Search results for "WETH"

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-31 15:35

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-30 15:35

Hedera DeFi Gets Automated Yield as Bonzo Vaults Enter Beta

Bonzo Vaults offers automated yield strategies via EVM smart contracts that rebalance and auto-compound on the Hedera network.

HBAR, HBARX, USDC, BONZO, SAUCE, DOVU, PACK, and JAM are supported, and wETH/wBTC (ERC-20) is scheduled for support.

Bonzo Finance Labs has introduced Bonzo Vaults,

CryptoNewsFlash·01-29 15:30

February Altseason Watchlist: 4 Risk-On Altcoins Showing 2× Potential Amid Early Accumulation

Early February shows increased accumulation across high-beta altcoins, signaling potential for sharp short-term moves.

XMR, LINK, LEO, WETH, and USDE combine liquidity, ecosystem activity, and volatility, making them market-sensitive.

Price projections of 2× remain speculative,

CryptoNewsLand·01-28 01:31

Ether.fi Card launches the "10% ETH Spending Cashback" promotion, the ultimate U Card for Christmas shopping

Ether.fi Crypto U Card Launches Year-End Second Wave Event "10 Days of ETHmas." The event lasts ten days, inviting friends to join and spend, with both parties earning 10% wETH cashback. ( Please register using the Dynamic Zone link to enjoy the 10% wETH spending cashback.

(Previous update: Ether.fi Card offers 10% spending cashback! Recommend 10 people to compete for VIP membership.)

(Additional background: Ether.fi Card's triple rewards now available: 400,000 ETHFI airdrop, rewards for card spending and deposits.)

Table of Contents

Core benefits of the event

Event schedule (Taiwan time)

Details of Ether.fi ETHmas reward mechanism

Participation eligibility and notes

E

動區BlockTempo·2025-12-13 09:40

Uncovering the $116 million Balancer attack: pinpointing the "rounding function" vulnerability, a fresh warning for DeFi security

Decentralized protocol Balancer confirms that the recent incident, which resulted in the theft of over $116 million worth of assets, was fundamentally caused by a logical error involving rounding in the protocol's internal "upscale" function. The attack affected multiple networks, including Ethereum, Arbitrum, Base, and Polygon, leading to significant losses in assets such as WETH, osETH, and wstETH.

Although the affected StakeWise protocol has successfully recovered approximately $19 million worth of osETH, the security team has immediately paused the impacted liquidity pools and is conducting asset tracing on all suspicious transactions. This highlights the urgent need for cross-chain DeFi governance layers to enhance security response capabilities.

MarketWhisper·2025-11-06 14:13

Balancer Hit By Exploit As $128M Moved From Vaults

Decentralized finance (DeFi) protocol Balancer has lost $128 million after suffering a malicious exploit. On-chain data shows over $128 million in assets withdrawn from the protocol’s vaults

The stolen funds include osETH, WETH, and wstETH, with the exploiter consolidating the stolen assets,

CryptoDaily·2025-11-04 14:14

Balancer DeFi Hack: $116 Million Loss Sparks Panic and Recovery Efforts

Balancer, a veteran DeFi protocol, has been hit by a devastating exploit in its V2 multi-chain pools, resulting in losses exceeding \$116 million, including major assets like WETH, wstETH, osETH, frxETH, rsETH, and rETH across Ethereum, Base, Sonic, Optimism, Arbitrum, and Polygon chains.

CryptopulseElite·2025-11-04 06:39

Balancer was attacked and $129 million was stolen! Berachain validators have urgently shut down and plan to implement a Hard Fork.

The decentralized finance (DeFi) protocol Balancer suffered a major smart contract vulnerability attack on November 3, resulting in losses of over $129 million in crypto assets for investors across multiple chains, including Ethereum, Base, and Berachain. The attacker is in the process of exchanging the stolen liquid staking tokens (LST) in real-time for WETH, and Berachain validators have urgently suspended the network in preparation for a hard fork in hopes of recovering the affected funds.

