2026 CWAR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: CWAR's Market Position and Investment Value

Cryowar Token (CWAR), positioned as a real-time multiplayer PVP gaming asset, has been making strides in the blockchain gaming sector since its launch in 2021. As of 2026, CWAR maintains a market capitalization of approximately $190,758, with a circulating supply of around 301.36 million tokens, and the price hovering near $0.000633. This asset, designed to power a gaming experience built on Unreal Engine and supported by the Solana network, is playing a role in the evolving play-to-earn and GameFi ecosystem.

This article will comprehensively analyze CWAR's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. CWAR Price History Review and Market Status

CWAR Historical Price Evolution Trajectory

- 2021: Token launched on November 8, 2021, with an initial offering price of $0.028. On November 12, 2021, CWAR reached its all-time high of $6.29, representing a significant surge in the early phase of the project.

- 2022-2025: Following the peak, the token entered a prolonged correction phase, with price declining substantially as the broader crypto market experienced downward pressure.

- 2026: On February 6, 2026, CWAR recorded its all-time low of $0.00059758, reflecting continued bearish sentiment in the gaming token sector.

CWAR Current Market Situation

As of February 9, 2026, CWAR is trading at $0.000633, showing mixed short-term performance. The token gained 1.09% over the past hour but declined 2.87% in the last 24 hours. Broader timeframes indicate more pronounced weakness, with losses of 23.82% over seven days, 31.20% over 30 days, and 70.36% over the past year.

The 24-hour trading range spans from $0.0005975 to $0.0006621, with trading volume at approximately $11,558.94. CWAR's circulating supply stands at 301,356,511.50 tokens (30.14% of the maximum supply of 1 billion tokens), resulting in a market capitalization of around $190,758.67. The fully diluted market cap is calculated at $633,000.

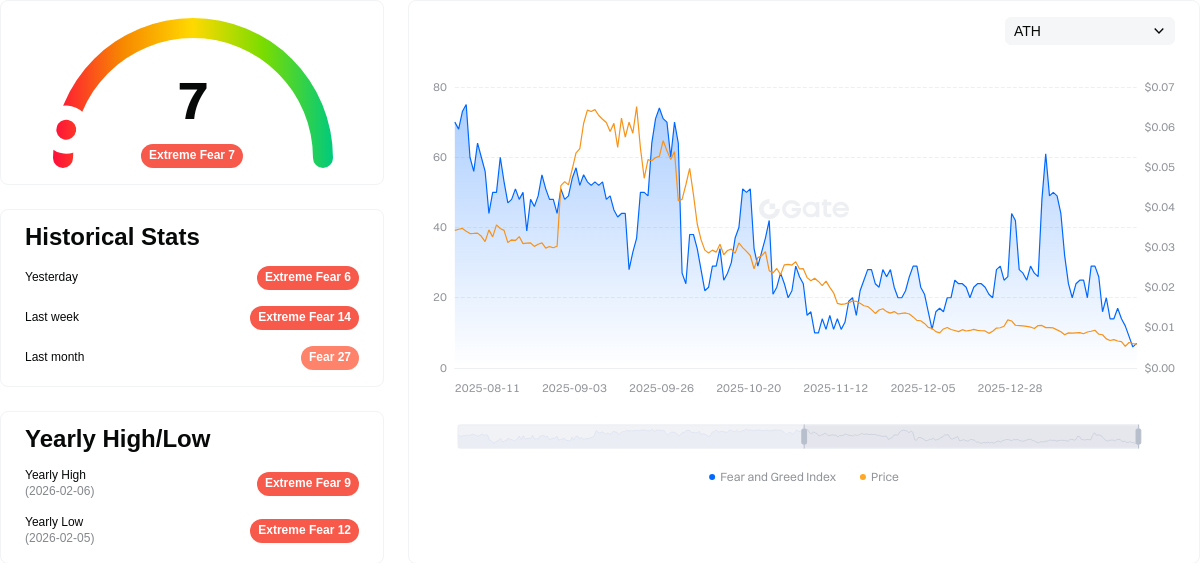

With a market dominance of 0.000025%, CWAR maintains a relatively modest presence in the overall cryptocurrency landscape. The token is held by 10,081 addresses and is currently available for trading on Gate.com. The Gate Fear and Greed Index registers at 7, indicating "Extreme Fear" in the market sentiment.

