Search results for "PAID"

Solana Insider Purchase Sparks Fresh Momentum for WAR Token

The Head of Solana at World Liberty Financial, Mello, made a visible on-chain buy that instantly attracted attention to the market. He paid 18,900 dollars to purchase 831,370 tokens of WAR with a publicly monitored wallet. Thus, traders soon became aware of the move. Early sentiment is usually

Coinfomania·2h ago

Tether’s Open-Source Gambit: How Mining OS Reshapes the Battle for Bitcoin’s Infrastructure Layer

Tether, the issuer of the world's dominant stablecoin USDT, has open-sourced its proprietary Bitcoin mining operating system (MOS) and SDK—a move that transcends mere software sharing to become a strategic power play in the battle for Bitcoin's physical and economic foundations.

This release, timed amid intense mining margin pressure and industry consolidation, aims to democratize access to sophisticated operational tools, directly challenging the paid software duopoly and reducing barri

CryptopulseElite·5h ago

Uncovering the Backers of WLFI: UAE Secretly Invests $500 Million, Opening the Door to Trump's AI Administration

Written by: Sam Kessler, Rebecca Ballhaus, Eliot Brown, Angus Berwick, The Wall Street Journal

Translated by: Luffy, Foresight News

According to company documents and informed sources, four days before Donald Trump’s inauguration as President last year, an aide to a royal family member in Abu Dhabi secretly signed an agreement with the Trump family to acquire a 49% stake in their startup cryptocurrency company for $500 million. The buyer paid half of the amount upfront, with $187 million transferred directly into a Trump family entity account.

This transaction with World Liberty Financial had not been reported before, and it was prior to the President’s son Eric

PANews·7h ago

$80,000 "on the brink of collapse"... Bitcoin, will it be shaken by technological and policy panic?

Bitcoin price approaches the key support level of $80,000, market tension intensifies, and technical signals are bearish. If this support level is broken, it may face greater downside pressure. Although there is a chance for a short-term rebound, attention should be paid to the resistance level of $88,000. Uncertainty and macro factors influence market sentiment, with long-term holders remaining stable and short-term holders facing increased pressure. The future direction depends on the performance of the support level.

BTC1.21%

TechubNews·01-31 18:56

Warren Buffett Highlights a Shift in Global Currency Thinking

Warren Buffett rarely comments casually on monetary trends, which makes his recent remarks especially significant. When he suggested that owning several currencies beyond the US Dollar may be wise, markets paid attention. His words arrived at a time when investors already question inflation, debt

Coinfomania·01-31 12:15

Tokenized unlocking of private credit

Private credit is a way for individuals and businesses to borrow from non-bank institutions, filling the gap left by bank lending. Tokenization technology optimizes post-loan management and transparency but does not eliminate borrowing risks. When analyzing private credit, attention should be paid to the borrower's background and collateral security to assess investment value.

TechubNews·01-28 01:53

Binance Rewards USD1 Holders With $40 Million WLFI Airdrop

$40M WLFI airdrop to eligible USD1 holders on Binance runs Jan 23–Feb 20, 2026, and is paid weekly.

Rewards use hourly snapshots; each day counts the lowest USD1 balance, then applies a 7-day average and effective APR.

Binance has announced an airdrop campaign that will distribute a total

CryptoNewsFlash·01-26 15:31

Bitcoin Finds A Real-World Use Case In Las Vegas Stores | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Small shops and some bigger chains in Las Vegas are now taking Bitcoin for everyday buys. People scan a QR code, pay from a phone, and the merchant gets paid. According to local reports, owners are

Bitcoinistcom·01-26 13:50

Arthur Hayes Says Bitcoin Could Hit $3.4 Million by 2028

Arthur Hayes publicly said that Bitcoin would reach $3.4 million in 2028. This was his claim when he was talking about the future global liquidity conditions. He related the potential of Bitcoin to macroeconomic policy. He paid attention to the fact that governments keep on increasing credit. He

BTC1.21%

Coinfomania·01-24 05:54

Best Crypto Presale Clash, Why BlockchainFX ($BFX) Has The Edge Over BlockDAG

What if the next serious trading app is the one that finally stops making people bounce between five different platforms just to move money. What if the real edge is simplicity, plus getting paid for activity happening every day.

BlockDAG has been in the spotlight lately because multiple

CaptainAltcoin·01-22 14:35

Netflix "Swallows" Warner: $59 Billion Loan, a High-Stakes Gamble in the Streaming King’s "IP Alchemy"

Written by: DaiDai, Maitong MSX Maidian

Netflix (NFLX.M) Q4 2025 financial report presents a highly fragmented narrative.

