2026 FLT Price Prediction: Expert Analysis and Market Forecast for Flare Network Token

Introduction: FLT's Market Position and Investment Value

Fluence (FLT), as the first decentralized "Cloudless" computing platform, has been providing an open alternative to major internet cloud monopolies since its launch in March 2024. As of 2026, FLT's market capitalization stands at approximately $1.16 million, with a circulating supply of around 257.44 million tokens, and the price maintains at approximately $0.0045. This asset, recognized as an innovative DePIN (Decentralized Physical Infrastructure Network) solution that aggregates excess computing capacity from top-tier data centers worldwide, is playing an increasingly significant role in the decentralized cloud computing sector.

This article will comprehensively analyze FLT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. FLT Price History Review and Market Status

FLT Historical Price Evolution Trajectory

- March 2024: Token launched on Gate.com with an initial price of $0.7, reaching historical high of $1.55 on March 25, 2024

- 2025: Price experienced significant volatility during market cycles

- January 2026: Price reached historical low of $0.003821 on January 25, 2026, reflecting broader market conditions

FLT Current Market Situation

As of February 3, 2026, FLT is trading at $0.004501, showing a 24-hour increase of 13.13%. The token demonstrates moderate short-term recovery with a 7-day gain of 4.04%. However, the 30-day performance shows a decline of 63.83%, and the 1-year change reflects a decrease of 96.95%.

The current 24-hour trading volume stands at $23,104.36, with the token reaching an intraday high of $0.00455 and a low of $0.003894. The circulating supply is 257,437,371.11 FLT, representing 25.74% of the total supply of 1 billion tokens. The current market capitalization is approximately $1.16 million, with a fully diluted valuation of $4.5 million.

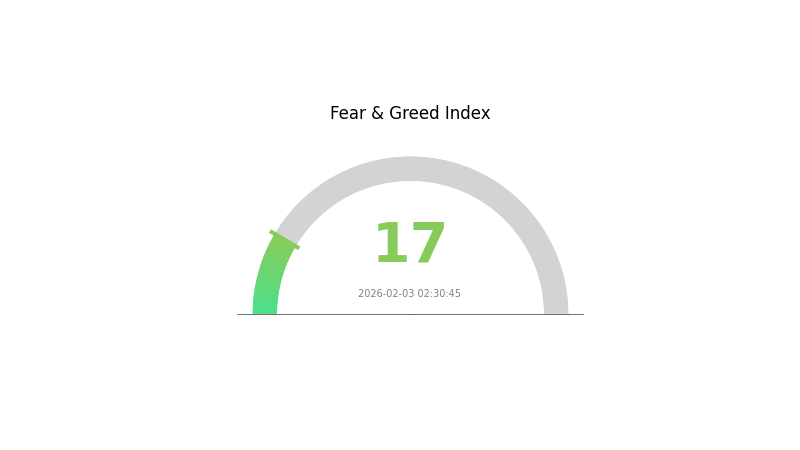

FLT maintains a market dominance of 0.00016% and ranks at position 2420 in the cryptocurrency market. The token is held by 7,603 addresses and is available for trading on 6 exchanges. Market sentiment analysis indicates an extreme fear level with a volatility index of 17.

Click to view current FLT market price

FLT Market Sentiment Index

02-03-2026 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 17. This exceptionally low reading indicates significant market pessimism and risk aversion among investors. When the index reaches such extreme levels, it often presents contrarian opportunities for seasoned traders, as markets tend to overreact during panic selling. However, caution remains advisable, as further downside pressure could continue before stabilization occurs. Investors should carefully assess their risk tolerance and investment strategies during this period of heightened market anxiety.

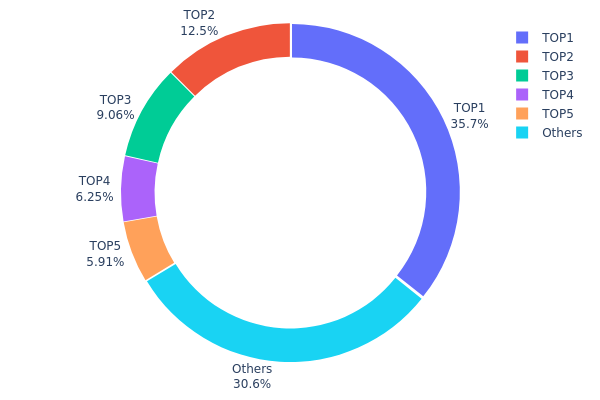

FLT Holding Distribution

The holding distribution chart reveals the concentration of FLT tokens across different wallet addresses, providing insights into the token's decentralization level and potential market dynamics. According to the latest on-chain data, the top 5 addresses collectively hold approximately 69.37% of the total FLT supply, indicating a relatively high concentration level that warrants careful analysis.

The largest holder controls 35.70% of the total supply with 357,096.83K tokens, while the second and third largest addresses hold 12.47% and 9.05% respectively. This pyramid-shaped distribution pattern, where the top address holds significantly more than subsequent addresses, suggests a centralized control structure that could pose risks to market stability. The remaining 30.63% is distributed among other addresses, indicating limited widespread adoption among retail investors.

