Search results for "SATS"

Sell Your Bitcoin and Cry Later? Tim Draper Backs a Way out as BTC Holders Face Brutal Liquidity Trap

Bitcoin holders can now tap liquidity without selling, as Tim Draper backs Sats Terminal’s non-custodial bitcoin-backed lending marketplace designed to preserve long-term upside while avoiding custody risks and forced exits.

Never Sell Your BTC Again? Tim Draper Backs a Non-Custodial Borrowing

BTC-0.92%

Coinpedia·01-07 03:38

If AI agents start accumulating Bitcoin, what will happen to this monetary system that was designed for ordinary people?

Written by: Liam 'Akiba' Wright

Translated by: Luffy, Foresight News

Imagine a wallet that never ages: no heirs, no need to handle inheritance, no retirement date—it works like a machine, continuously accumulating sats (the smallest unit of Bitcoin) for centuries.

By 2125, its balance would surpass the reserves of most national treasuries; its only purpose is to exist forever. In some block, miners will package its faint yet persistent transaction requests into the chain, and thus the blockchain continues to operate.

Bitcoin’s design assumes that users will eventually die.

But AI agents won’t. A group of long-lived or autonomously operating agents would see savings, fees, asset custody, and governance as topics to be considered over an infinite time horizon.

When a monetary system designed for mortal balance sheets encounters entities that run forever...

BTC-0.92%

DeepFlowTech·2025-12-09 09:28

YZi Labs Incubation Program EASY Residency Announces Second Season Selected Projects List

Wu said that YZi Labs' incubation program EASY Residency has announced the list of projects selected for its second season, including: event asset issuance protocol 42.space, spatial intelligence large model platform 4D Labs, cross-border self-custody neo-bank AllScale, AI-driven gene therapy platform Advent, agricultural robotics company AgriDynamics, professional trader wallet Frontrun, nonprofit token issuance platform Help.fun, permissionless leveraged market Hertzflow, AI-controllable 3D video generation platform Manifolds, stablecoin battle mobile game MeleeMon, non-opioid drug R&D platform Neomera BioLab, and Bitcoin liquidity protocol Sats.

BTC-0.92%

WuSaidBlockchainW·2025-12-03 08:31

Stacking Sats disclosed an increase in BTC holdings, with current holdings reaching 24.82 coins.

According to Mars Finance, the stacking sats company announced that it has invested $9,900.89 to increase its holdings by 0.098 BTC, bringing the company's Bitcoin holdings to 24.82 BTC.

BTC-0.92%

MarsBitNews·2025-11-07 11:54

Steak ’n Shake Embraces Bitcoin Payments, Launches Strategic Reserve, and Launches $5 Reward Program

Steak ’n Shake introduces a Strategic Bitcoin Reserve, holding all Bitcoin payments and donating 210 sats per meal to the OpenSats Initiative.

The restaurant reports a 15% same-store sales rise, linking growth to rising Bitcoin adoption and increased digital payment engagement from

BTC-0.92%

CryptoFrontNews·2025-11-01 10:19

Steak 'n Shak establishes strategic BTC reserves BTC falls below 110000 USD

Headline

Steak 'n Shake announces the establishment of a strategic Bitcoin reserve

The American fast food chain Steak 'n Shake has announced the establishment of a strategic Bitcoin reserve, and all payments made in Bitcoin will be deposited into its strategic Bitcoin reserve. Over the next 12 months, Steak 'n Shake will donate 210 satoshis from the sales of each Bitcoin meal to the Open Sats Initiative.

BTC-0.92%

金色财经_·2025-11-01 00:11

Toncoin Struggles, Hedera Rises, BullZilla Presale Explodes: Best New Coins for Exponential Returns

Could September 2025 be the month where traditional finance finally bends toward crypto adoption? With Visa and Stripe teaming up with Fold to launch a Bitcoin rewards card, everyday purchases are being converted into sats, giving crypto a tangible, daily-use utility. This landmark move signals

HBAR0.69%

CryptoFrontNews·2025-09-25 03:16

SpaceX acquires EchoStar spectrum for $17 billion, advancing Starlink global mobile services.

The world's richest man Elon Musk ('s space company SpaceX has acquired AWS-4 and H-block spectrum licenses from EchoStar Corp. for up to $8.5 billion in cash and up to $8.5 billion in SpaceX stock for satellite and mobile communications. EchoStar ) SATS ( surged nearly 20% yesterday to a historic high, and its bond prices also saw a significant rebound.

SpaceX acquisition of EchoStar spectrum license

EchoStar Corporation was founded in 1980, focusing on innovation in satellite, mobile networks, and audio-visual technology. It owns satellite communication technology and integrates ground and satellite networks in mobile networks.

SpaceX is worth up to $8.5 billion in cash and value

ChainNewsAbmedia·2025-09-09 02:03

Satoshi – The Real Currency of the Future?

The essay explores the significance of "satoshi," the smallest unit of Bitcoin, which may become the real currency in a future where 21 million BTC are distributed globally. It argues that owning sats is more accessible and relatable than BTC, potentially transforming economic standards and daily transactions.

LAI-10.43%

Blotienso·2025-09-07 04:31

Better late than never: Strategy restarts large-scale Bitcoin accumulation, purchasing 4048 BTC in a single week! Metaplanet receives shareholder approval to raise $3.7 billion to increase the position in BTC.

The largest institutional holder of Bitcoin, Strategy (formerly MicroStrategy), announced its latest purchase dynamics a day later, revealing that it bought 4,048 BTC between August 26 and September 1, demonstrating its strong financing and confidence in stacking sats. Although its purchasing methods raised concerns about stock dilution and liquidity, the company's average coin holding cost remains at a relatively low level. Coincidentally, Japanese giant Metaplanet also received shareholder approval on September 1, planning to finance up to $3.7 billion through the issuance of a new type of preferred stock to achieve its grand goal of holding 210,000 BTC by 2027, marking a new phase in the global listed company's Bitcoin reserve competition.

BTC-0.92%

MarketWhisper·2025-09-02 14:36

Trump’s favorite bar now offers massive discount for Bitcoin payments

Donald Trump’s 2024 campaign stop at PubKey, a Bitcoin-themed bar in New York City, has become part of crypto history.

It was there that Trump bought burgers with Bitcoin, paying in sats — the smallest unit of Bitcoin — in what many called a symbolic moment for Bitcoin adoption in the U.S.

Now, Pu

YahooFinance·2025-09-01 00:43

Top Crypto to Invest In: Skill-to-Earn With AurealOne or Stack Sats With Bitcoin? Why Not Both!?

As the crypto market continues to expand and mature, investors are actively seeking the top cryptocurrencies to invest in—projects that not only showcase strong fundamentals but also offer transformative potential beyond the blockchain space. In this article, we explore five standout projects that p

CryptoNewsLand·2025-07-14 14:44

Apple allows Bitcoin! iOS game Sarutobi launched on the App Store: Players can buy items using the Lightning Network and earn Sats.

The iOS game "Sarutobi" has finally been approved by Apple after being rejected. Players can purchase items, retry levels, and earn sats through the Bitcoin Lightning Network. This change is influenced by legal and market pressures, showcasing micropayment opportunities under Compliance, which may lead the next wave of gaming revolution.

