# PredictionMarketDebate

19.3K

A trader earned $400K on Polymarket from a political bet, raising insider trading concerns. New regulations are being discussed. Would tighter rules help or hurt prediction markets?

repanzal

#PredictionMarketDebate

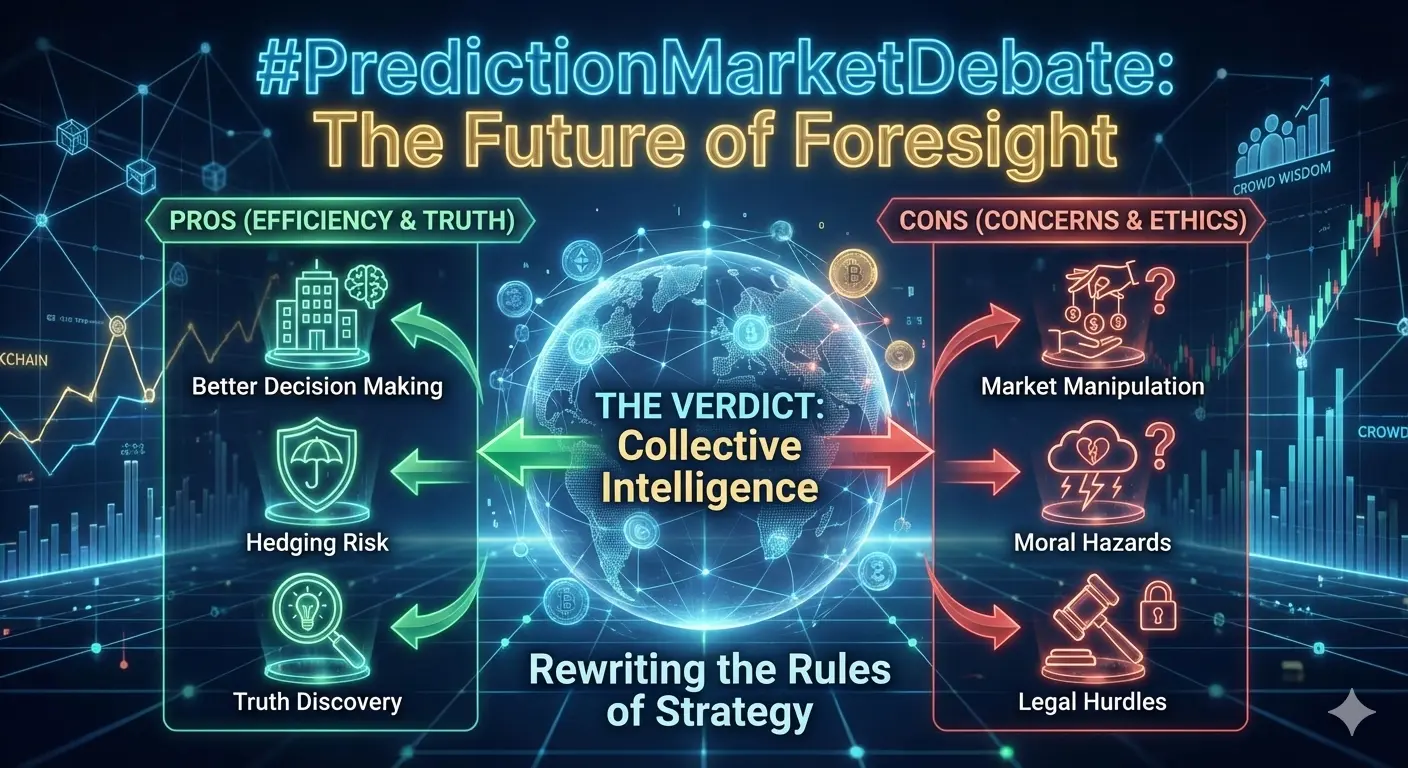

Prediction markets are once again at the center of debate, and honestly, crypto Twitter can’t decide whether they are the future of truth or just gambling with a PhD. On the surface, they look simple: people put money where their mouth is and bet on real-world outcomes. In reality, they sit at the crossroads of economics, psychology, politics, and pure human overconfidence.

