2026 NBLU Price Prediction: Expert Analysis and Market Forecast for NewBlue Interactive Stock Performance

Introduction: NBLU's Market Position and Investment Value

NuriTopia (NBLU), as a metaverse platform token integrating virtual and real-world social connections, has been developing its ecosystem since its launch in March 2023. As of February 2026, NBLU maintains a market capitalization of approximately $917,344, with a circulating supply of about 2.45 billion tokens, and the price hovering around $0.0003744. This asset, positioned as a "social metaverse rewards token," is playing an increasingly important role in facilitating interactive experiences and content creation within the NURITOPIA ecosystem.

This article will comprehensively analyze NBLU's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. NBLU Price History Review and Market Status

NBLU Historical Price Evolution Trajectory

- 2024: The token reached its peak value in May, with the price touching $0.01740432 on May 25, representing a significant milestone in its early trading phase

- 2025: The market experienced considerable volatility, with the price declining from higher levels and reaching its lowest point of $0.00035163 on November 24

- 2026: As of early February, the price stabilized at approximately $0.0003744, reflecting continued market adjustments

NBLU Current Market Situation

As of February 4, 2026, NBLU is trading at $0.0003744, showing a 24-hour decline of 2.66%. The token has demonstrated notable price fluctuations across different timeframes, with a 1-hour decrease of 0.29%, a 7-day drop of 12.78%, and a 30-day decline of 55.94%. Over the past year, the token has experienced an 84.06% decrease from its previous levels.

The trading volume over the past 24 hours stands at $40,115.60, with the price ranging between a low of $0.0003747 and a high of $0.0003879. The current market capitalization is approximately $917,344, with 2.45 billion tokens in circulation, representing 49% of the maximum supply of 5 billion tokens. The fully diluted market capitalization is calculated at $1.872 million.

NBLU currently holds a market ranking of 2571, with a market dominance of 0.000068%. The token is deployed on the BSC (BNB Smart Chain) network, with its contract address verified at 0x6bA5657BBFf83cb579503847C6bAa47295Ef79a8. The project maintains approximately 17,648 token holders according to available data.

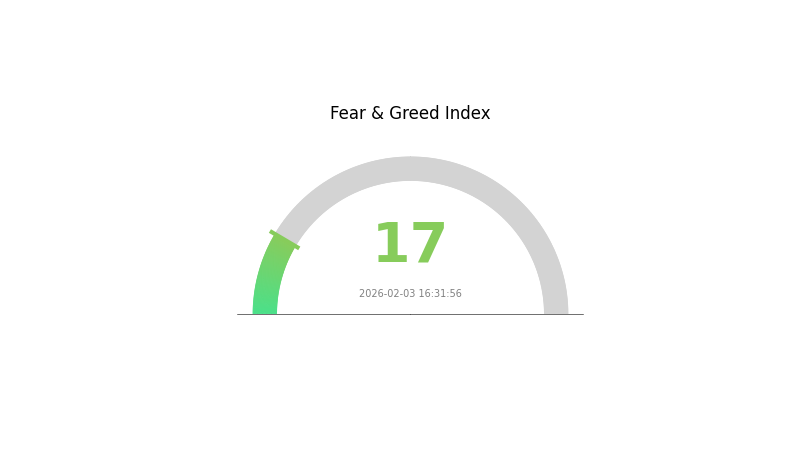

The current market sentiment indicator shows a reading of 17, classified as "Extreme Fear," suggesting cautious investor positioning in the broader cryptocurrency market environment.

Click to view current NBLU market price

NBLU Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This exceptionally low reading indicates severe market pessimism and heightened investor anxiety. During such periods, negative sentiment dominates, triggering widespread selling pressure and increased market volatility. However, extreme fear often signals potential opportunities for contrarian investors, as markets tend to overshoot on the downside. Traders should exercise caution while remaining alert to emerging opportunities. Monitor market developments closely and manage risk appropriately on Gate.com.