動區BlockTempo·2025-07-11 02:44

Latvia Allows Companies To Use Cryptocurrency For Share Capital

HomeNews Latvian companies can now register limited liability companies using cryptocurrency for share capital.

The new law removes the need for an external valuation of crypto assets as non-monetary contributions.

Sats Inc is the first company to use this option, specializing in Bitcoin

BITNEWSBOT·2025-07-10 10:13

Bitcoin Win Strategy Offered to Community by Jeremie Davinci

Davinci's advice to Bitcoin holders

259,259 Sats key BTC target for everyone, per Mow

Jeremie Davinci, an early Bitcoin adopter and YouTuber, who made a fortune after buying BTC in its early days and holding it, has published a tweet that contains strategy that can help Bitcoin holders

BTC-0.92%

UToday·2025-07-08 11:36

How to Earn Bitcoin by Playing Bitcoin Miner? A Beginner’s Guide

Bitcoin Miner gamifies crypto mining

Tap to mine coins, upgrade rigs, and unlock new tokens in a casual, beginner-friendly mobile game.

You can earn real Bitcoin, but very little

Rewards are in SATs and can be withdrawn, but actual earnings are minimal—even after long-term play.

Best for

BTC-0.92%

CoinRank·2025-06-26 10:04

Crypto 2029: The Dawn of a New Order

Written by: hitesh.eth

Compiled by: Shan Oppa, Golden Finance

2029. Bitcoin has become the new consensus among global investors. This year, its price has surpassed $500,000, but this was not a sudden surge; rather, it was the result of a decade-long struggle: narrative reversals, government compromises, and institutional rule changes. Today, billions of people around the world are hoarding "sats"—the smallest unit of Bitcoin—in various ways. Just as people once bought gold jewelry to pass down through generations, modern families now gather together to calculate how many sats they can leave for their descendants.

Smart contracts have already become a new asset class - they do not require regulation to prove their value. They are bought like collectibles, stored in decentralized vaults, and regarded as family heirlooms passed down through generations. Those millennials who laughed at Bitcoin in their 20s are now caught in an unprecedented FOMO.

BTC-0.92%

DeepFlowTech·2025-05-20 18:34

Crypto 2029: The Dawn of a New Order

Author: hitesh.eth Source: X, @hmalviya9 Translation: Shan Ouba, Golden Finance

2029. Bitcoin has become the new consensus among global investors. This year, its price has exceeded $500,000, but this is not a sudden surge; rather, it is the result of a decade-long sustained struggle: narrative reversals, government compromises, and institutions modifying rules. Today, billions of people around the world are hoarding "sats" - the smallest unit of Bitcoin - in various ways. Just as people once bought gold jewelry to pass down through generations, today’s families sit together, calculating how many sats they can leave for their descendants.

Smart contracts have already become a new asset class - they do not require regulation to prove their value. They are bought like collectibles, stored in decentralized vaults, and regarded as family heirlooms passed down through generations. Those millennials who laughed at Bitcoin in their twenties are now trapped.

BTC-0.92%

金色财经_·2025-05-20 09:24

Jack Dorsey Fights Against Sats, Supports Controversial Changes for Bitcoin

Jack Dorsey of Block seeks to simplify bitcoin transactions by replacing the term "sats" with "bitcoins" in retail transactions, as proposed in BIP 177 by John Carvalho. This change aims to enhance clarity and understanding of bitcoin's value in everyday use.

Coinpedia·2025-05-20 08:32

The dispute between "Satoshi (Sats)" and "bits" has reignited in the proposal for changing the basic unit of Bitcoin (BTC).

The proposal to change the basic unit of Bitcoin has sparked controversy. One side supports changing the Bitcoin unit to "Bit", while the other believes retaining "Satoshi" is more appropriate. Proponents argue that "Bit" is easier to understand, while opponents worry about causing confusion and misunderstanding. Bitcoin's founder Satoshi Nakamoto has expressed an open attitude toward changing the unit display method. As of now, the Bitcoin network has not implemented any improvement proposals.

AICoinOfficial·2025-05-19 07:32

After Alkanes, RSM will boost the Bitcoin ecosystem explosion.

With $BTC breaking through $100,000 again, the Bitcoin ecosystem has ushered in a new wave of prosperity, igniting market enthusiasm. $ORDI, $SATS, and $DOG have successively pumped, demonstrating investors' strong demand for Bitcoin's native assets. As the leader Token of the Runes 2.0 Alkanes @oylwallet protocol, METHANE's market capitalization has reached a new high of $16 million, laying a solid market foundation for the new round of "protocol wars."

So what kind of protocol will explode in the Bitcoin ecosystem and help the Bitcoin ecosystem to explode?

There should be the following four points:

1. Bitcoin Layer 1: The protocol must be based on Bitcoin Layer 1, supporting Bitcoin native.

BTC-0.92%

星球日报·2025-05-18 02:52

Bitcoin Ecosystem: Frenzy, Frustration, and the Dawn of Recovery

> The future of sustained revival depends on product implementation, increased developer activity, and the driving force of market cycles.

