Search results for "PLANET"

VC funding is bleak, new coin narratives are exhausted—what can the crypto market trade in a year?

Author: Mandy, Azuma, Odaily Planet Daily

This weekend, under internal and external pressures, the crypto market was once again bloodied. BTC is currently hesitating around the Strategy holding cost basis of $76,000, while altcoins are so volatile that just a glance at their prices makes traders want to gouge their eyes out.

Behind this current downturn, after chatting with projects, funds, and exchanges recently, a question kept recurring in my mind: What exactly is the crypto market trading a year from now?

And the more fundamental question behind this is: if the primary market no longer produces the "future of the secondary," then what is the secondary market trading a year from now? What changes will occur in exchanges?

Although the idea that altcoins are dead has long been a cliché, the past year has not been short of projects. Every day, projects are still lining up for TGE. As media, it’s quite straightforward—we continue to frequently coordinate with project teams for market promotion.

(Note: In this context

PANews·6h ago

The real culprit behind the crypto crash: Wash Effect

Author: jk, Odaily Planet Daily

Open any cryptocurrency data platform, and all you see is a sea of red.

As of press time, Bitcoin (BTC) is priced at $78,214, down 6.9% in 24 hours, with a 7-day decline of 12.4%. Ethereum (ETH) is even more brutal, currently at $2,415, down 10.5% in 24 hours, with an 18.2% drop over 7 days. Solana (SOL) is also not spared: $103.51, down 11.6% in 24 hours, with an 18.4% decline over 7 days. Looking at BNB and XRP, both have experienced double-digit drops.

The question is, what triggered this collective retreat?

The answer points to the same name: Kevin Warsh.

On January 30, U.S. President Donald Trump on the social platform Truth

PANews·02-02 00:03

The Davos Question Nobody Asked: Who’s Building the Wallet for AI?

Salesforce built an AI concierge for Davos. Named her EVA. She coordinated 3,000 of the most powerful people on the planet—heads of state, CEOs, the kind of people who have people.

EVA scheduled meetings. Generated her briefings. Managed the chaos of the world’s most overbooked conference in real t

NOBODY9.05%

CryptoBreaking·01-27 11:45

The Davos Question Nobody Asked: Who’s Building the Wallet for AI?

Salesforce built an AI concierge for Davos. Named her EVA. She coordinated 3,000 of the most powerful people on the planet—heads of state, CEOs, the kind of people who have people.

EVA scheduled meetings. Generated her briefings. Managed the chaos of the world’s most overbooked conference in real t

NOBODY9.05%

CryptoBreaking·01-26 11:40

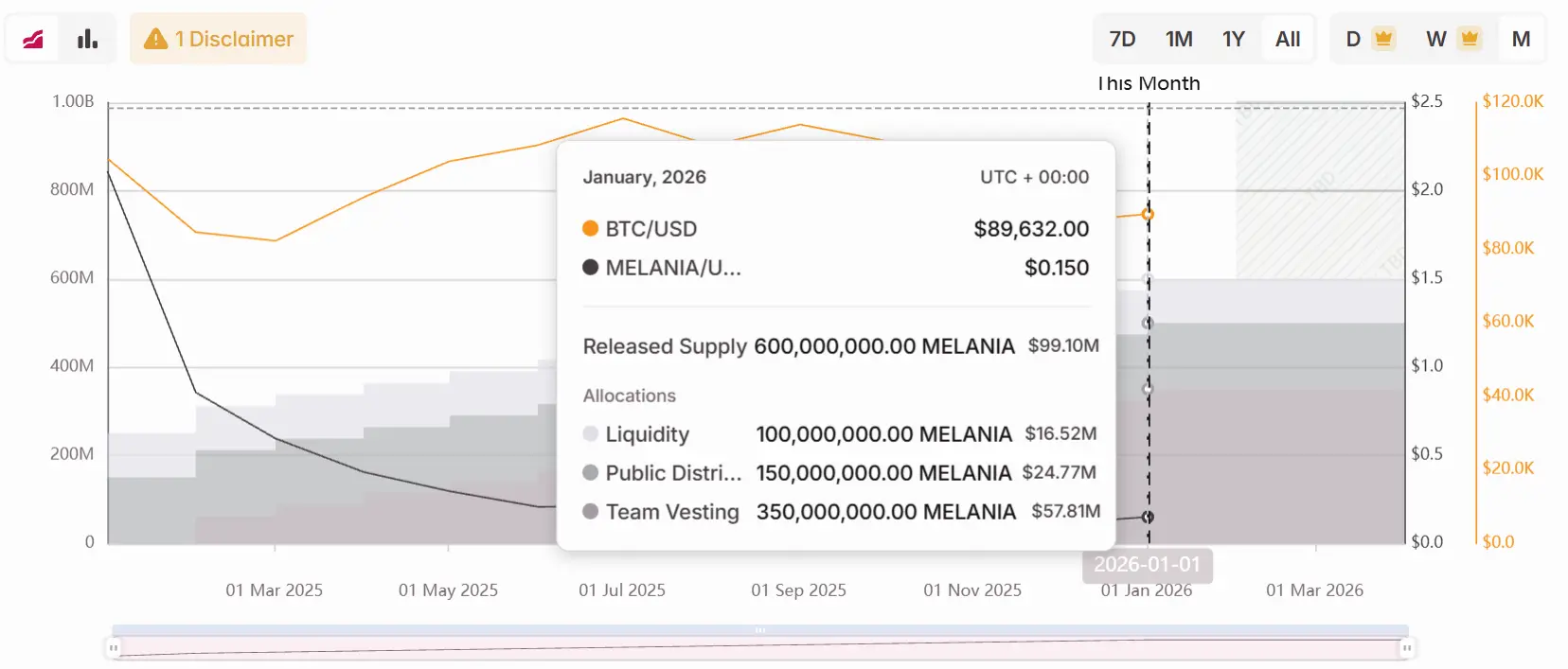

One year into Trump's presidency, the family is wildly printing "cryptocurrency banknotes"

Author: Dingdang, Odaily Planet Daily

On January 20, Trump Media & Technology Group (NASDAQ: DJT) announced that the record date for its previously announced digital token plan has been set for February 2, 2026. On the record date, the ultimate beneficial owners and registered shareholders holding at least one full DJT share will be eligible to receive the future issued digital tokens and related incentives. After the record date, Trump Media will collaborate with Crypto.com to handle the minting and distribution of the tokens, with specific implementation details still to be disclosed.

In terms of form, this appears more like an intersection experiment between crypto and traditional finance: although it is an airdrop, the holders are not crypto players but U.S. stock investors. However, as long as it involves “Trump family + issuing tokens,” market nerves are hard to avoid being triggered.

After all, Trump “takes

PANews·01-25 07:24

What is the most expensive thing in the 21st century? The traffic anxiety of exchanges

Author: Uncle Zuo

Out of money, I can only keep your attention

At 6 PM, I end the broadcast, change into OK's clothes, and head out to drink a few beers during Binance's big liquidation.

In the Meme counter's crazy Perp marketplace, earning some rebates by using mom KYC.

The big show of 2026 begins, witnessing the collapse of the exchange's skyscraper, unlike previous direct explosions such as major liquidations or triggering public opinion, now the public no longer focuses on the exchange, reflected in Binance Square and OKX Planet's inability to attract new users.

When even the inspiring stories of beautiful female dealers go unnoticed, the exchange has to come out and shout, "Look at the kids, you get to watch for free and even get paid!"

This article commemorates the first anniversary of Chuanbao's ascension, a presidential-level stunt that gives us full emotional value.

Lie back and wait for the money

If you don't explode in silence, you'll perish in silence.

