Search results for "DON"

Bitcoin suffers a heavy loss compared to the stock market! Analyst: Don't wait for the gold rotation, funds may no longer come

Analyst Benjamin Cowen warns that Bitcoin continues to underperform the stock market, and the rotation expectation between gold and silver is not materializing. Gold reaches $5,608, silver hits $121, both hitting new highs. BTC has fallen 6.12% this month, and the Fear Index is at 16. Swyftx's Hundal states that history lags by 14 months, expecting a bottom in February-March. Bitwise mentions that Bitcoin's discount is severe, and a turning point may occur in Q1.

BTC2.91%

MarketWhisper·01-30 07:03

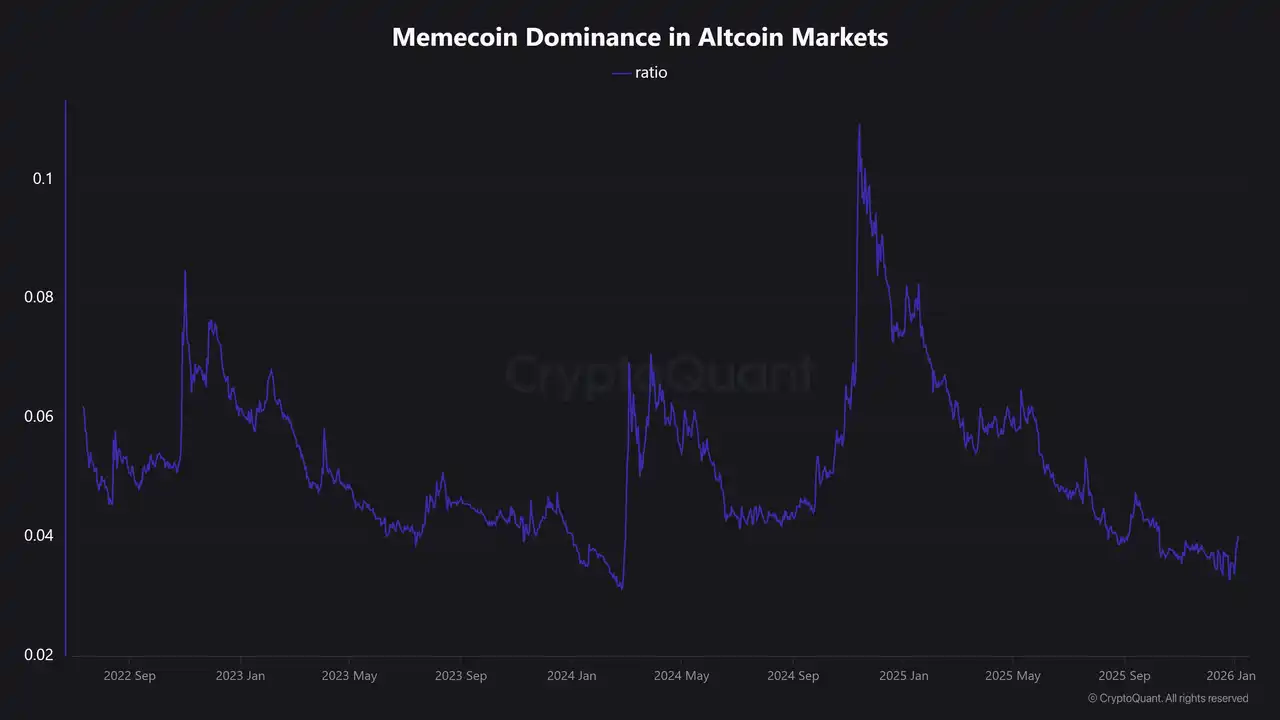

The whole world is celebrating, so why is only the crypto industry "wintering"?

Writing by: EeeVee

"Just don't invest in cryptocurrencies, and you can make money from everything else."

Recently, the crypto world and other global markets seem to be experiencing two completely different extremes.

Throughout 2025, gold surged over 60%, silver skyrocketed 210.9%, and the US stock Russell 2000 index rose 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, the divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares increased by over 15% in a single month.

In contrast, Bitcoin experienced six consecutive declines starting January 21, dropping from $98,000 and once again falling below $90,000 without looking back.

Silver's performance over the past year

It seems that after 1011, capital has decisively left the crypto space, BTC

区块客·01-30 00:05

Trump Family Net Worth Doubles to $10B: Crypto Empire Behind Surge

Trump family net worth stands at $10B, doubling since 2024. Donald Trump hit $7.3B, Eric $750M, Barron $150M at 19, Don Jr. $500M, Jared Kushner $1B. They generated $1.8B+ since November, with $1.2B from crypto.

MarketWhisper·01-28 06:42

Gold Breaks Through Stocks: The 1.45 Life and Death Line and the Truth About Your Assets Shrinking

Author: Alan Chen

An Overlooked Number

If your investment portfolio includes US stocks, gold, Bitcoin, or altcoins, this number might change your perspective on these assets.

The S&P 500 divided by the gold price (SPX:GOLD)), currently at a ratio of 1.45.

Most people don't pay attention to this number. After all, the stock market is still hitting new highs, account balances are rising, and Bitcoin is hovering at high levels. Who would care about calculating it with gold?

But Benjamin Cowen does. He recently released two videos analyzing this ratio and its impact on the entire cycle of stocks, gold, and cryptocurrencies. His conclusion is straightforward: we are at an extremely dangerous historical juncture, and this point will determine what assets you hold in the next 2-3 years.

