Search results for "KNIGHT"

Shiba Inu Price Analysis 2026: Is a SHIB Breakout Coming?

Shiba Inu holds key support above 846, signaling potential momentum buildup.

Analyst SHIB Knight predicts a 40% rise, targeting $0.00001200.

Lucie’s backing and community support boost optimism for a possible SHIB breakout.

Shiba Inu has captured the attention of crypto enthusiasts yet a

CryptoNewsLand·01-23 06:36

“It’s Time to Send” Shiba Inu, Analyst Confirms Clean Breakout on SHIB Chart

SHIB KNIGHT identifies signs of a potential breakout for Shiba Inu (SHIB) after it exceeds a descending resistance line, indicating reduced selling pressure. Analysts highlight the importance of sustaining support above key levels to maintain bullish momentum, despite a recent 2% price drop.

SHIB5.87%

TheCryptoBasic·01-15 09:54

How does the dispute between Trump and Powell affect Bitcoin?

Written by: Blockchain Knight

At the beginning of the year, Bitcoin still followed its usual trend under macroeconomic uncertainties, fluctuating with interest rates, the US dollar, and risk appetite.

But this week, market focus shifted from "What will the central bank do" to "Can the central bank make decisions without being forced," with the core trigger being the escalation of conflict between Trump and Federal Reserve Chair Powell.

Powell stated that he received a subpoena from a grand jury and faced criminal litigation threats related to testifying about the Federal Reserve building renovation project in Congress. The White House and Trump denied any misconduct, but the market has begun to reassess risks.

In the initial market response, gold surged to a near-record high of $4,600 per ounce, the US dollar weakened, US stock futures declined, and Bitcoin initially rose then fell amid "trust hedging" sentiment.

This linkage highlights that the dispute is not just political noise but involves substantive trading logic: for the first time, the market is considering "Federal Reserve independence."

BTC2.38%

TechubNews·01-13 03:30

While retail investors sell off, giant whales increase their holdings by 50,000 Bitcoins. Who is right and who is wrong?

Written by: Blockchain Knight

At the beginning of 2026, Bitcoin broke through $94,000, reaching a new high in over a month, marking the end of the market stagnation that persisted at the end of 2025.

Compared to the dull performance of the same period last year, this rebound has achieved a decisive reversal in market sentiment. The core driving forces are favorable macroeconomic conditions, recovering institutional demand, and healthy market mechanisms.

On the macro level, the shift in the US economic landscape provides support for Bitcoin.

First, the US Treasury yield curve has moved away from the inversion seen in 2022-2024, with short-term easing expectations coexisting with long-term high yields, prompting re-pricing of duration risk and credit risk.

Second, the structural weakening of the US dollar, although still solid, is controlled in its depreciation. Policy directions are enhancing trade competitiveness, and this combination benefits assets with defensive characteristics.

Meanwhile, at the end of 2025, ETF

BTC2.38%

TechubNews·01-07 10:32

What did Vitalik's New Year outlook talk about, and what will Ethereum be like in 2030?

Written by: Blockchain Knight

Ethereum founder Vitalik posted on social media a review of 2025, pointing out that Ethereum has overcome the industry's long-standing scalability trilemma, achieving a major technological breakthrough. However, the network needs to choose between chasing speculative trends and fulfilling the original goal of being a "neutral global computer."

He emphasized that the technological upgrades in 2025 are not the end, but the foundation for resisting the centralized subscription-based internet.

V God declared that the era of the scalability trilemma (decentralization, security, and scalability being difficult to achieve simultaneously) has ended and has been implemented in actual running code.

The core support comes from two major technological upgrades: PeerDAS mainnet has been activated, and ZK-EVM has reached production-level performance, with only security checks remaining.

The integration of these two makes Ethereum both decentralized, consensus-driven, and high-bandwidth, enhancing network processing

ETH3.38%

TechubNews·01-06 05:59

8 key data points to watch, hinting at Bitcoin price movements

Written by: Blockchain Knight

If 2024 is the year when crypto borrowing ETFs return to mainstream attention through advertising, then 2025 will be the year the market adapts to this focus.

Among them, eight core chart data points clearly connect capital flows, on-chain behavior, and price movements, becoming key to interpreting price trends.

1. The ETF daily net inflow chart records primary market creations and redemptions, reflecting the true cash demand for crypto exposure. The green (net inflow) bars indicate steady price increases and absorption of declines, while the red (net outflow) areas suggest short positions, revealing the true liquidity centers.

2. The profit and loss chart of long-term and short-term holders quantifies market sentiment, clearly distinguishing the positions of stable long-term holders from fragile short-term holders, witnessing the disparity in wealth distribution in 2025 and the signs of constructive reset.

3. Short-term holdings

TechubNews·01-05 07:55

What does the full-year settlement of $150 billion in derivatives mean for the market?

Author: Blockchain Knight

CoinGlass data shows that the forced liquidation amount in the cryptocurrency derivatives market will reach $150 billion in 2025. On the surface, this appears to be a crisis for the entire year, but in reality, it is a structural normality where derivatives dominate the marginal price market.

Margin calls and forced liquidations are more like periodic fees levied on leverage.

Against the backdrop of a total derivatives trading volume of $85.7 trillion for the year (an average of $264.5 billion daily), liquidations are merely a market byproduct, stemming from a price discovery mechanism dominated by perpetual swaps and basis trading.

As derivatives trading volume rises, open interest has rebounded from the deleveraging lows of 2022-2023. On October 7, the nominal open interest in Bitcoin contracts reached $235.9 billion (during which Bitcoin's price once touched $126,000).

However, record-breaking open interest, crowded long positions, and high leverage among small and medium altcoins...