In 2025, the exchange did nothing wrong, embracing Per

PANews·01-22 06:36

Public domain to the left, private domain to the right: Observing the SocialFi competition among crypto exchanges through OKX's "Planet"

OKX's Orbit product aims to change the relationship between users and exchanges by integrating social features with trading to create a closed loop of "trading as social." Unlike Binance Square, Orbit focuses on core fans and private domain traffic for trading strategies, simplifying the trading process. Although the business logic is attractive, there are regulatory risks and trust issues. This product marks a shift in exchange competition and could bring new opportunities to Web3 social finance.

TechubNews·01-20 12:40

Global Threats 2026: Economic Weapons, AI Chaos, and the Rise of Polycrisis

The global economy is entering a turbulent phase of distrust, technological disruption, and geopolitical tension. The newly released Global Risks Report 2026 by the World Economic Forum (WEF) warns that the planet is facing a true “polycrisis” — a dangerous blend of economic conflict, AI

Moon5labs·01-15 04:02

Will Trump's announced $2000 "tariff bonus" truly bring a liquidity feast?

Trump transforms into the "Adult Christmas Santa," claiming to distribute $2,000 "tariff dividends" to middle- and low-income Americans using tariff revenue, igniting a frenzy in the crypto market. However, this masks the hidden bills of inflation, fiscal deficits, and policy uncertainties — is this gift truly made of gold and silver, or just a sweet illusion? This article is sourced from On-Chain Revelation, compiled, translated, and written by Odaily Planet Daily.

(Previous summary: Trump calls for "$2,000 universal payments": Only fools oppose tariffs; U.S. Treasury Secretary is stunned: Never discussed this with me)

(Additional background: Trump’s latest move: imposing a 25% tariff on trade with Iran and other countries, with China and India being the first to bear the brunt)

Table of Contents

1. When the President announces nationwide money distribution: a carnival for the market

The gift box opened early: the source of dividends

How dividends are born

動區BlockTempo·01-14 16:35

Wintermute 28 Page Report: Unveiling the Flow of Off-Chain Funds

Wintermute releases the 2025 Cryptocurrency Over-the-Counter Market Analysis Report, revealing a fundamental shift in market liquidity mechanisms: capital is no longer widely dispersed, trading activity is concentrated in a few large tokens, the duration of altcoin trends has shortened, and the market is transitioning from narrative-driven cyclical fluctuations to a more structurally constrained, execution-led mechanism. This article is adapted from a piece by Wintermute, compiled, translated, and written by Odaily Planet Daily.

(Background note: Perhaps at the beginning of 2026, the crypto market will be manipulated by Wintermute)

(Additional background: Wintermute founder discusses "1011 Major Crash" and market outlook)

Table of Contents

Executive Summary

Part 1: Spot

Trading Volume Growth: Cyclical patterns are being short-circuited by short-term fluctuations

BTC0.26%

動區BlockTempo·01-14 13:56

The financial industry is all about paid knowledge content.

Author: Shen Hui, Yuan Chuan Investment Commentary

Hong Hao's Knowledge Planet officially announces a price increase, now priced at 1499 yuan/year, equivalent to a bottle of Maotai.

The price was 899 yuan the year before the increase. With 14,000 people recharging, in just two months, Hong Hao's GMV on Knowledge Planet reached 12.586 million yuan.

Coincidentally, Hong Hao's friend Li Bei also started paid knowledge services. With 200 spots, a course valued at 12,888 yuan sold out in two days. In other words, in just two days, Li Bei's course sales revenue reached 2.57 million yuan.

It is well known that media is a notoriously bad business. It’s easy to conclude this from the consistently poor performance of the media sector among the 31 first-level industries in Shenwan. However, in this sunset industry, private domain and course sales are considered anomalies, attracting countless financial professionals to compete fiercely.

Jin Yi, the former chief of fixed income at Guohai Securities, gained 1.6 million followers in three months on Douyin with his account “Bainian Talks Politics and Economics,” and charges a monthly fee of 4,283 yuan for 1V1 consulting services.

PANews·01-13 13:42

Is Tether's gold token XAUT worth buying?

Author: Wenser, Odaily Planet Daily

2026, Survival is King.

In the previous article "2026, Survive: A Bear Market Survival and Counterattack Manual for Crypto Enthusiasts," we systematically outlined this year's "survival strategies," emphasizing asset allocation in precious metals like gold as a key focus. For those aiming to hedge against inflation, fiat devaluation, and the falling US dollar exchange rate through gold, the next challenge is how to allocate gold-related assets.

In this regard, based on the author's personal understanding, XAUT issued by Tether may be the best way for crypto enthusiasts to allocate gold assets. Coupled with Tether's recent launch of a new accounting unit "Scudo" for Tether Gold (XAU₮), the barrier to entry for gold tokens has sharply dropped to just a few dollars.

This article

XAUT3.4%

区块客·01-12 15:01

From "Life K-line" to "Laozi," a review of the 5 hottest BSC "Chinese Meme Coins"

Author|Wenser, Odaily Planet Daily

The market recovery of cryptocurrencies in 2026 begins with Meme coins. Overnight, "the whole world is speaking Chinese."

As established Meme coins lead the surge, the BSC ecosystem quickly takes over. A wave of Chinese Meme coins, inspired by simple yet highly viral concepts like "I’m coming," have emerged, spreading rapidly within days. In a time of liquidity scarcity, every rise is not accidental but a result of attention competition.

This article will briefly review the currently popular Chinese Meme projects in the BSC ecosystem for readers' reference (Odaily Note: Meme coin prices are highly volatile; the following content is for sharing purposes only and does not constitute investment advice).

Chinese Meme New Leader: "I’m Coming," with a market cap of approximately $36 million

As the recent week’s "Chinese Meme

区块客·01-12 14:57

The biggest uncertainty in the crypto market moving forward: Will the CLARITY Act pass through the Senate?

Article by: Azuma (@azuma_eth), Planet Daily

Overseas cryptocurrency media Decrypt reported this morning that sources revealed to them that several representatives from Wall Street and the cryptocurrency industry held an offline closed-door meeting yesterday to resolve disagreements over the upcoming Senate review of the cryptocurrency market structure bill (known as CLARITY).

This closed-door meeting had not previously been publicly disclosed, but according to Decrypt, the main trade organization involved was the "Securities Industry and Financial Markets Association (SIFMA)," which had previously opposed the core provisions of the CLARITY bill, including explicit opposition to regulatory exemptions for DeFi and other decentralized financial services and their developers. Sources revealed that the discussions yesterday between the two sides focused on DeFi

TechubNews·01-12 02:02

When the market enters extreme panic: Why will the first wave of the 2026 bull run be Meme coins?

Edited|Odaily Planet Daily (@OdailyChina); Translator|Moni

After experiencing what can be called a "tormenting" Q4 of 2025, the cryptocurrency market finally shows signs of recovery in early 2026.

To many people's surprise, it was not Bitcoin or Ethereum that ignited the crypto rally at the start of the new year, but Meme coins. After a period of calm holidays and sluggish market activity, Meme coins are making a strong comeback.

Is the capital rotation cycle repeating?

Honestly, this Meme coin rally is not surprising. By the end of 2025, market liquidity dried up, FUD sentiment spread, and retail investors' risk tolerance dropped to the lowest point of the year. Meme coin market capitalization fell over 65%, and on December 19, it even dropped to $35 billion, hitting a new annual low, with traders' risk tolerance decreasing. After Christmas, Bitcoin

区块客·01-08 12:31

When the market enters extreme panic: Why will the first wave of the 2026 bull run be Meme coins?

