Analyst: Ether may drop to $1,367, but the potential return over the next year is 81%

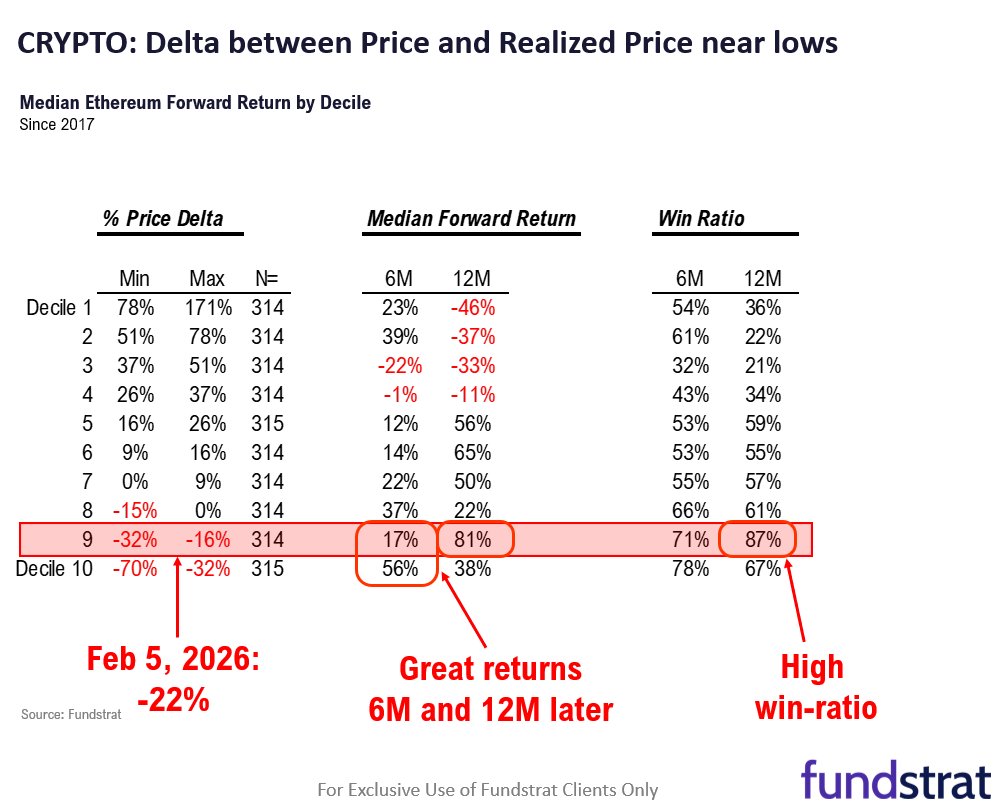

Fundstrat analysts point out that Ethereum investors are currently experiencing an average loss of 22%, but historical data suggests that the bottom may be near, with an implied return of 81% over the next 12 months.

(Background: Ethereum Foundation co-CEO announced stepping down, Vitalik heartfelt thanks: Tomasz transformed EF within a year)

(Additional context: Standard Chartered warns of “last dip”: Bitcoin may drop to $50,000 within months, Ethereum could fall to $1,400)

For ETH investors, the market turbulence early 2026 is causing anxiety, as prices have fallen from over $3,000 to below $2,000.

However, according to a research report by Fundstrat, led by Tom Lee, the market may be approaching “darkness before dawn.” Analyst Sean Farrell notes that while ETH still has room to decline, the current extreme pain phase, based on historical loss percentiles, often presents a long-term accumulation opportunity, with an estimated attractive return over the next year.

Current Loss Status and Bottom Forecast

Based on Farrell’s analysis, the average cost basis for ETH investors is about $2,241, meaning the market is at an approximate -22% unrealized loss.

Looking at historical data, during extreme conditions in 2022, the maximum loss reached 39%. Applying this, the bottom could be around $1,367; in the 2025 retracement scenario, with an average maximum loss of 21%, the bottom might be near $1,770.

We can compare this loss on “realized price” to prior ETH lows:

– in 2022, this loss reached -39%

– in 2025, this loss reached -21%If we apply this “loss” to the current realized ETH price of $2,241, we get implied “lows” for ETH

– using 2022, this implies $1,367

– using… pic.twitter.com/660UPm2Hg6— Bitmine (NYSE-BMNR) $ETH (@BitMNR) February 19, 2026

Why is the current risk-reward ratio worth paying attention to?

Fundstrat’s analysis uses the “realized loss percentile” indicator. Currently, the market loss level is in the 9th percentile since 2017, indicating an extreme phase of high losses and pain. Historically, this often signals exhausted sellers, suggesting the market bottom may be close.

According to Sean Farrell’s model, at this loss level, ETH’s implied return over the next 12 months could reach 81%. Tom Lee also agrees with this analysis, believing it helps in positioning near the bottom.

Although ETH may find support between $1,367 and $1,770, the historical realized losses suggest the bottom might not be far off. For long-term investors who can withstand short-term volatility, the +81% expected return over the next 12 months makes this an attractive entry zone.

Related Articles

Ethereum Supply Drops to 2017 Lows – Key Metrics Signal Demand Squeeze

Silicon Valley venture capital legend is quitting! Peter Thiel liquidates his holdings in the "ETHZilla" crypto company

Whale "0x049" Closes Leveraged Positions on ETH and BTC with $598,369 Loss

Bitmine Ethereum staking total surpasses 3 million coins, valued at $6.1 billion