PANews·2025-12-29 23:08

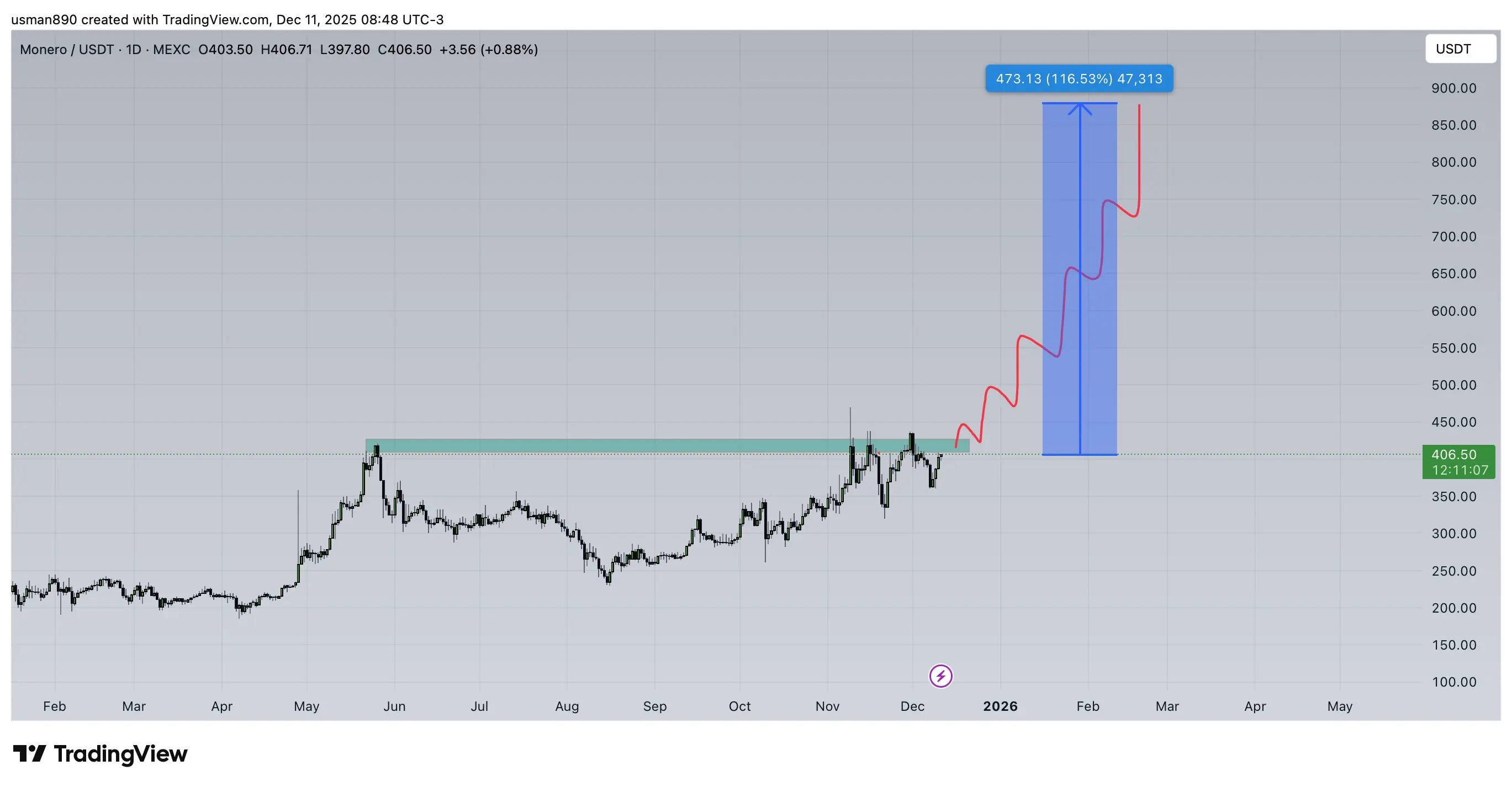

Privacy coin king XMR erupts! Traders: Expect to break through $900 before Christmas

Monero (XMR) has increased by 5% in the past 24 hours, with bulls pushing against the key resistance level of $420, indicating that this privacy token is recovering after a significant correction. Trading volume surged by 6%, exceeding $170 million, showing strong buying interest. Trader Crypto Knight predicts that if XMR breaks above the $420 resistance, the price could rise to around $900.

MarketWhisper·2025-12-18 02:19

Why is crypto the key infrastructure for the large-scale implementation of AI agents?

Written by: Blockchain Knight

For AI Agents to truly become "widely deployable autonomous software," they need two core capabilities: composability and verifiability.

These are precisely the two things that traditional Web2 cannot provide, but which cryptocurrency systems inherently possess.

1. AI Needs Composability, and Composability Must Be Built on Verifiability

The future of AI Agents is not a single model, but rather: automatically calling other services; composing with other Agents; automatically writing code; automatic testing; automatic execution of decisions (including those involving funds). This is called agent composability.

Here’s the problem: If one Agent calls another Agent, but you cannot verify that the other party actually executed as expected, the entire automation ecosystem cannot form a closed loop.

Web2’s infrastructure (API +

DeepFlowTech·2025-12-09 03:45

The debut of the Grayscale DOGE ETF was cold; what are the reasons behind it?

Author: Blockchain Knight

On November 24, the Grayscale Dogecoin ETF (GDOG) was listed on the NYSE Arca but faced a "cold opening."

On the first day, the trading volume in the secondary market was only 1.41 million USD, far below the 12 million USD predicted by Bloomberg analysts, and the net inflow of funds was 0, indicating no new capital was injected into the ecosystem. This performance clearly reveals that the market's demand for regulated products has been seriously overestimated.

