2026 ALMANAK Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: ALMANAK's Market Position and Investment Value

Almanak (ALMANAK), as a platform democratizing quantitative trading through AI-powered multi-agent systems, has emerged as an innovative solution in the decentralized finance space since its launch in 2025. As of February 2026, ALMANAK maintains a market capitalization of approximately $850,049, with around 268.75 million tokens in circulation and a current price hovering around $0.003163. This asset, positioned as a "no-code quant trading enabler," is playing an increasingly important role in making hedge-fund-grade financial strategies accessible to retail investors.

This article provides a comprehensive analysis of ALMANAK's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors.

I. ALMANAK Price History Review and Market Status

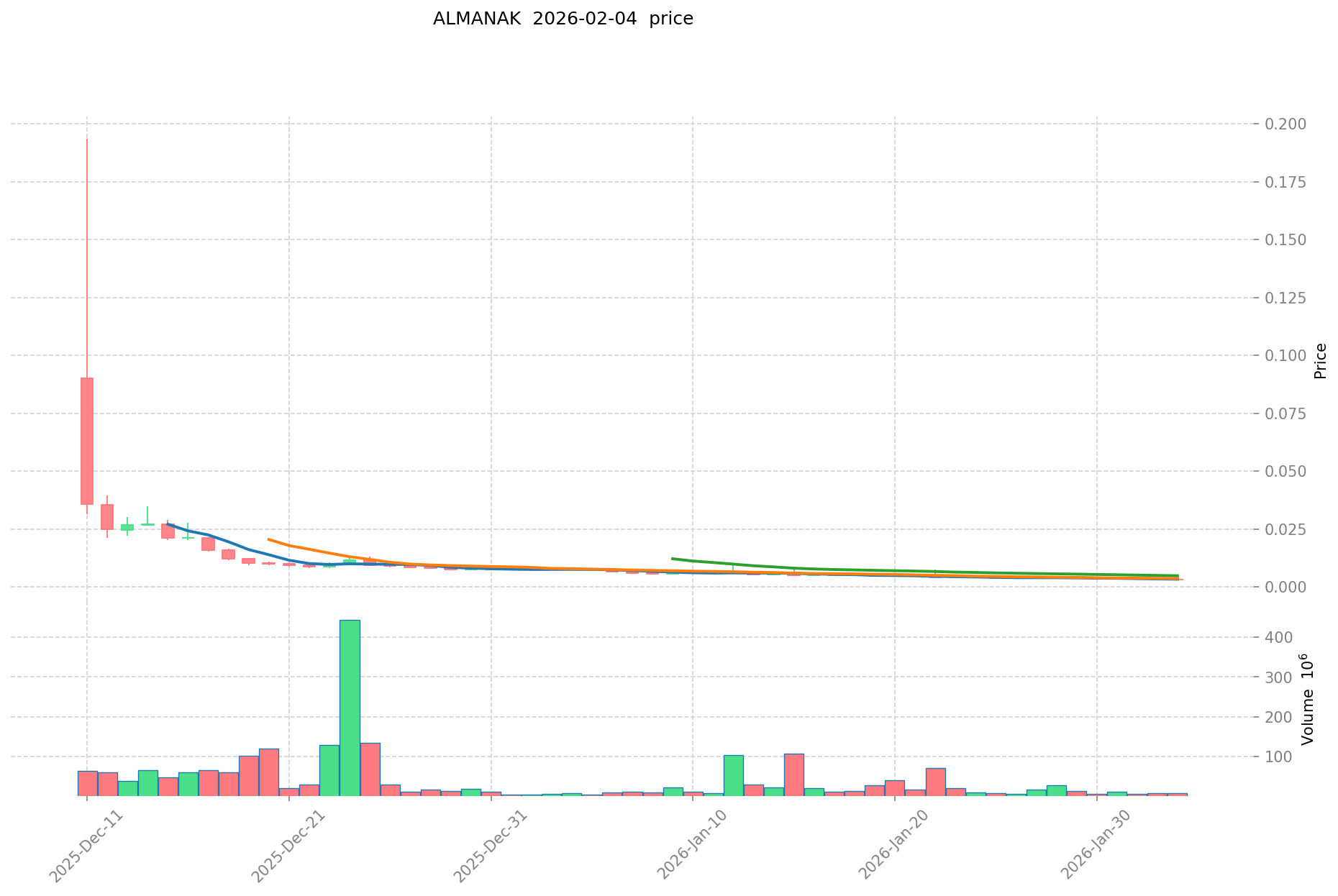

ALMANAK Historical Price Evolution Trajectory

- December 2025: ALMANAK reached a peak price of $0.19366 on December 11, 2025, marking a significant milestone shortly after its initial listing