Supporters argue that prediction markets are one of the most accurate forecasting tools ever created. Unlike polls or opinions, participants risk real capital, which forces them to research, think c

Prediction markets are once again at the center of debate, and honestly, crypto Twitter can’t decide whether they are the future of truth or just gambling with a PhD. On the surface, they look simple: people put money where their mouth is and bet on real-world outcomes. In reality, they sit at the crossroads of economics, psychology, politics, and pure human overconfidence.

Supporters argue that prediction markets are one of the most accurate forecasting tools ever created. Unlike polls or opinions, participants risk real capital, which forces them to research, think c

- Reward

- 12

- 12

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

New Year Wealth Explosion 🤑View More

#PredictionMarketDebate

How Tighter Regulations Could Help Prediction Markets

Introducing tighter rules could have several benefits. First, market integrity and public trust would increase. Markets where insider knowledge dominates can erode confidence among casual participants, and without a perception of fairness, participation which drives liquidity may decline. Clear rules on what constitutes illegal use of non-public information, combined with reporting requirements for large bets, could level the playing field, ensuring that the price signals generated are representative of collective

How Tighter Regulations Could Help Prediction Markets

Introducing tighter rules could have several benefits. First, market integrity and public trust would increase. Markets where insider knowledge dominates can erode confidence among casual participants, and without a perception of fairness, participation which drives liquidity may decline. Clear rules on what constitutes illegal use of non-public information, combined with reporting requirements for large bets, could level the playing field, ensuring that the price signals generated are representative of collective

- Reward

- 11

- 10

- Repost

- Share

Vortex_King :

:

Happy New Year! 🤑View More

#PredictionMarketDebate Forecasting, Finance, and the Fight for Legitimacy in 2026

As 2026 unfolds, prediction markets have moved from the fringes of crypto experimentation into the center of global policy and financial debate. Platforms such as Polymarket and Kalshi are no longer viewed merely as speculative tools or digital betting venues. Instead, they are increasingly shaping how investors, analysts, and even governments interpret probabilities around real-world events. This rapid rise in visibility has brought both credibility and controversy, as prediction markets now sit at the intersec

As 2026 unfolds, prediction markets have moved from the fringes of crypto experimentation into the center of global policy and financial debate. Platforms such as Polymarket and Kalshi are no longer viewed merely as speculative tools or digital betting venues. Instead, they are increasingly shaping how investors, analysts, and even governments interpret probabilities around real-world events. This rapid rise in visibility has brought both credibility and controversy, as prediction markets now sit at the intersec

- Reward

- 16

- 11

- Repost

- Share

CatAndMouse1 :

:

Buy To Earn 💎View More

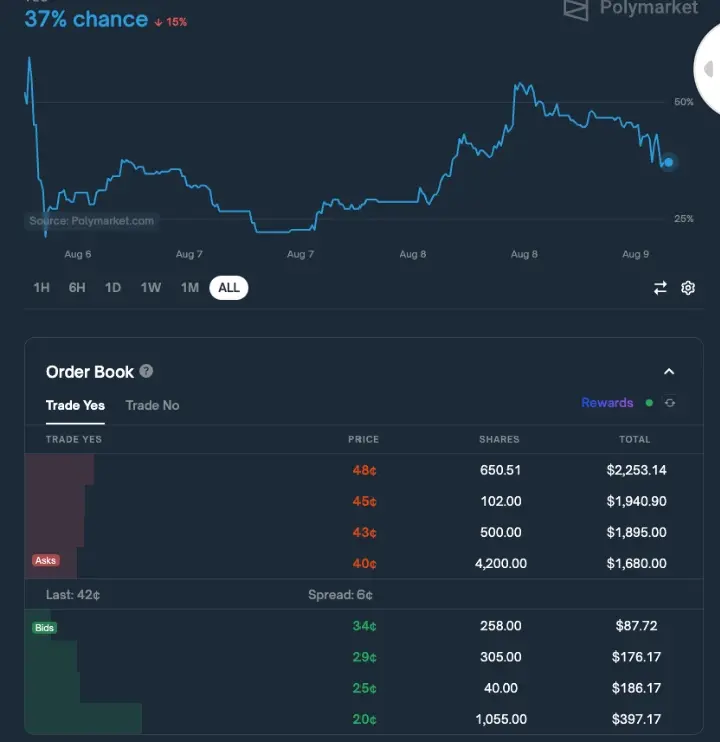

#PredictionMarketDebate $400K Polymarket Win: Skill, Luck, or a Warning Sign?

