Search results for "ROOT"

Base Mainnet Fix Restores Network Stability After Delays

Base Protocol faced transaction inclusion delays due to network congestion, causing confirmation times of up to two minutes. They deployed fixes to restore stability and will increase the minimum base fee to reduce future congestion. A Root Cause Analysis will follow.

ETH2.15%

CryptoFrontNews·02-01 13:06

Work even while sleeping! What is Clawdbot? 5-step installation must-see cybersecurity minefield

Clawdbot is an open-source AI assistant that became popular on the X platform, allowing remote execution of computer commands through messaging software. AWS free servers plus $20 API replace a $2000 monthly salary assistant. Developers warn that this is equivalent to giving AI Root privileges, and prompt injection could lead to GitHub data leaks. It is recommended to use a clean computer, enable sandboxing, whitelisting, limit tokens, and restrict group access.

MarketWhisper·01-27 03:55

[Editorial] Not De-dollarization, but the Beginning of "De-fiatization"

The article discusses the root causes of fiat currency crises, pointing out that the problem lies in the collapse of overall confidence in fiat currencies, not just the devaluation of the US dollar. The market is undergoing a transition towards "de-fiatization," with investors shifting their focus to tangible assets such as gold and silver to hedge against currency depreciation and systemic risks. In this context, individuals and businesses should adjust their asset allocations, focusing on long-term value rather than short-term fluctuations.

BTC2.11%

TechubNews·01-26 21:51

PA Daily|Space responds to controversy and will refund $7.3 million in excess funds; FIGHT will refund IC0 participants and airdrop tokens

Today's News Highlights:

David Sacks: Banks and the crypto industry will eventually merge into a single "digital asset industry"

Bloomberg: Wall Street institutions are withdrawing from Bitcoin "buy-and-sell arbitrage" trading

Space responds to community questions about fundraising limits and refund transparency, deciding to refund $7.3 million in excess funds

$FIGHT will fully refund ICO participants and simultaneously airdrop tokens

David Sacks: Banks and the crypto industry will eventually merge into a single "digital asset industry"

Vitalik proposes the "Native DVT Staking" plan to enhance Ethereum's security and decentralization

"Insider Whale 1011" agent: The increase in institutional participation did not end the crypto bull market but shifted from speculation to allocation structure

Zhao Changpeng's Davos speech: Some reserve system models are the root cause of banking liquidity crises, and the demand for physical banks will in the next decade

PANews·01-22 10:25

Sui mainnet experiences outage again! Restored after 6 hours of downtime, SUI price remains unaffected despite the overall market rally

On the early morning of January 15, the high-performance Layer 1 blockchain Sui Network experienced its second severe network outage in several months, with the mainnet completely halted for about 6 hours, during which no new blocks were produced.

Although the core team quickly intervened and ultimately restored the network, the market reaction to the SUI token was surprisingly "calm." Against the backdrop of Bitcoin leading the overall market surge, its price remained almost unchanged, staying around $1.89. This abnormal phenomenon reveals a subtle shift in the current valuation logic of the crypto market: under strong market maker support and a narrative-driven market environment, the impact of short-term technical failures on price may be diminishing. This article will thoroughly review the entire incident, analyze its technical root causes, and explore its profound implications for the development of the Sui ecosystem and the competitive landscape of Layer 1 protocols.

MarketWhisper·01-15 02:56

$3.7 million evaporated! YO Protocol experienced an abnormal token swap event: $3.84 million stkGHO only exchanged for $122,000 USDC

YO Protocol reports a serious token swap error: approximately $3.84 million worth of stkGHO was accidentally exchanged through Uniswap v4 extreme pools during an asset rebalancing operation, resulting in only about $122,000 USDC received, instantly evaporating nearly $3.7 million.

(Background: TrueBit protocol suspected of being hacked! 8,535 ETH transferred abnormally, $TRU instantly halved)

(Additional context: North Korean hackers set a record in 2025 by stealing $2.02 billion in cryptocurrency, with a money laundering cycle of about 45 days)

Table of Contents

Incident Details

YO Protocol Team’s Rapid Response

Summary of the Root Cause

Blockchain security firm BlockSec’s latest post reveals that DeFi protocol Y

動區BlockTempo·01-13 15:05

Treating the symptoms but not the root cause? V God points out the three major issues with centralized stablecoins, claiming that even the so-called perfect solutions are not perfect.

Ethereum founder Vitalik Buterin emphasizes the importance of decentralization, questions the long-term risks of USD stablecoins, and points out that oracles and staking yield competition pose challenges to stablecoins. He calls for the pursuit of broader value indicators to enhance resilience and proposes the need for anti-capture oracle systems, stressing that addressing these issues is essential to ensure the long-term survival of stablecoins.

