Search results for "FLOW"

Wintermute Ventures: Our Six Major Predictions for Digital Assets in 2026

Author: Wintermute Ventures

Translation: Bibi News

For decades, the internet has enabled information to flow freely across borders, platforms, and systems. However, the flow of "value" has always lagged behind. Money, assets, and financial contracts still rely on fragmented infrastructure, circulating through outdated tracks, national borders, and layers of intermediaries, each extracting costs.

And this gap is being filled at an unprecedented speed.

This creates opportunities for a class of infrastructure companies—those that directly replace traditional clearing, settlement, and custody functions.

Infrastructure that allows value to flow as freely as information is no longer just a theoretical concept; it is being actively built, deployed, and used at scale.

For years, while crypto assets existed on-chain, they were disconnected from the real economy. Now, this situation is changing.

Crypto is becoming an internet economy.

DEFI-3.06%

PANews·2h ago

Author of "Rich Dad Poor Dad" Reveals Secrets to Getting Rich! The Poor Sell Off Bitcoin, the Rich Are Buying Frenzily

"Rich Dad Poor Dad" author Robert Kiyosaki posted on February 2nd: During the market crash, the poor sell off their assets, while the rich hold cash and buy. He admits that selling $2.25 million worth of Bitcoin to buy real estate was a "big mistake," emphasizing the use of debt to acquire cash-flow-generating properties, and then using that cash flow to continuously buy gold, silver, and Bitcoin.

ETH-8.19%

MarketWhisper·5h ago

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·6h ago

It is during the darkest hours that winners and losers are distinguished: the market always returns stronger after a collapse.

This article addresses investors who feel hopeless during market crashes, urging them to stay resilient and emphasizing that the current predicament is the key to distinguishing winners from losers. Although market conditions are tough, the fundamentals remain strong, and more capital will flow in the future. The golden era will still come, encouraging investors not to give up.

動區BlockTempo·02-01 03:40

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-01 01:16

Bitcoin Long Update: Re-Risking After Shutdown Noise Clears, $84K in Focus

_Bitcoin traders re-risk as shutdown noise fades, focusing on $84K and the monthly close for near-term direction._

Bitcoin traders reassessed risk exposure after uncertainty tied to a possible U.S. government shutdown faded.

Order flow conditions improved during late Asian trading, while

BTC-2.56%

LiveBTCNews·01-31 08:20

Flow Foundation destroys 87.4 billion fake tokens

The Flow Foundation has permanently destroyed 87.4 billion counterfeit FLOW tokens as of January 31, concluding a security incident from December 27, 2025, which caused about $3.9 million in damage. This action, overseen by the Community Governance Committee, aims to restore user trust and improve network health, while the Flow network has recently shown recovery by processing over 3 million transactions weekly. The Foundation plans to focus on ecosystem expansion and security enhancements to prevent future risks.

FLOW-5.17%

TapChiBitcoin·01-31 04:44

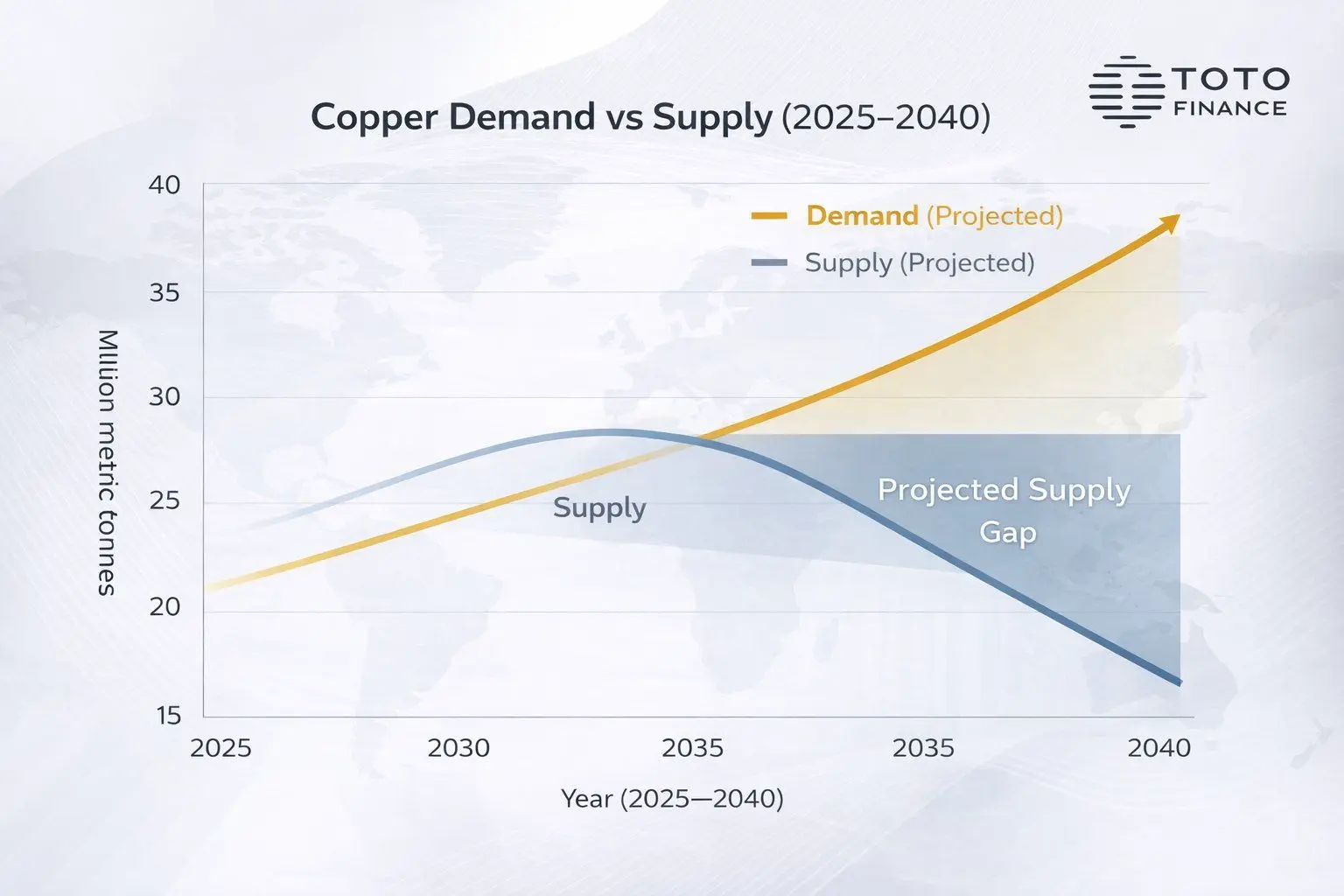

Signs that the demand for cryptocurrencies could surge in 2026

As gold and silver prices continue to reach new highs, smaller-cap metals like copper are also attracting strong interest from investment capital. Blockchain technology is expected to become an important bridge, helping this capital flow penetrate the cryptocurrency market through asset tokenization.