Why? Because the number 1.45 has appeared three times in financial history,

BTC2.91%

PANews·01-28 01:38

The prophecy comes true after 24 years! Hideo Kojima: Metal Gear Solid 2 is the future I don't want to see

Hideo Kojima clarifies that Metal Gear Solid 2 was not an AI prophecy but a discussion of digital society, exploring information overload and digital control, which became a reality 24 years later. "It's less about prediction and more about a future I don't want to see." During the internet bubble in 2001, "Blue Fear" and "Reon" also explored similar themes. He predicts that future remakes will incorporate AI, with humans focusing on innovation and planning to develop "training AI" games.

MarketWhisper·01-27 05:27

Hideo Kojima: The story of Metal Gear Solid 2 is not an AI prophecy, but a future I don't want to see.

Hideo Kojima clarifies that "Metal Gear Solid 2" is not a prophecy about AI; instead, it explores the impact of digital society. He emphasizes that the game focuses on digital control and information overload, rather than the future he hopes to avoid. Kojima also predicts that future remakes will be executed by AI, hoping that humans can focus on creating new experiences.

CryptoCity·01-26 08:55

Wood Sister interprets Big Ideas 2026: Why You Don't Have to Fear the AI Productivity Revolution

In the latest "Big Ideas 2026," Cathie Wood believes that AI and automation will trigger a wave of entrepreneurship rather than destroy jobs. She points out the high efficiency demonstrated by emerging companies and individuals' ability to leverage AI tools, making entrepreneurship easier and marking a significant boost in productivity.

PANews·01-26 03:55

a16z Heavy Report: Code Vulnerabilities Are More Deadly Than Quantum Computing, Don't Be Led Astray by Panic

a16z Crypto points out that the threat of quantum computing is exaggerated, and the likelihood of CRQC (cryptography-related quantum computers) appearing before 2030 is extremely low. Digital signatures and zkSNARKs are not vulnerable to "collect first, crack later" attacks, and switching too early may introduce risks. The current threats are code vulnerabilities and governance difficulties, and it is recommended to prioritize auditing and testing rather than rushing to upgrade.

ETH3.52%

MarketWhisper·01-26 02:58

Don't hand over your medical records to chatbots? ChatGPT Health: The Privacy Gamble Under the Mask of Medical Ambitions

OpenAI's ChatGPT Health allows users to upload personal medical data but loses HIPAA protections, raising privacy and legal risks. Experts warn that this could lead to data being queried or misused, and regulatory gaps enable tech companies to rapidly expand in gray areas. Users should be cautious when uploading data and follow the principle of minimalism.

動區BlockTempo·01-25 03:30

The whole world is celebrating, so why is only the crypto industry "wintering"?

Writing by: EeeVee

"Just don't invest in cryptocurrencies, and you can make money from everything else."

Recently, the crypto world and other global markets seem to be experiencing two completely different extremes.

Throughout 2025, gold surged over 60%, silver skyrocketed 210.9%, and the US stock Russell 2000 index rose 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, the divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares increased by over 15% in a single month.

In contrast, Bitcoin experienced six consecutive declines starting January 21, dropping from $98,000 and once again falling below $90,000 without looking back.

Silver's performance over the past year

It seems that after 1011, capital has decisively left the crypto space, BTC

区块客·01-24 15:05

The body is the ultimate cold wallet. Don't lose your healthy private key.

The article discusses the necessity of physical health as an important asset in the crypto market. The author builds a biological moat by employing methods such as data monitoring, diet optimization, and supplement enhancement to improve metabolic efficiency and cognitive ability, in order to cope with high-intensity mental decision-making and market volatility. He emphasizes that ensuring physical health through scientific means is actually laying the foundation for future capital appreciation.

BTC2.91%

PANews·01-23 01:37

The whole world is celebrating, so why is only the crypto industry "wintering"?

Article by: EeeVee

"Just don't invest in cryptocurrencies, and everything else can be profitable."

Recently, the crypto world and other global markets seem to be polar opposites.

In 2025, gold surged over 60%, silver skyrocketed 210.9%, and the US stock Russell 2000 index rose 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, the divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares increased by over 15% in a single month.

In contrast, Bitcoin experienced six consecutive declines starting January 21, dropping from $98,000 and once again falling below $90,000 without looking back.

Silver's performance over the past year

It seems that after 1011, capital has decisively left the crypto space, BTC

区块客·01-22 15:18

What is the most expensive thing in the 21st century? The traffic anxiety of exchanges

Author: Uncle Zuo

Out of money, I can only keep your attention

At 6 PM, I end the broadcast, change into OK's clothes, and head out to drink a few beers during Binance's big liquidation.

In the Meme counter's crazy Perp marketplace, earning some rebates by using mom KYC.

The big show of 2026 begins, witnessing the collapse of the exchange's skyscraper, unlike previous direct explosions such as major liquidations or triggering public opinion, now the public no longer focuses on the exchange, reflected in Binance Square and OKX Planet's inability to attract new users.

When even the inspiring stories of beautiful female dealers go unnoticed, the exchange has to come out and shout, "Look at the kids, you get to watch for free and even get paid!"

This article commemorates the first anniversary of Chuanbao's ascension, a presidential-level stunt that gives us full emotional value.

Lie back and wait for the money

If you don't explode in silence, you'll perish in silence.

In 2025, the exchange did nothing wrong, embracing Per

PANews·01-22 06:36

Don't build your next business empire with Vibe Coding; instead, achieve a workplace breakthrough by "forming a team alone."