A trader recently earned around $400,000 on Polymarket by placing a high-conviction political bet. The size and timing of the profit immediately sparked debate across crypto and TradFi circles. Was this an example of sharp analysis and risk-taking, or did it cross into insider-trading territory?

Now regulators are paying attention, and discussions around tighter rules for prediction markets are gaining momentum.

Why This Trade Triggered Alarm Bells

Prediction markets are built on one core idea: prices reflect collect

A trader recently earned around $400,000 on Polymarket by placing a high-conviction political bet. The size and timing of the profit immediately sparked debate across crypto and TradFi circles. Was this an example of sharp analysis and risk-taking, or did it cross into insider-trading territory?

Now regulators are paying attention, and discussions around tighter rules for prediction markets are gaining momentum.

Why This Trade Triggered Alarm Bells

Prediction markets are built on one core idea: prices reflect collect

- Reward

- 19

- 13

- Repost

- Share

Flower89 :

:

Happy New Year! 🤑View More

#PredictionMarketDebate

#PredictionMarketDebate — Ethereum (ETH) in the Spotlight

📍 Current ETH Price: ~$3,170 USD (slightly down recently).

Ethereum remains one of the most debated crypto assets in today’s markets — especially in the context of prediction markets, DeFi usage, liquidity trends, and real adoption vs speculation.

🔎 Price & Liquidity Context (Real Data)

Price Range:

• ETH is trading around $3,100–$3,200, reflecting recent volatility and profit-taking pressure.

Liquidity Insights:

• Stablecoin liquidity on Ethereum has hit record levels — ~$171 billion across Layer-1 and Layer-

#PredictionMarketDebate — Ethereum (ETH) in the Spotlight

📍 Current ETH Price: ~$3,170 USD (slightly down recently).

Ethereum remains one of the most debated crypto assets in today’s markets — especially in the context of prediction markets, DeFi usage, liquidity trends, and real adoption vs speculation.

🔎 Price & Liquidity Context (Real Data)

Price Range:

• ETH is trading around $3,100–$3,200, reflecting recent volatility and profit-taking pressure.

Liquidity Insights:

• Stablecoin liquidity on Ethereum has hit record levels — ~$171 billion across Layer-1 and Layer-

ETH-6.24%

- Reward

- 33

- 28

- Repost

- Share

BeautifulDay :

:

Happy New Year! 🤑View More

Prediction markets are one of those ideas that sound simple on the surface but change how we think about information once you really look at them. Instead of asking who has the loudest voice or the biggest platform, they ask a much quieter question: who is willing to put value behind their belief?

When people trade on whether something will happen, whether a price target will be hit, whether a project will launch, or whether an election result will hold, they are not just guessing. They are revealing how confident they actually are. That’s what makes prediction markets powerful. They turn opin

When people trade on whether something will happen, whether a price target will be hit, whether a project will launch, or whether an election result will hold, they are not just guessing. They are revealing how confident they actually are. That’s what makes prediction markets powerful. They turn opin

- Reward

- 7

- 4

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#PredictionMarketDebate

Ethereum (ETH) is showing signs of strong consolidation after recent bullish momentum. Traders and analysts are watching closely as ETH tests key support and resistance levels based on today’s market conditions. Recent trading activity highlights growing market interest, while sentiment and on‑chain metrics provide insights into where ETH might head next.

Key Highlight:

Ethereum (ETH) remains above $3,000 support, attempting to test $3,300–$3,350 resistance levels, signaling cautious optimism in the market as it holds above major psychological zones.

Technical Indicato

Ethereum (ETH) is showing signs of strong consolidation after recent bullish momentum. Traders and analysts are watching closely as ETH tests key support and resistance levels based on today’s market conditions. Recent trading activity highlights growing market interest, while sentiment and on‑chain metrics provide insights into where ETH might head next.

Key Highlight:

Ethereum (ETH) remains above $3,000 support, attempting to test $3,300–$3,350 resistance levels, signaling cautious optimism in the market as it holds above major psychological zones.

Technical Indicato

ETH-6.24%

- Reward

- 10

- 8

- Repost

- Share

User_any :

:

Happy New Year! 🤑View More

#PredictionMarketDebate

#PredictionMarketDebate — Ethereum (ETH) in the Spotlight

📍 Current ETH Price: ~$3,170 USD (slightly down recently).

