Search results for "ATM"

Senate Ag Committee Set to Vote on Crypto Market Bill

Senate Agriculture Committee resumes crypto bill markup today after weather delays to vote on oversight and jurisdiction amendments.

Amendments cover ethics limits, CFTC timing, retail definitions, ATM fraud rules and foreign adversary participation.

The vote comes amid shutdown risks,

CryptoFrontNews·01-29 13:51

Continue to buy! MicroStrategy Strategy invests an additional $264 million to acquire nearly 3,000 more Bitcoins, bringing the total holdings to over 710,000 BTC.

MicroStrategy Inc. increases its Bitcoin holdings again, surpassing 710,000 coins, and raises funds through ATM plans, demonstrating its long-term bullish strategy on Bitcoin. In the latest announcement, MicroStrategy purchased 2,932 Bitcoins in the short term, with a total investment of over $54.19 billion, and an average cost of approximately $76,037. The market will closely monitor its financial risk and asset volatility impacts.

動區BlockTempo·01-26 13:30

MicroStrategy Strategy invests an additional $2.1 billion and acquires 22,305 more Bitcoins! Total holdings officially surpass the 700,000 BTC mark

U.S.-listed company Strategy continues to increase its Bitcoin holdings, recently purchasing over 22,000 more coins, with a total expenditure of approximately $2.125 billion, bringing its Bitcoin holdings to 709,715 coins. This additional purchase reflects its long-term optimism towards Bitcoin, with the primary funding source being the ATM stock issuance plan. The market is closely watching its subsequent buying pace and the impact on the stock price.

BTC1.73%

動區BlockTempo·01-20 13:25

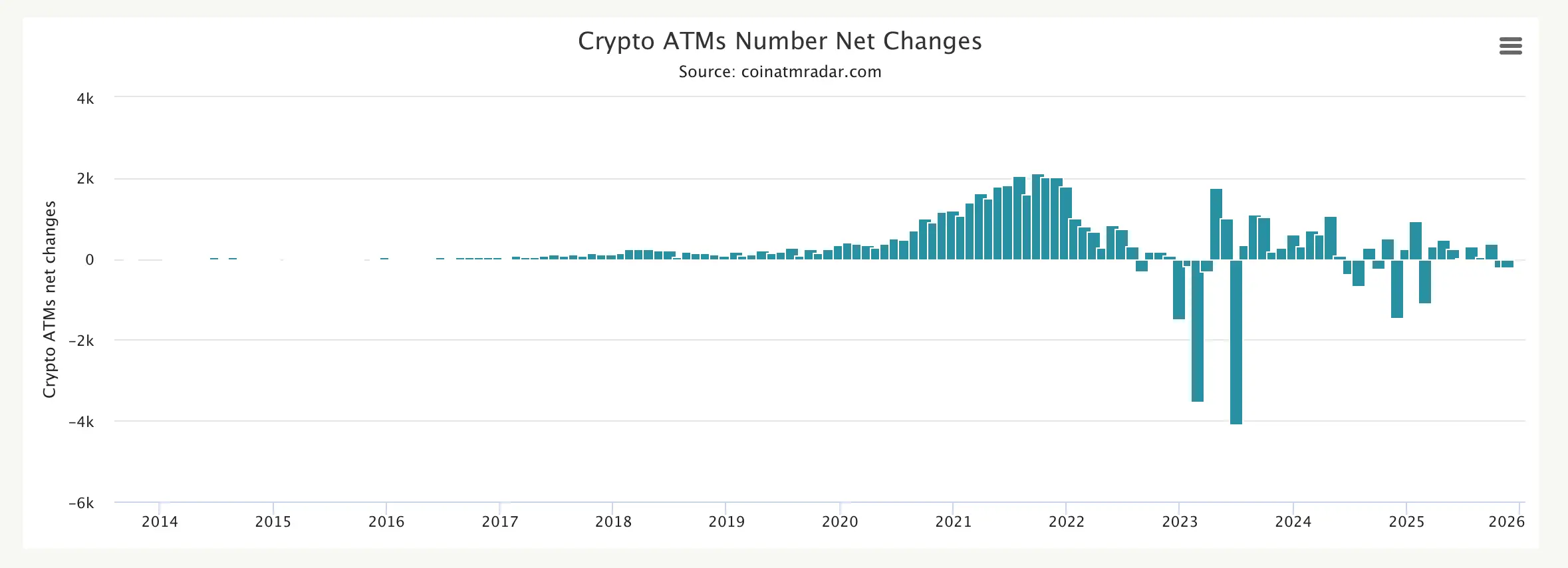

Bitcoin ATMs are completely cooling down! The daily trading volume of 30,000 units worldwide has fallen below $5,000.