The cooling of GDOG forms a stark contrast with the successful cases during the same period. The Solana ETF (BSOL), launched in late October, attracted $200 million in its first week, primarily due to its practical attribute of staking rewards, providing a difficult-to-access investment mechanism for traditional investors.

GDOG only provides exposure to social sentiment, as an ordinary spot product, with its underlying asset being Robi.

PANews·2025-11-26 07:10

MicroStrategy invests $800 million, Harvard increases its position by 200%: is the Whale buying the dip or is it a bull trap prelude?

Original Title: MicroStrategy and Harvard University, two major institutions, are increasing their positions against the trend. Is it bottom accumulation or a chase the price trap?

Original Author: Blockchain Knight

Source:

Reprinted: Daisy, Mars Finance

MicroStrategy and Harvard University, two major institutions, are increasing their positions against the trend. Is this bottom accumulation or a chase the price trap?

MicroStrategy purchased 8,178 Bitcoins for $835.6 million, locking in an average price of $102,171. Although the current price has dropped below $90,000, resulting in unrealized losses for this batch, the overall average cost of the company's holdings is approximately $74,433, still in a profitable state. It is estimated that 40% of its holdings were acquired at a trading price below cost.

Harvard Management Company disclosed in its 13F filing on September 30 that it holds 6.8 million shares of BlackRock Bitcoin ETF (IBIT), valued at $442.9 million, an increase of 200% from the previous quarter, making it the highest valued position among its U.S. listed stocks.

BTC2.38%

MarsBitNews·2025-11-20 13:26

CBOE plans to launch Bitcoin and Ether perpetual futures contracts in November.

Source: cryptoslate

Compiled by: Blockchain Knight

CBOE Global Markets announced plans to launch Bitcoin and Ethereum perpetual futures contracts on November 10, pending regulatory review.

According to the announcement on September 9, this new product set will be launched on the CBOE Futures Exchange, with contracts designed as a single long-term instrument with a duration of up to 10 years.

This design eliminates the traditional futures contract's iconic "rollover requirement," simplifying the position management process for traders seeking long-term exposure to digital assets.

The perpetual futures will use cash settlement and will undergo daily cash adjustments through a "transparent funding rate mechanism" to ensure that the prices remain consistent with the real-time spot market prices.

Derivatives regulated by the U.S. Commodity Futures Trading Commission (CFTC)

TechubNews·2025-09-10 07:35

Stablecoins lead the tokenization of assets, reaching 30 trillion dollars by 2034.

Source: cryptoslate

Compiler: Blockchain Knight

According to recent data from Token Terminal, the scale of RWAs has approached 300 billion USD, a milestone that was originally expected to be reached by 2030. Another report from RedStone Finance indicates that by 2034, the scale of on-chain RWAs could potentially exceed 30 trillion USD.

AUM of tokenized assets on the chain

Although the current growth momentum mainly comes from USDT and USDC.

TechubNews·2025-09-08 06:36

Standard Chartered Bank: Ethereum treasury company's valuation is underestimated, raising ETH year-end target to 7500 USD.

Source: cryptoslate

Compiled by: Blockchain Knight

Standard Chartered stated that even though the second-largest cryptocurrency, Ethereum, soared to a historic high of $4955 on August 25, the valuation of Ethereum and the companies holding its treasury remains undervalued.

Geoffrey Kendrick, head of cryptocurrency research at the Treasury, stated that since June, Treasury companies and ETFs have absorbed nearly 5% of the circulating Ethereum, with Treasury companies buying 2.6% and ETFs increasing their holdings by 2.3%.

The combined holding ratio of 4.9% is one of the fastest accumulation periods in cryptocurrency history, surpassing the speed of a 2% increase in circulating BTC held by the treasury and ETFs by the end of 2024.

Kendrick stated that the recent surge in accumulation marks a broader accumulation.

ETH3.38%

TechubNews·2025-08-27 03:32

Institutions managing 25 trillion change their tune: Bitcoin is a reliable store of value.

Source: cryptoslate

Compiled by: Blockchain Knight

In a recent investment report, Allianz Group announced that Bitcoin is a "reliable store of value," marking the first time that this institution, which manages $2.5 trillion in assets, recognizes digital assets as legitimate institutional investment targets.

This report titled "Bitcoin and Cryptocurrency: The Future of Finance" stands in stark contrast to Allianz's 2019 policy against investing in Bitcoin.

Today, this German investment giant defines the process of evolving Bitcoin "from an experimental protocol into a reliable store of value" as a core element of modern portfolio construction.

The report points out: "The deflationary design of Bitcoin, decentralized governance, and low correlation with traditional markets make it an attractive hedging tool and long-term asset."

Allianz emphasizes that Bitcoin is related to the S&P.

BTC2.38%

TechubNews·2025-08-22 05:31

The Federal Reserve Board of Governors reiterated a friendly stance towards Decentralized Finance, advocating for private sector-led payment innovation.

Source: cryptoslate

Compiled by: Blockchain Knight

Federal Reserve Board member Christopher Waller stated that just because DeFi operates outside traditional banking infrastructure does not mean it is "terrifying."

At the 2025 Wyoming Blockchain Symposium, Waller defined blockchain-based transactions as a "natural technological evolution" rather than a "disruptive threat."

He compared DeFi operations to traditional shopping, pointing out that "buying cryptocurrencies with stablecoins through smart contracts" is completely consistent with the basic process of "shopping at a grocery store with a debit card."

Waller stated: "There is nothing to fear in using smart contracts, tokenization, or distributed ledgers in everyday transactions."