Edited|Odaily Planet Daily (@OdailyChina); Translator|Moni

After experiencing what can be called a "tormenting" Q4 of 2025, the cryptocurrency market finally shows signs of recovery in early 2026.

To many people's surprise, it was not Bitcoin or Ethereum that ignited the crypto rally at the start of the new year, but Meme coins. After a period of calm holidays and sluggish market activity, Meme coins are making a strong comeback.

Is the capital rotation cycle repeating?

Honestly, this Meme coin rally is not surprising. By the end of 2025, market liquidity dried up, FUD sentiment spread, and retail investors' risk tolerance dropped to the lowest point of the year. Meme coin market capitalization fell over 65%, and on December 19, it even dropped to $35 billion, hitting a new annual low, with traders' risk tolerance decreasing. After Christmas, Bitcoin

区块客·01-06 12:46

Unveiling why the first wave of the 2026 market cycle is Meme coins: The underlying logic from extreme FUD to risk reversion

To everyone's surprise, at the beginning of the new year, the spark for the crypto market was not Bitcoin or Ethereum, but Meme coins. After a period of calm holidays and sluggish market activity, Meme coins are making a strong comeback. This article is based on pieces from Ambcrypto & Cointelegraph, compiled, translated, and written by Odaily Planet Daily.

(Previous context: Bitcoin reaches 90,000 USD, so why do meme coins PEPE and DOGE always lead the rise?)

(Additional background: CZ's beloved dog meme coin BROCCOLI714 skyrocketed tenfold before crashing again. Founder Vida of the formula: How did I make millions of dollars from it?)

Table of Contents

Is the capital rotation cycle repeating?

Technical analysis: Meme coin rebound is not without basis

Leverage and sentiment: Bulls entering but

動區BlockTempo·01-05 13:10

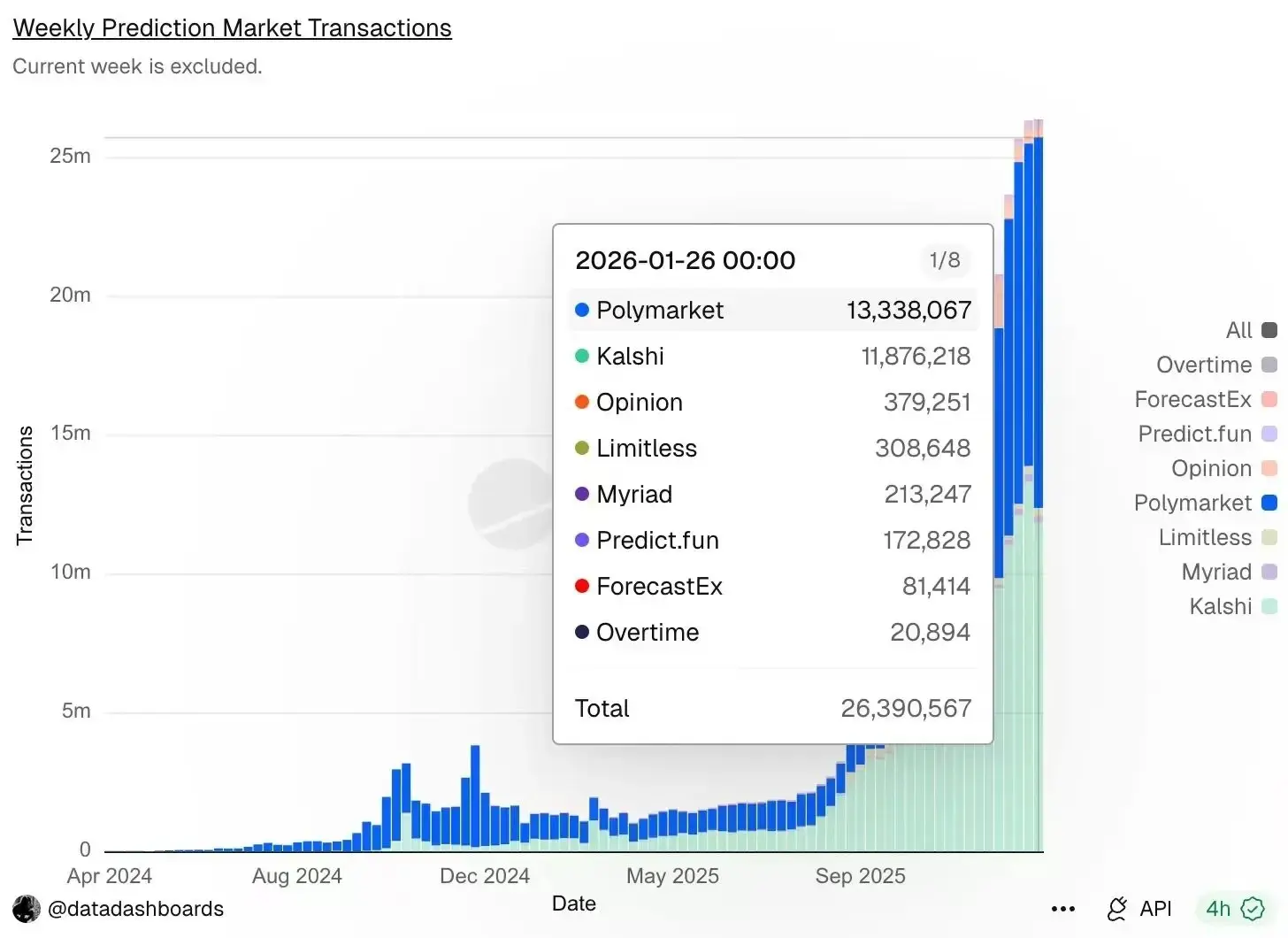

Why will 90% of prediction markets not survive until the end of 2026?

Author: Azuma, Odaily Planet Daily

In the past two days, there has been a lot of discussion on X about the formula Yes + No = 1 in prediction markets. The origin can be traced back to a detailed analysis of Polymarket's shared order book mechanism written by the influential DFarm (@DFarm\_club), which resonated emotionally with the community about the power of mathematics — the original article titled "A Comprehensive Explanation of Polymarket: Why Must YES + NO Equal 1?" is highly recommended.

In subsequent discussions, several influential figures, including Blue Fox (@lanhubiji), mentioned that Yes + No = 1 is another minimalist yet powerful formula innovation following x \ y = k, with the potential to unlock a trillion-dollar-scale information flow trading market. I fully agree with this, but

PANews·01-04 13:36

Future assets, pushing forward with the acquisition of Korbit… betting 1.4 trillion Korean won to enter the cryptocurrency market

Future Asset Group is pushing forward with the acquisition of Korbit, one of Korea's four major cryptocurrency exchanges. This financial giant rooted in traditional finance's attempt to officially enter the digital asset market is drawing industry attention.

According to Korea Economic Daily on the 29th, Future Asset Financial Group, headquartered in Seoul, is in discussions with Korbit's major shareholder NXC and SK Planet regarding equity acquisition. The current negotiations involve the 60.5% stake held by NXC and SK

TechubNews·2025-12-29 17:09

Community's Ten Questions to Lighter Founder: TGE Timing, Distribution, Points Program, Revenue Model......

Source: jez (@izebel\_eth)

Compiled by: Azuma, Odaily Planet Daily

Editor's note: Based on market rumors and the odds on Polymarket, it seems that the TGE for Lighter will happen on December 29, which is no longer a secret. As the final countdown to the token launch approaches, Lighter's founder and CEO Vladimir Novakovski participated in a Twitter Space interview hosted by jez (@izebel\_eth).

During the conversation, Vladimir addressed questions from the community regarding the token launch date, points distribution, whitelisting, product updates, future direction, and community communication.

Below are the highlights from Vladimir's interview, curated by Odaily Planet Daily.