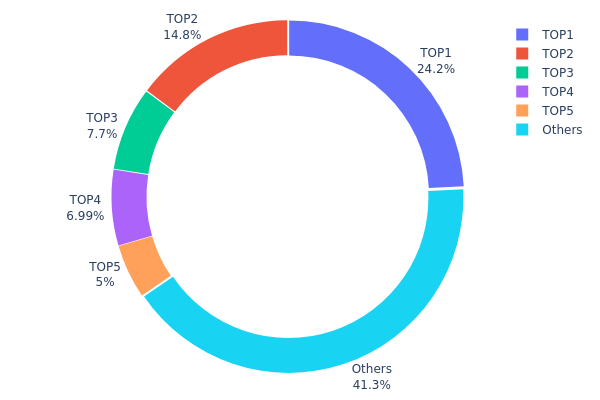

NBLU Holding Distribution

The holding distribution chart illustrates the concentration of NBLU tokens across different wallet addresses, providing insights into the decentralization level and potential market manipulation risks. This metric is crucial for assessing the health of a token's ecosystem and understanding the power dynamics among holders.

Based on the current data, NBLU exhibits a moderately high concentration pattern. The top holder controls approximately 24.18% of the total supply (1,209,203.28K tokens), while the second largest address holds 14.81% (740,796.72K tokens). Combined, the top five addresses collectively control 58.67% of the circulating supply, leaving only 41.33% distributed among other holders. This concentration level suggests that a relatively small group of entities possesses significant influence over NBLU's market dynamics.

Such concentration patterns present both opportunities and risks. On one hand, large holders may have long-term commitment to the project, potentially providing price stability during market turbulence. On the other hand, the substantial holdings of the top addresses create vulnerability to coordinated sell-offs or price manipulation. If any of the major holders decide to liquidate their positions, it could trigger significant downward pressure on NBLU's price. Additionally, this distribution structure indicates that NBLU's decentralization remains in early stages, with substantial room for improvement in achieving a more balanced holder distribution. Market participants should monitor any significant movements from these top addresses, as they could signal important shifts in market sentiment or project fundamentals.

Click to view current NBLU Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc3af...d7fa87 | 1209203.28K | 24.18% |

| 2 | 0xb774...caf406 | 740796.72K | 14.81% |

| 3 | 0xe0d7...74ba85 | 385000.00K | 7.70% |

| 4 | 0x4456...5612e5 | 349375.00K | 6.98% |

| 5 | 0x5336...c52a7b | 250000.00K | 5.00% |

| - | Others | 2065625.00K | 41.33% |

II. Core Factors Influencing NBLU's Future Price

Supply Mechanism

NBLU's price trajectory may be influenced by fundamental supply-demand dynamics in the cryptocurrency market. Historical patterns suggest that supply-side factors often play a significant role in price formation, though specific supply mechanisms for NBLU remain unclear from available information. Market participants should monitor token distribution patterns and circulation changes that could affect price stability.

Institutional and Whale Activity

Institutional participation and large holder behavior represent important variables in NBLU's price development. While specific institutional holdings data is not currently available, whale movements and concentrated ownership patterns typically create price volatility in emerging cryptocurrency assets. Monitoring on-chain metrics and large transaction flows may provide insights into potential price movements driven by major stakeholders.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions continue to influence cryptocurrency markets broadly. Tightening monetary conditions may reduce risk appetite for digital assets, while accommodative policies could support price appreciation.

- Market Sentiment: Investor psychology and overall market sentiment play crucial roles in NBLU's price discovery. Shifts in risk appetite, influenced by economic indicators and financial market conditions, may create price fluctuations.

- Regulatory Developments: Policy adjustments and regulatory frameworks across different jurisdictions can significantly impact cryptocurrency valuations. Evolving compliance requirements and government positions toward digital assets remain key considerations for price outlook.