Bitcoin ATM fees range from 5-20%, averaging 7-10%, far exceeding the exchange's fee of a few per thousand. There are 30,000 ATMs worldwide, with a daily transaction volume of less than $5,000. Falling into the user paradox: those who use Bitcoin don't need ATMs from exchanges, and those who need cash won't use Bitcoin. The rise of stablecoin payments and U cards have completely defeated Bitcoin ATMs.

MarketWhisper·01-20 05:13

Buying spree! MicroStrategy Strategy invests an additional $1.25 billion to purchase 13,000 more Bitcoins, bringing the total holdings to over 687,000 BTC

The world's largest Bitcoin reserve company Strategy makes a move again! Today (12th), the company announced that through an ATM fundraising plan, it has purchased over 13,000 Bitcoins in just one week, continuously expanding its holdings.

(Previous update: MicroStrategy's first purchase of the new year! Invested $116 million to buy 1,283 Bitcoins, with USD reserves also expanding to $2.25 billion)

(Additional background: MicroStrategy Strategy invested another $100 million to buy 1,229 Bitcoins, bringing the total holdings to over 672,000 BTC)

The publicly listed company with the most Bitcoin holdings, Strategy (formerly MicroStrategy), announced today (12th) that it will continue to increase its Bitcoin holdings, once again demonstrating its long-term optimism about Bitcoin as a core reserve asset.

BTC1.73%

動區BlockTempo·01-12 13:50

Crypto Scam: Louisiana Bitcoin ATM Protections Help Recover $200,000 - Details | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

A recently ratified law in the state of Louisiana has helped seniors recover $200,000 following a Bitcoin ATM-related scam operation. This development represents a fine example of government

Bitcoinistcom·01-11 11:06

PA Daily | Musk to open-source the new X platform algorithm within 7 days; BNB Chain Foundation purchases various Chinese Meme tokens

Today's News Highlights:

1. Next Week's Macro Outlook: CPI Challenges the Fed's Firepower, Fed Officials Speak Intensively

2. FBI: Crypto ATM Scam Losses Reach $240 Million in the First Half of 2025, Multiple States Considering Banning Crypto ATMs

3. Elon Musk: Will Open Source the New X Platform Algorithm Within 7 Days, Repeating Every Four Weeks

4. Vitalik: The Crypto Industry Needs to Solve Three Major Problems to Develop Better Decentralized Stablecoins

5. BNB Chain Foundation Bought $BinanceLife, $Hakeem, $IAmComing, and $Laozi Within Two Days

6. Analyst Willy Woo: Optimistic About Bitcoin's Performance in January-February, Cautious About 2026

Macro & Regulation

Next Week's Macro Outlook: CPI Challenges the Fed's Firepower, Fed Officials Speak Intensively

In the first full trading week of 2026, cross-asset prices rose simultaneously, Hua

PANews·01-11 09:08

FBI: US Crypto ATM Scams Break $330 Million Last Year, Multiple States Launch Bans

FBI reports that losses from cryptocurrency ATM scams in the United States are projected to surge to $333 million in 2025, with several states soon tightening regulations.

(Background: An Australian man discovered an ATM "infinite withdrawal bug" and chartered a private jet to rent a hotel, at the cost of serving one year in prison)

(Additional context: Bitcoin ATMs are required to enforce KYC, with a single transaction limit of $1,000. Wisconsin has introduced new laws to strengthen regulation.)

Seemingly convenient cryptocurrency ATMs are being exploited by criminals as tools to scam the elderly. According to FBI data, from January to November 2025, the total losses nationwide from crypto ATM scams reached $333 million, a significant increase from $250 million in all of 2024.

Most victims are not young speculators but elderly individuals with a median age of 71. This wave of scams has also forced...