PANews·2025-12-28 08:08

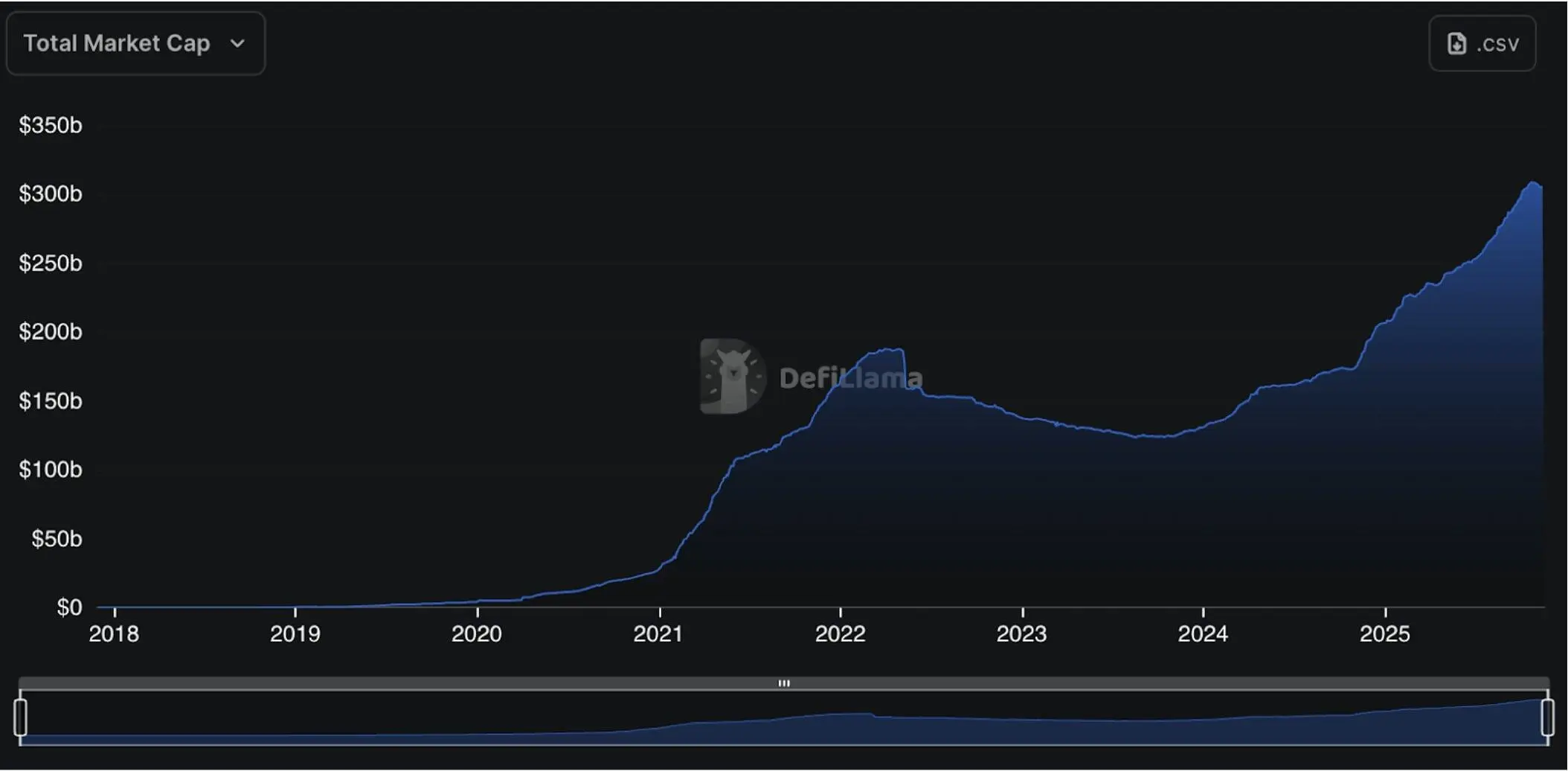

Small profit business? No, DeFi lending protocols are the underestimated "King of Value"

Original Title: Why the DeFi Lending Moat Is Bigger Than You Think

Original Author: Silvio, Cryptocurrency Researcher

Original Compilation: Dingdang, Odaily Planet Daily

As the market share of vaults and curators in the DeFi world continues to grow, the market begins to question: Are lending protocols gradually squeezing profit margins? Is lending no longer a good business?

But if we shift our perspective back to the entire on-chain credit value chain, the conclusion is quite the opposite. Lending protocols still hold the strongest moat in this value chain. We can quantify this with data.

In Aave and

PANews·2025-12-25 11:08

Narrative is dead, faith collapses? Seven veteran industry insiders fiercely debate the "Four-Year Cycle Theory"

Author: Dingdang; Editor: Hao Fangzhou

Produced by: Odaily Planet Daily

In the eighteen years since the birth of Bitcoin, the "four-year cycle" theory has almost become the foundational belief of the cryptocurrency market. Bitcoin halving, supply contraction, price increases, and altcoin seasons have not only explained multiple bull and bear market transitions in history but also profoundly influenced investors' position management, project fundraising rhythms, and even the industry's understanding of "time."

However, after the April 2024 halving, Bitcoin only rose from $60,000 to a historical high of $126,000, with gains far below previous cycles. Altcoins are even more weak, and macro liquidity and policy variables have become more sensitive market anchors. Especially after the large-scale entry of spot ETFs, institutional funds, and traditional financial instruments, a question has been repeatedly discussed:

Does the four-year cycle in the crypto market still exist?

PANews·2025-12-24 07:07

Acquiring the Axelar team but abandoning the tokens: Circle's "want people but not coins" sparks controversy

Original: Odaily Planet Daily

Author: Azuma

On the early morning of December 16, the stablecoin giant Circle officially announced that it has completed the agreement signing, acquiring the core talent and technology of the initial development team of cross-chain protocol Axelar Network, Interop Labs, to advance Circle's cross-chain infrastructure strategy and help Circle achieve seamless, scalable interoperability on its core products such as Arc and CCTP.

This is another typical case of industry giants acquiring high-quality teams, seemingly a win-win situation, but the key issue lies in—Circle explicitly mentioned in the acquisition announcement that this transaction only involves the Interop Labs team and its proprietary intellectual property, while Axelar Network

区块客·2025-12-20 07:10

What Is Aptos Hitting 22,000 TPS and Why It’s Becoming the Go-To Chain for Global Trading

Aptos has officially cemented itself as one of the fastest, cheapest, and most institution-friendly layer-1 blockchains on the planet, pushing real-world throughput above 22,000 TPS with sub-second finality and fees consistently under $0.01.

CryptopulseElite·2025-12-11 05:30

From ETH to SOL: Why Will All L1s Ultimately Lose to Bitcoin?

Original Title: Can L1s Compete Against BTC as Cryptomoney?

Original Author: AvgJoesCrypto, Messari

Translated by: Dingdang, Odaily Planet Daily

Editor's Note: Recently, Haseeb Qureshi, a renowned partner at Dragonfly, published a lengthy article rejecting cynicism and embracing exponential thinking, which unexpectedly brought the community's discussion back to the core question: How much value do L1s really have left? The following content is excerpted from @MessariCrypto’s upcoming "The Crypto Theses 2026," organized by Odaily Planet Daily.

Cryptocurrency Drives the Entire Industry

It is very important to refocus the discussion on "cryptocurrency" itself.