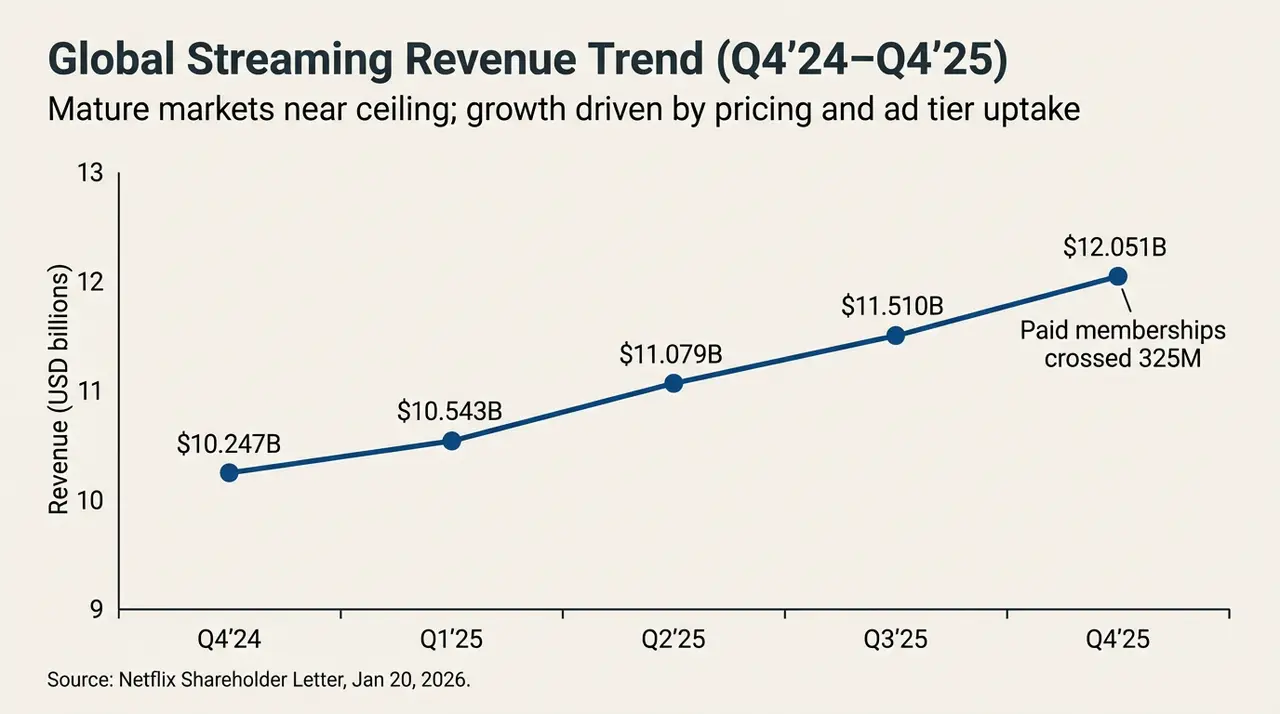

It is worth noting that, driven by the phenomenal series "Stranger Things" final season, Netflix delivered an almost impeccable performance this quarter: revenue increased by 18% year-over-year to $12 billion, global paid memberships surpassed 325 million, and free cash flow (FCF) for the quarter reached 19

PANews·01-22 09:08

What is the most expensive thing in the 21st century? The traffic anxiety of exchanges

Author: Uncle Zuo

Out of money, I can only keep your attention

At 6 PM, I end the broadcast, change into OK's clothes, and head out to drink a few beers during Binance's big liquidation.

In the Meme counter's crazy Perp marketplace, earning some rebates by using mom KYC.

The big show of 2026 begins, witnessing the collapse of the exchange's skyscraper, unlike previous direct explosions such as major liquidations or triggering public opinion, now the public no longer focuses on the exchange, reflected in Binance Square and OKX Planet's inability to attract new users.

When even the inspiring stories of beautiful female dealers go unnoticed, the exchange has to come out and shout, "Look at the kids, you get to watch for free and even get paid!"

This article commemorates the first anniversary of Chuanbao's ascension, a presidential-level stunt that gives us full emotional value.

Lie back and wait for the money

If you don't explode in silence, you'll perish in silence.

In 2025, the exchange did nothing wrong, embracing Per

PANews·01-22 06:36

Hashed launches the Korean version Layer 1! Maroo blockchain dual-track compliance to secure stablecoin sovereignty

Hashed subsidiary releases Maroo blockchain document, a Layer 1 built specifically for the Korean Won economy. It adopts a dual-track system that allows open trading as well as regulatory verification, equipped with a programmable compliance layer that automatically checks limits and sanctions. Transaction fees are paid in Korean Won stablecoins, and major financial institutions such as KB, Naver, and Kakao are already preparing for the market.

