Search results for "SAFE"

Trezor vs. Ledger: Which Cold Wallet Wins?

Is your crypto truly safe? Digital thieves are getting smarter, now able to worm their way into the tightest software wallets.

How can you stay safe? One method is storing your currency in an offline or ‘cold wallet’. If you’ve ever thought about doing so, you’re probably familiar with Ledger and

DailyCoin·15h ago

Mercedes-Benz S-Class luxury electric sedan welcomes the most heavyweight ambassador in history, Jensen Huang

NVIDIA founder Jensen Huang delivered a speech at Mercedes-Benz's 140th anniversary, introducing NVIDIA's collaboration with Mercedes-Benz on L4 autonomous driving technology, emphasizing the application of the NVIDIA DRIVE AV architecture and the Alpamayo artificial intelligence model to advance a safe and automated driving experience. The technology will also partner with Uber to create a premium autonomous transportation service.

ChainNewsAbmedia·01-31 03:35

Bitcoin (BTC) Not a Safe Haven? How the “Digital Gold” Failed When It Mattered Most

Bitcoin price tends to attract the safe-haven label during moments of stress, yet the latest market shock painted a very different picture. Gold price collapsed in dramatic fashion, wiping out about $6 trillion in market value within minutes. The speed and scale stood out immediately.

This

CaptainAltcoin·01-30 10:05

Black Friday Massacre! Bitcoin drops below $82,000, analysts warn 'may dip to $70,000'

Recently, the global financial markets have weakened, and the cryptocurrency market has been severely impacted. Bitcoin has fallen below $82,000, and in the short term, it may drop to $70,000. Liquidation amounts reached $1.779 billion, affecting 283,515 traders. Analysts hold differing views on Bitcoin's medium-term outlook, with some predicting a rebound above $100,000, while others warn of a potential larger correction. Market uncertainty is driving funds into safe-haven assets, and currently, Bitcoin is still considered a risk asset.

区块客·01-30 08:09

Repricing of Safe-Haven Funds: The Logic Behind Gold's Strength and Bitcoin's Divergence

Against the backdrop of rising global risk aversion, gold prices continue to rise, stabilizing at $5000 per ounce, driven by geopolitical tensions and dollar depreciation. Meanwhile, Bitcoin faces capital outflows, and investor sentiment remains cautious. Experts believe that Bitcoin is unlikely to replace gold's safe-haven function, and the market will re-rank asset safety in the future.

BTC-4.6%

PANews·01-30 05:36

Benchmark: Quantum computing threatens only 200K BTC, and most assets are still safe

Benchmark analysts dismiss the quantum panic, arguing that attacks take decades rather than years. Only 100-200 public keys are at risk for exposing addresses. Timeline Controversy: Chamath predicts 2-5 years, Adam Back thinks 20-40 years. Ethereum has a $100K bonus, and Coinbase has set up a committee. Jefferies eliminated BTC this month.

MarketWhisper·01-30 01:02

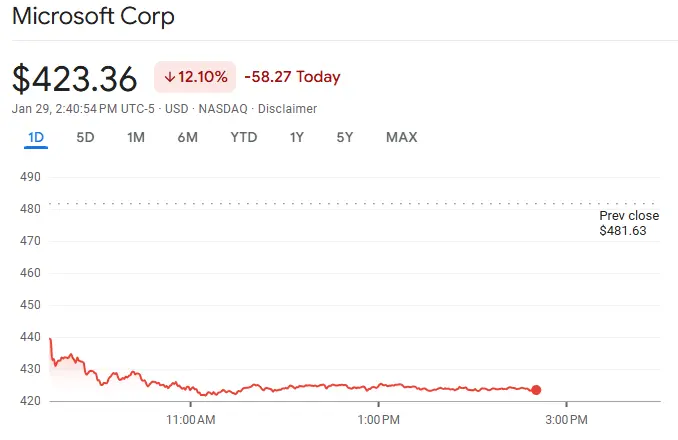

Bitcoin Slumps to $83K Amid Nasdaq’s AI-Driven Free-Fall

Bitcoin’s digital gold narrative eroded further on Jan. 29, as the cryptocurrency’s price action mimicked the volatility of tech stocks rather than acting as an independent safe haven asset.

