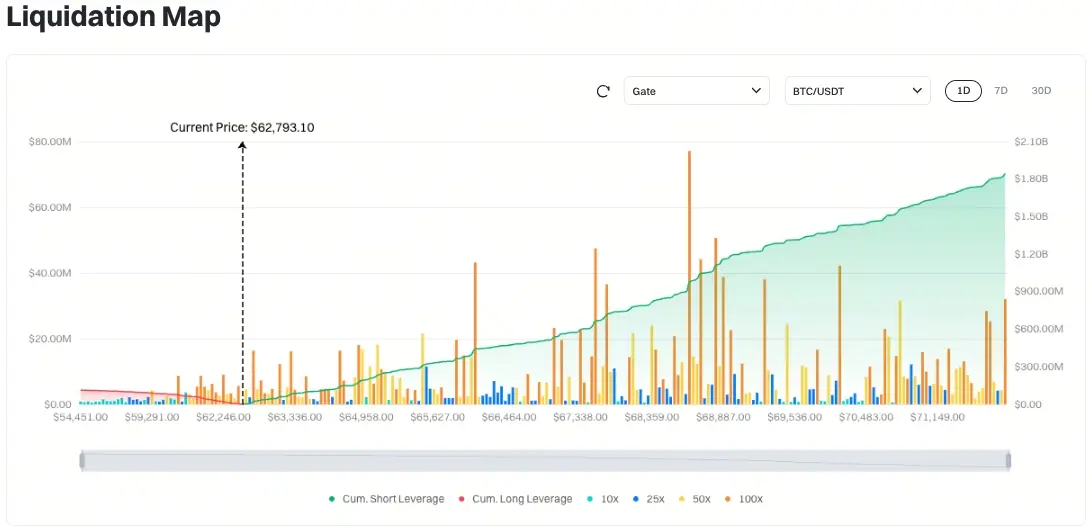

Visa enables on-chain settlement of Ethereum stablecoins, with USDC annual trading volume exceeding $3.5 billion

February 10 News, global payments giant Visa has officially launched an on-chain settlement system based on the Ethereum network, using USDC as the settlement medium. The service was quietly launched in December 2025, but its on-chain annualized transaction volume has already exceeded $3.5 billion, marking an acceleration of the traditional financial system's migration to blockchain infrastructure.

By transferring some cross-border and institutional payments on-chain, Visa provides corporate clients with 24/7 fund settlement capabilities, eliminating delays caused by banking hours and multiple intermediaries. The settlement cycle has been compressed from several days to just a few minutes, while also enhancing the traceability and transparency of fund flows. This change demonstrates that Ethereum is no longer just a smart contract platform but is evolving into a global settlement network.

ETH-0.96%

GateNewsBot·2h ago