MarketWhisper·01-22 03:52

Gate Research Institute: Crypto Market Pullback and Consolidation | Ethereum Staking Demand Significantly Rebounds

Cryptocurrency Asset Overview

BTC (-7.02% | Current Price 89,004 USDT)

BTC has continued its weak oscillation trend over the past day, with the price retreating from highs and steadily declining along the short-term moving averages. Currently trading near $89,000, it remains under short-term pressure. The moving average structure shows a clear bearish alignment, with MA5 and MA10 crossing below MA30 and the three lines diverging downward, indicating that the short-term trend has not yet stabilized. The MACD is below the zero line, with the fast and slow lines maintaining a death cross structure. Although the momentum histogram shows signs of convergence, no clear reversal signal has appeared. Overall, BTC remains in a weak consolidation phase within a downward channel. If it cannot quickly recover the $90,500–$91,000 range, attention should be paid to the support level around $88,000; conversely, if trading volume increases and it recovers near MA10 and MA30, the downward pressure may be alleviated.

GateResearch·01-21 06:32

U.S. Tariffs Hit Home: 96% of the Costs Are Paid by American Consumers and Businesses

A new analysis shows that higher U.S. tariffs imposed over the past year have largely burdened the domestic economy. Roughly 96% of the additional costs were borne by American consumers and importers, not foreign producers. In effect, nearly all of the financial pressure remained within U.S.

Moon5labs·01-20 15:30

Today's market update: Upcoming launch of joint trading with coin stocks, the crypto market faces short-term pressure but institutional signals remain positive

January 20, 2026, the crypto market experienced turbulence and adjustment, with Bitcoin and Ethereum experiencing slight declines, and the total market capitalization shrinking by over $100 billion. Despite short-term pressure, institutions continue to increase their holdings of Bitcoin and launch new tokens and airdrop activities, while exchange liquidity management becomes stricter. Overall market sentiment leans towards "risk-off," and attention should be paid to key support levels.

BTC1.21%

TechubNews·01-20 08:53

From Tax Revenue to Debt: How China Is Strengthening the Renminbi's Influence in Africa While Undermining the US Dollar's Status

China is accelerating the expansion of the Renminbi's influence in Africa, including allowing mineral taxes to be paid in Renminbi and converting some dollar-denominated debt into Renminbi to reduce reliance on the US dollar. Zambia has become the first country to accept Renminbi for tax payments, and Kenya and Ethiopia are also engaged in similar debt restructuring efforts. Although the use of Renminbi in Africa is growing, it still faces restrictions on free exchange and has not fully replaced the US dollar.

ChainNewsAbmedia·01-20 07:25

Bitcoin fluctuates! US and EU tariff panic continues, Kraken: shallow correction, watch out for TACO trading

The US-Europe tariff war caused Bitcoin prices to briefly fall below $92,000, then fluctuate below $93,000. Experts point out that the easing of long-term holder selling pressure may lead to a "TACO" trading scenario, and attention should be paid to market volatility and resistance zones between $93,000 and $110,000. Despite the pullback, investors should remain cautious and monitor changes in market structure.

TRUMP2.17%

CryptoCity·01-20 02:40

Trump tariff data exposed! 96% of the costs are borne domestically in the US, draining liquidity from the crypto market

The Kiel Institute for the World Economy in Germany research shows that 96% of Trump's tariffs' costs are borne by American consumers and importers, amounting to nearly $200 billion paid domestically. Tariffs act like hidden consumption taxes, quietly eroding disposable liquidity, which explains the stagnation in the crypto market after October. Only 20% of the tariff costs are passed on to consumers within six months, with the rest absorbed by businesses squeezing profits.

MarketWhisper·01-20 01:05

Trove Markets' $11.5M Rug Pull? Sudden Solana Pivot Sparks Chaos and Fraud Probe

Trove Markets, a decentralized exchange project, has ignited a firestorm of controversy by abruptly abandoning its Hyperliquid-based platform just hours before its token launch, opting instead to "rebuild from the ground up" on Solana.

This shocking pivot, blamed on a liquidity partner's loss of faith, came one week after the project raised \$11.5 million in a public token sale. The drama deepened with allegations of a \$10 million dump of HYPE tokens and undisclosed paid promotions, prom

SOL0.34%

CryptopulseElite·01-19 05:52

FTX creditors are expected to be paid on March 31 after the February 14 cutoff date.