COINVOICE(链声)·2025-12-08 04:03

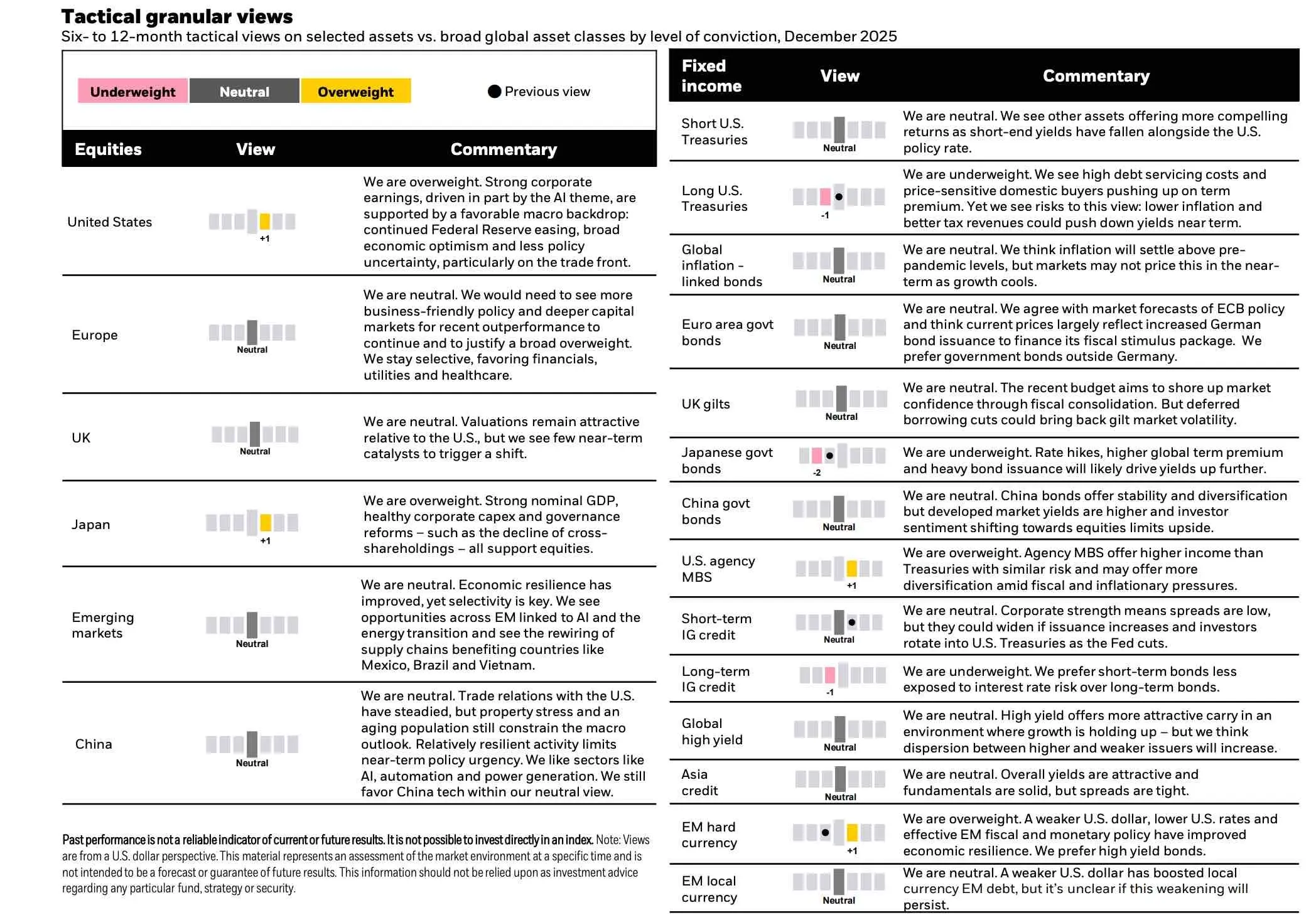

An Overview of BlackRock's 2026 Investment Outlook Highlights: Can the Global Bull Market Driven by the AI Bubble Be Sustained?

Author: Azuma, Odaily Planet Daily

On December 2, BlackRock, the world's largest asset management company, released its 2026 Investment Outlook report. Although the report does not have much direct relevance to the cryptocurrency market (only one page out of the 18-page PDF mentions stablecoins), as the "king of global asset management," BlackRock outlines the current environment and variables facing the global economy. With the increasing interconnection between the cryptocurrency market and mainstream financial markets, this may offer some guidance for future macro changes. Additionally, BlackRock provides its allocation strategy under the new market environment, which may serve as a reference for users looking to expand their investment horizons.

The full report is quite lengthy. In the following text, Odaily Planet Daily will attempt to provide a concise summary of BlackRock's 2026 outlook.

PANews·2025-12-07 01:12

BlackRock 2026 Investment Outlook: Can the Global Bull Market Driven by the AI Bubble Be Sustained?

Author: Azuma, Odaily Planet Daily

On December 2, BlackRock, the world’s largest asset management company, released its 2026 Investment Outlook report. Although the report has little direct connection to the cryptocurrency market (of the 18-page PDF, only one page mentions stablecoins), as the “king of global asset management,” BlackRock outlines the current environment and variables of the global economy in the report. As the interaction between the cryptocurrency market and mainstream financial markets becomes increasingly close, this may provide some guidance for future macro changes; in addition, BlackRock also provides its allocation strategy for the new market environment, which may serve as a reference for users looking to expand their investment scope.

The full report is lengthy. In the following, Odaily Planet Daily will attempt to provide a concise summary of BlackRock’s

MarsBitNews·2025-12-06 12:34

From ETH to SOL: Why Will All L1s Ultimately Lose to Bitcoin?

Original Title: Can L1s Compete Against BTC as Cryptomoney?

Original Author: AvgJoesCrypto, Messari

Original Translator: Dingdang, Odaily Planet Daily

Editor's Note: Recently, Haseeb Qureshi, a well-known partner at Dragonfly, published a long article rejecting cynicism and embracing exponential thinking, unexpectedly bringing the community’s discussion back to the core question: How much value do L1s really have left? The following excerpt is from MessariCrypto’s upcoming “The Crypto Theses 2026,” compiled by Odaily Planet Daily.

Cryptocurrency Drives the Entire Industry

Refocusing the discussion on “cryptocurrency” itself

MarsBitNews·2025-12-06 09:39

Why prediction markets really aren't gambling platforms

Author: Planet Xiaohua

In the past two years, prediction markets have rapidly moved from a fringe concept in the crypto space into the mainstream spotlight of tech venture capital and financial investment.

The compliance-focused newcomer Kalshi recently completed a $1 billion Series E round, raising its post-money valuation to $11 billion. Its roster of investors includes top names such as Paradigm, Sequoia, a16z, Meritech, IVP, ARK Invest, CapitalG, and Y Combinator.

Meanwhile, industry leader Polymarket secured a strategic investment from ICE at a $9 billion valuation, and then reached a $12 billion valuation through investment led by Founders.

金色财经_·2025-12-04 06:22

Why do people say that prediction markets are really not gambling platforms?

Original Title: "Why Prediction Markets Really Aren't Gambling Platforms"

Author: Planet Xiaohua

Source:

Reprinted from: Mars Finance

Over the past two years, prediction markets have rapidly moved from a fringe concept in the crypto world into the mainstream spotlight of tech entrepreneurship and financial capital.

The compliance-focused rising star Kalshi recently completed a $1 billion Series E financing round, bringing its post-money valuation to $11 billion. Its investor lineup includes industry heavyweights such as Paradigm, Sequoia, a16z, Meritech, IVP, ARK Invest, CapitalG, and Y Combinator.

Meanwhile, the industry leader Polymarket secured a strategic investment from ICE at a $9 billion valuation, and later reached a $12 billion valuation with...

