ETH Gains on BTC—Altcoin Season Index Vaults Higher as Crypto Frenzy Escalates

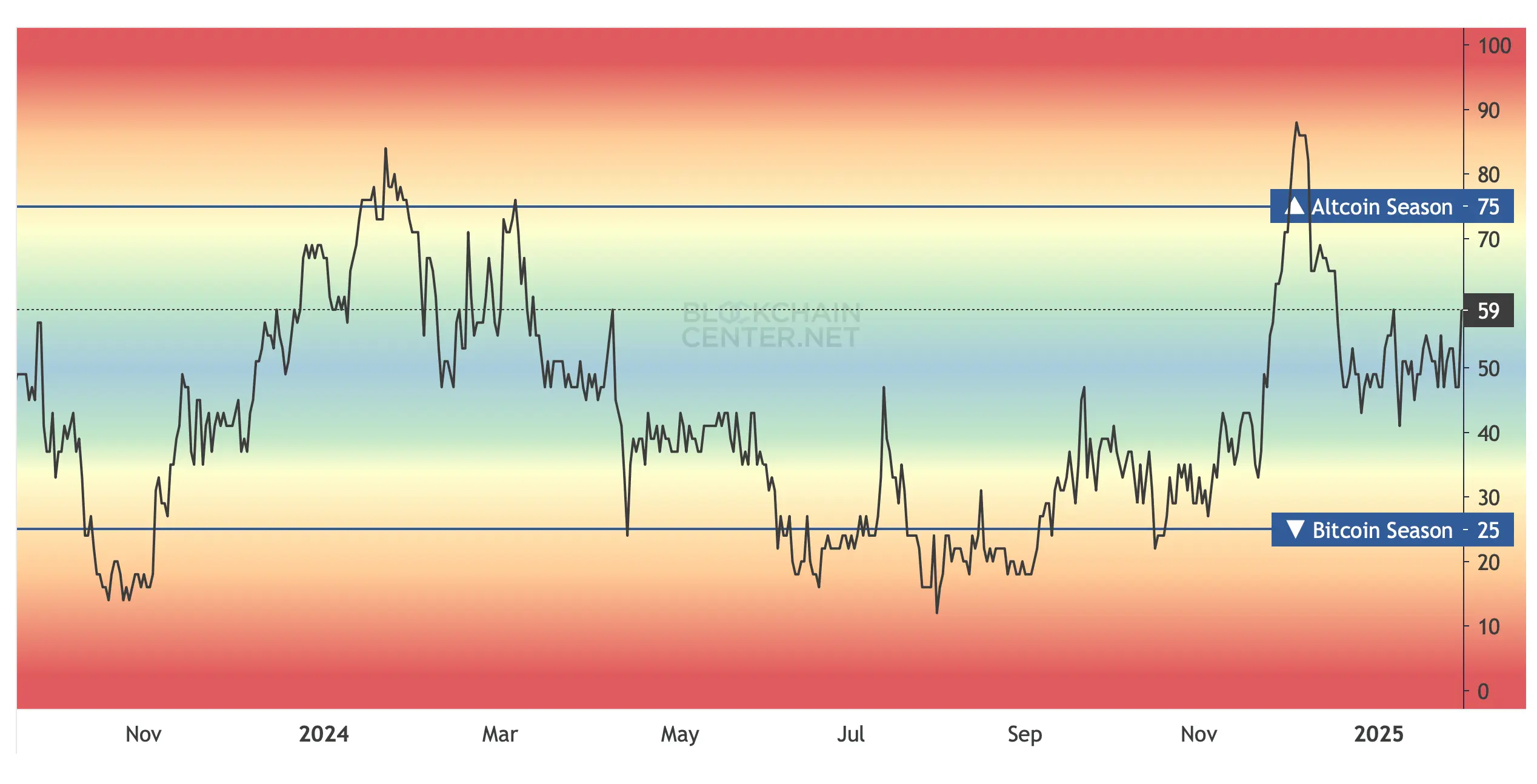

Following Jan. 30, 2025, blockchaincenter.net’s Altcoin Season Index reveals a 28.26% leap, vaulting from a low of 46 to its present tally of 59—a numerical crescendo hinting that the fabled ‘ Altcoin Season’ inches toward fruition. Across social media platforms like X, crypto-focused commentators now trumpet with scholarly fervor that this cyclical financial spectacle may soon grace markets.

Altcoins Surge Past Bitcoin—ASI Spikes

Between Jan. 27 and Jan. 30, the Altcoin Season Index (ASI) hovered at 46, only to climb to 59 by Jan. 31—a numerical leap that teases the tantalizing proximity of a crypto phenomenon long anticipated. A fleeting taste of Altcoin Season flickered briefly during Dec. 1-9, 2024, yet this brief period paled against the sustained rallies etched into the cryptoverse’s collective memory, such as those witnessed in 2017, 2018, 2021, and 2022.

