Search results for "USDC"

Cardano (ADA) Didn’t Get USDC – Here’s Why USDCx Might Be Enough

Cardano just took a meaningful step forward in its stablecoin journey, even if it’s not the exact version many were hoping for.

USDCx isn’t native USDC, but it does bring Cardano much closer to the global stablecoin ecosystem without cutting corners on design or decentralization.

As Cardano

CaptainAltcoin·2h ago

AceTrader Teams Up With Myriad for $30K Prediction Contest

In brief

Prediction market Myriad has teamed up with AceTrader, enabling users to predict on the AceTrader 100 competition.

The competition sees celebrity crypto traders competing for a $1 million USDC trade fund.

Myriad users can compete for a share of a prize pool of $30,000 in Trade

USDC-0.03%

Decrypt·5h ago

Circle Unveils 2026 Roadmap for Internet-Native Finance

Arc moves toward production with sub second finality, wider validators and compliance focused governance after heavy testnet usage.

USDC expands across 30 chains with CCTP moving $126B while USYC hits $1.6B and xReserve enables partner issuance.

Payments and FX lead priorities as Circle P

CryptoFrontNews·02-01 08:36

Here’s Why Cardano (ADA) Got USDCx Instead of USDC

Cardano introduces USDCx, a privacy-focused stablecoin by Circle, instead of the expected native USDC. While it aligns with Cardano's decentralized values, its impact on liquidity is uncertain, leading to mixed reactions in the community.

CaptainAltcoin·01-31 17:35

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-31 15:35

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-30 15:35

WisdomTree Expands Tokenized Fund Access to Solana Blockchain

WisdomTree added Solana support for its regulated tokenized funds via WisdomTree Connect and WisdomTree Prime.

Retail users can fund with USDC, buy tokenized funds, and hold them in self-custody wallets on Solana.

WisdomTree has expanded access to its regulated tokenized funds by adding

CryptoNewsFlash·01-30 15:05

Circle 2026 Strategic Exposure! Arc Blockchain Launches Institutional Stablecoin, Deepening USDC Full-Chain Deployment

Circle 2026 focuses on promoting institutional adoption of durable infrastructure. The Arc blockchain moves from testing to production, deepening the practicality of USDC, EURC, and USYC. Expand the payment network to allow institutions to use stablecoins without building their own infrastructure. USDC market cap is 70 billion, ranking second, with Tether leading at 186 billion. Invest in seamless cross-chain operation, simplifying complexity and optimizing development tools.

MarketWhisper·01-30 07:33

Vitalik finalizes Ethereum's ultimate goal! No developer intervention needed for operation, the stablecoin revolution is imminent

Vitalik envisions 2026: Ethereum aims to achieve "protocol finality" that can operate autonomously without developer intervention through "letting go of testing." Seven major tasks are proposed, including quantum resistance, scalability, state management, account abstraction, and more. Criticizing decentralized stablecoins, it is necessary to address issues such as dollar dependence, oracle security, and staking yield conflicts to challenge USDT and USDC.

MarketWhisper·01-30 06:17

New York's 120 billion funding gap exploded! Former Mayor Adams meme coin involved killing 60% of traders

The new mayor, Mamdani, announced a $12 billion funding gap for the two fiscal years, and Adams refuted the denial of leaving $8 billion in reserves. The background of the controversy is that Adams launched the NYC meme coin in January, and the market value collapsed from 600 to 10, and the deployer withdrew 250 USDC from the high, with 60% of the 4,300 people losing money and 15 people losing more than 10 million.

USDC-0.03%

MarketWhisper·01-30 03:06

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-29 15:30

Major Capital Withdrawal from the Cryptocurrency Market! Stablecoin Market Cap Plummets, Bitcoin's Rebound May Not Last?

The cryptocurrency market is facing warning signs of shrinking stablecoin supply, with the market caps of USDT and USDC falling to new lows, reflecting a trend of traders withdrawing funds. USDC is under greater pressure, with its market cap decreasing by over $4 billion, indicating that investors are choosing to cash out directly rather than stay in the market, which could impact the market's rebound strength.

