Search results for "SIX"

Strategy's Bitcoin Bet Dips Underwater as Firm Adds to $56 Billion BTC Stash

In brief

Strategy’s Bitcoin bet showed losses on paper for the first time in years.

Its shares have fallen 62% over the past six months.

The company recently raised more money than it spent on Bitcoin.

Strategy’s Bitcoin bet showed losses on paper for the first time in years, as the

BTC1.65%

Decrypt·5h ago

Why XRP Is Gaining Ground in the Tokenized RWA Market Ahead of Ethereum

The XRP Ledger now boasts $1.44 billion in represented asset value, recording a 266% surge in the past 30 days to rank fourth on the charts.

XRPL has overtaken most of the major networks, holding over six times more in RAV than Ethereum and twice as much as Avalanche.

The XRP Ledger has

CryptoNewsFlash·9h ago

Story Protocol Delays Team and Investor Token Unlock to Ease IP Selling Pressure

Story Protocol has announced that its token unlock has been postponed by six months to August to ease the selling pressure on its IP token.

The crypto industry will record over $400 million in increased supply from unlocks this month, with emissions from miners and stakers adding

CryptoNewsFlash·9h ago

Wintermute Ventures: Our Six Major Predictions for Digital Assets in 2026

Author: Wintermute Ventures

Translation: Bibi News

For decades, the internet has enabled information to flow freely across borders, platforms, and systems. However, the flow of "value" has always lagged behind. Money, assets, and financial contracts still rely on fragmented infrastructure, circulating through outdated tracks, national borders, and layers of intermediaries, each extracting costs.

And this gap is being filled at an unprecedented speed.

This creates opportunities for a class of infrastructure companies—those that directly replace traditional clearing, settlement, and custody functions.

Infrastructure that allows value to flow as freely as information is no longer just a theoretical concept; it is being actively built, deployed, and used at scale.

For years, while crypto assets existed on-chain, they were disconnected from the real economy. Now, this situation is changing.

Crypto is becoming an internet economy.

DEFI-2.31%

PANews·17h ago

Why XRP Is Gaining Ground in the Tokenized RWA Market Ahead of Ethereum

The XRP Ledger now boasts $1.44 billion in represented asset value, recording a 266% surge in the past 30 days to rank fourth on the charts.

XRPL has overtaken most of the major networks, holding over six times more in RAV than Ethereum and twice as much as Avalanche.

The XRP Ledger has

CryptoNewsFlash·02-01 13:40

How can ordinary people survive during an economic downturn? These seven tips will help you get through the tough times.

During an economic downturn, the key to survival lies in resource management rather than quick action. This article proposes six survival strategies, including building emergency funds, reducing debt, developing multiple income streams, allocating inflation-resistant assets, maintaining cash reserves, and seeking entrepreneurial opportunities to help people face an uncertain future with confidence.

動區BlockTempo·01-30 09:50

Arthur Hayes’ Warning: A $300B Liquidity Crunch Is Crushing Bitcoin's Price

BitMEX co-founder and noted crypto macro analyst Arthur Hayes has pinpointed a massive \$300 billion contraction in U.S. dollar liquidity as the primary force behind Bitcoin's recent price weakness.

Hayes argues that this move, driven by the U.S. Treasury rebuilding its cash reserves, transcends crypto-specific sentiment and represents a broad macro headwind for all risk assets. This analysis is corroborated by a nearly 7% decline in the key USDLIQ dollar liquidity index over six months.

