Search results for "PRIME"

Trump announces that India’s tariffs will be "cut from 25% to 18%"! India agrees to stop purchasing Russian oil and to buy $500 billion worth of goods from the United States

Trump posted on Truth Social that he has reached trade and energy agreements with Indian Prime Minister Modi, including lowering tariffs, expanding purchases of American goods, and stopping the purchase of Russian oil. He stated that this will help facilitate the end of the Russia-Ukraine war and further strengthen US-India relations.

動區BlockTempo·3h ago

WisdomTree Expands Tokenized Fund Access to Solana Blockchain

WisdomTree added Solana support for its regulated tokenized funds via WisdomTree Connect and WisdomTree Prime.

Retail users can fund with USDC, buy tokenized funds, and hold them in self-custody wallets on Solana.

WisdomTree has expanded access to its regulated tokenized funds by adding

CryptoNewsFlash·01-30 15:05

Ripple Exec: XRP Will Remain 'At the Heart' of Company Vision - U.Today

Ripple reinforces XRP's central role in its corporate strategy amid its expansion beyond payments into custody and prime brokerage. Upcoming updates will clarify XRP's evolving significance, emphasizing its core position in Ripple's vision for the future.

XRP1.37%

UToday·01-28 06:24

Bankless Founder: As Trump tears down the old order, Ethereum is establishing new rules

This year's Davos Forum focused on cryptocurrencies, but the statements from the Trump administration regarding the shift in the global order drew more attention. Speeches by the U.S. Secretary of Commerce and the Canadian Prime Minister mentioned the failure of the international order, emphasizing the fragility of cooperation between nations. Despite the failure of global cooperation efforts, decentralized protocols like Bitcoin and Ethereum may become a new hope for coordination mechanisms, potentially leading to a higher level of organizational structure.

PANews·01-26 09:06

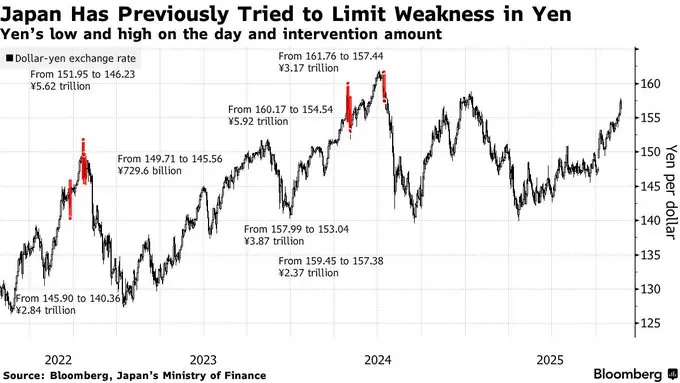

The Federal Reserve rarely signals intervention in the yen! The dollar weakens, and Bitcoin may repeat the August crash

The Japanese Yen experienced its largest single-day increase since June, soaring from 160 to 155.6. The Prime Minister warned of "abnormal fluctuations." The New York Fed and major banks are communicating, which is usually a sign of coordinated intervention. The 1985 Plaza Accord showed that joint US-Japan efforts could stabilize the Yen, weaken the US dollar, and boost assets. However, short-term risks include arbitrage unwinding, as the Bank of Japan's rate hike in August 2024 triggered Bitcoin to plummet from 64,000 to 49,000 USD, evaporating 15 billion.

MarketWhisper·01-26 00:54

GameStop Moves 4,710 Bitcoin, Signaling Potential Sale

Introduction

GameStop’s Bitcoin treasury has moved under the microscope again after the retailer transferred its entire 4,710-coin stack to Coinbase Prime. The move, first highlighted by CryptoQuant, has reignited questions about whether the retailer is rethinking its crypto treasury strategy or

CryptoBreaking·01-25 05:40

GameStop’s Bitcoin Shift Fuels Fears of BTC Sell-off

GameStop has transferred its entire Bitcoin treasury to Coinbase Prime, sparking speculation of an imminent sale amid market volatility. This move, accompanied by Ryan Cohen’s recent shares purchase, indicates a potential reevaluation of GameStop's digital asset strategy.