Copper –

TapChiBitcoin·01-31 02:36

Will Wosh promote capital flow into Bitcoin? After being nominated by Trump, gold drops below $5,000, and BTC briefly rebounds to $83,700.

After U.S. President Trump nominated Kevin Wash to succeed as Federal Reserve Chair, the market experienced capital rotation, leading to a pullback in gold and a rebound in Bitcoin. Wash has a positive view of Bitcoin, believing it can serve as a good watchdog for monetary policy. Experts warn that the short-term market reaction may just be emotional fluctuations, and investors should remain cautious.

BTC-2.56%

動區BlockTempo·01-30 15:50

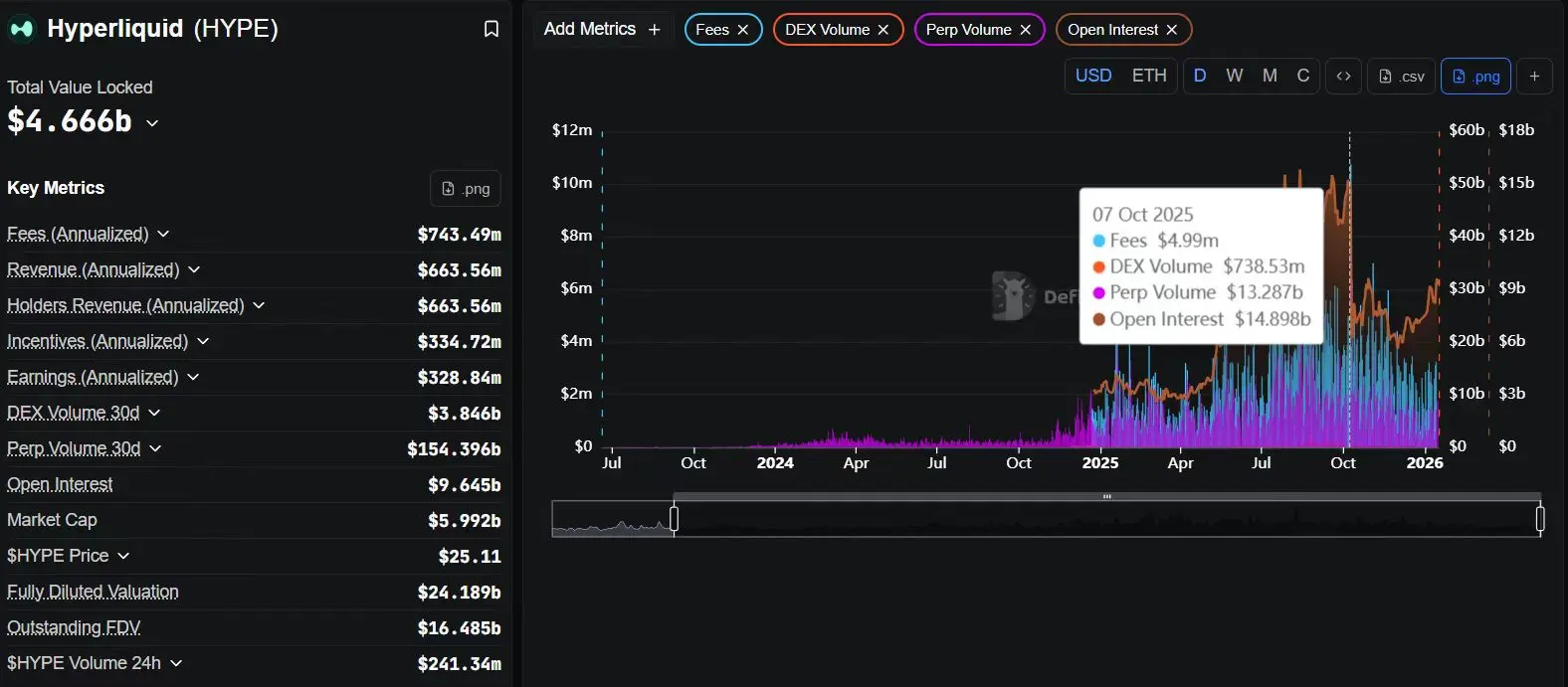

From Trading to Buyback: How Hyperliquid Builds a Self-Sustaining System

Hyperliquid enters a new phase in 2026, focusing on whether sustainable value can be achieved. Its profit structure shifts from traffic-driven to cash flow-driven, generating stable income through transaction fees, and enhancing value through buyback mechanisms and locked tokens. The team unlock process is smoothly released to reduce market pressure, and market share depends not only on trading volume but also on open interest contracts. Despite its advantages, caution is needed regarding risks caused by declining trading activity. Overall, Hyperliquid aims to build a business model with cash flow and returns.

HYPE-1.19%

PANews·01-30 11:34

Absolute Energy scam case related incident: "DeFi lending platform" raises 5 billion! Thousands of victims buy worthless coins

Taipei District Prosecutors Office is investigating the "Absolute Energy" scam case, involving over 5 billion yuan in funds and nearly 1,000 victims. The company attracted investments through the issuance of EGT, TBT tokens, and DeFi lending platforms, promising high returns. Core members have been arrested, and the investigation will clarify the flow of funds and responsibilities. Victims are concerned about the recovery of their funds.

BTC-2.56%

動區BlockTempo·01-30 09:40

Handled 350,000 Bitcoins over 3 years! U.S. Department of Justice seizes mixer Helix with over $400 million in cryptocurrency

The U.S. Department of Justice (DOJ) has officially completed a large-scale cryptocurrency seizure operation. Regarding the mixing service Helix, which played a key role in money laundering on the dark web, the U.S. government has lawfully obtained the final ownership of assets exceeding $400 million.

