Post content & earn content mining yield

placeholder

alexcobb

r/overemployed - work multiple jobs during the same 40 hours, reach financial freedom.

- Reward

- like

- Comment

- Repost

- Share

📉 From Euphoria to Reality in 4 Months

Nearly 50% Market Cap Gone in just 120 days.

🗓 Oct 7, 2025 — Total Crypto Market Cap: $4.26T

🗓 Feb 6, 2026 — Total Crypto Market Cap: $2.16T

That’s a $2.1 TRILLION wipeout.

And yes… we’ve seen worse.

Let’s zoom out 👇

🔻 2014–2015 Bear Market

• Market cap fell ~-86%

• From ~$15B → ~$2B

Mt. Gox collapsed.

70% of Bitcoin volume vanished overnight.

Trust was shattered. Exchanges failed.

Crypto was declared “dead” for the first time.

🔻 2018 Bear Market

• Market cap crashed ~-84%

• From ~$830B → ~$130B

The ICO bubble imploded.

Projects with no product evap

Nearly 50% Market Cap Gone in just 120 days.

🗓 Oct 7, 2025 — Total Crypto Market Cap: $4.26T

🗓 Feb 6, 2026 — Total Crypto Market Cap: $2.16T

That’s a $2.1 TRILLION wipeout.

And yes… we’ve seen worse.

Let’s zoom out 👇

🔻 2014–2015 Bear Market

• Market cap fell ~-86%

• From ~$15B → ~$2B

Mt. Gox collapsed.

70% of Bitcoin volume vanished overnight.

Trust was shattered. Exchanges failed.

Crypto was declared “dead” for the first time.

🔻 2018 Bear Market

• Market cap crashed ~-84%

• From ~$830B → ~$130B

The ICO bubble imploded.

Projects with no product evap

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRAV19ABQ

View Original

- Reward

- like

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$8.35K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRCUQ1WAW

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

May I ask everyone, how do you verify this ID?

Choosing China as the display region cannot be verified?????????????

Looking for an answer.

View OriginalChoosing China as the display region cannot be verified?????????????

Looking for an answer.

- Reward

- like

- 1

- Repost

- Share

XiaoJia :

:

Dear user, please provide relevant screenshots so our online customer service can verify your issue. You can tap the profile picture in the top left corner on the app homepage, then tap the headset icon in the top right corner, and select "Online Customer Service" below. In the chat box below, type "Human" and send, then click "Human Customer Service" to inquire.Today Market Analysis