The core of Vibe Coding lies in restructuring individual workflows, breaking free from dependence on others, and emphasizing the ability to "stand alone." With the assistance of AI, individuals can focus on decision-making and creativity rather than tedious execution. This revolution is not about commercialization or monetization, but about creating your own "secret weapon," improving efficiency, and satisfying personal needs.

動區BlockTempo·01-21 03:40

Elon Musk: Don't make analogies, think from first principles!

Elon Musk pointed out in an interview that most people think through "analogies," while he advocates for "first principles," which involves breaking down things from the most fundamental level and reconstructing understanding. Using batteries as an example, he emphasized that by analyzing material costs, many commonly accepted views are actually inaccurate, and innovation should be based on this.

PANews·01-21 03:10

Bitcoin ATMs are completely cooling down! The daily trading volume of 30,000 units worldwide has fallen below $5,000.

Bitcoin ATM fees range from 5-20%, averaging 7-10%, far exceeding the exchange's fee of a few per thousand. There are 30,000 ATMs worldwide, with a daily transaction volume of less than $5,000. Falling into the user paradox: those who use Bitcoin don't need ATMs from exchanges, and those who need cash won't use Bitcoin. The rise of stablecoin payments and U cards have completely defeated Bitcoin ATMs.

MarketWhisper·01-20 05:13

Trump dissatisfied with not receiving the Nobel Peace Prize: Then I don't have to consider peace alone. Denmark cannot protect Greenland from Chinese and Russian encroachment.

The Trump administration plans to impose tariffs on 8 NATO countries starting from February to force Europe to cede Greenland, raising legal questions and the risk of financial retaliation. If negotiations fail, tariffs, legal actions, and capital measures may be simultaneously initiated, escalating US-Europe tensions and impacting global bond markets and alliance structures.

動區BlockTempo·01-20 04:50

From "I'm here" to "Binance Life": A successful experiment in attention monetization?

The collective celebration of Chinese Meme, how exactly did it happen?

(Background recap: The viral meme coin trader "Kuzuo P Xiaojiang" made $430,000 in 30 days. How did he catch the first 5 seconds of the Golden Dog appearance?)

(Additional background: CZ Zhao Changpeng's Binance AMA summary: Bitcoin reaching $200,000, the end of the altcoin season, don't rely on Binance executives' statements to speculate on meme coins)

Table of Contents

01 Liquidity War: BSC's Counterattack

02 CZ and He Yi's Meme-Making Ability

03 Listing Expectations: The Imagination Space of BSC Meme

04 The Cultural Code of Chinese Meme

05 Summary

On January 1, 2026, Binance co-founder He Yi posted a New Year tweet: "I'm coming."

Rough, straightforward, just like crypto traders in

MEME0.79%

動區BlockTempo·01-17 09:00

Elon Musk responds to X regulation controversy for the first time, stating that Grok has not produced any underage images

Elon Musk's community platform X and its AI chatbot Grok have recently attracted the attention of regulatory agencies across Europe, Asia, and the Americas due to allegations of generating sexualized images of women and minors. After the controversy escalated, Musk finally responded directly to the accusations, emphasizing "no knowledge, zero evidence," and denying that Grok has ever generated any nude images of minors.

Musk's statement: The literal meaning of "zero"

Elon Musk recently posted on X: "I don't know of Grok generating any nude images of minors, literally zero." He pointed out that Grok itself does not "generate" images on its own; all image outputs are initiated by user requests.

Musk further emphasized that Grok's operation principles are to comply with laws of various countries and states. As long as the generated content involves illegal activities, the system

ChainNewsAbmedia·01-16 18:14

"Insider Whale" Garrett Jin is bullish on Ethereum: $3000 is the key price level for institutional accumulation. If you don't buy now, you'll lose at the starting line.

Garrett Jin urges corporate and institutional investors to enter the market as Ethereum price approaches $3000, and recommends staking to earn fixed income. He believes that ETH is no longer just a speculative asset but has become an important tool for corporate asset allocation. His background and influence have made his comments attract market attention, especially considering the controversies he has been involved in and his connections with major whale accounts.

ETH3.52%

動區BlockTempo·01-16 13:05

Don't let Trump profit from himself? Lawmakers call for a temporary halt to WLFI's banking license review until Trump cuts ties with crypto interests

U.S. Senator Warren pressures regulatory agencies to temporarily halt the Trump family's cryptocurrency platform World Liberty Financial's application for a banking license, citing concerns over significant conflicts of interest. She accuses regulators of potentially being unable to remain neutral and raises political ethical issues, demanding that the application not be reviewed until Trump and his family's financial ties to the company are fully severed.

CryptoCity·01-16 02:36

As global tensions ease, Bitcoin rises and oil prices fall: Crypto Daybook Americas

Need to Know:

You are reading Crypto Daybook Americas, your morning briefing covering last night's crypto market developments and expectations for the day ahead. Crypto Daybook Americas will start your morning with comprehensive insights. If you haven't subscribed to the email yet, click here. You definitely don't want to start your day without it.

Author: Francisco Rodrigues (All times are Eastern Time unless otherwise noted)

Bitcoin (BTC) rose nearly 2% in 24 hours, breaking through $97,000 as investor risk appetite increased and it successfully surpassed a resistance level that had held for two months.

"Bitcoin has lagged behind stocks and precious metals in gains, but it has finally broken through the $95,000 mark that has constrained its rise since November last year," QCP Capital

BTC2.91%

TechubNews·01-16 02:23

Twitter's viral post with millions of views: If you have diverse interests, don't waste time in the next 2-3 years

Author: DAN KOE

Translation: randomarea

Introduction

Society makes you think that having a wide range of interests is a flaw.