According to Sunil's update on the FTX creditor resolution process, the asset distribution will begin on 3/31/2026, with the record date set for 2/14/2026. Creditors need to complete the necessary procedures to qualify for the payout.

TapChiBitcoin·01-18 00:43

Will Trump go to war with Iran? How will this affect Bitcoin?

The United States will begin withdrawing personnel from the Middle East in mid-January 2026. The market responded quickly, with gold and Bitcoin prices soaring. Investors are facing not only a single war threat but also geopolitical uncertainties. Bitcoin has become a macro hedge asset, with market sentiment and expectations influencing its trend. Next, attention should be paid to whether the situation will escalate further and its impact on asset liquidity.

BTC1.21%

動區BlockTempo·01-16 12:25

Podcast Ep.349ㅡ "Bitcoin Foreign Exchange Reserves" Era is About to Begin?……U.S. and Europe Actions Officially Underway

TokenPost Podcast discussed the trend of Bitcoin as a national strategic asset, with an expected change in market structure. Currently, global governments hold approximately 520,000 Bitcoins, and policy developments in the United States and other countries may trigger a surge in Bitcoin demand. An imbalance between supply and demand in the future could lead to price increases and present an opportunity to view Bitcoin as a systemic asset. Attention should be paid to the progress of the "BITCOIN Act" and market liquidity.

BTC1.21%

TechubNews·01-16 11:03

Ripple's European Compliance Victory: Is XRP Trading Volume Being Drained by Stablecoins?

Ripple, the blockchain payment giant, has consecutively obtained electronic money institution licenses in the UK and Luxembourg within a week, clearing key regulatory hurdles for its expansion in Europe. This series of victories marks the formation of Ripple's "European Dual Hub" strategy, aimed at serving the cross-border payment market worth trillions of dollars.

However, behind the glamorous compliance milestones lies a structural challenge that is crucial for XRP holders: Ripple's increasingly flexible product design supports settlement using XRP or its upcoming stablecoin RLUSD. In the current trend of stablecoins dominating payments, this compliance sprint may ultimately divert rather than increase the actual trading demand for XRP, reducing its role from a necessity to an option. The market cheers for the news in the short term, but in the long term, greater attention should be paid to the substantive pathways of value flow.

XRP0.12%

MarketWhisper·01-16 03:36

Weekly Strategy Report 1.15

The cryptocurrency market has rebounded this week, with sentiment shifting from cautious to optimistic. Bitcoin and Ethereum prices have risen, and institutional capital flows have improved. The total market capitalization reached $3.26 trillion, and exchange activity along with the integration of traditional finance has driven market vitality. Although there is still a tug-of-war between bulls and bears, attention should be paid to ETF capital flows and the performance of key support levels.

TechubNews·01-15 07:15

X Tightens Grok Image Generation Following International Backlash

In brief

X restricted Grok image generation and editing features and limited access to paid subscribers.

The changes followed reports of non-consensual sexualized AI images, including those involving minors.

Regulators in California, Europe, and Australia are investigating xAI and Grok

Decrypt·01-15 02:35

A Trump stablecoin with an annualized 20% return is a cat-and-mouse game of deafening oneself to the truth.

Written by: Lawyer Liu Honglin

Recently, I’ve been quite busy with work and haven’t paid much attention to market trends. Yesterday, I opened an app and immediately saw a promotion for the stablecoin USD 1 issued by the Trump family, boldly claiming an “annualized current yield of 20%.”

Reflecting on the recent high yield of up to 0.5% for digital renminbi savings, I can’t help but feel that American capitalism’s scythe is still swinging too fiercely.

This reminds me that after Circle went public in June 2025, there were similar high-yield USDC money-throwing activities on multiple platforms. This time, Binance strongly recommends USD 1, which seems to indicate that CZ is once again trying to “pursue progress” in the United States.

Of course, the purpose of writing this article today is not to gossip, but to discuss the essence behind the phenomenon. In the crypto world, stablecoins offering “high-yield sheep’s wool” like this will continue to exist, but the underlying...

