Helium Hotspots and Network Activity Fuel HNT Price Rally

- Helium’s HNT has gained 90% in the past week to hit a one-month high as daily trading volume surged past $20 million for the first time this year.

- Data shows that social engagements have almost doubled in that time as the crypto market’s interest in DePIN continues to rise.

The crypto market started the new week on a dip, with most tokens recording over 4% in price drops, as we reported. However, Helium is bucking the trend and over the past seven days, its token, HNT, has shot up nearly 90%, with its other network metrics also recording significant rises. HNT trades at** $1.55** at press time, an 89% rise in the past seven days. In the past 24 hours, it has gained 33% to push its market cap to $285.6 million. Trading volume has also more than doubled in that time to hit $28.43 million. In the past month, no other crypto in the top 200 has recorded higher gains. Helium’s rise goes beyond the price charts. According to LunarCrush, its social engagements are up 85% over the past week as decentralized physical infrastructure networks, better known as DePIN, takes center stage in the crypto circles.

Helium social engagements are up 85.03% while $HNT price has jumped 59.1% over last week.

What’s everyone talking about? DePIN network growth. Helium’s network is experiencing significant growth in active hotspots and data transfer, indicating real-world usage and infrastructure… pic.twitter.com/hTt9SR9xbO

— LunarCrush (@LunarCrush) February 16, 2026

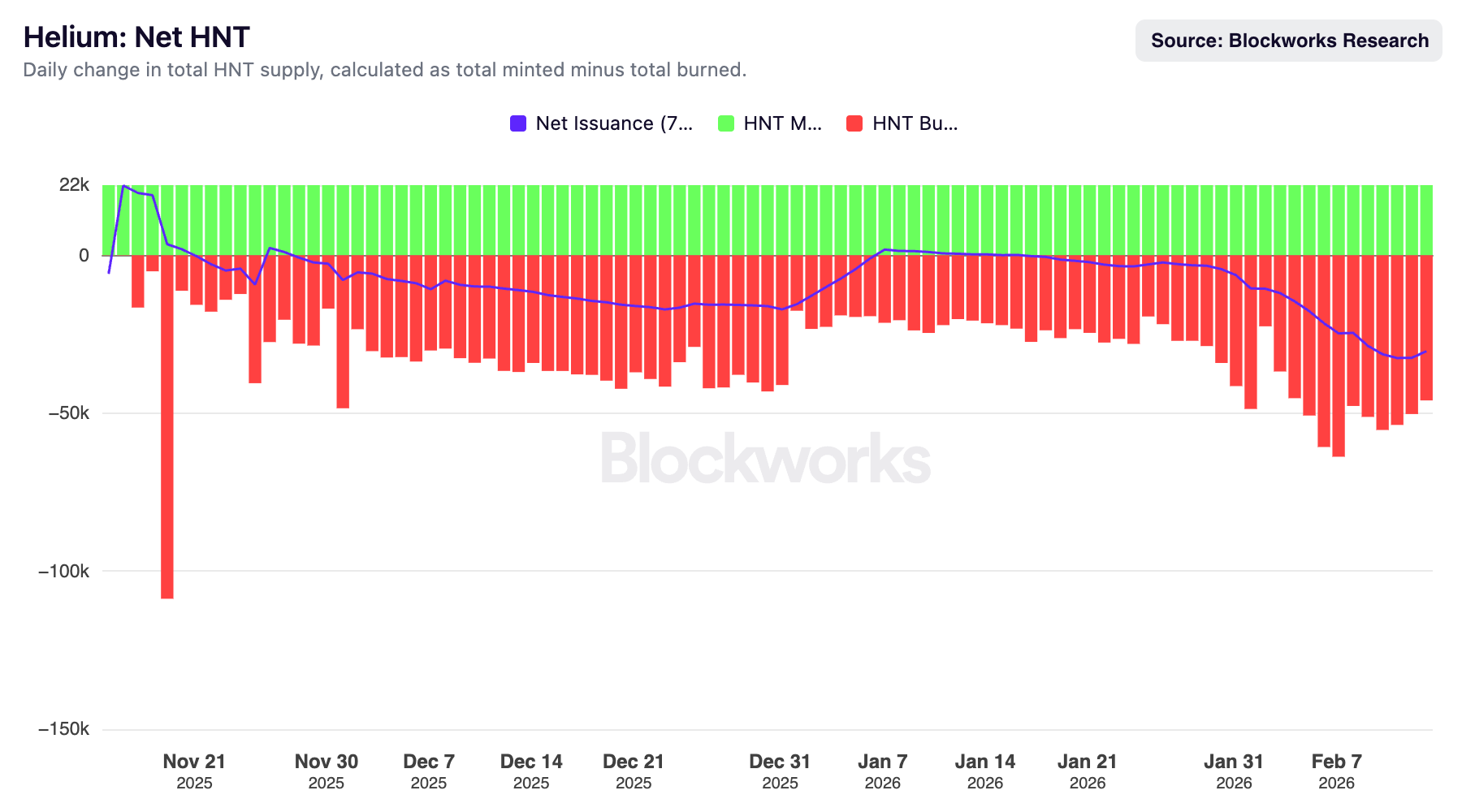

Amir Haleem, one of the founders of Nova Labs, the company behind Helium, further revealed that the project has become of the most deflationary in crypto, burning more HNT tokens than it produces daily. According to data from Blockworks, the project has been burning more than it mints since November last year, with a few days as exemptions. On February 14, it minted just over 22,000 HNT tokens, but burned 46,000.

Source: Blockworks

As we previously reported, Helium partnered with AT&T last year to boost mobile connectivity with over 90,000 decentralized wireless hotspots. Helium’s Rise as DePIN Explodes Helium’s recent momentum comes at a time when decentralized physical infrastructure networks (DePIN) is receiving rising interest in the crypto sector. The current DePIN market cap stands at $8.5 billion, with Bittensor, Render, Filecoin and The Graph among the biggest projects. DePIN decentralizes the ownership and operation of infrastructure like telecom towers and cloud servers, allowing anybody to contribute and earn revenue, rather than relying on a few centralized players. With Helium, users install wireless hotspots in their homes and provide the connection to other users, with a focus on low-powered IoT (LoRAWAN), to earn HNT rewards. The network expanded support to 5G and other networks in 2021-22, partnering with companies to deploy cellular hotspots. The expansion has made Helium one of the crypto projects with the highest number of non-speculative users. On Valentines’ Day, it recorded nearly three million users, processing over 114 terabytes of data and generating over $50,000 in real-world revenue.

Nearly 3M phones connected to Helium.

114 TB of Network traffic (5.7 trillion ‘Happy Valentine’s Day’ texts) 💌 pic.twitter.com/UhxowRD0AS

— Helium🎈 (@helium) February 14, 2026

Related Articles

Kiyosaki Warns: Giant Market Crash Could Be Imminent

Tom Lee tells investors: Stop obsessing over finding the "bottom," now is the "buying opportunity"

XRP Network Activity Down 26% as Active Addresses Fall to 40,778 - U.Today

Analysis: The bear market may continue until mid-2027. Close attention should be paid to the crossover signals between the 90-day moving average and the 365-day moving average.