MarketWhisper·2025-11-04 02:12

5 years, 6 incidents causing over a hundred million in losses, the history of Hacker visits to the old-school DeFi protocol Balancer.

Written by: David, Deep Tide TechFlow

When it rains, it pours; hackers tend to strike when the market is down.

In the recent environment of a sluggish cryptocurrency market, established DeFi protocols have suffered another blow.

On November 3, on-chain data showed that the protocol Balancer was suspected of being hacked. Approximately 70.9 million USD worth of assets were transferred to a new wallet, including 6,850 osETH, 6,590 WETH, and 4,260 wstETH.

Subsequently, according to Lookonchain monitoring relevant wallet addresses, the total loss amount from the protocol attack has risen to 116.6 million dollars.

The Balancer team stated after the event:

"A vulnerability attack that may affect the Balancer v2 pool has been discovered, and its engineering and security teams are treating it as a high priority."

DeepFlowTech·2025-11-03 12:16

Ethereum's tokenization variants: from wrapped tokens to liquid staking tokens

Author: Tanay Ved

Source: Coin Metrics

Compiled by: Shaw Golden Finance

Key points

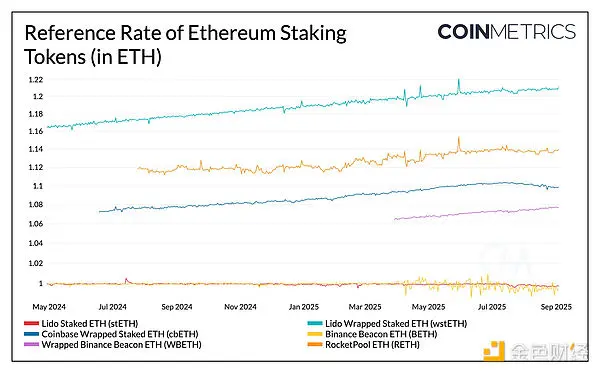

Tokenized versions of ETH (such as WETH, LST, and LRT) enable ERC-20 compatibility, greater interoperability, and higher on-chain capital efficiency.

Approximately 24% of ETH is staked through Lido, and stETH along with its wrapped form wstETH has become a widely used form of DeFi collateral, often employed in looping strategies to enhance yield.

The pricing and reward mechanisms of these tokens vary; some use a rebalancing design, while the wrapped versions appreciate in value as the exchange rate with ETH rises.

As the scale of these assets expands, monitoring the validator queue, secondary market liquidity, and the premium of LST over ETH.

ETH2.4%

TechubNews·2025-09-10 08:52

Ethereum's tokenization variants: from wrapped tokens to liquid staking tokens

Author: Tanay Ved, Source: Coin Metrics, Translated by: Shaw Jinse Finance

Key Points

The tokenized versions of ETH (such as WETH, LST, and LRT) enable ERC-20 compatibility, greater interoperability, and higher on-chain capital efficiency.

Approximately 24% of ETH is staked through Lido, with stETH and its wrapped form wstETH becoming widely used forms of DeFi collateral, often employed in looping strategies to enhance yields.

The pricing and reward mechanisms of these tokens vary, with some adopting a rebalancing design, while the wrapped versions appreciate in value as the exchange rate with ETH rises.

As the scale of these assets expands, monitoring the validator queue, secondary market liquidity, and the premium/discount of LST to ETH will become very important for assessing redemption and liquidity risks.

ETH2.4%

金色财经_·2025-09-10 07:40

Lido launches GG Vault: automated DeFi yields on ETH, WETH, stETH, and wstETH in the Earn tab

On September 3, 2025, Lido activated GG Vault (GGV), a vault that automates the allocation of ETH, WETH, stETH, and wstETH across at least seven protocols (Uniswap, Aave, Euler, Balancer, Gearbox, Fluid, Morpho), centralizing everything in the new Earn tab and reducing the operational

TheCryptonomist·2025-09-04 16:32

Over $40 million stolen, the story of GMX's precise ambush.