Tech Earnings Trigger a Market Contagion

As January 2026 draws to a close, a sobering reality has set in

BTC-4.6%

Coinpedia·01-29 20:11

Bitcoin Today News: Hawkish Federal Reserve not cutting interest rates, $88,000 support at risk

Bitcoin fell to around $88,000 on January 29, with increased trading volume indicating bearish sentiment. The Federal Reserve maintained interest rates at 3.50%-3.75%, and US-Iran tensions boosted safe-haven demand. On-chain data shows rising loss supply, with average exchange deposits increasing from 0.7 BTC to 1.2 BTC. Technical analysis indicates a descending wedge target of $84,000, and the weekly bear flag points to $70,000.

BTC-4.6%

MarketWhisper·01-29 07:07

Why did Bitcoin rise today? Trump's dollar theory sparks a risk-off wave, BTC bulls return to 89,000

Bitcoin prices remained stable above $89,000 on Wednesday, with President Trump’s comments on the dollar triggering Bloomberg’s dollar index to experience its steepest four-day decline. The dollar’s weakness boosted safe-haven buying. Rhode Island reintroduced a blockchain bill, and the Trump family’s American Bitcoin holdings increased to 5,843 BTC. Coupled with technical support at $86,100, multiple positive factors drove BTC to rebound.

BTC-4.6%

MarketWhisper·01-28 00:37

Gold’s Digital Rally Signals Dollar Pressure as Tokenized Gold Surges

The market for tokenized gold is expanding in step with rising demand for physical bullion, highlighting a broader shift toward traditional safe-haven assets as geopolitical tensions and trade uncertainty push investors away from the US dollar. On Monday, Tether disclosed that its Tether Gold,

CryptoBreaking·01-27 20:40

Is Bitcoin truly the "Digital Gold"?… Alea Research reexamines the positioning of cryptocurrencies amid interest rate shocks

Alea Research report指出,美国国债收益率上升和日本财政政策混乱影响全球风险资产市场,cryptocurrencies like Bitcoin are seen as assets linked to macro risks and have not served as safe-haven tools. Despite facing pressure, DeFi still demonstrates unique value, and institutional investors are gradually paying attention to its structural opportunities. AI technology will also impact the cryptocurrency market. Overall, cryptocurrencies are no longer tools for quick profits, but still contain opportunities.

TechubNews·01-27 14:55

Claude AI Forecasts XRP Price: \$6 Possible by 2026 Amid Silver's Surge & Ripple's Saudi Move

A confluence of pivotal developments is reshaping the landscape for XRP. An AI-driven price model has unveiled three distinct pathways for XRP through 2026, with an optimistic target of \$6 hinging on robust ETF inflows and regulatory progress.

This forecast emerges against a stark macroeconomic backdrop where silver, not Bitcoin, is dominating the safe-haven narrative, having surged 270% since early 2025 and drastically outperforming major cryptocurrencies. Simultaneously, Ripple has for

CryptopulseElite·01-27 08:27

Gold’s Digital Rally Signals Dollar Pressure as Tokenized Gold Surges

The market for tokenized gold is expanding in step with rising demand for physical bullion, highlighting a broader shift toward traditional safe-haven assets as geopolitical tensions and trade uncertainty push investors away from the US dollar. On Monday, Tether disclosed that its Tether Gold,

CryptoBreaking·01-26 20:35

Ethereum Foundation Forms Post-Quantum Security Team

Ethereum elevates post-quantum security as a strategic priority with $2M funding for research and developer coordination.

Thomas Coratger leads multi-client devnets and weekly calls to prepare Ethereum for quantum-safe consensus and transactions.

$2M in prizes and workshops incentivize

ETH-9.41%

CryptoFrontNews·01-26 15:36

Crypto Falters as Macro Risks Trigger $550M Liquidations

Crypto markets faced heavy selling pressure, leading to significant liquidations. Bitcoin dropped to $86K and Ethereum to $2,785 amid political uncertainty and macroeconomic risks, prompting investors to seek safe-haven assets like gold.

