Bitcoin heads towards $7.7 trillion in market cap as Wall Street runs out of money to "buy the dip"

This morning, I read a rather sharp analysis that goes beyond the usual chart patterns and market sentiment, with a notable statement: there is almost no “money left on the sidelines” anymore.

If this is true, it challenges a long-held assumption in both the crypto market and traditional markets: that a large amount of idle capital is always waiting to flow into risky assets like Bitcoin and stocks.

Cash is often seen as a safety valve and a “dry powder” for the next rally after corrections. When investors believe liquidity on the sidelines is plentiful, dips are usually viewed as buying opportunities.

But if most of this money has already been deployed, the impact on market liquidity, Bitcoin’s price trajectory, and overall risk sentiment will become much more complex.

When a chart shows the “sidelines are empty,” the perception is very direct: the market is being stretched too far, a shakeout could turn into a sharp decline, and retail investors are often the first to suffer losses.

A post from Global Markets Investor suggests that idle cash has “disappeared” from three areas: individual investor portfolios, mutual funds, and professional fund managers. The clear message: optimism has eroded the safety cushion, and market structure has become more fragile.

Why the story of “money on the sidelines” always matters

The issue isn’t just a tweet or a chart, but how this narrative shapes market behavior.

The belief that a lot of money is waiting to be deployed encourages traders to buy on dips, expecting a new wave of capital to come in afterward. Conversely, if everyone believes that all capital is “all-in,” cautious investors will stay on the sidelines longer. In crypto markets, stories about liquidity even spread faster than underlying data.

The reality lies in the middle ground. Some indicators show the market is stretched. Certain segments have thin cash buffers. However, the total amount of money in the system remains very large—it’s just parked in a “different place.”

And that difference is where real risk can form.

Retail investor cash holdings are below long-term averages

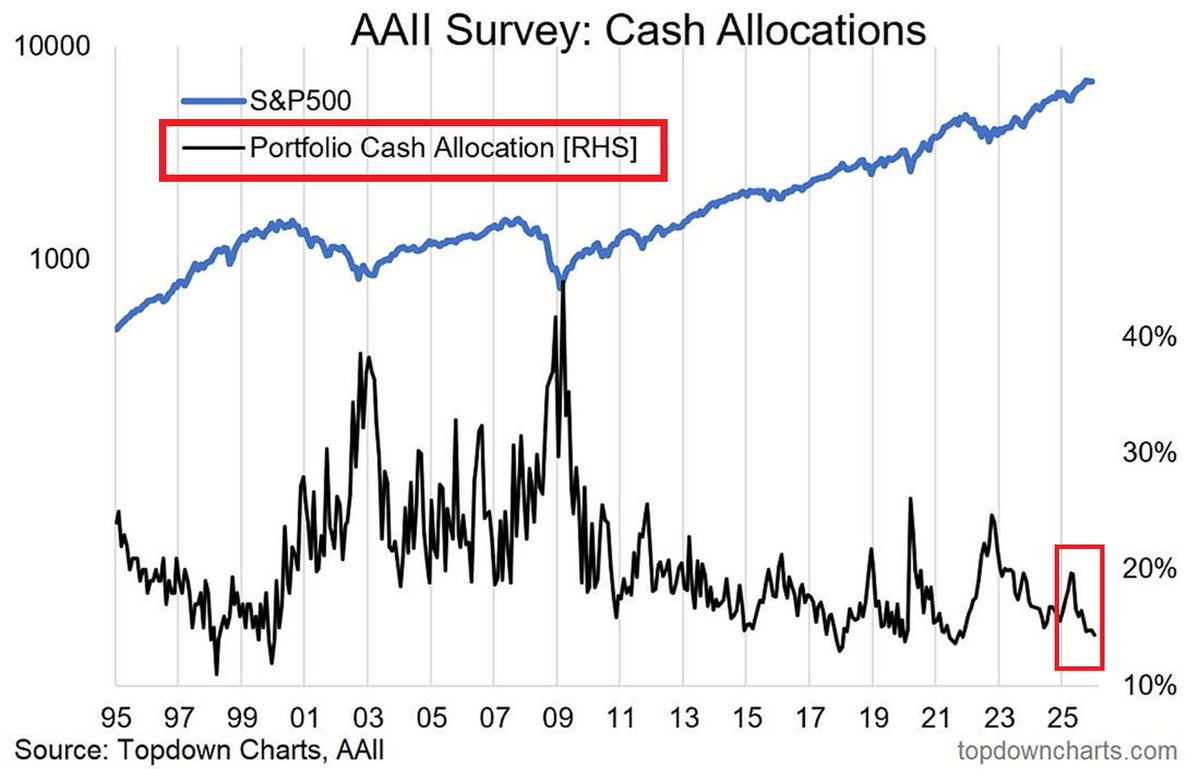

The clearest data point comes from the proportion of cash in retail investor portfolios, according to AAII surveys.