Go to school.

Get a degree.

Find a job.

Retire at some point.

But this sequence of life has too many problems.

We no longer live in the industrial age. Betting everything on a single skill is almost like slow suicide. Today, we probably all realize: mechanical lifestyles and siloed learning are extremely dangerous to your mind and soul. People can also feel that we are experiencing a “Second Renaissance.” Your curiosity and desire to learn are advantages in the modern world — but there’s still a missing piece.

For a long time, I kept learning, learning, learning. I was trapped in “tutorial hell.” Some people might call it “shiny object syndrome.”

PANews·01-15 14:37

Copying Pokémon again? The physical card of Mythical Beast Paru announced sparks controversy! The developer retorts to players: If you don't like it, go play other games.

"Fantasy Beast Paru" recently announced the launch of a physical card game, sparking player concerns that its model is similar to "Pokémon." Designer Buckley responded strongly to the criticism, stating that critics should spend their time enjoying other games. The developer promised that the development of the card game and the main game will not affect each other, and plans to release an official version to further develop the project.

動區BlockTempo·01-15 08:05

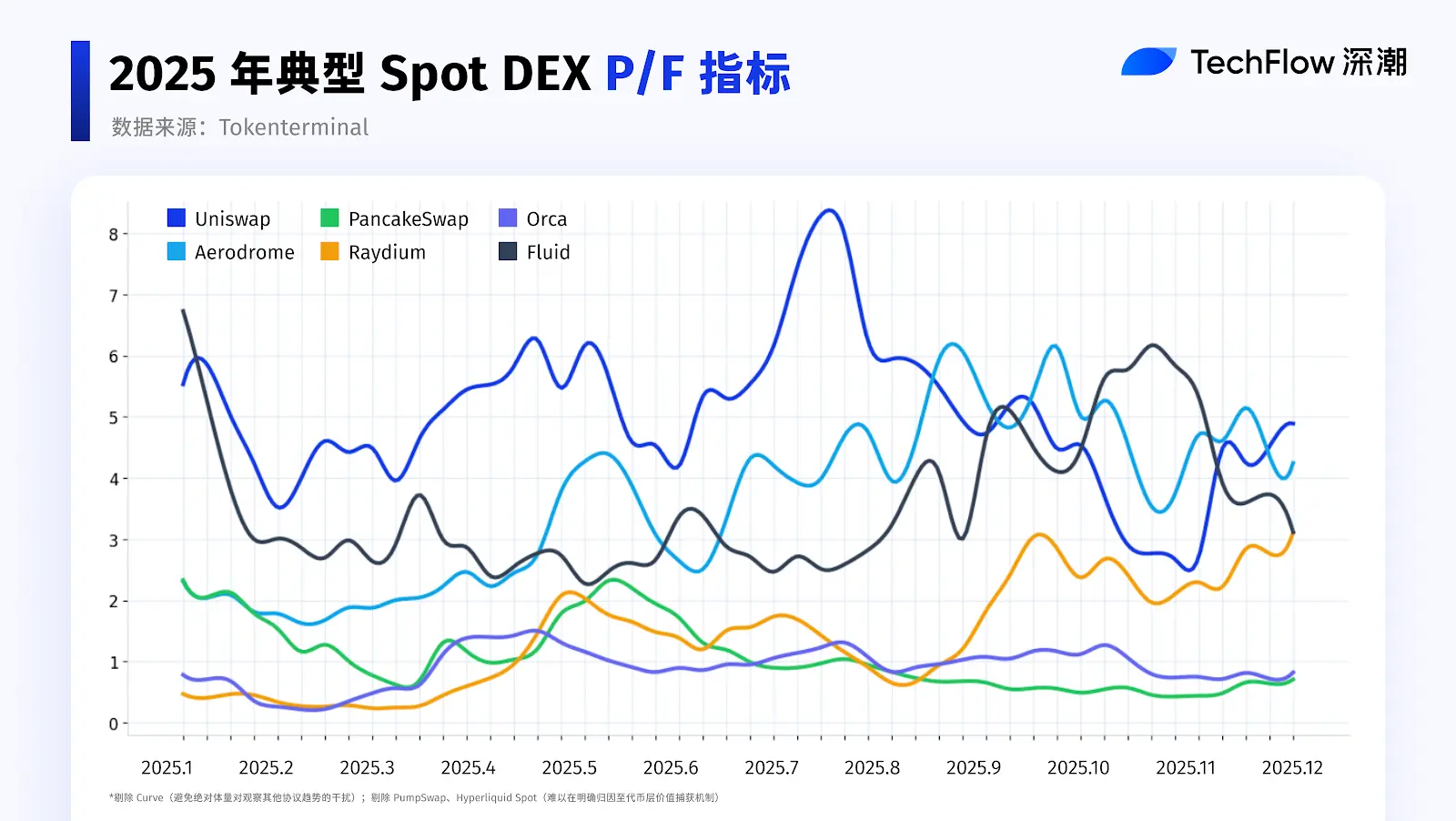

Reviewing the 2025 showdown between DEX and CEX: Perp DEX is the biggest engine

Writing by: Cecelia, Deep Tide TechFlow

DEX, is it really going to replace CEX?

From a lower market share in 2020 to a rapid increase in trading volume this year, the presence of decentralized exchanges is indeed becoming stronger.

Is the DEX comeback really not far away? But maybe not so soon?