Written by: Luke, Mars Finance

From peak to trough: a year of extremes

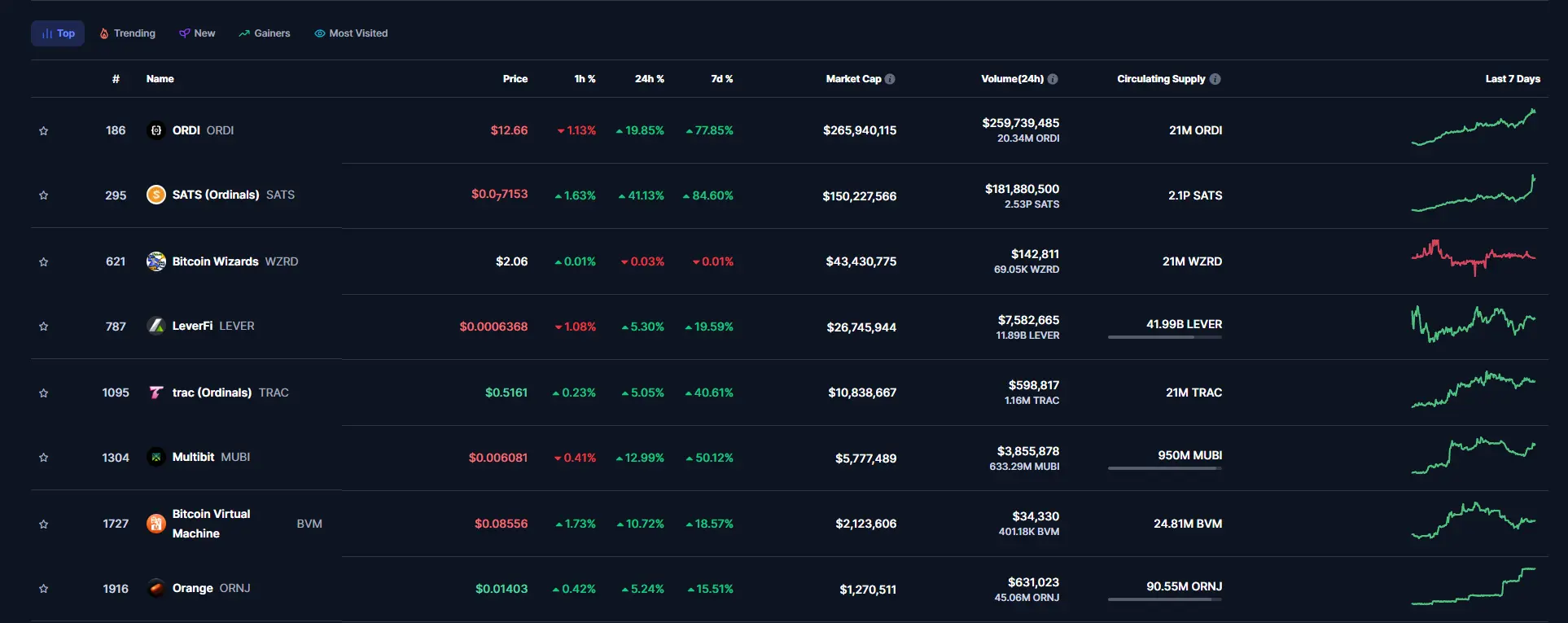

Looking back at the spring of 2024, the Bitcoin ecosystem resembled a dazzling supernova. The rise of the BRC-20 token standard, driven by the inscription frenzy of the Ordinals protocol, ignited a frenzy in the market. Inscriptions—an innovation that embeds unique data directly into Bitcoin's smallest unit, "satoshi"—caused on-chain activities to soar like a rocket. The prices of tokens like ORDI skyrocketed, with some assets doubling or even tripling in market value within just a few weeks. Projects like SATS and RATS also joined the celebration, bringing astonishing returns. Bitcoin's on-chain transaction volume surged, gas fees skyrocketed, and miner incomes rose significantly. It was a golden era.

BTC-0.92%

ForesightNews·2025-05-14 10:47

The Bitcoin ecosystem Meme Tokens are generally rising, with SATS increasing by 45.3% in 24 hours.

According to Mars Finance news on May 14, the Bitcoin ecosystem Meme tokens have experienced a general rise, among which: SATS is currently quoted at 0.0(7)7285 USD, with a 24-hour rise of 45.3%; ORDI is currently quoted at 12.91 USD, with a 24-hour rise of 23.8%; PIZZA is currently quoted at 0.4955 USD, with a 24-hour rise of 23.28%; RATS is currently quoted at 0.000032 USD, with a 24-hour rise of 12.3%.

MarsBitNews·2025-05-14 07:33

SPAR Switzerland Now Lets You Pay with Bitcoin at Checkout - Crypto News Flash

The SPAR supermarket in Zug now accepts Bitcoin payments using the Lightning Network.

Customers simply scan a QR code to pay with sats at SPAR checkout

---

The SPAR supermarket in the Bahnhofstrasse area of Zug, Switzerland, is now accepting Bitcoin payments directly at the checkout. Not

CryptoNewsFlash·2025-04-20 00:47

A total of 12 projects received financing this week, with the largest financing amount being 50 million USD.

This week, a total of 12 DeFi projects received funding, including BugsCoin, APX Lending, OpenZK, Meanwhile, Wunder Social, DecentralGPT, Lyzi, Sats Terminal, Octane Security, Blackbird, Firefish, and Cap Labs, with the largest funding amount reaching 50 million USD.

DeepFlowTech·2025-04-13 11:47

Best Cryptos to Invest in Today: THORChain, Alchemy Pay, and SATS

THORChain, Alchemy Pay, and SATS enable cross-chain swaps, global payment solutions, and Bitcoin microtransactions, respectively, expanding asset accessibility, liquidity, and usability for users.

CryptoNewsLand·2025-02-03 01:59

Trump’s Bitcoin Digital Trading Cards Debut on Ordinals Protocol With Unique Alpha Sats Technology

160 Trump Bitcoin Digital Trading Cards launched on Ordinals protocol with claim period open until January 31. Prices for Trump-inspired NFTs on Magic Eden reach up to 9.8 BTC, boosting Ordinals market rebound. Trump's move reflects changing dynamics in Bitcoin NFT ecosystem.

CryptoNewsLand·2025-01-09 10:35

John Carvalho Wants to Get Rid of ‘Sats’

The Synonym CEO suggested the change via a Bitcoin Improvement Proposal (BIP) last week.

Longtime Bitcoiner Seeks to Redefine Bitcoin Units

John Carvalho, CEO of Bitcoin software company Synonym wants to do away with the idea of “satoshis” or “sats” – the smallest units of bitcoin (BTC).

Each

Coinpedia·2024-12-17 06:31

Unusual Proposal Offered for Bitcoin: "1 Satoshi Shall Now Be 1 BTC"

Bitcoin advocate John Carvalho has proposed a new Bitcoin Improvement Proposal (BIP) that aims to fundamentally redefine how Bitcoin is measured and displayed. The proposal transforms the current system where one Bitcoin (BTC) equals 100 million satoshis (sats) into making satoshi a new fundamental unit.

BTC-0.92%

Bitcoinsistemi·2024-12-15 16:03

Top BRC-20 Tokens ORDI and 1000SATS Eyeing For Key Breakouts: What To Expect Ahead?

ORDI and 1000SATS tokens are experiencing bullish momentum with potential for key breakouts as Bitcoin dominance declines. ORDI could see gains of up to 130% if it breaks through its crucial resistance zone, while SATS may offer a potential upside of 56% if it confirms a breakout. Traders should watch for confirmation signals for sustained upward movement.

CoinsProbe·2024-11-30 08:49

Bull Market enters the second phase, trading strategies and recommendations

The bull run enters the second phase, most altcoins will experience a general rise but not across the board, driven by market confidence recovery and funds tied up at the bottom due to Margin Replenishment and other factors; Strategy one is to hold positions lying in ambush in zones with a probability of increase, Strategy two is to increase positions in favorable zones; Favorable zones include MEME zone (PNUT, ACT, some on-chain MEME with potential), BTC zone (ordi, SATS, pizza, etc.), AI zone (io, CLORE).

BTC-0.92%

AICoinOfficial·2024-11-29 10:29

Data: BRC-20 inscription project Ω recently reached a historical high, with a price of 0.00013 Sats

CoinVoice has recently learned that the BRC-20 inscription project Ω has recently reached a historical high, with a price of 0.00013 SATS, a 24-hour increase of up to 80%, and Holdings users have exceeded 7000+ people.

Recently, Ω has attracted

SATS-1.02%

CoinVoice·2024-11-26 14:33

I Did Basically Nothing And Got $500 in Bitcoin

Earn Bitcoin without investing your hard-earned dollars with bitcoin rewards apps like Lolli and Fold. These apps allow people to stack sats on everyday purchases with no change in behavior required. These apps offer a clever gateway to Bitcoin for those unfamiliar with it. The rewards earned on purchases can be worth more than the purchases themselves as Bitcoin continues to increase in value.

BitcoinMagazine·2024-11-01 14:53

Three OP_CATprotocols a day, does the BTC ecosystem want to 'change'?