CryptoCity·01-13 01:01

Starknet Team Reveals Root Cause Behind Recent Network Outage

Starknet Resolves Recent Network Disruption with Root Cause Analysis

The Starknet team has issued a detailed post-mortem following a recent outage that temporarily disrupted its mainnet, marking the second significant network disruption this year. The incident underscores the complexities of

STRK0.93%

CryptoBreaking·01-11 21:05

Starknet Team Reveals Root Cause Behind Recent Network Outage

Starknet Resolves Recent Network Disruption with Root Cause Analysis

The Starknet team has issued a detailed post-mortem following a recent outage that temporarily disrupted its mainnet, marking the second significant network disruption this year. The incident underscores the complexities of

CryptoBreaking·01-10 21:00

Research Report 2025 Crypto in Review – 12 Months, 12 Narratives

Tiger Research's year-end report reflects on 2025's cryptocurrency market, characterized by rapid narrative turnover. While many themes flared brightly only to fade quickly, a select few took root—driving genuine structural progress and reshaping the industry.

CryptopulseElite·01-05 09:44

2025 Crypto Year in Review: Rapid Narrative Cycles and Lasting Institutional Shifts

2025 was a year of relentless narrative churn in cryptocurrency—hype built and collapsed at breakneck speed. Yet beneath the surface noise, meaningful structural changes took root, driven by institutional adoption and clearer regulatory signals. While many stories proved fleeting, a few solidified into foundations for sustainable growth.

CryptopulseElite·01-04 09:56

Bitcoin's "24,000 USD" fake fall: an in-depth analysis of the liquidity trap in the new USD1 trading pair

During the Christmas holiday, the BTC/USD1 trading pair on mainstream cryptocurrency exchanges experienced a shocking flash crash. The price of Bitcoin instantly dropped to $24,111 on the chart, then quickly rebounded to above $87,000 within seconds. This extreme volatility did not affect the prices of major trading pairs like BTC/USDT. The root cause was the newly launched stablecoin USD1 issued by World Liberty Financial, which has Trump as a background, with extremely scarce liquidity.

This incident coincided with the platform launching a high-yield promotion offering 20% annualized interest for USD1, leading to a surge of arbitrage funds. During the holiday's low trading volume, a simple sell order triggered a price collapse. This serves as a warning to all traders: operating in emerging or low-liquidity trading pairs may face slippage and risks far beyond expectations.

MarketWhisper·2025-12-26 02:46

More than 80% of the new coins TGE are the root cause and antidote of the false prosperity of Web3.

Original text: Solus Group; Translated by: CryptoLeo

Editor’s note: Recently, analyst Ash stated in a popular post that among over 100 new tokens with TGE in 2025, 84.7% of the tokens have FDV lower than the FDV at TGE. The median FDV of these tokens has dropped by 71% compared to their issuance (with a median market cap drop of 67%). Only 15% of the tokens saw an increase in FDV compared to their TGE value. Overall, most of the new tokens issued in 2025 belong to the category of "TGE price being the peak."

Following these data, I found a more interesting article (from Solus Group), which also starts from the project token TGE and counts 113 types of tokens after their TGE in 2025.

金色财经_·2025-12-23 06:47

Why does Vitalik Buterin support prediction markets? More reliable than social media as a "truth discovery tool".

Recently, Ethereum co-founder Vitalik Buterin publicly posted on Farcaster, defending the ethical value of prediction markets. He pointed out that compared to social media, which fuels sensationalist rhetoric, prediction markets built on economic incentives are a superior "truth discovery tool." This statement immediately sparked intense ethical clashes with Quilibrium founder Cassie Heart and others, who criticized the act of betting on human life and death as the root of the "industry's disdain." Meanwhile, prediction market platforms like Polymarket and Kalshi are accelerating mainstream adoption, with data being included by Google Finance, and regulatory approval from the Commodity Futures Trading Commission in the form of a "no-action" exemption, signaling that this sector will continue to expand amid controversy.

MarketWhisper·2025-12-22 03:08

Crypto needs to take advantage of the current political opportunity to root itself in the financial system before the risk of backlash in the future.

Danny Ryan warns that the Trump administration's progress in cryptocurrency legislation could politicize the field due to the family's deep involvement. He emphasizes the need for the crypto industry to integrate more into mainstream finance to shift future debates from existence to responsible management and governance.

TapChiBitcoin·2025-12-21 05:23

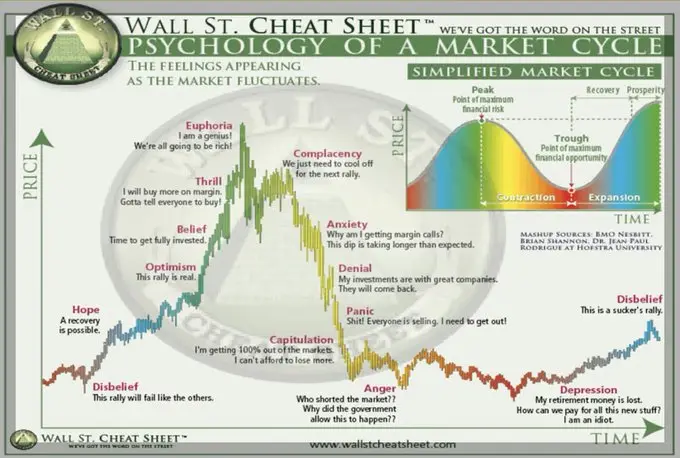

Stop only focusing on Bitcoin; we have long been in a bear market.

Author: XY

Translation: Tim, PANews

Entering the bear market for a year

It took me some time to convince myself: we are in a bear market, and it has been ongoing for about a year.