Such concentrated holding patterns typically introduce elevated volatility risks and potential price manipulation concerns. Large holders possess substantial market influence, capable of triggering significant price movements through sizeable transactions. However, this concentration level is not uncommon in early-stage or specialized tokens within the crypto ecosystem. Investors should monitor whether these major holders represent project teams, strategic partners, or institutional investors, as their long-term holding intentions directly impact market confidence and price stability. The current distribution structure suggests that FLT's on-chain governance remains relatively centralized, and further decentralization efforts may be necessary to enhance market resilience.

Click to view current FLT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7f62...82afac | 357096.83K | 35.70% |

| 2 | 0xcda6...685cba | 124702.27K | 12.47% |

| 3 | 0x0e0a...634aac | 90579.34K | 9.05% |

| 4 | 0x5e6b...bd6d3a | 62461.60K | 6.24% |

| 5 | 0x2065...e17e77 | 59144.00K | 5.91% |

| - | Others | 306015.96K | 30.63% |

II. Core Factors Influencing FLT's Future Price

Supply Mechanism

- Total Supply Cap: Fluence (FLT) has a total supply of 1 billion tokens, creating a defined scarcity parameter that may influence long-term valuation dynamics as demand fluctuates relative to this fixed ceiling.

- Market Circulation: Current trading activity shows volatility, with recent 24-hour price movements reflecting a -7.67% decline, indicating that short-term supply-demand imbalances can create meaningful price pressure.

Institutional and Major Holder Dynamics

While specific institutional holding data for FLT was not available in the provided materials, the broader cryptocurrency market continues to see varying levels of institutional participation that can influence liquidity and price stability across digital assets.

Macroeconomic Environment

- Market Trends: Broader cryptocurrency market trends remain a significant driver for FLT price movements, as correlations with major digital assets and overall market sentiment can create momentum shifts.

- Regulatory Landscape: Evolving regulatory frameworks in major jurisdictions continue to shape the operational environment for decentralized computing platforms, potentially affecting adoption rates and market positioning.

Technology Development and Ecosystem Building

- Decentralized Serverless Architecture: Fluence's core innovation centers on its decentralized serverless infrastructure, which functions as a blockchain-driven computational marketplace. This architecture enables developers to build and deploy applications within a network of diverse computing providers, creating a foundation for scalable decentralized computing services.

- Developer Adoption: The platform's ability to attract developers and support application deployment represents a critical growth vector, as expanding use cases can drive token utility and demand over time.

Investors considering FLT should monitor these interconnected factors, recognizing that price trajectories will likely reflect the complex interplay between technological advancement, market adoption, regulatory developments, and broader macroeconomic conditions affecting the cryptocurrency sector.

III. 2026-2031 FLT Price Prediction

2026 Outlook

- Conservative Prediction: $0.00302 - $0.0045

- Neutral Prediction: $0.0045

- Optimistic Prediction: $0.00576 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a steady growth phase with gradual price appreciation, supported by potential ecosystem development and broader market recovery trends.

- Price Range Predictions:

- 2027: $0.00452 - $0.00529

- 2028: $0.00349 - $0.00724

- 2029: $0.00554 - $0.00666

- Key Catalysts: Platform upgrades, strategic partnerships, expanding user base, and overall cryptocurrency market sentiment could serve as primary drivers for price movement during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00541 - $0.00844 (assuming continued project development and stable market conditions)

- Optimistic Scenario: $0.00744 - $0.0099 (with enhanced ecosystem functionality and increased institutional interest)

- Transformative Scenario: Above $0.0099 (requires breakthrough technological implementation or significant market-wide bullish momentum)

- 2026-02-03: FLT trading around baseline levels as the project establishes its market position

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00576 | 0.0045 | 0.00302 | 0 |

| 2027 | 0.00529 | 0.00513 | 0.00452 | 14 |

| 2028 | 0.00724 | 0.00521 | 0.00349 | 15 |

| 2029 | 0.00666 | 0.00622 | 0.00554 | 38 |

| 2030 | 0.00844 | 0.00644 | 0.00541 | 43 |

| 2031 | 0.0099 | 0.00744 | 0.00439 | 65 |

IV. FLT Professional Investment Strategies and Risk Management

FLT Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the decentralized computing infrastructure narrative and can tolerate high volatility

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to build positions gradually, given FLT's significant price fluctuation (down 96.95% over one year)

- Set clear exit criteria based on project milestones such as network expansion or partnership announcements

- Storage solution: Use Gate Web3 Wallet for secure, self-custody storage with multi-signature options

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($23,104) relative to market cap to identify accumulation or distribution patterns

- Support and Resistance Levels: Track the 24-hour range ($0.003894 - $0.00455) to identify potential entry and exit points

- Key Trading Considerations:

- FLT showed 13.13% gain in 24 hours but remains 63.83% down over 30 days, indicating high volatility suitable for experienced traders