Click to view the current CWAR market price

CWAR Market Sentiment Index

2026-02-08 Fear and Greed Index: 7(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 7. This exceptionally low reading indicates intense market pessimism and heightened risk aversion among investors. During such periods, price volatility typically increases as panic selling intensifies. However, contrarian investors often view extreme fear as a potential buying opportunity, as markets tend to recover from oversold conditions. Traders should exercise caution and conduct thorough analysis before making investment decisions in this highly uncertain environment.

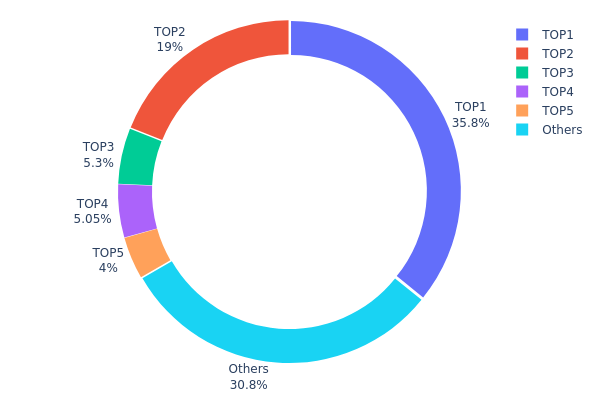

CWAR Token Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different addresses on the blockchain. As a critical on-chain metric, it reveals the degree of decentralization and potential market manipulation risks within a token's ecosystem. By analyzing the proportion of tokens held by top addresses versus the broader holder base, investors can assess the structural stability and price volatility exposure of a cryptocurrency.

According to the current data, CWAR exhibits a highly concentrated holding pattern. The top address controls 358,094.54K tokens, representing 35.80% of the total supply, while the second-largest holder possesses 190,000.00K tokens (19.00%). Combined, the top two addresses alone account for 54.80% of the circulating supply. The top five addresses collectively hold 691,638.44K tokens, or approximately 69.14% of the total, leaving only 30.86% distributed among other holders. This concentration level significantly exceeds the healthy threshold typically observed in mature cryptocurrency projects, indicating a centralized ownership structure.

Such extreme concentration poses multiple concerns for market participants. First, the dominant positions held by top addresses create substantial price manipulation risks, as large-scale sell-offs from any of these whales could trigger cascading liquidations and sharp price declines. Second, the limited distribution among smaller holders suggests weak organic community support and restricted trading liquidity, potentially amplifying volatility during market stress. Third, this structure undermines the decentralization principle fundamental to blockchain technology, concentrating governance power and economic influence in the hands of a few entities. The current holding distribution reflects an immature market structure with elevated systemic risks, warranting heightened caution from potential investors regarding both short-term price stability and long-term project viability.

Click to view current CWAR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 27Dah2...a2Hyte | 358094.54K | 35.80% |

| 2 | 3TQ6aH...V2ACLS | 190000.00K | 19.00% |

| 3 | u6PJ8D...ynXq2w | 52994.95K | 5.29% |

| 4 | FGxchk...tweSuh | 50548.95K | 5.05% |

| 5 | GxqkWd...9X8LDC | 40000.00K | 4.00% |

| - | Others | 308349.50K | 30.86% |

II. Core Factors Influencing CWAR's Future Price

Technology Development and Ecosystem Building

- Technical Progress: Technical advancements represent a fundamental driver of CWAR's price trajectory. The token's performance correlates closely with the development momentum of its underlying gaming ecosystem and platform capabilities.

- Market Sentiment: Investor confidence and overall market sentiment play pivotal roles in determining CWAR's valuation. Negative rumors and sentiment shifts can trigger selling pressure, particularly given the high volatility characteristics common in gaming tokens.

- Solana Network Dynamics: As CWAR operates within the Solana ecosystem, network performance, transaction efficiency, and broader Solana network adoption directly influence CWAR's market position and growth potential.

Macroeconomic Environment

- Macroeconomic Factors: Broader economic conditions including inflation trends, monetary policy shifts, and global financial stability create ripple effects across cryptocurrency markets. These factors can amplify price volatility and influence investor risk appetite toward gaming tokens like CWAR.

- Market Volatility: High-volatility assets face magnified price fluctuations during periods of economic uncertainty. Cost pressures, market turbulence, and income risks can affect consumer spending patterns, potentially impacting engagement with gaming platforms and token demand.