CryptoFrontNews·01-26 14:36

Gold Reaches Record High Above $5K as Bitcoin Falls Under $86K

Gold surges to multi-decade highs as geopolitical risk and tariff tensions fuel a metals bid, while Bitcoin drifts lower in a widening gap with traditional safe havens. Prices for gold topped the $5,000 level, climbing to a record around $5,080 on Monday after a robust year-to-date rally of

BTC-4.6%

CryptoBreaking·01-26 04:05

Gold Soars Past $5,000: Panic Buying Unveils Three Key Market Risks

Gold prices shattered records, surging past the monumental \$5,000 per ounce threshold for the first time in history, fueled by a potent mix of safe-haven demand and escalating global anxieties.** **

This unprecedented rally, which saw gold gain over \$650 in January alone, coincides with silver also reaching an all-time high above \$100 per ounce. The dramatic flight to precious metals underscores investor jitters over a trio of immediate threats: a potential tariff clash between the US,

CryptopulseElite·01-26 02:34

Why did Bitcoin drop today? GameStop sells off 4,710 BTC, US aircraft carrier strike group arrives in the Middle East

Bitcoin drops to $88,700, and GameStop transferring 4,710 BTC to exchanges sparks selling rumors. Safe-haven funds flood into precious metals, with gold surpassing $5,000 and silver rising to $106. The Middle East situation escalates, with the US aircraft carrier strike group arriving in the Middle East. $88,000 becomes a key support level for Bitcoin.

BTC-4.6%

MarketWhisper·01-26 00:34

Why is Bitcoin failing in the role of a "safe haven" compared to gold?

In theory, bitcoin is expected to benefit during unstable periods due to its characteristics as a scarce and censorship-resistant form of currency. However, in practice, it is often the asset that investors sell first when pressure increases.

In the past week, as geopolitical tensions escalated

BTC-4.6%

TapChiBitcoin·01-25 02:30

IPO Genie Price Prediction: Whales Rotate To DeepSnitch AI 300x Bonus Amidst $1.8 Billion Liquidation Flush

As a brutal $1.8 billion liquidation flush wipes out overleveraged safe plays, a high conviction IPO Genie price prediction has emerged as the ultimate retail signal. While legacy VCs gatekeep private wealth, this IPO Genie price prediction suggests a vertical 100x shift as the January 31st

CaptainAltcoin·01-24 09:20

A surge of 147 transactions and an outflow of $1 million in a short period! HOYA BIT confirms "hot wallet theft"

Taiwan-based cryptocurrency exchange HOYA BIT recently experienced a suspected hacking incident, with approximately $1 million USD in funds anomalously flowing out in a short period. The exchange confirmed that this incident only affected hot wallet assets, and user funds remain safe. To enhance security, HOYA BIT has suspended services and launched an investigation.

区块客·01-24 09:15

Why are gold prices hitting new highs while Bitcoin stalls? Delphi Digital: It's all due to the surge in U.S. Treasury yields putting pressure on the global market

The rise in Japan's 10-year government bond yield has become a global financial market stress indicator, affecting the performance of gold and Bitcoin. Gold is absorbing increased pressure, indicating its strength as a safe-haven asset, while Bitcoin is performing relatively weaker. If the Bank of Japan intervenes to stabilize yields, it may lead to consolidation in gold prices, providing an opportunity for Bitcoin to recover. The market is focused on Japan's policy risks, and the changes between the two are important signals.

動區BlockTempo·01-23 17:50

Bitcoin Offers No Safe Haven From Trump’s Greenland Dreams

Introduction (50–100 words)

The Davos forum saw geopolitics and crypto collide as President Donald Trump indicated he would not use force to seize Greenland, easing immediate tensions with NATO allies. While the rhetoric cooled, markets remained on edge about the broader implications for U.S.-EU

BTC-4.6%

CryptoBreaking·01-23 15:25

Bitcoin Bearish Sentiment Climbs as BTC Price Slips Under $89K

In brief

Prediction market users have increased Bitcoin’s chance of crashing to $69,000 from 11.6% a week ago to 30% today.

The top crypto’s choppy price action and failed recovery attempts are a result of defensive capital and capped open interest.

Gold is hogging Bitcoin’s safe-haven

BTC-4.6%

Decrypt·01-23 12:36

Taiwan Exchange HOYA BIT Hacked: Wallets Outflowing Millions of MGB, Official: User Assets Unaffected, Operations Restored

Taiwan-based cryptocurrency exchange HOYA BIT was hacked on January 22nd, resulting in a loss of nearly one million USD from hot wallets. The official statement assured users that their assets are safe as they are stored in cold wallets, and security measures have been strengthened along with the restoration of services. Additionally, they are cooperating with law enforcement agencies to conduct an investigation.