CryptopulseElite·01-30 09:07

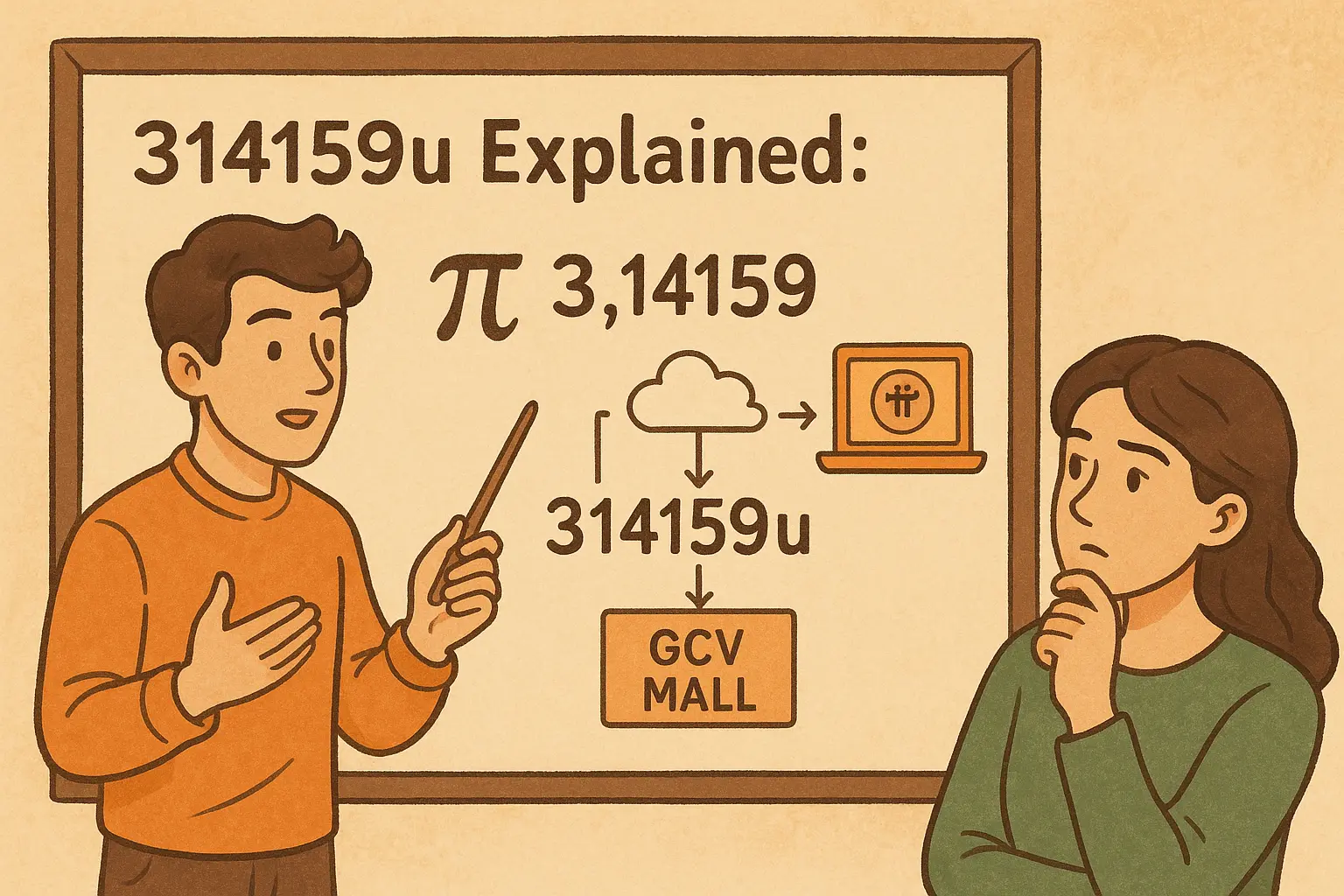

314159u Explained: The Pi Network Code Behind GCV MALL Mystery

314159u represents Pi's first six digits (3.14159) plus "u" identifier, playing a crucial role in 314159U GCV MALL, a Pi Network decentralized marketplace. The code serves cryptography and data processing applications, though the platform faces scrutiny due to missing SSL certificate and lack of legal documentation.

MarketWhisper·01-30 08:41

Amazon lays off 16,000 employees! From the expansion and correction of the epidemic, AI is reshaping the global enterprise architecture

Amazon announced 16,000 layoffs, with a total of 30,000 jobs laid off within six months, mainly on the corporate side, reflecting changes in labor demand due to advances in AI technology. The company aims to improve efficiency by reducing management levels and automation while shutting down underperforming brick-and-mortar businesses and shifting to an AI-centric development model.

CryptoCity·01-30 01:31

The whole world is celebrating, so why is only the crypto industry "wintering"?

Writing by: EeeVee

"Just don't invest in cryptocurrencies, and you can make money from everything else."

Recently, the crypto world and other global markets seem to be experiencing two completely different extremes.

Throughout 2025, gold surged over 60%, silver skyrocketed 210.9%, and the US stock Russell 2000 index rose 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, the divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares increased by over 15% in a single month.

In contrast, Bitcoin experienced six consecutive declines starting January 21, dropping from $98,000 and once again falling below $90,000 without looking back.