動區BlockTempo·01-11 03:50

Maine Reaches $1.9M Settlement With Bitcoin ATM Operator Over Scam Losses

In brief

Maine regulators have secured $1.9 million for consumers defrauded through Bitcoin Depot ATMs in a settlement.

The agreement followed a two-year investigation.

The settlement comes amid a nationwide crackdown on crypto ATMs.

Maine regulators have reached a $1.9 million settl

BTC1.73%

Decrypt·01-06 14:16

Americans Lost $333 Million to Bitcoin ATM Scams in 2025, Warns FBI

Scammers have exploited Bitcoin ATMs to steal over $333 million from Americans in 2025, a significant increase from 2024. The FBI warns that the speed of transactions and rising ATM presence create opportunities for fraud. Citizens are urged to avoid sending cryptocurrency in response to unsolicited requests.

BTC1.73%

Moon5labs·01-06 01:01

Bitcoin ATM scams steal $333m from Americans in 2025, FBI says

Summary

FBI data show Bitcoin ATM scams in the U.S. jumped to more than $333m in losses between January and November 2025, up from roughly $250m in 2024.

Scammers impersonate officials or banks, pressure victims into feeding cash into Bitcoin ATMs, then route funds to crypto wallets that are

BTC1.73%

Cryptonews·01-05 09:06

$330 million evaporated! Bitcoin ATMs become a scam paradise, with 31,000 units in the US potentially being removed from shelves

In 2025, Americans lost over $333 million due to Bitcoin ATM scams, with the FBI recording more than 12,000 complaints, doubling the number of cases compared to the previous year. Approximately 31,000 terminals across the United States have become tools for scams, with a disproportionately high percentage of elderly victims. California has issued an emergency warning, and other states are shifting from consumer education to strict legislation. Countries like Australia have set transaction limits and banned the spread of such scams.

MarketWhisper·01-04 01:46

The Year in Bitcoin and Crypto ATMs 2025: Power Tools, Scams and Calls for Action

In brief

Some crypto ATMs were targeted by law enforcement in 2025.

Meanwhile, some states took action against Bitcoin ATM operators.

There were some renewed calls for restrictions on Capitol Hill.

Crypto ATMs faced heightened scrutiny in 2025, as authorities and lawmakers tried to c

BTC1.73%

Decrypt·01-02 19:15

The Year in Bitcoin and Crypto ATMs 2025: Power Tools, Scams and Calls for Action

In brief

Some crypto ATMs were targeted by law enforcement in 2025.

Meanwhile, some states took action against Bitcoin ATM operators.

There were some renewed calls for restrictions on Capitol Hill.

Crypto ATMs faced heightened scrutiny in 2025, as authorities and lawmakers tried to c

BTC1.73%

Decrypt·01-01 19:11

MSTR Stock Faces January 15 MSCI Index Deadline after 50% Drop in 2025, What's in 2026? - Coinspeaker

Key Notes

The MSCI index exclusion of MSTR stock could lead to an $8.8 billion rout, according to JPMorgan.

Ongoing share issuance to fund Bitcoin purchases, a planned $11 billion ATM program, and a mNAV below 1 have weighed on sentiment.

Despite the selloff, analysts note that Strategy’s Bitco

BTC1.73%

Coinspeaker·01-01 08:58

The Year in Bitcoin and Crypto ATMs 2025: Power Tools, Scams and Calls for Action

In brief

Some crypto ATMs were targeted by law enforcement in 2025.

Meanwhile, some states took action against Bitcoin ATM operators.

There were some renewed calls for restrictions on Capitol Hill.

Crypto ATMs faced heightened scrutiny in 2025, as authorities and lawmakers tried to c

BTC1.73%

Decrypt·2025-12-31 19:11

FBI Warns Of Rising Bitcoin ATM Fraud: Americans Lose Over $330 Million In 2025 | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

The Federal Bureau of Investigation (FBI) has recently raised alarms about the increasing number of cryptocurrency scams, particularly those involving Bitcoin ATMs

Crypto Requests Now Top

Bitcoinistcom·2025-12-31 04:05

The Year in Bitcoin and Crypto ATMs 2025: Power Tools, Scams and Calls for Action

In brief

Some crypto ATMs were targeted by law enforcement in 2025.

Meanwhile, some states took action against Bitcoin ATM operators.