The DOJ issued a statement on Thursday stating that a final forfeiture order was issued by the court last week, confirming that the government can legally receive and dispose of previously seized cryptocurrencies, real estate, and financial account assets. These assets are closely related to Helix's operations and money laundering activities.

Investigations show that between 2014 and 2017, Helix handled at least 354,468 bitcoins. The platform's main users were individuals attempting to conceal the origins of illegal funds, including proceeds from dark web black markets.

A so-called "cryptocurrency mixer" or "mixing service" refers to the process of blending multiple cryptocurrency transactions to deliberately obscure the flow of funds.

区块客·01-30 08:12

【Madman on Trends】Bitcoin heading towards "break," consider swing trading below 80,000

Bitcoin's current trend forecast suggests a short-term rebound below 80,000, with an amplitude of about 6-10%. If it drops to 77,000-78,000, it may still rebound to the current price. Recently, trading volume has been sluggish, making it unlikely to form a new low in the short term. It is necessary to observe the flow of bottom-fishing funds to see if they can drive a market rebound.

区块客·01-30 08:05

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-30 01:10

IOTA Brings Seafood Supply Chains On-Chain With Kalalohko Partnership

IOTA adds Kalalohko to its Business Innovation Program to trace seafood from hook to plate and improve transparency for supply chains.

Kalalohko plans to use IOTA Identity, Notarization, and Gas Station to verify provenance and sponsor fees for a smoother user flow.

IOTA has added seafood tr

IOTA-3.39%

CryptoNewsFlash·01-29 15:20

The UAE Central Bank approves USD stablecoin USDU, the first regulated settlement token that complies with the regulatory framework.

The Central Bank of the United Arab Emirates officially approves the first USD stablecoin USDU as a tool for cross-border settlement and virtual asset trading. USDU is issued by Universal Digital, fully backed by USD reserves, stored in a protected account at a top UAE bank, aiming to provide institutional investors with a secure capital flow channel and showcase the UAE's competitiveness in digital asset regulation.

動區BlockTempo·01-29 07:20

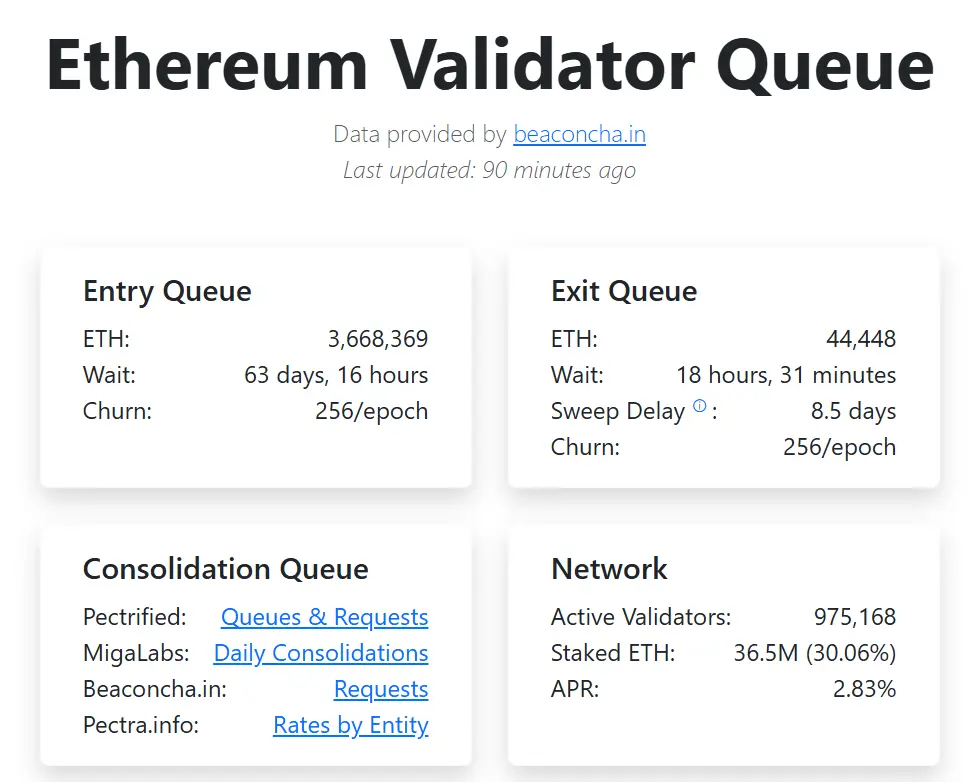

Ethereum exchange supply plummets by 34%! 3.6 million tokens queued for staking and waiting for 63 days

Ethereum exchange holdings decreased from 12.31 million to 8.15 million. 3.6 million are queued for 63 days to stake, with only 44,448 released after 18 hours. Total staking amount is 36 million. BitMine has staked a total of 2.5 million. During sideways trading, supply continues to flow out, and the staking frenzy persists.

MarketWhisper·01-29 06:54

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-29 01:05

IOTA Brings Seafood Supply Chains On-Chain With Kalalohko Partnership

IOTA adds Kalalohko to its Business Innovation Program to trace seafood from hook to plate and improve transparency for supply chains.

Kalalohko plans to use IOTA Identity, Notarization, and Gas Station to verify provenance and sponsor fees for a smoother user flow.