Silver's performance over the past year

It seems that after 1011, capital has decisively left the crypto space, BTC

区块客·01-30 00:05

XRP Today's News: Senate Vote Countdown, ETF Inflows for 6 Consecutive Days, Attracting $1.26 Billion

XRP remains at $1.9, with US XRP spot ETF inflows reaching $1.26 billion for six consecutive days. On January 29, the Senate Agriculture Committee will vote on the Market Structure Bill. Analysts expect the bill's progress to boost demand, with a medium-term target of $3 and a long-term target of $3.66.

MarketWhisper·01-29 03:45

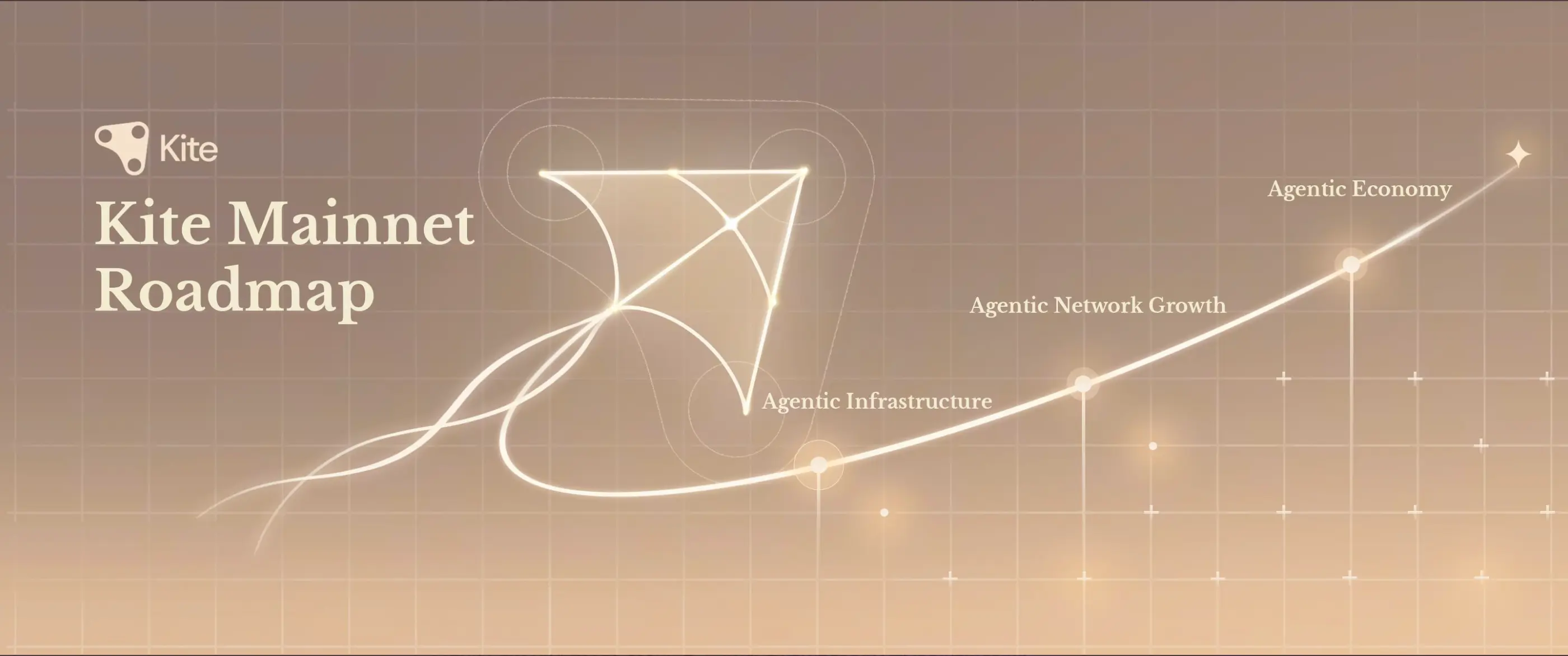

Kite Mainnet Roadmap Unveiled: The Foundational Layer for an Autonomous Agent Economy

The Kite Network has officially unveiled its comprehensive mainnet roadmap, charting a decisive course to build the essential infrastructure for an economy run by autonomous AI agents.

Moving beyond conceptual frameworks, this roadmap details six strategic pillars designed to solve the core bottlenecks of identity, payment, and governance in a machine-driven world. Crucially, Kite positions itself as the native settlement layer for standards like Coinbase’s x402, enabling a seamless "pay

CryptopulseElite·01-28 03:52

Kite Mainnet supports x402 protocol! Six pillars build AI agent pay-per-use

As AI agents evolve from "answering questions" to "executing trades," traditional payments become the biggest bottleneck. The Kite mainnet builds autonomous economic infrastructure through six pillars, with the core innovation being support for the x402 protocol, the largest compliant crypto exchange in the US, integrating payments into HTTP requests to enable pay-per-use. The mainnet is launched in phases, from identity governance to payment settlement and ecosystem expansion.

