# FedKeepsRatesUnchanged

35.48K

With rates on hold and “higher for longer” priced in, are you positioning defensively or starting to rotate into risk assets? How do you see the impact on BTC vs altcoins?

DragonFlyOfficial

Dragon Fly Official insight: Rates on hold — defensive or risk-on? 💹🐉

Markets are digesting “higher for longer” interest rate expectations, and positioning now is key. The interplay between BTC and altcoins is subtle but actionable.

🔍 Market Structure & Analysis

BTC as a macro hedge: With rates stable but high, BTC often behaves like a risk-adjusted safe haven. Large inflows tend to rotate into BTC first when equities or risk-on assets hesitate.

Altcoins and risk appetite: Alts historically lead during rotations from BTC dominance dips or when liquidity expands. Current data shows moderate

Markets are digesting “higher for longer” interest rate expectations, and positioning now is key. The interplay between BTC and altcoins is subtle but actionable.

🔍 Market Structure & Analysis

BTC as a macro hedge: With rates stable but high, BTC often behaves like a risk-adjusted safe haven. Large inflows tend to rotate into BTC first when equities or risk-on assets hesitate.

Altcoins and risk appetite: Alts historically lead during rotations from BTC dominance dips or when liquidity expands. Current data shows moderate

BTC-1.08%

- Reward

- 13

- 20

- Repost

- Share

DragonFlyOfficial :

:

Are you staying defensive in BTC, or exploring selective alts? Which projects do you think have real rotation potential under “higher for longer” rates?View More

#FedKeepsRatesUnchanged

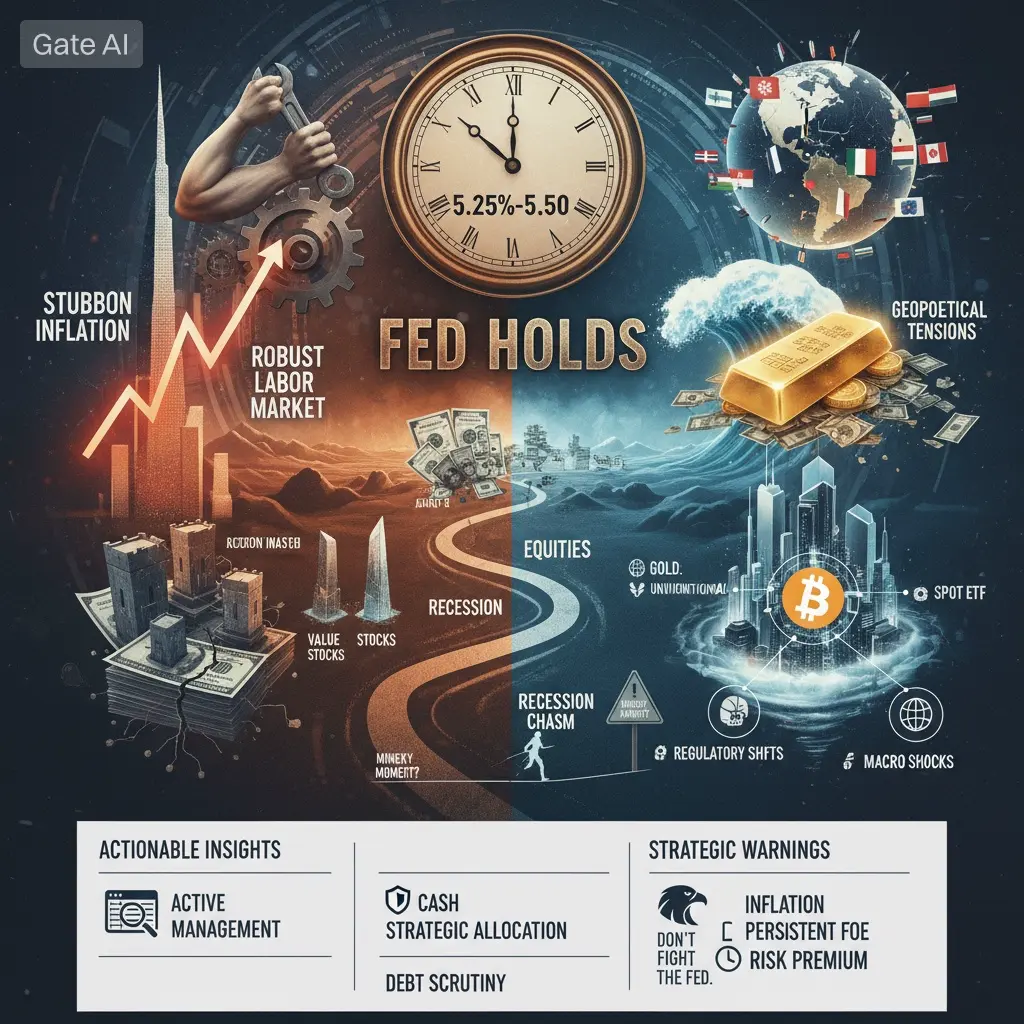

The Federal Reserve has chosen to keep interest rates unchanged, maintaining the “higher for longer” environment that markets have been pricing in for months. This decision signals a pause in tightening, but not a shift toward easing, reinforcing caution in macro-sensitive markets. For investors, particularly in crypto, this creates a nuanced landscape where careful positioning between defensive allocations and tactical risk-on rotations is crucial.