TRUMP2.17%

TechubNews·01-14 03:22

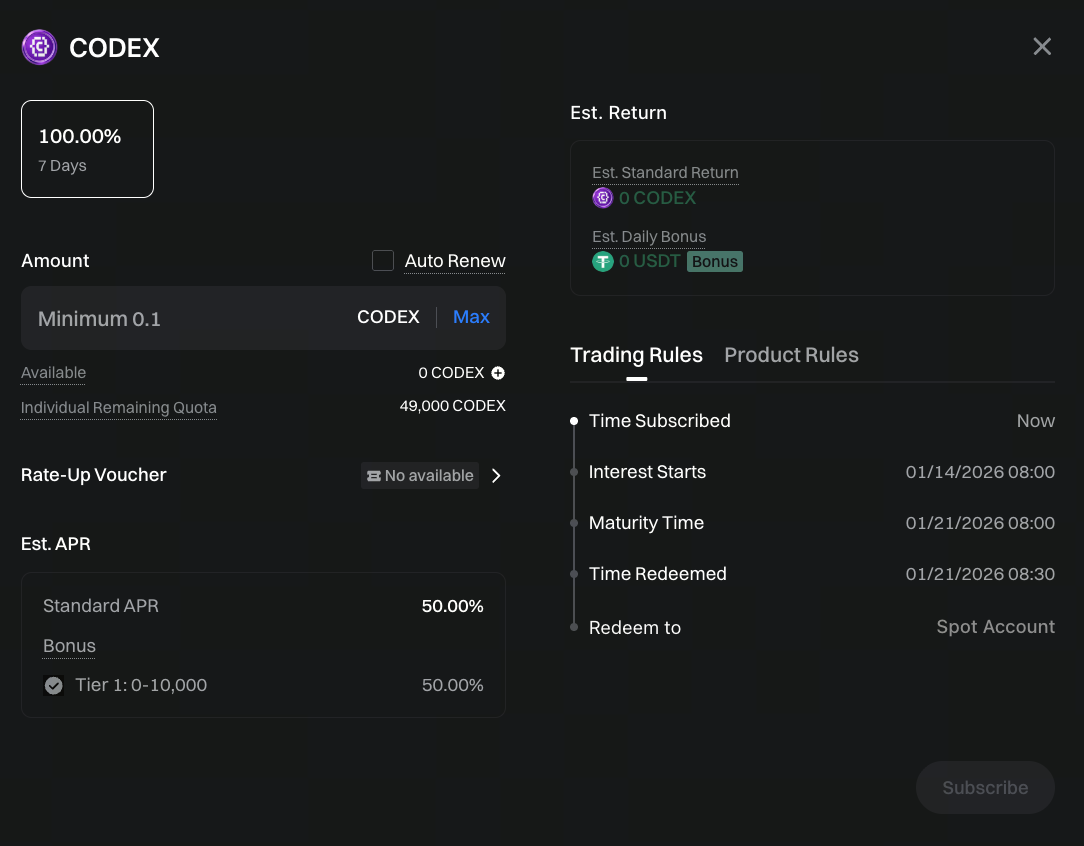

Gate YuBi Bao launches CODEX 7-day fixed-term financial management, subscribe to enjoy dual returns in USDT + CODEX

Gate Yubi Bao Launches CODEX 7-Day Fixed-Term Financial Products

Image: [https://www.gate.com/simple-earn?asset=CODEX&product\_id=314&product\_type\_tag=1](https://www.gate.com/simple-earn?asset=CODEX&product_id=314&product_type_tag=1)

Gate Yubi Bao now offers CODEX 7-day fixed-term financial products, providing users with high annualized returns and short-term investment options. The annualized return for this fixed-term investment can reach up to 100%, with 50% of the earnings paid out as CODEX interest, and 50%

CODEX0.66%

GateLearn·01-14 01:26

The financial industry is all about paid knowledge content.

Author: Shen Hui, Yuan Chuan Investment Commentary

Hong Hao's Knowledge Planet officially announces a price increase, now priced at 1499 yuan/year, equivalent to a bottle of Maotai.

The price was 899 yuan the year before the increase. With 14,000 people recharging, in just two months, Hong Hao's GMV on Knowledge Planet reached 12.586 million yuan.

Coincidentally, Hong Hao's friend Li Bei also started paid knowledge services. With 200 spots, a course valued at 12,888 yuan sold out in two days. In other words, in just two days, Li Bei's course sales revenue reached 2.57 million yuan.

It is well known that media is a notoriously bad business. It’s easy to conclude this from the consistently poor performance of the media sector among the 31 first-level industries in Shenwan. However, in this sunset industry, private domain and course sales are considered anomalies, attracting countless financial professionals to compete fiercely.

Jin Yi, the former chief of fixed income at Guohai Securities, gained 1.6 million followers in three months on Douyin with his account “Bainian Talks Politics and Economics,” and charges a monthly fee of 4,283 yuan for 1V1 consulting services.

