# ETHUnderPressure

181

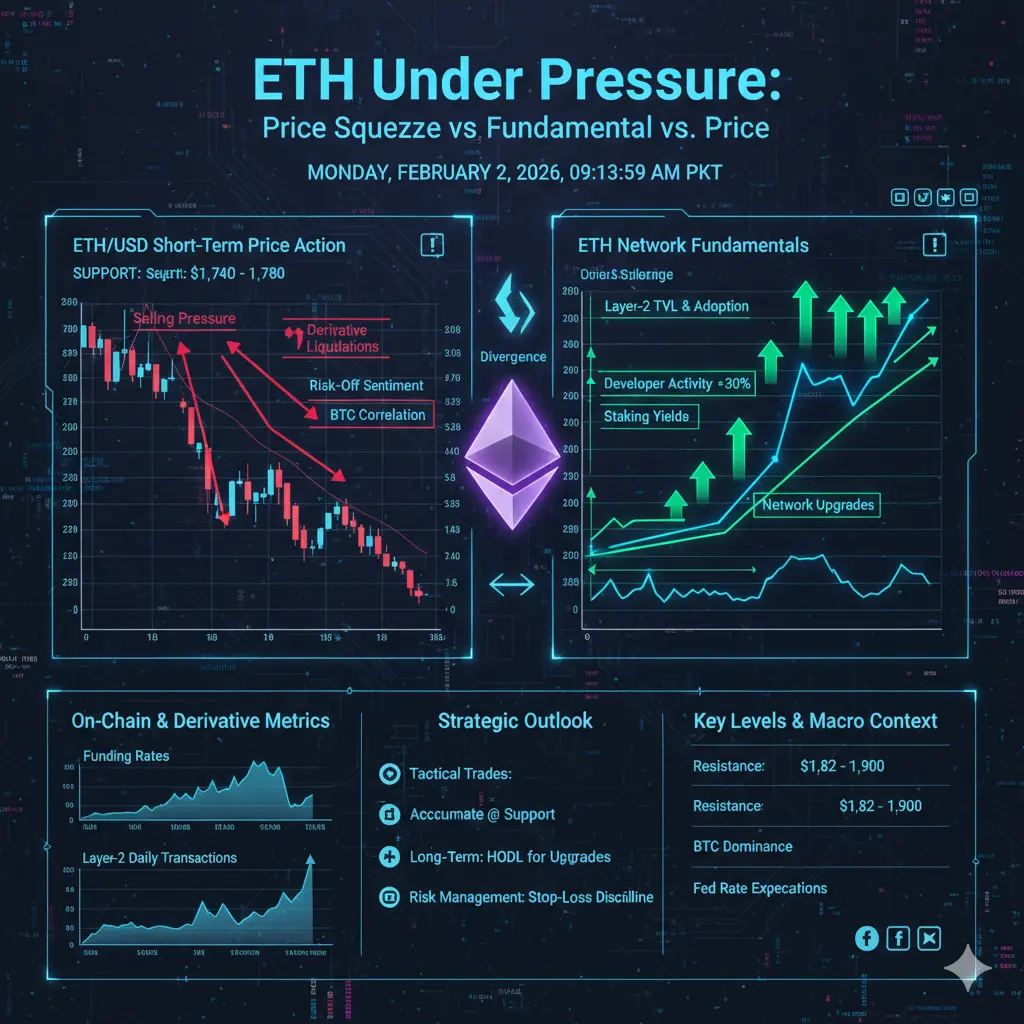

ETH is under price pressure while upgrades and Layer-2 activity continue. How do you position ETH when price and fundamentals diverge?

Peacefulheart

#ETHUnderPressure Ethereum Faces Key Stress Levels

Ethereum has recently come under noticeable pressure, testing critical support zones while broader market volatility amplifies downside risks. The combination of leveraged positions, macro uncertainty, and market sentiment has placed ETH in a delicate position, making technical observation and risk management crucial for traders and investors alike.

Technical Overview — Support & Resistance

ETH is currently testing the $1,700–$1,780 support zone, a historically significant area where buyers have previously stepped in. Immediate resistance lie

Ethereum has recently come under noticeable pressure, testing critical support zones while broader market volatility amplifies downside risks. The combination of leveraged positions, macro uncertainty, and market sentiment has placed ETH in a delicate position, making technical observation and risk management crucial for traders and investors alike.

Technical Overview — Support & Resistance

ETH is currently testing the $1,700–$1,780 support zone, a historically significant area where buyers have previously stepped in. Immediate resistance lie

- Reward

- like

- Comment

- Repost

- Share

#ETHUnderPressure

Ethereum is currently under short-term price pressure, testing support levels near $1,740–$1,780, even as its fundamentals including network upgrades, Layer-2 scaling adoption, and developer activity remain strong. This divergence between price action and fundamental progress creates both opportunities and challenges for traders and investors. On the technical side, recent weakness in ETH is influenced by broader market volatility, BTC correlation, and derivative-driven liquidations, which can exaggerate short-term moves. Simultaneously, Ethereum’s ongoing upgrades, includin

Ethereum is currently under short-term price pressure, testing support levels near $1,740–$1,780, even as its fundamentals including network upgrades, Layer-2 scaling adoption, and developer activity remain strong. This divergence between price action and fundamental progress creates both opportunities and challenges for traders and investors. On the technical side, recent weakness in ETH is influenced by broader market volatility, BTC correlation, and derivative-driven liquidations, which can exaggerate short-term moves. Simultaneously, Ethereum’s ongoing upgrades, includin

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

373.34K Popularity

1.07K Popularity

577 Popularity

685 Popularity

197 Popularity

181 Popularity

165 Popularity

219 Popularity

1.73K Popularity

23 Popularity

32.5K Popularity

70.44K Popularity

19.47K Popularity

24.42K Popularity

218.13K Popularity

News

View MoreJustLend DAO launches the WBTC market supply mining activity

1 m

JustLend DAO launches USDD 2.0 supply mining phase fourteen

2 m

Data: 8.739 million ASTER tokens transferred out from Wintermute, valued at approximately $4.69 million.

4 m

ETH Breaks Through 2250 USDT

4 m

Two Ethereum OGs who had been dormant for 5 years borrowed to buy 45,319 ETH, with a total value exceeding $100 million

8 m

Pin