There were some renewed calls for restrictions on Capitol Hill.

Crypto ATMs faced heightened scrutiny in 2025, as authorities and lawmakers tried to c

BTC1.73%

Decrypt·2025-12-30 19:06

MicroStrategy Strategy invests another $100 million to purchase 1,229 Bitcoins, bringing the total holdings to over 672,000 BTC.

MicroStrategy purchased 1,229 Bitcoins for approximately $108.8 million between December 22 and 28, 2025, bringing its total holdings to 672,497 Bitcoins, and raised over $100 million through ATM programs to support Bitcoin investments. The company still has significant capital market fundraising capacity to further expand its Bitcoin position.

BTC1.73%

動區BlockTempo·2025-12-29 13:50

From "Money Tree" to "ATM"? ETHZilla sells $74.5 million ETH to pay off debts, triggering a major test of the corporate encryption treasury model.

The crypto market is witnessing a dramatic differentiation in corporate holdings strategies. ETHZilla, a company once endorsed by Peter Thiel and whose stock price soared, recently filed documents with the SEC, revealing that it has sold $74.5 million worth of Ethereum to pay off debts. This is the company's second cash-out after selling $40 million worth of Ethereum at the end of October, and its holdings have significantly shrunk from their peak. In stark contrast, another giant, Bitmine Immersion, is hoarding Ethereum at an unprecedented pace, with its holdings surpassing 4.06 million coins, valued at approximately $13.2 billion, accounting for 3.37% of the global total supply, firmly maintaining its position as the largest Ethereum corporate treasury in the world. This extreme phenomenon of "one selling, one hoarding" not only reveals the differences in survival strategies of different companies under the crypto winter but also prompts a profound reflection on the sustainability of the business model of "public company crypto treasuries" in the market.

MarketWhisper·2025-12-23 02:48

VanEck: Bitcoin miners are experiencing large-scale capitulation, indicating that now is the market bottom.

Bitcoin Computing Power decreased by 4% this month, and the wave of Miner capitulation is spreading; VanEck points out that historical data shows that such washouts often lay the foundation for the next bull run.

(Background: Bitcoin failed to break through 90,000 USD and fell back, while Ethereum held strong at 3,000 USD, and the US stock market's Christmas rally rose across the board.)

(Background information: MicroStrategy announced last week that it has paused buying Bitcoin: ATM raised $740 million to replenish cash reserves, with debt and dividends being the urgent issues?)

Table of Contents

Computing Power Decline and Cost Pressure: The Digital Thermometer of the Cold Wave

Historical Backtesting: Bad News Turns Positive Over Time

Chip reorganization at the low point of the fear index

Macro Noise and Risk Boundaries

The winter of 2025 pushes the Bitcoin ( mining farm to the brink of shutdown. The price has fallen 30% from the October high of $126,080, hovering around

動區BlockTempo·2025-12-23 02:40

MicroStrategy announced last week that it has paused Bitcoin purchases: ATM raised $740 million to replenish cash reserves, and debt and dividends are the urgent priorities?

The world's largest Bitcoin reserve company Strategy (formerly MicroStrategy) announced that there were no new Bitcoin purchases last week, with open interest remaining at 671,268 coins and a total cost of approximately $50.33 billion. At the same time, the company raised over $700 million through common stock, increasing its dollar reserves to $2.19 billion, strengthening liquidity and financial stability.

BTC1.73%

動區BlockTempo·2025-12-22 13:45

Crypto ATM Scams Spread Inside US Convenience Stores

Just inside the entrance of a Circle K convenience store in Niceville, Florida, a district manager stared angrily at a crypto ATM after yet another elderly customer had lost thousands of dollars to a scam. Police body-camera footage from September captured the manager saying he wanted the machines r

BTC1.73%

ICOHOIDER·2025-12-17 11:19

Crypto ATM operator to expand to Texas, citing friendly regulation

Bitcoin Bancorp plans to deploy up to 200 cryptocurrency ATMs in Texas by early 2026, leveraging the state's supportive regulations and status as a crypto hub. Texas has also initiated its own Bitcoin reserve strategy and invested in Bitcoin ETFs.

Cointelegraph·2025-12-15 16:15

MicroStrategy invests another $980 million to buy 10,000 Bitcoin, with total holdings surpassing 670,000 BTC, maintaining its position as the global leader.