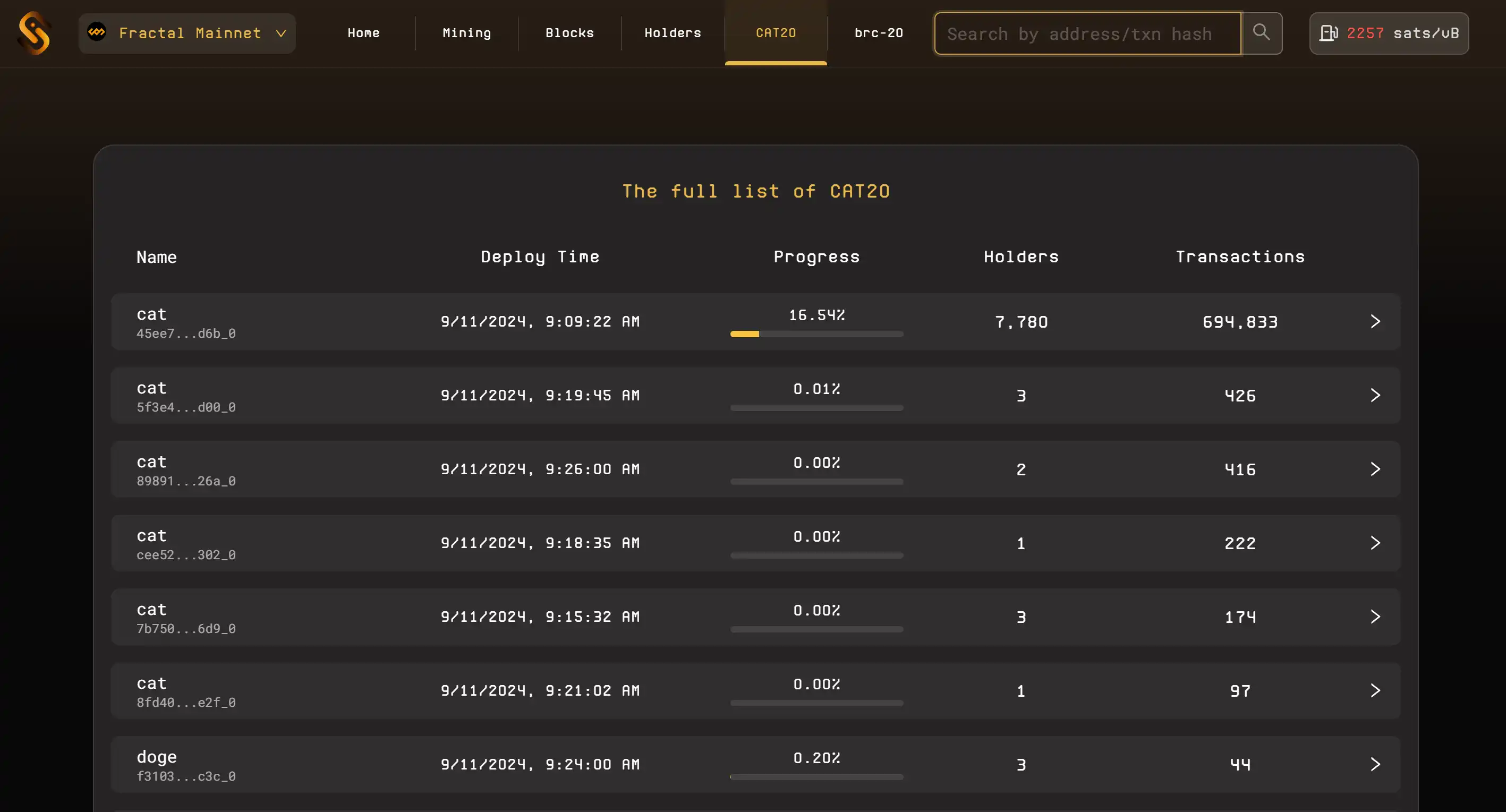

Yesterday may have been a day suitable for cats to come out and sunbathe, at least in the BTC ecosystem. Within a day, we saw 3 BTC FT protocols driven by OP\_CAT—CAT20 on Fractal, CATNIP by the 'Quantum Cat' team, and 'Danny CAT20' by the 'Moto series'.

Among these three, CAT20 on Fractal has already been implemented vigorously, and the price of $FB once exceeded $30. At the time of writing this article, the on-chain Miner fee rate of Fractal has reached as high as 2000 sats/vb.

律动·2024-09-12 02:28

Gate Research Institute: Babylon's launch of staking on the mainnet raised Bitcoin network fees, while the market smoothly absorbed the Mt. Gox payment pressure.

Gate Research Institute Daily Report: On August 23rd, BTC and ETH rebounded on the daily candlestick, but still constrained by weekly resistance. BTC ETF net inflow was $64.91 million, while ETH ETF net outflow was $0.8746 million. The market sentiment index is 39, indicating panic sentiment. The impact of Mt.Gox's large-scale repayment on the market is gradually diminishing. In terms of popular tokens, KONET rose by 149.2%, ALPACA rose by 97.92%, and CREAM rose by 58.74%. The significant increase in these tokens may be related to the upgrade of the corresponding protocols and market dynamics. - BTC and ETH rebounded on the daily candlestick, but a clear trend still requires a breakthrough in the range. - BTC Spot ETF net inflow was $64.91 million, while ETH ETF net outflow was $0.8746 million. - Mt.Gox continues to repay on a large scale, and the market smoothly absorbs its potential fluctuations. - The balance of BTC Over-the-counter Trading platform has soared to a two-year high, and the pressure of Minerdumping is emerging. - Babylon opens the Mainnet stake, BTC on-chain Gas has soared to 1,500 sats. - Today, a total of 7 projects received financing, with the highest financing amount of $8 million, totaling $24.7 million in financing.

GateLearn·2024-08-23 15:47

SATS price doubled in 10 days, how far can UniSat's support go?

Even if a UniSat falls, there will be ten thousand more "UniSats" standing up again.

SATS-1.02%

ForesightNews·2024-08-15 03:00

Analyzing 85 big dump data: which coins Rebound the fastest? Which zones are the weakest?

LST, AI, and Meme zone saw the biggest drops. SATS, TAO, RENDER, PEPE, PENDLE have the greatest elasticity.