KITE6.78%

MarketWhisper·01-28 02:55

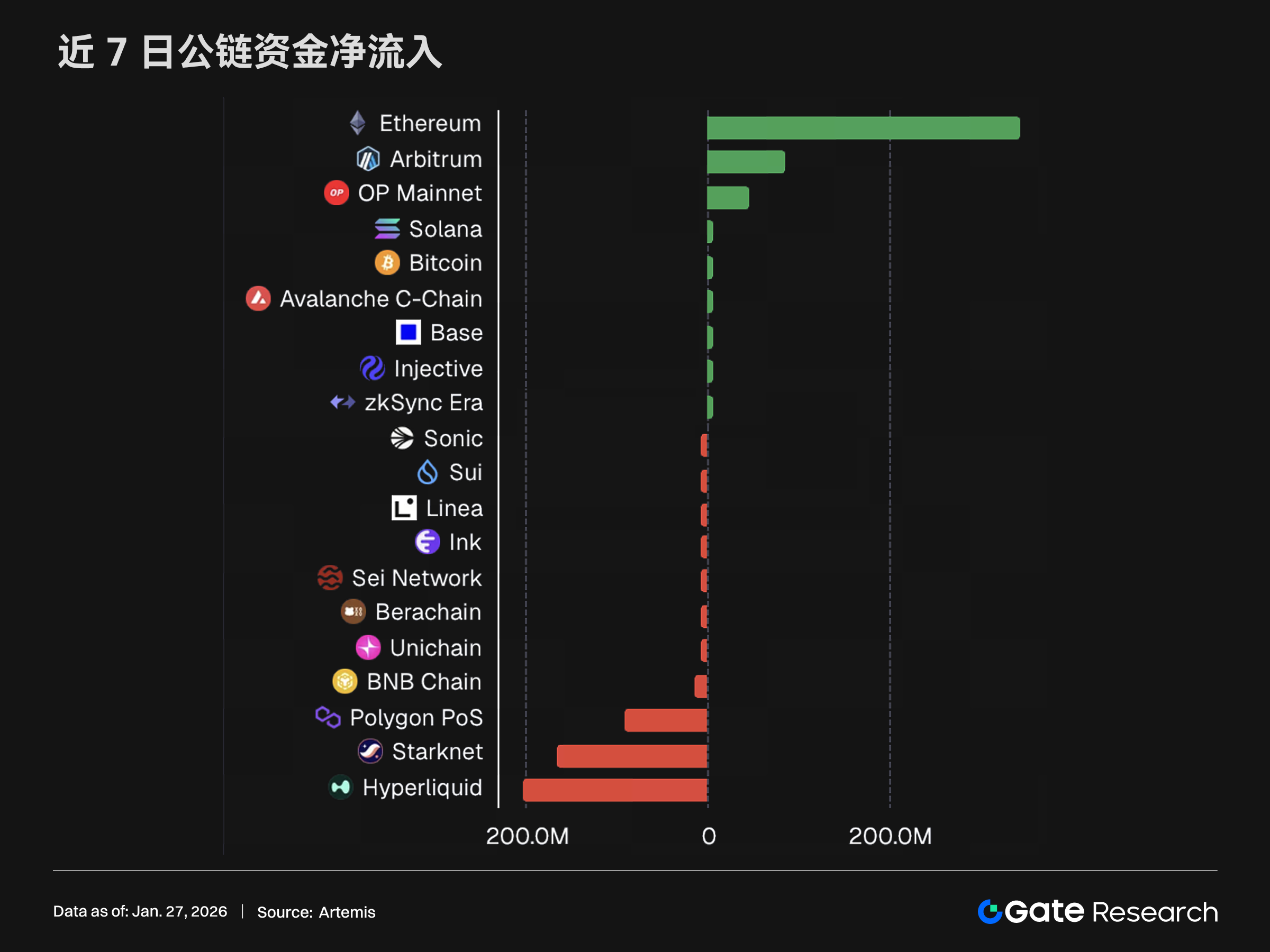

The US dollar experiences its largest decline in six months, with Ethereum receiving defensive capital inflows|Gate VIP Weekly Report (January 19, 2026 – January 25, 2026)

Last week, the market performance was weak, with BTC and ETH both showing weak oscillations, and the rebound mainly due to technical correction. On-chain capital flow was defensive, with Ethereum attracting net inflows, while multiple networks experienced capital outflows. This report will analyze these trends in depth, providing market data and technical insights.

