# MiddleEastTensionsEscalate

68.04K

Rising U.S.–Iran tensions have driven gold above the $5,000 milestone, while Bitcoin has pulled back and market sentiment turns cautious. Would you allocate to gold now, or look for a BTC dip?

HanssiMazak

#MiddleEastTensionsEscalate Geopolitical Stress Hits Crypto Markets

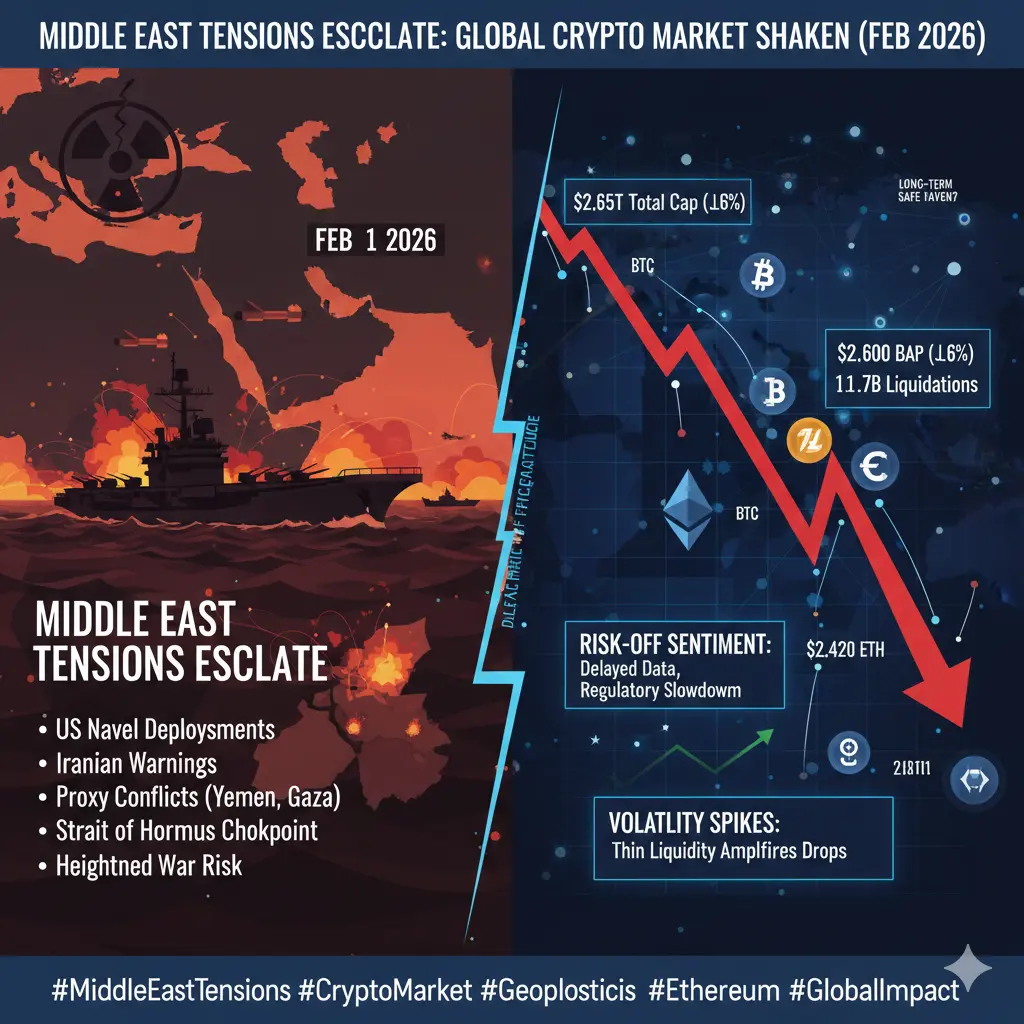

Geopolitical tensions in the Middle East have rapidly intensified, sending shockwaves through cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off environment. Escalation involving the U.S. and Iran triggered immediate market reactions: accelerated price declines, thinning liquidity, and liquidation-driven volume spikes. These developments underscore how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies Losses

Before the fl

Geopolitical tensions in the Middle East have rapidly intensified, sending shockwaves through cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off environment. Escalation involving the U.S. and Iran triggered immediate market reactions: accelerated price declines, thinning liquidity, and liquidation-driven volume spikes. These developments underscore how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies Losses