TheNewsCrypto·01-24 12:15

GameStop Moves $422M in Bitcoin to Coinbase Prime, Fueling Sell-Off Speculation

_Staggered on-chain transfers have traders watching closely, as large Bitcoin wallet activity often signals upcoming market action._

GameStop has transferred all of its Bitcoin holdings to Coinbase Prime, prompting questions across crypto markets. On-chain data shows the move covered the

LiveBTCNews·01-24 10:05

The White House releases "Trump leading a penguin walk in Greenland" causing $PENGUIN to surge! Denmark: Arctic endurance military exercises will continue until the end of the year

U.S. President Trump no longer plans to buy Greenland and released an AI image of Trump holding a penguin, sparking online ridicule. Danish Prime Minister explicitly stated that sovereignty is non-transferable and launched military exercises to strengthen defense capabilities. This incident also caused the related meme coin PENGUIN's market capitalization to skyrocket.

TRUMP1.97%

動區BlockTempo·01-24 06:55

GameStop Moves 4,710 Bitcoin, Signaling Potential Sale

Introduction

GameStop’s Bitcoin treasury has moved under the microscope again after the retailer transferred its entire 4,710-coin stack to Coinbase Prime. The move, first highlighted by CryptoQuant, has reignited questions about whether the retailer is rethinking its crypto treasury strategy or

CryptoBreaking·01-24 05:35

Bitcoin selling pressure warning! GameStop appears to be preparing to liquidate 4,710 BTC reserves, with unrealized losses of $76 million forced to exit DAT strategy?

GameStop's on-chain wallet has transferred all 4,710 Bitcoins to Coinbase Prime, which is widely interpreted by the market as a potential sell signal. The company bought Bitcoin at a high point and is now facing a loss of tens of millions of dollars. The official has not commented yet, and the motive remains unclear. This move could impact the crypto market sentiment.

BTC1.24%

動區BlockTempo·01-23 13:20

GameStop Moved 4.7K BTC to Coinbase Prime at $76M Loss - Coinspeaker

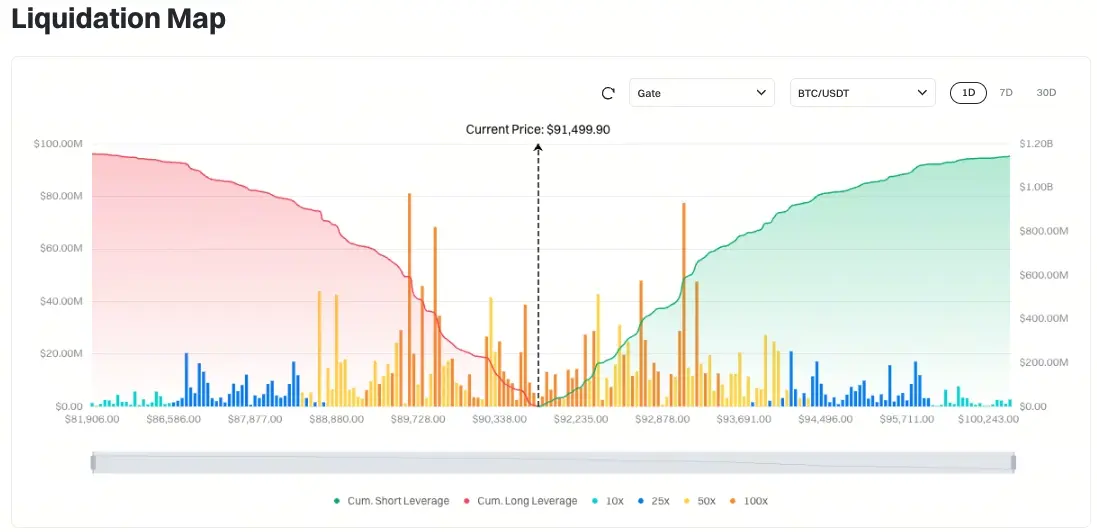

GameStop faces significant losses on its Bitcoin holdings, having deposited over 4,700 BTC to Coinbase Prime and incurring potential losses of $76 million. CEO Ryan Cohen also recently bought 500,000 shares of GameStop stock. Meanwhile, Bitcoin struggles below $90,000 amid rising exchange inflows and ETF outflows due to market uncertainty.

Coinspeaker·01-23 09:09

Sanae Takashi approves dissolution of the House of Representatives: "The Yen will come down soon!" Nomura: The yen exchange rate will only be intervened when it falls to 165

Japanese Prime Minister Sanae Takaichi announces dissolution of the House of Representatives and early elections, triggering the "Takaichi trading" trend, leading to the yen's continuous depreciation against the US dollar, approaching 159. Market analysis indicates that Takaichi's expansionary fiscal policies will keep the yen weak.