ForesightNews·2024-08-06 06:47

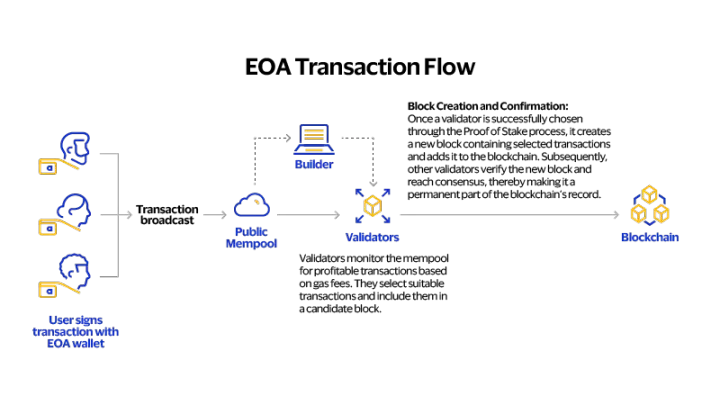

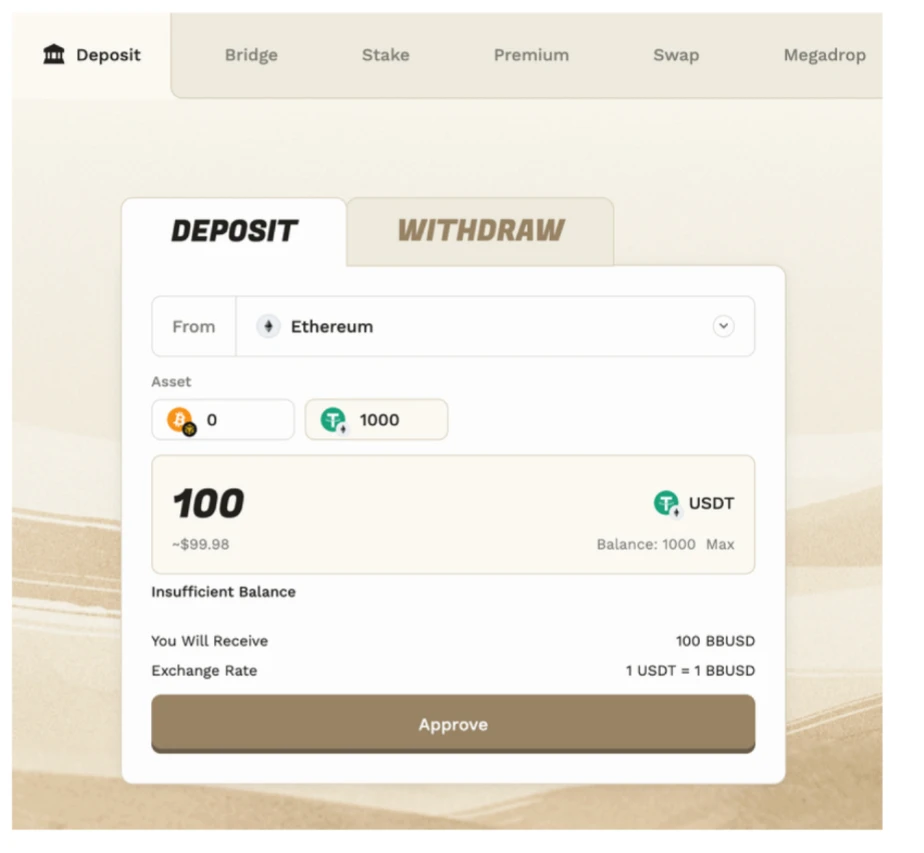

Operation Guide: Step-by-Step Tutorial on How to Participate in Ethena on BounceBit

BounceBit collaborates with Ethena, allowing users to participate in Ethena products on the platform and earn multiple benefits, including $sUSDe earnings, $ENA, $BB stake rewards, and 5x Sats activity rewards. This article provides a detailed guide, including depositing $USDT for $BBUSD, cross-chain interaction to the BounceBit chain, and staking $BBUSD to Ethena.

星球日报·2024-06-04 14:25

Ethena Q2 Mining Yield Analysis, 400%+APY Is Not a Dream?

Original article by Donovan Choy, former analyst at Bankless

Compilation: Odaily Planet Daily Azuma

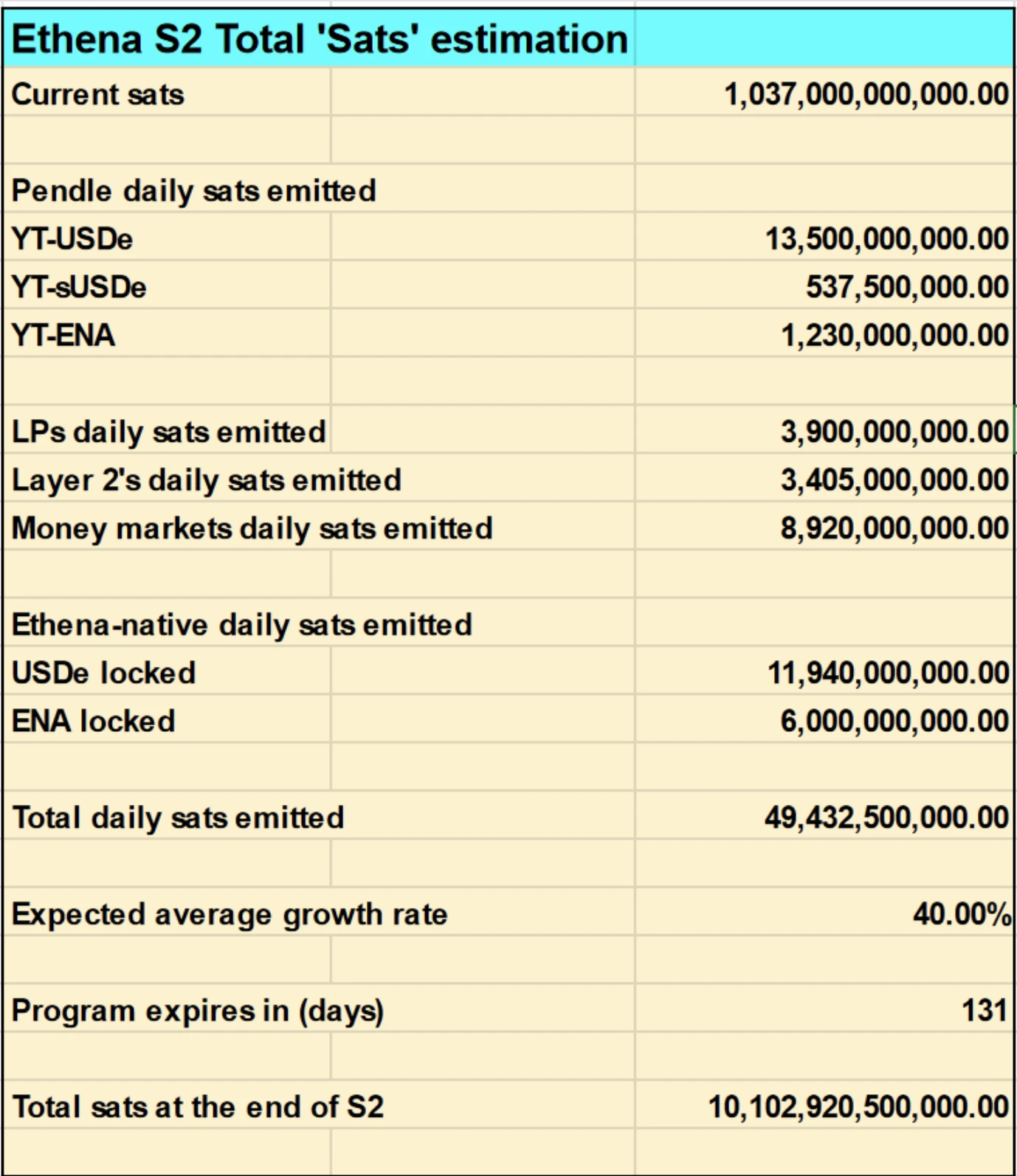

Editor's note: Earlier this month, USDe developer Ethena Labs announced the launch of the second season of Sats, a new event that will align with Ethena to support BTC and is expected to run until September 2 (a five-month run) or until USDe's supply rises to $5 billion, whichever comes first.