USDC-0.03%

区块客·01-29 11:11

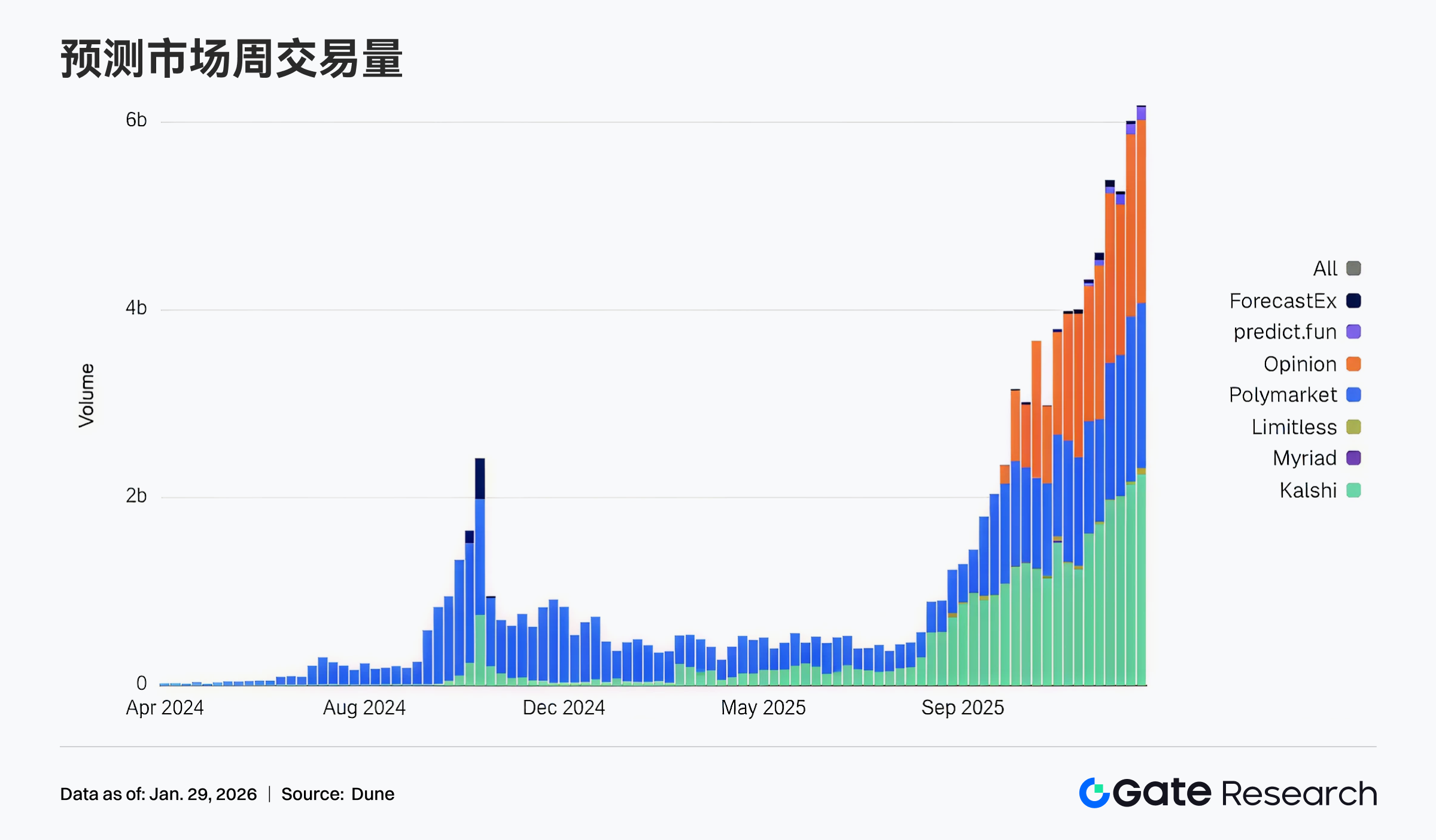

Gate Research Institute: Ethereum-led Tokenization of Commodities Issuance | Prediction Market Trading Volume Reaches New High

Summary

BTC and ETH experienced a rebound after a sharp rise and subsequent correction; funds are leaning towards defensive assets, flowing into tokenized commodities/gold, payments, privacy, and DID among stable altcoin sectors.