November 2024 will be a period of market excitement, and the issuance of $TRUMP pushed the market to extreme euphoria, marking the final狂欢 that no one wants to believe.

Below, I will explain my perspective.

It all started with that old cliché: “History doesn’t repeat itself, but it often rhymes.”

This silly phrase has caused huge misconceptions in market analysis, essentially doing more harm than good.

It led us to develop path dependence and also caused us to lose the ability to question.

Yes, this reliance on historical patterns for prediction is like looking at the world through a prism engraved with old patterns, inevitably leading to misreading the current new reality, and ultimately causing us to overlook the latest driving factors of the market. This is precisely the dangerous root

PANews·2025-12-18 09:36

The Evolution and Awakening of Public Chains: Redefining the True "DEX On-Chain Trading" Standard

In the forest of tombstones in the crypto world, there are countless projects trying to put the "Central Limit Order Book (CLOB)" on the blockchain. From the earliest EtherDelta to the countless challengers who boasted high performance, most of them failed to escape the fate of liquidity depletion or lag.

For a long time, there has been a misconception in the industry: "The order book cannot be done because the chain is not fast enough." ”

As a result, public chains are caught in an arms race of TPS (transaction volume per second). From 15 TPS to 1,000 TPS to the 100,000 TPS claimed today. But strangely, even though the chain is already surprisingly fast, top market makers still dare not bring up core liquidity.

The root cause is never speed, but genetic conflicts.

The traditional public chain logic pursues "consistent state of the whole network", while the matching engine pursues "unambiguous time order". Both of these are in the old days

PANews·2025-12-10 05:03

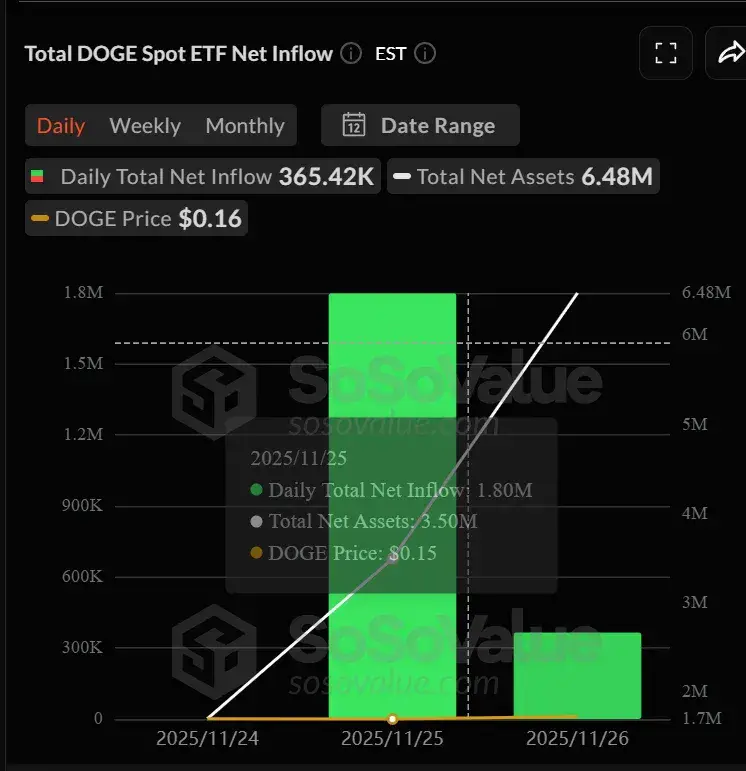

Taking Root Amid the Ruins: Extreme Polarization in the Altcoin ETF Market

November 2025 marked a historic moment for the US cryptocurrency market—after nearly two years of successful operation of Bitcoin and Ethereum spot ETFs, the first wave of altcoin ETFs was finally approved for listing.

The four altcoin ETFs—Litecoin, XRP, Solana, and Dogecoin—experienced dramatically different fates. XRP and Solana together attracted over $1.3 billion in institutional funds, emerging as the absolute winners in the market, while Litecoin and Dogecoin were completely snubbed, with their combined inflows totaling less than $8 million.

This report provides a comparative analysis of the performance of the four major altcoin ETFs, delves into their interconnected impact on the market, and forecasts how subsequent ETFs may influence market trends.

Part One: The Two Extremes of the Four Major ETFs

XRP: The Biggest Winner Among Altcoin ETFs

PANews·2025-12-09 23:01

Redefining the true standard of "DEX on-chain trading"

Author: On-chain Tidbits

In the graveyard of the crypto world, countless projects have tried to bring the "Central Limit Order Book (CLOB)" onto the blockchain. From the early days of EtherDelta to the many self-proclaimed high-performance challengers that followed, most have failed to escape the fate of liquidity droughts or laggy user experiences.

For a long time, there has been a common misconception in the industry: "Order books can't work because blockchains aren't fast enough."

As a result, public chains have been caught in an arms race over TPS (transactions per second)—from 15 TPS to 1,000 TPS, and now to 10,000 TPS or more. Strangely, even with these blazing fast upgrades, top market makers still don't dare to bring core liquidity on-chain.

The root cause has never been speed, but a fundamental conflict in their DNA.