Macro Context:

Interest Rates: While rates remain unchanged, they are still elevated, impacting borrowing costs, corporate

The Federal Reserve has chosen to keep interest rates unchanged, maintaining the “higher for longer” environment that markets have been pricing in for months. This decision signals a pause in tightening, but not a shift toward easing, reinforcing caution in macro-sensitive markets. For investors, particularly in crypto, this creates a nuanced landscape where careful positioning between defensive allocations and tactical risk-on rotations is crucial.

Macro Context:

Interest Rates: While rates remain unchanged, they are still elevated, impacting borrowing costs, corporate

BTC-1.08%

- Reward

- 1

- 4

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#FedKeepsRatesUnchanged 📈 Rates on hold, “higher for longer” priced in — what’s your move?

Markets are at a crossroads:

BTC remains the core defensive asset, drawing institutional flows and ETF interest.

Altcoins need selective positioning — only strong narratives, clear catalysts, and solid metrics are seeing rotation.

💡 My approach:

Core BTC holds the fort

Tactical exposure to high-potential alts

Cash ready for volatility-driven opportunities

This isn’t broad risk-on… it’s a stock-picker’s market.

Are you staying defensive or slowly rotating into risk? 👀

#Bitcoin #Altcoins #CryptoMarkets

Markets are at a crossroads:

BTC remains the core defensive asset, drawing institutional flows and ETF interest.

Altcoins need selective positioning — only strong narratives, clear catalysts, and solid metrics are seeing rotation.

💡 My approach:

Core BTC holds the fort

Tactical exposure to high-potential alts

Cash ready for volatility-driven opportunities

This isn’t broad risk-on… it’s a stock-picker’s market.

Are you staying defensive or slowly rotating into risk? 👀

#Bitcoin #Altcoins #CryptoMarkets

BTC-1.08%

- Reward

- 4

- 2

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

📊 Interest Rates on Hold — What’s Next for Crypto?

Insights from Dragon Fly Official show that with interest rates on hold and the market pricing in “higher for longer”, investors are at a crossroads: position defensively or rotate into risk assets like BTC and altcoins? ⚖️💡

📈 Market Analysis:

BTC: Bitcoin often behaves as a macro-sensitive risk asset. With rates stable, BTC may see measured strength, but Dragon Fly Official notes that sustained high rates can cap upside, keeping volatility moderate.

Altcoins: Historically, altcoins outperform BTC during periods of stable liquidity and rene

Insights from Dragon Fly Official show that with interest rates on hold and the market pricing in “higher for longer”, investors are at a crossroads: position defensively or rotate into risk assets like BTC and altcoins? ⚖️💡

📈 Market Analysis:

BTC: Bitcoin often behaves as a macro-sensitive risk asset. With rates stable, BTC may see measured strength, but Dragon Fly Official notes that sustained high rates can cap upside, keeping volatility moderate.

Altcoins: Historically, altcoins outperform BTC during periods of stable liquidity and rene