Don't rush to applaud the victory of decentralization, and don't dismiss it with old reasons like complex processes and poor user experience.

Read this report first, and you'll know for sure.

2025: The Year DEX Liquidity Takes Off

Compared to the slow growth in the past two years, 2025 can be said to be the year when DEX liquidity truly takes off.

In terms of both scale and growth rate, the trading volume of DEX has shown a significant leap, approaching nearly 4 times the previous total trading volume.

Data source: dune.com (@c

PANews·01-15 01:31

CZ Zhao Changpeng Binance Plaza AMA Summary: Bitcoin to reach $200,000, Altcoin season will eventually return, Don't rely on Binance executives' statements to hype meme coins

Binance founder CZ discussed the outlook for Bitcoin during an AMA live stream, believing that its long-term rise to $200,000 is a "matter of time," and is optimistic about the return of altcoins. He is confident in BNB and its ecosystem but warns investors to be cautious with Meme coins and contract trading, recommending beginners start learning with spot trading. In the future, he plans to regularly host live interactive sessions on Binance Plaza.

動區BlockTempo·01-14 14:30

Russell 2000 Index Breaks Out Strongly, Is the Cryptocurrency Rally Ready to Take Over?

Author: Our Crypto Talk

Translator: Yuliya, PANews

This article is not about a cryptocurrency chart, nor about a Meme coin narrative, and is even temporarily unrelated to Bitcoin. We want to focus on the Russell 2000 Index quietly accomplishing a feat that has only happened twice in its history: breaking through and thereby driving a return of risk appetite.

If you've been in the market long enough, you've seen this "movie" more than once.

A pattern that most people continue to ignore

History always repeats itself, and even if you don't believe in cycles, you should respect this repetition.

In 2017, the Russell 2000 Index broke through, followed by the arrival of the "altcoin season."

In 2021, the Russell 2000 Index broke through again, followed by the "altcoin season."

ETH3.52%

区块客·01-14 14:17

"If you have multiple interests, don't waste the next 2~3 years" article has received tens of millions of views, and a second cultural renaissance is happening.

Dan explicitly states: society makes you think that having multiple interests is a weakness. Most people follow a sequence: go to school, get a degree, find a job, retire at some point. But he points out that this entire setup has many problems. We are no longer living in the industrial age. Focusing solely on a single skill is almost equivalent to slow death. He describes: we are currently in a "Second Renaissance." In today's world, curiosity and a love for learning are advantages.

Dan reflects on his own experience in the article, stating that over the years he has engaged in various learning pursuits but fell into a cycle of absorbing tutorials without applying them. The short-term sense of achievement mainly comes from understanding more, but life and career have not fundamentally improved because of it. It wasn't until he realized he needed a "container" that could integrate interests and turn curiosity into valuable results that he found a breakthrough.

Starting from industrial division of labor: specialists are not necessarily more free; they may be more dependent.

ChainNewsAbmedia·01-14 10:24

Hong Kong man with dual master's degrees falls from his father's sight! Suspected of being unemployed for 3 years and losing 40 million TWD in cryptocurrency

A highly educated young man from Hong Kong fell to his death from his own home in Kowloon after losing over 10 million HKD in cryptocurrency investments, sparking recent discussions about the psychological impact of investment losses.

(Background: Professor Zhou Guannan from NCCU angrily criticizes short-term trading as a "negative-sum gamble," and Giant Jie fires back: You don't understand real combat!)

(Additional context: Your "scarcity mindset" is the biggest enemy in crypto trading.)

Losing money and feeling hopeless! On the afternoon of the 12th, a report came from Flower Garden in Bijiashan, Kowloon, Hong Kong, that a 32-year-old man surnamed Chen jumped from his balcony and died. Police investigations indicate that he had just returned to Hong Kong from the UK less than two hours earlier and confessed to his father that he had lost about 10 million HKD (approximately 1.28 million USD, 40.5 million TWD) in cryptocurrency investments. After losing control of his emotions, he chose to take his own life.

Event Overview

According to information from the Hong Kong Golden Forum, police on the 14th reported,

動區BlockTempo·01-14 10:00

AI proxy purchasing books but scams money? IBM reveals the risk of indirect prompt injection in AI agents

As AI agents begin to have the ability to browse the internet independently, some people have simply outsourced hobbies like collecting second-hand books to AI labor. From searching, price comparison, filtering criteria, to finally placing orders, users don't have to manually do anything. However, a recent case has emerged where AI clearly found reasonably priced products but ultimately chose a version that was nearly twice as expensive. Further investigation revealed that the issue was not a calculation error by AI but an invisible manipulation called "indirect prompt injection."

Outsourcing book purchasing to AI, price comparison and ordering completed in one go

According to IBM security technology director Jeff Crume and IBM chief inventor Martin Keen, in an analysis video, a well-known internet user outsourced the book purchasing process to an AI agent that combines large language models with browsing capabilities. Just by entering the desired book title, the AI will

ChainNewsAbmedia·01-14 04:08

National Chengchi University Professor Zhou Guan-nan angrily criticizes short-term trading as a "negative-sum gamble," and giant Jay shoots back: You don't understand real combat at all!

Is short-term trading ultimately a zero-sum game unfavorable to retail investors, or an indispensable part of the market? Professor Zhou Guan-nan of National Chengchi University Business School's sharp critique has sparked heated discussion in the investment community. Renowned traders and founders of the crypto industry have also expressed vastly different viewpoints, igniting a fierce debate on the nature of investment and the role of the market.