Traditional public chains are designed to pursue "global state consistency," while matching engines require "absolute, unambiguous time ordering." These two...

ASTER3.77%

金色财经_·2025-12-08 07:43

SlowMist: The root cause of the yearn attack is that the Yearn YETH pool contract contains unsafe mathematical operations.

Mars Finance news: According to monitoring by SlowMist, the decentralized finance protocol yearn has suffered a hacker attack, resulting in a loss of approximately $9 million. The SlowMist security team analyzed the incident and confirmed the root cause as follows: The vulnerability originated in the logic of the _calc_supply function used for calculating supply in the Yearn yETH Weighted Stableswap Pool contract. Due to unsafe mathematical operations, this function allowed for overflows and rounding errors during calculations, resulting in significant deviations in the product of the new supply and the virtual balance. Attackers exploited this flaw to manipulate liquidity to specific values and excessively mint liquidity pool (LP) tokens, thereby profiting illegally. It is recommended to strengthen edge case testing and use secure and verified arithmetic mechanisms to prevent similar issues in such protocols.

MarsBitNews·2025-12-05 03:19

In-depth Analysis of HashKey's Prospectus: Why Stepping Outside Traditional Perspectives is Necessary to Understand the Strategic Value Behind It

Original Title: In-Depth Analysis of HashKey's Prospectus: Why Stepping Out of Traditional Perspectives is Necessary to Understand Its Strategic Value

Original Author: Luccy

Source:

Reprinted: Mars Finance

The listing is undoubtedly a milestone victory for HashKey. However, when the prospectus unveiled its details, the continuous financial losses over the past four years, a mere 138,000 users on the trading platform, and the bleak data concerning its L2 chain ecosystem posed a sharp question to the market: how can this "unprofitable trading platform" justify itself?

If we only use a compliant trading platform or traditional internet metrics to evaluate HashKey, these metrics will inevitably lead to a pessimistic conclusion. The root of the problem lies in the fact that the market is still viewing a company that is essentially trying to become a digital asset financial entity in Asia through the framework of "Web2 platform companies" or "Web3 trading platforms."

RWA2.23%

MarsBitNews·2025-12-02 11:08

Arbitrum (ARB) hold above important support when the 'Arbitrum Everywhere' framework is being highlighted.

Arbitrum (ARB) is slightly sliding and currently trading around 0.22 USD on Thursday, amidst the crypto market continuing to be in a 下行 trend. Since hitting the peak of Q3 at 0.62 USD in August, ARB has been struggling to find its bounce back trajectory, indicating that pessimistic sentiment is taking root in the community.

ARB-0.51%

TapChiBitcoin·2025-11-20 04:33

Global cryptocurrency market capitalization has evaporated by $1 trillion: a healthy pullback or the beginning of a Bear Market?

According to Bloomberg, on November 19, 2025, Bitcoin fell to $88,522, the lowest level since April, causing the total market capitalization of Crypto Assets to shrink from the peak of $4.3 trillion on October 6 to $3.2 trillion, losing over $1 trillion in just six weeks. The market's vulnerability was exposed during the $19 billion leverage Position liquidation event on October 10. Although sentiment slightly recovered after Nvidia's earnings report, analysts warned that the psychological barriers of $85,000 and $80,000 may be tested. The root of this round of decline lies in the delayed expectations of Fed interest rate cuts and the structural retreat of institutional demand.

MarketWhisper·2025-11-20 02:17

Vitalik harshly criticizes FTX: it is a negative example of turning Ethereum principles "180 degrees".

According to Mars Finance, Vitalik Buterin, co-founder of Ethereum, stated at the Devconnect conference in Argentina that the now-defunct crypto exchange FTX is a "counter-example" of Ethereum's philosophy. He pointed out that FTX relied on a centralized structure, requiring users to "trust that the platform will not do evil," while Ethereum's core is decentralization, transparent collaboration, and a technology design that is "incapable of doing evil." In his speech, Vitalik opened with old remarks from Sam Bankman-Fried and emphasized that the centralized architecture is the root cause of FTX's collapse; in contrast, all upgrades to Ethereum are reviewed and advanced collectively by the community in a public environment. He stated that FTX is a "company," while Ethereum is a "community," and the two are fundamentally different in structure and values.

ETH2.15%

MarsBitNews·2025-11-18 01:07

Robert Kiyosaki says cash crunch driving crash, stays bullish on Bitcoin, gold

Robert Kiyosaki remains committed to Bitcoin and gold despite market declines, citing a global cash shortage as the root cause. He predicts significant money creation by governments will enhance the value of cryptocurrencies. Kiyosaki advises forming Cashflow Clubs for better investment strategies.

Cointelegraph·2025-11-15 10:35

From On-Chain to Everyday Life: An Overview of the Global Consumption Landscape of Stablecoins in 2025

By 2025, spending stablecoins on everyday consumption is no longer a romantic footnote of "global financial equality and financial inclusion," but a tangible reality taking root.

Although the broader cryptocurrency market continues to fluctuate between bull markets and regulatory adjustments, most activity remains focused on capital flows, remittances, and decentralized finance (DeFi) infrastructure. Stablecoins, however, have carved out a lasting niche: they are being used for payments and consumption, not just for storage or trading.