(Background recap: After record-breaking demand during internal testing, Bitget officially opens TradFi trading to all users)

(Additional background: Japan's 40-year government bond yield surpasses 4%, hitting a new high; 20-year auction demand remains weak)

Table of Contents

Yomiuri Shimbun reports: Takaichi Cabinet plans to call early elections for 465 House seats

Sanae Takaichi confirms on January 19: Dissolution of the House of Representatives on the 23rd, election on February 8

"Takaichi trading" continues to ferment: yen weakens, stock market oscillates at high levels

Exchange rate: Yen

Under pressure, the

動區BlockTempo·01-23 04:15

Shiba Inu Price Prediction: SHIB Death Cross Looms as Ethereum Falls and DeepSnitch AI Rips Toward 100X Launch

SkyBridge is leaning into macro trades as volatility rises across the digital asset sector. Anthony Scaramucci remains optimistic about the long-term case for Bitcoin despite recent liquidations.

This period of macro uncertainty creates a prime opportunity for those using the right

CaptainAltcoin·01-22 22:20

River advances chain-abstracted stablecoin infrastructure construction, receives a $8 million strategic investment from TRON.

River, an abstract stablecoin protocol, has received a strategic investment of $8 million from TRON to develop cross-ecosystem asset minting and stablecoin yield products, advancing ecosystem integration between both parties. This will enhance TRON's stablecoin liquidity and cross-chain fund efficiency, and create new yield allocation schemes such as Smart Vault and Prime Vault to meet funding needs in a multi-chain environment.

動區BlockTempo·01-22 07:30

GameStop Moves 2,300 BTC: What This Means for Bitcoin

_GameStop moved over 2,300 BTC to Coinbase Prime this January. Here’s how these transfers could affect the market as a whole._

GameStop, the famous gaming retailer, is back in the news. Recent data shows that the company moved a massive amount of digital currency to a major exchange.

This news

LiveBTCNews·01-21 10:05

GameStop Moves 2,300 BTC: What This Means for BTC

_GameStop moved over 2,300 BTC to Coinbase Prime this January. Here’s how these transfers could affect the market as a whole._

GameStop, the famous gaming retailer, is back in the news. Recent data shows that the company moved a massive amount of digital currency to a major exchange.

This news

BTC1.24%

LiveBTCNews·01-21 09:45

Grayscale Files with US SEC to Launch NEAR Trust ETF, Will NEAR Price Rally Soon? - Coinspeaker

Key Notes

The Grayscale NEAR ETF will track the NEAR price using the CoinDesk reference rate, with Coinbase Custody serving as prime custodian.

Following the SEC filing, NEAR price bounced back after hitting the lows of $1.5 earlier today.

Market analysts continue to stay bullish as NEAR

Coinspeaker·01-21 08:52

Trading Moment: "Sell US" trades trigger gold to hit a new high of $4888, Bitcoin faces short-term divergence, Ethereum faces a battle to defend $2800

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

The global financial markets ushered in turbulence on January 20th due to a sharp sell-off in Japan's long-term government bond market. Concerns over Prime Minister Fumio Kishida's expansionary fiscal plans potentially triggering a "Japan Truss Moment" led to a historic surge in Japan's 40-year government bond yields, breaking above 4%. Traders described the sell-off as "crazy," and it quickly propagated through Japan, one of the largest holders of U.S. debt, transmitting pressure to the United States and pushing the 10-year U.S. Treasury yield up to 4.311%. Citigroup issued a warning that volatility in the Japanese bond market could force risk parity funds to sell up to $130 billion worth of bonds in the U.S. market.

As U.S. stocks opened on Tuesday, former President Trump reiterated the need to control Greenland and threatened to impose tariffs on several European countries, which helped release market tensions and triggered a "

PANews·01-21 07:43

Davos Forum | Canadian Prime Minister Mark Carney Declares the Collapse of the International Order: Small Nations Unite to Counter Hegemony of Major Powers

Canadian Prime Minister Justin Trudeau emphasized at the World Economic Forum in Davos, Switzerland, that the "rules-based international order" has become a fiction, calling for middle powers to unite against great power hegemony. He declared that the traditional partnership between the US and Canada has ended, promoted a variable geometry diplomacy strategy, and supported Denmark's sovereignty over Greenland, demonstrating a commitment to uphold international rule of law. Additionally, after visiting Beijing, he successfully reached a trade consensus, expanding Canada's negotiation space.