IOTA has added seafood tr

IOTA-3.39%

CryptoNewsFlash·01-28 15:15

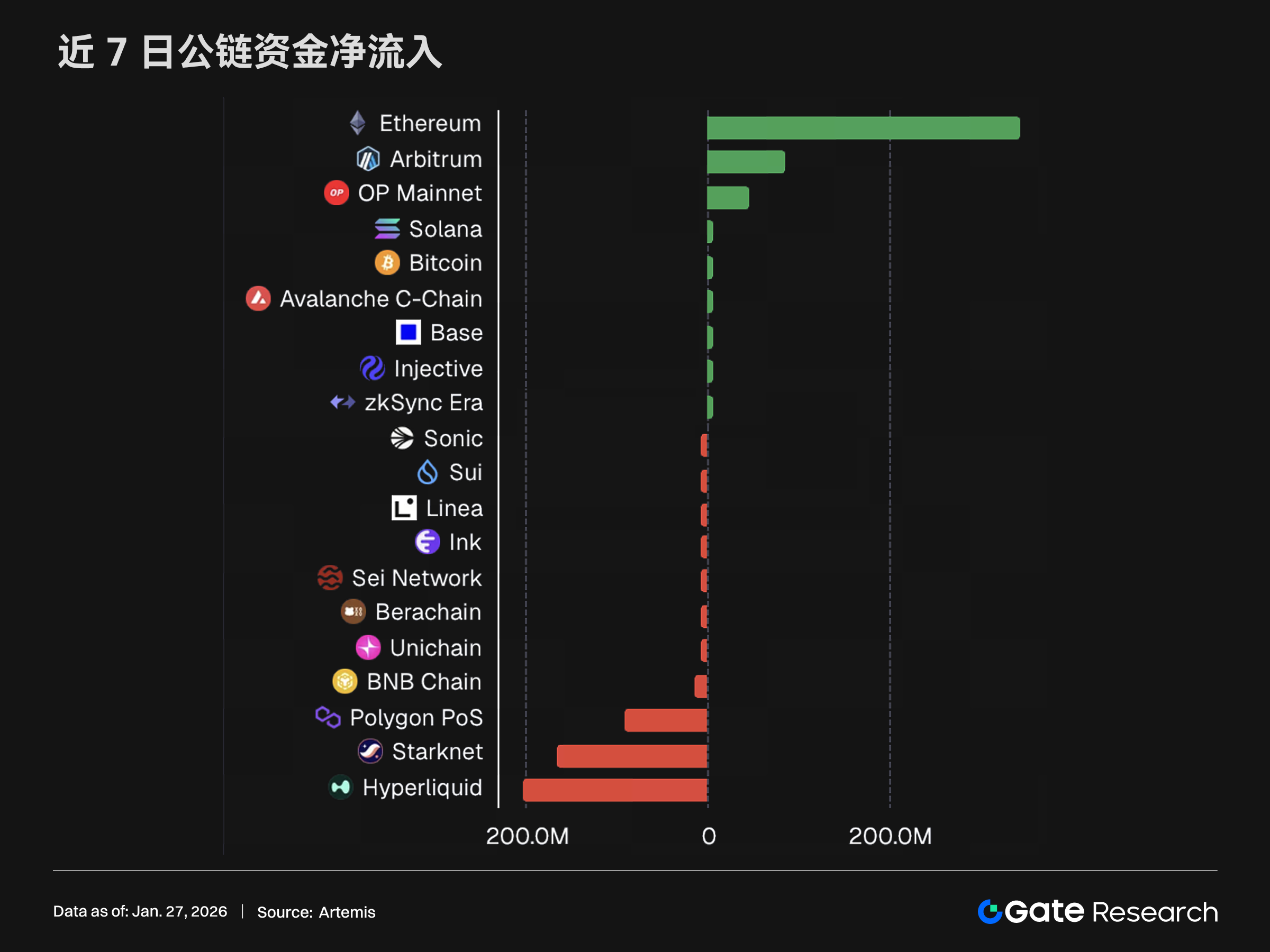

[Stable Flow] Inflows to Solana and infrastructure, large-scale outflows from Ethereum and centralized exchanges

In the past week, there has been a significant change in stablecoin capital flows, with large-scale outflows from centralized exchanges and Ethereum, while Solana and the infrastructure sector experienced capital inflows. Infrastructure saw a net increase of $251.7 million, and centralized exchanges experienced a net outflow of $1.9 billion. Additionally, Solana became the leader in supply growth, with stablecoins like USD1 and USDY performing strongly, while USDC faced a net outflow of $2.6 billion.

TechubNews·01-28 07:56

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-28 01:01

Unveiling the giant of US stock market crypto accumulation! MicroStrategy invests 53.9 billion with leverage, BitMine earns 590 million annually through staking

BTC hovers around $89,000, ETH approximately $3,200. MicroStrategy holds 710,000 BTC (invested $53.9 billion) in a leveraged mode, while BitMine holds 4.2 million ETH with an annual staking yield of $590 million in cash flow. The two major crypto giants have vastly different strategies.