This Federal Reserve governor positions DeFi technology as "transfer

DEFI-2.95%

TechubNews·2025-08-21 03:16

VanEck: Deflationary mechanisms may help Ethereum's value storage status surpass Bitcoin

Source: cryptoslate

Compiled by: Blockchain Knight

Analysts at VanEck have stated that Ethereum is steadily becoming a stronger competitor than Bitcoin in the race for dominance as a value store.

The driving force behind this transformation is the increasing popularity of Digital Asset Treasuries (DATs), with global enterprises increasingly favoring Ethereum and Bitcoin as their choices for digital asset reserves.

Initially, Bitcoin became the primary choice for digital asset treasury due to its fixed supply and recognized stability. However, recent developments have sparked more interest in Ethereum in the market.

The regulatory changes in the United States highlight the necessity of stablecoins and tokenization, which are at the core functions of the Ethereum ecosystem.

This has expanded the use of ETH beyond its original design, and several large brokerages and exchanges have launched tokenized stocks on the Ethereum blockchain.

In addition, the increasing flexibility of Ethereum is seen as its relative advantage.

PANews·2025-08-08 08:14

Will the "GENIUS Act" once again give rise to a "DeFi Summer"?

> What do these latest developments in the global value transfer sector mean?

Written by: Blockchain Knight

Welcome to "Slate Sundays," a brand new weekly column launched by CryptoSlate, focusing on in-depth interviews, expert analyses, and thought-provoking commentaries that go beyond the headlines to explore the ideas and voices shaping the future of cryptocurrency.

If 2024 is the "Year of the Dragon," then 2025 will be the "Year of Stablecoins." In particular, dollar-backed digital assets have become the focus and have even received recognition from the highest levels.

In March this year, the DeFi platform controlled by the Trump family launched the World Liberty stablecoin USD1. In May, Vice President JD Vance spoke about Bitcoin in the big

DEFI-2.95%

ForesightNews·2025-07-28 02:53

Report: RWA market size surpasses 24 billion USD, may reach 30 trillion by 2034

> Gauntlet's model suggests that once the tokenized loan distribution reaches 5% of the global $30 trillion market, the on-chain private credit market could exceed $250 billion.

Original source: cryptoslate

Compiled by: Blockchain Knight

According to a joint report released on June 26, risk modeling company Gauntlet, analysis provider RWA.xyz, and RedStone predict that by 2034, the on-chain RWA market size could reach up to $30 trillion.

Research shows that the scale of tokenized real-world assets without stablecoins has grown from approximately 5 billion USD in 2022 to over 24 billion USD by June 2025, with an annual growth rate of 85%, becoming one of the only in the Crypto field.

RWA4.94%

ForesightNews·2025-06-27 03:13

ETH ETF inflows hit a record high, is the spring of ETH coming?

> After breaking through the $3 billion mark, the Spot Ether ETF added $1 billion in just 15 trading days.

Source: cryptoslate

Compile: Blockchain Knight

On June 23, the listed Spot Ethereum ETF in the United States saw cumulative net inflows surpassing $4 billion, just 11 months after its listing.

These products were launched on July 23, 2024, and have seen a cumulative net inflow of $3 billion as of May 30 after 216 U.S. trading days.

After breaking through the $3 billion mark, the Spot Ethereum ETF increased by $1 billion in just 15 trading days, with its lifetime net inflows rising to $40.1 billion as of the close on June 23rd.

ETH3.38%

ForesightNews·2025-06-25 03:35

Texas signs Bitcoin reserve bill, potential allocation size reaches $2.1 billion

> If Arizona passes a similar bill, BTC investment will increase to over $2.3 billion.

Source: cryptoslate

Compiled by: Blockchain Knight

Texas Governor Greg Abbott signed the "BTC Reserve Bill" (SB 21) into law on June 21, allowing the state to withdraw unlimited funds from the state fund to invest in BTC.

The SB 21 bill established the Texas Strategic BTC Reserve and allows the comptroller to purchase BTC, provided that the asset's market value exceeds $500 billion, which currently only BTC has reached.

With the signing and effectiveness of this proposal, Texas becomes the third state in the United States to have official BTC reserves, following New Hampshire and Iowa.

BTC2.38%

ForesightNews·2025-06-24 03:57

JPMorgan Chase applies for the "JPMD" trademark for digital asset payment services, hinting at a potential stablecoin.

Written by: Blockchain Knight

JPMorgan submitted a trademark application for "JPMD," which covers transactions, exchanges, transfers, and payment services related to Crypto assets, digital tokens, and Blockchain-enabled currencies.

According to reports on June 16, this application lists electronic fund transfers, real-time token trading, custody services, and secure online financial transactions. The document notes that the trademark owner is JPMorgan Chase Bank, located in Columbus, Ohio.

This move comes after reports on May 23 that JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are discussing a joint stablecoin initiative.

Frax Finance founder Sam Kazemian confirmed the relevant discussions and stated that the discussions have moved beyond the initial conceptual stage.

TechubNews·2025-06-17 09:13

Will the globally popular Labubu meet the same fate as NFT?

> After all, no matter how magnificent the narrative, there will be a day of collapse, and currently, it seems that only BTC has not broken this curse.

Written by: Blockchain Knight

Labubu is a fictional IP character created by Hong Kong artist Long Jiasheng in 2015, belonging to the "THE MONSTERS" series under Pop Mart. Its design blends elements of dark elves from Norse mythology with Eastern aesthetics, forming a unique "ugly-cute" style that subverts the sweet paradigm of traditional toys.

Originally a niche character in picture books, it quickly rose from the art world to a global phenomenon in trendy toys after collaborating with Pop Mart to launch blind boxes in 2019.