MarsBitNews·2025-12-04 06:20

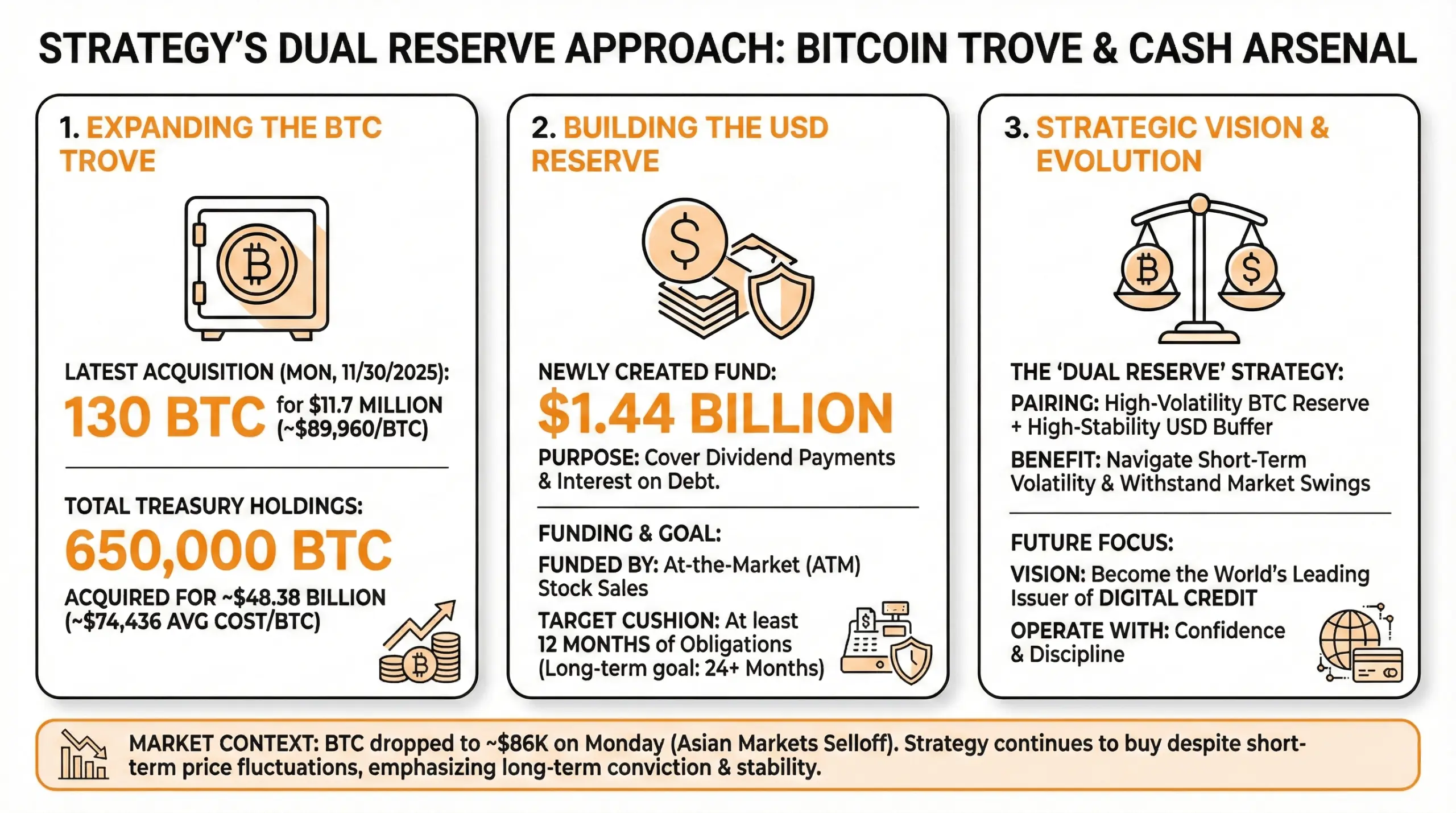

Strategy Flexes Hard With Fresh 130 BTC Grab and $1.44B War Chest

On Monday, Strategy — the largest bitcoin treasury outfit on the planet — revealed it scooped up another 130 BTC, nudging its stash to a hefty 650,000 BTC. At the same time, the firm rolled out a USD Reserve worth $1.44 billion, setting the stage for future dividend payouts with plenty of

BTC0.26%

Coinpedia·2025-12-01 14:42

Dragonfly Partners Long Article: Reject Cynicism, Embrace Exponential Thinking

Author: Haseeb Qureshi, Managing Partner at Dragonfly

Compiled by: Azuma, Odaily Planet Daily

Editor’s Note: The industry is currently facing a moment of frozen confidence regarding the future. Is the bubble too large? Are the valuations too high? Do the things I hold in my hands have any value? Questions like these are continuously undermining market confidence.

On November 28th, Haseeb Qureshi, a well-known bald partner of Dragonfly, wrote a heartfelt long article today. In the article, Haseeb summarized the mainstream sentiment currently permeating the community as "financial cynicism" (a fundamentally skeptical or even distrustful attitude towards the financial system, market participants, asset prices, policy motivations, etc.); at the same time, he pointed out that the industry's focus is shifting from Silicon Valley to Wall Street, which is an overemphasis on linear thinking and on indices.

PANews·2025-11-29 07:59

The collapse of the 760-fold myth, how did the sports betting king Polymarket fall to this?

Original Title: "The Mystery of the Fall of Polymarket, the 'God of Sports Predictions', After Assets Drop to Zero with a Profit of 4 Million Dollars"

Original: Odaily Planet Daily

Author: Wenser

Polymarket's prediction games have always been a feast for the few and a gamble for the many. Similar to contract markets, it is also filled with "black swan reversals," especially in the case of unexpected outcomes in sports.

Today, we are going to talk about the fall of a trader once known as the "God of Sports Prediction"—Mayuravarma. This trader, with an Indian caste-style ID, violently ramped up his initial capital of $5,000 to $3.8 million in just a month, achieving a profit of up to 760 times and briefly ranking sixth on the sports profit list. However, what rises must fall; in just one week, his assets were nearly drop to zero.

Mayuravar

PANews·2025-11-27 09:06

We are still in a Supercycle of encryption, but not the one you expect.

Original Title: The Supercycle Is Here. Just Not the One You Were Promised

Original author: Lomashuk

Compiled by Odaily Planet Daily; Translator: Asher

Recently, if you casually scroll for five minutes on X, it's easy to come to a conclusion: we are back in a bear market. BTC prices continue to decline, and altcoins are plummeting without end, with retail investor sentiment nearly evaporated. The ultimate bullish narrative proposed by Su Zhu, which embodies the industry's imagination of "crypto assets breaking free from the cycle constraints and achieving escape velocity"—the "Supercycle"—now seems more like a collective illusion.

However, the super cycle has not ended. The real problem is that we have been misreading it all along. The super cycle in traditional narratives is a kind of "digital

PANews·2025-11-26 05:09

Wall Street is counting on Bitcoin's high volatility to pay year-end bonuses.

null

This article is from: Jeff Park, Bitwise Advisor

Compiled by: Moni, Odaily Planet Daily

In just six weeks, Bitcoin's market value has evaporated by $500 billion, with ETF fund outflows, Coinbase discounts, structured sell-offs, and poorly positioned long positions being liquidated, while there are no clear catalysts to stimulate a market rebound. Moreover, concerns about whale sell-offs, struggling market makers with significant losses, lack of defensive liquidity supply, and the survival threat posed by the quantum crisis continue to hinder Bitcoin's potential for a rapid recovery. However, throughout this decline, one question has persistently troubled the community: what has happened to Bitcoin's volatility?

In fact, the volatility mechanism of Bitcoin has quietly undergone a transformation.

