Polygon Flips Ethereum in Daily Fees as Polymarket Activity Explodes

- Polygon fees exceeded Ethereum for 3 days, with $407,100 on Friday vs $211,700 for Ethereum.

- Polymarket generated over $1,000,000 in fees on Polygon in 7 days, while Origin World generated about $130,000.

Polygon has posted higher daily transaction fees than Ethereum for three consecutive days amid accelerating activity on Polymarket. Data from Token Terminal shows the network generated about $407,100 in revenue on Friday, while Ethereum recorded $211,700 on the same day. The next day, Polygon’s fees were nearly $303,000, and Ethereum’s were around $285,000. The figures marked the first recorded instance of Polygon surpassing Ethereum in daily fees, based on the dataset referenced by analysts tracking both networks. Polygon hosts Polymarket, a prediction market that uses Polygon-based USDC for trading. As trading volume rose, fee generation on the Layer-2 network increased, and that rise coincided with steady fee levels on Ethereum. **Polymarket Dominates Polygon Revenue ** Matthias Seidl, co-founder of Ethereum analytics platform growthepie, attributed the recent surge in Polygon activity to Polymarket usage. He shared a breakdown indicating Polymarket produced just over $1 million in fees on Polygon over the past seven days, while the next-largest application, Origin World, contributed about $130,000.

More fees were paid on Polygon PoS than on Ethereum Mainnet 🤯

This is fully driven by Polymarket

-> see screenshots of app breakdown by fees paid https://t.co/EU5zDofxiO pic.twitter.com/toqo346VEs

— matze | growthepie 🥧 (@web3_data) February 16, 2026

Polygon’s team also pointed to concentrated demand in specific markets. In a post on X, Polygon said more than $15 million in wagers were placed in a single Oscars market category. Polygon provided the settlement layer for their settlement. The network added that automated, trustless agents are being deployed to execute strategies on the prediction market.

Alongside prediction markets, stablecoin transfers have been a major source of transactions. One data analyst wrote on X that the network reached a new weekly high of 28 million USDC transactions. Because Polymarket uses USDC for positions and payouts, higher stablecoin throughput can translate into additional fee activity when usage spikes.

Separate data reported record daily onchain revenue when the fees surged. The update noted demand at all-time highs and said blockspace was full, while average transaction costs stayed around $0.03. It also noted an accelerating POL burn and stronger validator rewards, framing the changes as usage-driven.

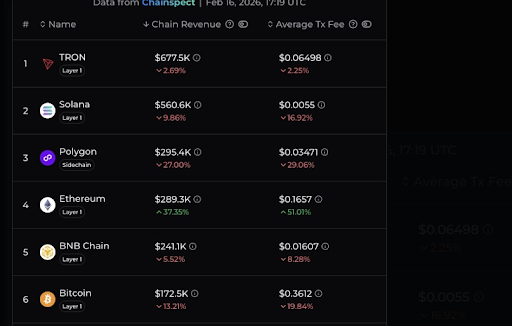

Analytics site Chainspect placed Polygon among the top chains by daily revenue, behind TRON and Solana. It paired revenue with average transaction fees, showing Polygon’s fees were above Solana’s and below TRON’s.

Source: Polygon on X

Prediction markets have gained traction since the last US election cycle, and several crypto firms have launched similar products. Most recently, Polygon proposed PIP 82 to recycle up to $1 million in PoS base gas fees for eligible agentic commerce and x402 transactions. We reported how any POL not recycled under the program would be sent to the burn collector. At the time of reporting, POL traded at $0.1064, up 1.3% in 24 hours, with a $1.12 billion market cap and $62.91 million in daily volume.

Related Articles

Chainlink Expands Adoption With Integrations on Ethereum, Solana, and BNB Chain

On-chain ASTER's largest long position, "neoyokio.eth," continues to roll over, with the position size reaching $14.9 million.

Hedera (HBAR), Ethereum (ETH), and ONDO: Which Altcoin Will Dominate the RWA Sector?

Nillion: nilChain will cease operation on March 23rd, and users need to promptly migrate their NIL tokens to Ethereum.

The whale "pension-usdt.eth" took profit on BTC long positions, previously totaling approximately $67 million.