In April 2024, BLACKPINK member Lisa posted a Labubu doll on social media, calling it "my baby," which sparked a sensation in Southeast Asia.

LABUBU-3.88%

ForesightNews·2025-06-16 01:49

BlackRock's RWA fund is close to $3 billion, having risen 3 times in 90 days.

> As of June 11, BUIDL has reached a scale of 2.89 billion USD, making it the largest tokenized currency market fund currently.

Source: cryptoslate

Compilation: Blockchain Knight

BlackRock's U.S. Institutional Digital Liquidity Fund (BUIDL) expanded by approximately $1 billion from March 26 to June 11, accounting for about half of the $2 billion growth in the tokenized U.S. Treasury market during the same period.

According to data from rwa.xyz, as of June 11, the scale of BUIDL has reached $2.89 billion, making it the largest tokenized currency market fund currently, accounting for 40% of the $7.34 billion market.

March 26th is a benchmark date of great significance, as it is the day

RWA4.94%

ForesightNews·2025-06-13 02:26

Countdown to the vote on Wednesday! The "GENIUS Act" needs 60 votes to overcome the filibuster.

> The controversial bipartisan GEN Act aims to establish the first comprehensive federal stablecoin regulatory framework in the United States and may be passed in the Senate on June 11 (Wednesday).

Written by: Blockchain Knight

The controversial bipartisan "GENIUS Act" aims to establish the first comprehensive federal stablecoin regulatory framework in the United States and is expected to be passed in the Senate on June 11 (Wednesday).

This timetable was established after Senate Majority Whip John Thune submitted a motion to end debate (Cloture) on Amendment 2307 today. This amendment is a key bipartisan alternative to the original bill (S.1582) and also addresses the original bill itself.

The motion to end debate is a procedural tool used to limit debate and force a final vote, allowing the Senate to proceed with 30

ForesightNews·2025-06-10 02:23

The Spanish coffee chain will follow Strategy with a $1 billion Bitcoin bet.

Source: beincrypto

Compiled by: Blockchain Knight

"Spanish coffee chain Vanadi plans to invest more than $1.1 billion in BTC as a core move in its new reserve strategy. This is a new trend that is emerging in corporate boards around the world.

The company does not intend to use BTC to supplement its income but plans to fully transform into a BTC-centric business. After reporting losses in 2024, Chairman Salvador Martí is betting on the Web3 space.

MicroStrategy is the first company to establish a large-scale BTC reserve, and this practice has become an important trend in recent months. From logistics companies in China to football teams in France, various types of businesses are purchasing BTC, and now a new company has joined this ranks.

local

BTC2.38%

DeepFlowTech·2025-06-04 09:31

The Middle Eastern "white knight" acquiring HiPhi Automotive is surprisingly issuing coin for financing.

Author: Deep Tide TechFlow

Do you remember that stylish yet unfortunately bankrupt car brand, Hozon Auto?

It has welcomed the Middle Eastern white-clad knight, and it may rise from the dead.

According to reports, a Middle Eastern electric vehicle company named EV Electra plans to invest 1 billion USD in the restructuring of HiPhi Automotive and seeks to obtain a controlling stake.

According to Tianyancha, on May 22, Jiangsu high合汽车有限公司 was officially established, with a registered capital of 14326.65 million USD. The company was jointly funded by the Lebanese electric vehicle company EV Electra Ltd. and the parent company of high合汽车, 华人运通, with shareholding ratios of 69.8% and 30.2%, respectively.

The latest environmental assessment report disclosed by the Yancheng Economic and Technological Development Zone shows that the renovation project of the Yueda Kia No. 1 factory, which once served as a contract manufacturer for HiPhi automobiles, has been launched, with plans to produce the HiPhi X, Y, and Z.

DeepFlowTech·2025-05-28 05:01

Report: 40% of Bitcoin holders in the United States are under 40 years old.

Original source: Cryptoslate

Compiled by: Blockchain Knight

According to a report released by River on May 20, the United States is striving to become the global center for BTC and the broader digital asset ecosystem, which could lay the foundation for a new phase of domestic economic growth in the U.S.

The "2025 US Report" claims that the United States has a unique advantage in benefiting from the institutionalization process of BTC in the financial, energy, and technology sectors.

The survey data cited in the report shows that over 40% of American adults under 40 have used or invested in BTC, highlighting the relevance of BTC among this generation.

Among the small business owners surveyed, 29% expressed interest in accepting BTC or using BTC as a reserve asset for diversification.

Organizational Maturity

River pointed out

BTC2.38%

DeepFlowTech·2025-05-21 12:28

The Russian Ministry of Finance and the Central Bank plan to launch a national crypto assets exchange.

Source: Blockchain Knight

Local media reported on April 23 that the Russian Ministry of Finance and the Central Bank plan to launch a Crypto asset exchange aimed solely at high-qualified investors, confirming rumors from earlier this year.

The exchange aims to regulate digital asset activities under a pilot legal framework and promote its application in cross-border trade. It will operate within an experimental legal system established to allow foreign trade participants to conduct transaction settlements using Crypto assets.

The system, effective from September 2024, provides a strictly controlled environment for digital asset experiments, but it has not legalized Crypto asset payments in the domestic economy of Russia.

Finance Minister Anton Siluanov outlined the plan at a recent Ministry of Finance committee meeting, indicating that the government intends to create a compliance framework for large-scale Crypto asset trading.

世链财经_·2025-05-19 10:29

"The Dark Knight" screenwriter David Goyer launches a blockchain-driven sci-fi project "Emergence"

According to Mars Finance, renowned screenwriter David S. Goyer (known for works including "The Dark Knight," "Blade," and the Apple TV+ series "Foundation") announced at the 2025 Toronto Consensus conference the launch of a new sci-fi project "Emergence," which is based on the blockchain platform Incention that he founded, aiming to leverage Web3 technology and AI.