- Reward

- 5

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

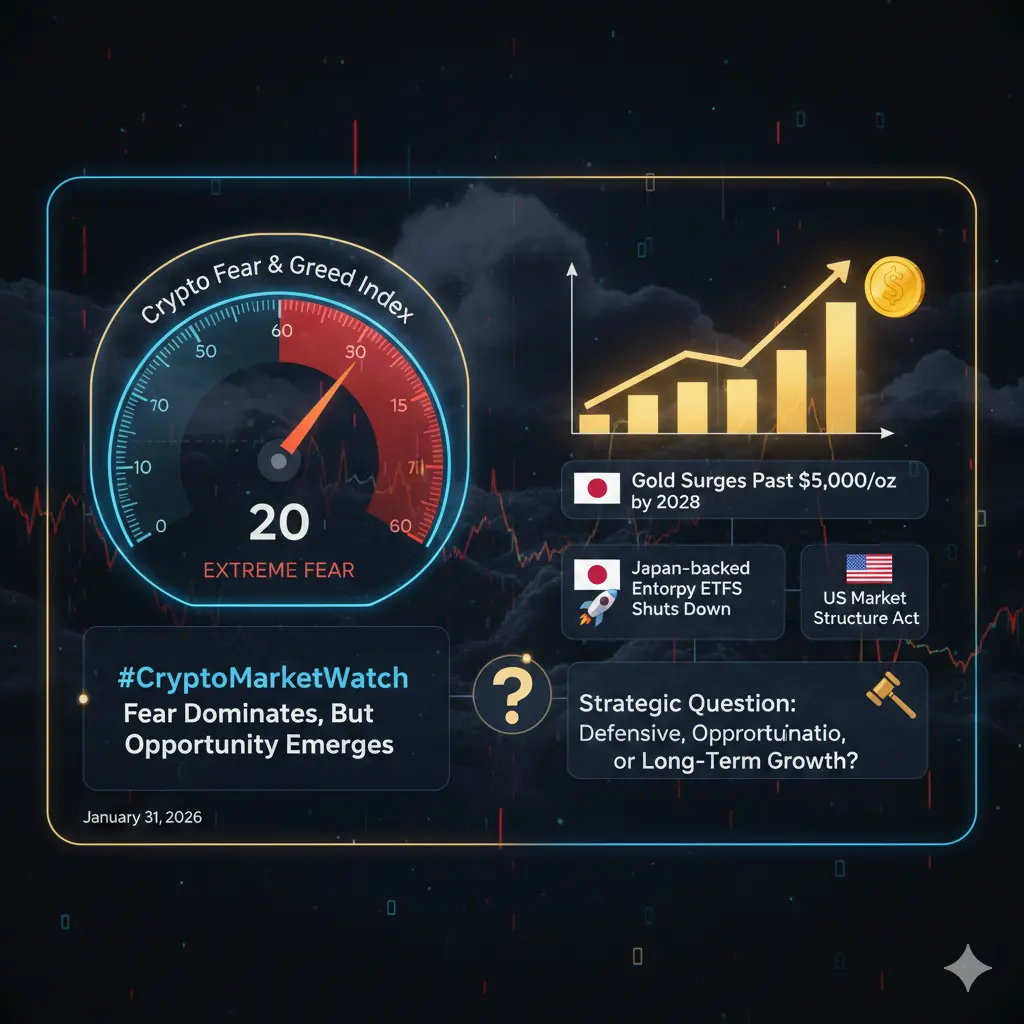

BITCOIN SHAKEOUT SPARKS PANIC ; BUT HISTORY SAYS THIS IS HOW BULL MARKETS ARE BUILT

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

Now step back. Every major Bitcoin run has been preceded by the same pattern: a violent flush that wipes out leverage, shaken confidence that convinces people it’s “over,” and a silent accumulation phase while attention fades.

That discomfort is what sets the foundation for the next expansion.

Reminder: dips are gifts.

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #USGovernmentShutdownRisk #FedKeeps

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

Now step back. Every major Bitcoin run has been preceded by the same pattern: a violent flush that wipes out leverage, shaken confidence that convinces people it’s “over,” and a silent accumulation phase while attention fades.

That discomfort is what sets the foundation for the next expansion.

Reminder: dips are gifts.

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback #USGovernmentShutdownRisk #FedKeeps

- Reward

- 10

- 5

- Repost

- Share

GateUser-5f202a86 :

:

Just by sharing on social media, you can get 1 spin. Good luck! Share Your Luck & Win More Prizes! https://gate.com/activities/p2p-fortune-hunt?ch=p2pFortuneHunt_20260126&ref=VQVHULWNAQ&invite_uid=OU6mj2zMizAl8PI6oGNTiw**&ref_type=155

View More

📊 Interest Rates on Hold — What’s Next for Crypto?

Insights from Dragon Fly Official show that with interest rates on hold and the market pricing in “higher for longer”, investors are at a crossroads: position defensively or rotate into risk assets like BTC and altcoins? ⚖️💡

📈 Market Analysis:

BTC: Bitcoin often behaves as a macro-sensitive risk asset. With rates stable, BTC may see measured strength, but Dragon Fly Official notes that sustained high rates can cap upside, keeping volatility moderate.

Altcoins: Historically, altcoins outperform BTC during periods of stable liquidity and rene

Insights from Dragon Fly Official show that with interest rates on hold and the market pricing in “higher for longer”, investors are at a crossroads: position defensively or rotate into risk assets like BTC and altcoins? ⚖️💡

📈 Market Analysis:

BTC: Bitcoin often behaves as a macro-sensitive risk asset. With rates stable, BTC may see measured strength, but Dragon Fly Official notes that sustained high rates can cap upside, keeping volatility moderate.

Altcoins: Historically, altcoins outperform BTC during periods of stable liquidity and rene

- Reward

- 2

- 23

- Repost

- Share

ox_Alan :

:

HODL Tight 💪View More

#FedKeepsRatesUnchanged With the Federal Reserve holding interest rates steady, markets are shifting focus from the decision itself to what comes next. This pause is not an endpoint — it’s a checkpoint. The real signal lies in forward guidance, incoming data, and evolving liquidity conditions rather than the headline rate decision.