Ethereum leads the issuance of tokenized commodities, accounting for 85% of the share.

Long-term holders are accelerating their reduction of positions, with Bitcoin facing the strongest selling pressure since August.

Market trading volume hits a record high, becoming the on-chain "expectation pricing layer."

Polymarket drives a surge in USDC usage, Mizuho upgrades Circle's rating and is optimistic about growth resilience.

SUI will unlock approximately $60.94 million worth of tokens in the next 7 days, representing 11% of the circulating supply.

Market Analysis

Market Commentary

BTC Market — Over the past week, BTC quickly bottomed near $86,100 and rebounded to around $91,200.

GateResearch·01-29 06:23

USDC Use in Polymarket Drives Fresh Optimism for Circle Stock

_Rising prediction market volumes are strengthening demand and improving revenue outlook for Circle’s stablecoin business._

Growing use of USDC on crypto prediction markets is improving sentiment around Circle Internet Group’s stock. Analyst commentary suggests rising activity on Polymarket

USDC-0.03%

LiveBTCNews·01-29 03:30

Fidelity Investments will launch an Ethereum-based stablecoin "FIDD" in February... officially competing with USDT and USDC

Fidelity Investments will launch an Ethereum-based stablecoin "FIDD" in February, targeting both institutional and retail investors, potentially competing with USDC and USDT in the market. This move is based on new regulatory legislation, and Fidelity aims to improve payment efficiency and introduce new financial products. The launch of this token will impact the stablecoin market structure, particularly by lowering the barriers for institutional investment.

TechubNews·01-28 17:41

Flare Rolls Out FXRP/USDH, Edging Closer to an “XRP Standard” on Hyperliquid

Flare announced today that it has added an FXRP/USDH spot market to Hyperliquid, a move designed to deepen XRP liquidity and broaden the token’s utility inside one of DeFi’s fastest-growing on-chain order-book ecosystems. The FXRP/USDH pair follows the earlier rollout of FXRP/USDC and is part of Fla

BlockChainReporter·01-28 14:04

Major Capital Withdrawal from the Cryptocurrency Market! Stablecoin Market Cap Plummets, Bitcoin's Rebound May Not Last?

The cryptocurrency market is facing warning signs of shrinking stablecoin supply, with the market caps of USDT and USDC falling to new lows, reflecting a trend of traders withdrawing funds. USDC is under greater pressure, with its market cap decreasing by over $4 billion, indicating that investors are choosing to cash out directly rather than stay in the market, which could impact the market's rebound strength.

USDC-0.03%

区块客·01-28 11:10

Circle’s USDC Under Pressure Following Tether’s USAT Debut - Coinspeaker

Key Notes

Tether launches USAT, targeting the US regulated stablecoin market.

Circle’s USDC remains widely used, with Ethereum transfers hitting record highs.

Bitwise deepens USDC exposure via DeFi lending on the Morpho.

Tether launched its U.S.-regulated stablecoin, USAT, on Jan. 27,

Coinspeaker·01-28 08:24

[Stable Flow] Inflows to Solana and infrastructure, large-scale outflows from Ethereum and centralized exchanges

In the past week, there has been a significant change in stablecoin capital flows, with large-scale outflows from centralized exchanges and Ethereum, while Solana and the infrastructure sector experienced capital inflows. Infrastructure saw a net increase of $251.7 million, and centralized exchanges experienced a net outflow of $1.9 billion. Additionally, Solana became the leader in supply growth, with stablecoins like USD1 and USDY performing strongly, while USDC faced a net outflow of $2.6 billion.

TechubNews·01-28 07:56

Tether launches "Made in USA" stablecoin USAT! Aiming for a market capitalization of $1 trillion within 5 years

Tether announces entry into the US market with the launch of a dollar stablecoin called "USAT," competing with rival Circle's USDC. USAT fully complies with US regulatory frameworks, issued by Anchorage Digital Bank, and is federally supervised. Tether aims to leverage its financial strength to boost USAT's market capitalization to 1 trillion dollars within five years and attract institutional investors with high transparency.