GateResearch·01-27 09:43

Chan Maobo: Hong Kong to issue stablecoin licenses in early 2026, with $2.1 billion in tokenized green bonds issued

Written by: Liang Yu

Edited by: Zhao Yidan

On January 21, 2026, the snow and ice in Davos, Switzerland, have not yet melted, and a heated discussion about the future of global finance is underway. Hong Kong SAR Financial Secretary Paul Chan announced to the world that Hong Kong is expected to issue its first batch of licenses related to stablecoins within the year and reaffirmed the principle of "same activity, same risk, same regulation." This statement is consistent with his public confirmation six months ago in December 2024 of the plan to introduce a stablecoin licensing system this year.

This upcoming policy is not an isolated move. In his speech in Davos, Paul Chan systematically outlined Hong Kong's strategic blueprint for digital assets: since 2023, Hong Kong has already...

TechubNews·01-27 03:32

How SharpLink Aims to Be the Most 'Focused, Disciplined' Ethereum Treasury in 2026

In brief

SharpLink Gaming plans to differentiate itself from other Ethereum treasury firms in 2026.

The second-largest ETH treasury will not just accumulate for the sake of it, SharpLink CEO Joseph Chalom told _Decrypt_.

SBET shares have fallen over the last six months, but

Decrypt·01-26 17:06

Tezos Tallinn Upgrade Goes Live, Slashing Block Times to 6 Seconds as TenX Bets \$3.25M on Staking

The Tezos blockchain has successfully activated its 20th major protocol upgrade, dubbed "Tallinn," achieving a significant milestone by reducing base layer block times to just six seconds and introducing critical optimizations for storage and network efficiency.

This technical leap coincides with a major vote of confidence from institutional infrastructure: publicly-listed TenX Protocols has acquired 5.5 million XTZ tokens (worth approximately \$3.25 million) in a strategic staking partne

CryptopulseElite·01-26 03:54

Fed’s Yen Warning Shakes Markets: Is Bitcoin’s Mega-Rally or Meltdown Next?

Global currency markets are on edge as the Japanese Yen records its most dramatic single-day surge in six months, propelled by an extraordinary signal from the U.S. Federal Reserve. For the first time in over a decade, the New York Fed has reportedly contacted major banks regarding Yen exchange rates—a classic precursor to coordinated currency intervention.

This move, aimed at arresting the Yen's precipitous decline, has sent shockwaves through traditional finance, with analysts debating

BTC1.65%

CryptopulseElite·01-26 03:21

Key Token Unlocks to Watch This Week: Over $600 Million in Supply to Hit Markets

The crypto market is bracing for a significant wave of token supply inflation next week, with major unlocks scheduled across six projects. According to data from Token Unlocks, over \$618 million worth of previously locked tokens will be released into circulation between January 26th and February 1st.** **

The event is headlined by a massive \$508 million unlock for BGB token, constituting over 10% of its circulating supply. Other notable unlocks include Sign (SIGN), Jupiter (JUP), Kamino

CryptopulseElite·01-26 02:25

After reading Warren Buffett's shareholder letter from 40 years ago, this is what I want to tell you

Author: BoringBiz\_

Translation: Deep Tide TechFlow

Introduction: As Warren Buffett prepares to step down after nearly 60 years at the helm of Berkshire Hathaway, it is especially important to revisit the core ideas from his early years.

This article is a translation of an in-depth review of Buffett's shareholder letters from 1981 to 1982. Even after more than 40 years, Buffett's statements on "rejecting mediocre mergers," "inflation as a parasite eroding companies," and "real economic surplus surpassing accounting profits" still hold strong warning significance for today's Web3 investors, DAO governors, and business operators.

The full text is as follows:

During Warren Buffett's nearly six decades as CEO of Berkshire Hathaway and his eventual handover

FARM0.53%

PANews·01-26 02:02

Ledger aims for a $4 billion IPO! Goldman Sachs leads 6 major crypto giants vying for listing

Ledger plans a $4 billion New York IPO, hiring Goldman Sachs and others as underwriters, surpassing the total industry sum of $3.4 billion in 2025. After BitGo's listing this week, six more follow: Kraken, Consensys, CertiK, Evernorth, Animoca Brands, and Bithumb.