Fundamental Recovery and Growth Scenarios

- Gaming Adoption Rate: The expansion of the gaming platform's user base and active player engagement directly correlates with CWAR token utility and demand. Increased adoption strengthens fundamental value propositions.

- Multiple Catalysts: Future price outlook encompasses various scenarios ranging from bear market conditions to fundamental recovery phases and potential bull market environments. Each scenario depends on the convergence of technical milestones, ecosystem expansion, and favorable market conditions.

- Fundamental Recovery: Strengthening fundamentals through enhanced platform features, partnerships, and user growth can support sustained price appreciation and investor confidence restoration.

III. 2026-2031 CWAR Price Forecast

2026 Outlook

- Conservative estimate: $0.00056

- Neutral estimate: $0.00063

- Optimistic estimate: $0.00086 (subject to favorable market conditions)

2027-2029 Mid-term Outlook

- Market phase expectation: The token may enter a gradual growth phase with increasing market recognition and potential ecosystem developments

- Price range forecast:

- 2027: $0.00058 - $0.0008

- 2028: $0.00062 - $0.001

- 2029: $0.00065 - $0.00093

- Key catalysts: Market adoption expansion, potential project milestones, and broader crypto market trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.00065 - $0.00091 (assuming stable project development and moderate market conditions)

- Optimistic scenario: $0.00091 - $0.00103 (with enhanced ecosystem utility and positive market sentiment)

- Transformative scenario: $0.00097 - $0.00141 (under exceptional favorable conditions including significant partnerships or technological breakthroughs)

- 2026-02-09: CWAR shows stable positioning within its projected range as the market continues to evaluate its long-term value proposition

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00086 | 0.00063 | 0.00056 | 0 |

| 2027 | 0.0008 | 0.00075 | 0.00058 | 18 |

| 2028 | 0.001 | 0.00077 | 0.00062 | 22 |

| 2029 | 0.00093 | 0.00089 | 0.00065 | 40 |

| 2030 | 0.00103 | 0.00091 | 0.00065 | 43 |

| 2031 | 0.00141 | 0.00097 | 0.00054 | 52 |

IV. CWAR Professional Investment Strategies and Risk Management

CWAR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance who believe in the long-term potential of blockchain gaming and Play-to-Earn models

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry risk, especially given the token's significant volatility (down 70.36% over the past year)

- Monitor the development progress of the Cryowar gaming platform and community engagement metrics

- Store assets in Gate Web3 Wallet for secure custody with full control over private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts

- Volume Analysis: Monitor the 24-hour trading volume ($11,558.94) relative to market cap to gauge liquidity and trading interest

- Swing Trading Considerations:

- Pay attention to the 24-hour price range ($0.0005975 - $0.0006621) to identify potential entry and exit points

- Set stop-loss orders to manage downside risk, particularly given recent price declines

CWAR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: 5-10% of crypto portfolio with active monitoring

(2) Risk Hedging Strategies

- Diversification: Balance CWAR holdings with other gaming tokens and established cryptocurrencies to reduce sector-specific risk

- Position Sizing: Limit individual position size based on the token's low market cap ($190,758.67) and limited exchange availability

(3) Secure Storage Solutions

- Non-custodial Wallet Recommendation: Gate Web3 Wallet for full control over CWAR tokens stored on the Solana blockchain

- Multi-signature Solution: Consider multi-sig arrangements for larger holdings to enhance security

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (HfYFjMKNZygfMC8LsQ8LtpPsPxEJoXJx4M6tqi75Hajo) before transactions

V. CWAR Potential Risks and Challenges

CWAR Market Risks

- Extreme Volatility: The token has experienced a 70.36% decline over the past year and 31.20% decline in the past 30 days, indicating significant price instability

- Limited Liquidity: With a daily trading volume of only $11,558.94 and availability on just one exchange, liquidity constraints may impact the ability to execute large trades

- Low Market Penetration: The market cap of approximately $190,758.67 and market dominance of 0.000025% indicate minimal market recognition

CWAR Regulatory Risks

- Gaming Token Classification: Uncertainty around how gaming tokens with reward mechanisms may be classified by regulators in different jurisdictions

- Securities Law Compliance: Potential scrutiny regarding whether the token's structure and distribution comply with securities regulations