MicroStrategy once again increased its Bitcoin holdings by 10,645 BTC from December 8 to 14, 2025, with a total investment of approximately $980.3 million, bringing its total Bitcoin holdings to 671,268 BTC, making it the largest publicly traded company holder worldwide. Its cumulative investment cost is approximately $50.33 billion, and it continues to raise funds through ATM issuance plans, maintaining strong financial flexibility.

BTC1.73%

動區BlockTempo·2025-12-15 13:35

Strive Launches $500M SATA ATM Program to Fuel Bitcoin Expansion

Strive’s $500M SATA ATM aims to fund Bitcoin acquisitions and strengthen financial flexibility for future growth.

Analyst projects stock could rise 30x in 10 years with BTC amplification and sustained compounding effects.

SATA demand is critical; higher uptake could drive long-term stock price to

BTC1.73%

CryptoFrontNews·2025-12-10 09:17

Washington orders Bitcoin ATM giant Coinme to refund $8 million, cease operations

The Washington State Department of Financial Institutions (DFI) has ordered Coinme—the Bitcoin ATM operator—to cease all money transmission activities and refund over $8 million to customers. The regulator accuses Coinme of unlawfully converting funds from unredeemed vouchers into revenue, violating the Money Transmitters Act.

BTC1.73%

TapChiBitcoin·2025-12-04 12:34

Bitcoin ATM operator Coinme ordered to return over $8 million to customers

Washington state regulators have ordered Bitcoin ATM operator Coinme to cease operations and return $8 million in unclaimed funds, accusing the company of counting unredeemed vouchers as revenue in violation of money transmission regulations. The regulators are seeking to revoke Coinme's license and impose a fine.

BTC1.73%

DeepFlowTech·2025-12-04 11:07

Coinme Ordered to Return Over $8M to Customers in Washington State Crackdown

In brief

Washington regulators allege that Bitcoin ATM operator Coinme claimed more than $8 million in unredeemed vouchers as income, violating state money-transmission laws.

The company faces license revocation, a $300,000 fine, a $375 investigation fee, and a potential 10-year industry ban