ChainNewsAbmedia·01-21 04:13

PRIME Joins FishWar to Advance AI-Driven GameFi Innovation Via SEI Network

PRIME and FishWar have partnered to enhance Web3 gaming on the SEI Network, focusing on innovative GameFi solutions. This collaboration combines AI technology with immersive gameplay, aiming for sustainability and broader consumer engagement.

BlockChainReporter·01-20 21:03

Ripple Invests in TJM to Speed Up Institutional Trade Clearing

Ripple invested in TJM to strengthen institutional trade execution and clearing using Ripple Prime infrastructure.

The partnership boosts capital efficiency and balance-sheet support for regulated institutional brokerage clients.

TJM will expand into digital assets, offering unified execu

CryptoFrontNews·01-20 08:41

Japan's 40-year government bond yield breaks 4%, hitting a record high, while 20-year auction demand remains weak.

The Japanese bond market experienced intense volatility, with the 40-year government bond yield surpassing 4% for the first time, hitting a record high. The reasons include concerns over Prime Minister Fumio Kishida's tax cut policies. Demand for the 20-year government bond auction was weak, with bid-to-cover ratios below expectations. Insurance companies set a record by selling long-term bonds, and foreign holdings increased. The market is focused on the upcoming Bank of Japan meeting and political risks.

動區BlockTempo·01-20 07:00

Trump writes to the Presidents of Norway and Finland: Not receiving the Nobel Peace Prize, no obligation to consider peace

President Trump of the United States is dissatisfied with the sovereignty and trade tariffs issues of many European countries due to not receiving the Nobel Peace Prize. In communications with the Prime Ministers of Norway and Finland, he stated that he is no longer considering peace. Subsequently, Trump announced tariffs on multiple countries, and the EU is considering retaliatory measures to counter trade threats. world leaders are calling for dialogue to de-escalate tensions and plan to discuss related issues at the Davos Forum.

ChainNewsAbmedia·01-20 03:34

Gao City dissolves the National Assembly and the House of Representatives, and her political stance is outspoken, it's not just about the school lunch.

Japanese Prime Minister Sanae Takaichi announces the dissolution of the House of Representatives, with a general election scheduled for February 8. She seeks public support for her reform plans and economic policies. She emphasized that this move is to strengthen the legitimacy of her governance and to address rising prices, healthcare crises, and international security challenges. She hopes to let voters directly decide the future political direction through the election.