By January 2026, the average cash allocation was about 14.42%, significantly below the long-term average of 22.02%. This aligns with the general perception: investors are no longer waiting on the sidelines but are more actively participating in the market.

At the end of 2022—during the bear market—this ratio was around 21–24%. The drop from over 20% to the teens indicates a significant change, showing portfolios now have less “buffer” to absorb shocks with new buying power.

But it’s important to understand the nature of this data: it reflects survey-based portfolio composition, investor sentiment, and positioning, not a comprehensive bank deposit survey or full liquidity map. It measures risk appetite and perceived flexibility remaining with investors.

Thus, cash levels also serve as a psychological indicator: when cash shrinks, it often signals rising safety concerns or pressure to keep up with performance.

Mutual funds maintain thin liquidity buffers

Data on mutual funds shows that the proportion of assets that can be quickly converted to cash remains low, according to liquidity statistics from the Investment Company Institute (ICI).

By the end of 2025, the liquidity ratio of equity funds was only around 1–2%. This isn’t inherently dangerous, as equity funds are designed to maintain high investment levels.

Risks emerge when daily redemption behavior intensifies during volatile periods. With thin cash buffers, funds are forced to sell assets to meet redemption requests—and they tend to sell the most liquid assets first. This can deepen declines and spread across multiple sectors.

Here, the “money on the sidelines” story takes on a different meaning: it’s not about how much cash is waiting to buy in, but how quickly the system can generate cash when needed. Thin buffers alter the shape and impact of shocks.

Money isn’t disappearing—it’s shifting into money market funds

The incomplete picture of “no more money on the sidelines” lies in the enormous scale of money market funds.

As of mid-February 2026, total assets in these funds were about $7.77 trillion—a huge amount of money in near-cash instruments, short-term yield-generating assets, and highly liquid products.

This indicates that the demand for safety, yield, and flexibility remains very strong. Investors may hold less cash in stocks but keep large amounts in “side” positions through money market products.

This cash flow only becomes a “compressed spring” for risky assets when the motivation shifts. If short-term yields decline along with interest rates, some capital can rotate into bonds, dividend stocks, credit, and even crypto. The speed of rotation determines the impact: slow rotation supports stability, fast rotation can create bubbles and leave liquidity gaps.

Professional fund managers are in a high-deployment stance

Another fragile signal comes from the cash holdings of professional fund managers, according to the Bank of America Global Fund Manager Survey.

By the end of 2025, the average cash allocation was only about 3.3%—a record low in the survey’s history. This indicates a high level of risk-taking commitment. When cash is low, the ability to buy during market dips is limited; the initial reaction to volatility is often to reduce positions rather than increase them.

This is the real point of vulnerability: it’s not whether cash exists, but whether marginal buyers are willing and able to act.

Why crypto traders should care about this story

Crypto markets are heavily dependent on liquidity conditions, even if surface narratives focus on technology, politics, or ETF flows. When money is cheap and risk appetite is high, crypto tends to benefit. When liquidity tightens, correlations with risky assets increase, and volatility can spike rapidly.

BlackRock’s research has shown that Bitcoin is notably sensitive to USD real interest rates—similar to gold and emerging market currencies.

Macro analyst Lyn Alden also views Bitcoin as a “global liquidity indicator” over the long term, stripping out short-term noise.

If short-term yields decline and large cash flows shift away from monetary instruments, crypto can benefit along with other risk assets. Conversely, if shocks force funds and managers to deleverage, crypto can also be dragged down despite its fundamentals remaining unchanged.

Conclusion: concentrated money, tense positions, and new catalysts are key

The statement that “there’s almost no money left on the sidelines” is a strong way to describe a real tension.

Retail investor cash is below long-term averages. Equity funds maintain thin liquidity buffers. Professional fund managers hold record-low cash levels.

However, the total in money market funds remains enormous. Liquidity isn’t gone—it has just shifted position.

The critical point isn’t the slogan, but the drivers behind money movement: interest rates, growth expectations, and policy shocks. The next catalysts will matter far more than any tweet.

Related Articles

Consensys Founder: Still optimistic about the long-term development of the crypto industry; ETH has a stronger functional demand compared to BTC