(Previous context: Dissecting the Korean crypto market: Who is behind the 16 million users and the narrative?)

(Additional background: A trader on BNB chain bought "I'm coming" and it skyrocketed 1720 times! From 85 to over $140,000)

Table of Contents

Zhou Guan-nan: Short-term trading does not create positive social value

Giant Jie strongly counters: Theory detached from practice, questioning academic criticism motives

Benson: Short-term and long-term each have their market roles

Professor Zhou Guan-nan of Taiwan's National Chengchi University Business School recently posted on Facebook, directly pointing out that "stock

BNB2.25%

動區BlockTempo·01-13 13:25

It's time to start profiting again: Breakthrough of the Russell 2000 Index or the rallying call for crypto surge

Author: Our Crypto Talk

Translation: Yuliya, PANews

This article is not about a cryptocurrency chart, nor about a Meme coin narrative, and it is temporarily unrelated to Bitcoin. What we want to focus on is the Russell 2000 Index quietly accomplishing a feat that has only happened twice in its history: breaking through and thereby driving a return of risk appetite.

If you have been in the market long enough, you have seen this "movie" more than once.

A pattern that is often overlooked by most

History always repeats itself. Even if you don't believe in cycles, you should respect this repetition.

In 2017, the Russell 2000 Index broke through, followed by the arrival of the "Shanzhai Season."

In 2021, the Russell 2000 Index broke through again, and the "Shanzhai Season" played out once more.

PANews·01-13 11:33

CZ loudly warns, "Don't blindly buy the same-named meme appearing in my tweets," as there's a high chance of losing money!

CZ warns investors on Twitter not to blindly buy meme coins based on his casual tweets, emphasizing that this is not investment advice. He likes memes, but following his tweets for trading carries a high risk of loss. As the market capitalization of meme coins rises, market funds are shifting toward mainstream assets, and retail investors should exercise caution.

MEME0.79%

動區BlockTempo·01-13 08:00

Michael Saylor "Bad DAT? Still better than companies that don't invest at all"

Michael Saylor stated in an interview that it is more inappropriate for the community to criticize companies with the same理念 that hold Bitcoin than to criticize companies that hold Bitcoin. He believes that high-quality companies purchasing Bitcoin can improve their situation and should not be criticized for their size or profitability. Saylor emphasized that buying Bitcoin is a positive choice, and both enterprises and individuals should actively participate rather than fall into criticism.

BTC2.91%

TechubNews·01-13 04:55

The true collateral is the reputation of 580,000 residents: Ethical and legal pitfalls behind Wyoming stablecoins

—— A closed-loop funding system operating under the reputation of approximately 588,000 Wyoming residents

Source | U.S. MSB Daily News

Translation | USMSB Chinese

Review | Dali News

Wyoming hopes the market believes it has just invented a "secure" payment stablecoin.

What it actually launched is something much colder:

A limited recourse funding closed-loop wrapped in government jerseys, surrounded by a set of legal language that reads like a "pre-written escape route."

You can call it the Frontier Stable Token (FRNT).

You can also call it "unprecedented."

You might also call it "boring money."

But don't call it something it isn't:

Public guarantee.

Because once you strip away the patriotic narrative, this design's

PANews·01-09 13:48

Elon Musk's latest interview warns "Old-fashioned humans" to prepare for being pushed out: offices turning into blue-collar classes, energy more important than AI

Elon Musk predicts that white-collar workers will be the first to be eliminated, with robot doctors surpassing humans within three years. This is not science fiction, but a redistribution of capital. This article breaks down the logic behind this "supersonic tsunami" and analyzes how much time we have left to adapt as elites become redundant.

(Previous context: Musk comments on "Trump's nationwide spending spree": in the future, there will be no poverty, so there's no need to save money)

(Additional background: 2025 is approaching its end, and none of Musk's boasts have come true)

Table of Contents

The Reversal of Value Systems: Why Your MacBook Is More Dangerous Than a Hammer

Energy and Hardware: The Real Bottleneck and Power Centers in the AI Era

Refutation and Reflection: Don't Use "Human Warmth" as an Excuse to Escape Reality

Conclusion: Choose to be a participant, not a survivor

I have seen countless "Next Big Things,"

動區BlockTempo·01-07 10:00

Besides 114514, what other Meme coins can you buy? These 3 strategies will ensure you don't miss out

114514 doubled in two days, skyrocketing 250 times to break through a $40 million market cap. The total market cap of Meme coins rebounded from 35 billion to 50 billion, with Pepe increasing 70% over the week. Investors should focus on three main directions: attention rotation to new hot spots, classic Meme coins, and income-generating projects with token rights implementation.

MarketWhisper·01-07 03:28

Stop gambling within the "Fortune" framework: Don't ask AI whether to buy or not, first talk to it about your thinking and current situation.

The article discusses how quick actions in response to problems can lead to misconceptions and emphasizes the importance of thinking before acting. By engaging in conversations with AI, individuals can identify their own strengths and establish an effective execution system framework. Reflection and summarization help to extract applicable decision-making models to enhance market responsiveness. Ultimately, understanding oneself and leveraging personal strengths are key to success.

PANews·01-05 10:34

[Editorial] The 2027 Digital Asset Taxation "Time Bomb" - Don't Miss the Last Window of Opportunity in 2026

In 2026, the digital asset market faces a dual backdrop of economic instability and Federal Reserve liquidity injections. Investors need to adjust their strategies to cope with the upcoming substantial taxation. Additionally, the selling pressure from long-term investors has weakened, and the market's potential for explosive growth has increased. Coupled with political cycles, this is favorable for the development of digital assets. Investors should seize this "golden time."