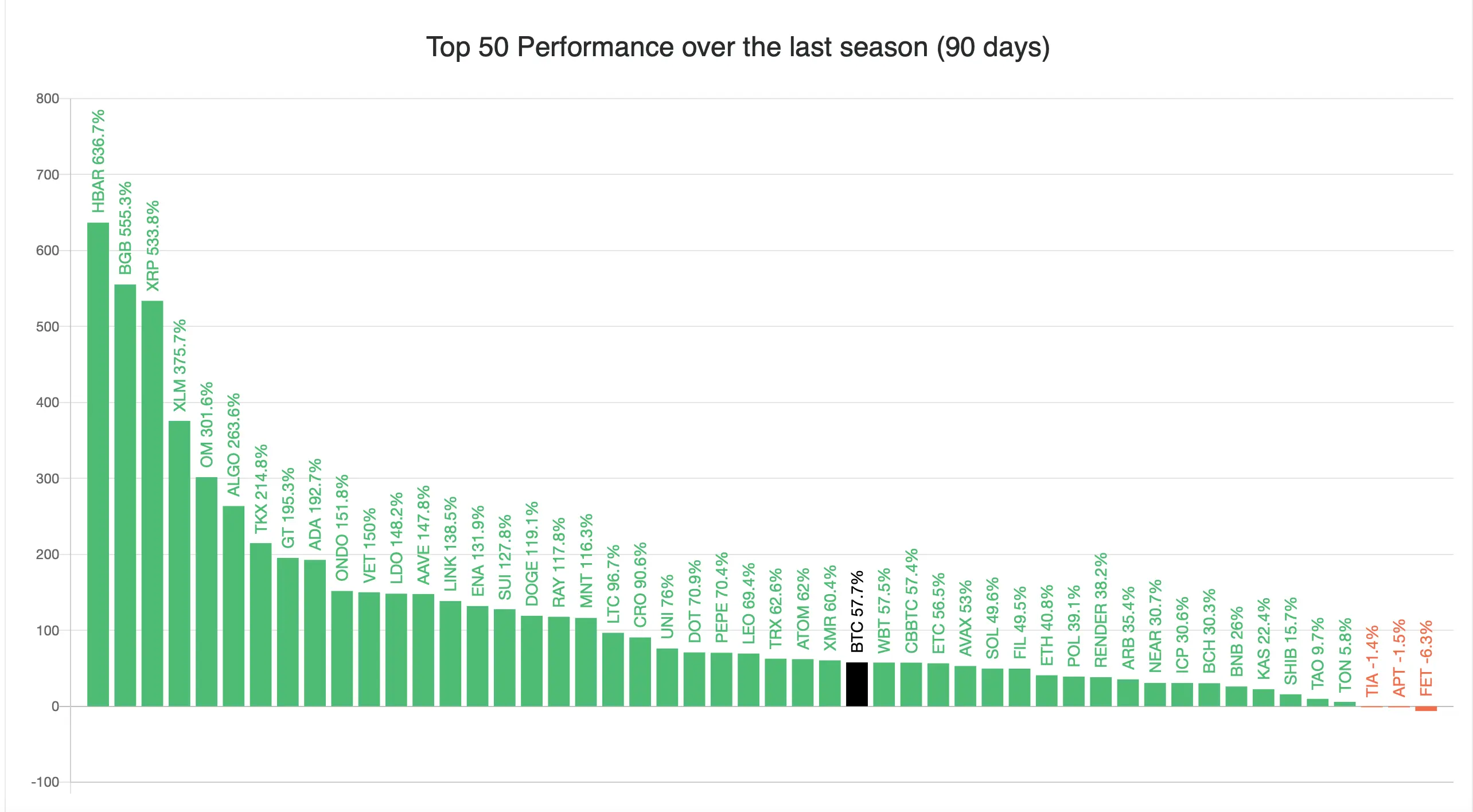

Blockchaincenter.net’s threshold for declaring an official Altcoin Season demands that 75% of the top 50 cryptocurrencies eclipse bitcoin’s performance across a 90-day epoch. With the index anchored at 59, a constellation of cryptocurrencies—both within and beyond the top 50 pantheon—have eclipsed bitcoin’s trajectory.

HBAR, for instance, has ballooned 636.7%, while BGB flaunts a meteoric 555.3% escalation; XRP follows with a 375.7% uptick, and OM parades a 301.6% ascent. Venturing outside this the top 50 group, a troupe of lesser-known tokens spins into the spotlight, brandishing four-digit percentage leaps. For example, fartcoin (FARTCOIN) has catapulted 3,851.16% over the past three months.

AI16Z has advanced 3,355.13% in 90 days, while XCN has gained 2,420.59% within the same period. AIXBT has appreciated 1,747.62%, and FAI has expanded 1,388.87% against the U.S. dollar over the past 90 days. Over the past 24 hours, ethereum ( ETH) has outpaced bitcoin ( BTC), a development often viewed as a signal that Altcoin Season may be on the horizon.

“ ETH breaking out is good signs for the entire altcoin market,” explained the crypto influencer Lark Davis. “With Feb historically being a bullish month, we could see a full-blown alt season play out soon.”

“Charts are showing the potential for an imminent ‘ Altcoin Season,’” the X account Asuka wrote on Friday. “The effect will be the same as bitcoin skyrocketing, the accelerated arrival of a new Global Financial Crisis bigger than 2008. The value being transferred from the U.S. Dollar etc. into crypto will be more than enough to crash the system, the market caps of crypto are now large enough to have this impact e.g. Bitcoin itself is already now larger than the entire M1 supply of Canadian Dollars.”

As the Altcoin Season Index edges toward its critical threshold, surging altcoins signal a potential recalibration of crypto’s hierarchy, challenging bitcoin’s dominance. While historical patterns and bullish projections hint at transformative momentum, the meteoric rises of obscure tokens and speculative fervor underscore volatility’s double-edged nature. Whether this materializes remains to be seen.

Related Articles

Bitcoin is increasingly linked to the macroeconomic cycle after adjusting for US employment data.

Data: If BTC breaks through $70,941, the total liquidation strength of mainstream CEX short positions will reach $918 million.

When the "Old Map" No Longer Applies: A Review of 8 "Failing Classic Cryptocurrency Indicators"