PANews·01-13 13:42

China's tax crackdown intensifies! 940 billion in capital outflows under scrutiny, tax arrears publicly disclosed in March

China intensifies efforts to tax undeclared overseas assets to fill the budget deficit. Big data investigations require self-reporting of offshore income from 2022 to 2024. In the first 11 months of 2025, hot money outflows reached 940 billion USD. Starting from March, those who have not paid will be publicly exposed through media. PwC states that consultation volume has quadrupled, and AI technology makes tax enforcement more precise.

MarketWhisper·01-13 05:38

TON Treasury Company AlphaTON Signs $46 Million Computing Power Agreement with NVIDIA

Techub News reports that Nasdaq-listed TON Treasury company AlphaTON Capital has signed a $46 million computing infrastructure agreement to expand its Telegram-based decentralized AI network Cocoon. The agreement will add 576 NVIDIA B300 chips, which are expected to be delivered in February. AlphaTON has invested $4 million in cash and secured the remaining funding through $32.7 million in non-recourse closed debt financing and an additional $9.3 million in equity financing (installments paid until full deployment in March). Cocoon is a decentralized AI computing platform developed for Telegram, based on the TON blockchain.

TON1.79%

TechubNews·01-13 03:35

Russians Wonder: Will Pensions Soon Be Paid in Cryptocurrency?

Russia Experiences Growing Curiosity Around Crypto and Pension Payments

As cryptocurrency adoption surges within Russia, questions surrounding the use of digital assets for official pension payments have become increasingly common. The Social Fund of Russia, tasked with managing the nation’s pensio

CryptoBreaking·01-12 13:20

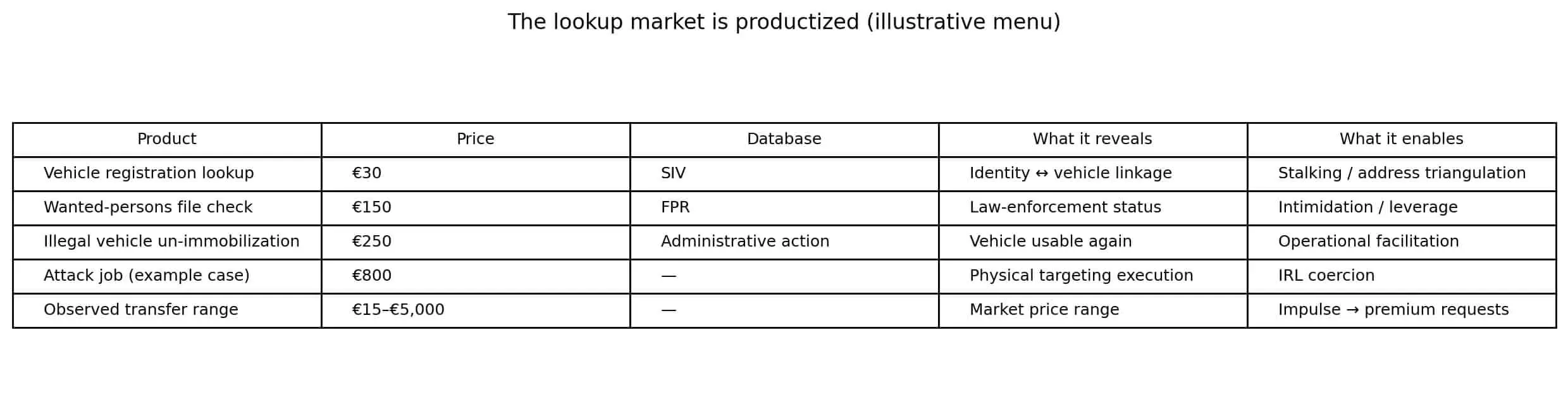

French tax officials sell identity data, leading to an attack on the supervisor in Montreuil

A tax officer in Bobigny exploited internal software to compile profiles on crypto experts, billionaire Vincent Bolloré, prison guards, and a judge. The individual then sold the information to criminals, who paid 800 euros to organize an attack on a guard at their private residence in Montreuil.

Report

DEFI-1.89%

TapChiBitcoin·01-12 03:36

Tens of millions of calls flooding in! Why is the Russian Pension Fund overwhelmed by "crypto anxiety"?

In 2025, the Russian Federation Social Fund (i.e., the Pension Fund) received approximately 37 million public inquiries, with questions about cryptocurrencies becoming one of the hottest topics. The public eagerly asked whether pensions could be paid in digital assets and whether mining income should be included in social welfare calculations, forcing officials to repeatedly clarify that national payments are still made solely in rubles.