USDC-0.03%

区块客·01-28 05:53

Tether Goes Domestic: USA₮ Launch Ignites Federal Stablecoin Wars

In a landmark move that reshapes the American digital asset landscape, Tether has officially launched USA₮, the first federally regulated, dollar-backed stablecoin built explicitly for the U.S. market under the new GENIUS Act framework.

Issued by the nationally chartered Anchorage Digital Bank, USA₮ represents Tether's strategic pivot to reclaim and dominate the onshore U.S. market, directly challenging Circle's USDC. This launch marks the end of the "Wild West" era for stablecoins in Ame

CryptopulseElite·01-28 03:37

SwapNet Exploit Drains $16.8M After Approval Flaw on Matcha Meta

The SwapNet exploit led to a loss of $16.8 million, primarily affecting users without one-time approval protections. The attacker exchanged USDC for ether and bridged assets to Ethereum, raising concerns about persistent token permissions in DeFi.

CoincuInsights·01-26 14:19

Trump-Backed USD1 Breaks Into the Top Five Stablecoins

USD1, a stablecoin by World Liberty Financial, has reached nearly $5 billion market cap, becoming the fifth-largest stablecoin. Its rise, driven by treasury investments, faces criticism over governance issues and transparency while still lagging behind major players like Tether and USDC.

ICOHOIDER·01-26 12:04

Digitap ($TAP) Projected to Hit $1 After Solana Deposits Go Live: Best Crypto to Buy in 2026

Digitap ($TAP) has entered a new phase of its rollout with Solana deposits now officially live on the platform. The update allows users to fund their Digitap wallets using SOL, USDT, and USDC on Solana, unlocking faster settlement times and lower transaction costs across the app. This

CaptainAltcoin·01-26 11:05

Where is the true battleground for stablecoin issuance: compliance, liquidity, or distribution?

Written by: Chuk (Former Paxos Employee)

Translated by: Dingdang (@XiaMiPP)

Introduction: Everyone is issuing stablecoins

Stablecoins are evolving into application-level financial infrastructure. After the enactment of the GENIUS Act and clearer regulatory frameworks, brands like Western Union, Klarna, Sony Bank, and Fiserv are shifting from "integrating USDC" to "launching their own USD through white-label issuance partners."

The driving force behind this shift is the explosive growth of "issuance-as-a-service" platforms. A few years ago, Paxos was almost the only preferred option in the market; now, depending on the project type, there are more than 10 feasible pathways, including

TechubNews·01-26 10:00

Is the crypto world "sitting at the same table" with traditional finance?

Original Author: Mankun Brand Department

Editor's Note:

In this issue of the Little Tavern, against the backdrop of a quiet market, we focus on three major signals:

Circle obtaining a US banking license

Visa announcing support for USDC settlement

SEC shifting attitude to promote crypto user education.

This is not the traditional financial sector “taking over” the crypto world, but rather an active and in-depth process of compliance integration and differentiation. Traditional financial giants are entering the crypto space through compliance channels, while crypto-native forces are exploring different survival paths.

Whether you are an industry trend observer, a builder seeking opportunities, or a cautious investor, this issue’s guests will clarify the connections and clashes between the crypto industry and traditional sectors from legal, financial, tax, and frontline risk perspectives, providing highly valuable insights.

Meg from McGraw: The topics in the Little Tavern are quite relaxed, a change from the usual perception of lawyers being “serious”.

PANews·01-26 08:05

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, reaching a record high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-25 08:20

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Language Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, setting a new all-time high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-24 08:15

New Wallet FOMOs into ASTER: 5x Leveraged Long on Hyperliquid

A trader entered the market with $2.44 million in USDC and shifted from a cautious buy to a high-risk leveraged long position on ASTER. FOMO influenced his decision-making, leading to greater risks and potential losses. The essay discusses the pitfalls of emotional trading, the importance of discipline, and the current challenges faced by ASTER in a competitive market.

Coinfomania·01-23 10:08

Coinbase Introduces Staked Ethereum Loans, Allowing Users to Borrow Up to $1 Million

Coinbase has introduced a borrowing feature for U.S. users, allowing them to borrow up to $1 million in USDC against staked ETH using cbETH as collateral, maintaining exposure to ETH and earning staking rewards. However, loans must be carefully managed to avoid liquidation risks.