BTC1.73%

Decrypt·2025-12-04 11:03

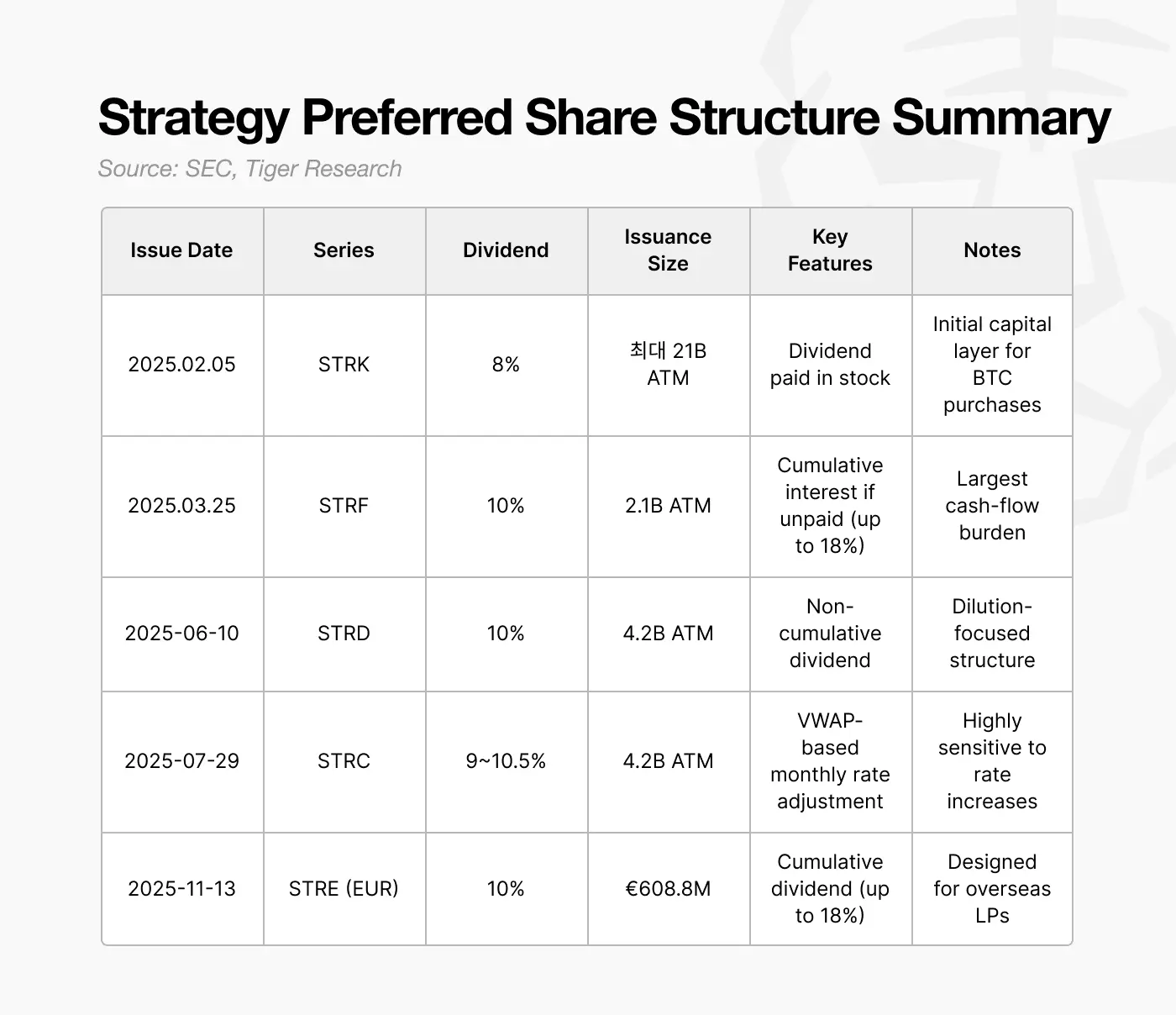

Will Bitcoin fall to 80,000 USD break the model of Strategy?

Author: Ekko an, Ryan Yoon Source: Tiger Research Translation: Shan Ouba, Golden Finance

As the price of Bitcoin falls, the market's focus shifts to DAT company, which holds a large amount of Bitcoin, with Strategy being one of the most notable companies. The key issue is how the company accumulates assets and manages risks in the face of increased market volatility.

Key Points Summary

The static bankruptcy threshold of the Strategy is expected to be around $23,000 in 2025, almost double the $12,000 in 2023.

In 2024, the company will shift its financing model from a simple combination of cash and small convertible bonds to a diversified mix including convertible bonds, preferred stock, and ATM issuances.

The call options held by investors allow them to redeem early before expiration. If the price of Bitcoin drops, it

BTC1.73%

金色财经_·2025-12-02 08:45

Strategy Establishes $1.44 Billion USD Reserve Dedicated to Preferred Dividends and Debt Service

Strategy Inc. (NASDAQ: MSTR) announced that the creation of a $1.44 billion USD cash reserve exclusively earmarked for paying dividends on its outstanding preferred shares and servicing interest on existing debt obligations. The funds were generated through the sale of Class A common stock under the company’s at-the-market (ATM) equity offering program.

BTC1.73%

CryptopulseElite·2025-12-02 06:21

The Bitcoin ATM company is offering a 10% bearish on Bitcoin on Black Friday.

Athena Bitcoin is offering a 10% discount on Bitcoin purchases through its ATMs for Black Friday on November 28, 2025, encouraging holiday gifting of Bitcoin. Despite this, the Bitcoin ATM industry faces challenges, including significant fines and rising crime.

BTC1.73%

TapChiBitcoin·2025-11-27 12:39

TD Cowen: The Bitcoin premium for Strategy has fallen to "crypto winter" lows, still maintaining a target price of 535 USD.

According to Deep Tide TechFlow news on November 25, reported by The Block, TD Cowen's research shows that the Bitcoin premium for Strategy continues to decline, and is returning to the low levels seen during the "crypto winter" of 2021-2022.

Lance Vitanza, Managing Director at TD Cowen, stated that Strategy did not proceed with the market issuance (ATM) plan to increase stock or purchase new Bitcoin yesterday. The two Bitcoin premium charts released by the company show that the indicator is steadily compressing to levels seen at the end of 2021 and the beginning of 2022. Despite the continuous decline in premium, TD Cowen maintains a buy rating and a target price of $535, which is about 200% higher than the current stock price of approximately $180.