The next phase will be shaped by three dominant forces: the trajectory of inflation, resilience in the labor market, and global financial conditions. If inflation continues to moderate while employment remains stable, the path toward eventual rate cuts becomes clear

The next phase will be shaped by three dominant forces: the trajectory of inflation, resilience in the labor market, and global financial conditions. If inflation continues to moderate while employment remains stable, the path toward eventual rate cuts becomes clear

- Reward

- 16

- 22

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#FedKeepsRatesUnchanged

The Fed kept interest rates steady — and the market response says everything.

No celebration. No collapse. Just a cautious pause loaded with tension.

This decision isn’t neutral.

It’s the Fed admitting the economy is walking a narrow line.

Inflation is easing, but it’s not defeated. Growth is slowing, but not breaking.

So the Fed waits — not because the job is done, but because timing now matters more than action.

For risk assets, this creates a quiet but dangerous environment.

Stable rates reduce immediate liquidity shocks, but they also remove clear direction.

Bitcoin

The Fed kept interest rates steady — and the market response says everything.

No celebration. No collapse. Just a cautious pause loaded with tension.

This decision isn’t neutral.

It’s the Fed admitting the economy is walking a narrow line.

Inflation is easing, but it’s not defeated. Growth is slowing, but not breaking.

So the Fed waits — not because the job is done, but because timing now matters more than action.

For risk assets, this creates a quiet but dangerous environment.

Stable rates reduce immediate liquidity shocks, but they also remove clear direction.

Bitcoin

- Reward

- 6

- 5

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

#FedKeepsRatesUnchanged

The Federal Reserve has decided to keep interest rates unchanged at 3.50–3.75%, pausing after three rate cuts in 2025 that were designed to support economic growth, encourage borrowing, and stabilize the job market. Throughout 2025, the Fed gradually reduced rates to make loans, mortgages, and business credit more affordable, stimulate spending and investment, and provide liquidity amid inflationary pressures and global uncertainties. By maintaining the current rate, the Fed signals caution, as inflation remains slightly above its 2% target at around 2.7–2.8%, while GD

The Federal Reserve has decided to keep interest rates unchanged at 3.50–3.75%, pausing after three rate cuts in 2025 that were designed to support economic growth, encourage borrowing, and stabilize the job market. Throughout 2025, the Fed gradually reduced rates to make loans, mortgages, and business credit more affordable, stimulate spending and investment, and provide liquidity amid inflationary pressures and global uncertainties. By maintaining the current rate, the Fed signals caution, as inflation remains slightly above its 2% target at around 2.7–2.8%, while GD

- Reward

- 1

- Comment

- Repost

- Share

#FedKeepsRatesUnchanged #FedKeepsRatesUnchanged

The Federal Reserve just left rates unchanged, and markets are reacting—not with fireworks, but with a tense pause that demands respect. This isn’t a headline to skim over. It’s a signal of the Fed’s careful tightrope act between controlling inflation and not stifling growth.

🔹 Why this matters: By holding rates steady, the Fed is acknowledging the fragile balance of the current economy. Inflation is cooling, but not enough to declare victory. The markets are interpreting this as a “wait-and-see” stance—a pause, not a pivot.

🔹 Impact on crypto

The Federal Reserve just left rates unchanged, and markets are reacting—not with fireworks, but with a tense pause that demands respect. This isn’t a headline to skim over. It’s a signal of the Fed’s careful tightrope act between controlling inflation and not stifling growth.

🔹 Why this matters: By holding rates steady, the Fed is acknowledging the fragile balance of the current economy. Inflation is cooling, but not enough to declare victory. The markets are interpreting this as a “wait-and-see” stance—a pause, not a pivot.

🔹 Impact on crypto

- Reward

- 3

- 4

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

38.36K Popularity

72.53K Popularity

370.7K Popularity

50.2K Popularity

69.34K Popularity

22.78K Popularity

27.85K Popularity

22.33K Popularity

94.18K Popularity

40.49K Popularity

35.48K Popularity

29.23K Popularity

19.12K Popularity

25.32K Popularity

216.91K Popularity

News

View MoreETH drops below 2300 USDT

1 h

Data: In the past 24 hours, the entire network has been liquidated for $362 million, with long positions liquidated for $228 million and short positions liquidated for $134 million.

1 h

BTC drops below 77,000 USDT

1 h

Data: If BTC breaks through $81,986, the total liquidation strength of mainstream CEX short positions will reach $1.318 billion.

2 h

ETH Breaks Through 2350 USDT

3 h

Pin