Search results for "WBTC"

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-31 15:35

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-30 15:35

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-29 15:30

World Liberty Fi Shifts Strategy: Moves Away From WBTC and Doubles Down on Ethereum and USD1

The DeFi investment fund World Liberty Fi is continuing a major restructuring of its portfolio. Recent on-chain data show that the project is systematically reducing its exposure to Wrapped Bitcoin (WBTC) and reallocating capital into Ethereum, which it views as a more flexible and yield-efficient a

Moon5labs·01-07 22:59

WLFI Traders Swap $15M WBTC for ETH Amid Insider Alerts

WLFI executed $15M WBTC-ETH swaps, showing high-frequency, algorithm-driven DeFi trading loops.

Polymarket wallets bet on Maduro leaving office before news, suggesting potential insider trading.

ENS domains linked to WLFI co-founder hint at possible privileged information influencing trad

CryptoFrontNews·01-07 14:41

Whale Moves Another $24.6 Million of ETH to WBTC, Sparks Ether’s Uncertainty Amid Unlocking DeFi ...

Today, an Ethereum whale attracted attention among crypto market participants following his decision to convert 7,828 ETH worth $24.6 million into 269 WBTC (Wrapped Bitcoin). Today’s move follows the investor’s action (yesterday) to exchange another 14,145 ETH (valued at $44.3 million) into 492 WBTC

BlockChainReporter·01-05 09:03

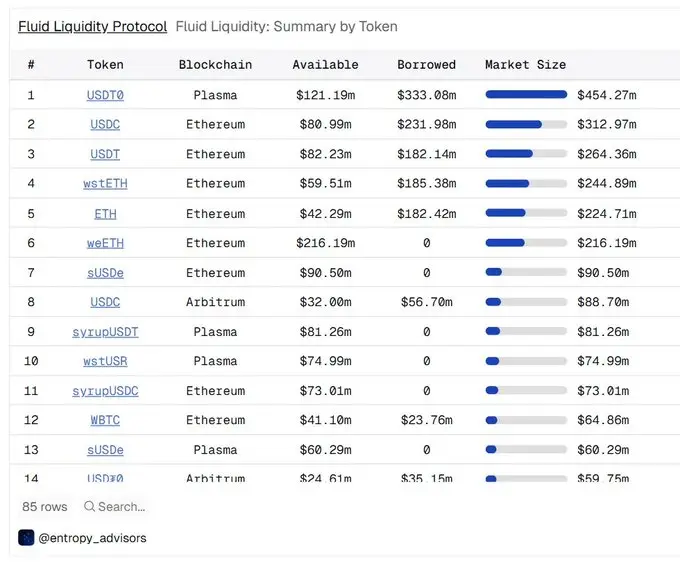

A High-Leverage Stablecoin Arbitrage Tool? Detailed Analysis of Fluid's 39x Leverage Strategy and the Dual Nature of Its "Low Liquidation Penalty"

Fluid is an interesting, hard-to-understand, and highly controversial DeFi protocol. As a "new" DeFi protocol launched in 2024, its peak TVL exceeded $2.6 billion, and it currently still holds $1.785 billion in TVL.

In the past 30 days, its trading volume reached $16.591 billion, accounting for 43.68% of Uniswap's trading volume on the ETH mainnet. This is quite an impressive achievement.

Fluid combines lending and DEX, accepting LPs (such as ETH/wBTC) as collateral. While being used as collateral, LPs can still earn fees. Fluid calls this Smart Collateral.

Well, it doesn't seem all that extraordinary.

Image by Nano Banana Pro - Gemini

PANews·2025-12-08 10:07

Babylon's Trustless Vaults will add native Bitcoin collateralized lending through Aave.