BTC2.91%

TechubNews·2025-12-31 18:55

Vitalik may not have realized that transitioning Ethereum to PoS actually planted a financial "landmine"

After shifting consensus from PoW to PoS, $ETH now has staking yields, creating an "maturity mismatch" arbitrage opportunity between one's own LST liquid staking tokens and LRT liquidity re-mortgage tokens.

As a result, leveraging, cyclic lending, and maturity arbitrage of ETH staking yields have become the largest application scenarios for lending protocols like Aave, and also form one of the foundations of current on-chain DeFi.

That's right, the biggest application scenario for DeFi today is "arbitrage."

But don't panic, and don't be discouraged; traditional finance is the same.

The problem is, ETH's maturity mismatch hasn't brought additional liquidity or other value to the blockchain industry, or even to the Ethereum ecosystem itself, but only ongoing selling pressure. After all, institutions earning ETH staking yields will eventually cash out.

The selling pressure, ETH buying, and deflation form a micro

PANews·2025-12-31 04:17

New Year's countdown is imminent. Risks don't take a break. Before 2026 arrives, investors must watch these three major market indicators.

No matter whether investors' performance this year is bountiful or under pressure, as the calendar is about to turn, the market will soon enter a brand-new starting point. The last trading week before 2026 secretly contains several key signals that could influence market sentiment at the beginning of the year, and investors should not take them lightly. This article is excerpted from Investopedia, for market observation purposes only, not investment advice.

U.S. stocks will trade as usual until December 31 (Eastern Time)

Since traders will take a day off on Thursday for the New Year's Day holiday, this week's trading hours will be shortened due to the holiday. Therefore, initial jobless claims, Federal Reserve meeting minutes, and pending home sales data will be the focus. The bond market will close early at 2 p.m. on Wednesday, while the stock market will trade as usual on New Year's Eve.

First, this week is significantly affected by the New Year's holiday, resulting in shortened trading hours. U.S. stocks will trade as usual on New Year's Eve (December 31), but the U.S.

ChainNewsAbmedia·2025-12-30 04:54

[Editorial] The "Linux Moment" of Cryptocurrency: The End of Ideology and the Victory of Pragmatism

The huge foundation supporting the internet world is "Linux." Most servers worldwide run on Linux, and the core of the Android smartphones we use every day is also Linux. However, ordinary users may not even realize they are using Linux. They don't need to know. As long as the network speed is fast and applications run smoothly, that's enough.

The turning point currently facing the cryptocurrency market is precisely this "Linux path." In the past few years, the cryptocurrency industry misjudged the public's willingness to follow their values. They believed that concepts like decentralization, self-sovereign identity, and radical transparency would change the world.

But this assumption is wrong. As previously diagnosed in this publication through editorials, the pain and initial state of the cryptocurrency market integrating into the mainstream financial system are not driven by grand ideals. The public has chosen pure "pragmatism."

Recently, institutions and mainstream applications have introduced crypto into the market.

TechubNews·2025-12-29 15:23

Fake Financial Supervisory Commission rushes to meet year-end targets! Calling claiming your account is frozen, accurately report your personal information—don't be fooled.

Year-end is approaching, and scam groups are impersonating the Financial Supervisory Commission or the Inspection Bureau, falsely claiming account abnormalities and freezing accounts to induce remittances. The authorities reiterate that they have no such authority. Citizens should call 165 to verify.

Recently, unscrupulous individuals have impersonated "Financial Supervisory Commission" or "Inspection Bureau" officers, falsely claiming that citizens' bank account remittance funds are abnormal and that their personal information is precisely known, attempting to scam citizens out of their money. As the year-end approaches, it is the time for scam groups to boost their performance. Please also remind your elders not to panic and accept everything blindly, or they might lose their retirement funds.

Taiwan's New Type of Scam: Financial Supervisory Commission Officers Call to Freeze Accounts

------------------

Recently, unscrupulous individuals have impersonated "Financial Supervisory Commission" or "Inspection Bureau" officers, falsely claiming that citizens' bank account remittance funds are abnormal, have been listed or frozen, and claiming they can assist with processing. In fact, this is the work of scam groups. These groups usually follow the process below, exploiting citizens' fear of the law and

CryptoCity·2025-12-29 07:27

If You Don't Have a Rich Dad: 9 Steps for Ordinary People to Achieve Financial Freedom

Tired of the 9-to-5 life? This article provides a clear path to financial freedom, from leveraging work opportunities, finding passion, mastering the attention economy, building communities, diversifying monetization, to smart investing. It teaches you how to go from ordinary to extraordinary. This article is originally written by hooeem, compiled, translated, and authored by PANews.

(Previous context: Grayscale Outlook 2026 White Paper: Top 10 Cryptocurrency Investment Opportunities and Pseudo Hotspots)

(Additional background: Sentora Research: Bitcoin expected to challenge $150,000 in 2026! Three major catalysts are brewing)

Table of Contents

1. Work

2. Luck (Non-essential accelerators)

3. Passion

4. Attention Economy

5. Building Communities from 0 to 1

6. Business Monetization

動區BlockTempo·2025-12-28 05:35

Understanding the Market Essence Through "Trading Psychology Analysis": A Numerical Game of Patterns and Probabilities

Most traders fail not because they lack methods or information, but because they don't understand the essence of trading. Trading is not about prediction or seeking certainty, but about executing plans within a probabilistic environment. This article will analyze the core concepts of "Trading Psychology Analysis" and reveal why trading is a pattern recognition game in numbers. The article is based on an essay by AsymTrading, organized, compiled, and written by Foresight News.