Original | Odaily Daily Report (@OdailyChina)

Author | Asher (@Asher\_ 0210 )

Last night, the leading on-chain DeFi protocol GMX platform encountered a major security incident, with over $40 million in cryptocurrency assets stolen by hackers, involving various mainstream tokens such as WBTC, WETH, UNI, FRAX, LINK, USDC, and USDT. After the incident, Bithumb issued an announcement stating that GMX's deposit and withdrawal services would be suspended until the network stabilizes.

Due to this theft incident

GMX5.09%

星球日报·2025-07-10 00:46

New Crypto Listing: Mind of Pepe (MIND) Trending on CoinMarketCap

After a successful presale that raised over $12.7 million in approximately five months, the AI meme coin Mind of Pepe has made its much-anticipated exchange debut.

The MIND/WETH pair went live on Uniswap at 2PM today, Tuesday, and was subsequently listed on CoinMarketCap, where it is now

PEPE1.28%

TheCryptonomist·2025-06-03 19:26

New Uniswap Listing: Viral AI Crypto Mind of Pepe Goes Live

The viral new AI crypto, Mind of Pepe (MIND), is finally live after a stellar presale performance, which raised over $12.7 million in short order

The MIND/WETH pair went live on Uniswap at 2 PM today, on Tuesday,

CryptoDaily·2025-06-03 19:04

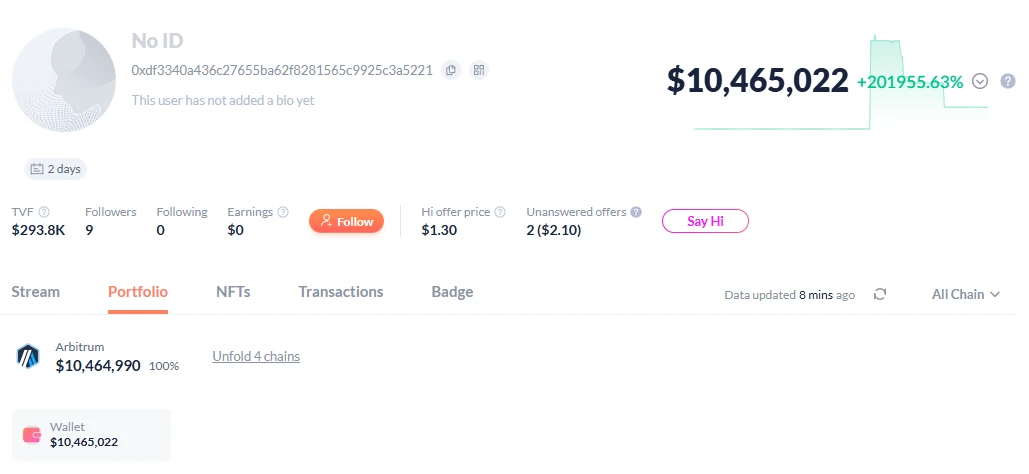

Aave is set to launch the Umbrella system to prevent bad debts from June 5, 2025.

AAVE will launch the Umbrella system on June 5, 2025, allowing users to collateralize aTokens to prevent bad debts in the protocol and receive rewards. Umbrella will replace the previous staking methods, providing more efficient capital utilization. Initially available on Ethereum, Arbitrum, Avalanche, and Base networks supporting assets like USDC, USDT, and WETH. Umbrella system is ready for deployment.

TapChiBitcoin·2025-06-02 19:26

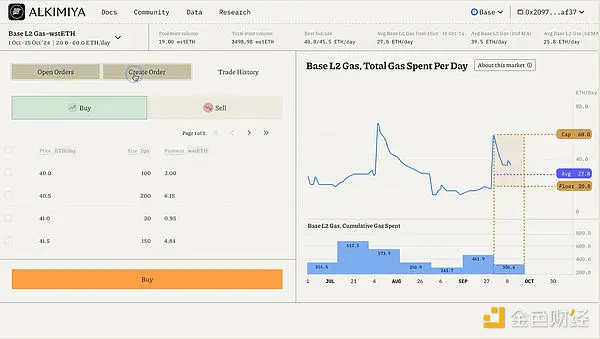

CoinVoice has recently learned that, according to Onchain Lens monitoring, the Address 0xc725...839d recently withdrew 4677.7 WETH (worth approximately 11.52 million USD) from Aave V3, with an average transaction price of 2463 USD.