- Low market cap ($1.16M) means liquidity constraints may impact larger orders

FLT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-5% of crypto portfolio allocation

- Professional Investors: May allocate 3-8% based on comprehensive due diligence and risk models

(II) Risk Hedging Solutions

- Position Sizing: Limit exposure due to low market dominance (0.00016%) and limited exchange availability (6 exchanges)

- Stop-loss Orders: Consider trailing stops given the token's historical volatility from ATH of $1.55 to current $0.004501

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with convenient access

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding comfortable risk exposure

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract address (0x236501327e701692a281934230af0b6be8df3353 on Ethereum) before transactions

V. FLT Potential Risks and Challenges

FLT Market Risks

- Extreme Volatility: Token has declined 96.95% from launch price of $0.7, demonstrating significant downside risk

- Limited Liquidity: With only 6 exchanges listing FLT and relatively low 24-hour volume, investors may face challenges entering or exiting positions

- Market Cap Concerns: Current market cap of $1.16M represents only 25.74% of fully diluted valuation, indicating potential dilution pressure

FLT Regulatory Risks

- Decentralized Infrastructure Classification: Evolving regulatory frameworks for decentralized computing platforms may impact project operations

- Token Utility Scrutiny: Regulatory authorities may assess whether FLT's utility sufficiently distinguishes it from securities

- Geographic Restrictions: Access to decentralized computing services may face regulatory barriers in certain jurisdictions

FLT Technical Risks

- Network Adoption: Success depends on attracting sufficient compute providers and application developers to the Fluence platform

- Competition: The decentralized computing space includes established projects with larger market presence

- Technical Execution: Maintaining network uptime and performance standards while competing on 80% cost savings versus traditional cloud providers requires significant technical capability

VI. Conclusion and Action Recommendations

FLT Investment Value Assessment

Fluence presents a speculative opportunity in the decentralized physical infrastructure network (DePIN) sector, addressing the growing demand for cloud computing alternatives. The project's value proposition of 80% cost savings compared to traditional cloud providers targets a massive addressable market. However, the token's severe price decline from $1.55 ATH to current levels around $0.0045, combined with low market capitalization and limited liquidity, reflects substantial execution risk and market skepticism. Only 25.74% of maximum supply is currently circulating, which may create selling pressure as tokens unlock. The investment case depends heavily on the project's ability to achieve meaningful network adoption and demonstrate sustainable competitive advantages.

FLT Investment Recommendations

✅ Beginners: Avoid or limit to micro-positions (under 0.5% of crypto portfolio) until project demonstrates greater market traction and stability ✅ Experienced Investors: Consider small speculative allocation (1-3%) with strict risk management, focusing on project milestone achievements and network growth metrics ✅ Institutional Investors: Conduct comprehensive due diligence on network economics, token unlock schedules, and competitive positioning before considering strategic allocation

FLT Trading Participation Methods

- Spot Trading: Available on Gate.com and 5 other exchanges, suitable for straightforward exposure with manageable position sizes

- Dollar-Cost Averaging: Systematic accumulation approach to mitigate timing risk given high volatility

- Monitoring Key Metrics: Track on-chain activity, holder growth (currently 7,603), and compute capacity additions to inform position adjustments

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of FLT token? What are its all-time high and all-time low prices?

FLT token current price data varies by market conditions. Historical all-time high reached approximately $0.50, while all-time low stood near $0.001. Current price fluctuates based on market demand and trading volume. Check real-time data for the most up-to-date pricing information.

What factors affect FLT price?

FLT price is influenced by overall market sentiment, trading volume, and supply-demand dynamics. News events, market trends, and technical analysis also impact price fluctuations significantly.

What are expert predictions for FLT's future price?

Experts predict FLT's price could reach a maximum of 1.25 CAD and a minimum of 0.80 CAD based on analyst evaluations and market analysis.

What advantages does FLT have compared to other cryptocurrencies?

FLT offers superior energy efficiency with significantly lower power consumption and minimal carbon footprint. Its advanced consensus mechanism reduces operational costs while maintaining robust security, making it ideal for environmentally conscious investors seeking sustainable blockchain solutions.

How to conduct FLT price technical analysis?

Analyze FLT price by collecting historical data and using technical indicators like moving averages, RSI, and MACD. Track volume patterns, support/resistance levels, and chart patterns. Use Python libraries for data visualization and trend analysis to identify trading opportunities.

What are the circulating supply and market cap of FLT?

FLT has a circulating supply of 50 million tokens with a circulating market cap of $227,100. The maximum supply and total supply are both 1 billion tokens, with a circulation rate of 5%.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

How to Buy Bitcoin Anonymously

Top 10 Play-to-Earn NFT Games

2026 NBLU Price Prediction: Expert Analysis and Market Forecast for NewBlue Interactive Stock Performance

2026 KYO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Bull Run

2026 MTRG Price Prediction: Expert Analysis and Market Forecast for Matrixport Token