However, closer observation shows that less than 10% of these activities are directly linked to actual spending—i.e., purchasing goods and services.

Yet, this seemingly insignificant 10% is expanding at a visibly rapid pace, quietly rewriting the rules in the gaps of daily life: from street vendors to cross-border remittances, stablecoins are no longer just "crypto geek toys," but real tools in consumers' pockets.

USDC-0.02%

金色财经_·2025-11-09 04:37

Balancer identifies root cause of $116m hack

Balancer has uncovered the technical root cause behind the recent hack that shook its platform.

Summary

Balancer identified a rounding bug in its "upscale" function as the cause of the exploit that drained assets across multiple networks.

Over $116 million was stolen, with losses spanning

Cryptonews·2025-11-06 14:00

Gold vs. Bitcoin: How Will Liquidity Pressure and Macroeconomic Uncertainty Affect the Next Move?

As top executives from leading banks like Morgan Stanley, Goldman Sachs, and JPMorgan issue rare market warnings, global investors' risk aversion has surged sharply. Gold and Bitcoin, both considered "safe-haven assets," are showing markedly different trends amid liquidity tightening and macroeconomic uncertainty: gold remains steady or slightly rises, while Bitcoin faces downward pressure due to funding constraints and a decline in market speculation. This article will analyze the root causes of the divergence between gold and Bitcoin from three perspectives—liquidity, macroeconomic data, and investment structures—and explore the potential impact of this "safe-haven battle" on the crypto market.

BTC2.11%

MarketWhisper·2025-11-06 00:59

Preliminary Analysis of the Balancer V2 Attack Incident

On November 3rd, the Balancer V2 protocol and its fork projects suffered attacks on multiple chains, resulting in severe losses of over $120M. BlockSec issued an early warning for [1] and provided initial analysis conclusions for [2]. This is a highly complex attack incident. Our preliminary analysis indicates that the root cause lies in the attacker manipulating the invariant, thereby distorting the price calculation of the BPT (Balancer Pool Token ) -- which is the LP token of the pool) and enabling them to profit from a single batchSwap operation in a stable pool.

Background knowledge

1. Scaling and Rounding

To unify the decimal points of different tokens, Balancer combines

BPT3.69%

金色财经_·2025-11-03 13:42

BNB Chain reveals root cause of $13k X account hack

BNB Chain has discovered the root cause of the X account hack which resulted in a loss amounting to $13,000. The team claims that all users have been fully compensated.

Summary

BNB Chain confirmed that all 13 users affected by the Oct. 1 X account hack have been fully reimbursed in USDT,

Cryptonews·2025-10-31 10:54

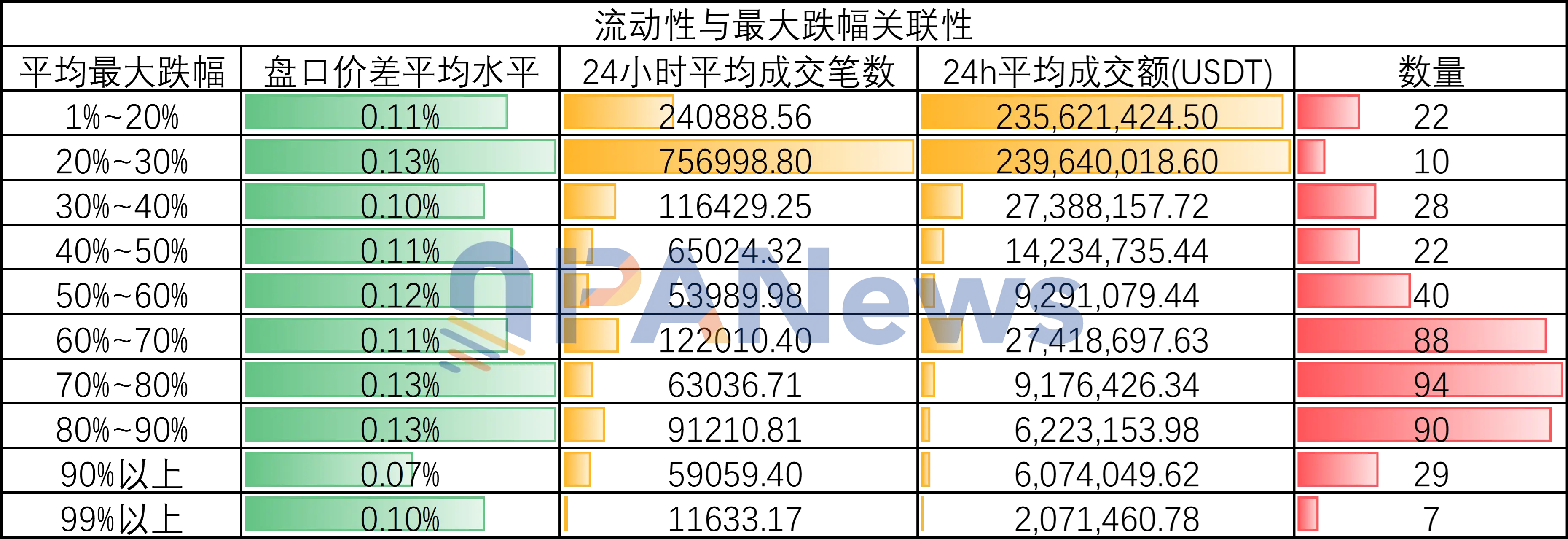

October 11 Data Observation After the Flash Crash: Liquidity and the Severity of the Big Dump Are Proportional, Prices Have Generally Recovered 80%

Author: Frank, PANews

Although more than ten days have passed, the flash crash on October 11th still leaves the marketplace unsettled. On that day, the prices of many tokens approached "zero" in a very short period, only to then experience violent rebounds of a thousand or even ten thousand times, causing extreme market panic.