The address purchased this batch of ETH for 6.8 million USDC one month ago, and this operation realized a profit of 4.717 million USD.

CoinVoice·2025-05-13 01:13

According to Techub News, monitored by Onchain Lens, the address starting with 0xf6b exchanged 2000 WETH for 5.01 million USDC four hours ago.

USDC-0.02%

TechubNews·2025-05-12 02:07

World Liberty Financial Makes Massive $4.94M WETH & WBTC Purchase: Unpacking the Trump Family Crypto Link

, a project reportedly associated with the Trump family, has recently made a substantial acquisition of Wrapped Ethereum (WETH) and Wrapped Bitcoin (WBTC).

Understanding the World Liberty Financial Purchase

According to data shared by on-chain analyst @ai\_9684xtpa on X, World Liberty Financial c

BitcoinWorldMedia·2025-05-09 09:55

Midday News Update #Web3

🍽️ $TRUMP dinner leaderboard locks on May 12 — the 220th spot needs ~3,147 TRUMP to qualify.

🐋 @WLFI\_xyz‑linked wallet just scooped 1,587 $WETH & 9.7 $WBTC within 25 min.

🎁 @binance to airdrop $DOOD to holders of $MUBARAK, $BROCCOLI714, $TST, $BabyDoge, $KOMA.

💼 @Metaplanet\_JP issues $21.25 M zero‑coupon bonds — proceeds go to more #Bitcoin for the treasury.

🎮 CS:GO Skin Index drops 20% in 3 days; several top items have halved in price.

#TRUMP #WLFI

CoinRank·2025-05-09 07:48

According to a report from 深潮 TechFlow, on May 9, on-chain analyst Ai姨 (@ai 9684xtpa) monitored that the Trump family's encryption project WLFI has used associated addresses to purchase 1587 WETH at an average price of 2200 USD in the past 25 minutes, and 9.7 WBTC at an average price of 103,092 USD, totaling approximately 4.94 million USD.

DeepFlowTech·2025-05-09 07:09

New crypto token ZENTRY debuts with WETH pairing on Aerodrome

A new player has entered the decentralized finance space. On May 8, 2025, Aerodrome announced the official launch of the Zentry token ($ZENTRY), now available for trading and liquidity provision against Wrapped Ether ($WETH). This move introduces a project that merges blockchain with gaming,

Coinfomania·2025-05-08 04:52

ASTRA Price Gains Momentum As Astra Pay Launch and Key Levels Drive Market Sentiment

ASTRA defends support at 0.7463 WETH, eyeing breakout at $0.9900 for bullish confirmation. Upcoming Astra Pay launch may boost adoption. Potential surge to $1.8648 and beyond as market anticipates positive catalysts.

ASTRA3.83%

CryptoNewsLand·2025-04-04 22:58

Data: A certain Whale sold 2.18 million USD of LDO and bought AAVE at an average price of 181 USD.

According to Mars Finance news, Onchain Lens monitoring indicates that a Whale has sold 2.25 million LDO (2.18 million USD) in exchange for WETH, and then exchanged it for 12,037 AAVE at a price of 181 USD. The Whale previously bought 3.6 million LDO with 2,234 ETH (7 million USD) and currently has 1.35 million LDO remaining.

MarsBitNews·2025-03-29 08:54

U.S. Government Moves $10.3M in BTC and ETH from Seized Crypto Funds

The U.S. Government transferred 97.34 BTC and 884.3 ETH, valued at $10.3 million, within eight hours after seizing funds from Sae-Heng.

Authorities currently hold 198,439 BTC ($17.28B) and 58,085 ETH ($116M), alongside other assets like WETH, USDC, and SHIB from previous seizures.