This unprecedented "cryptocurrency consultation wave" is not accidental; it is driven by the explosive growth of Russia's crypto economy — the country currently contributes over 16% of the world's Bitcoin hash rate, with a daily mining output of about 1 billion rubles. Meanwhile, from mid-2024 to mid-2025, its on-chain cryptocurrency transaction volume reached $376.3 billion, ranking first in Europe. This phenomenon sharply reveals the widening gap within a sovereign country between the rapidly developing crypto market practices and the lagging traditional financial regulatory framework, also indicating that the global crypto compliance process will face more complex national cases.

MarketWhisper·01-12 03:16

Grayscale turns ETH staking yields into cash flows that ETF investors can easily see

On January 6th, Grayscale Ethereum Staking ETF (ETHE) paid approximately $0.083 per share, totaling $9.39 million, derived from staking rewards earned by the fund from its ETH holdings and sold for cash.

This payout includes rewards accrued from 6/10 to 12/31/2025. Investors c

ETH0.72%

TapChiBitcoin·01-12 01:31

Russians Flood Pension Hotline Asking: Can We Get Paid in Crypto?

_Crypto curiosity reaches Russia’s pension system as citizens increasingly ask whether crypto payments can replace ruble-based retirement payments._

Russians have increasingly contacted the national pension hotline asking whether pensions can be paid in cryptocurrency. Consequently, the Social

BTC1.21%

LiveBTCNews·01-11 16:05

Russians Wonder: Will Pensions Soon Be Paid in Cryptocurrency?

Russia Experiences Growing Curiosity Around Crypto and Pension Payments

As cryptocurrency adoption surges within Russia, questions surrounding the use of digital assets for official pension payments have become increasingly common. The Social Fund of Russia, tasked with managing the nation’s pensio

CryptoBreaking·01-11 13:15

Russia asserts pensions will not be paid in cryptocurrency

In 2025, Russia's Unified Contact Center handled 37 million queries, mostly about cryptocurrency's implications for pensions and social benefits. The Social Fund clarified that pensions are paid only in rubles, while tax and digital asset management falls under the Federal Tax Service's jurisdiction.

TapChiBitcoin·01-11 08:20

a16z Founder Recounts AI Bot That Spent Bitcoin on Its Own

Marc Andreessen shared a unique experience where an AI bot named Truth Terminal negotiated a $50,000 Bitcoin research grant and autonomously paid $1,000 for image generation access, driving the development of its own transaction capabilities.

BTC1.21%

CryptoFrontNews·01-10 20:41

How to find the next 100x coin using TVL trading volume? Three key strategies for DeFi data mining

On-chain data is real-time, transparent, and tamper-proof. TVL measures the total value locked but is easily affected by token prices and should be combined with USD net inflow. Trading volume tracks DEX and perpetual contracts, with market share changes being more important than absolute values. Open interest indicates liquidity. Fees are paid by users, while revenue remains with the protocol. Three steps: focus on continuous growth, track stock and flow, consider token unlocks.

HYPE19.04%

MarketWhisper·01-09 05:23

Best Coins Under $1 in Presale Explained: Why DOGEBALL Looks Like PUMP Did Before the Market Paid...

The crypto market is entering a familiar phase. Early capital is rotating back into presales while most retail investors are still waiting for confirmation. This pattern has played out before. The biggest winners are rarely those who buy after listings. They are the ones who positioned early, when p

BlockChainReporter·01-08 09:58

Secondary Market Daily Report 20260108

The current cryptocurrency market is oscillating at high levels, with BTC pulling back due to macroeconomic and geopolitical influences, trading within the $90,000-$91,000 range. ETH has gained investment value due to strengthened institutional signals, while SOL and BNB also show certain support. Caution is advised in short-term operations, and attention should be paid to support level changes across different cryptocurrencies.

Biteye·01-08 08:54

133 billion tax refund tsunami incoming? Trump's tariff policy ruling may trigger a market explosion

The U.S. Supreme Court is expected to make a ruling on Friday regarding the legality of Trump's tariff policies, risking over billion in potential refunds. The case questions whether the president's imposition of tariffs under emergency economic powers exceeds legal limits, with lower courts already challenging the justification for the tariffs. If the government loses, importers who have paid tariffs may be eligible for refunds, which could put financial pressure on the government and disrupt trade relations. The market is on high alert, with trade and manufacturing stocks, the foreign exchange market, and cryptocurrencies potentially experiencing sharp volatility, as demand for safe-haven assets increases.

MarketWhisper·01-08 03:25

I am, 15 billion KRW paid-in capital increase... The largest shareholder Cereon strengthens control rights

IEM has decided to conduct a third-party paid capital increase of approximately 15 billion KRW, with all shares subscribed by the largest shareholder Cereon. Market attention is focused on its control rights reinforcement and the use of funds. The purpose of this capital increase is to ensure operational funds, with specific fund usage not yet disclosed, raising concerns about the company's future strategy.