Over the past two years, it has been widely believed that ETFs have "tamed" Bitcoin, suppressing its volatility.

BTC0.26%

MarsBitNews·2025-11-23 14:52

97% big dump didn't kill it: Solana's eight-year blood and tears history unveiled - it turns out that true strong ones never follow the script.

Original Title: How Solana Survived When Most Other Coins Fell

Original author: NEW ECONOMIES CryptoLeo, Odaily

Source:

Reprint: Daisy, Mars Finance

In the midst of a poor market, a qualified SOL guardian is here to try to strengthen your faith. Solana co-founder Anatoly Yakovenko was interviewed by NEW ECONOMIES in November, discussing the origins and development of Solana, the experience of lows and recoveries, and also talking about regulations and stablecoin-related topics. Additionally, Anatoly outlined the grand vision for Solana's future. Odaily Planet Daily has compiled it as follows (due to the abundance of trivial content, the

SOL-0.22%

MarsBitNews·2025-11-21 15:19

Anatoly Shares Behind-the-Scenes Stories of Solana's Eight Years

Original video: NEW ECONOMIES Translation: CryptoLeo (@LeoAndCrypto)

In the midst of a poor market, a dedicated SOL supporter is once again here to try to strengthen your conviction. Solana co-founder Anatoly Yakovenko was interviewed by NEW ECONOMIES in November, covering Solana's origins and development, its journey through downturns and recovery, as well as discussing regulation and stablecoins. In addition, Anatoly outlined Solana’s grand vision for the future. Odaily Planet Daily has compiled and translated the main points as follows (presented in the first person for clarity due to the abundance of minor details):

The origin of Solana: from side project to full-time

Solana originated from a combination of "the right time, right place, and right people." At that time, a friend and I started a...

SOL-0.22%

金色财经_·2025-11-21 14:31

In these eight years of Solana, Anatoly shares the behind-the-scenes story.

null

Original Video: NEW ECONOMIES

Compiled by: CryptoLeo (@LeoAndCrypto)

In a bearish market, a qualified SOL guardian is here to try to bolster your confidence. Solana co-founder Anatoly Yakovenko was interviewed by NEW ECONOMIES in November, discussing the origins and development of Solana, its lows and recoveries, and regulatory and stablecoin-related topics. Additionally, Anatoly outlined a grand vision for Solana's future. Odaily Planet Daily has compiled it as follows (due to the excessive trivial content, the key points will be presented in the first-person narrative):

The origin of Solana, from side hustle to full-time.

Solana originated from a moment of "timing, location, and harmony of people," at that time, I and a

SOL-0.22%

MarsBitNews·2025-11-21 02:55

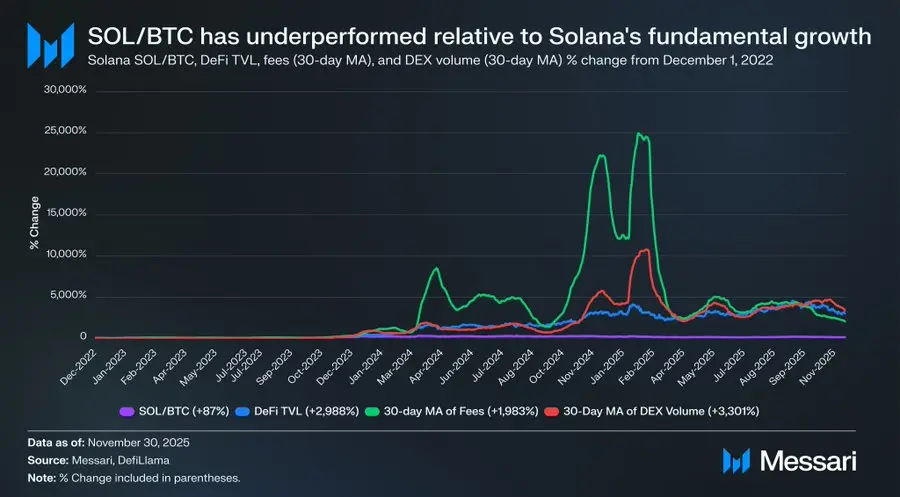

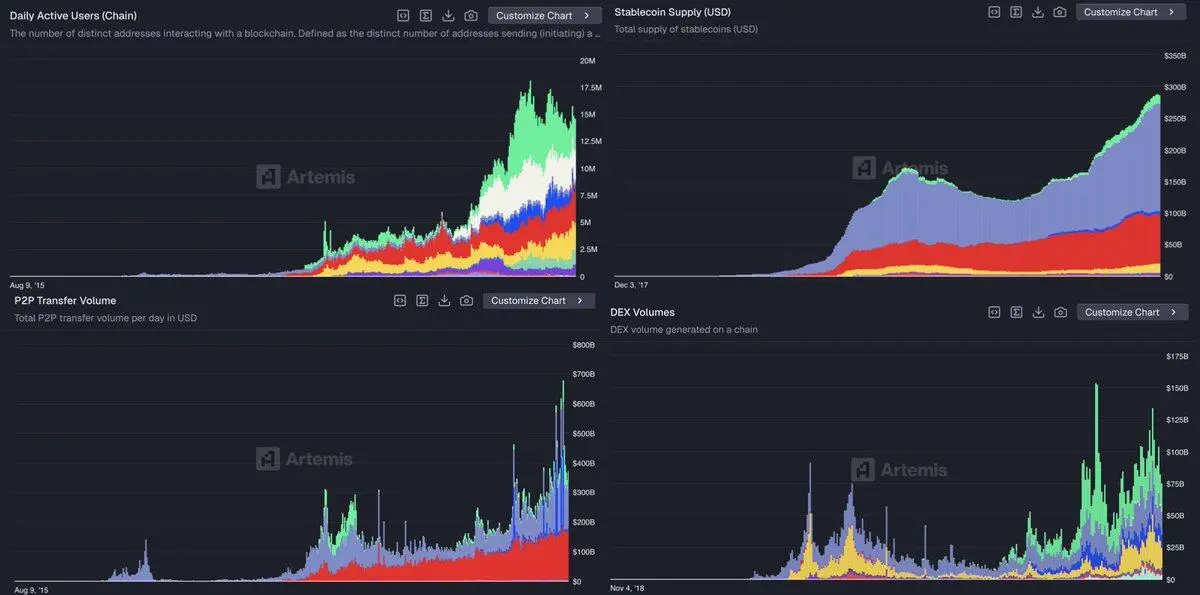

Has SOL reached its limit? Multidimensional data reveals the true picture of Solana.

> Original Title: Time to Call the SOL Bottom?

>

>

> Original author: blocmates

> Original compilation: Dingdang, Odaily Planet Daily

>

>

In the third quarter of 2025, it is a "two-sided story on the same chain" for Solana. On the surface, the "Meme retreat" has brought a significant cooling effect: daily active addresses are declining, and the user dominance is gradually being eroded by competitors. However, beneath the surface, the fundamentals of this chain are becoming increasingly solid. The Solana core team has consistently maintained high-frequency iterations, continuously advancing one of the most ambitious technology roadmaps in the crypto industry; at the same time, its

SOL-0.22%

COINVOICE(链声)·2025-11-19 02:28

2026 Outlook: These six structural forces are paving the way for the next cycle

Original Title: Road to 2026: 6 Trends Shaping Crypto

Original author: 0xJeff, AI investor

Original translation: Dingdang, Odaily Planet Daily

The year 2025 will be a challenging one for the crypto industry — despite the current U.S. president's promise to make the U.S. a global center for crypto and AI, the crypto market remains very difficult this year.