- February 2026: The token experienced substantial downward pressure, declining to $0.003132 on February 3, 2026, representing a correction of approximately 98.4% from its peak

ALMANAK Current Market Situation

As of February 4, 2026, ALMANAK is trading at $0.003163, showing a modest recovery from its recent low. The token has experienced notable short-term volatility, with a 1-hour decline of 0.98%, a 24-hour decrease of 5.75%, and a 7-day drop of 21.2%. Over the past 30 days, the token has declined by 59.11%.

The current 24-hour trading volume stands at $25,454.21, with the token fluctuating between $0.003132 and $0.003372 within the past 24 hours. ALMANAK's circulating supply represents 26.87% of its maximum supply of 1 billion tokens, with 268,748,008 tokens currently in circulation. The market capitalization is approximately $850,049.95, while the fully diluted market cap is valued at $3,163,000.

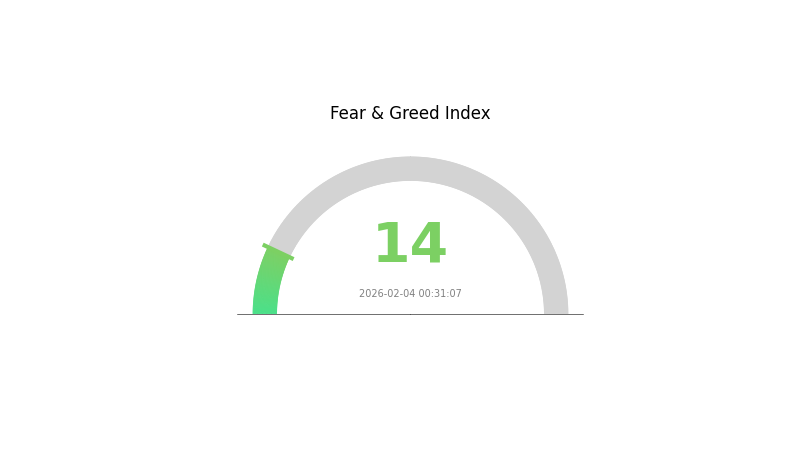

The token maintains a market dominance of 0.00011% and is listed on 8 exchanges. According to market sentiment indicators, the current VIX reading of 14 suggests an "Extreme Fear" environment in the broader market.

Click to view current ALMANAK market price

ALMANAK Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 14. This exceptionally low reading reflects significant market pessimism and risk aversion among investors. During periods of extreme fear, asset prices often face substantial downward pressure as panic selling intensifies. However, such extreme sentiment levels historically present contrarian opportunities for long-term investors. The current market conditions suggest heightened volatility and uncertainty, requiring careful risk management. Traders should monitor market developments closely and consider their investment strategies accordingly in this highly bearish environment.

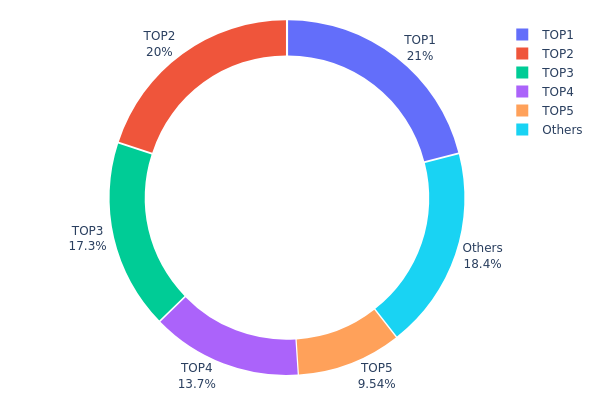

ALMANAK Holding Distribution

The holding distribution chart provides a comprehensive view of token concentration across wallet addresses, revealing the decentralization level and potential market manipulation risks. By analyzing the proportion of tokens held by top addresses versus the broader community, investors can assess the project's governance structure and price stability outlook.