- Reward

- like

- Comment

- Repost

- Share

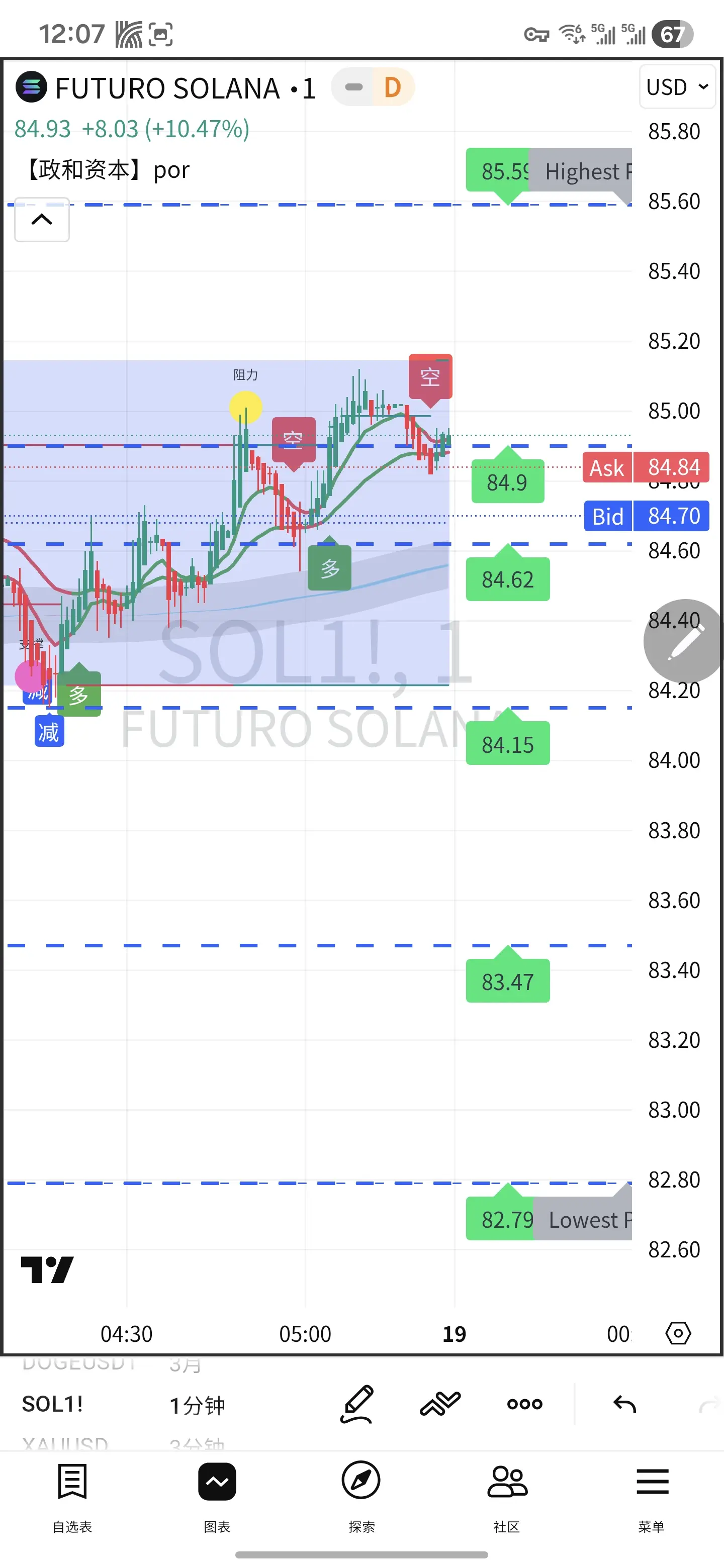

📊 2026-02-14 SOL Technical Analysis (as of 12:00 Beijing Time)

Current Price: Approximately $84.5 (following BTC rebound, intra-day oscillation leaning bullish)

1. Key Levels (Core Battleground)

- Resistance Levels (Upward)

- Short-term: $88–$90 (intraday strong resistance, high concentration of positions)

- Mid-term: $94–$96 (previous high + Fibonacci 38.2%)

- Strong Resistance: $100 (psychological barrier + 50-day moving average)

- Support Levels (Downward)

- Immediate: $81–$83 (intraday support, yesterday’s low)

- Critical: $78–$80 (high concentration of positions + bull-bear dividin

Current Price: Approximately $84.5 (following BTC rebound, intra-day oscillation leaning bullish)

1. Key Levels (Core Battleground)

- Resistance Levels (Upward)

- Short-term: $88–$90 (intraday strong resistance, high concentration of positions)

- Mid-term: $94–$96 (previous high + Fibonacci 38.2%)

- Strong Resistance: $100 (psychological barrier + 50-day moving average)

- Support Levels (Downward)

- Immediate: $81–$83 (intraday support, yesterday’s low)

- Critical: $78–$80 (high concentration of positions + bull-bear dividin

SOL7.79%

- Reward

- 1

- Comment

- Repost

- Share

#GateSquare$50KRedPacketGiveaway

GateSquare$50KRedPacketGiveaway

The GateSquare $50K Red Packet Giveaway is a standout campaign in the crypto world because it perfectly merges community engagement, strategic incentives, and long-term growth. Unlike typical promotions that reward only trading volume or large holdings, this initiative is designed to recognize consistent participation, meaningful contributions, and active engagement. In essence, GateSquare is rewarding the behaviors that sustain a healthy and vibrant ecosystem, not just short-term speculation.