TheNewsCrypto·01-23 09:24

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, reaching a record high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-23 08:15

Capital One to Acquire Fintech Company Brex for $5.15 Billion

In brief

Capital One plans to acquire Brex in a $5.15 billion stock-and-cash transaction.

In September, Brex unveiled plans to launch native stablecoin payments, starting with USDC.

The acquisition is expected to close in mid-2026, subject to regulatory approval.

Capital One said

USDC-0.03%

Decrypt·01-23 01:30

Stablecoin Market Cap Hits New Peak as Broader Crypto Market Struggles

In brief

Stablecoin supply hit a new all-time high above $311 billion this week, led by USDT and USDC, even as Bitcoin slid below $90K.

Crypto volatility spiked, with $592.4M in liquidations in 24 hours, including $230M in Ethereum and $204M in Bitcoin, signaling a rise in risk

Decrypt·01-22 13:05

Bitcoin, USDC, and APIs Redefined Crypto Payments in 2025, Says Report

Bitcoin reclaimed top payment asset at 22.1%, with Lightning leading usage; Litecoin and TRX followed in 2025.

Stablecoin use shifted as USDC orders surged 1,264%, dominating payouts and accounting for 44.2% of stablecoin payments.

Merchants increasingly settled in crypto, with 37.5%

CryptoFrontNews·01-22 10:36

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, reaching a record high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-22 08:10

CoinGate Data Shows Broadening Use Beyond Bitcoin in Crypto Payments

_Merchants increasingly use Bitcoin and USDC as operational capital, signaling crypto’s move beyond checkout into core finance._

Crypto payment activity in 2025 showed a shift in how merchants handle digital assets. Data from CoinGate shows that crypto is used less as a payment option and more a

LiveBTCNews·01-22 06:30

Solana Surpasses $1T Stablecoin Volume in 2025

In 2025, Solana processed over $1 trillion in stablecoin transactions, showcasing its evolution into a leading payments network. The increase in USDC liquidity, rapid transaction speeds, and developer tools have facilitated its adoption for real-world financial applications, despite fluctuations in stablecoin TVL.

Coinfomania·01-21 08:35

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Language Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, setting a new all-time high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-21 08:05

Delphi Digital 2026 Top 10 Predictions: AI Agents Autonomous Trading, Perp DEX Becomes the New Wall Street

Delphi Digital releases the 2026 Outlook Report, presenting ten key predictions. The report states that AI agents will achieve autonomous trading through x402 and ERC-8004 protocols, perpetual contract decentralized exchanges will disrupt traditional finance and become the new Wall Street, the market is expected to upgrade to first-class derivatives, and the ecosystem will regain stablecoin yields from USDC issuers.

MarketWhisper·01-21 02:42

Last night's and this morning's important news (January 20 - January 21)

Aave total loan issuance approaches $1 trillion

According to official disclosures from Aave, as of January 2026, the decentralized lending protocol Aave has issued a total of nearly $1 trillion in loans since its launch in 2020.

A whale address leverages shorted 6 times in 5 days, earning over $15 million

According to Lookonchain tracking, address 0xD835 deposited $3 million USDC into Hyperliquid five days ago, then fully leveraged shorted and continued to add positions. As the market declined, unrealized gains soared to $15.35 million, with total assets increasing to $18.35 million. Currently, its holdings include 1,667 BTC (approximately $148 million), 45,523 ETH (approximately $135 million), 929,000 HYPE, and 824 XMR, with a total market value exceeding $300 million.

Noble will be delisted from C

PANews·01-21 02:31

K33 Launches Crypto-Backed USDC Loans in Nordic Region

K33 has launched crypto-backed loans, allowing clients to borrow USDC using Bitcoin or other digital assets as collateral, enhancing liquidity access while maintaining long-term exposure. The initial rollout targets eligible clients to ensure compliance with regulatory standards.