Although the BTC-backed lending market has grown to a scale of billions of dollars, most of this activity relies on custodial models. Against the backdrop of decentralized finance (DeFi) long depending on wrapped Bitcoin (WBTC) and custodial intermediaries, the collaboration between Bitcoin staking project Babylon and Aave is bringing a breakthrough advancement to DeFi: native Bitcoin (Native BTC) can be used directly as lending collateral. This integration will be supported by Babylon's Trustless Vaults and will be officially enabled in the upcoming V4 version of Aave, meaning DeFi is expected to connect with real Bitcoin liquidity on a large scale for the first time.

Moving away from wrapped assets: Aave to support native Bitcoin collateral

In the past, the way for BTC to enter the DeFi market was extremely

ChainNewsAbmedia·2025-12-03 14:33

An Address deposited 5000 coins ETH to Binance, with a total deposit of over 13,400 coins in the past two weeks.

According to Mars Finance news, an on-chain analyst Ai Yi monitored that an address that built a position in WBTC at a low price four years ago and took profit at a high this year deposited 5000 ETH to Binance 10 hours ago, worth about 15.36 million USD. In the past two weeks, this address has accumulated deposits of 13,403.28 ETH to the exchange, with a total value of 41.06 million USD. Currently, the address still holds 15,000 ETH and interacts with an address associated with Galaxy Digital, but the wallet's vesting cannot be confirmed at this time.

ETH2.07%

MarsBitNews·2025-11-29 02:57

A certain Address deposited 5000 coins ETH Flap to assist with fire rescue in Hong Kong.

Headline

▌A certain address deposited 5000 ETH to Binance, with a total deposit exceeding 13,400 ETH in the past two weeks.

According to on-chain analyst Ai Yi's monitoring, an address that had built a low-cost position in WBTC four years ago and took profits at a high this year has deposited 5,000 ETH to Binance 10 hours ago, worth approximately $15.36 million.

ETH2.07%

金色财经_·2025-11-29 02:45

A Whale is going long on WBTC with an average price of 85376.5 USD.

According to Mars Finance, on-chain analyst Ai Yi (@ai 9684xtpa) monitored that a certain Whale investor (Wallet Address 0xaFA...f7731) withdrew 150 WBTC from Binance today, and then staked it on the Aave platform to borrow 6 million USDC, suspected of buying 150 WBTC again. Currently, the investor has accumulated long positions in WBTC worth 25.75 million USD, with an average entry price of 85376.5 USD.

WBTC1.6%

MarsBitNews·2025-11-23 04:47

Data: 50 WBTC transferred to Binance, worth approximately 4.1886 million USD.

According to Huoxing Finance, data from Arkham shows that at 21:18, 49.99563407 WBTC (worth approximately 4188584.23 USD) was transferred from an anonymous address (starting with 0x481c...) to Binance.

WBTC1.6%

MarsBitNews·2025-11-22 14:23

Data: 60 WBTC transferred from an anonymous Address, then routed to another anonymous Address.

According to Mars Finance, data from Arkham shows that at 09:01, 60 WBTC (worth approximately 5.08 million USD) were transferred from an anonymous address (starting with 0xCa3a...) to another anonymous address (starting with 0x1E53...). Subsequently, that address transferred 35 WBTC to another anonymous address (starting with 0x9258...).

WBTC1.6%

MarsBitNews·2025-11-22 01:51

An address sold about 99 WBTC on-chain in the past 10 hours, earning a profit of 7.32 million USD.

According to Mars Finance news, on-chain analyst Ai Yi monitored that Address 0x3A2...bED2a bought 577.17 WBTC at a low price of $16,933.54, spending $9.77 million; in the past 10 hours, he sold 99.2938 of them on-chain ($8.995 million), making a profit of $7.32 million, and currently, there are still 350.7 WBTC ($32.12 million) on-chain.

WBTC1.6%

MarsBitNews·2025-11-19 14:36

Hedera integrates WBTC to unlock Bitcoin DeFi for users

Wrapped Bitcoin (WBTC) has launched on Hedera, enhancing decentralized finance options for Bitcoin holders. This integration, supported by BitGo and LayerZero, aims to attract institutional-grade liquidity and improve Hedera's traction in the DeFi space.