ChainNewsAbmedia·01-20 02:36

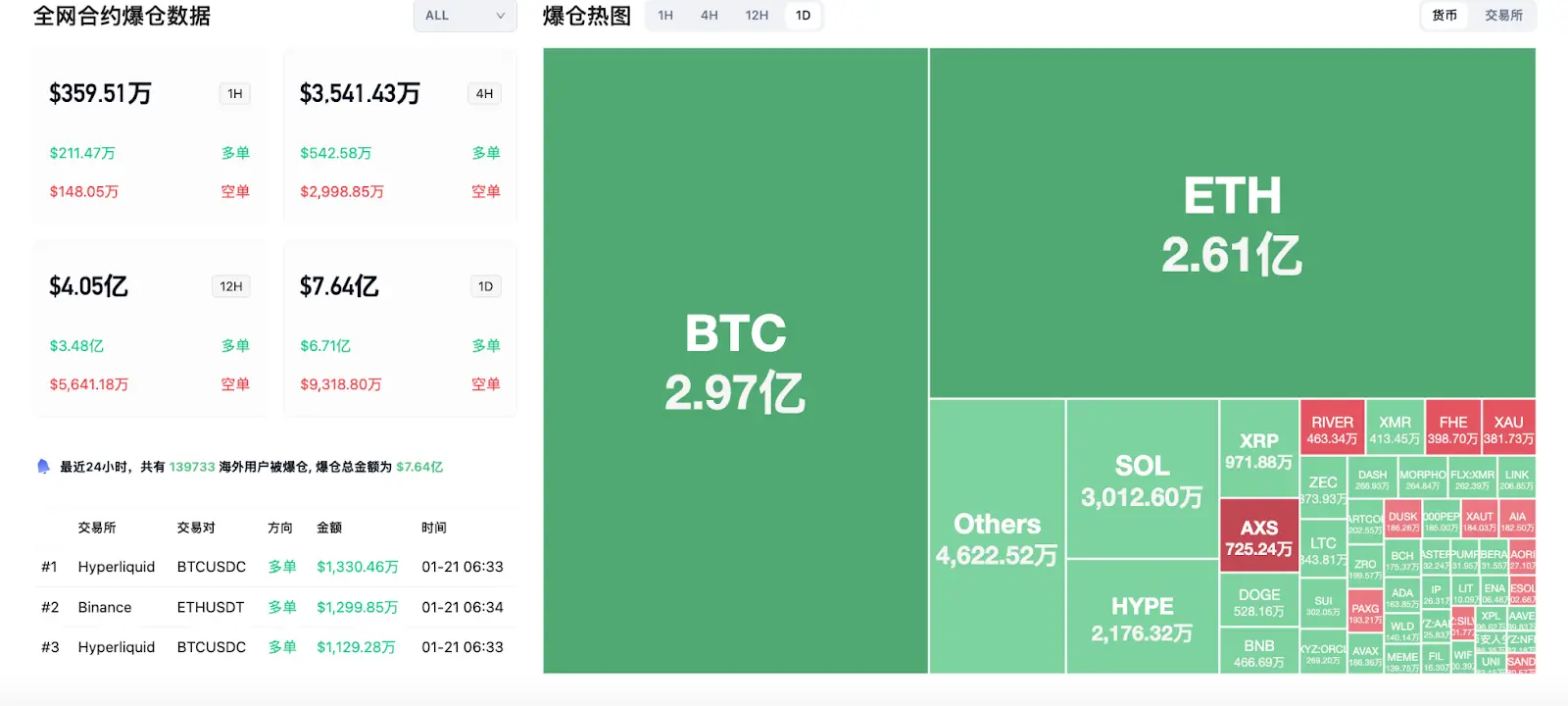

The EU is preparing to impose tariffs on the US! Bitcoin plummets, crypto market liquidates $600 million

Trump threatened to impose tariffs on 8 European countries over the weekend unless a "purchase of Greenland" agreement is reached. Starting February 1, a 10% tariff will be applied, rising to 25% in June. The EU held an emergency summit to discuss countermeasures, with French President Macron advocating for the use of the Anti-Coercion Instrument (ACI), and Italian Prime Minister Meloni seeking diplomatic solutions. On Monday, Bitcoin dropped below $92,000, plunging 3.6%, with the crypto market liquidating $600 million. Safe-haven asset gold surged to a record high.

MarketWhisper·01-19 02:45

Digital Wealth Partners Hands $250M Bitcoin Mandate to Two Prime in Landmark Institutional Deal

_Large Bitcoin mandates show institutions now favor active management, risk controls, and transparency over passive exposure._

A major U.S. investment advisor has made a major move into professional Bitcoin management. Digital asset strategies are drawing deeper interest from traditional firms a

BTC1.24%

LiveBTCNews·01-17 23:00

BlackRock Withdraws Bitcoin as BTC Slips to $95K Sparking Sell Fears

_BlackRock withdraws BTC from Coinbase as Bitcoin drops to $95K, sparking market speculation of a possible sell-off._

BlackRock has withdrawn a large amount of Bitcoin from Coinbase Prime shortly after the cryptocurrency dropped to $95,000. This move has caused speculation in the market, with ma

BTC1.24%

LiveBTCNews·01-17 16:05

Hong Kong Listed Yingzheng International Moves Into Web3 Blockchain Sector

A Hong Kong listed company is stepping into the world of Web3. Yingzheng International (Prime Intelligence Solutions Group Limited), formerly known as Lazy Pig Technology. It has announced plans to enter the blockchain and digital asset sector. The company shared the update through an official

Coinfomania·01-17 08:48

[Midnight News Brief] West Virginia proposes bill to invest up to 10% of public funds in Bitcoin External

West Virginia proposes to invest 10% of public funds in Bitcoin, Coinbase plans to expand stock tokenization trading, Riot partners with AMD to build data centers, and Two Prime manages $250 million in Bitcoin assets. Iran's cryptocurrency market size surpasses $8 billion, Strive acquires Semler Scientific holding 12,700 Bitcoins, and Pantera Capital completes 31 investments. Belarus signs digital token regulation law, Canaan Creative receives a delisting warning from NASDAQ.