- Cross-border Gaming Regulations: Evolving regulatory frameworks for blockchain-based gaming platforms may impact project operations

CWAR Technical Risks

- Smart Contract Vulnerabilities: Potential security risks associated with the token contract on the Solana blockchain

- Network Dependency: Reliance on Solana network performance and stability for game functionality and token transactions

- Game Development Risks: Execution risks related to delivering the promised real-time multiplayer PVP gaming experience using Unreal Engine

VI. Conclusion and Action Recommendations

CWAR Investment Value Assessment

Cryowar Token (CWAR) represents a high-risk investment in the blockchain gaming sector. While the project leverages Solana's fast transaction speeds and low fees to support its multiplayer PVP gaming experience, the token faces significant challenges. The substantial price decline of over 70% in the past year, combined with limited liquidity and extremely low market capitalization, suggests considerable market skepticism. The project's long-term value proposition depends heavily on successful game development and user adoption in the competitive Play-to-Earn gaming space. Short-term risks include continued price volatility, limited trading venues, and uncertain market sentiment.

CWAR Investment Recommendations

✅ Beginners: Exercise extreme caution. Due to high volatility and limited liquidity, this token may not be suitable for those new to cryptocurrency investing. If considering investment, allocate no more than 1% of your crypto portfolio and thoroughly research the project first.

✅ Experienced Investors: Consider CWAR only as a speculative, high-risk allocation within a diversified gaming token portfolio. Monitor game development milestones and community growth metrics closely. Use strict position sizing and stop-loss strategies.

✅ Institutional Investors: Conduct comprehensive due diligence on the project's technical infrastructure, team credentials, and competitive positioning. Given the low liquidity and market cap, this token may only be suitable for specialized gaming-focused funds with high-risk mandates.

CWAR Trading Participation Methods

- Spot Trading on Gate.com: Trade CWAR directly with available trading pairs, monitoring the 24-hour price range and volume

- Dollar-Cost Averaging: Implement systematic purchases over time to reduce timing risk and average entry prices

- Secure Storage via Gate Web3 Wallet: Transfer tokens to Gate Web3 Wallet for self-custody on the Solana blockchain, ensuring full control over your assets

Cryptocurrency investments carry extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is CWAR? What are its uses and application scenarios?

CWAR is Conditional Value at Risk, a risk management tool quantifying extreme market risks. It's applied in finance and insurance for optimizing trading decisions, portfolio management, and reducing exposure to tail risks in volatile crypto markets.

How has CWAR performed historically in price, and what are the main factors affecting its price fluctuations?

CWAR exhibits high volatility influenced by token scarcity, gaming adoption rates, and macro-economic conditions. Price movements reflect market sentiment, on-chain activity, and broader crypto market trends.

How to predict CWAR price? What analysis methods and tools are available?

Use technical analysis methods like moving averages and oscillators. Popular tools include TradingView. CWAR is predicted to grow 6.86% in 2026, with average price ranging from $0.000081 to $0.000668.

What are the risks of investing in CWAR? How should I evaluate its investment value?

CWAR faces market volatility and sector risks. Evaluate by analyzing token fundamentals, community growth, transaction volume, development progress, and market adoption potential. Monitor price trends and project roadmap execution for long-term value assessment.

What are the advantages and disadvantages of CWAR compared to similar tokens?

CWAR offers specialized DeFi utility with innovative features, but faces competition from established tokens. Its advantage lies in unique ecosystem integration, while disadvantage is lower market recognition and liquidity compared to major alternatives.

What are expert price predictions for CWAR? What is the future outlook?

Experts predict CWAR may rise if the Federal Reserve signals rate cuts, supported by its inflation-resistant properties. However, market uncertainty remains. Future performance depends on global economic conditions and policy changes. Current data suggests moderate growth potential in the medium term.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

2026 MAK Price Prediction: Expert Analysis and Market Forecast for Makiblox Token

What Are Crypto Forks?

2026 GUI Price Prediction: Expert Analysis and Market Forecast for Graphical User Interface Technology Investments

Is Tranche Finance (SLICE) a good investment?: A Comprehensive Analysis of Token Utility, Market Performance, and Risk Factors for 2024

Is Clube Atlético Mineiro Fan Token (GALO) a good investment?: Analyzing Market Potential, Risk Factors, and Strategic Value for Crypto Investors