MarsBitNews·2025-05-16 15:04

CoinVoice recently learned that Coindesk analyst Oliver Knight said that Bitcoin's current trend is similar to 2021 and may constitute a "double top" structure. Key on-chain indicators include the weekly RSI (RSI is a technical indicator that measures overbought and oversold, bearish divergence is when the RSI goes down and the price goes up), three bearish divergences, low volume on breakouts, and divergence between futures open interest and price. Knight noted that despite the record price highs, the overall upward momentum has weakened significantly.

BTC2.38%

CoinVoice·2025-05-14 12:26

The SEC has delayed decisions on multiple ETF applications related to crypto assets.

Source: Blockchain Knight

The SEC postponed its decision on multiple ETF applications related to Crypto assets on May 13, including those submitted by Grayscale and BlackRock.

These delays have extended the agency's review timeline, in line with market expectations that the SEC will not approve any applications before the last quarter of 2025.

The SOL and LTC spot ETF applications proposed by Grayscale have been postponed. The new submission deadlines for both are August 11 and October 10.

The SEC has also postponed action on BlackRock's request to enable physical redemption for its approved spot BTC ETF. There is no updated deadline for BlackRock's application, as it primarily involves technical mechanisms rather than preliminary approval.

In addition, the SEC confirmed that it received the spot DOGE submitted by 21Shares.

金色财经_·2025-05-14 03:58

The new chairman of the SEC reiterated the need for a complete reform of Crypto rules and promised to end "enforcement regulation".

> Atkins compares the transformation of securities to blockchain to the digital revolution in the music industry, believing that on-chain assets could fundamentally change the capital market just as MP3s reshaped audio issuance.

Original source: cryptoslate

Compilation: Blockchain Knight

SEC Chairman Paul Atkins called for a comprehensive modernization of U.S. crypto asset policy and outlined a three-part strategy for reforming the regulation of issuance, custody, and trading.

On May 12, Atkins made the above statement during his keynote speech at the latest roundtable meeting of the SEC Crypto Assets Special Working Group, which discussed tokenization and its potential to upgrade the Capital Market.

Atkins compares the transformation of securities to blockchain to music.

ForesightNews·2025-05-13 02:27

Goldman Sachs takes a Heavy Position of $1.4 billion in IBIT, leading institutions in the "rush to acquire" BTC ETF.

Author: zycrypto

Compiled by: Blockchain Knight

According to the latest 13F filing submitted to the SEC, Goldman Sachs has significantly increased its holdings in BTC ETFs, reflecting the growing demand for BTC among institutions against the backdrop of changing macroeconomic conditions.

Just less than three months ago, Goldman Sachs mentioned Crypto assets for the first time in its annual letter to shareholders.

Goldman Sachs bets 1.4 billion dollars on BTC, through

BTC2.38%

DeepFlowTech·2025-05-12 15:36

Meta joins the stablecoin competition, with small payments becoming the new battleground.

> Reports say that Meta is in preliminary discussions with several crypto asset companies to assess the feasibility of using stablecoins as a means of managing cross-border payments.

Original source: cryptoslate

Compiled by: Blockchain Knight

According to a report by Fortune magazine on May 8, citing informed sources, Meta is exploring a payment infrastructure based on stablecoins, making another effort to integrate blockchain technology into its platform.

According to reports, this tech giant is in preliminary discussions with multiple crypto asset companies to assess the feasibility of using stablecoins as a means for managing cross-border payments.

Relevant discussions involve use cases such as creator revenue payments on Instagram, where stablecoins can provide a lower-cost option compared to fiat currency transfer fees.

XLM5.67%

ForesightNews·2025-05-09 02:32

U.S. Treasury Secretary: Digital assets could lead to $2 trillion in government bond demand, stablecoins are the key driver.

Original text: cryptoslate

Compiled by: Blockchain Knight

U.S. Treasury Secretary Scott Bessent stated that in the coming years, the demand for U.S. government bonds in the digital asset space may surge, with a potential scale reaching $2 trillion.

Bessent made the above remarks during a hearing held by the House Financial Services Committee on the global financial system, where he emphasized the increasing financial importance of digital assets to the broader economy.

Bessent stated that the United States must take a leadership role in establishing global standards for the crypto asset market, noting that the U.S. has the opportunity to benefit while guiding innovation.

He pointed out that the integration of stablecoins and other blockchain-based financial products with the US dollar and the US Treasury market is deepening, indicating that digital assets can support the financial interests of the United States.

Stablecoin Growth

ACT3.48%

DeepFlowTech·2025-05-08 11:47

House of Representatives Crypto Bill: Definition of Digital Assets Clarified, Regulatory Gaps to Be Filled

Source: Blockchain Knight

On May 5th, leaders of the U.S. House Committee on Financial Services and the Agriculture Committee released a discussion draft outlining a federal framework for regulating the U.S. Crypto asset industry.

House Financial Services Committee Chairman French Hill (Republican, Arkansas), Agriculture Committee Chairman Glenn "G.T." Thompson (Republican, Pennsylvania), Financial Services Committee Digital Assets Subcommittee Chairman Bryan Steil (Republican, Wisconsin), and Agriculture Committee Commodity Markets Subcommittee Chairman Dusty

金色财经_·2025-05-06 03:52

The Russian Ministry of Finance and the Central Bank plan to launch a national Crypto Assets exchange.

