Prominent crypto attorney and U.S. Senate candidate John Deaton has escalated his opposition to any pardon for former FTX CEO Sam Bankman-Fried, rejecting recent attempts to portray the exchange as solvent before bankruptcy.

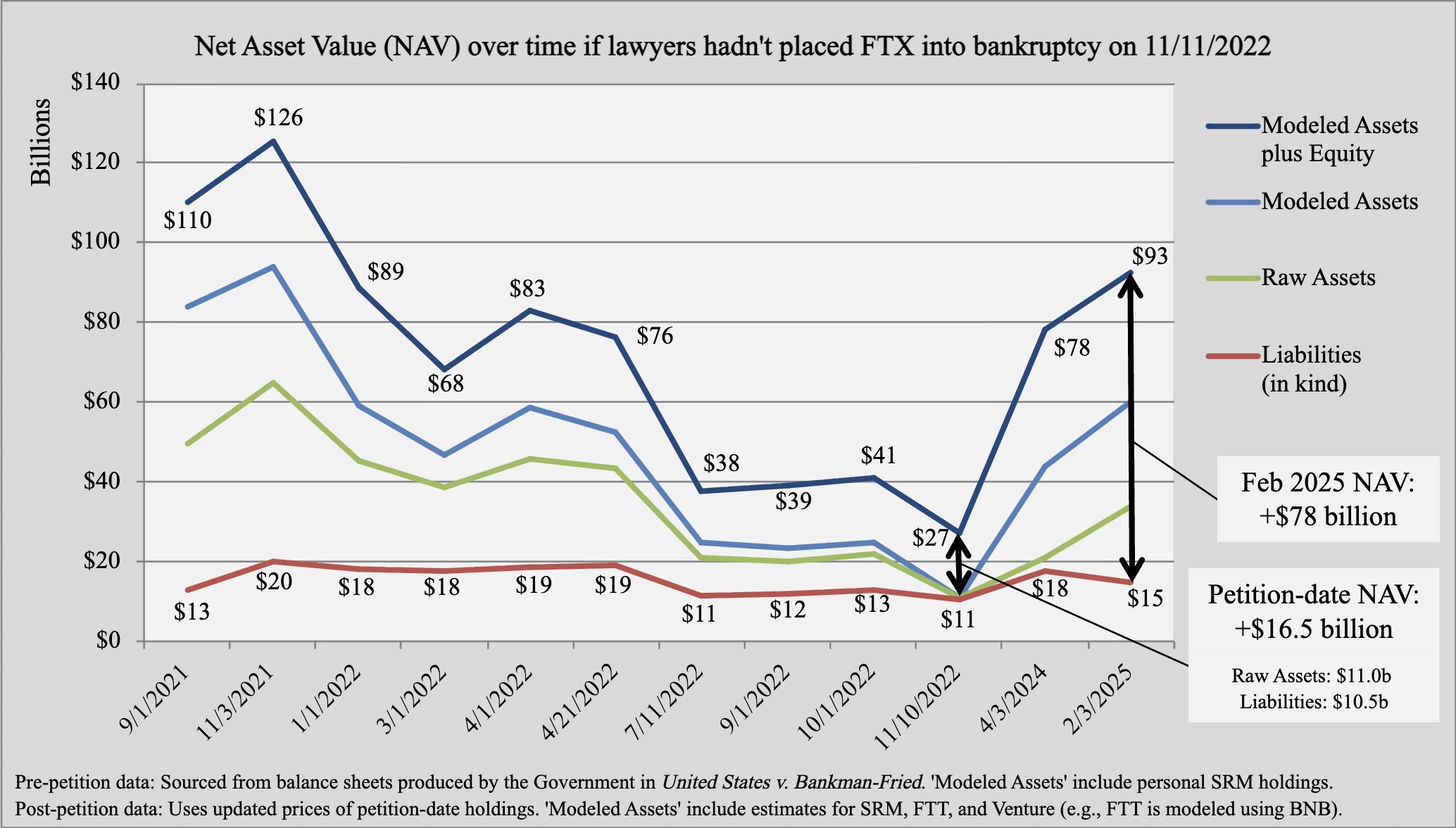

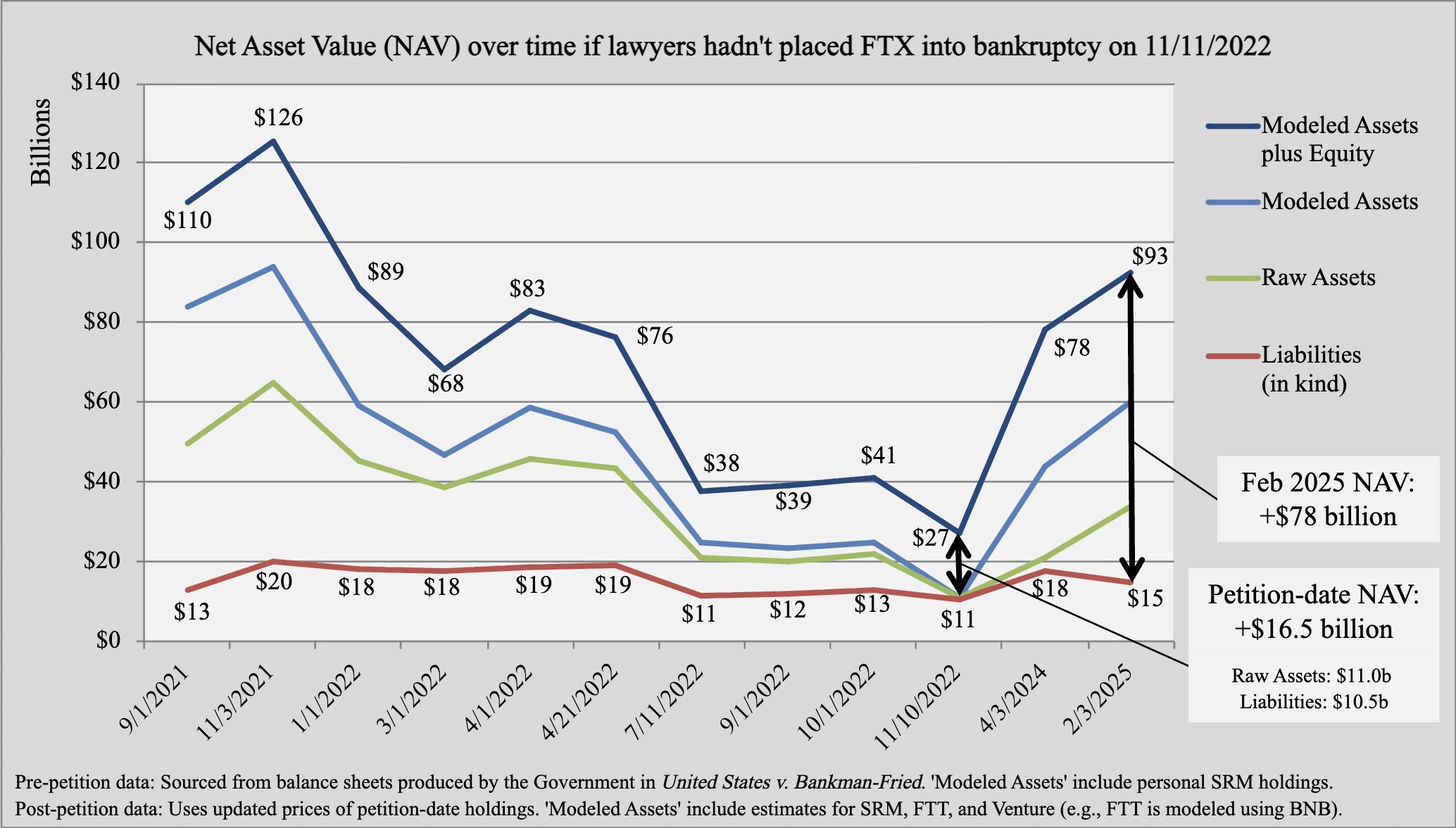

As SBF circulates modeled charts projecting a potential $78 billion net asset value by 2025, Deaton argues the legal verdict and creditor losses outweigh theoretical recoveries.

John Deaton rejects SBF’s $78B solvency claims and pardon plea

Deaton’s comments follow Bankman-Fried’s attempts at a digital comeback In a recent “10 Myths About Me & FTX” post on X, SBF disputed insolvency claims and shared a chart modelling FTX’s net asset value over time.

HOT Stories

Morning Crypto Report: XRP on the Edge vs Bitcoin as February Ends, Vitalik Buterin Donates More ETH for Charity, Shiba Inu (SHIB) May Challenge PayPal USD in March

XRP Records Largest On-Chain Realized Loss Spike Since 2022

The graphic there suggested that had bankruptcy not been initiated in November 2022, net asset value could have climbed to $78 billion by February 2025, compared with a petition-date NAV of $16.5 billion. The projections rely in part on modeled valuations of holdings, including tokens such as SRM and FTT.

