025 and early 2026 remains stark. Prior years showed steady capital accumulation and expanding liquidity. The current year shows contraction and capital withdrawal. Market structure looks more fragile as a result.

Stable ETF flows could improve sentiment. Rising cumulative inflows would signal that demand is returning. In addition, steady buying may help absorb supply again. Until that happens, tight liquidity may continue to exert downward pressure on Bitcoin.

Darkfost’s analysis frames the current weakness as part of a broader slowdown rather than a sudden break. Last year’s waning momentum has now been confirmed in the current market atmosphere. For now, the appetite for crypto-tied investment funds remains a key variable to watch.

Related Articles

Monero Price Surges 3%, Outperforms Bitcoin Amid Market Decline

Data: 149.19 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

South Korean Police Lose 22 Bitcoin From Cold Wallet in Gangnam Evidence Case

Altcoins Set to Surge: 5 Coins with +18 Potential as $OTH/BTC Bullish MACD Signals Return