Source: Blockchain Knight

Local media reported on April 23 that the Russian Ministry of Finance and the Central Bank plan to launch a Crypto asset exchange aimed only at qualified investors, confirming rumors from earlier this year.

The exchange aims to regulate digital asset activities under a pilot legal framework and promote their application in cross-border trade. It will operate within an experimental legal system established to allow foreign trade participants to settle transactions using Crypto assets.

Starting from September 2024, this system provides a rigorously controlled environment for digital asset experiments, but it does not legalize crypto asset payments within the domestic economy of Russia.

Finance Minister Anton Siluanov outlined the plan at a recent Ministry of Finance committee meeting, indicating that the government intends to create a compliance framework for large-scale Crypto asset trading.

世链财经_·2025-04-26 02:02

Citigroup predicts that the market capitalization of stablecoins could exceed $1.6 trillion by 2030.

Original source: cryptoslate

Compiled by: Blockchain Knight

The stablecoin sector is entering a period of accelerated application, comparable to the early growth of generative AI tools like ChatGPT, with an expected market value of over $1.6 trillion by 2030.

According to a new report released by Citigroup's Global Insights and Solutions division on April 24, the use cases for stablecoins are now expanding from the realm of crypto assets to a broader range of financial and public sectors.

The supporting factors for this transformation include improved regulatory clarity, increased institutional interest, and global market demand for dollar-denominated digital assets.

The report compares the early adoption phase of ChatGPT with the current growth phase of stablecoins, suggesting that 2025 will become a stable

TechubNews·2025-04-25 05:18

The Russian Ministry of Finance and the Central Bank plan to launch a national Crypto exchange.

> Deputy Minister of Finance Ivan Chebeskov stated that Russia's current exchange infrastructure can support the upcoming trading activities of crypto assets.

Source: cryptoslate

Compiled by: Blockchain Knight

Local media reported on April 23 that the Russian Ministry of Finance and the Central Bank plan to launch a Crypto asset exchange aimed only at high-qualified investors, confirming rumors from earlier this year.

The exchange aims to regulate digital asset activities within a pilot legal framework and promote its application in cross-border trade. It will operate under an experimental legal system established to allow foreign trade participants to settle transactions using Crypto assets.

This system, effective from September 2024, is for digital assets.

ForesightNews·2025-04-24 02:27

The forward-looking vision of a new era, how a16z founder predicted the development of Bitcoin 11 years ago?

> Bitcoin is by no means a fairy tale of liberalism or a hype from Silicon Valley, but rather an excellent opportunity to reimagine the way the financial system operates in the internet age and a catalyst for reshaping a financial system that is more favorable to individuals and businesses.

Compiled by: Blockchain Knight

This article titled "Why BTC Matters?" written by a16z founding partner Marc Andreessen in 2014 profoundly reveals the essence of BTC as a breakthrough in computer science, and its foresight remains outstanding even 11 years later.

The article foresaw that BTC would generate a four-sided network effect (consumers, merchants, miners, developers), which has now evolved into a trillion-dollar ecosystem: over 200 million users worldwide hold BTC, 89 countries support BTC payments, and over 9 globally.

BTC2.38%

ForesightNews·2025-04-21 02:19

VanEck proposes to launch a "Treasury + BTC" bond to resolve the $14 trillion challenge.

> The concept was proposed at the Strategic BTC Reserve Summit, aimed at addressing sovereign financing needs and investors' demand for inflation protection.

Source: cryptoslate

Compiled by: Blockchain Knight

Matthew Sigel, Head of Digital Asset Research at VanEck, proposed the launch of "BitBonds," a hybrid debt instrument that combines U.S. Treasury exposure with BTC, as an innovative strategy to address the U.S. government's imminent $14 trillion refinancing needs.

The concept at the Strategic BTC Reserve Summit

BTC2.38%

ForesightNews·2025-04-16 03:25

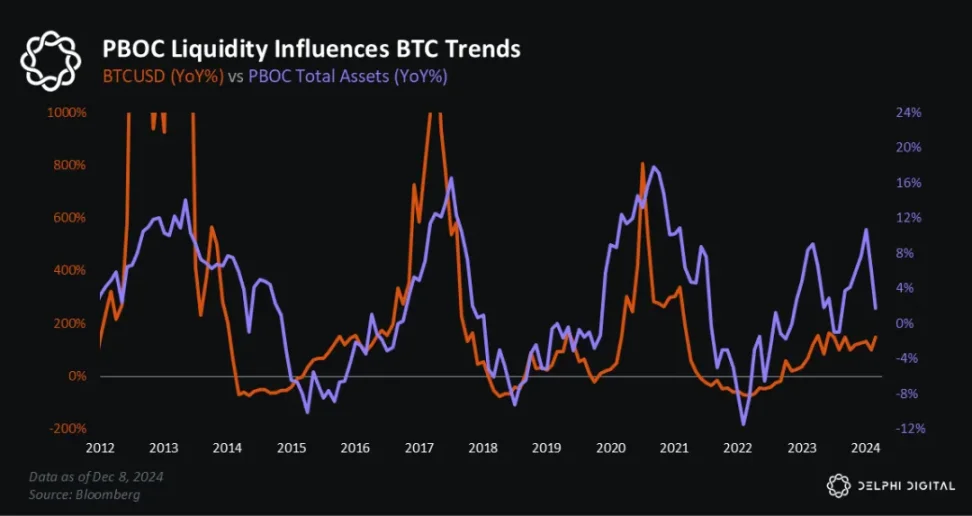

Besides the Federal Reserve (FED) cutting interest rates, there is another important data that determines the future trend of crypto.

> In addition to closely following the point shaving situation in the United States, it is also important to pay attention to changes in domestic financial data.

