Most 2025 token launches are trading below their debut prices as venture capital (VC) returns slump and new crypto fund creation falls to five-year lows, signaling a major shift in market dynamics.

Top VCs No Longer Guarantee Token Gains

The crypto venture capital machine that once powered explosive token launches is losing momentum. According to recent data highlighted by Galaxy Research, roughly 85% of tokens launched in 2025 are currently trading below their launch price. Even projects backed by top-tier venture firms are struggling to deliver meaningful returns, with many barely breaking even and some deep in the red.

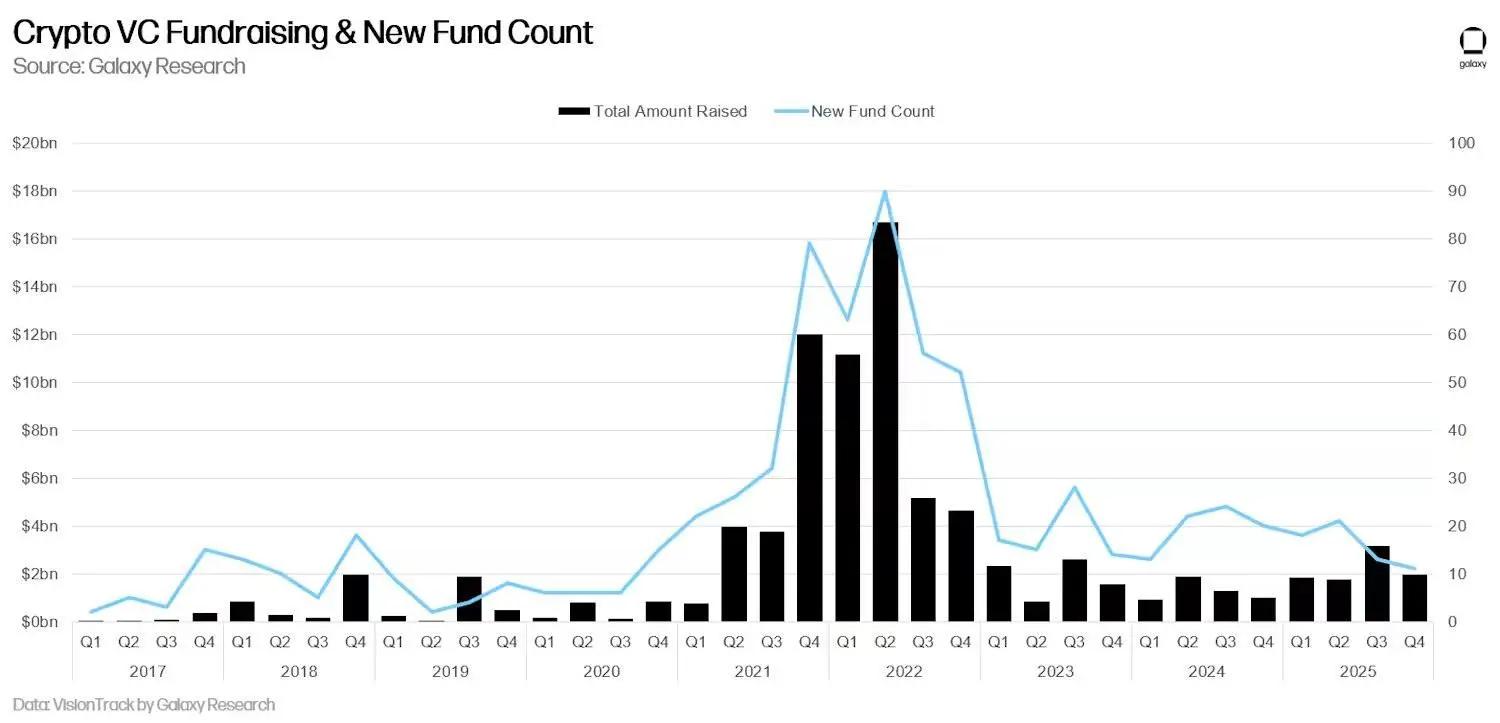

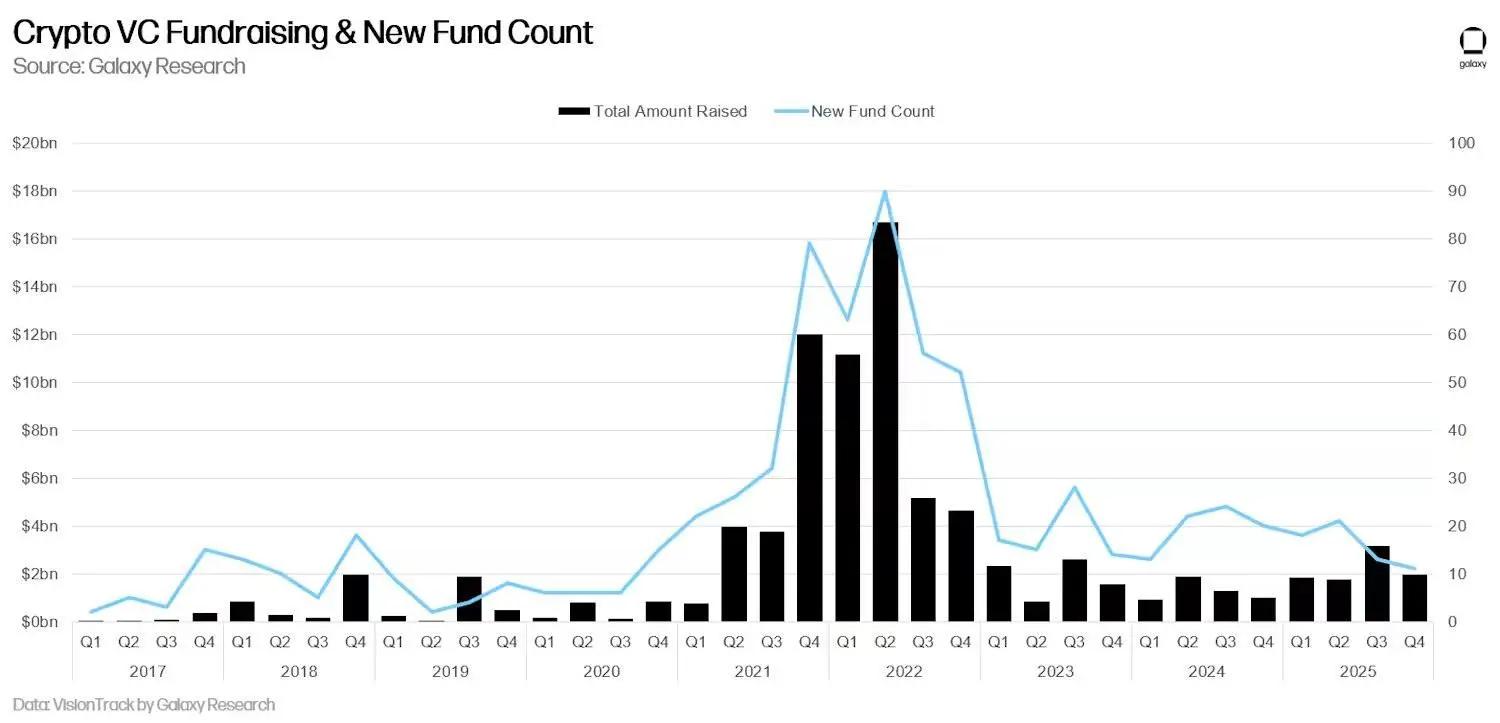

The contrast with 2022 is stark. In Q2 2022 alone, crypto VCs raised nearly $17 billion across more than 80 new funds. Institutional investors flooded the space, often backing projects with little more than a token roadmap and a pitch deck.

Fast forward to today, and the tide has turned. VC return on investment has been declining steadily since 2022. The number of new crypto funds has dropped to a five-year low. Fundraising last quarter amounted to just 12% of the capital raised during the Q2 2022 peak.

While venture firms reportedly invested $8.5 billion last quarter, an 84% quarter-over-quarter increase, analysts note this is largely capital raised during the 2022 boom. In fact, total capital deployed between 2023 and 2025 roughly matches what was raised in 2022 alone.

Yet there may be a silver lining. As easy VC money dries up, projects are being forced to focus on product-market fit, user growth, and sustainable revenue rather than token hype. Reduced insider influence could also mean fewer aggressive token unlocks and improved alignment between builders and communities.

Commenting on this, @thedefiedge, a decentralized finance (DeFi) research firm said, “When VC influence fades, the projects that win are the ones with real users and real revenue. Hopefully less chains, and more builders who optimize for product instead of the next raise.”

The downturn may mark the end of capital-driven token cycles and the beginning of a more fundamentals-driven crypto ecosystem.

FAQ 📊

- Why are most 2025 tokens down?

Weak demand and declining VC-driven momentum are pressuring prices.

- **How much did VCs raise in 2022?**Nearly $17 billion in Q2 2022 alone.

- **Is new crypto VC funding slowing?**Yes, new fund creation is at a five-year low.

- **What does this mean for crypto projects?**Teams must prioritize real users and revenue over hype.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Analysis: Ethereum is currently in a "narrative vacuum," with institutional funding and privacy modes becoming key variables for the future

Ethereum is currently in a "narrative gap period," with the market lacking long-term value logic, and focus shifting to zero-knowledge technology and privacy capabilities. Attracting institutional funds requires protocol-level privacy. Additionally, the expansion of spot ETFs is also changing the price formation mechanism of Ethereum.

GateNewsBot23m ago

HBAR Price Surge Pauses as Hedera’s Partnership with FedEx Strikes a New Milestone

Key Insights:

HBAR’s price surged due to the ongoing crypto rally and a significant partnership with FedEx, a major logistics player.

Despite the recent gains, HBAR faces challenges, including stagnant growth in its DeFi ecosystem and declining ETF demand.

Technical analysis shows that HBA

CryptoFrontNews42m ago

The bear market still needs to last for several more months! CryptoQuant: Bitcoin's "ultimate bottom" is at $55,000

Bitcoin has recently shown weak performance, and many investors are curious about "where the bottom really is." Analytical firm CryptoQuant points out that the "ultimate bottom" of this Bitcoin bear market is around $55,000. However, the market is still several months away from "completing the bottom formation," and it may take repeated testing; it won't be over with just one "panic sell-off" or "capitulation."

Key Indicator 1: The "Realized Price" Support Level Has Not Been Broken

CryptoQuant states that Bitcoin's "Realized Price (the average cost of all Bitcoins last moved on the market)" has almost always served as a long-term price support zone during previous bear markets. Therefore, it is considered an important reference for the "ultimate bottom."

CryptoQuant indicates that Bitcoin is currently about 25% above its realized price. In past bear markets, such as during the FTX collapse,

区块客54m ago

Robert Kiyosaki Draws Attention to His Stock Market Crash Prediction, Crypto Expected to Surge

Robert Kiyosaki draws attention to his stock market crash prediction.

He expects the price of crypto to surge soon.

As a Greater Depression approaches, he encourages accumulating real assets.

The prices of crypto assets are trading at much lower prices as compared to Q4 2025. Despite th

CryptoNewsLand57m ago

Cryptocurrency Market Sentiment Diverges: Wall Street Remains Bullish on Bitcoin, While Non-U.S. Investors Rapidly Withdraw

Global Bitcoin market sentiment is increasingly divided, with Wall Street institutional investors remaining bullish, but funds outside the United States are withdrawing noticeably. The premium on CME futures trading is higher than on Deribit, indicating that American institutions still have a strong risk appetite. Recently, Bitcoin has been affected by concerns over quantum computing technology, but its actual performance has declined in tandem with related companies, reflecting a cooling of market risk appetite for long-term assets.

区块客1h ago

Tax Refund Season May Spark a Major Retail Crypto Rally

Analysts predict that a substantial Tax Refund season in the U.S. could inject up to $150 billion into the economy, potentially boosting investments in Bitcoin and other assets. While this influx might revive risk-taking among investors, market conditions differ from previous years, affecting overall impact.

Coinfomania1h ago