Cryptonews·2025-11-13 23:06

WBTC expands to Hedera as Bitcoin liquidity flows into new DeFi rails

Wrapped Bitcoin (WBTC) has integrated with the Hedera network, enhancing DeFi opportunities for Bitcoin holders by providing additional liquidity. This move could foster greater usage of Bitcoin in lending and trading without losing exposure to the asset.

Cointelegraph·2025-11-13 21:15

A certain Whale made a Heavy Position purchase of WBTC for 20 million USD, with an average price of 109,219 USD.

According to Mars Finance news, on-chain analyst Ai Yi (@ai\_9684xtpa) monitored that address 0x6e1...90733 purchased 183.12 WBTC at an average price of $109,219 in the past hour, with a total value of approximately $20 million. This address previously profited about $651,000 through swing trading of WBTC in July.

WBTC1.6%

MarsBitNews·2025-10-21 08:35

A whale was liquidated for 1.45 million dollars on Aave, as BTC fell below the 104,000 dollar mark.

According to Mars Finance, market news reports that a whale wallet with the address 0x19c4…d26a had its long positions of WBTC, ETH, and LINK on the Aave platform forcibly liquidated, with a total liquidation amount of approximately $1.45 million.

MarsBitNews·2025-10-17 11:04

Alameda Transfers 250 BTC Days After Receiving 500 BTC via WBTC Unwrap

Sister company of bankrupt crypto exchange FTX, Alameda Research, transferred 250 BTC to Binance earlier today, valued at $30.6 million

The transaction was flagged by

BitcoinInsider·2025-10-04 03:50

WBTC Strengthens Its Role As Multichain Standard for Bitcoin in DeFi

Wrapped Bitcoin (WBTC) is expanding its integration across various blockchain networks to enhance cross-chain functionality and usage in the DeFi ecosystem, representing about USD 14.5 billion in market cap while maintaining high custody standards.

CaptainAltcoin·2025-09-29 12:05

Solana on-chain WBTC supply hits an all-time high, with market capitalization surpassing 1.03 billion USD for the first time.

According to Mars Finance, SolanaFloor has reported that the supply of WBTC on the Solana chain has reached 9,270 pieces, setting a new historical high, and its on-chain market capitalization has first surpassed 1.03 billion USD.

WBTC1.6%

MarsBitNews·2025-09-26 13:19

How to Earn with USDT & WBTC on Kava

@kava gives you real ways to put your stablecoins and Bitcoin to work. With native support for USDT (via Tether) and WBTC (via BitGo), you can earn yield directly inside the Kava DeFi ecosystem—no complex wrappers or bridges required.

1. Lending with Kava Lend v2

The main way to earn on USDT and WB

MasteringCrypto·2025-09-04 05:50

Whale selling 16 million USD ETH to Bitcoin, but ETH/BTC support remains stable.

Recently, the market has shown signs of capital rotation, with a Whale exchanging Ethereum (ETH) worth $16 million for Wrapped Bitcoin (WBTC). Some institutional investors have also withdrawn ETH worth $38 million. However, despite the rising dumping pressure, the ETH/BTC Exchange Rate has still maintained the key support level of 0.037, indicating that the structural strength of Ethereum has not yet been broken.

MarketWhisper·2025-08-21 02:05

ETH Market Volatility: Market Game Under the Interweaving of Institutional Layout and Technical Indicators

Event Review 🎯

In recent days, the ETH market has experienced significant fluctuations: in just 12 minutes, the price rapidly rose from $4227 to $4322, an increase of 2.25%. Subsequently, the market oscillated at high levels, with prices hovering between $4305 and $4309, eventually retreating to $4286.09. During this wave of volatility, the frequent intervention of institutional funds and multiple signals from technical indicators intertwined, outlining a complex picture of both short-term reversals and medium-term pressures in the market.

Timeline ⏰

17:13: The market has first revealed the risk of liquidation, with some analyses pointing out that the liquidation amount of high-leverage long positions in ETH is approaching 500 million USD, indicating that risks are accumulating.