BTC1.24%

TechubNews·01-16 14:45

This is not AI! Sana Gao and Lee Jae-myung drum and perform KPOP video exposure, what did the Japan-Korea leaders say during their meeting

During a recent summit between South Korean and Japanese leaders, Osaka Mayor Sanae and Lee Jae-myung engaged in "drum diplomacy," performing a KPOP song together. The leaders focused on supply chain resilience and maintained diplomatic space on the Taiwan Strait issue.

Japan-South Korea Leaders' Meeting: Osaka Mayor Sanae and Lee Jae-myung's Drum Diplomacy Video Revealed

-----------------------

South Korean President Lee Jae-myung recently visited Japanese Prime Minister Sanae Osaka, and after their meeting on January 13, the Japanese side prepared a surprise "drum diplomacy" activity.

Sanae Osaka, who was a heavy metal band drummer in university, personally instructed Lee Jae-myung in drumming techniques, and the two performed BTS's "Dynamite" and the theme song "Golden" from the anime "KPOP Witch Group."

Perhaps because the image of both national leaders drumming simultaneously was too rare, after Taiwanese media reposted the publicly released Japanese government video

CryptoCity·01-14 10:30

Standard Chartered Explores Crypto Prime Brokerage to Meet Rising Institutional Trading Demand

Standard Chartered plans a crypto prime brokerage to serve institutions while limiting balance sheet risk exposure.

The bank aims to meet rising institutional crypto demand through trading custody financing and risk tools support.

Growing crypto prime brokerage interest shows banks

SC2.75%

CryptoNewsLand·01-14 05:36

Standard Chartered Bank Reinvents Crypto Engine: Plans to Establish Prime Brokerage Business, Declares "Ethereum Era" is Coming

Standard Chartered, a major player in international finance, is planning to establish a Prime Brokerage business focused on cryptocurrency trading within its wholly-owned venture capital arm, SC Ventures.

This move is seen as a landmark step for traditional banking to deeply participate in the digital asset market, aiming to provide institutional clients with one-stop services such as financing, custody, and cross-market trading. Meanwhile, Geoffrey Kendrick, head of digital asset research at the bank, issued a bold prediction, stating that 2026 will be the "Year of Ethereum," with ETH expected to outperform Bitcoin and an optimistic outlook of long-term gains reaching $40,000. This series of actions clearly indicates that established banks are leveraging both business innovation and market analysis to compete vigorously in the emerging institutional-grade crypto financial ecosystem.

MarketWhisper·01-14 03:47

Standard Chartered launches crypto prime brokerage services! From custody to trading, building a comprehensive ecosystem map

Standard Chartered Plans to Launch Crypto Prime Brokerage via SC Ventures to Bypass Basel Capital Pressures, Integrate Custody, Trading, and Financing, and Capture the Core Entry Point for Institutional Funds into the Crypto Market

Standard Chartered Plans to Establish Crypto Prime Brokerage through SC Ventures

--------------------------

According to Bloomberg, Standard Chartered is planning to launch a cryptocurrency prime brokerage business under its venture capital arm, SC Ventures.

This multinational bank, headquartered in London with an asset management scale of up to $850 billion, is attempting to expand its services to meet the growing trading demands of institutional clients in the digital asset industry. The proposed new business aims to provide risk hedging

CryptoCity·01-14 01:05

UK Lawmakers Push Starmer to Ban Crypto Donations Amid Foreign Interference Fears

Senior Labour backbenchers are pressuring U.K. Prime Minister Keir Starmer to ban cryptocurrency donations to political parties, warning that digital assets and AI make foreign interference cheaper and harder to trace.

Concerns Over Foreign Interference

United Kingdom (U.K.) Prime Minister Keir S

Coinpedia·01-13 07:33

Baron Trump Marries a Princess to Swap for Greenland? Trump's Son's Marriage Proposal Goes Viral with Tens of Millions of Views

Amid Trump's push to annex Greenland, community users proposed a marriage alliance between 19-year-old Barron Trump and 18-year-old Danish Princess Isabella, with Greenland as a dowry sent to the United States. This "simple diplomatic solution" post received nearly 10 million views, and netizens used AI to generate photos of the two's children for jokes. On January 9, Trump hinted at using force to seize Greenland, while the Danish Prime Minister warned that an invasion would end NATO and the post-World War II security system.

MarketWhisper·01-13 07:15

Standard Chartered Plans Crypto Prime Brokerage Launch

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Banking giant Standard Chartered is reportedly planning to launch a prime brokerage for cryptocurrency trading amid a global push by banks to establish digital asset ventures and compete in the

PRIME10.13%

Bitcoinistcom·01-13 04:13

Gate Daily (January 13): Former New York City Mayor launches NYC Token; Thai Prime Minister orders tightening of digital asset regulations

Bitcoin (BTC) experiences a short-term rebound, currently around $91,400, as Federal Reserve survey results and Trump's tariffs boost risk aversion sentiment. Former New York City Mayor Eric Adams announced the launch of the "NYC Token" cryptocurrency project. Thailand's Prime Minister has ordered tighter regulations on gold trading and digital assets to combat "gray funds."

MarketWhisper·01-13 01:22

Standard Chartered Eyes Crypto Prime Brokerage Move

_Standard Chartered explores launching a crypto prime brokerage under SC Ventures, signaling deeper institutional commitment amid rising demand._

Standard Chartered is evaluating a crypto prime brokerage initiative as institutional crypto demand steadily expands. The bank then keeps the

LiveBTCNews·01-12 16:05

Ripple Expands Strategic Ties With BNY as Tokenized Deposits Go Live

BNY Mellon launches tokenized deposits with Ripple Prime as an early user to boost liquidity and enable faster blockchain settlements.

Platform mirrors deposits on-chain without replacing bank records, as TradFi moves toward 24/7 blockchain-based operations.

Bank of New York Mellon (BNY), th

USDP-0.02%

CryptoNewsFlash·01-12 09:05

Ripple CEO: Completed $2.25 billion strategic acquisition, institutional adoption of XRP accelerating by 2026

Ripple CEO Brad Garlinghouse confirms the completion of a $2.25 billion strategic acquisition in 2025, including a $1.25 billion purchase of Hidden Road, which will be renamed Ripple Prime. Ripple has obtained an electronic money license from the UK FCA, paving the way for the RLUSD stablecoin. Garlinghouse emphasizes that XRP will accelerate adoption through institutional infrastructure in 2026.

XRP1.37%

MarketWhisper·01-12 03:40

Ripple Expands Strategic Ties With BNY as Tokenized Deposits Go Live

BNY Mellon launches tokenized deposits with Ripple Prime as an early user to boost liquidity and enable faster blockchain settlements.

Platform mirrors deposits on-chain without replacing bank records, as TradFi moves toward 24/7 blockchain-based operations.

Bank of New York Mellon (BNY), th

USDP-0.02%

CryptoNewsFlash·01-11 09:05

Banking Lobby Runs Prime-Time Ads Against DeFi

_Anti-DeFi organization calls on senators to strip crypto bill of DeFi provisions with Fox News advertisements before key committee votes next week. _

The advertisements were aired in prime time by an unknown advocacy group against DeFi provisions in upcoming crypto billing. The advertisements

LiveBTCNews·01-11 04:15

BNY ventures into tokenized deposits, ICE joins to prepare for 24-hour stock market trading?

Bank of New York Mellon (BNY) officially announces the launch of tokenized deposit services, becoming the latest example of the global banking industry's deepening digital asset strategy. This service converts customer deposits into digital form on the blockchain, aiming to address the efficiency bottlenecks in fund transfers within traditional financial systems, especially in a 24/7 trading environment. Through collaborations with major institutions such as Intercontinental Exchange (ICE), Citadel Securities, and Ripple Prime, BNY is committed to leveraging blockchain technology to accelerate collateral management and margin settlement processes.

BNY's Tokenized Deposit Technology Architecture and Liquidity Optimization

BNY's tokenized deposits are essentially digital certificates of bank deposits on the blockchain, which, like traditional deposits, are liabilities of the bank and can generate interest. This is different from the typical...

ChainNewsAbmedia·01-11 00:15

Japanese Prime Minister Fumio Kishida is expected to dissolve the House of Representatives, USD/JPY breaks near one-year high, Nikkei futures surge.