At its core, this giveaway is about

GateSquare$50KRedPacketGiveaway

The GateSquare $50K Red Packet Giveaway is a standout campaign in the crypto world because it perfectly merges community engagement, strategic incentives, and long-term growth. Unlike typical promotions that reward only trading volume or large holdings, this initiative is designed to recognize consistent participation, meaningful contributions, and active engagement. In essence, GateSquare is rewarding the behaviors that sustain a healthy and vibrant ecosystem, not just short-term speculation.

At its core, this giveaway is about

- Reward

- 5

- 4

- Repost

- Share

AylaShinex :

:

To The Moon 🌕View More

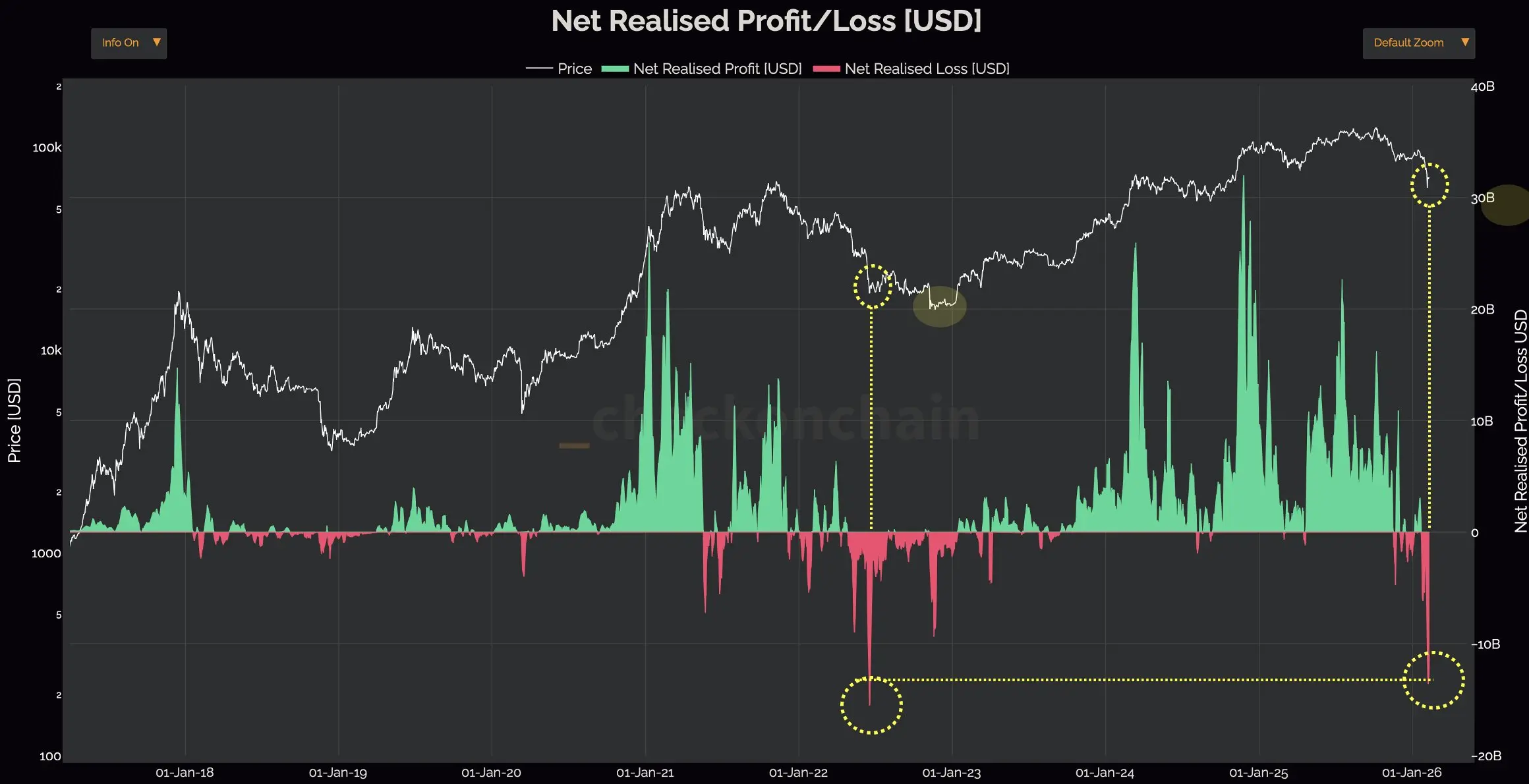

🚨 $BTC at a Critical Inflection Point: Profit Euphoria vs Capitulation ShockNet Realized Profit/Loss is flashing a high tension signal right at elevated price structureRealized profits recently surged toward extreme historical bands, echoing prior late cycle distribution phases. When green spikes expand aggressively while price grinds near highs, it typically reflects strategic profit taking rather than fresh impulsive accumulationThe latest sharp red print marks one of the deepest realized loss events since the 2022 capitulation. Such violent downside spikes historically occur during liquidi

BTC3.57%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

芝麻开门

芝麻开门

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2K

More Tokens