MarketWhisper·01-28 00:58

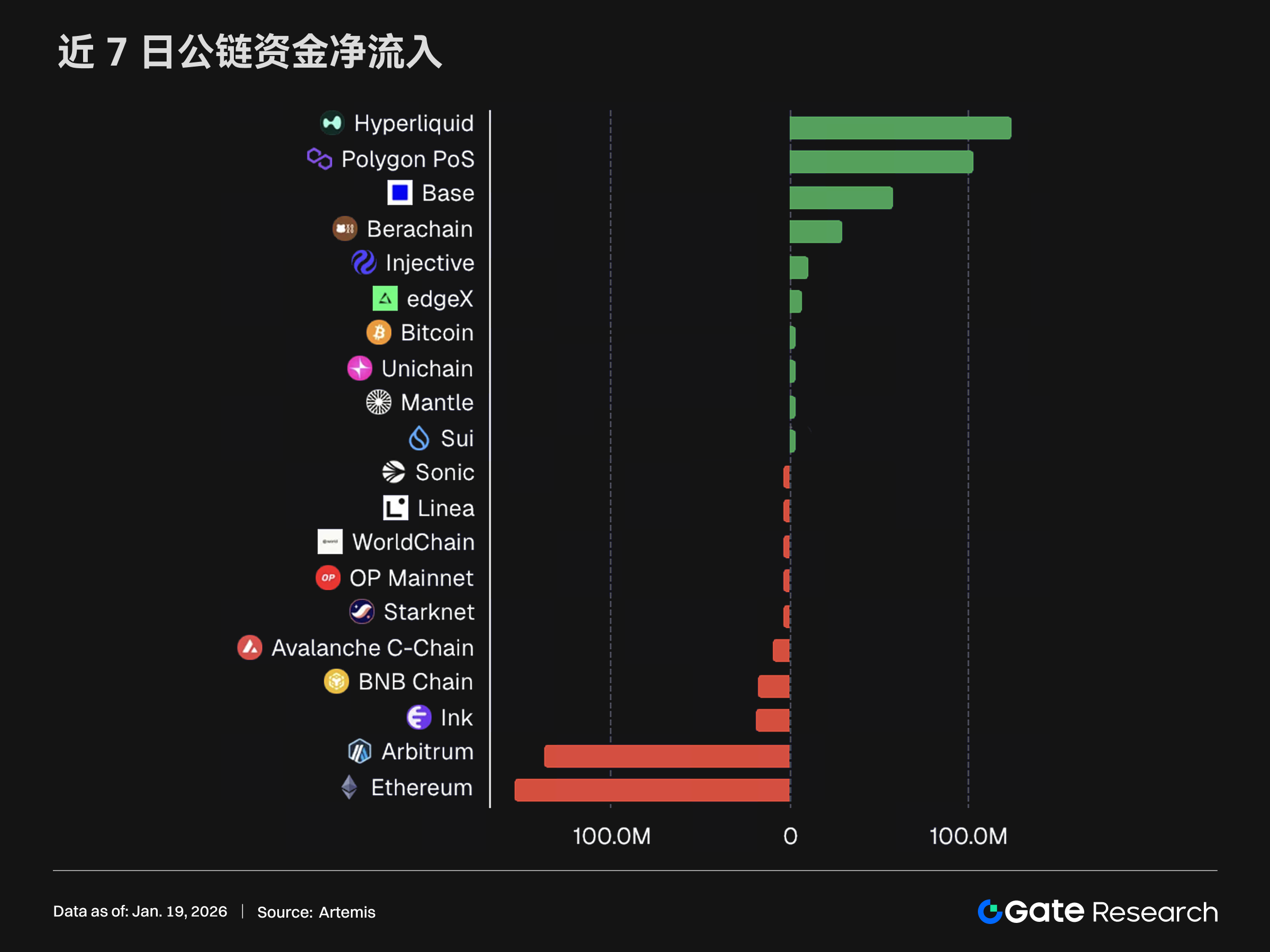

The US dollar experiences its largest decline in six months, with Ethereum receiving defensive capital inflows|Gate VIP Weekly Report (January 19, 2026 – January 25, 2026)

Last week, the market performance was weak, with BTC and ETH both showing weak oscillations, and the rebound mainly due to technical correction. On-chain capital flow was defensive, with Ethereum attracting net inflows, while multiple networks experienced capital outflows. This report will analyze these trends in depth, providing market data and technical insights.

GateResearch·01-27 09:43

MICA Daily|CryptoQuant: The crypto market keeps falling, who is actually selling off?

Recent Bitcoin pullbacks have sparked investor concern. The selling behavior of miners and large investors indicates that the current market is in a controlled "absorption phase." The miner holdings index and net flow suggest their selling volume is below average; exchange reserves and net flows are declining, reflecting risk-averse behavior rather than panic; meanwhile, whale activity shows small-scale inflows, but far below previous levels, implying the market is still undergoing strategic adjustments.

BTC-2.56%

区块客·01-27 06:40

ETF Bitcoin "open-close" fluctuations, three scenarios for Bitcoin's next all-time high?

The path for Bitcoin to return to its all-time high and enter a new price discovery phase is increasingly dependent on whether the flow of capital into Bitcoin spot ETFs can be sustained, following the two-way start of 2026 – a period that has tested the "rootedness" of institutional demand.

BTC-2.56%

TapChiBitcoin·01-27 06:02

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-26 11:48

Silver Price Hits $108 as Mining Stocks Enter a Cash Flow Boom

The silver price looks pretty much unstoppable right now. Spot silver in the U.S. has surged to $108 per ounce, while prices in Shanghai are trading near a record $124 per ounce, creating a $16 premium over Western prices that ranks among the widest gaps on record.

This kind of divergence

CaptainAltcoin·01-26 09:35

Afghanistan becomes a fertile ground for crypto innovation: rewriting the world of conflict and humanitarian aid

Afghan startup HesabPay is developing blockchain tools aimed at revolutionizing humanitarian aid distribution in conflict zones, connecting aid efforts in Afghanistan and Syria. The platform has successfully provided funding to tens of thousands of families, reducing transaction costs and increasing transparency. Blockchain technology enables aid organizations to track the flow of funds, enhancing accountability, but still faces potential risks. Beneficiaries have expressed their expectations for the system, hoping to continue using this new approach to improve their lives.

動區BlockTempo·01-26 06:25

From Crypto to Multi-Market: How Gate TradFi Contracts Are Reshaping Trading Resilience

Gate TradFi contracts incorporate traditional Contracts for Difference (CFD) into the platform, allowing users to flexibly participate in markets such as forex and commodities within a crypto environment. The USDx valuation mechanism simplifies fund flow and reduces cross-market operational complexity. These contracts follow traditional contract rules, with specified opening and closing times, leverage limits, and transparent fee rates, helping users to flexibly adjust strategies and risk management across multiple markets.

GateLearn·01-26 01:35

Best Cryptos To Invest in January Include TRX and ZRO, but the One That Could Attract a Flow of Capital Is DeepSnitch AI

The past few days, most headlines capturing the sentiment in financial markets have been “cold”. Cold, because they either had to do with Greenland, or with Davos, Switzerland (or both).

The Greenland conflict, the World Economic Forum (WEF), and, ultimately, Trump’s de-escalation of the Gree

CaptainAltcoin·01-25 09:35

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun

Author: Ryan Watkins

Translation: Deep Tide TechFlow

Introduction: By 2026, the crypto economy is in its most critical transition in eight years. This article explores how the market has achieved a "soft landing" from the overexuberance of 2021 and is gradually establishing a valuation framework based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for the industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but also an underestimated, cross-cycle entry opportunity.

Full text below:

Key Points

This asset class in 202

PANews·01-25 02:40

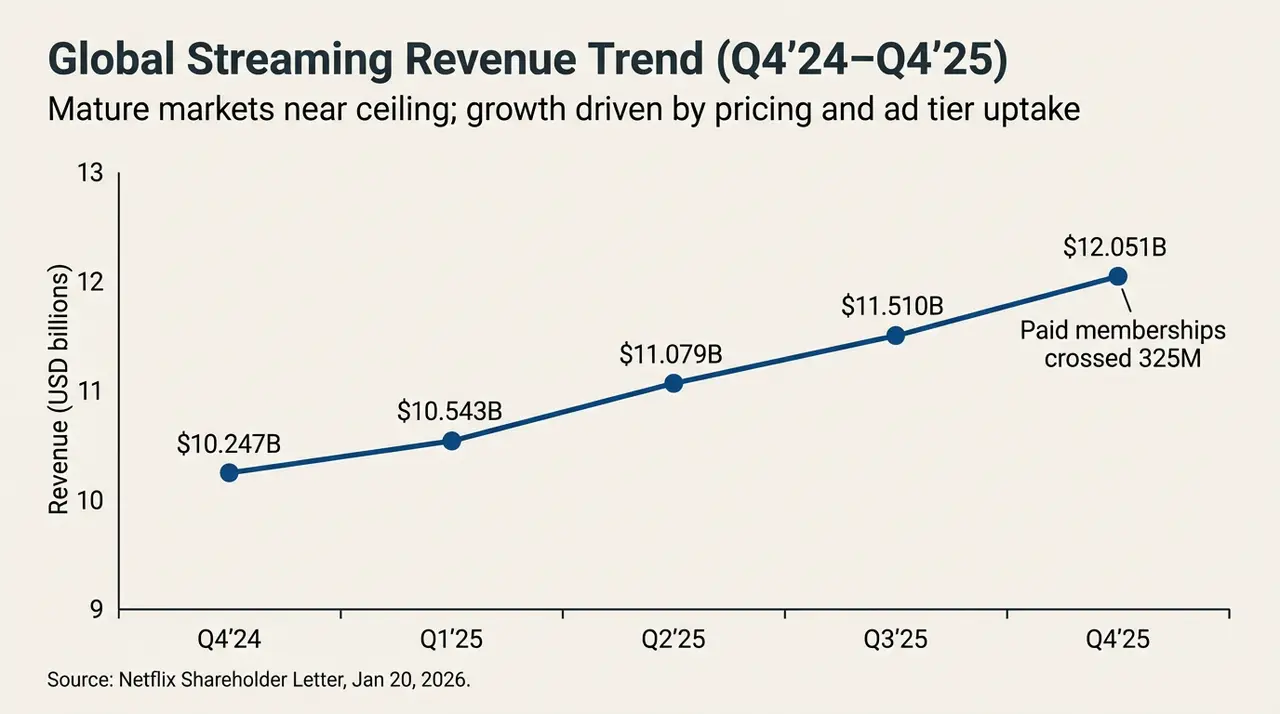

Netflix "Swallows" Warner: $59 Billion Loan, a High-Stakes Gamble in the Streaming King’s "IP Alchemy"

Written by: DaiDai, Maitong MSX Maidian

Netflix (NFLX.M) Q4 2025 financial report presents a highly fragmented narrative.

It is worth noting that, driven by the phenomenal series "Stranger Things" final season, Netflix delivered an almost impeccable performance this quarter: revenue increased by 18% year-over-year to $12 billion, global paid memberships surpassed 325 million, and free cash flow (FCF) for the quarter reached 19

PANews·01-22 09:08

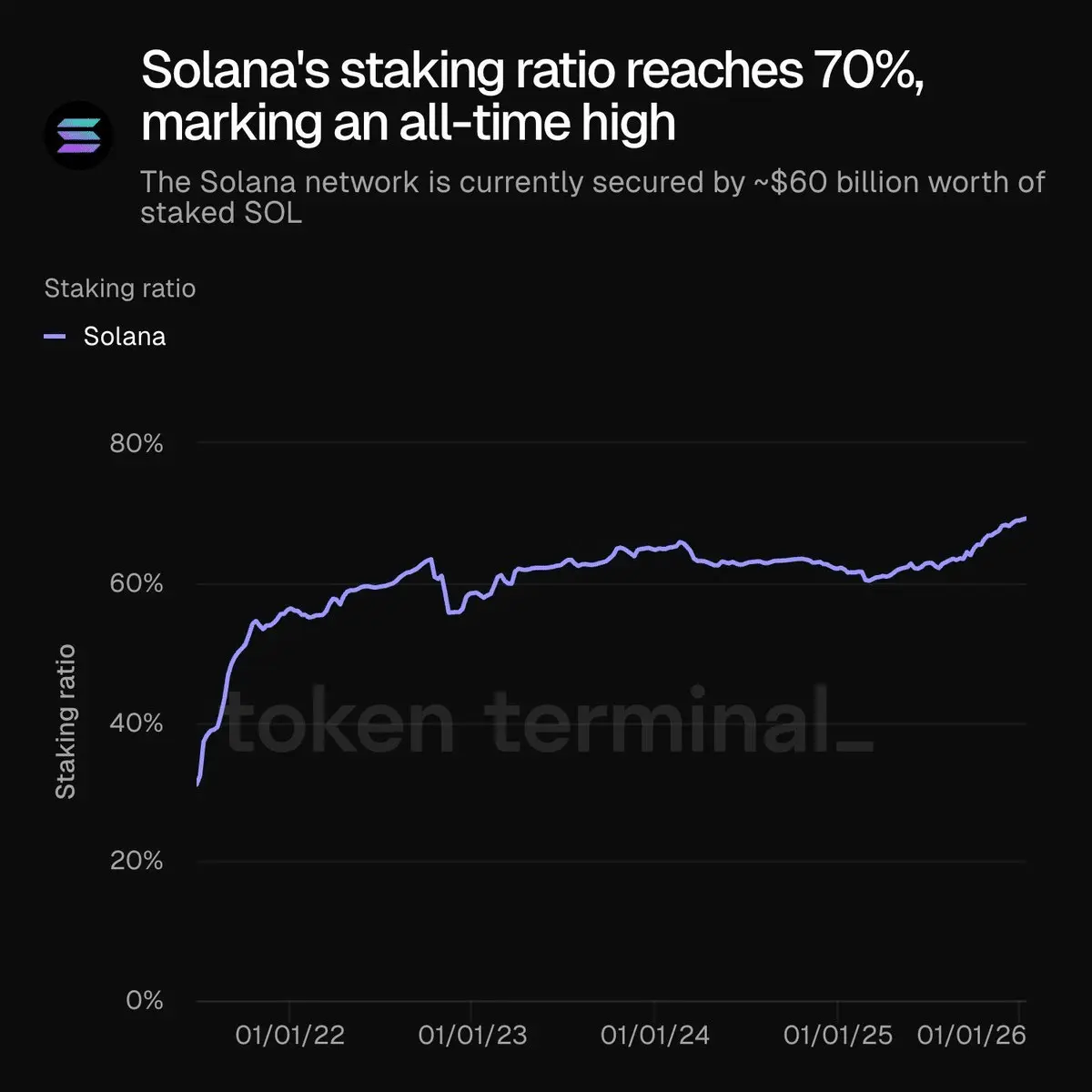

Here is how Solana is outperforming Ethereum, from staking to market momentum

The market is in a state of instability, and investor confidence is continuously being challenged.

