Market panic shifts to ETFs: BlackRock's IBIT options volume explodes

Bitcoin’s sharp decline toward the $60,000 mark, accompanied by familiar volatility on trading platforms, reveals that the true scale of panic is most evident elsewhere: in the options market linked to the BlackRock iShares Bitcoin Trust (IBIT) ETF. In a single trading session, IBIT options volume reached approximately 2.33 million contracts — a record high — precisely at the time of the most intense price swings.

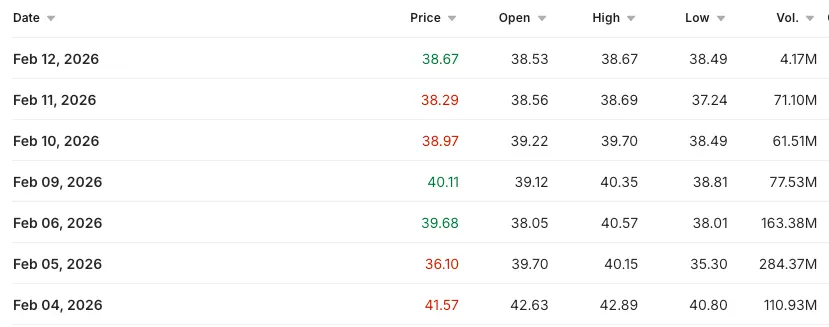

On the same day, IBIT itself also experienced a surge in liquidity, with over 284 million shares traded, equivalent to a nominal value exceeding $10 billion. This indicates that pressure and risk rebalancing activities are not only happening on crypto exchanges but are also spreading strongly into regulated products listed in the U.S.

Volatility not only damages exchanges but also triggers demand for hedging and restructuring positions through regulated derivatives. Instead of using offshore perpetual swaps, many investors are choosing ETF options to express bearish views, trade volatility, and establish protective hedges against deep declines.

The surge in derivatives activity is significant because it shifts the market’s real-time signals of stress. Throughout Bitcoin’s history, pressure has often manifested most quickly in offshore leveraged markets, especially perpetual contracts — where liquidations and funding can turn a dip into a chain of cascading sell-offs.

Perpetual contracts remain important, but this time, a different “layer” appears to be serving as a pressure gauge: ETF options. These contracts trade on U.S. exchanges, cleared through U.S. infrastructure, and are easily accessible to large institutional capital flows.

This timing also explains the sharp increase in demand for options. Bitcoin bottomed out around $60,017.60 on February 6 and then rebounded above $70,000 — a powerful reversal in a short period. Such volatility creates ideal conditions for options: high uncertainty, price gap risks, and the need to predefine maximum losses.

When prices can fluctuate thousands of dollars within minutes, traders with existing positions often want to buy insurance against worse scenarios the next day — and options are the fastest, most direct, and effective tool for doing so.

The record options volume also fuels speculation about the possibility of a large “unwind” following the volatility. However, more important than hypotheses is the actual market behavior. During tense periods, the ETF options chain reveals fingerprints of different participant groups, as each trading motive leaves distinct patterns.

The most obvious group is trend-following investors. Portfolios holding Bitcoin via spot, ETFs, or IBIT as an internally approved investment structure can quickly hedge by buying put options. Puts act as insurance: paying upfront premiums and offsetting losses if prices fall below the strike — suitable for investment committees seeking risk reduction without reversing entire strategies.

*The chart shows IBIT options trading volume from February 4 to 12, 2026 (Source: Investing.com)*Additionally, volatility traders — those who see large price moves as “products” to trade — are active. When markets fall sharply, implied volatility often spikes due to increased demand for hedging. Buying options before volatility is priced high or selling when premiums are expensive allows traders to profit from sudden drops without long-term Bitcoin exposure. These strategies often involve complex spreads, better suited for regulated markets with efficient risk offset mechanisms.

*The chart shows IBIT options trading volume from February 4 to 12, 2026 (Source: Investing.com)*Additionally, volatility traders — those who see large price moves as “products” to trade — are active. When markets fall sharply, implied volatility often spikes due to increased demand for hedging. Buying options before volatility is priced high or selling when premiums are expensive allows traders to profit from sudden drops without long-term Bitcoin exposure. These strategies often involve complex spreads, better suited for regulated markets with efficient risk offset mechanisms.

The third group involves basis and relative-value strategies — structures increasingly making crypto markets resemble traditional interest rate and equity index markets. These trades often pair instruments: long spot and short futures, or long ETFs and short futures on CME, aiming to capture carry spreads. When volatility rises and margin requirements jump, these structures come under pressure. Options then serve as temporary hedges while large positions are gradually unwound.

Data on volume indicates that IBIT and its options chain are becoming “risk repositories.” A day with ETF turnover exceeding $10 billion amid a deep market decline may signal capitulation, but it can also reflect two-way trading: sellers exiting positions, others entering, with market makers acting as intermediaries.

When options volume hits 2.33 million contracts, it shows many participants are not only selling spot in panic but also restructuring exposures, adding hedges, and trading volatility — fulfilling the role of a large-scale options market.

There are three main interpretations for such a record options session — and they can coexist. First is pure hedging demand: prices break down, ETFs have liquidity, and portfolios buy puts to lock in risk margins. Second is forced repositioning elsewhere, using options as a temporary stabilizing bridge. Third is volatility and convexity speculation — strategies exploiting the nonlinear profit potential of options, which, if overly crowded, can amplify swings as dealers hedge against price movements.

The IBIT options volume data from Investing.com shows peak stress clearly on February 6, then gradually easing. ETF capital flow data from Farside Investors also reveals an interesting paradox: net capital continued to flow into ETFs on days of heavy selling — indicating that exposure buying and insurance purchasing can occur simultaneously.

A notable shift is that volatility is increasingly “manifesting onshore.” Offshore perpetual contracts still trigger liquidation cascades, but the active centers of institutional activity are expanding into ETFs, ETF options, and U.S.-listed futures. This links Bitcoin price shocks to U.S. market-making and options hedging mechanisms, making dealer hedging flows part of daily movements.

This reality also indicates a structural change: previously, Bitcoin’s main activity was outside traditional finance and only later reflected back in. Now, large institutional reactions can directly appear within BlackRock’s products, during U.S. trading hours, through options — tools designed for hedging and volatility trading.

In future volatility episodes, monitoring IBIT options volume and trading structure will become an important early indicator: it reveals how fear is priced, tail risk hedging demand, and which market participants are actively engaged.

Vương Tiễn