CryptoFrontNews·01-20 20:41

Bermuda Joins Coinbase and Circle to Create a Fully On-Chain Economy

Introduction

The Bermudian government is advancing a bold plan to anchor a fully on-chain national economy, leveraging digital asset infrastructure in partnership with Coinbase and Circle. Presented at the World Economic Forum in Davos, the initiative would deploy the USDC stablecoin and Coinbase’

ON-0.09%

CryptoBreaking·01-20 20:35

Bermuda Partners With Coinbase, Circle for Onchain Economy

Bermuda will pilot USDC payments across government agencies to cut costs and improve access without mandating adoption.

Coinbase and Circle provide infrastructure, onboarding, and education under Bermuda’s early digital asset laws.

The plan builds on prior USDC pilots and will scale at th

CryptoFrontNews·01-20 13:06

FRNT USDC Swap Boosts Solana’s Stablecoin Infrastructure

Kraken will enable users to swap USD Coin for the government-backed Frontier Stable Token on the Solana blockchain starting January 21, 2026. This integration boosts Solana's role in digital payments and enhances trust in cryptocurrencies, potentially leading to broader adoption.

Coinfomania·01-20 12:22

Bermuda Turns to Stablecoins to Modernize Public Finance

_Bermuda partners with Coinbase and Circle to pilot stablecoin payments, expand USDC adoption, and build a fully onchain public finance system._

The Government of Bermuda has announced a landmark partnership with Coinbase and Circle to modernize its public finance system. The initiative is

PUBLIC-0.32%

LiveBTCNews·01-20 11:05

Algorand Enables USDC Bridging From Solana, Ethereum, Base, Sui, and Stellar

Allbridge Core now supports native USDC bridging to Algorand from Solana, Ethereum, Base, Sui, and Stellar.

Algorand USDC transfers require an ASA opt-in and a small ALGO balance, usually around 0.1 ALGO per asset.

Allbridge Core has added Algorand to its cross-chain bridge network,

CryptoNewsFlash·01-20 09:46

BlackRock and Visa double down on stablecoins, what are smart money seeing?

Author | Cathy, Plain Language Blockchain

In January 2026, the total market capitalization of the global stablecoin market surpassed $317 billion, setting a new all-time high.

But what’s truly worth paying attention to is not the number itself, but the trend behind it: Circle’s USDC surged 73% in 2025, outpacing Tether’s USDT (36%) for the second consecutive year. In December 2025, Visa announced the launch of USDC settlement services in the United States.

As the world’s largest payment network begins settling with stablecoins, BlackRock, which manages $10 trillion in assets, issues on-chain currency funds, and JPMorgan settles $3 billion daily via blockchain—what exactly are these traditional financial giants seeing?

01. Why Are Traditional Financial Giants Going All In on the Chain?

2024

区块客·01-20 08:05

Magic Eden Bets Big: 15% Revenue for Buybacks & Staking Rewards Explained

Magic Eden, the leading multi-chain NFT marketplace, has announced a major overhaul of its tokenomics, pledging to allocate 15% of all platform revenue to a dual-mechanism rewards program starting February 1.

This groundbreaking initiative will see half of the allocated sum used for strategic buybacks of its native \$ME token on the open market, while the other half will be distributed as USDC rewards to long-term \$ME stakers. This move, a significant expansion from its previous marketpl

ME3.1%

CryptopulseElite·01-20 03:23

Bermuda aims to build a "full on-chain national economy" cooperation Coinbase, Circle: taxes and payment fees settled entirely with USDC

Bermuda collaborates with Coinbase and Circle to plan the full migration of taxation, payments, and public services to the blockchain, with USDC becoming the official payment core. This all-on-chain economic system aims to reduce transaction costs, increase transparency and liquidity, promote digital financial education, and enhance residents' risk awareness. If successful, Bermuda will become a national brand that attracts external capital.

USDC-0.03%

動區BlockTempo·01-20 02:30

Bermuda Joins Coinbase and Circle to Create a Fully On-Chain Economy

Introduction

The Bermudian government is advancing a bold plan to anchor a fully on-chain national economy, leveraging digital asset infrastructure in partnership with Coinbase and Circle. Presented at the World Economic Forum in Davos, the initiative would deploy the USDC stablecoin and Coinbase’

ON-0.09%

CryptoBreaking·01-19 20:30

Load More