Current data shows a highly concentrated holding pattern for ALMANAK, with the top 5 addresses controlling approximately 81.55% of the total token supply. The largest address holds 21.00% (210,000K tokens), followed by the second-largest at 20.00% (200,000K tokens), while the third through fifth addresses hold 17.27%, 13.74%, and 9.54% respectively. This concentration level significantly exceeds industry standards for decentralized projects, indicating potential centralization risks. The remaining 184,289.35K tokens (18.45%) are distributed among other addresses, suggesting limited circulation in the broader market.

Such extreme concentration poses multiple implications for market dynamics. First, the dominance of top holders creates asymmetric power dynamics, where major addresses could execute large-scale selling operations that trigger significant price volatility. Second, this distribution pattern may indicate early investor or team allocations that haven't fully unlocked, potentially creating future selling pressure. Third, limited token dispersion restricts organic price discovery mechanisms, as market depth remains shallow and susceptible to manipulation. However, if these concentrated holdings represent locked protocol reserves or ecosystem development funds, the actual circulating supply concentration might be even higher than surface data suggests.

From an on-chain structure perspective, ALMANAK's current holding distribution reflects a nascent decentralization phase typical of early-stage projects. While high concentration doesn't necessarily indicate malicious intent, it does constrain the project's resilience against single-point failures and reduces community-driven governance effectiveness. Investors should monitor subsequent token unlock schedules and circulation expansion trends to evaluate whether the project can achieve healthier distribution equilibrium over time.

Click to view current ALMANAK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd24b...291b8f | 210000.00K | 21.00% |

| 2 | 0x853a...1b3a9b | 200000.00K | 20.00% |

| 3 | 0x4792...412372 | 172774.91K | 17.27% |

| 4 | 0x69c9...5f8e2a | 137486.58K | 13.74% |

| 5 | 0xcd29...19256e | 95449.16K | 9.54% |

| - | Others | 184289.35K | 18.45% |

II. Core Factors Influencing ALMANAK's Future Price

Supply Mechanism

- Token Distribution Model: ALMANAK employs a structured token distribution approach that integrates capital raising, community building, and long-term governance. This mechanism optimizes fairness in token allocation while lowering participation barriers, forming a sustainable interest alignment that supports the project's long-term expansion in the AI × DeFi sector.

- Historical Pattern: Projects with well-designed token economics that balance stakeholder interests tend to demonstrate more stable price performance during ecosystem development phases.

- Current Impact: The phased release of AI Swarm functionality and gradual expansion of access permissions may create sustained demand for the token as the platform scales toward public availability.

Institutional and Major Holder Dynamics

- Institutional Position: The project has attracted attention from crypto AI research communities and DeFi-focused investment entities, though specific institutional holdings require monitoring through on-chain analytics.

- Enterprise Adoption: ALMANAK is positioning itself as infrastructure for quantitative trading strategies, with early adopters including quantitative traders and DeFi strategy developers seeking non-custodial execution environments.

- Regulatory Consideration: The project's non-custodial architecture and emphasis on user control aligns with evolving regulatory expectations around asset custody and execution transparency.

Macroeconomic Environment

- Monetary Policy Influence: Broader crypto market conditions remain sensitive to central bank policies and interest rate environments, which affect risk appetite for digital assets including specialized DeFi infrastructure tokens.

- Market Adoption Dynamics: The transition toward "Dynamic DeFi" driven by AI and machine learning could accelerate DeFi expansion, potentially benefiting platforms like ALMANAK that provide AI-driven strategy execution infrastructure.

- Competitive Landscape: ALMANAK occupies a distinctive position as one of few projects focusing specifically on quantitative trading within the AgentFi sector, though competition from traditional DeFi tools and emerging AI-driven platforms requires ongoing monitoring.

Technical Development and Ecosystem Building

- Multi-Agent AI Architecture: The AI Swarm system covering complete strategy development cycles represents a core technological differentiator, enabling users to research, test, and deploy complex DeFi strategies without coding expertise while maintaining full asset control.

- Multi-Chain Expansion: Planned integration with Solana, Hyperliquid, Avalanche, Optimism, and additional DeFi protocols aims to broaden the platform's reach and utility across diverse blockchain ecosystems.