How severe was this epic crash? Which categories of tokens were hit the hardest? Behind the astonishing rebound data, has the marketplace's "true" trauma already healed?

More importantly, is the widely speculated "liquidity exhaustion" truly the root cause of this crisis? To clarify the truth, PANews conducted a detailed data analysis of 430 spot trading pairs on Binance from October 10th to October 20th. This article will reveal the facts behind this extreme market condition through multi-dimensional data, layer by layer.

This data analysis uses Binance from October

PANews·2025-10-22 01:59

South Korea has implemented a "destructive housing policy" where the loan amount for high-priced properties is less than 10%. Should Taiwan follow suit?

The South Korean government has implemented the most severe housing restrictions in history, akin to a high-risk surgical operation, attempting to excise the speculative tumor in one fell swoop. In contrast to Taiwan's gentle and holistic approach, these are two completely different paths. Which one can truly resolve the century-old dilemma of housing justice? (Background: The Executive Yuan opens the housing loan Faucet! Deciding on new arrangements to exclude Article 72-2 of the Banking Act has caused a stir in the legal community: Is an administrative order greater than the law?) (Supplementary background: Taiwan's real estate market is experiencing "sky-high asking prices, with transactions flatlining"; price negotiations start at a 15% cut, will there be another fall next year?) Recently, the South Korean government dropped a bombshell: "The most severe housing restrictions in history" have almost severed the possibility of ordinary people obtaining loans to purchase homes, attempting to excise the tumor of housing prices that has taken root in the heart of South Korean society. The government has stipulated that in core areas of the capital region, such as Seoul, the price of upscale residences exceeding 2.5 billion KRW (approximately 53.87 million TWD) has seen the loan limit plummet to just 200 million KRW (less than TWD 450).

動區BlockTempo·2025-10-21 09:39

The most stable leverage creates the most collapsing situation: Trump ignited the fire, why is my account footing the bill?

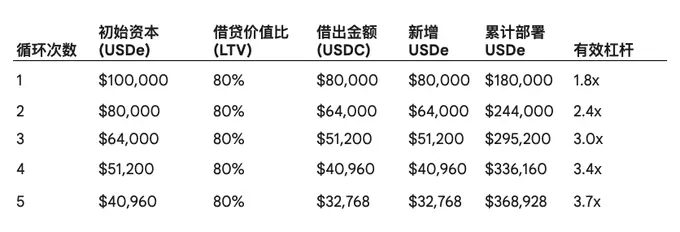

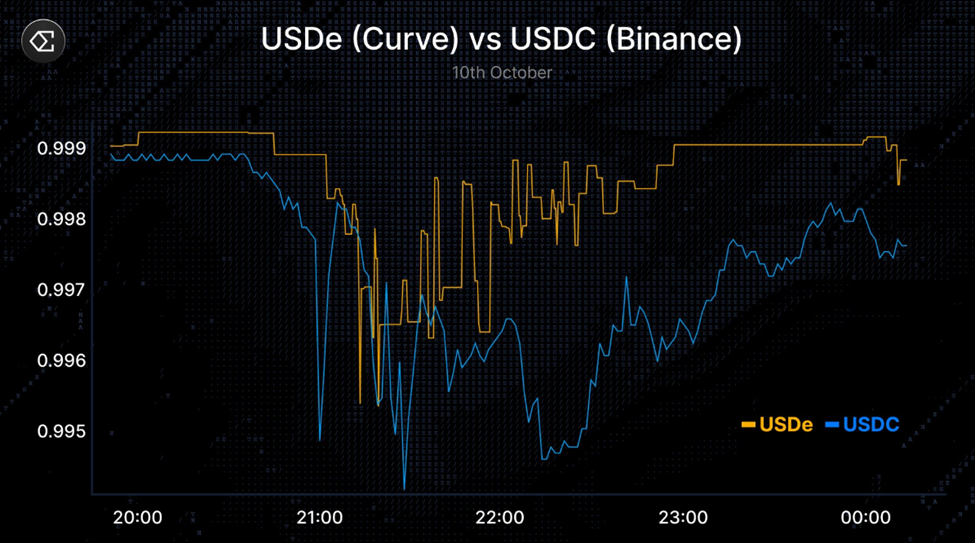

Although this big dump was sparked by Trump, its disastrous destructive power stems from the high-leverage environment within the native financial system of the crypto market. High-yield stablecoin USDe, the recursive "circular lending" strategy built around it, and its widespread use as Margin Collateral by market makers and other mature market participants have collectively created a highly concentrated and extremely fragile risk Node.