Since Trump officially took office in January, the market has experienced moments of pressure time and time again, the most deadly of which was the flash crash event in October – that plunge nearly paralyzed the entire crypto industry.

Although the chain reaction from this flash crash has not yet fully resolved, the macro backdrop and favorable industry factors are pointing towards a more positive quarter and a more optimistic outlook for 2026.

This article will deeply analyze 6 ongoing cases.

DEFI0.5%

COINVOICE(链声)·2025-11-16 01:47

2026 Outlook: These six structural forces are paving the way for the next cycle

null

Original Title: Road to 2026: 6 Trends Shaping Crypto

Original author: 0xJeff, AI investor

Original Translation: Dingdong, Odaily Planet Daily

The year 2025 is set to be a challenging one for the cryptocurrency industry—despite the current U.S. president's promise to make the U.S. a global center for cryptocurrency and AI, the crypto market remains quite tough this year.

Since Trump officially took office in January, the market has experienced moments of pressure time and again, the most deadly of which was the flash crash event in October — that plunge nearly paralyzed the entire crypto industry.

Although the chain reaction of this flash crash has not yet been completely resolved, the macro background and favorable industry factors are pointing to a more positive quarter and a more optimistic outlook for 2026.

This article will deeply analyze

DEFI0.5%

MarsBitNews·2025-11-15 11:11

Has SOL reached its limit? Multidimensional data reveals the true picture of Solana.

null

Author: @blocmates

Compiled by: Odaily Planet Daily

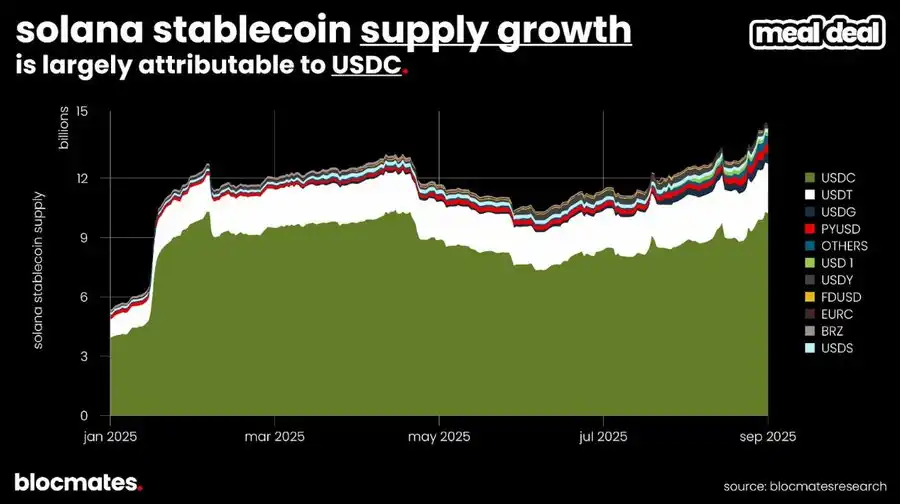

In the third quarter of 2025, it is a "two-sided story on the same chain" for Solana. On the surface, the "Meme retreat" has brought a significant cooling effect: daily active addresses have declined, and the user dominance is gradually being eroded by competitors. However, beneath the surface, the fundamentals of this chain are becoming increasingly solid. The core team of Solana has consistently maintained high-frequency iterations and continues to advance one of the most ambitious technology roadmaps in the crypto industry; meanwhile, its TVL has grown by over 26% in the third quarter, and the supply of stablecoins has almost tripled since the beginning of the year.

This report will systematically outline the core technological upgrades that are defining the future of Solana (such as Alpenglow, Agave), and conduct an in-depth analysis of on-chain data performance and the health of ecological applications.

SOL-0.22%

MarsBitNews·2025-11-15 06:46

The next round of big pump starts from "pre-market": a detailed analysis of the early benefits from the five major exchanges, who is secretly printing money?

Original Title: How to Earn the First Wave of Market Before Opening: CEX Pre-Market Strategy and Profit Guide

Original author: Friends of Planet君

Original source:

Reprinted: Daisy, Mars Finance

The cryptocurrency market is never short of opportunities, but the first wave of gains always belongs to a few. In cryptocurrency trading, the "pre-market" phase has become a key window for the new generation of traders to compete. To some extent, the market has already started trends and movements before the official opening. For individual traders, pre-market strategies often determine two major things: first, whether they can sense the starting point of the market narrative in advance; second, whether they can complete their positioning before mainstream sentiment floods in. Ignoring the pre-market means missing the golden window from seed valuation to explosive growth.

The only three things that really matter for making money in pre-market are:

How long has it been since the project was born when you entered the market? The closer it is to the seed round, the more primitive the valuation and the thicker the meat.

The moment the market opens

MarsBitNews·2025-11-14 15:47

Bybit Eyes South Korean Expansion with Korbit Acquisition - Coinspeaker

Bybit is reportedly considering acquiring a 31.5% stake in Korbit, South Korea’s fourth-largest cryptocurrency exchange, owned by SK Planet. Korbit denies the rumor. The acquisition may help Bybit strengthen its presence in Asia's crypto market amidst a growing regulatory landscape.

IN-2.57%

Coinspeaker·2025-11-10 15:04

Bybit is said to be negotiating the acquisition of the South Korean exchange Korbit.

According to Maeil Business Newspaper, Bybit is pursuing an acquisition of Korbit — the fourth largest crypto exchange in South Korea. Sources say Bybit has met with the leadership of Korbit to initiate the takeover process. Korbit is currently 60.5% owned by NXC and 31.5% by SK Planet; Bybit is said to be considering acquiring the portion.

CHO1.01%

TapChiBitcoin·2025-11-10 13:40

The revival of old coins like DASH, ZEC, and ICP collectively, is it a nostalgia of capital or a precursor to a new narrative?

null

Original | Odaily Planet Daily Dingdong

In the past few days, the market has continued to weaken, yet a group of "old coins" has risen against the trend, sparking a frenzy on their own.

As mainstream narratives become increasingly exhausted, these long-forgotten names are reappearing at the top of the gainers list. They are not the creators of new stories, but they shine once again amidst the ruins of the old era. Some see this as a "veteran's return," while others believe it is merely a momentary curiosity for new capital. Nevertheless, during a phase of low liquidity and a lack of hot topics, the unexpected stir of old projects has become a mirror reflecting market sentiment.

DASH, ZK: The rotation game of privacy funds

Privacy coins are undoubtedly the core engine of this market wave. After ZEC skyrocketed 40 times in a month, the market fell into a dilemma—afraid to chase further, yet unwilling to miss out. As a result, funds began to rotate among similar themes, XMR, DA

MarsBitNews·2025-11-10 05:38

The night after Bitcoin fell below 100,000: who defied the trend and surged? Who got wiped out and went to zero?

On November 5th, the crypto market was severely hit, with derivatives liquidations totaling 2.1 billion USD, and Bitcoin falling below the 100,000 USD mark. Meanwhile, the older coins unexpectedly rose against the trend, and the privacy sector has become a key force. The author of this article is Ding Dang from Planet Daily (@XiaMiPP). (Previous context: The night before, Bitcoin dropped below 100,000 USD! It quickly fell 0.8% within an hour.) (Additional background: Is MicroStrategy no longer "madly buying" Bitcoin the reason for this decline?) Is the spring for older coins just an illusion? At 5 a.m. on November 5th, the crypto market suffered a heavy blow. Derivatives liquidations reached 2.1 billion USD, with long positions liquidated at 1.68 billion USD. Although this figure is far below the over 20 billion USD "century liquidation" on October 11th, this decline was even more damaging. Bitcoin lost the 100,000 USD whole number.

動區BlockTempo·2025-11-08 03:15

Load More