No more broadcasts, everyone remember to think of me.

View Original

- Reward

- 3

- 2

- Repost

- Share

TradeMoreByBuyingAtTheBottom :

:

Qingshan remains unchanged, and the green waters flow foreverView More

Gate Live Trading Champions Battle|Win USDT & Official Merchandise https://www.gate.com/campaigns/4023?ref_type=132

- Reward

- like

- Comment

- Repost

- Share

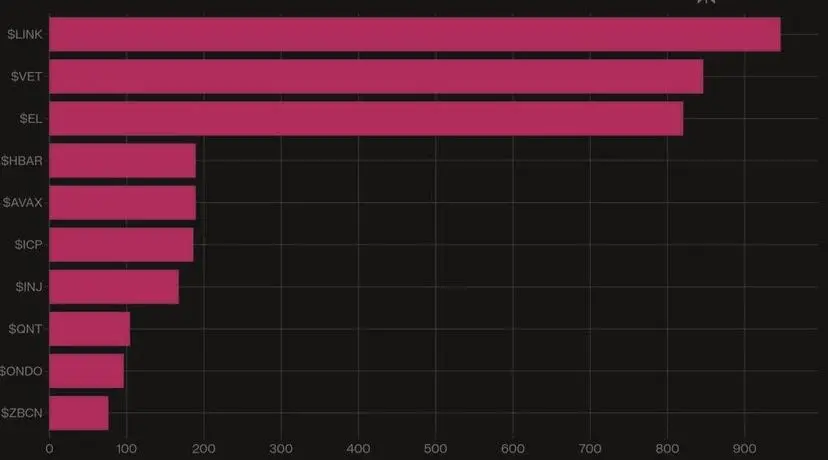

Top 10 #RWA Projects by 24-Hour Engagement

Current RWA cryptocurrencies dominating social media (engagement):

$LINK : 946K

$AVAX: 189K

$HBAR : 189K

$VET: 846K

$ICP: 186K

$INJ: 167K

$EL: 820K

$QNT: 104K

$ZBCN: 76K

$ONDO : 96K

LINK leads RWA discussions, but ONDO has now entered the top 10 with 96K engagement. $LINK #我在Gate广场过新年

Current RWA cryptocurrencies dominating social media (engagement):

$LINK : 946K

$AVAX: 189K

$HBAR : 189K

$VET: 846K

$ICP: 186K

$INJ: 167K

$EL: 820K

$QNT: 104K

$ZBCN: 76K

$ONDO : 96K

LINK leads RWA discussions, but ONDO has now entered the top 10 with 96K engagement. $LINK #我在Gate广场过新年

LINK5.66%

- Reward

- like

- Comment

- Repost

- Share

📌 Bloomberg reports that Russia wants to rejoin the USD system. Specifically, Russia proposes economic cooperation with the US if an Ukraine agreement is reached. The sectors include oil and gas, LNG, minerals, and nuclear. At the same time, signals are being sent to reopen the market for American businesses. Clearly, Russia wants to reconnect with the USD payment system.