17:17: On-chain data records show that whale funds have quietly intervened—large holders have withdrawn a significant amount of WBTC and ETH from trading platforms, reflecting signs of bottom fishing.

17:27: The sharp trader starts to enter

ETH2.07%

AICoinOfficial·2025-08-18 10:22

From Value Storage to Capital Operation: Analyzing BTC on-chain Finance

In recent years, the crypto market has gradually entered the era of "asset efficiency" and "on-chain yields," with Ethereum's staking economy and liquid staking token ecosystem maturing, while Bitcoin is still in the early stages of on-chain capital efficiency. Although Bitcoin is regarded as "digital gold," its lack of composability and yield capability makes BTC high in long-term value but low in utilization. The increasing demand for BTC liquidity innovation in the Asian market has prompted projects such as WBTC, Babylon, and Lombard to explore the yields and composability of BTC, driving its transformation into on-chain assets. The overall trend points to a future development of diversification, low risk, and cross-chain.

BTC1.58%

金色财经_·2025-08-18 02:20

A wallet address associated with WLFI has purchased 1.911 ETH and 84.5 WBTC.

On August 16, an address related to WLFI used $18.6 million USDC to buy 1,911 ETH and 84.5 WBTC. The transaction highlights strong interest in ETH and WBTC amidst their rising values, reflecting growing activities by large investors, impacting market liquidity and volatility.

TapChiBitcoin·2025-08-16 03:31

Coinbase Wrapped Bitcoin Sees Unusual 6,887% Transaction Surge: Details

Coinbase's Wrapped Bitcoin (WBTC) experienced a remarkable 6,887% surge in large transaction volume, suggesting increased whale activity and interest. As institutional demand for Bitcoin rises, the market anticipates regulatory changes that could expand investment options in retirement plans.

WBTC1.6%

UToday·2025-08-07 15:04

Volo Unveils wBTC Vault to Boost Bitcoin DeFi on Sui

The vault provides smooth, high-yield DeFi strategies with one-click accessible on Sui by using wBTC.

With the growing popularity of Bitcoin-backed financing, Volo’s cutting-edge vaults let customers make the most of wBTC.

The launch of Volo wBTC Vault, a DeFi product intended to unlock the Bitco

TheNewsCrypto·2025-08-06 16:30

Gate Daily: Bitcoin retraces to 117,000, depeg from Ethereum; Strategy hints at possible accumulation this week; Trump signs the GENIUS Act, establishing history.

Bitcoin (BTC) has retraced from last week's high, currently reporting around $117,110 in the Asian morning session today (21), with long positions sentiment clearly declining. U.S. President Trump approved the GENIUS Act to boost crypto assets buying interest, and Michael Saylor has once again released Strategy Bitcoin Holdings tracking information, which may disclose accumulation data this week. Four years ago, whales built positions and sold WBTC, while several whales are starting to accumulate Ethereum (ETH).

MarketWhisper·2025-07-21 00:55

Over $40 million stolen, the story of GMX's precise ambush.

Original | Odaily Daily Report (@OdailyChina)

Author | Asher (@Asher\_ 0210 )

Last night, the leading on-chain DeFi protocol GMX platform encountered a major security incident, with over $40 million in cryptocurrency assets stolen by hackers, involving various mainstream tokens such as WBTC, WETH, UNI, FRAX, LINK, USDC, and USDT. After the incident, Bithumb issued an announcement stating that GMX's deposit and withdrawal services would be suspended until the network stabilizes.

Due to this theft incident

GMX7.07%

星球日报·2025-07-10 00:46

Wrapped Bitcoin On TRON Deemphasized Amid Transparency Issues

Wrapped Bitcoin (WBTC) on the TRON blockchain remains underused, with about 100 BTC backing it. Transparency has declined, and involvement from Justin Sun and BiT Global hasn't led to growth. Recent data analytics are missing, leaving the product's future uncertain.