The price de-anchoring event of USDe is like the first domino in a chain reaction, triggering a large-scale deleveraging that spreads from on-chain DeFi protocol liquidations to centralized derivatives exchanges. This article will dissect the operational principles of this mechanism in detail from the perspectives of large holders and market makers.

Part One: Powder Keg x Spark: Macro Triggers and Market Vulnerability

1.1 Tariff Declaration: Catalyst, not Root Cause

The trigger for this market turbulence is: Trump announced plans to start from January 2025.

TRUMP1.72%

PANews·2025-10-13 07:15

The truth about USD depeg big dump to 0.65 USD: Oracle Machine vulnerability or a coordinated attack?

The USDe depeg event shocked the market, with the price falling from 1 USD to 0.65 USD, triggering a 1 billion USD liquidation wave. Ethena founder Guy Young revealed that the root cause of the USDe depeg lies in the exchange's Oracle Machine issues, rather than the protocol itself. Analysts questioned whether the USDe depeg was a meticulously planned coordinated attack, while Ethena promoted reserve proof reforms to rebuild trust.

MarketWhisper·2025-10-13 00:33

In just a few minutes, 19 billion dollars evaporated: the truth behind the big dump of alts is not Binance?

In October 2025, the United States imposed tariffs on China, causing panic in the global financial market, and the market capitalization of Crypto Assets evaporated by $19 billion in an instant. Although Binance became the main trading platform, the root cause of the crash lay in the market maker mechanism and highly leveraged trading, exposing the vulnerabilities of the centralized order book system. The market lacked Liquidity support, leading to a big dump in prices, and the overall system risk was magnified. This incident reminds the industry to pay attention to response capabilities and risk transmission models.

ChainNewsAbmedia·2025-10-12 02:33

Slow Mist: Detected potential suspicious activity related to Milady Strategy

According to Mars Finance, Slow Fog announced on social media that potential suspicious activities related to Milady Strategy have been detected, with the root cause being the same vulnerability discovered by TokenWorks. Users are advised to remain vigilant.

MarsBitNews·2025-09-30 03:31

Hyperliquid's Hyperdrive was hacked, and a vulnerability in the smart contracts led to the theft of $782,000.

The Hyperliquid borrowing protocol Hyperdrive on the blockchain encountered a serious security incident on Saturday night, where hackers successfully stole approximately $782,000 in assets by exploiting a vulnerability in the smart contracts. This is the third major security incident faced by the well-known Layer 1 network this year, raising concerns in the market about the security of DeFi protocols. The Hyperdrive team has confirmed that they have identified the root cause of the issue and applied a patch, while also committing to announce a compensation plan for the affected users soon.

MarketWhisper·2025-09-29 01:45

Hyperdrive: The root cause of the issue has been identified and fixed, and a compensation plan will be developed for affected users.

Hyperdrive has released a security incident update, the issue has been identified and resolved, and a compensation plan will be formulated for affected accounts. The market is expected to return to normal within 24 hours, and users are reminded to be vigilant against scams, not to interact with the protocol or send funds.