MarketWhisper·01-26 02:00

Japan 2028 to legalize cryptocurrency ETFs! Nomura and SBI rush into the $6.4 billion market

Nikkei reports that the Japanese Financial Services Agency plans to lift the ban on cryptocurrency ETFs by 2028. The authorities will amend the Investment Trust Law to classify virtual currencies as investable "specified assets." Major institutions such as Nomura and SBI have already promoted product development, with at least six asset management firms researching. The lifting of restrictions is contingent on tax reform, reducing the tax rate from a maximum of 55% to 20%. The market anticipates a scale of 1 trillion yen (approximately $640 million).

MarketWhisper·01-26 00:39

How SharpLink Aims to Be the Most 'Focused, Disciplined' Ethereum Treasury in 2026

In brief

SharpLink Gaming plans to differentiate itself from other Ethereum treasury firms in 2026.

The second-largest ETH treasury will not just accumulate for the sake of it, SharpLink CEO Joseph Chalom told _Decrypt_.

SBET shares have fallen over the last six months, but

Decrypt·01-25 17:05

Ethereum Loses Momentum as This Key Indicator Hits Peak

_Ethereum struggles at $3,200-$3,400 resistance with weak volume, showing corrective, not impulsive rallies_

_ETH-Russell 2000 correlation drops to 0.3 from 0.7 peaks, marking rare decoupling of risk assets today_

_Historical data shows 65% of similar divergences close within six

LiveBTCNews·01-25 13:35

The whole world is celebrating, so why is only the crypto industry "wintering"?

Writing by: EeeVee

"Just don't invest in cryptocurrencies, and you can make money from everything else."

Recently, the crypto world and other global markets seem to be experiencing two completely different extremes.

Throughout 2025, gold surged over 60%, silver skyrocketed 210.9%, and the US stock Russell 2000 index rose 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, the divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares increased by over 15% in a single month.

In contrast, Bitcoin experienced six consecutive declines starting January 21, dropping from $98,000 and once again falling below $90,000 without looking back.

Silver's performance over the past year

It seems that after 1011, capital has decisively left the crypto space, BTC

区块客·01-24 15:05

What Crypto to Buy Now: All Clues Point at $DSNT, the AI Token That Surged 140% in Presale and Is Rumored to List on Several CEXs in January

A six-hour outage on Sui just reminded the market how fragile even fast-growing blockchains can be. When networks stall, traders lose access, liquidity freezes, and confidence gets tested. Moments like this push investors to rethink what really matters in crypto.

While Sui and other chains

CaptainAltcoin·01-24 08:20

XRP’s Critical $2.1 Breakout: Will It Spark Rally?

_XRP needs to break above $2.1 resistance to start a new uptrend. Chart Nerd reveals a simple step after six months of decline. Current price sits at $1.91._

XRP faces a straightforward path to recovery. The cryptocurrency needs to surpass one key level. That level sits at $2.1, according to rec

XRP1.37%

LiveBTCNews·01-24 00:00

Dormant Bitcoin Wallets Show Continued Activity Despite Sub–Six-Figure Prices

While bitcoin has been stuck pacing between $87,600 and $91,100 over the past few days, a sizable cluster of long-silent wallets dating back to the 2016–2017 vintage suddenly stirred, shifting 498 BTC valued at $44.6 million. In another instance, onchain analyst Sani discovered 107 wallets that

BTC1.65%

Coinpedia·01-23 23:16

Coinbase assembles quantum computing defense team! 6 experts respond to blockchain encryption crisis

Coinbase establishes a Quantum Computing Advisory Committee, bringing together six experts including Stanford's Dan Boneh, Ethereum's Justin Drake, and others. Quantum computers may potentially crack Bitcoin and Ethereum encryption. The committee will release threat assessments and prevention recommendations, while Coinbase is simultaneously advancing the post-quantum signature ML-DSA upgrade.

MarketWhisper·01-23 05:21

The whole world is celebrating, so why is only the crypto industry "wintering"?

Article by: EeeVee

"Just don't invest in cryptocurrencies, and everything else can be profitable."

Recently, the crypto world and other global markets seem to be polar opposites.

In 2025, gold surged over 60%, silver skyrocketed 210.9%, and the US stock Russell 2000 index rose 12.8%; meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, the divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in A-shares increased by over 15% in a single month.

In contrast, Bitcoin experienced six consecutive declines starting January 21, dropping from $98,000 and once again falling below $90,000 without looking back.