動區BlockTempo·01-23 04:45

Gold approaches the historic $5,000 mark, while Bitcoin lags behind in the safe-haven asset race

Bitcoin is significantly weakening compared to gold, challenging its status as "digital gold." While gold prices have surged to nearly $5,000/ounce, Bitcoin has barely moved around $90,000. Over one to five years, gold outperformed Bitcoin. The BTC/gold ratio is currently 18.46, well below its 200-week moving average, suggesting a potential long-term decline.

BTC-4.6%

TapChiBitcoin·01-23 04:39

Gold surges past 5000 while Bitcoin pulls back! Wall Street experts fiercely debate who is the true safe haven?

Gold hits a new high of $4,930, approaching $5,000, while silver rises by 3.7%. Bitcoin, however, drops to $89,000, down 30% from its peak. Jim Bianco believes that narrative adoption has failed and a new theme is needed. Balchunas counters: a 300% increase over 20 months is just consolidation, and early investors cashing out is normal.

MarketWhisper·01-23 02:14

Bitcoin Offers No Safe Haven From Trump’s Greenland Dreams

Introduction (50–100 words)

The Davos forum saw geopolitics and crypto collide as President Donald Trump indicated he would not use force to seize Greenland, easing immediate tensions with NATO allies. While the rhetoric cooled, markets remained on edge about the broader implications for U.S.-EU

BTC-4.6%

CryptoBreaking·01-22 15:20

Why Ethereum and Stablecoins Aren’t Safe for Crypto Laundering in 2026

_Crypto laundering in 2026 evolves beyond mixers, with Ethereum, stablecoins, and bridges being risky choices for illicit activities._

Crypto laundering is evolving in 2026. While many still think mixers are the safest option, that’s no longer the case.

Advanced criminals have moved beyond

LiveBTCNews·01-22 05:25

Cathie Wood's Shocking Prediction: Bitcoin Soars to $800,000, NVIDIA's Growth Slows Down

Cathie Wood's ARK Invest releases the "Big Ideas for 2026" report, predicting that Bitcoin's market capitalization will reach $16 trillion, with a price of $800,000 per coin. ARK believes that Bitcoin's volatility is decreasing, shifting from a speculative asset to a safe-haven asset. However, they are cautious about NVIDIA's prospects, warning that it faces competition from AMD, Broadcom, and others, and that operational cost pressures may limit profit margins.

MarketWhisper·01-22 01:28

BingX Reaches $1 Billion in TradFi Volume, Gold Trading Leads the Surge

BingX sees $1 billion in 24-hour TradFi volume, with gold trading accounting for over half amid rising global tensions.

Gold futures on BingX surpass $500 million in volume, driven by safe-haven demand and geopolitical uncertainties.

BingX’s TradFi copy trading hits $51.84 million in 15 d

IN-14.27%

CryptoFrontNews·01-21 21:36

Paradex Confirms Mithril Trading Bot Hack Affecting 57 User Keys

Paradex reported a security breach involving the Mithril Trading Bot, exposing 57 user subkeys but ensuring user balances remain safe. The incident highlighted risks of third-party services and prompted quick actions by Paradex to limit damage and emphasize security.

Coinfomania·01-21 08:23

Dalio: Trade war may escalate into a capital war! US bonds may face a sell-off crisis, consider allocating gold for hedging

Ray Dalio warns at Davos that a trade war could escalate into a "capital war," leading to a decline in trust in dollar assets and impacting the U.S. bond market. In light of this risk, investors should reduce their reliance on the dollar and increase allocations to safe-haven assets like gold, which perform well during geopolitical instability.

CryptoCity·01-21 07:10

Geopolitical Tremors Reshape 2026 Markets: Gold Soars Past $4,800 as Bitcoin Retreats Below $90,000

Escalating geopolitical instability, fueled by renewed US-Europe trade tensions and territorial disputes, has triggered a dramatic flight to safety in global markets. Gold (XAU) has surged decisively above the $4,800 mark, while Silver (XAG) eyes the critical $100 level, as investors seek traditional safe havens.