The latest trans

CryptoFrontNews·2025-03-28 17:35

MetaMask Introduces a Feature Allowing Users to Pay Gas Fees with Tokens

MetaMask's Gas Station feature allows users to pay gas fees using a selection of tokens, eliminating transaction failures due to insufficient ETH. It currently supports USDT, USDC, DAI, ETH, wETH, wBTC, wstETH, and wSOL. The new system factors in network charges into the quoted price, ensuring a smoother experience. Meanwhile, Ethereum's recent gas limit increase to a maximum of 36 million units aims to improve scalability and ease congestion to support DeFi growth.

CryptoPotato·2025-02-05 10:13

What's in Donald Trump's Electronic Wallet Before He Takes Office?

President Trump, một người ủng hộ Bitcoin, sở hữu một lượng lớn tài sản tiền điện tử bao gồm cả meme coins, nhưng không rõ liệu ông ấy có sở hữu bất kỳ Bitcoin nào hay không và số lượng là bao nhiêu. Danh sách các loại tiền điện tử mà Trump sở hữu bao gồm TROG, TRUMP, ETH, WETH, GUA, TRUMPIUS, TUA, RIO, USACOIN, và INJ. Tuy nhiên, cần lưu ý rằng nhiều trong số các tài sản này đã được gửi cho ông ấy bởi các nhà phát triển altcoin thay vì được mua bởi Trump. Số lượng ETH mà Trump sở hữu chủ yếu đến từ việc bán NFT.

Blotienso·2025-01-12 15:11

"Smart money with an 82% swing trading success rate" Shorted 10,612.59 WETH trapped yesterday, currently floating loss of $908,000.

Shenzhen TechFlow News, on January 3rd, according to @ai_9684xtpa data, the 'smart money with a swing trading win rate of 82%' was trapped in shorting 10,612.59 WETH yesterday, and 11 hours ago, it shorted another 5000 ETH in an ultra-short-term operation:

The address sold 5000 ETH at an average price of $3459.38 after borrowing from Aave, and bought back at an average price of $3436 five hours ago, earning a profit of $117,000. However, the short position at $3384.3 yesterday was still at a loss of $90.8.

DeepFlowTech·2025-01-03 02:54

Plus Wallet Turns Trading Into Unlimited Income – Discover Why MetaMask’s Payment Card & Deus’s D...

This week, three cryptocurrency wallets are highlighted for their distinctive features and recent improvements.

MetaMask has recently introduced a cryptocurrency payment card in the U.S. as part of a limited trial. This allows users to make purchases with cryptocurrencies like USDC, USDT, and WETH