As the most concerned stablecoin project in the current market, the popularity of Ethena Labs has reached its peak with ENA's TGE. Currently, ENA has a full float valuation (FDV) of more than $13 billion, and for users interested in participating in the project, in addition to buying directly in the secondary market

星球日报·2024-04-26 05:33

Runes Eco Guide: How to minting runes with tools (with tutorial)

距离比特币减半仅剩一百多个区块, 4 月份的比特币生态无疑成为市场焦点。其中,最炙手可热的话题莫过于 Runes 概念,在尚未上线主网的 Runes 协议中,已经出现了近 20 家提供铸造、交易等服务的基础设施平台。相关阅读:《Runes 还没上线,但生态已经成了红海》

对比特币生态的老玩家来说,Runes 协议的铸造并不复杂,但对大部分新人用户来说,还是有比较大的门槛。

图源:Doggfather

在钱包的下载、注册和使用方法上,BlockBeats 此前梳理了六款比较常用的比特币钱包,因此不多赘述。相关阅读:《六款比特币钱包入门交互教程,别再错过下一个财富密码了》。在 Runes 生态中,兼容性最好的应该还是 Unisat、Xverse 钱包和 OKX WEB3 钱包,可以挑选自己顺手的使用。

除了钱包,对于用户最关心和最重要的铸造工具,BlockBeats 选取了几个已经上线过测试网的项目,在下文中制作了详细的讲解和教程,为上线主网后的铸造流程有极大借鉴意义。

## 钱包及铸造平台

### Xverse

Xverse 是比特币生态上常用的钱包,自然不会缺席本次「符文热潮」。Xverse mint 现已上线,在 Runes 主网上线后用户可以在网站上铸造符文。

1. 打开Xverse 官网,选择 chrome 浏览器下载插件并安装。在 chrome 浏览器扩展程序中,打开 Xverse 插件。新用户在此界面选择「Create a new wallet」(创建新钱包)。点击后会弹出 12 位助记词,备份助记词并设置密码,完成钱包创建。

需要注意的是,Xverse 钱包主网有 2 个地址,「 3 」开头的 BTC 地址和「bc 1 」开头的资产存放地址(Ordinals、Runes、稀有聪等,测试网有 1 个地址,是「 2 」开头的)。如果要在主网进行交互,则把准备的好的 BTC 转入「 3 」开头的 BTC 地址,不要转入「bc 1 」开头的资产地址。

2. 在 Xverse 的测试网中,我们可以看到在钱包连接成功后可点击「Mint」方框进行铸造。

Xverse 提供了 3 种不同的 runes 铸造测试币,分别是「I•NEED•TEST•RUNES」「A•SQUARE•IS•NOT•A•LOGO」「ZERO•DIVISIBILITY•RUNE」,三者均于 3 月 30 日部署,仅用于测试,每次 mint 的数量为 1000 。

3. 选择任意 runes 后点击「Mint」,在弹出的交易信息中点击「Confirm」,支付费用后即可完成铸造。待 840000 区块产出后符文部署会开放,用户可自己部署符文代币。

### Unisat

作为 BRC 20 最早「吃螃蟹的人」,UniSat 算是比特币生态最古早的钱包了。4 月 14 日,UniSat 在其社交平台表示,UniSat 钱包将支持 Runes,并将推出 Runes 铭刻服务和交易市场。目前测试网已经上线,同样我们可以根据测试网的操作,来熟悉主网上线后的流程。

1. 打开 Unisat官网,选择 chrome 浏览器下载插件并安装。

2. 在 chrome 浏览器扩展程序中,打开 Unisat 插件。新用户在此界面选择「Create new wallet」(创建新钱包)。输入密码注册后会弹出 12 位助记词,备份助记词,选择后面为 m/86/0/0/0/0 的地址,点击「Continue」即可创建成功。

3. 打开 unisat 测试网,在「Inscribe」(铭刻)页面切换至「Mint」(铸造)选项。在「Rune / Rune Id」列内输入想要铸造的 ruen 名字,在「Repeat Mint」列内手动输入或拖动滑轨确定要铸造的 rune 数量。确定好后点解「Next」(下一步)。

4. 在「To Single Address」(发送单一地址)内输入要接受符文的测试网地址,根据需求选择不同的铸造速度。值得注意的是,Custom 可以在「Sats In Inion」(铭刻费)列表自定义调整 gas。最后点击「Submit Pay invoice」(提交并支付)即可提交订单。

5. 最后选择一种支付方式签名支付即可。若先泽钱包支付,需确保钱包里有余额,否则支付会失败。支付成功后,耐心等待区块确认即可。可以在 mempool 中查看进度,铸造完成后会在钱包里显示。