Conversely, Bitcoin has tumbled back below $90,000, mirroring a broad sell-off in risk assets like equities and bonds. This divergence underscores a classic market shift: capi

BTC-4.6%

CryptopulseElite·01-21 06:13

Japan Bond Market Earthquake Sparks Global Sell-Off: Is Bitcoin a Risk Asset or Safe Haven?

A seismic shock in Japan's government bond (JGB) market has sent tremors through global financial markets, triggering a sharp risk-off sell-off that pulled Bitcoin down over 3% to around \$89,300.

U.S. Treasury Secretary Scott Bessent described the move as a "six-standard-deviation" event, an extreme statistical rarity underscoring its severity. This turmoil directly threatens the "yen carry trade," a longstanding source of cheap global liquidity that has fueled investments in risk assets

CryptopulseElite·01-21 05:33

Bitcoin falls below 130 million KRW... Influenced by Trump's tariff remarks, BTC, ETH, XRP, SOL plummet

Bitcoin plummeted sharply due to Trump's threat of tariffs on Europe and a wave of leverage liquidations, dropping 3.3% within 24 hours and accumulating a decline of about 9%. Market fear intensified, with liquidation amounts reaching 7.13 trillion KRW. Analysts expect Bitcoin to potentially further decline to the range of 58 million to 62 million KRW. The overall crypto market contracted, and insufficient liquidity led to larger declines in altcoins. The demand for safe-haven assets increased, causing gold prices to rise.

TechubNews·01-21 04:13

Japanese Yen and US Dollar decline, US-Europe tariff war intensifies! Bitcoin drops below 88,000, with liquidations of 1 billion USD

Bitcoin has recently continued to decline due to the US-Europe trade war and market sentiment turning to fear, breaking below $88,000 and triggering nearly $1 billion in liquidations. Market concerns about the economic outlook suggest that Bitcoin may test the levels of $85,000 or even $80,000, while other assets like gold have risen due to increased demand for safe-haven assets.

BTC-4.6%

CryptoCity·01-21 02:35

Why did Bitcoin drop today? Trump's tariffs triggered a "sell US" trade, and safe-haven funds flooded into gold.

Bitcoin today dropped to around $88,500, while gold surged to $4,755. Trump's Greenland tariff threat triggered a global sell-off, with the S&P 500 plunging 2.1%, evaporating $1.2 trillion. The BTC-Gold ratio RSI fell to 30, reaching the bottom levels of 2015, 2018, and 2022 bear markets, indicating a possible rebound.

BTC-4.6%

MarketWhisper·01-21 00:36

January 21st Commuter Podcast — "Digital Gold" shaken by Trump's tariffs and re-Japanization impact... Bitcoin faces a brutal test

On January 20, 2026, due to Trump's tariff policies and the collapse of Japanese government bonds, the global financial markets plunged into chaos. Gold prices soared to a record high of $4,175, while Bitcoin plummeted as the market reverted to risk assets. Despite market turbulence, long-term investors continued to buy Bitcoin, indicating its potential long-term value. Experts point out that the safe-haven attributes of Bitcoin and gold differ, and institutions are gradually differentiating between cryptocurrencies with more precision.

TechubNews·01-20 23:03

Gold breaks through $4,740 to hit a new all-time high! The Polish central bank announces an additional 150 tons of gold reserves, and rising risk aversion boosts gold prices to soar.

Spot gold today broke through $4,700 per ounce, reaching a new all-time high with a 1.5% increase. Escalating trade tensions and geopolitical risks are driving safe-haven demand, while the Polish central bank plans to purchase 150 tons of gold, strengthening the global central bank gold-buying trend and further boosting gold prices.

動區BlockTempo·01-20 14:30

Monero Leads 13% Rally as Privacy Coins Become New Digital Safe Haven

In a striking display of market divergence, privacy-focused cryptocurrencies have surged over 13% in the past week, starkly outperforming a broader crypto market reeling from nearly \$1 billion in liquidations.

Leading assets like Monero (XMR), Dash, and DUSK posted gains of 8.9%, 119%, and a staggering 354% respectively, even as Bitcoin fell 3%. Analysts attribute this counter-cyclical surge to a profound shift in investor behavior, where capital is rotating into censorship-resistant ass

SAFE-5.53%

CryptopulseElite·01-20 05:29

MICA Daily|BTC breaks below the trend line again, possibly testing $91,000 after volatility

Last week, it was mentioned that after BTC challenged and broke through $98,000, there was a high chance it would test $93,000. On Monday morning, a repeat of the "11/10 crash" small version occurred, with BTC dropping directly from $95,000 to a low of $91,000, then temporarily stabilizing at the $93,000 level. Altcoins experienced another major sell-off, with over $860 million in positions forcibly liquidated, of which $780 million came from long positions.