Before the fl

- Reward

- 1

- 1

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊#MiddleEastTensionsEscalate Geopolitical Stress Hits Crypto Markets

Geopolitical tensions in the Middle East have rapidly intensified, sending shockwaves through cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off environment. Escalation involving the U.S. and Iran triggered immediate market reactions: accelerated price declines, thinning liquidity, and liquidation-driven volume spikes. These developments underscore how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies Losses

Before the fl

Geopolitical tensions in the Middle East have rapidly intensified, sending shockwaves through cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off environment. Escalation involving the U.S. and Iran triggered immediate market reactions: accelerated price declines, thinning liquidity, and liquidation-driven volume spikes. These developments underscore how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies Losses

Before the fl

- Reward

- like

- Comment

- Repost

- Share

#MiddleEastTensionsEscalate Geopolitical Stress Hits Crypto Markets

Geopolitical tensions in the Middle East have rapidly intensified, sending shockwaves through cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off environment. Escalation involving the U.S. and Iran triggered immediate market reactions: accelerated price declines, thinning liquidity, and liquidation-driven volume spikes. These developments underscore how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies Losses

Before the fl

Geopolitical tensions in the Middle East have rapidly intensified, sending shockwaves through cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off environment. Escalation involving the U.S. and Iran triggered immediate market reactions: accelerated price declines, thinning liquidity, and liquidation-driven volume spikes. These developments underscore how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies Losses

Before the fl

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#MiddleEastTensionsEscalate Geopolitical Stress Hits Crypto Markets

The rapid escalation of geopolitical tensions in the Middle East has significantly intensified stress across cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off event. As tensions involving the U.S. and Iran intensified, digital assets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes, highlighting how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies the Downside

The rapid escalation of geopolitical tensions in the Middle East has significantly intensified stress across cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off event. As tensions involving the U.S. and Iran intensified, digital assets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes, highlighting how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies the Downside

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate

Market Impact Update

The continued escalation of Middle East geopolitical tensions has deepened stress across crypto markets, shifting conditions from a standard correction into a structural risk-off environment. What initially looked like a controlled pullback has evolved into a headline-driven volatility cycle, with liquidity deterioration amplifying every move.

Price Action Update: Downside Pressure Broadens

As geopolitical uncertainty intensified further:

Bitcoin (BTC) extended losses into high single to low double digits, losing key psychological and technical

Market Impact Update

The continued escalation of Middle East geopolitical tensions has deepened stress across crypto markets, shifting conditions from a standard correction into a structural risk-off environment. What initially looked like a controlled pullback has evolved into a headline-driven volatility cycle, with liquidity deterioration amplifying every move.

Price Action Update: Downside Pressure Broadens

As geopolitical uncertainty intensified further:

Bitcoin (BTC) extended losses into high single to low double digits, losing key psychological and technical

- Reward

- 4

- 6

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#MiddleEastTensionsEscalate The rapid escalation of geopolitical tensions in the Middle East has materially intensified stress across the cryptocurrency market, transforming what initially looked like a controlled pullback into a full-scale risk-off event. As tensions involving the U.S. and Iran escalated, crypto markets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes—highlighting just how sensitive digital assets remain to global instability.

Price Impact: Escalation Multiplies the Downside

Before the geopolitical flare-up intensif

Price Impact: Escalation Multiplies the Downside

Before the geopolitical flare-up intensif

- Reward

- 14

- 17

- Repost

- Share

YingYue :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate

The rapid escalation of Middle East geopolitical tensions has materially intensified stress across the cryptocurrency market, turning what began as a controlled pullback into a high-impact risk-off event. As tensions involving the U.S. and Iran worsened, crypto markets experienced accelerated price declines, shrinking liquidity, and explosive liquidation-driven volume, clearly showing how sensitive digital assets are to global instability.

Price Impact: Escalation Multiplies the Downside

Before the escalation, Bitcoin was trading in a relatively stable range. Once

The rapid escalation of Middle East geopolitical tensions has materially intensified stress across the cryptocurrency market, turning what began as a controlled pullback into a high-impact risk-off event. As tensions involving the U.S. and Iran worsened, crypto markets experienced accelerated price declines, shrinking liquidity, and explosive liquidation-driven volume, clearly showing how sensitive digital assets are to global instability.