Amid increasing macroeconomic concerns, capital continues to flow out, causing risk assets to decline across the board. In this environment, maintaining key support levels is crucial.

TapChiBitcoin·01-22 06:05

Private credit is considered a "fertile ground" for tokenization: Maple Finance CEO

According to Maple Finance CEO Sidney Powell, private credit is growing due to banks tightening lending, creating opportunities for tokenization. Bringing private credit onto the blockchain could improve transparency and transactions in this market, although onchain credit defaults are expected. He links inflation to a positive outlook for Bitcoin and predicts that capital will flow in from major institutions seeking yields.

TapChiBitcoin·01-22 03:01

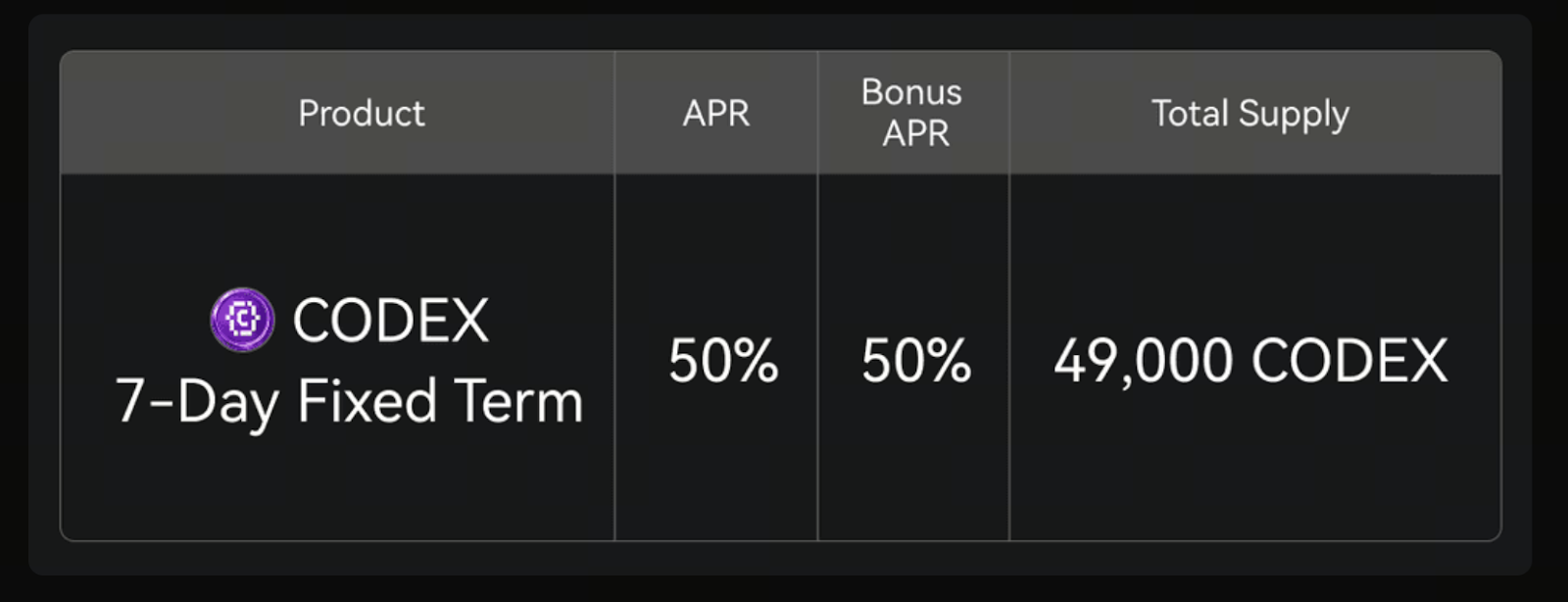

Short-term investment options amid accelerated capital flow: Gate launches CODEX 7-day fixed-term plan

As the volatility of the crypto market increases, investors are beginning to favor short-term financial products. Gate's launched CODEX 7-Day Fixed-term Investment locks in for 7 days, with high annualized returns of up to 100%, and offers a dual reward mechanism covering the CODEX token and USDT reward pool. This product helps improve capital efficiency and reduce liquidity risk. Users should assess their own risk tolerance before participating, and the product has quota limits.

CODEX2.04%

GateLearn·01-22 01:46

The Central Bank of Iran secretly hoarded 500 million USDT last year! It was revealed that it was used to stabilize the Rial exchange rate and respond to international sanctions.

Under international sanctions, the Central Bank of Iran has obtained large amounts of USDT stablecoins to inject dollar liquidity into the domestic market, supporting the Rial exchange rate and serving as an alternative settlement tool. This model and the flow of funds have attracted external attention, demonstrating the dual role of stablecoins in a sanctions environment—providing Iran with financial flexibility while also aiding regulators in tracking capital flows.

動區BlockTempo·01-21 17:50

Gold Hits New ATH and Crypto Analysts Expect This Liquidity to Flow Into Bitcoin Once Gold Price Tops

Gold and silver hit new ATH records.

Crypto analysts expect this liquidity to flow into Bitcoin once gold price tops.

Bearish and bullish debate the many possibilities for 2026.

The low-risk asset markets rejoice as the prices of gold and silver go on to hit new ATH prices. In detail, g

CryptoNewsLand·01-21 15:36

The Rise and Future of Perp DEX: A Structural Revolution in On-Chain Derivatives

Over the past two years, one of the most important changes in the crypto market has not been a new public chain or a popular narrative, but rather the gradual and continuous migration of derivatives trading from centralized exchanges to on-chain platforms. In this process, Perpetual DEX (Decentralized Perpetual Contract Exchange) has gradually evolved from an experimental product to one of the most valuable tracks within the DeFi ecosystem.

If spot trading is considered the starting point of DeFi, then perpetual contracts are becoming its true "cash flow core."

Why Perp DEX is Rising

In the traditional crypto trading system, perpetual contracts have long been the most important profit source for centralized exchanges. Whether it’s trading fees, funding rates, or additional earnings from liquidations, CEXs almost monopolize the entire derivatives cash flow. For DeFi, this is not a question of “whether to do it”

PANews·01-21 09:13

Bitcoin falls below 90,000, but are the whales secretly accumulating?