At the same time, gold prices hit a new high, breaking through $4,600 per ounce. The market believes this was caused by Trump's weekend announcement of a 10% tariff increase on Denmark and seven other European countries. The escalation of geopolitical risks due to tariffs and trade wars has boosted safe-haven demand and led to the selling of risk assets. Since Monday was a holiday in the US, it was only natural that cryptocurrencies became the primary assets to be sold off.

区块客·01-20 05:09

Why did Bitcoin drop today? Trump's sudden tariffs triggered a sell-off, and safe-haven funds flooded into gold.

Bitcoin remained stable at $93,000 on Monday, with overnight selling pushing it down to $91,800. Trump threatened to impose tariffs on eight European countries, mainly due to the Greenland dispute. Starting February 1, tariffs will be 10%, rising to 25% in June. Ethereum dropped 3.7%, altcoins declined 5-10%, and gold surged to a new high of $4,690. Bitfinex indicated resistance between $93,000 and $110,000.

MarketWhisper·01-20 00:51

Crypto Markets Hold Steady Amid Trump’s Greenland-Tariff Moves

Bitcoin fell to $93K amid EU tariff news, as gold and silver hit record highs, indicating safe-haven interest. Nearly $800M in crypto longs were liquidated, reflecting trader caution. Market volatility remains low as investors await clearer macro signals.

CryptoFrontNews·01-19 15:16

Ethereum DAOs face overhaul as Vitalik warns token voting has failed

Summary

Buterin argues most DAOs have devolved into token-controlled treasuries that are inefficient, vulnerable to whales, and far from Ethereum's original governance vision.

He highlights five core DAO use cases: robust oracles, on-chain dispute resolution, shared "safe lists," rapid short-ter

ETH-9.41%

Cryptonews·01-19 14:18

Worried about Bitcoin's quantum threat! Jefferies executive switches BTC allocation to gold, returning from digital to physical

J.P. Morgan's chief strategist, Wood, has withdrawn 10% of Bitcoin from his simulated portfolio and reallocated it to physical gold due to concerns over the potential threat of quantum computing. He believes that quantum computers could undermine Bitcoin's security and long-term value, prompting investors to reassess risks, with gold being seen as a more reliable safe-haven asset. This move has sparked widespread debate in the market about the future of Bitcoin.

BTC-4.6%

CryptoCity·01-19 07:20

Russia Crypto Legalization Moves Forward Under 2026 Plan

Russia is moving towards regulating cryptocurrency, aiming to legalize its use while maintaining the Ruble as legal tender. This creates a framework for safe investment, addresses market activity, and aims to protect users from scams, despite potential restrictions on freedom.

BTC-4.6%

Coinfomania·01-19 07:19

Bitcoin Crashes to $92K While Gold Skyrockets: The 3 Hidden Forces Behind the Carnage

The Bitcoin price has plunged over 3% to a low of \$92,089, triggering a market-wide liquidation event exceeding $850 million, as geopolitical tensions reach a boiling point.

This dramatic sell-off coincides with gold surging to new record highs above \$4,660, highlighting a stark divergence between traditional and digital "safe havens." Behind the headline-grabbing tariff war lies a deeper, more precarious reality: a Bitcoin rally built on weak derivatives flows, not strong hands, now f

BTC-4.6%

CryptopulseElite·01-19 05:35

Gold Soars to $4,700 as Bitcoin Crashes: The Great Safe-Haven Divergence

Gold has surged to a record high of $4,690 per ounce as escalating US-EU trade tensions trigger a classic flight to safety. In a stark contrast, Bitcoin has tumbled below $92,000, shedding over $4,000 in value and triggering nearly $1 billion in leveraged liquidations.

This dramatic divergence has reignited a fundamental debate: is Bitcoin failing its test as "digital gold"? This article analyzes the tariff-driven market shock, examines the technical wreckage in crypto, and explores w

CryptopulseElite·01-19 05:24

Load More