CaptainAltcoin·2024-12-25 15:39

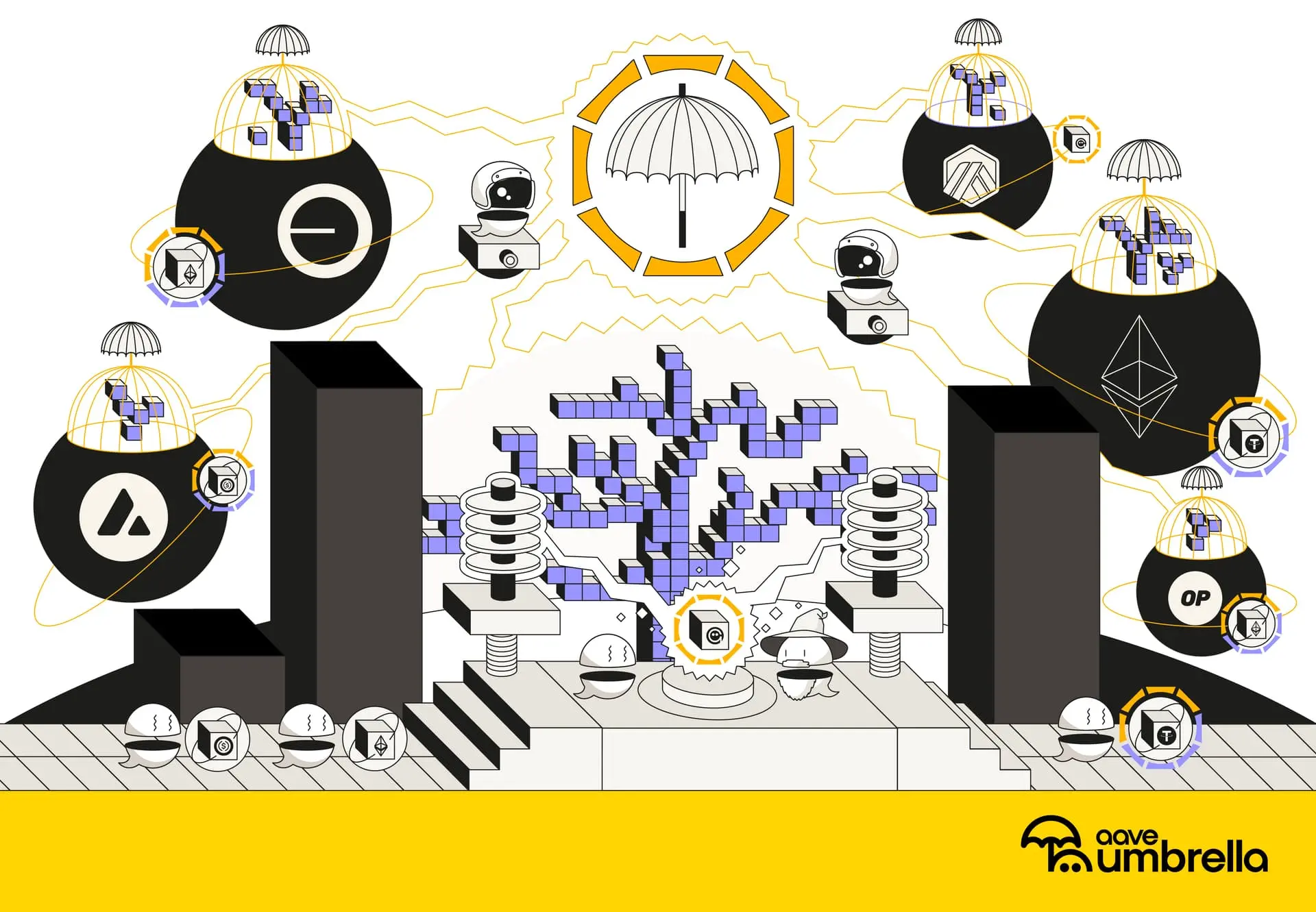

How to earn wETH on Base by trading Gas fees?

Author: 0XNATALIE

Since the beginning of this year, the community has begun to discuss topics related to gas fee derivatives. In June, Nethermind researcher Finn proposed a model for pricing Ethereum's base fee options, which has attracted widespread attention in the community. This financial tool provides participants in the Ethereum ecosystem with a new way to deal with the uncertainty of gas fee fluctuations, not only to help users hedge the volatility of operating costs, but also to bring new speculative opportunities.

Base Gas Market: Betting on future Gas cost fluctuations

Recently, Alkimiya has built such a financial market on Base: the Base Gas Market (not yet officially launched), allowing users to trade Base

TechubNews·2024-12-23 03:15

"Famous CEO Reveals: 'Trump is Investing Heavily in These Two Surprise Altcoins, Besides Bitcoin, ETF Approval May Come!"

The support for Bitcoin (BTC) and cryptocurrencies has put the cryptocurrency investments of the new US president Donald Trump in the spotlight and is closely followed by investors.

The wallet identified by Arkham contains altcoin investments such as Trump's TROG, Ethereum (ETH), Trump, and WETH.

Bitcoinsistemi·2024-12-20 16:20

5 Must-Read Articles in the Evening | How much money did Trump make through Cryptocurrency?

1. Why is the BTC Reserve Act or breaking the four-year cycle of Cryptocurrency?

With more and more speculation, the incoming president Donald Trump may sign an executive order announcing BTC reserves on the first day or establish reserves through legislation during his term. Many are wondering if this will lead to a super cycle for Crypto Assets. Click to read

2. How do I earn wETH on Base by trading gas fees?

Since the beginning of this year, the community has started to discuss topics related to Gas fee derivatives. In June, Finn, a researcher from Nethermind, proposed a model for pricing Ethereum's base fee options, which has attracted widespread attention from the community. This financial tool provides participants in the Ethereum ecosystem with a way to deal with Gas fees.

金色财经_·2024-12-20 11:35

How to earn wETH on Base by trading Gas fees?

Author: 0xNatalie Source: ChainFeeds

Since the beginning of this year, the community has started to discuss topics related to Gas fee derivatives. In June, Nethermind researcher Finn proposed a model for pricing Ethereum's base fee options, which has attracted widespread attention in the community. This financial instrument provides participants in the Ethereum ecosystem with a new way to deal with the uncertainty of Gas fee fluctuations, not only helping users hedge the volatility of operating costs, but also bringing new speculative opportunities.

Base Gas Market: Betting on future Gas fee fluctuations

Recently, Alkimiya has built such a financial market on Base: Base Gas Market (not yet officially launched), which allows users to trade

金色财经_·2024-12-20 09:38

CryptocurrencyWallet MetaMask launches Cryptocurrency payment card pilot program in the United States

Techub News message, MetaMask has announced the launch of the Cryptocurrency payment card MetaMask Card pilot program in the United States, allowing users to use the Cryptocurrency held in their MetaMask Wallet in physical stores and online. Through the limited-time pilot program, users in the United States can use Cryptocurrency for daily shopping anywhere that accepts Mastercard. The company stated that the card functions similarly to an encryption debit card.

Users can link their digital Wallet to Apple Pay or Google Pay to use their Cryptocurrency. According to the official announcement, eligible currencies include USDC, USDT, and WETH on the Linea network. Currently, MetaMask Card is not available for users in New York or Vermont.

USDC-0.02%

TechubNews·2024-12-19 09:19

Data: Decentralized Finance market borrowing Interest Rate hit a new high since 2022, Aave's net inflow of funds reached $5 billion this week

According to the TechFlow news on December 13th, as users heavily use WBTC and WETH as collateral to borrow stablecoins, the Decentralized Finance lending market has ushered in a new wave of enthusiasm, with interest rates surpassing 10%, reaching as high as 40% for some projects, setting a new high since the bull market in 2022. The largest lending protocol on the Ethereum network, Aave, has seen a net inflow of funds of 5

DeepFlowTech·2024-12-13 14:20

Data: ETH swing trading win rate 83.3% Whale dumping 1434 WETH, equivalent to $5.23 million

According to CoinVoice, the Whale with a swing trading win rate of 83.3% has dumped 1434 WETH at an average cost of $3647, making a profit of $56,000. The Whale had previously increased the position of 1434 WETH at a cost of $3607.9 at the morning low point and currently holds 5419 WETH with an average cost of $3706. This round of swing trading has accumulated a position of 6854 WETH, with a total value of $25.1 million.

ETH2.4%

CoinVoice·2024-12-03 07:26

ETH wave success rate 83.3% Whale dumping 1434 WETH, profit approximately $56,000

According to on-chain analyst Ai Yi's monitoring, the win rate of ETH swing trading is 83.3%. In the past two hours, the Whale has dumpedtake profit at an average price of $3647, dumpingtake profit a total of 1434 WETH (costing $3607.9), worth about $5.23 million, with a profit of about $56,000. bitcoin

REVOX·2024-12-03 07:23

Data: ETH swing trading success rate 83.3% Whale increased the position of 1434 WETH at the low point, equivalent to $5.17 million.

CoinVoice has learned that according to on-chain analyst @ai_9684xtpa, taking advantage of the dumping of BTC by the US government in the early morning, ETH swing trading has a success rate of 83.3%. The Whale increased the position by 1434 WETH (worth $5.17 million) at the low point, with a cost of $3607.9.