MarsBitNews·2025-09-28 07:11

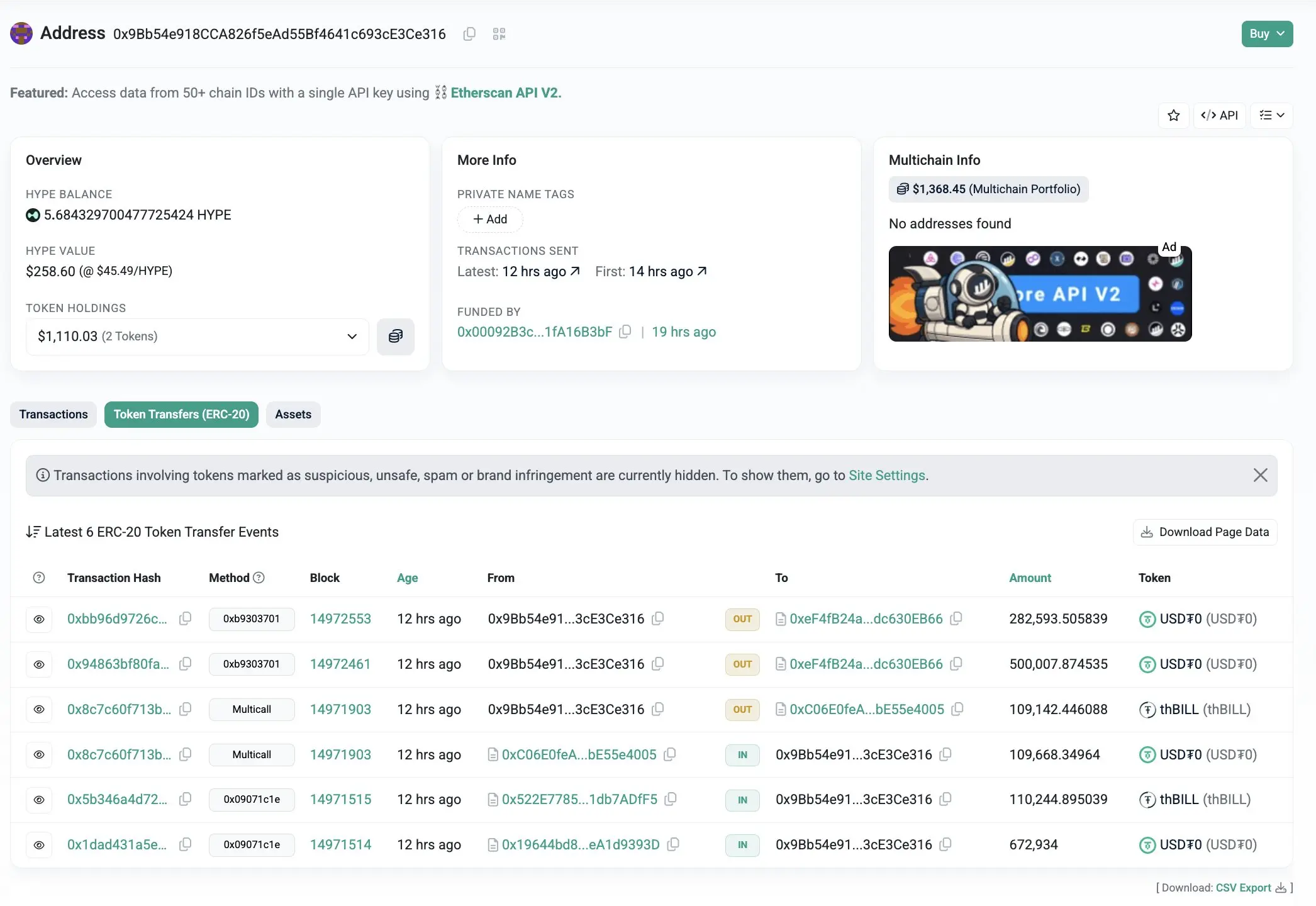

Hyperliquid faces a "security crisis": two major ecological protocols were attacked within 48 hours, resulting in losses exceeding $4.3 million, and HYPE fell over 20% in a single day.

The Hyperliquid blockchain, rapidly emerging in the Decentralized Finance (DeFi) space, is facing a severe security crisis. In just 48 hours, two major core yield protocols within its ecosystem encountered issues. First, the HyperVault protocol experienced an "exit scam," taking away $3.6 million in funds; subsequently, the flagship protocol Hyperdrive was confirmed to be exploited due to operator permission vulnerabilities, resulting in a loss of approximately $700,000 and being forced to suspend all markets. This series of events has deeply questioned the security resilience of the Hyperliquid network, especially as it relies on only four validating nodes, with its centralization risk considered to be the root cause attracting attackers.

MarketWhisper·2025-09-28 06:07

Why can't Chinese people stay rich for more than three generations? The founder of Tron revealed the harsh truth 9 years ago: it's not a money problem.

"Why can't Chinese people become wealthy? Even if they do become rich, why can't they sustain it beyond three generations?" - This question, which has troubled countless entrepreneurs and economists, was addressed by the founder of Tron in a lecture nine years ago, providing a disquieting yet penetrating answer. This entrepreneur believes that the root of the problem lies not solely in economic or business capabilities, but in structural flaws deeply embedded in culture, institutions, and social values.

TRX-0.14%

MarketWhisper·2025-09-12 01:39

Dolomite: The DeFi Platform Aiming for Real Utility and Sustainable rise

In the decentralized finance world (DeFi), most platforms offer a few basic functions such as lending, borrowing, or trading. However, very few protocols can do all of that on a large scale, while ensuring asset diversity and protecting the root interests of DeFi users.

Da

Blotienso·2025-09-10 09:07

The Acceleration of the U.S. Debt Spiral: Under a $38 Trillion National Debt Crisis, Bitcoin and Encryption Assets Become Core Hedging Tools | In-Depth Analysis

As U.S. national debt surged by $1 trillion in just 48 days, approaching a historical high of nearly $38 trillion, Elon Musk's earlier warnings about the fiscal deficit are becoming a reality. This article deeply analyzes the root causes of the debt crisis—whether it is a problem of interest rates or uncontrolled spending. It also explores how Crypto Assets (Bitcoin, Ether, and DeFi) are transforming from speculative assets into structural hedging tools against the collapse of the fiat system, providing macro trend insights for crypto investors.

BTC2.11%

MarketWhisper·2025-08-25 00:49

From Tokens to Access: How Web3 and Mirror Links Are Reshaping Digital Freedom

For years, “Web3” has been synonymous with speculation—an ecosystem dominated by NFTs, memecoins, and volatility. But beneath the noise of token trading and decentralized finance hype, a quieter, more revolutionary movement is taking root. One that’s less about wealth—and more about access.

In

CryptoDaily·2025-08-11 19:43

Pharos Network Teams Up With Morpho to Launch Native Lending for RWAs

RWA blockchain Pharos Network has revealed that it’s working with lending network Morpho to roll out native lending backed by tokenized real-world assets. The collaboration will see new lending capabilities take root on Pharos, adding greater utility to RWAs and giving them DeFi-like powers,

MORPHO10.11%

CryptoDaily·2025-08-10 10:25

Load More