(Background recap: Funding rates become a money tree! A trader shorted Bitcoin for two months and made a floating profit of $12.5 million, earning $9.6 million just from funding fees)

(Additional background: An 80% asset drawdown is not the end! Crypto traders reflect: how to rebirth from investment lows?)

Table of Contents

Trading is not prediction

Patterns do not predict — they only define "advantage"

Outcomes are random, probabilities are not

"Everything

動區BlockTempo·2025-12-27 05:10

8,000 Bitcoins buried in a landfill, British man "warns beginners": Don't use leverage contracts, Wall Street can liquidate you at any time

8,000 Bitcoins buried deep in the Wales landfill, James Howells ultimately lost the case, warning investors about leverage, backups, and institutional risks

(Background: He gave up! After 12 years searching through the landfill for 8,000 Bitcoins, the British engineer announced plans to tokenize his BTC)

(Additional background: Tragedy! The landfill where the British man accidentally threw away 8,000 Bitcoins will be permanently closed. After resigning and spending 12 years trying to excavate, it remains futile)

Table of Contents

Leverage Trap: Newcomers Become Liquidity Fuel

Digital Decay: Even Veterans Can Be Betrayed by Time

Institutional Embrace: The Outline of a Golden Cage

Skeptics: Observing Actions Instead of Rhetoric

Just after Christmas 2025, the community is busy organizing the predictions and outlooks from major analysts for 2026, and reflecting on the market outlook for 2026 from an experienced Bitcoin OG.

BTC2.91%

動區BlockTempo·2025-12-26 07:55

"Fake Financial Supervisory Commission" rushes for year-end performance! Be precise when reporting personal information, don't be fooled

Recently, unscrupulous individuals have been impersonating "Financial Supervisory Commission" or "Inspection Bureau" officers, falsely claiming that there are anomalies in citizens' bank account remittances, and even accurately obtaining personal information in an attempt to scam people's funds. As the year-end approaches, it is a time when scam groups boost their performance. Please also remind your elders not to panic and accept everything at face value, so their retirement funds won't be lost.

Taiwan's New Type of Scam: Financial Supervisory Commission Officer Calls to Freeze Accounts

Recently, unscrupulous individuals have been impersonating "Financial Supervisory Commission" or "Inspection Bureau" officers, falsely claiming that citizens' bank account remittances are abnormal, have been flagged or frozen, and claiming they can assist with processing. In fact, this is carried out by scam groups. These groups typically follow the process below, exploiting people's fear of the law and the authority of public power:

Impersonating identities: The caller claims to be a "Financial Supervisory Commission officer" or "Inspection Bureau officer," and can even accurately state your name and ID number to gain trust.

Creating panic: Informing you that your ID has been used to open accounts.

ChainNewsAbmedia·2025-12-26 03:43

Lawyer's Perspective: RWA Utility Tokens, Don't Deceive Yourself

The asset nature emphasized by regulation is real economic activity. In mainstream standards, the vast majority of functional RWA tokens are regarded as securities. This article is written by Professor Shao Jiadian from Mankun Blockchain and reorganized by PANews.

(Previous context: RWA explosion: opportunity or scam?)

(Additional background: Lawyers warn that China’s RWA industry has only two paths: go overseas or completely give up)

Table of Contents

Introduction

You think you're doing "RWA functional," but what are you doing in the eyes of regulation?

Real Case 1:

Real Case 2:

Why is the "functional" aspect particularly untenable in the RWA field?

A harsh reality you must face:

A brutally honest summary

So, does RWA "only" have to be securities?

End

動區BlockTempo·2025-12-25 06:05

Beyond Narratives: How does IDN Network view the real implementation and long-term adoption of Web3

For a long time, the "adoption" of Web3 has been simplistically understood as two things:

Waiting for the next bull market or relying on more user education.

But reality is proving that neither of these are true solutions.

Real Web3 adoption has never been the result of "persuasion," but rather a natural choice after the system itself is reliable, user-friendly, and trustworthy enough.

This is precisely the core perspective from which IDN Network views the implementation of Web3.

1. Adoption doesn't start with users, but with the system

There is a long-standing misconception in the Web3 industry:

As long as applications are innovative enough and traffic is large enough, users will stay.

But the truth is quite the opposite.

Users don't care about "chains," "protocols," or "architecture"; they only care about three things:

Whether it can be used stably

Whether the rules are clear and predictable

TechubNews·2025-12-24 09:41

Why has fixed-rate lending never been able to explode in DeFi?

Fixed interest rate lending has always been considered an important piece in the maturation of decentralized finance (DeFi). However, despite multiple market cycles, fixed interest rate products have never become mainstream. Instead, the floating interest rate money markets continue to expand, supporting most on-chain lending activities.

In response to this structural phenomenon, crypto researcher Prince (X account @0xPrince) recently published a lengthy analysis pointing out that the limitations of fixed interest rates in DeFi are not simply because users "don't want them," but because protocols design products based on traditional credit market assumptions. These products are deployed in an ecosystem that highly favors liquidity, leading to a long-term mismatch between capital behavior and product structure.

This article summarizes and reinterprets his views, analyzing why fixed interest rate lending has always been difficult to scale in the crypto market.

Traditional finance has credit markets; DeFi is more like an instant capital market

AAVE1.34%

ChainNewsAbmedia·2025-12-24 05:45

Load More