As of now, the 19th swing trading has accumulated a Build a Position of 6854 WETH, with a total value of $25.1 million and an average cost of 3662.

CoinVoice·2024-12-03 02:53

Data: Trump holds $5.4 million in cryptocurrency, with ETH being the asset with the highest holdings

CoinVoice recently learned that Donald Trump currently holds $5.4 million in Cryptocurrency, with ETH being his largest asset, holding 495.664 ETH, worth about $1.7 million. His top five holdings also include: WETH (worth about $1.64 million), TRUMP (worth about $1 million), TROG (worth about $400,000), GUA (worth about $150,000).

CoinVoice·2024-11-26 06:43

Data: The value of assets in Trump's encrypted wallet has risen to $7.09 million, a rise of $1.77 million in 24 hours.

CoinVoice has learned that, according to Arkham monitoring, Trump currently holds encryption assets worth about $7.09 million, with a 24-hour rise of $1.77 million. The Holdings values of tokens worth over $1 million are ETH (1.7 million), TROG (1.69 million), WETH (1.65 million), TRUMP (104

CoinVoice·2024-11-26 02:04

Trump's total cryptocurrency position reached $7.236 million, with a rise of approximately $1.91 million in the past 24 hours.

Trump's encryption wallet holds multiple encryption assets, with a total holdings value of $7.235925 million as of November 26th, with a rise of approximately $1.91 million in the last 24 hours. The main holdings include TROG, ETH, WETH, and TRUMP.

DeepFlowTech·2024-11-26 01:22

What does the current Ethereum fee pump mean?

The cost of ETH network is gradually pumping, but traders seem to be not very sensitive. In addition to Wrapped Ethereum (WETH), tokens such as Hana (HANA), Virtual USD (VUSD), Incept (INCEPT), Doggo (DOGGO) have also contributed a lot to the fees, reflecting the activity of the ETH ecosystem. The cost pumping may be the result of the increase in decentralized finance activities, which is a positive signal for the health of the ecosystem, but attention should also be paid to the relationship between cost pumping and market speculative bubbles.

ETH2.4%

金色财经_·2024-09-27 04:00

Planet Daily | Blast announces the detailed distribution rules of the second phase of the airdrop; Starknet founder: Approximately 400 million STRK tokens are reserved for future airdrop rounds (July 4th)

Headlines

Blast announced the points distribution details for the second phase of the Airdrop, which will distribute 10 billion BLAST.

Blast announces the detailed rules for the distribution of points for the second phase of the airdrop. In the second phase, Blast will distribute 10 billion BLAST tokens, with 50% of the share allocated to regular points (Point). Users can earn by holding ETH, WETH, USDB, and BLAST.

星球日报·2024-07-04 01:56

Dismantling Uniswap V3 data cleaning process

> We calculated the user net worth and rate of return on Uniswap from the perspective of user addresses. This time, our goal remains the same, but we include the cash holdings of these addresses in the calculation to obtain the total net worth and yield.

Written by: Zelos

Introduction

In the last issue, we calculated the net worth and rate of return of users on uniswap from the perspective of user addresses. This time, our goal remains the same. But the cash held by these addresses must be counted. Get a total net worth and rate of return.

There are two pools for this statistical object, including

usdc-weth(fee:0.05) on polygon, pool address:

ForesightNews·2024-01-11 11:06

FTX’s latest liability and asset summary: How much debt can you repay?

Author: Cat Brother, Source: Wu Shuo Real

According to the latest court documents on September 10, as of August 31, FTX held a total of $3.4 billion in crypto assets, mainly including $1.16 billion SOL, $560 million BTC, $192 million ETH, $137 million APT, USD 120 million USDT, USD 119 million XRP, USD 49 million BIT, USD 46 million STG, USD 41 million WBTC and USD 37 million WETH. These ten major assets account for 72% of the crypto assets compiled by FTX. The document also details SBF and other executives including Nishad Singh, Zixiao “Gary” Wang and Carolin...

金色财经_·2023-09-12 02:15

Load More