After 2022, Russia has intensified de-dollarization, shifting towards CNY, bilateral payments, and gold accumulation. It seems Russia is reconsidering the costs of staying outside the US financial network. Energy trade is

View OriginalAfter 2022, Russia has intensified de-dollarization, shifting towards CNY, bilateral payments, and gold accumulation. It seems Russia is reconsidering the costs of staying outside the US financial network. Energy trade is

- Reward

- like

- Comment

- Repost

- Share

$XAG Explosion is imminent!

Entry: 24.50 🟩

Target 1: 25.00 🎯

Target 2: 26.00 🎯

Stop Loss: 24.00 🛑

This is not a drill. Large-scale accumulation has been confirmed. Smart money is entering the market. Get ready to take off. Your portfolio will thank you. Don't get left behind. This is your chance. Act now.

Disclaimer: Trading involves risk. #我在Gate广场过新年 $XAG

Entry: 24.50 🟩

Target 1: 25.00 🎯

Target 2: 26.00 🎯

Stop Loss: 24.00 🛑

This is not a drill. Large-scale accumulation has been confirmed. Smart money is entering the market. Get ready to take off. Your portfolio will thank you. Don't get left behind. This is your chance. Act now.

Disclaimer: Trading involves risk. #我在Gate广场过新年 $XAG

View Original

- Reward

- like

- Comment

- Repost

- Share

Bitcoin at a Crossroads: Bullish Toward the Left, Sideways Toward the Right?

If the Bitcoin market were turned into a movie, it might currently be in the scene where "the protagonist stands at a crossroads, deep in thought." The candlestick charts sometimes rise, sometimes fall, resembling someone hesitating whether to message an ex.

Many people always want to predict when the next big bullish move will come, but the market is more like a weather forecast—trends can be seen, but details are hard to predict. At this stage, Bitcoin is caught between sentiment and fundamentals: on one side, funds

If the Bitcoin market were turned into a movie, it might currently be in the scene where "the protagonist stands at a crossroads, deep in thought." The candlestick charts sometimes rise, sometimes fall, resembling someone hesitating whether to message an ex.

Many people always want to predict when the next big bullish move will come, but the market is more like a weather forecast—trends can be seen, but details are hard to predict. At this stage, Bitcoin is caught between sentiment and fundamentals: on one side, funds

BTC3.57%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Good luck and prosperity 🧧This Valentine's Day, let Gate Square keep you company! May your trades be as sweet as love and your profits bloom like roses🌹

- Reward

- 8

- 9

- Repost

- Share

HighAmbition :

:

To The Moon 🌕View More

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=A1cQUAxb

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More64.49K Popularity

401 Popularity

765 Popularity

48.7K Popularity

104 Popularity

Hot Gate Fun

View More- MC:$2.49KHolders:20.06%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreCLARITY Act New Developments: Crypto Groups Challenge Bank Proposals, Stablecoin Regulation May Reach a Compromise

12 m

PI (Pi) increased by 9.86% in the past 24 hours

17 m

Gold prices slightly increased today, with the Gate Metal Contracts sector offering 24/7 continuous trading.

25 m

Bitcoin spot ETF saw a total net inflow of $15,202,900 yesterday, with Fidelity FBTC leading with a net inflow of $11,985,100.

41 m

BCH (Bitcoin Cash) up 9.76% in the last 24 hours

42 m