BTC1.73%

DeepFlowTech·2025-11-25 00:32

Bitcoin ATM Company Crypto Dispensers Considers $100M Sale After Indictment

Crypto ATM operator Crypto Dispensers is considering a $100 million sale after both the company and its founder were charged in an alleged money-laundering scheme

Founder, Firas Isa, and the company have pleaded not guilty

Crypto Dispensers and Its CEO Indicted in Alleged $10 Million

BTC1.73%

CryptoDaily·2025-11-24 18:04

Hong Kong Dollar to New Taiwan Dollar: Complete Guide and Best Exchange Rate Recommendations

[4](https://www.gate.com/post/topic/4) [ATM](https://www.gate.com/post/topic/ATM) [投資](https://www.gate.com/post/topic/%E6%8A%95%E8%B3%87) The exchange rate between HKD and TWD has always been a topic of concern for investors and travelers. But when is the best time to exchange HKD for TWD to get the best exchange rate? This article will uncover the latest trends in the HKD/TWD exchange rate and provide strategies for precise conversion using the HKD/TWD exchange rate calculator. Whether you want to grasp the best timing for currency exchange between Hong Kong and Taiwan or are looking for favorable HKD/TWD exchange offers, the practical advice here will help you make the best decision.

The exchange rate between Hong Kong Dollar and New Taiwan Dollar has generally remained relatively stable in recent years.

幣圈動態·2025-11-24 16:05

Crypto ATM Count Slips for the First Time Since March

Metrics reveal that, for the first time since March, the global count of crypto automated teller machines (ATMs) has contracted. Even with this recent pullback, roughly 1,480 crypto ATMs have still been added since the year began.

403 Crypto ATMs Vanished Since October

According to data

Coinpedia·2025-11-23 21:38

Crypto Dispensers Faces $100M Sale Following CEO Indictment

Crypto Dispensers is considering a $100 million sale amid legal troubles for its CEO, Firas Isa, who faces charges of money laundering. The company is shifting to a software-based platform while navigating increasing regulatory scrutiny in the crypto ATM industry.

BTC1.73%

CryptoBreaking·2025-11-23 08:23

Bitcoin ATM firm explores $100M sale following CEO’s federal indictment

Crypto Dispensers, a Chicago-based operator of Bitcoin ATMs, is considering a potential $100 million sale as its founder faces federal money laundering charges.

In a Friday press release, the company announced that it has hired advisors to conduct a “strategic review” and explore buyer interest. C

Cointelegraph·2025-11-23 07:20

Bitcoin ATM Firm Weighing $100 Million Sale Following Money Laundering Charges

In brief

Bitcoin ATM operator Crypto Dispensers says it's considering a $100 million sale of the company.

Both the company and founder and CEO Firas Isa were charged in an alleged $10 million money laundering scheme earlier this week.

Crypto Dispensers and Isa pleaded not guilty to the

BTC1.73%

Decrypt·2025-11-22 22:03

Encryption ATM machines become new tools for fraud: 28,000 outlets spread across the U.S., defrauding 240 million dollars in six months.

By: Cameron Fozi, Chloe Rosenberg, and Reeno Hashimoto, The New York Times

Compiled by: Chopper, Foresight News

Cryptocurrency ATMs spread across convenience stores and gas stations, which seem to be convenient cash-to-coin terminals, have actually become a money-sucking trap aimed at the elderly by scammers. Behind the disappearing deposits are meticulously designed scams.

Mary Handeland, a real estate agent from Grafton, Wisconsin, met a match on a dating app last year. The other party claimed to be

BTC1.73%

DeepFlowTech·2025-11-20 10:02

Bitcoin Price Prediction: Kenya ATM Tests Legal Framework, ETF Redemption of 1.1 Billion Sets Worst Record in History

Kenya has suddenly launched Bitcoin ATMs, posing a challenge to its crypto assets laws. The US government is reopening the economy, and it is expected that over 100 new crypto assets ETF applications will be listed by 2026, putting pressure on Bitcoin. The Bitcoin price has already fallen this week to the critical demand range of $83,800 to $75,000, with traders closely following changes in regulatory policies.