Silver's performance over the past year

It seems that after 1011, capital has decisively left the crypto space, BTC

区块客·01-22 15:18

Gate Research Institute: BTC long-term signals remain bullish | Ondo expands to Solana and adds tokenized stocks

Cryptocurrency Asset Overview

BTC (+1.19% | Current Price 90,086.0 USDT)

In the past week, BTC stabilized at a low after a rapid decline, with prices oscillating around a key support zone. After six days of decline, the current trading price fluctuates between $88,000 and $89,000, down nearly 10% from the recent high of approximately $98,000. Factors contributing to this decline include: Trump's threat to impose tariffs on Greenland, significant adjustments in global bond prices, record highs in precious metals, and market risk asset sell-offs. The short-term moving averages are still below the medium- and long-term averages, and the trend has not fully reversed. However, the MACD is rebounding from low levels, and bearish momentum is weakening, indicating a temporary easing of downward pressure and a phase of correction.

ETH (+2.11% | Current Price 3,026.99

GateResearch·01-22 06:44

CAKE Supply Shrinking Fast – Deflation Hits Hard in 2025

PancakeSwap has also reinforced its long-term sustainability by emphasizing high CAKE token supply deflation. The decentralized trade proved that the burns of CAKE have always outpaced the new tokens releases during the last six months. It is a sign that the tokenomics will be changing

Coinfomania·01-21 12:30

Japan Bond Market Earthquake Sparks Global Sell-Off: Is Bitcoin a Risk Asset or Safe Haven?

A seismic shock in Japan's government bond (JGB) market has sent tremors through global financial markets, triggering a sharp risk-off sell-off that pulled Bitcoin down over 3% to around \$89,300.

U.S. Treasury Secretary Scott Bessent described the move as a "six-standard-deviation" event, an extreme statistical rarity underscoring its severity. This turmoil directly threatens the "yen carry trade," a longstanding source of cheap global liquidity that has fueled investments in risk assets

CryptopulseElite·01-21 05:33

Japan's Bond Volatility Puts Global Liquidity, Bitcoin Under Pressure

In brief

Japanese government bond yields surged at a pace not seen since 2022, spilling into U.S. Treasurys and jolting global rates markets.

Treasury Secretary Scott Bessent called the move a “six-standard-deviation” shock, underscoring how abruptly volatility returned to sovereign debt mar

Decrypt·01-21 05:21

ChatGPT Ads Are Officially Here: What Started as “Not an Ad” Is Now OpenAI’s New Revenue Play

The app suggestions that sparked outrage in December? They were just the warm-up.

Six weeks ago, OpenAI insisted the Target shopping prompts appearing in ChatGPT weren’t ads. They were “app suggestions,” the company said, part of an SDK partnership, not a monetization play. Users weren’t buying

NOT-0.31%

CryptoBreaking·01-20 15:20

Bitcoin bulls risk further pain as Peter Brandt flags bearish channel

Veteran trader Peter Brandt warns that Bitcoin may face further price drops unless strong buying breaks through key resistance near six figures. He acknowledges the potential for error in his forecasts amid current volatility and macro concerns.

BTC1.65%

Cryptonews·01-20 08:48

Day 30 of Presale: Sixth Crypto Exchange Listing for Patos Token Confirmed Today

According to official documentation released by BiFinance, the digital asset trading platform has formally committed to listing Patos Meme Coin ($PATOS) upon the conclusion of its presale on June 26, 2026. This confirmation establishes $PATOS as having secured six centralized exchange (CEX) lis

TOKEN41.24%

CaptainAltcoin·01-20 07:25

XRP Price Prediction: Can ETF Demand Overcome Trade War Fears and Spark a Rally?

XRP has faced significant selling pressure, declining for six consecutive days to trade around \$1.98, as escalating US-EU trade tensions and delays in US crypto legislation rattled investor sentiment.

Despite briefly falling below \$1.85, the token found support, with its medium-term outlook buffered by robust demand for XRP-spot Exchange-Traded Funds (ETFs). Technical analysis shows XRP trading below its key 50-day and 200-day Exponential Moving Averages (EMAs), signaling bearish moment

CryptopulseElite·01-20 03:29

XRP Today's News: Trump's Tariff Threat Triggers Six Consecutive Drops, Can ETF Demand Save the Day?