BITNEWSBOT·2025-06-19 18:09

Top 4 AI Crypto Trading Bots Reviewed in 2025 for DeFi Profitability and User Experience

Both BBSOL and WBTC posted solid price gains of over 3%, driven by surging trading volumes

AB Token's explosive 513.70% volume spike and rapid recovery from intraday volatility point to heightened market interest, possibly driven.

MetaVerse-M shows quiet price gains with almost no volume,

DEFI-2.97%

CryptoNewsLand·2025-06-16 23:43

The crisis in the altcoin that had a big problem with Coinbase has been resolved: They reached an agreement!

The legal dispute between Coinbase and BiT Global, resulting from the delisting of BiT Global's Wrapped Bitcoin (wBTC) token from the Coinbase platform, has been resolved with the parties reaching a settlement.

BiT Global has "definitively" withdrawn the lawsuit it filed in the Northern District Court of California. This means that the case

Bitcoinsistemi·2025-06-08 00:25

Aptos Hosts $400M in BTC Assets as BTCfi Growth Accelerates with Key Integrations from OKX, Echo, and Aries

On June 4, Aptos confirmed a major milestone in its BTCfi ecosystem, now hosting nearly $400 million in BTC assets. This surge follows the integration of key protocols like Echo Protocol’s aBTC, OKX’s xBTC, Aries Markets’ WBTC, and Echelon Market’s SBTCZ. Aptos shared the growth details via X,

Coinfomania·2025-06-03 22:03

Whale sold WBTC and then made a large purchase of AAVE, accumulating an unrealized gains of over 26 million USD.

A whale/institutional investor sold WBTC through Wintermute OTC and then purchased AAVE, with a total investment of over 30 million USD to buy 224,010 AAVE, resulting in unrealized gains of approximately 26.32 million USD.

DeepFlowTech·2025-05-24 06:14

CoinVoice has recently learned that, according to on-chain analyst Yu Jin's monitoring, the Trump family's encryption project WLFI currently holds 12 types of tokens including ETH, WBTC, TRX, LINK, AAVE, ENA, MOVE, ONDO, SEI, AVAX, MNT, and EOS. The total investment in this portfolio is 347 million USD, with a current total value of 291 million USD, resulting in unrealized losses of 53.07 million USD and a decline of 15%.

CoinVoice·2025-05-16 11:39

According to Deep Tide TechFlow news, on May 16, on-chain analyst Yu Jin monitored that the Trump family's crypto project WLFI currently holds a portfolio of 12 tokens including ETH, WBTC, TRX, LINK, AAVE, ENA, MOVE, ONDO, SEI, AVAX, MNT, and EOS. The total investment in this portfolio is 347 million dollars, and the current total value is 291 million dollars, resulting in unrealized losses of 53.07 million dollars, with a fall of 15%.

DeepFlowTech·2025-05-16 08:29

According to Techub News, as monitored by Yu Jin, the Trump family’s cryptocurrency project World Liberty Financial (WLFI) has spent a total of 347 million USDT to purchase 12 types of tokens including ETH, WBTC, TRX, LINK, AAVE, ENA, MOVE, ONDO, SEI, AVAX, MNT, and EOS, with a current total value of approximately 291 million USD, resulting in unrealized losses of about 53.07 million USD.

TechubNews·2025-05-16 08:22

📉 Trump-backed crypto project down over $53M!

On-chain data reveals that World Liberty Financial (WLFI) has spent $347M USDT to buy 12 tokens including ETH, WBTC, TRX, LINK, AAVE, ENA, MOVE, ONDO, SEI, AVAX, MNT, and EOS.

📉 Current portfolio value: $291M

💸 Unrealized loss: $53.07M

💬 Even Trump’s crypto bet is underwater. This bull market feels... suspiciously sluggish. 🐌

#TRUMP #CryptoLosses #OnchainData

CoinRank·2025-05-16 07:41

The WLFI investment portfolio purchased 12 types of Tokens for a total of 347 million USD, currently with unrealized losses of about 53.07 million USD.