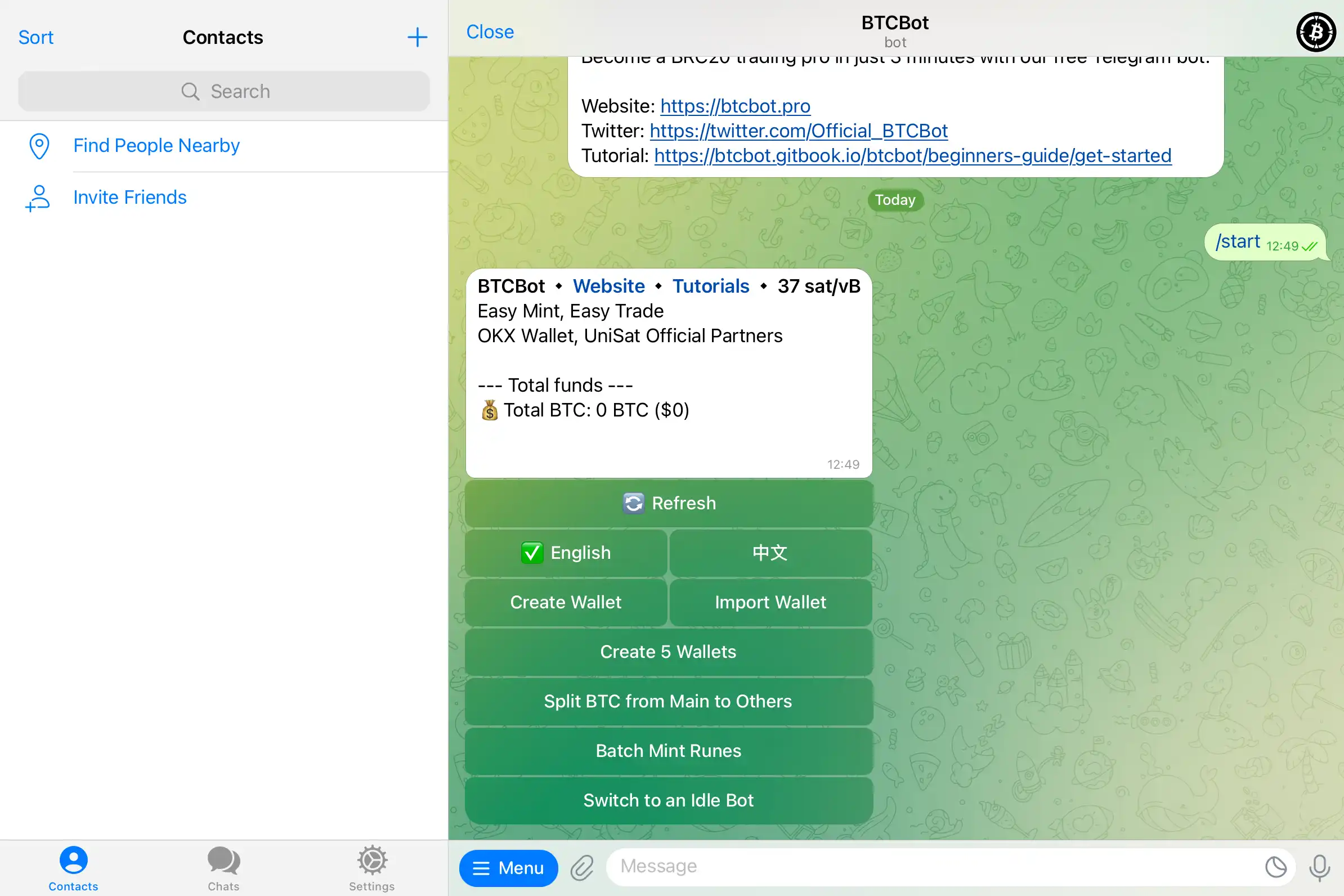

### BTCBot

在最近的铸造平台的市场预热过程中,BlockBeats 也能看到市场上出现了一些新面孔,比如 Bot 工具,这是第一次比特币生态里出现了 Bot,常出现在「铸造平台网页崩溃时作为替补方案」的使用语境中。

虽然铸造平台网页前端出现崩溃的情况微乎其微,同时比特币网络的交易形式与 EVM 不同,在代码设计上存在漏洞的可能性未经验证,因此 BlockBeats 以其中一个作为教程教学案例。

1. 在 Telegram 中打开BTCBot,点击「Start」(开始)进入机器人聊天窗口。

2. 目前,BTCBot 服务可以选择中文模式或英文模式。可在对话框选项中选择「Create Wallet」(创建钱包)或「Create 5 Wallets」(创建 5 个钱包),bot 将会发送新的钱包地址及私钥。或者可以选择「Import Wallet」(导入钱包),将钱包私钥发送给 bot 即可自动完成地址识别。

3. 在与 bot 完成识别的钱包中,至少存入 0.00 2B TC 即可建立新的交易。完成所有设置后就能在启动交易中使用 BTCBot。

4. 选择 bot 的「Batch Mint Runes」(批量铸造 Runes),输入希望铸造的 Runes 名称。这里以 UNCOMMON•GOODS 为例,bot 会告知 UNCOMMON•GOODS 的基本信息。若确定要铸造,则点击「添加到自动打新的白名单」,当铸造开始后,bot 将自动铸造。铭刻张数也可通过直接与 bot 对话设定。

## 其他工具

### Rune pro

Rune pro 是这一轮里新出的交易市场工具,旨在帮助用户提升交易体验感。

如何创建销售 Runes 代币:在页面的第一个区域点击「Sell 出售」。

输入您想要出售的代币数量和每个代币的 sats 价格。检查订单并签署交易(您需要创建与列表相同的转账金额)。一旦完成,列表将以以下方式显示。

如何创建一个竞价订单,以竞购想购买的代币:选择「buy 购买」。

输入每个代币的数量和 sats 价格。检查订单并确认(注意您只能为每个代币创建一个竞价,这是由于 utxo 的限制),一旦完成,列表将以以下方式显示。

如何购买一个代币:点击卡片上的「购买」并在钱包中确认交易。

如何出售至一个列表:首先为列出的出价创建一个准确的转账描述。一旦转账描述创建完成,直接通过点击「Sell 出售」按钮出售至该出价。

### Allet

Allet 工具能够实时更新减半的进度,包括剩余的区块数量和预计的时间,以及比特币的价格和 GAS。

目前 Allet 还有很多工具没有上线,但据官方显示,Allet 之后还会更新的一些生态相关的重要 KOL 和项目团队社交媒体账号,保持消息灵通。此外还会收到详细的更新地板上的价格和 24 小时交易量的所有文有关的收藏品,例如 RSIC 和符石。

星球日报·2024-04-19 10:02

Selling wave in BRC20s: Why are they falling?

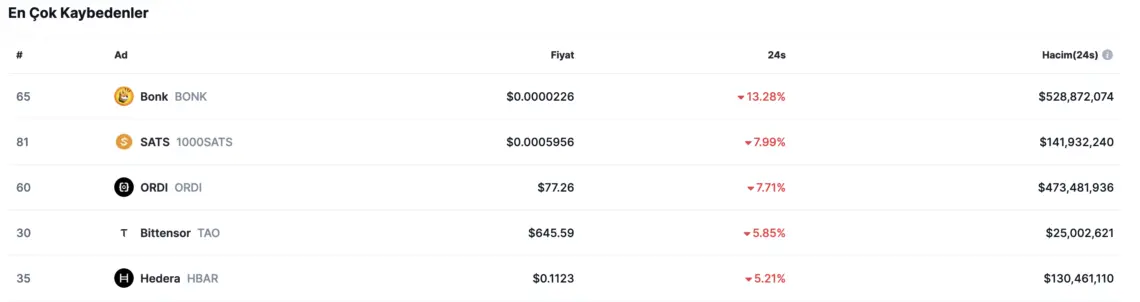

The most important names of BRC20s, Ordi (ORDI) and Sats (SATS), created an atmosphere of panic with their short-term decline.

The price movements of Ordi (ORDI) and Sats (SATS), which were in a downward trend after Bitcoin (BTC) corrected, were frightening. ORDI and SATS, leading the BRC20 trend,

Coinkolik·2024-03-03 03:00

Sales blow to Sats (SATS): It fell by more than 20 percent in two days!

Sats (SATS), one of the well-known names of BRC20 projects, created an atmosphere of panic with its short-term loss of value.

Sats (SATS), one of the prominent projects of the BRC20s, lost a great deal of value due to the decline in Bitcoin (BTC). The popular coin, which started to retreat after failing to overcome a significant resistance, only

Coinkolik·2024-02-21 04:15

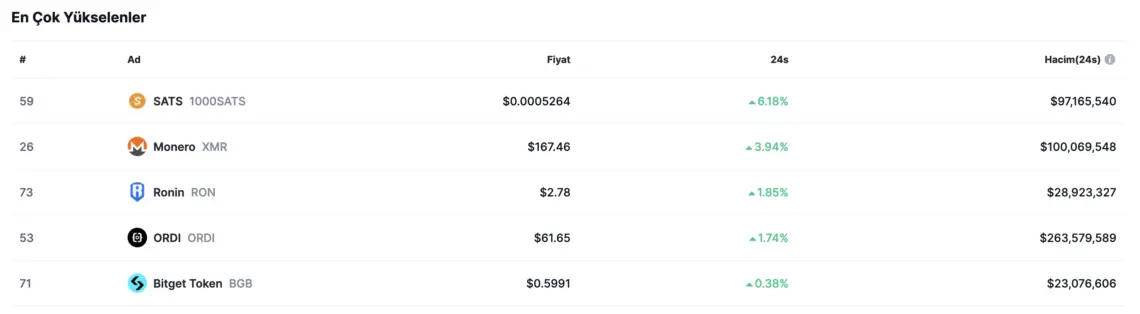

BRC-20 wind is unabated: It found strength in Bitcoin!

