2025 BTC Price Prediction: Analyzing Macroeconomic Factors and Market Cycles That Could Drive Bitcoin to New Heights

Introduction: BTC's Market Position and Investment Value

Bitcoin (BTC), as the pioneer and leader in the cryptocurrency market, has achieved remarkable success since its inception in 2008. As of 2025, Bitcoin's market capitalization has reached $2,213,979,383,654.40, with a circulating supply of approximately 19,917,696 coins, and a price hovering around $111,156.4. This asset, often referred to as "digital gold," is playing an increasingly crucial role in the global financial ecosystem and as a store of value.

This article will comprehensively analyze Bitcoin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BTC Price History and Current Market Status

BTC Historical Price Evolution

- 2009: Bitcoin launched, price effectively $0

- 2013: First major bull run, price reached $1,242 before crashing

- 2017: Massive bull market, price peaked at $19,783 before bear market

- 2021: New all-time high of $68,789, followed by correction

- 2025: Current all-time high of $124,128 set on August 14

BTC Current Market Situation

As of September 8, 2025, Bitcoin (BTC) is trading at $111,156.4. The cryptocurrency has shown resilience in the past 24 hours with a 0.39% increase. Over the past week, BTC has demonstrated strong momentum, gaining 3.30%. However, the 30-day performance shows a decline of 4.49%, indicating some short-term volatility.

Bitcoin's market capitalization stands at $2,213,979,383,654.40, maintaining its position as the largest cryptocurrency with a market dominance of 54.24%. The circulating supply is 19,917,696 BTC, which is 94.85% of the maximum supply of 21,000,000 BTC.

The 24-hour trading volume is $628,604,349, reflecting active market participation. Bitcoin is currently trading at 89.55% of its all-time high, suggesting potential room for growth while also indicating the maturity of the market.