Technical Development and Ecosystem Building

The long-term value proposition of NBLU depends on its technical infrastructure and ecosystem maturity. While specific technical upgrades or ecosystem applications are not detailed in available materials, successful blockchain projects typically demonstrate continuous development activity, growing user bases, and expanding use cases. Investors should evaluate the project's development roadmap, partnership announcements, and community engagement as indicators of potential value creation.

III. 2026-2031 NBLU Price Prediction

2026 Outlook

- Conservative prediction: $0.00032

- Neutral prediction: $0.00038

- Optimistic prediction: $0.00051

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase with moderate volatility as market conditions evolve and adoption potentially expands.

- Price range prediction:

- 2027: $0.00029 - $0.00049, with an average of $0.00045

- 2028: $0.00040 - $0.00068, with an average of $0.00047

- 2029: $0.00048 - $0.00067, with an average of $0.00057

- Key catalysts: Broader market recovery trends, potential ecosystem developments, and increased trading activity may contribute to price movements during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00041 - $0.00070 (assuming stable market conditions and continued project development)

- Optimistic scenario: $0.00052 - $0.00082 (with favorable market sentiment and enhanced utility adoption)

- Transformative scenario: Approaching $0.00082 by 2031 (under highly favorable conditions including significant ecosystem expansion and sustained investor interest)

- February 4, 2026: NBLU trading within $0.00032 - $0.00051 range (initial phase of the forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00051 | 0.00038 | 0.00032 | 0 |

| 2027 | 0.00049 | 0.00045 | 0.00029 | 18 |

| 2028 | 0.00068 | 0.00047 | 0.0004 | 24 |

| 2029 | 0.00067 | 0.00057 | 0.00048 | 53 |

| 2030 | 0.0007 | 0.00062 | 0.00041 | 66 |

| 2031 | 0.00082 | 0.00066 | 0.00052 | 77 |

IV. NBLU Professional Investment Strategy and Risk Management

NBLU Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to metaverse and social platform ecosystems with medium to long-term horizons

- Operational Suggestions:

- Consider gradual position building during market consolidation phases to average entry costs

- Monitor NURITOPIA platform development progress and user adoption metrics as key performance indicators

- Implement secure storage solutions through Gate Web3 Wallet for enhanced asset protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume trends; current volume at approximately $40,115 indicates liquidity levels for entry and exit planning

- Support and Resistance Levels: Track the 24-hour range between $0.0003747 and $0.0003879 to identify short-term trading boundaries

- Swing Trading Key Points:

- Set stop-loss orders given the asset's volatility, particularly considering the 55.94% decline over the past 30 days

- Evaluate risk-reward ratios carefully before position entries, accounting for the token's distance from its all-time high

NBLU Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Allocate no more than 1-2% of cryptocurrency portfolio

- Aggressive Investors: Consider up to 3-5% allocation within speculative asset categories

- Professional Investors: May allocate 5-8% with active hedging strategies and continuous monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance NBLU holdings with established assets to mitigate metaverse sector-specific risks

- Position Sizing: Scale investments proportionally to account size and maintain strict capital preservation protocols

(III) Secure Storage Solutions

- Gate Web3 Wallet Recommended: Provides comprehensive security features for BSC-based tokens with user-friendly interface

- Cold Storage Option: For larger holdings, consider transferring to hardware wallets after initial trading activities

- Security Precautions: Always verify contract addresses (0x6bA5657BBFf83cb579503847C6bAa47295Ef79a8 for BSC), enable two-factor authentication, and never share private keys

V. NBLU Potential Risks and Challenges

NBLU Market Risks

- High Volatility: The token has demonstrated substantial price fluctuations, with an 84.06% decline over the past year from its May 2024 peak

- Liquidity Constraints: With approximately $40,115 in 24-hour trading volume, larger position exits may face slippage challenges

- Market Sentiment Dependency: Performance may correlate strongly with broader metaverse sector trends and risk appetite cycles