Author: Blockchain Knight

After a week of ups and downs due to tariff frictions, the market finally had some breathing room over the weekend. However, it remains to be seen how long this respite will last, as tariff issues are event-driven emergencies that lead to capital flight and a temporary collapse of sentiment, resulting in significant volatility.

However, once the market confirms the fundamental changes brought about by tariffs and the release of risk aversion sentiment, the entire financial market can find a new balance. This is why global stock markets, especially the US stock market, ended last week's volatility with gains last Friday. We can see this from the changes in the volatility index of the S&P 500.

It can be seen that last week the VIX index reached a recent high, comparable to it in recent years.

ForesightNews·2025-04-14 02:34

Senate finalizes! Pual Atkins to lead the SEC, crypto regulations may undergo significant adjustments.

> The Atkins plan relaxes regulatory requirements, reduces corporate disclosure rules, and continues the committee's support for the new stance on Crypto assets.

Source: cryptoslate

Compilation: Blockchain Knight

The U.S. Senate has confirmed Paul Atkins as the new chairman of the U.S. Securities and Exchange Commission (SEC). Senators approved the appointment on Wednesday with a vote of 52 in favor and 44 against.

Atkins is known for his loose regulatory philosophy, criticizing the "over-politicization and cumbersome" rules that stifle capital formation. Senate Banking Committee Chairman Tim Scott praised Atkins as a leader who "promotes capital formation and provides clarity for digital assets," acknowledging his potential to alleviate compliance burdens.

Atk

ATK-26.8%

ForesightNews·2025-04-10 04:01

Clarify stablecoin regulation, FDIC emphasizes key points for banks' Crypto business

Source: cryptoslate

Compiled by: Blockchain Knight

The Federal Deposit Insurance Corporation (FDIC) is developing a more flexible and transparent framework for American banks to engage in crypto asset activities, including the use of public, permissionless blockchains.

On April 8, FDIC Acting Chairman Travis Hill spoke at the American Bankers Association Washington Summit, outlining the agency's evolving stance on crypto-related activities.

Guidelines for Interacting with Public Blockchains

One of the key areas under review involves the interaction between regulated banks and public, permissionless blockchains.

Hill acknowledged that while jurisdictions outside the United States have allowed banks to use public blockchains for many years, U.S. banking regulators have taken a more cautious approach.

TechubNews·2025-04-09 07:41

Clarifying stablecoin regulation: FDIC emphasizes key points for banks' crypto operations.

Source: Blockchain Knight

The Federal Deposit Insurance Corporation (FDIC) is developing a more flexible and transparent framework for U.S. banks to engage in crypto asset activities, including the use of public, permissionless blockchains.

On April 8, FDIC Acting Chairman Travis Hill spoke at the American Bankers Association Washington Summit, outlining the agency's evolving stance on Crypto-related activities.

Guidelines for Interacting with Public Blockchains

One key area under review involves the interaction between regulated banks and public, permissionless Blockchains.

Hill acknowledged that while jurisdictions outside the United States have allowed banks to use public blockchains for years, U.S. banking regulators have taken a more cautious approach.

The FDIC now believes that a complete ban on the use of public blockchains is too strict. However, Hill emphasized the need for appropriate safeguards.

金色财经_·2025-04-09 02:07

Why are more and more people choosing to leave the Web3 industry recently?

Written by: Blockchain Knight

"Only when the tide goes out do you discover who has been swimming naked." Using this quote from Buffett to describe the current Crypto market is probably the best description. Over the past period, we have often heard or seen scattered news about XXX "withdrawing from the circle." Such news is more about expressing the current state of the industry rather than complaints or grievances.

As for why these people choose to leave the industry, I have roughly tracked it down to several main reasons.

First of all, the most is due to the dismal market conditions in the past period or changes brought about by the market, which forced some people to temporarily leave this industry to seek "new life"; secondly, for the past year or two, Web3 has been in a certain undesirable "pathological" growth, and some value creators have chosen to leave this field because they do not see real value growth; in addition, there is also a portion of people looking at...

DeepFlowTech·2025-04-07 18:11

Why are more and more people choosing to leave the Web3 industry recently?

Written by: Blockchain Knight

"Only when the tide goes out do you discover who's been swimming naked." Using this quote from Buffett to describe the current Crypto market is probably the best depiction. Over the past period, I have often heard or seen scattered news about XXX "withdrawing from the circle". Such news is more about expressing the current state of the industry rather than complaints or grumbling.

As for why these people choose to leave the industry, I have roughly tracked it down to a few main reasons.

First of all, the most is due to the bleak market conditions over the past period or the changes brought about by the market, causing some people to have to temporarily leave this industry to seek "new life"; secondly, for the past year or two, Web3 has been in a kind of undesirable "pathological" growth, and some value creators choose to leave this field because they cannot see real value growth; furthermore,

TechubNews·2025-04-07 06:35

The issuer of USDC, Circle, has officially submitted an IPO application, which may become a milestone in the development of stablecoins.

> Circle is the issuer of USDC and plans to list its Class A common stock on the New York Stock Exchange under the ticker symbol "CRCL."

Source: cryptoslate

Compiled by: Blockchain Knight

According to a filing submitted to the U.S. Securities and Exchange Commission (SEC) on April 1, Circle has officially submitted an S-1 application for an initial public offering (IPO).

Circle is the issuer of USDC and plans to list its Class A common stock on the New York Stock Exchange under the ticker symbol "CRCL."

According to the prospectus, Circle will offer an undisclosed number of Class A common shares, while certain existing shareholders will also register shares for sale. The expected price range per share has not yet been determined.

Circl

USDC-0.01%

ForesightNews·2025-04-02 03:57

Load More