Click to view the current BTC market price

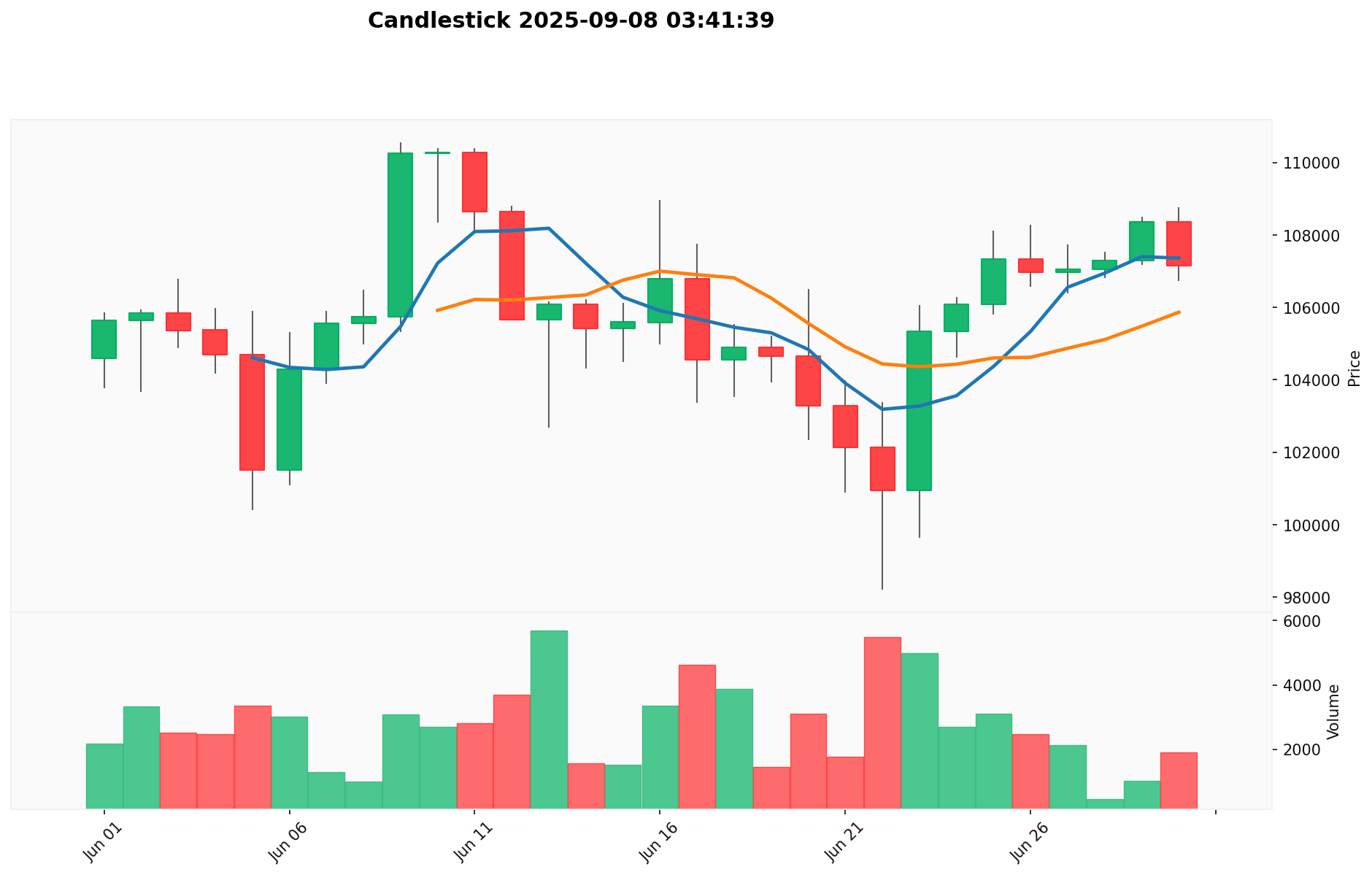

II. BTC Technical Analysis

Key Technical Indicators

- 24-hour price range: $110,474 (low) to $111,600 (high)

- 1-hour change: +0.16%

- 7-day change: +3.30%

- 30-day change: -4.49%

- 1-year change: +105.30%

Technical Outlook

The recent price action shows a bullish short-term trend, with positive 1-hour, 24-hour, and 7-day changes. However, the negative 30-day performance suggests some consolidation after the recent all-time high. The substantial 1-year gain of 105.30% indicates a strong long-term uptrend.

III. BTC Fundamental Analysis

Project Overview

Bitcoin, proposed by Satoshi Nakamoto in 2008, is a decentralized digital currency operating on a peer-to-peer network. It uses cryptography to secure transactions and control the creation of new units, operating independently of central banks.

Key Metrics

- Market Cap: $2,213,979,383,654.40

- Fully Diluted Valuation: $2,334,284,400,000.00

- Circulating Supply: 19,917,696 BTC

- Maximum Supply: 21,000,000 BTC

- Holders: 54,270,049

Network and Adoption

- Bitcoin is listed on 75 exchanges

- The project maintains active development on GitHub

- Strong community presence on Twitter, Reddit, and Bitcointalk forum

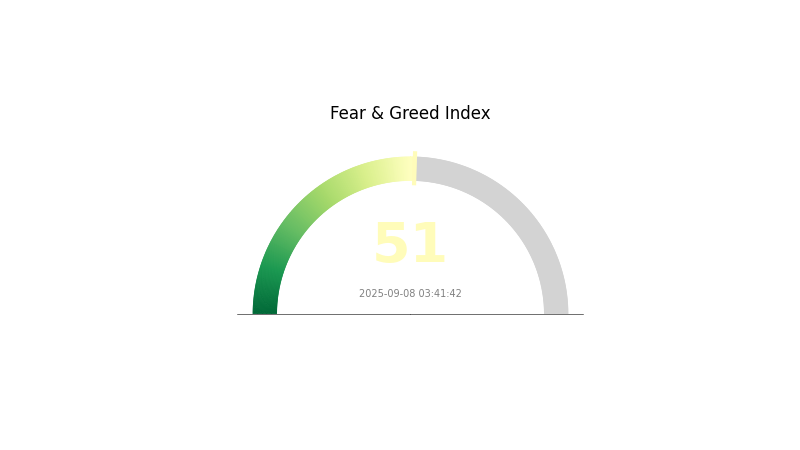

IV. Market Sentiment and Volatility

The current market emotion for Bitcoin is positive, with a rating of 1. The VIX (Volatility Index) stands at 51, indicating a neutral market state. This suggests that while there is optimism around Bitcoin, investors should remain cautious of potential market swings.

V. Investment Considerations

- Bitcoin's strong market dominance and increasing adoption provide a solid foundation for long-term growth.

- The upcoming halving event (expected in 2026) could potentially impact supply dynamics and price.

- Regulatory developments worldwide continue to influence Bitcoin's price and adoption rate.

- Macroeconomic factors, including inflation and global economic uncertainties, may affect Bitcoin's performance as a store of value.

VI. Conclusion

Bitcoin continues to lead the cryptocurrency market, showing strong long-term growth despite short-term volatility. Its robust fundamentals, increasing institutional adoption, and limited supply make it an attractive asset for many investors. However, as with all investments, thorough research and risk assessment are essential before making any financial decisions.

BTC Market Sentiment Indicator

2025-09-08 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index standing at 51, indicating a neutral outlook. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. Such a neutral stance often reflects a period of consolidation or uncertainty, where market participants are cautiously assessing various factors before making significant moves. Traders and investors should remain vigilant and consider both potential risks and opportunities in this balanced market environment.

BTC Holdings Distribution

The BTC address holdings distribution provides valuable insights into the concentration of Bitcoin ownership. Analyzing the top 5 addresses, we observe that the largest holder possesses 248,600 BTC, accounting for 1.25% of the total supply. The subsequent four largest addresses hold between 0.48% to 0.71% each. Collectively, the top 5 addresses control 3.79% of all Bitcoin, while the remaining 96.21% is distributed among other addresses.

This distribution pattern suggests a relatively decentralized ownership structure for Bitcoin. While there are significant holders at the top, their individual influence is limited, with no single address controlling more than 1.25% of the supply. The fact that over 96% of Bitcoin is held by addresses outside the top 5 indicates a broad distribution across the network. This level of decentralization potentially contributes to market stability and resilience against manipulation by any single entity.

However, it's important to note that the concentration among the top holders could still impact market dynamics, particularly during large transactions. The actions of these major holders may influence short-term price movements, though the overall market structure appears robust due to the wide distribution of the remaining supply.

Click to view the current BTC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248.60K | 1.25% |

| 2 | bc1ql4...8859v2 | 140.57K | 0.71% |

| 3 | 3M219K...DjxRP6 | 140.40K | 0.70% |

| 4 | bc1qgd...jwvw97 | 130.01K | 0.65% |

| 5 | bc1qaz...uxwczt | 94.64K | 0.48% |

| - | Others | 19163.41K | 96.21% |

II. Key Factors Affecting BTC's Future Price

Supply Mechanism

- Halving: Bitcoin's supply is controlled by a halving mechanism that reduces the block reward every four years.

- Historical Pattern: Past halvings have typically led to significant price increases in the following months.

- Current Impact: The next halving is anticipated to potentially drive up BTC's price due to reduced supply inflation.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions continue to hold and accumulate Bitcoin as a part of their investment portfolios.

- Corporate Adoption: Companies like MicroStrategy and Tesla have adopted Bitcoin as a treasury reserve asset.

Macroeconomic Environment

- Hedge Against Inflation: Bitcoin has shown properties of an inflation hedge, potentially benefiting from high inflation environments.

Technological Development and Ecosystem Building

- Lightning Network: Continued development of the Lightning Network is improving Bitcoin's scalability and transaction speed.

- Ecosystem Applications: The growth of DeFi and other applications built on Bitcoin's Layer 2 solutions is expanding its utility.

Three. 2025-2030 Bitcoin Price Prediction

2025 Outlook

- Conservative prediction: $75,686 - $95,000

- Neutral prediction: $95,000 - $130,000

- Optimistic prediction: $130,000 - $153,599 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $106,623 - $161,459

- 2028: $114,529 - $230,627

- Key catalysts: Increased institutional adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $193,758 - $218,947 (assuming steady market growth)

- Optimistic scenario: $218,947 - $244,135 (assuming strong bullish momentum)

- Transformative scenario: Above $244,135 (extreme favorable conditions like mass adoption)

- 2030-09-08: Bitcoin $218,947 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 153599.934 | 111304.3 | 75686.924 | 0 |

| 2026 | 172187.7521 | 132452.117 | 68875.10084 | 19 |

| 2027 | 161459.130623 | 152319.93455 | 106623.954185 | 36 |

| 2028 | 230627.612902155 | 156889.5325865 | 114529.358788145 | 41 |

| 2029 | 244135.80165785265 | 193758.5727443275 | 116255.1436465965 | 74 |

| 2030 | 232084.0184331554795 | 218947.187201090075 | 144505.1435527194495 | 96 |

IV. BTC Professional Investment Strategies and Risk Management

BTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Dollar-cost averaging (DCA) to reduce timing risk

- Hold for at least one full market cycle (4-5 years)

- Use hardware wallets for secure storage

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and support/resistance levels

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

BTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of portfolio

- Aggressive investors: 5-15% of portfolio

- Professional investors: 15-30% of portfolio

(2) Risk Hedging Solutions

- Options trading: Use put options for downside protection

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

(3) Secure Storage Solutions

- Hardware wallet recommendation: Ledger Nano X or Trezor Model T

- Cold storage solution: Paper wallet or steel backup plates

- Security precautions: Use strong passwords, enable 2FA, and never share private keys

V. Potential Risks and Challenges for BTC

BTC Market Risks

- Volatility: Extreme price fluctuations can lead to significant losses

- Market manipulation: Whales and large institutions can influence prices

- Liquidity risk: Large sell-offs can cause rapid price declines

BTC Regulatory Risks

- Government crackdowns: Potential bans or restrictions in various countries

- Taxation changes: Evolving tax laws may impact profitability

- AML/KYC requirements: Stricter regulations may limit accessibility

BTC Technical Risks

- 51% attack: Theoretical vulnerability to network takeover

- Quantum computing: Future advancements may threaten current cryptography

- Software bugs: Potential vulnerabilities in the Bitcoin protocol

VI. Conclusion and Action Recommendations

BTC Investment Value Assessment

Bitcoin remains the leading cryptocurrency with strong network effects and brand recognition. Its long-term value proposition as digital gold and a hedge against inflation is compelling. However, short-term volatility and regulatory uncertainties pose significant risks.

BTC Investment Recommendations

✅ Beginners: Start with small, regular investments using DCA strategy ✅ Experienced investors: Consider a core holding with active management of a portion ✅ Institutional investors: Explore Bitcoin as part of a diversified alternative asset portfolio

BTC Trading Participation Methods

- Spot exchanges: Direct purchase and trading of BTC

- Bitcoin ETFs: Regulated investment vehicles for traditional market exposure

- Bitcoin futures: Leveraged trading opportunities for experienced investors

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

2026 HOUSE Price Prediction: Expert Analysis and Market Trends for the Coming Year

2026 ZKWASM Price Prediction: Expert Analysis and Future Market Outlook for Zero-Knowledge WebAssembly Token

2026 RJV Price Prediction: Expert Analysis and Market Forecast for the Next Generation Investment Token

2026 OOE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Is MultiVAC (MTV) a good investment?: Comprehensive Analysis of Price Potential, Technology, and Market Prospects in 2024