XRP Today's news shows a sixth consecutive decline, affected by Trump's threat to impose a 10% tariff on 8 European countries and the delay of the Market Structure Bill. XRP briefly dropped to $1.8502, then temporarily rebounded to $2. Despite breaking below the 50-day and 200-day moving averages, spot ETF inflows totaling $1.3 billion provide support at the bottom, with a medium-term target of $3.0 and a long-term target of $3.66.

XRP1.37%

MarketWhisper·01-20 03:01

Dollar collapse, stagflation coming? What can we do

Peter Schiff warns that the ten-year Japanese government bond yield is rising, indicating that U.S. bond prices will fall, potentially triggering stagflation. The article explains the causes of stagflation and the challenges it poses to policymakers, and proposes six investment strategies to cope with future economic instability, including maintaining liquidity, investing in inflation-resistant assets, and diversifying investments.

BTC1.65%

ChainNewsAbmedia·01-20 02:44

Trump tariff data exposed! 96% of the costs are borne domestically in the US, draining liquidity from the crypto market

The Kiel Institute for the World Economy in Germany research shows that 96% of Trump's tariffs' costs are borne by American consumers and importers, amounting to nearly $200 billion paid domestically. Tariffs act like hidden consumption taxes, quietly eroding disposable liquidity, which explains the stagnation in the crypto market after October. Only 20% of the tariff costs are passed on to consumers within six months, with the rest absorbed by businesses squeezing profits.

MarketWhisper·01-20 01:05

Billionaire Draper: Bitcoin to Hit $10,000,000 - U.Today

Venture capitalist Tim Draper predicts Bitcoin could rise to $250,000 in six months and ultimately reach $10 million, driven by currency replacement amid inflation and debt. Despite past prediction delays, Draper maintains his bullish outlook, asserting regulatory changes will support this growth.

BTC1.65%

UToday·01-19 18:51

ChatGPT Ads Are Officially Here: What Started as “Not an Ad” Is Now OpenAI’s New Revenue Play

The app suggestions that sparked outrage in December? They were just the warm-up.

Six weeks ago, OpenAI insisted the Target shopping prompts appearing in ChatGPT weren’t ads. They were “app suggestions,” the company said, part of an SDK partnership, not a monetization play. Users weren’t buying

NOT-0.31%

CryptoBreaking·01-19 15:15

Sei Network Sees Stablecoin Payments Surge as P2P Supply Nears $100M

Sei Network’s P2P stablecoin supply surged 150% in six months, nearing $100 million.

Fast settlement and near-zero fees are driving real-world stablecoin payment adoption on Sei.

In half a year, the Sei Network has seen a strong upswing in stablecoin activity. P2P stablecoin balances held

CryptoNewsFlash·01-18 11:35

SUI Weathers Extended Shutdown with Minimal Price Impact

The SUI token price showed minimal movement despite a nearly six-hour network shutdown.

The consensus failure marked the blockchain’s second significant operational halt since its 2023 debut.

Investor confidence remained, defying expectations that such technical news would trigger a

CryptoNewsLand·01-18 08:41

Ripple Partners With UC Berkeley: What It Means for XRP Adoption

_Ripple and UC Berkeley launch UDAX to boost institutional adoption of XRP Ledger after a successful six-week pilot program._

Ripple has launched a new blockchain initiative with UC Berkeley to support the institutional use of the XRP Ledger.

The collaboration, known as the Digital Asset

XRP1.37%

LiveBTCNews·01-17 16:20

Cardano Foundation Backs $80M Draper Dragon Fund to Scale Global Adoption

The Cardano Foundation has partnered with Draper Dragon to launch an $80 million fund to scale the network’s adoption over the next six years.

The fund will focus on direct investments in high-potential startups building on the network, global marketing and liquidity provision and education s

ADA3.83%

CryptoNewsFlash·01-17 16:11

Sei Network Sees Stablecoin Payments Surge as P2P Supply Nears $100M

Sei Network’s P2P stablecoin supply surged 150% in six months, nearing $100 million.

Fast settlement and near-zero fees are driving real-world stablecoin payment adoption on Sei.

In half a year, the Sei Network has seen a strong upswing in stablecoin activity. P2P stablecoin balances held

CryptoNewsFlash·01-17 11:30

Gold And Other Metals Surge To Record Highs, Signaling Broader Economic Worries

Gold, silver, and copper have all surged to record highs, outperforming stocks.

Gold has beaten the S&P 500 for six straight months, silver has crossed $90 per ounce, and copper is up roughly 40% in six months.

The synchronized metals rally suggests investors are hedging against economic

Blockzeit·01-16 12:27

Load More