Ordi (ORDI) and Sats (SATS), which took action accompanied by the sharp rise of Bitcoin (BTC), continue to give hope for the BRC-20 trend.

With the rise of Bitcoin (BTC) to $ 50,000, the most notable names among the altcoins that gained momentum were Ordi (ORDI) and Sats (SATS). BRC-20s are popular

Coinkolik·2024-02-12 23:30

Impressive performance from Sats (SATS): Standing up against all odds!

Despite the BRC-20 hype and the decline in Bitcoin (BTC), SATS (1000SATS) was highly appreciated.

BRC-20s, which have not been talked about for some time, have reminded itself of themselves accompanied by the rise of SATS (1000SATS). As the BRC-20 hype loses its power and the BTC last night

Coinkolik·2024-02-01 01:30

Account X named Satoshi made a profit: Big scam!

An X account opened in the name of Satoshi Nakamoto made a profit by sharing a shitcoin called SATS, which was launched on the Solana network.

The other day there was an interesting moment in the cryptocurrency market. An X account created with the username Satoshi, tweet about SATS launched on the Solana network

Coinkolik·2024-01-22 00:30

Detailed explanation of the new asset of the Atomicals protocol, Sophon Zhizi (with minting tutorial)

Although the Atomicals community is technically pure, it is known as the "technical halal" of the Bitcoin ecosystem. But the Atomicals community seems to realize that, unlike ordi and sats, where the Ordinals protocol is widely known, they are in dire need of a meme that can attract attention within the wider circle.

Some time ago, the Quark Token appeared precisely to meet this demand, as an attempt to increase the awareness of Atomicals on a broader scale. As an ARC 20 Token, quarks get their name from quarks in physics, which are the basic units of matter. This name forms an interesting echo with sats (satoshis), the smallest units that make up Bitcoin, giving quarks a certain meme

星球日报·2024-01-18 09:05

AI Currency: How to combine Bitcoin micropayments with AI?

>Bitcoins are mine, sats belong to AI.

Written by: Fat Garage

Sometimes I find it amazing. When mentioning Bitcoin in different environments, I will always encounter some people who express their skepticism about Bitcoin because they “don’t (want) to understand” and “have impure motives.” Their points are mostly about "time" and "value", not about the exquisitely designed thing/technology itself.

I'm not skeptical, and Bitcoin is an irreplaceable source of novelty for me.

Recently, this novelty comes from the lightning experience of continuously sending satoshis into the wallet from the other side of the ocean. "A value as small as 1 satoshi (1 satoshi = $0.00023) can also be sent to you through the network cable of immeasurable distance." hand";

ForesightNews·2024-01-15 01:47

Bitget Research: Bitcoin rebounds to $44,000, Ethereum will test Cancun upgrade on January 17

> In the past 24 hours, many new popular currencies and topics have emerged in the market. Perhaps they will be the next market focus.

Written by: Bitget Research Institute

In conclusion

1. Popular currencies:

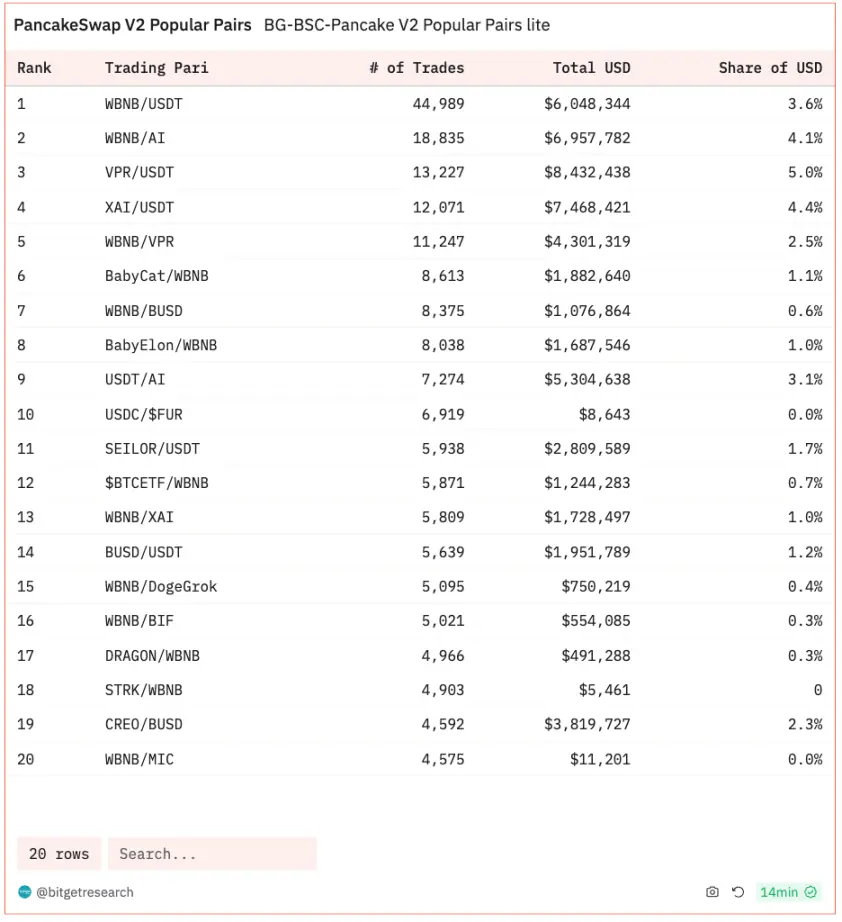

RATS (Token): The on-chain trading volume of BRC20 track tokens ORDI and SATS has dropped significantly after being listed on the leading exchange. Currently, RATS remains the top trading volume on the chain. The trading volume in the past 24 hours is 1.15 million US dollars, which has dropped in the past 14 days. 19%.

MICKEY (Token): A meme coin with the classic Disney image Mickey Mouse as its core intention. As of January 1 this year, Disney no longer owns the copyright of the first version of Mickey Mouse. Multiple Mickey Mouse meme coins appeared on the chain. Eventually,

ForesightNews·2024-01-05 09:21

Bitget Research Institute: BTC briefly fell to $40,000, and the Federal Reserve meeting minutes poured cold water on expectations of interest rate cuts.

> In the past 24 hours, many new popular currencies and topics have emerged in the market. Perhaps they will be the next market focus.

Written by: Bitget Research Institute

In conclusion

1. Popular currencies:

INSC (Token): BRC20 token, representing inscriptions, was deployed on March 17, 2023. It was mined by some community users after SATS to have a certain meme status in the BRC20 track. The current market value of the token is 15 million US dollars, the 24-hour on-chain transaction volume is 880,000, and the number of held addresses is 2,250, which is still at a relatively small stage.

BEND (Token): BendDao is an NFT lending platform on Ethereum, the latest issued BDIN

ForesightNews·2024-01-04 12:05

Load More