Ethereum remains one of the most debated crypto assets in today’s markets — especially in the context of prediction markets, DeFi usage, liquidity trends, and real adoption vs speculation.

🔎 Price & Liquidity Context (Real Data)

Price Range:

• ETH is trading around $3,100–$3,200, reflecting recent volatility and profit-taking pressure.

Liquidity Insights:

• Stablecoin liquidity on Ethereum has hit record levels — ~$171 billion across Layer-1 and Layer-

#PredictionMarketDebate — Ethereum (ETH) in the Spotlight

📍 Current ETH Price: ~$3,170 USD (slightly down recently).

Ethereum remains one of the most debated crypto assets in today’s markets — especially in the context of prediction markets, DeFi usage, liquidity trends, and real adoption vs speculation.

🔎 Price & Liquidity Context (Real Data)

Price Range:

• ETH is trading around $3,100–$3,200, reflecting recent volatility and profit-taking pressure.

Liquidity Insights:

• Stablecoin liquidity on Ethereum has hit record levels — ~$171 billion across Layer-1 and Layer-

ETH-6.24%

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#PredictionMarketDebate

Information, Incentives, and the Limits of “Market Truth” (January 2026)

The #PredictionMarketDebate has intensified as prediction platforms gain visibility across politics, macroeconomics, and crypto-native forecasting. These markets are increasingly being framed as “truth machines,” but that framing deserves closer scrutiny. While prediction markets are powerful tools for aggregating information, they are not neutral or infallible indicators of reality.

At their core, prediction markets reflect where capital is willing to take risk, not necessarily what is objectivel

Information, Incentives, and the Limits of “Market Truth” (January 2026)

The #PredictionMarketDebate has intensified as prediction platforms gain visibility across politics, macroeconomics, and crypto-native forecasting. These markets are increasingly being framed as “truth machines,” but that framing deserves closer scrutiny. While prediction markets are powerful tools for aggregating information, they are not neutral or infallible indicators of reality.

At their core, prediction markets reflect where capital is willing to take risk, not necessarily what is objectivel

- Reward

- 6

- 4

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🙌 “Solid analysis, thanks for sharing this!”View More

#PredictionMarketDebate

The Future of Foresight: Why Prediction Markets are Rewriting the Rules of Strategy

In an era of "fake news" and unpredictable global shifts, how do we actually find the truth? Traditionally, we rely on pundits, polls, or "expert" opinions. But there is a more powerful, decentralized tool emerging that often outperforms them all: The Prediction Market.

What Exactly is a Prediction Market?

At its core, a Prediction Market is a place where people trade "shares" in the outcome of future events. Whether it's the result of a presidential election, the success of a movie at

The Future of Foresight: Why Prediction Markets are Rewriting the Rules of Strategy

In an era of "fake news" and unpredictable global shifts, how do we actually find the truth? Traditionally, we rely on pundits, polls, or "expert" opinions. But there is a more powerful, decentralized tool emerging that often outperforms them all: The Prediction Market.

What Exactly is a Prediction Market?

At its core, a Prediction Market is a place where people trade "shares" in the outcome of future events. Whether it's the result of a presidential election, the success of a movie at

REP-3.53%

- Reward

- 15

- 22

- Repost

- Share

MissCrypto :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

376.03K Popularity

4.39K Popularity

4.23K Popularity

2.87K Popularity

1.72K Popularity

3.19K Popularity

1.51K Popularity

2.15K Popularity

1.87K Popularity

23 Popularity

52.88K Popularity

68.04K Popularity

20.08K Popularity

25.2K Popularity

201K Popularity

News

View MoreNomura Cuts Back on Crypto Strategy! Emergency "Brake" After Q3 Losses, Bitcoin Plunge Triggers Chain Reaction Among Institutions

5 m

QCP: The key to Bitcoin's future trend depends on whether it can maintain the $74,000 support level. If it holds this level, the market may see a rebound; if it breaks below, further declines could occur. Investors should closely monitor the price action around this critical support to make informed decisions.

5 m

Solana (SOL) life or death? A 15% correction in a week, $95 becomes the battleground between bulls and bears

10 m

Buy again after Bitcoin plummets? Strategy (MSTR) signals "additional purchase," Bitcoin Treasury Company bets big on the next cycle

11 m

A certain whale adds $4.5 million worth of ETH long positions, bringing the total long position holdings in the account to $157 million.

11 m

Pin