MarketWhisper·2025-11-20 07:25

Crypto ATM Operator and CEO Indicted for Alleged $10M Laundering of Fraud

Virtual Assets LLC and CEO Firas Isa face charges for laundering over $10 million through crypto ATMs, converting illicit funds into cryptocurrency from 2018 to 2023, amid increased regulatory scrutiny in the U.S.

CryptoNewsLand·2025-11-19 13:24

US indicts crypto ATM operator in $10M money laundering scheme

Virtual Assets LLC and its founder, Firas Isa, have been indicted for laundering $10 million in illicit funds through crypto ATMs. Prosecutors allege they disguised the source of funds linked to fraud and narcotics. Both have pleaded not guilty.

Cryptonews·2025-11-19 08:42

U.S. Attorney Charges Crypto Dispensers CEO with $10 Million Money Laundering Conspiracy

The U.S. Attorney’s Office for the Northern District of Illinois announced on November 18, 2025, that Firas Isa, founder and CEO of Virtual Assets LLC — the parent company of Bitcoin ATM operator Crypto Dispensers — has been indicted on one count of conspiracy to commit money laundering involving approximately $10 million.

BTC1.73%

CryptopulseElite·2025-11-19 06:17

Crypto Assets Money Laundering 10 million USD! Founder of Chicago ATM company indicted.

According to the announcement from the U.S. Attorney's Office for the Northern District of Illinois, Firas Isa, founder of the Chicago virtual asset company Virtual Assets LLC (the operating entity of Crypto Dispensers), has been indicted by a federal grand jury, accused of conspiring with others to use crypto assets ATMs to convert and transfer at least $10 million in proceeds from telecommunications fraud and drug crimes to virtual wallets to conceal the sources of the funds.

MarketWhisper·2025-11-19 02:07

Bitcoin ATM Company Founder Charged in Alleged $10 Million Money Laundering Scheme

In brief

Prosecutors charged Firas Isa, founder of Virtual Assets LLC, with operating a money laundering conspiracy tied to at least $10 million.

The indictment said Isa converted fraud and narcotics proceeds into cryptocurrency and sent the assets to other wallets.

Isa and the company

BTC1.73%

Decrypt·2025-11-18 19:30

Bitcoin Depot enters Hong Kong as part of its strategy to expand into Asia

Bitcoin Depot (Nasdaq: BTM), the largest Bitcoin ATM operator in North America, has expanded into Asia with its launch in Hong Kong — marking the company's first international step. This move aims to meet the increasing demand for converting cash to cryptocurrency. Bitcoin Depot aims to be

BTC1.73%

TapChiBitcoin·2025-11-13 01:48

Bitcoin Depot enters Hong Kong as part of Asian expansion

Bitcoin Depot is expanding into Hong Kong, aiming to become a top Bitcoin ATM operator in Asia amid rising demand for cash-to-crypto transactions. The company has ensured compliance with local regulations as the city becomes a growing hub for digital assets.

BTC1.73%

Cointelegraph·2025-11-12 21:20

Are you planning to buy Bitcoin with a cash amount of 10,000? Community voting shows 40% support. Check out the top 5 claiming strategies all at once.

The universal cash distribution of 10,000 yuan has finally opened for registration! The Department of Finance announced that the "online registration and deposit" method will go live on November 5th, offering five ways to receive the funds: online registration and deposit, ATM withdrawal, post office counter pickup, direct deposit, and registration-based distribution. A discussion titled "11/12 Universal Cash Distribution of 10,000 Yuan — What Cryptocurrency Would You Buy?" appeared on the Dcard community. Bitcoin support has exceeded 40%, sparking a debate among young people about investing the 10,000 yuan distribution.

MarketWhisper·2025-11-05 08:32

Data: Multiple tokens are showing a rebound from the bottom, with ATM rising nearly 10%.

Mars Finance reports that the Binance Spot market shows various dynamics, including a significant rise in multiple coins such as 1INCH and ADA, demonstrating a "bottoming out and rebound" state; while ATM and BAT have shown a "high to low" trend, falling by 9.5% and 5.48%, respectively.

ATM1.03%

MarsBitNews·2025-11-04 03:48

Load More