NBLU Regulatory Risks

- Evolving Metaverse Regulations: Jurisdictional approaches to virtual world economies and digital asset classifications remain in development

- Token Classification Uncertainty: Regulatory treatment of platform tokens with reward mechanisms may vary across different regions

- Compliance Requirements: Future regulatory frameworks may impose additional operational obligations on metaverse platforms

NBLU Technical Risks

- Smart Contract Dependencies: As a BSC-based token, vulnerabilities in the underlying smart contract could impact asset security

- Platform Development Risk: The success of NURITOPIA's virtual and real-world integration depends on continued technical execution

- Blockchain Network Risks: Reliance on BSC infrastructure means exposure to network congestion, potential security incidents, or technical upgrades

VI. Conclusion and Action Recommendations

NBLU Investment Value Assessment

NBLU represents exposure to the metaverse and social connectivity sector through the NURITOPIA platform. With a current market cap of approximately $917,344 and a circulating supply of 2.45 billion tokens (49% of max supply), the asset operates in the speculative range of the cryptocurrency market. The platform's vision of integrating virtual and real-world social experiences offers conceptual appeal, though the token's performance over the past year, including substantial price declines, reflects both sector-wide challenges and project-specific execution risks. The fully diluted valuation at approximately $1.87 million suggests modest market expectations. Investors should weigh the platform's development potential against heightened volatility and liquidity considerations.

NBLU Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio) only after thorough research; prioritize understanding of metaverse concepts and platform fundamentals before committing capital ✅ Experienced Investors: Consider as a speculative position within a diversified metaverse portfolio allocation; implement strict stop-loss protocols and monitor platform development milestones closely ✅ Institutional Investors: Conduct comprehensive due diligence on the NuriFlex Group's operational track record and NURITOPIA's user adoption metrics; assess position sizing relative to liquidity constraints and redemption time horizons

NBLU Trading Participation Methods

- Spot Trading: Access NBLU through available exchanges including Gate.com for direct token purchases with various trading pairs

- Dollar-Cost Averaging: Implement systematic investment plans to mitigate timing risks in volatile market conditions

- Portfolio Integration: Incorporate as part of a broader metaverse or social platform token basket to distribute sector-specific risks

Cryptocurrency investments carry extreme risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is NBLU token and what is its use case?

NBLU token is the native currency of the NuriTopia ecosystem. It enables users to purchase in-app assets and services within the platform. NBLU facilitates all transactions and value exchange within the NuriTopia environment.

What factors influence NBLU price movements and market trends?

NBLU price movements are driven by market supply and demand, investor sentiment, regulatory developments, technological updates, and overall crypto market conditions. Trading volume and network adoption also significantly impact price trends.

What is the historical price performance of NBLU and what are expert price predictions for 2024-2025?

NBLU has shown volatile price movements historically. Expert analysts predict potential growth through 2024-2025, with forecasts suggesting steady appreciation driven by market fundamentals and adoption trends. Current projections indicate positive momentum ahead.

What are the main risks and volatility factors when investing in NBLU?

NBLU faces risks including price volatility, market sentiment swings, and trading volume fluctuations. Rapid price movements can significantly impact returns. Factors like regulatory changes, market adoption, and macroeconomic conditions drive volatility.

How does NBLU compare to similar tokens in the same ecosystem or category?

NBLU features a fixed supply of 1 billion tokens, offering greater scarcity compared to similar tokens like ADA which has 45 billion maximum supply. This limited supply mechanism positions NBLU favorably for long-term value appreciation within its category.

What is the current market capitalization and trading volume of NBLU?

As of February 3, 2026, NBLU has a market capitalization of $961,812. The current trading volume data is not readily available at this time. For real-time market data, please check major cryptocurrency data platforms.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to Web3 Marketing

2026 TLOS Price Prediction: Expert Analysis and Market Forecast for Telos Network Token Growth

2026 RWAINC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2026 RING Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2026 TURBOS Price Prediction: Expert Analysis and Market Forecast for the Coming Year