Price Impact: Escalation Multiplies the Downside

Before the escalation, Bitcoin was trading in a relatively stable range. Once

- Reward

- 11

- 8

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#MiddleEastTensionsEscalate

Rising geopolitical tensions between the U.S. and Iran have once again sent shockwaves across global financial markets, reinforcing the role of gold as the ultimate safe-haven asset while creating turbulence in risk-sensitive markets like Bitcoin and other cryptocurrencies. Gold has surged past the $5,000 per ounce milestone, reflecting both fundamental and technical buying, as investors seek protection against escalating geopolitical risks and potential economic fallout. The acceleration in gold’s price highlights the shift in market psychology toward safety, with

Rising geopolitical tensions between the U.S. and Iran have once again sent shockwaves across global financial markets, reinforcing the role of gold as the ultimate safe-haven asset while creating turbulence in risk-sensitive markets like Bitcoin and other cryptocurrencies. Gold has surged past the $5,000 per ounce milestone, reflecting both fundamental and technical buying, as investors seek protection against escalating geopolitical risks and potential economic fallout. The acceleration in gold’s price highlights the shift in market psychology toward safety, with

- Reward

- 3

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊#MiddleEastTensionsEscalate #MiddleEastTensionsEscalate

Middle East Tensions Escalate: A Global Flashpoint Reshaping Markets, Energy, and Investment Strategy

Rising tensions in the Middle East are once again becoming a central driver of global uncertainty. What begins as regional conflict rarely stays regional. In today’s interconnected world, every escalation sends shockwaves through energy markets, financial systems, supply chains, and investor psychology.

As we move further into 2026 and beyond, this situation is no longer just about geopolitics — it is about economic resilience, capital pr

Middle East Tensions Escalate: A Global Flashpoint Reshaping Markets, Energy, and Investment Strategy

Rising tensions in the Middle East are once again becoming a central driver of global uncertainty. What begins as regional conflict rarely stays regional. In today’s interconnected world, every escalation sends shockwaves through energy markets, financial systems, supply chains, and investor psychology.

As we move further into 2026 and beyond, this situation is no longer just about geopolitics — it is about economic resilience, capital pr

BTC-1.97%

- Reward

- 4

- 4

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate

Bitcoin plunged sharply in the past few days as tensions escalated in the Middle East. At one point, Bitcoin dropped under $78,000 on Saturday, marking a significant decline from its recent price highs.

The main reasons behind this drop were rising geopolitical risks—particularly increased conflict and uncertainty involving Iran and the U.S.—plus growing concerns over U.S. political stability and new tariff threats. Thin weekend liquidity made it even easier for panic selling to push the price down. Just two days earlier, Bitcoin was trading around $84,400; since t

Bitcoin plunged sharply in the past few days as tensions escalated in the Middle East. At one point, Bitcoin dropped under $78,000 on Saturday, marking a significant decline from its recent price highs.

The main reasons behind this drop were rising geopolitical risks—particularly increased conflict and uncertainty involving Iran and the U.S.—plus growing concerns over U.S. political stability and new tariff threats. Thin weekend liquidity made it even easier for panic selling to push the price down. Just two days earlier, Bitcoin was trading around $84,400; since t

BTC-1.97%

- Reward

- 8

- 6

- Repost

- Share

YingYue :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

375.65K Popularity

4.18K Popularity

4.09K Popularity

2.85K Popularity

1.64K Popularity

3.19K Popularity

1.35K Popularity

2.13K Popularity

1.87K Popularity

23 Popularity

52.88K Popularity

68.04K Popularity

20.08K Popularity

25.2K Popularity

201K Popularity

News

View MoreBitcoin ETF holders face over 15% unrealized losses: Will the decline in BTC price trigger a new wave of redemptions?

3 m

ETH briefly drops below $2200, triggering a liquidation storm: Will Ethereum's price fall below $2000?

6 m

Solana continues to lead other blockchains in 7-day revenue and DEX trading volume, maintaining its position as the top performer in these metrics.

7 m

Alpha Token Launch: 3KDS is now live

8 m

Alpha Token Launch: XAUT is now live

8 m

Pin