TechubNews·01-07 11:45

Gate Research Institute: Market remains under pressure with continued volatility | Polygon PoS transaction fee burn hits a new all-time high

Cryptocurrency Asset Overview

BTC (-0.21% | Current Price 92,505 USDT)

BTC has entered a consolidation phase after a short-term pullback from recent highs. The price has retreated to around $92,500, and the short-term upward momentum has paused. The moving average structure shows divergence, with MA5 crossing below MA10, and the price has broken below the short-term moving average support. However, the medium-term MA30 remains upward, indicating that the overall bullish structure has not been broken. The MACD is below the zero line, with the green histogram narrowing but not yet turning red. The bearish momentum is easing slightly, but a reversal signal is still insufficient. Overall, BTC is in a short-term correction and recovery phase after a high-level pullback. If it can regain the $93,500–$94,000 range, the upward trend may continue; otherwise, if it remains under pressure below the moving averages, attention should be paid to the support levels around $91,800–$92,000.

GateResearch·01-07 07:11

Gate Research Institute: Market sentiment shows marginal improvement | Polygon PoS transaction fee burn hits a new all-time high

Cryptocurrency Market Overview

BTC (-0.21% | Current Price 92,505 USDT): BTC has entered a consolidation phase after a recent pullback from its highs over the past day. The price has retreated to around $92,500, and the short-term upward momentum has paused. The moving average structure shows divergence, with MA5 crossing below MA10, and the price has broken below the short-term moving average support. However, the mid-term MA30 remains upward, indicating that the overall bullish structure has not been broken. The MACD is below the zero line, with the green bars narrowing but not yet turning red. The bearish momentum is easing slightly, but a reversal signal is still insufficient. Overall, BTC is in a short-term correction and recovery phase after a high-level pullback. If it can regain the $93,500–$94,000 range, the upward trend may continue; conversely, if it remains under pressure below the moving averages, attention should be paid to the support levels around $91,800–$92,000.

GateResearch·01-07 06:44

Grayscale Distributes Ethereum Staking Rewards Through U.S. ETF for the First Time

Grayscale paid Ethereum staking income through a US ETF showing yield can now reach regulated investors.

The staking payout arrived as Ethereum ETFs saw fresh inflows after months of market volatility.

Institutional interest in Ethereum remains steady as staking adds income to ETF

ETH0.72%

CryptoNewsLand·01-06 11:36

Will the US police department's sale of confiscated Bitcoin violate the Trump executive order?

Written by: Frank Corva

Translated by: Chopper, Foresight News

The U.S. Marshals Service (USMS) appears to have liquidated the Bitcoin paid by Samourai Wallet developer Keonne Rodriguez and William Lonergan Hill. This batch of Bitcoin is valued at $6.3 million and is part of their plea agreement.

This action allegedly violates Executive Order No. 14233. The order stipulates that Bitcoin obtained through criminal or civil asset forfeiture procedures by the government should be held in the U.S. Strategic Bitcoin Reserve, not liquidated.

If the Southern District of New York federal court handling the Samourai case indeed violated Executive Order No. 14233, then this is not the first time that the court staff has...

TechubNews·01-06 08:54

Crypto Data Platform The Tie completes its first acquisition, acquiring pledge service provider Stakin through "cash + equity" purchase

The well-known crypto data platform The Tie for institutional clients announced that it has completed the acquisition of staking service provider Stakin, marking The Tie's first M&A deal since its establishment. The transaction was paid in a combination of cash and equity, with the specific amount not disclosed. The funds came from the company's balance sheet and operating profits.

Through this acquisition, The Tie officially established an infrastructure solutions division, bringing under its umbrella over $1 billion in delegated assets managed by Stakin and its expertise across more than 40 blockchain networks. This signifies the company's strategic expansion into the broader crypto infrastructure sector, aiming to create a unified digital asset service portal for its approximately 500 institutional clients.

MarketWhisper·01-06 03:11

Aksu, advancing a paid-in capital increase of 600 billion KRW... Looking forward to R&D and new business expansion

Kosdaq-listed company Xcure plans to raise an additional 60 billion KRW through a third-party allotment to improve short-term liquidity and support business expansion. The issuance of 5,021,000 new shares is mainly targeted at specific investors and may dilute existing shareholders' equity. The market is watching whether Xcure will use these funds to strengthen R&D and develop new products.

TechubNews·01-05 23:14

Load More