Bitcoin price once fell below $90,000, but during this period, large investors bought back $3.2 billion worth of Bitcoin against the trend, indicating accumulation. The market shows a divergence between capital flow and price, which may suggest weakening bearish momentum. Although bullish signals exist, the sustainability of the rebound still needs to be observed through trading volume and market risks.

動區BlockTempo·01-21 07:30

XRP Price Alert: Falling Wedge Targets $2.23 as Ripple Exec Predicts $1 Trillion Corporate Boom

XRP is exhibiting critical technical strength, defending the \$1.85 support level as a bullish "falling wedge" pattern on its 4-hour chart suggests a potential breakout toward \$2.23 and possibly \$3.00.

This consolidation coincides with a monumental fundamental forecast from Ripple President Monica Long, who predicts over \$1 trillion in digital assets will flow into corporate treasuries by 2026, with half of Fortune 500 companies formalizing crypto strategies. The convergence of a posit

CryptopulseElite·01-21 05:46

ONDO Market Structure Analysis: Critical Support and Bullish Outlook for 2026

ONDO is at a critical market inflection point, with bullish order flow and key support zones signaling potential for significant 2026 growth.

Whale spot orders dominate ONDO’s accumulation phase, with rising CVD and strategic positioning ahead of the 2026 unlock event.

The $0.20 support l

ONDO-5.56%

CryptoFrontNews·01-21 05:36

[Market Analysis] The "Beast" on Wall Street Has Awakened... The New York Stock Exchange Will Counter Cryptocurrency with a "Dual Exchange" Strategy

The New York Stock Exchange launches a "dual exchange" strategy, operating traditional and blockchain trading systems in parallel. This move aims to break through the "innovator's dilemma," utilizing traditional cash flow for the development of digital exchanges, promoting on-chain assets and the issuance of native digital securities, and further enhancing market position. Wall Street views cryptocurrencies as mainstream financial tools, rewriting the rules of the financial game.

TechubNews·01-20 21:58

DUSK surges thanks to on-chain capital flow and active derivatives trading

On Tuesday, the DUSK (DUSK) price continued to stay above $0.20 after recording an impressive increase of over 31% on Monday. This privacy-focused cryptocurrency surged more than 1.75 times just last week, as open interest (OI) and trading volume hit all-time highs. This momentum is further boosted

TapChiBitcoin·01-20 14:40

Caviar receives strategic investment from COPX DAO to jointly build a new Web3 luxury goods consumption and financial aggregation ecosystem

Luxury goods e-commerce Caviar and fintech platform COPX DAO's collaboration has achieved innovative integration in the Web3 environment, reshaping luxury consumption logic and financial value flow. By sharing resources and optimizing user incentive models, both parties aim to create a new value experience for high-net-worth users and promote the transformation of ecosystem integration and resource allocation, marking a key shift in Web3 competition.

DEFI-3.06%

TechubNews·01-20 11:17

CLARITY Act, the Battle Between Banks and Yields

The CLARITY Act proposal bans digital asset service providers from paying interest due to customer holdings of stablecoins, aiming to protect the profit model of traditional banks. Banks are concerned that deposits will flow toward stablecoins and DeFi products offering higher yields, thereby affecting lending capacity. This change has prompted customers to pay more attention to interest rates, increasing competition among banks. The rise of stablecoins could reshape the financial system and challenge the business models of low-interest-rate banks.

TechubNews·01-20 10:34

The true essence of cryptocurrency investing: it's not about finding 100x coins, but about finding asymmetric opportunities!

Experienced investors emphasize that the true opportunity in the crypto market lies in "asymmetric investing," which involves controlling risk and entering during market panic to achieve high returns. The key is timing and information flow, with a focus on quality teams rather than short-term hype. Successful investors know how to be patient and act decisively during market downturns.

CryptoCity·01-20 10:15

Mirror Weekly exposes: Lin Chenyu (Ma De) has a large abnormal flow of Tether USDT.

Mirror Weekly reports that prosecutors found a large amount of abnormal USDT transactions on the mobile phone and accounts of CTi reporter Lin Chen-You, suspecting that he used cryptocurrency to receive funds from China, totaling over one million New Taiwan Dollars. This case is similar to the earlier national security case, where cryptocurrencies have become infiltration tools due to low transaction fees and lack of oversight.

動區BlockTempo·01-20 10:15

When the "Beast Lord" forges his financial city-state: Tom Lee's $200 million bet and the ultimate evolution of the attention economy

In January 2026, Wall Street's crypto narrative king Tom Lee announced an investment of $200 million in Beast Industries, the holding company of MrBeast. On the surface, this news appears to be another alliance between Wall Street capital and traffic, but in essence, it is a draft social contract for the digital age. When the "Beast Lord" with 460 million global subscribers begins to collaborate with the "Financial Architect" well-versed in blockchain storytelling, they are no longer trying to build more luxurious content castles, but rather a complete digital city-state with an independent economic system.

MrBeast's predicament is a microcosm of all super-individuals in the digital age: he controls the largest attention domain in human history, with each video capable of mobilizing tens of millions of views and interactions. His chocolate brand Feastables has penetrated over 30,000 stores across North America. However, this lord himself has long been in a state of "negative cash flow."

DEFI-3.06%

TechubNews·01-20 10:07

Plain language breakdown of X's new recommendation algorithm: from "data collection" to "scoring"

Twitter's new recommendation algorithm has shifted to rely entirely on AI models, accurately suggesting content based on user behavior data and personal preferences. The algorithm builds user profiles, combines content from acquaintances and strangers, and performs data filtering and scoring to optimize the information flow. This change improves the accuracy and fairness of recommendations, providing more exposure opportunities for new and small accounts, but it may also deepen users' dependence on information and capture emotionally charged content.

TechubNews·01-20 09:50

Gate Research Institute: FED Chair Candidate Draws Attention, Solana Ecosystem Meme Activity Picks Up | Gate VIP Weekly Report

Last week, the crypto market rebounded, with BTC entering a high-level consolidation, and ETH performing more steadily. Capital flow was concentrated in high-efficiency trading scenarios, with Perp DEX and prediction markets attracting significant funds. The report will provide an in-depth analysis of these trends, along with market data and technical insights.

GateResearch·01-20 09:36

Load More