Source: Sam Bankman-FriedDeaton, widely known for his advocacy for the XRP community during the SEC v. Ripple escalation, is not buying the statistical revisionism. For him, the former billionaire was a “crook, thief, and liar,” and his previous operations were essentially a family-coordinated effort to siphon retail savings into political influence and global marketing.

Source: Sam Bankman-FriedDeaton, widely known for his advocacy for the XRP community during the SEC v. Ripple escalation, is not buying the statistical revisionism. For him, the former billionaire was a “crook, thief, and liar,” and his previous operations were essentially a family-coordinated effort to siphon retail savings into political influence and global marketing.

Beyond the “Sam Bankman Fraud” moniker, Deaton’s critique extends to the “two-tiered justice system,” questioning why SBF’s parents, both Stanford professors, have not faced similar criminal repercussions for their alleged roles in the FTX ecosystem.

While SBF’s team shares charts, legal experts remain skeptical, noting that “modeled assets” often rely on illiquid tokens that lack real-world market depth.

As the 2026 political cycle heats up, Deaton’s categorical opposition may signal that the crypto industry’s “pro-law” faction is ready to fight any narrative that minimizes the gravity of the FTX fraud, regardless of current market valuations or theoretical recoveries.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Elliptic reveals 5 exchanges assisting Russia in evading sanctions: ABCeX alone trades $11 billion

Blockchain analytics company Elliptic has identified five cryptocurrency exchanges assisting Russia in evading sanctions, with ABCeX's total trading volume exceeding $11 billion. The report analyzes the operational models of these exchanges, including obfuscating transaction sources and dealings with sanctioned platforms. The European Union plans to impose a comprehensive ban on cryptocurrency transactions with Russia, but enforcement faces challenges. After each round of sanctions, new trading platforms quickly emerge, undermining the effectiveness of the sanctions.

動區BlockTempo12h ago

Elliptic: Five crypto trading platforms assist Russia in evading sanctions, filling the gap left by Garantex's closure

Elliptic reports that after sanctions, the Russian crypto trading platform Garantex was seized, and at least five alternative platforms still provide funding channels for sanctioned entities, although most have not yet been sanctioned. Platforms like Bitpapa and ABCeX frequently change wallets to evade monitoring, and research shows that related sanctions evasion activities continue across multiple platforms.

GateNewsBot16h ago

12 Malaysian officers under investigation for forcing the transfer of Chinese citizen's crypto assets

Malaysian authorities arrested 12 police officers for allegedly extorting around 200,000 ringgit (51,000 USD) in crypto from Chinese citizens during a midnight raid. The investigation follows a victim's complaint, highlighting ongoing anti-corruption efforts in Malaysia.

TapChiBitcoin02-21 09:02

Netherlands imposes heavy penalty on Polymarket! Illegally providing prediction market services, potentially facing a fine of up to 840,000 euros

The Dutch gambling authority Ksa has issued a cease and desist order and fined Polymarket for providing gambling services in the Netherlands without a license, facing a penalty of €420,000 per week, with a maximum of €840,000. This incident has sparked legal controversy over whether prediction markets are considered gambling. Ksa emphasizes that unlicensed platforms are not allowed to operate in the market and that prediction markets may pose social risks, which could influence future regulatory trends.

ChainNewsAbmedia02-21 04:45

The U.S. Democratic Party has written to the Secretary of the Treasury requesting a suspension of WLFI review and a thorough investigation into the UAE "Spy Emir"

More than 40 Democratic members of the U.S. Congress have written to the Secretary of the Treasury, requesting an investigation into the Trump family-operated World Liberty Financial (WLFI) and its massive investments with members of the UAE royal family, expressing concerns that political and geopolitical pressures may influence financial regulation. They are calling for a suspension of WLFI's banking charter review to maintain public trust and ensure transparency and independence.

ChainNewsAbmedia02-21 04:36

The Netherlands bans Polymarket, deeming it illegal gambling. Prediction markets are facing setbacks across Europe.

The Dutch gambling regulatory authority KSA has classified Polymarket as illegal gambling, requiring it to cease operations locally and imposing a fine of €420,000 per week. The article discusses the legal positioning and regulatory trends of prediction markets, showing that Europe is tightening its stance compared to the more lenient approach in the United States, and emphasizes the regulatory challenges faced by Polymarket and the double-edged sword effect of globalization.

動區BlockTempo02-21 03:50