According to Foresight News, as monitored by Yu Jin, as of now, the Trump encryption project World Liberty Financial (WLFI) has spent a total of 347 million USDT to purchase ETH, WBTC, TRX, LINK, AAVE, ENA, MOVE, ONDO, SEI, AVAX, MNT and.

ForesightNews·2025-05-16 07:00

According to Deep Tide TechFlow news on May 14, analyst Yu Jin monitored that a certain Whale Address sold 197.1 WBTC on-chain in the past half hour for 20,444,000 USDT, at a selling price of $103,697. The Whale withdrew 197.1 WBTC from OKX to the on-chain address half an hour ago, then sold it for USDT and transferred the funds back to the OKX exchange.

WBTC1.6%

DeepFlowTech·2025-05-14 22:37

CoinVoice has learned that, according to on-chain analyst Yu Jin's monitoring, a certain Whale Address sold 197.1 WBTC on-chain in the past half hour for 20,444,000 USDT, with a selling price of 103,697 USD.

The Address withdrew 197.1 WBTC to an on-chain Address from OKX half an hour ago, then sold it for USDT and transferred it back to OKX.

WBTC1.6%

CoinVoice·2025-05-14 16:18

CoinVoice has recently learned that, according to on-chain analyst Yu Jin's monitoring, the whale address "silentraven" exchanged 100 WBTC (approximately 10.36 million USD) for 3,855.2 ETH about 1 hour ago.

The address has exchanged a total of 200 WBTC (approximately 20.84 million USD) for 7,913.9 ETH in the past 3 days, with an exchange rate of 0.0252.

CoinVoice·2025-05-14 05:01

According to a report from 深潮 TechFlow on May 14, on-chain analyst 余烬 (@EmberCN) monitored that the whale address "silentraven" exchanged 100 WBTC (approximately 10.36 million USD) for 3,855.2 ETH about 1 hour ago. Over the past 3 days, this address has exchanged a total of 200 WBTC (approximately 20.84 million USD) for 7,913.9 ETH, with an exchange rate of 0.0252.

DeepFlowTech·2025-05-14 04:59

CoinVoice has learned that, according to Onchain Lens monitoring, a whale address starting with 0x454 purchased 4586.79 ETH at a price of 2455 dollars each. The transaction used 67 WBTC (approximately 6.85 million dollars) and 4.41 million dollars of DAI, with a total transaction amount exceeding 11 million dollars.

CoinVoice·2025-05-13 09:25

Data: A certain Whale sold 22,567.63 AAVE for a value of 3.64 million dollars.

According to Mars Finance, monitoring by Onchain Lens shows that the whale address "adorableraccoon.eth" recently sold 22,567.63 AAVE at a unit price of 225.84 USD, obtaining approximately 3.64 million USDS and 14 WBTC (approximately 1.45 million USD). The purchased WBTC was used to repay loans.

AAVE3.48%

MarsBitNews·2025-05-11 08:07

CoinVoice has learned that, according to on-chain analyst Yu Jin's monitoring, the Whale "silentraven" currently has unrealized gains exceeding 10 million by going long on HYPE with 3x leverage. He went long on 801,000 HYPE at a price of $12.9 on April 9, and now the price of HYPE has doubled to $26. His unrealized gains amount to $10.62 million.

Additionally, in the past half hour, he exchanged 100 WBTC for 4071.6 stETH. The exchange rate was 0.0245.

CoinVoice·2025-05-11 03:00

The Whale "silentraven" is currently go long on HYPE with 3x leverage and has unrealized gains of 10.62 million USD.

Whale "silentraven" is using 3x leverage to go long on $HYPE, currently with unrealized gains exceeding 10 million USD. Additionally, he recently exchanged 100 $WBTC for 4071.6 stETH, with an exchange rate of 0.0245.

HYPE10.99%

PANews·2025-05-11 00:51

Load More