Yomiuri Shimbun reports that Japanese Prime Minister Sanae Takaichi is considering dissolving the House of Representatives at the regular Diet session convened on January 23. The plan points to a general election in the House of Representatives to be held in early to mid-February. Following the news, Nikkei futures surged, and the yen against the US dollar hit a one-year low, with USD/JPY reaching around 158, an increase of approximately 0.6% to 0.7% for the day.

Industry analysts interpret that since Takaichi's cabinet took office in October 2025, support ratings have remained around 70%. They aim to dissolve the House of Representatives while support is still high to proactively contest the election. If Takaichi's administration wins a majority in the House of Representatives, the market expects more aggressive fiscal policies, leading to a reaction of selling the yen. Since taking office, Takaichi's policy style has been "proactive fiscal policy + tolerating a weaker yen to boost the stock market and exports."

Yomiuri Shimbun: Japanese Prime Minister Sanae Takaichi may dissolve the House of Representatives on January 23.

ChainNewsAbmedia·01-09 17:34

The behind-the-scenes signal of Chen Zhi's deportation to China: Can China and the US recover the 127,000 BTC?

Chen Zhi was arrested in Cambodia and deported to China. In October, the US confiscated 127,000 BTC, and in December, Cambodia revoked his nationality, granting China law enforcement authority. The July Phnom Penh arrest was led by Chinese authorities. Cambodia, unable to offend both China and the US simultaneously, cooperated. Chen Zhi was once friends with a British lord and the Prime Minister's children. Singapore froze 150 million SGD, with total assets exceeding 15 billion. China will pursue compensation and may seek the return of BTC from the US.

BTC1.24%

MarketWhisper·01-09 02:11

Carney Heads to Beijing: Canada Seeks a Reset With China Amid Pressure From Trump’s Tariffs

Canadian Prime Minister Mark Carney is set to travel to China next week, where he is expected to meet with President Xi. The visit aims to reopen trade talks and ease the economic strain caused by the escalation of tariffs pushed by the administration of Donald Trump.

It will be the first visit by a

Moon5labs·01-08 06:00

Prince Group's Chen Zhi Arrested and Extradited to China! 14 Billion Bitcoin Scam Empire Collapses

Prince Group founder Chen Zhi was arrested in Cambodia and deported to China. The United States accused him of orchestrating a scam, seizing $14 billion in Bitcoin, the largest case in history. Singapore froze 150 million SGD, Taiwan confiscated 4.5 billion TWD, and Hong Kong froze HKD 2.75 billion. Cambodian Prime Minister Hun Sen quickly distanced himself. Chen Zhi, 37 years old, previously held the title of Duke and served as a government advisor.

MarketWhisper·01-08 00:42

Trump's Strategic Reserve Order Gets Flushed! Department of Justice Illegally Sells 57 Bitcoins Triggering Investigation

The U.S. Marshals announced the liquidation of 57 Bitcoins on November 3, potentially violating Trump's Strategic Reserve order. The BTC confiscated from Samourai Wallet was processed through Coinbase Prime. On-chain data shows the funds moving to Coinbase, but foreign media pointed out that it cannot be confirmed whether they have been sold. Trump's advisors have launched an investigation into this.

BTC1.24%

MarketWhisper·01-07 07:39

Did the U.S. Department of Justice openly defy Trump? Samouiri's seizure of $6.3 million worth of Bitcoin may have already been secretly sold

On January 5, 2026, multiple cryptocurrency media outlets reported that the U.S. Department of Justice may have secretly sold approximately 57.55 bitcoins, seized from Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill, through the U.S. Marshals Service, valued at about $6.3 million.

This move is alleged to potentially violate Executive Order No. 14233 signed by President Trump earlier, which explicitly requires federal agencies to treat seized bitcoins as "U.S. government bitcoins" and include them in the U.S. strategic bitcoin reserve, prohibiting arbitrary sales. However, in-depth on-chain data analysis shows that these bitcoins indeed flowed into a Coinbase Prime custody address, but blockchain evidence does not conclusively prove they have been sold. This controversy surrounding "on-chain traces" and "executive orders" is not only about the disposition of a single asset but also profoundly reveals internal disagreements and power struggles within the U.S. judicial system regarding cryptocurrency policy.

BTC1.24%

MarketWhisper·01-06 01:33

Load More