- Security Infrastructure: The technical stack combining TEE (Trusted Execution Environment), Safe Wallet, and Zodiac Roles Modifier provides institutional-grade security with granular permission management, supporting automated on-chain execution while protecting strategy privacy.

- Vault Tokenization: ALMANAK Vaults transform trading strategies into tokenized, composable financial products based on ERC-7540 standard, enabling capital allocation, yield distribution, and strategy sharing within the broader DeFi ecosystem.

- Ecosystem Applications: The platform serves as both a capital allocator directing TVL to DeFi projects and a vault creation platform for fund managers, positioning it at the intersection of strategy development and capital deployment infrastructure.

III. 2026-2031 ALMANAK Price Forecast

2026 Outlook

- Conservative forecast: $0.00299 - $0.00315

- Neutral forecast: Around $0.00315

- Optimistic forecast: Up to $0.00334 (requiring favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may experience moderate volatility with gradual upward momentum during this mid-term period, potentially influenced by broader crypto market cycles and project development milestones.

- Price range forecast:

- 2027: $0.00224 - $0.00429

- 2028: $0.00211 - $0.00388

- 2029: $0.00336 - $0.00432

- Key catalysts: Platform adoption rates, technological upgrades, and overall cryptocurrency market sentiment could serve as primary drivers for price movement during this period.

2030-2031 Long-term Outlook

- Base scenario: $0.00244 - $0.00464 (assuming steady ecosystem growth and stable market conditions)

- Optimistic scenario: $0.00405 - $0.00584 (contingent upon accelerated adoption and favorable regulatory developments)

- Transformational scenario: Potential to reach the upper range of $0.00584 by 2031 (under exceptionally favorable conditions including significant partnerships and widespread platform integration)

- 2026-02-04: ALMANAK trading near initial range levels as the market establishes baseline valuation patterns

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00334 | 0.00315 | 0.00299 | 0 |

| 2027 | 0.00429 | 0.00325 | 0.00224 | 2 |

| 2028 | 0.00388 | 0.00377 | 0.00211 | 19 |

| 2029 | 0.00432 | 0.00382 | 0.00336 | 20 |

| 2030 | 0.00464 | 0.00407 | 0.00244 | 28 |

| 2031 | 0.00584 | 0.00436 | 0.00405 | 37 |

IV. ALMANAK Professional Investment Strategy and Risk Management

ALMANAK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to AI-driven quantitative trading infrastructure with a multi-year outlook

- Operational recommendations:

- Consider accumulating positions during periods of lower volatility, given the token's recent significant price decline of approximately 59% over the past 30 days

- Monitor project development milestones and adoption metrics of the no-code AI agent platform

- Utilize Gate Web3 Wallet for secure storage with multi-signature features to protect long-term holdings

(2) Active Trading Strategy

- Technical analysis tools:

- Volume Analysis: Track the 24-hour trading volume (currently $25,454) alongside price movements to identify potential reversals or continuation patterns

- Support and Resistance Levels: Monitor the recent 24-hour low of $0.003132 as potential support and the high of $0.003372 as near-term resistance

- Swing trading considerations:

- Given the 21.2% decline over 7 days, traders may look for oversold conditions and potential short-term rebounds

- Set clear stop-loss orders to manage downside risk in this volatile environment

ALMANAK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Moderate investors: 3-5% of crypto portfolio allocation

- Aggressive investors: 5-10% of crypto portfolio allocation, only for those with high risk tolerance

(2) Risk Hedging Approaches

- Portfolio Diversification: Combine ALMANAK with established digital assets and stablecoins to reduce concentration risk

- Position Sizing: Scale into positions gradually rather than committing full allocation at once, especially during periods of heightened volatility

(3) Secure Storage Solutions

- Software Wallet recommendation: Gate Web3 Wallet offers convenient access with built-in security features for active traders

- Hardware wallet option: For larger holdings intended for long-term storage, consider cold storage solutions to minimize online exposure

- Security precautions: Never share private keys, enable two-factor authentication, verify contract addresses (0xdefa1d21c5f1cbeac00eeb54b44c7d86467cc3a3 on Ethereum), and be cautious of phishing attempts

V. ALMANAK Potential Risks and Challenges

ALMANAK Market Risk

- High Volatility: The token has experienced substantial price fluctuations, declining 59.11% over 30 days and 21.2% over 7 days, indicating significant market volatility

- Limited Liquidity: With a circulating market cap of approximately $850,050 and 24-hour volume of $25,454, liquidity may be limited during periods of market stress

- Early-stage Valuation: The token currently trades significantly below its initial high of $0.19366 (recorded on December 11, 2025), reflecting market uncertainty around valuation

ALMANAK Regulatory Risk

- AI and Algorithmic Trading Oversight: Regulatory frameworks for AI-driven trading platforms remain evolving, potentially impacting the project's operations

- Securities Classification Uncertainty: Platforms facilitating automated trading strategies may face regulatory scrutiny regarding securities laws in various jurisdictions

- Cross-border Compliance: Operating a global quantitative trading platform requires navigating complex international regulatory requirements

ALMANAK Technical Risk

- Platform Adoption: Success depends on user adoption of the no-code AI agent system for quantitative strategy development

- Smart Contract Security: As an ERC-20 token on Ethereum, vulnerabilities in smart contract code could pose risks to user funds

- Competition: The AI-driven trading platform space faces competition from established quantitative trading solutions and emerging blockchain-based alternatives

VI. Conclusion and Action Recommendations

ALMANAK Investment Value Assessment

Almanak presents an innovative approach to democratizing quantitative trading through AI-driven, no-code platforms backed by notable investors including Delphi Labs, BanklessVC, and Hashkey. The project addresses a genuine market need by reducing barriers to sophisticated trading strategies. However, the token faces significant near-term headwinds reflected in its 59% decline over 30 days and limited liquidity. The long-term value proposition depends on successful platform adoption and user growth, while short-term risks include continued price volatility, regulatory uncertainty, and competitive pressures in the AI-trading space.

ALMANAK Investment Recommendations

✅ Beginners: Approach with extreme caution; if interested, allocate only a minimal portion (under 1-2%) of your overall crypto portfolio and prioritize learning about the project fundamentals before investing ✅ Experienced investors: Consider small, speculative positions (2-5% of crypto allocation) while closely monitoring platform development metrics and user adoption; implement strict risk management protocols ✅ Institutional investors: Conduct thorough due diligence on the technology stack, team execution capability, and competitive positioning; consider pilot allocation with regular performance review milestones

ALMANAK Trading Participation Methods

- Spot Trading: Purchase ALMANAK directly on Gate.com and other supporting exchanges, currently trading at approximately $0.003163

- Dollar-Cost Averaging: Spread purchases over time to mitigate timing risk, particularly given recent price volatility

- Research-Driven Approach: Monitor project announcements, platform updates, and adoption metrics before making investment decisions; review the litepaper available at almanak.co for detailed information

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ALMANAK token? What are its practical uses?

ALMANAK is an innovative cryptocurrency with unique technology and novel applications. It primarily supports its ecosystem functions through trading and incentive mechanisms. The token demonstrates broad market potential and development prospects within the Web3 space.

How to predict ALMANAK price trends? What analysis methods are available?

ALMANAK price trends can be predicted through technical analysis and on-chain data interpretation. Utilize historical price patterns, trading volume data, and market indicators to identify potential price movements and make informed investment decisions.

What factors affect ALMANAK price?

ALMANAK price is influenced by technical development, market demand, trading volume, community activity, and ecosystem growth. Strong technological progress and active community support enhance its value potential.

What are the main risks of investing in ALMANAK?

Main risks include market volatility and concentration risk. ALMANAK price fluctuates based on market conditions and sentiment. Centralized dependency may amplify losses. Always conduct thorough research (DYOR) before investing to understand tokenomics and project fundamentals.

What advantages does ALMANAK have compared to similar tokens?

ALMANAK incentivizes quality content creation through its token mechanism and unlocks advanced features. With over $25 million in total locked value (TVL) and completed token sales, it demonstrates strong market traction. Its innovative platform features and robust community engagement distinguish it from competitors.

What is ALMANAK's historical price performance?

ALMANAK reached an all-time high of $0.173061 on December 11, 2025, and touched a low of $0.0039725 on January 23, 2026. Currently trading between $0.00405762 and $0.00419733, showing significant volatility in its price movement.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Bitcoin Dominance and Market Analysis: A Comprehensive Guide

Comprehensive Guide to Crypto Branding

Top-Ranked Cryptocurrencies with Growth Potential and Key Indicators for Identification

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems