2026 SMURFCAT Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: SMURFCAT's Market Position and Investment Value

Real Smurf Cat (SMURFCAT), as a memecoin launched on the Ethereum blockchain, has been part of the cryptocurrency ecosystem since its inception in 2023. As of February 2026, SMURFCAT maintains a market capitalization of approximately $804,400, with a circulating supply of 100 billion tokens, and the price hovering around $0.000008044. This asset, which pays tribute to the viral Smurf Cat internet meme originally created by Nate Hallinan and popularized through TikTok, represents a unique segment within the memecoin category of the crypto market.

This article will comprehensively analyze SMURFCAT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. SMURFCAT Price History Review and Market Status

SMURFCAT Historical Price Evolution Trajectory

- 2023: Token launched on Ethereum blockchain in September with an initial price of $0.000000001, reaching an notable price level of $0.000430001 in October

- 2024-2025: Market experienced considerable adjustment period with fluctuating trading activities

- 2026: Price declined to $0.00000749 in early February, representing a shift from previous levels

SMURFCAT Current Market Situation

As of February 4, 2026, SMURFCAT is trading at $0.000008044, showing a 1.019% increase over the past hour. The 24-hour trading volume stands at $13,499.71, with the price fluctuating between $0.00000749 and $0.000008648 during this period.

The token maintains a circulating supply of 100 billion SMURFCAT, which represents 100% of the total and maximum supply. The current market capitalization is approximately $804,400, with the fully diluted valuation matching this figure. The token's market dominance stands at 0.000029%.

Over different timeframes, SMURFCAT has shown varied performance: a 3.63% decrease in the past 24 hours, a 27.70% decline over 7 days, a 38.12% decrease over 30 days, and an 81.95% decline over the past year. The token holder count currently stands at 12,379 addresses.

SMURFCAT, created as a tribute to the Smurf Cat internet meme originally developed by Nate Hallinan and popularized on TikTok, operates on the Ethereum blockchain using the ERC20 standard. The token is available for trading on 2 exchanges.

Click to view current SMURFCAT market price

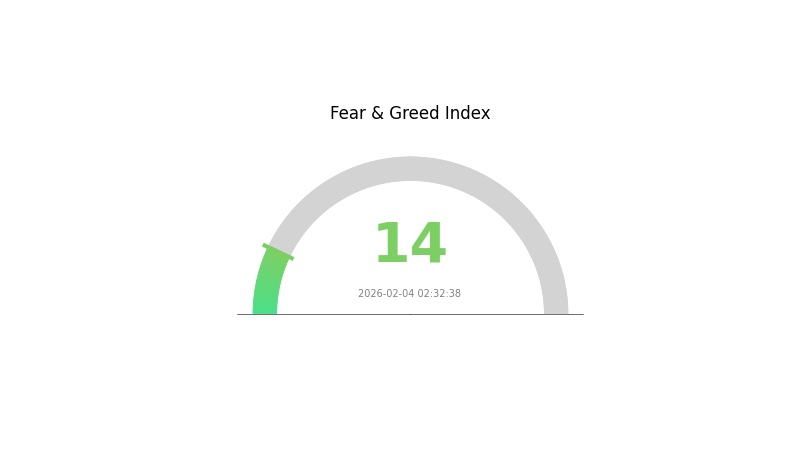

SMURFCAT Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 14. This reading reflects significant market pessimism and heightened investor anxiety. During such periods, market participants typically adopt a risk-averse stance, leading to potential selling pressures. However, experienced traders often view extreme fear as a potential accumulation opportunity, as markets historically tend to recover from such lows. Investors should remain cautious while monitoring for potential turning points in market sentiment.

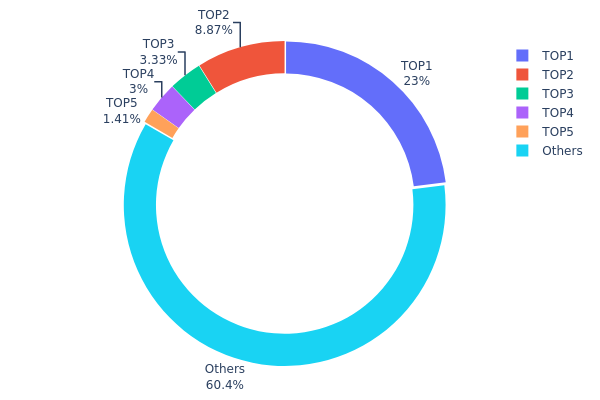

SMURFCAT Holdings Distribution

The holdings distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. This metric helps investors understand whether token supply is broadly distributed among many holders or concentrated in the hands of a few large wallets, which directly impacts price stability and market dynamics.

Based on the current data, SMURFCAT exhibits a moderately concentrated holdings structure. The top address holds approximately 23.02% of total supply (23.02 million tokens), while the top five addresses collectively control 39.62% of circulation. The remaining 60.38% is distributed among other holders, suggesting a mixed distribution pattern. This concentration level falls within a concerning range, as the top holder possesses nearly a quarter of all tokens, granting significant influence over market movements. The second-largest holder controls 8.87%, further reinforcing the dominance of major addresses.

This distribution pattern presents notable implications for market stability. The substantial holdings by top addresses create vulnerability to large-scale sell pressure, as coordinated or individual liquidations from these wallets could trigger significant price volatility. However, the fact that over 60% remains with smaller holders provides some cushion against complete market manipulation. Investors should remain vigilant about potential whale activity, particularly monitoring on-chain movements from the top five addresses. The current structure suggests SMURFCAT operates with moderate decentralization, neither completely centralized nor ideally distributed, positioning it in a transitional phase where community growth and broader token distribution would enhance long-term stability.

Click to view current SMURFCAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x977c...497c6d | 23023070.60K | 23.02% |

| 2 | 0x9642...2f5d4e | 8870462.74K | 8.87% |

| 3 | 0x0d07...b492fe | 3331334.74K | 3.33% |

| 4 | 0x3ee1...8fa585 | 2998433.80K | 2.99% |

| 5 | 0x3cc9...aecf18 | 1411800.27K | 1.41% |

| - | Others | 60364897.85K | 60.38% |

II. Core Factors Influencing SMURFCAT's Future Price

Market Sentiment and Investor Confidence

- Social Media and News Impact: Market sentiment plays a direct role in SMURFCAT price movements. News regarding widespread adoption or significant technological breakthroughs can trigger notable price fluctuations.

- Whale Activity: Large-scale transactions by major holders may lead to substantial volatility in the short term.

- Community Dynamics: Social media trends and community sentiment serve as important drivers of price action, particularly for meme-based tokens.

Macroeconomic Environment

- Global Economic Trends: Macroeconomic factors such as inflation concerns, geopolitical tensions, and central bank interest rate adjustments may drive investors toward digital assets as a store of value.

- Monetary Policy Impact: During periods of economic uncertainty, demand for alternative assets like SMURFCAT could potentially increase, affecting its exchange rate against fiat currencies.

- Risk Appetite: The overall risk appetite in financial markets influences capital flows into speculative crypto assets.

Adoption and Utility

- Use Case Development: The practical applications and utility of SMURFCAT within its ecosystem may influence long-term price sustainability.

- Market Positioning: As a highly dynamic crypto asset, SMURFCAT's adoption rate and integration into various platforms could affect its market valuation.

- Network Effects: Growing user base and community engagement may contribute to price momentum over time.

III. 2026-2031 SMURFCAT Price Prediction

2026 Outlook

- Conservative forecast: $0.00001

- Neutral forecast: $0.00001

- Optimistic forecast: $0.00001 (requires stable market conditions)

2027-2029 Outlook

- Market stage expectation: early development phase with gradual price discovery

- Price range forecast:

- 2027: $0.00001 (19% growth)

- 2028: $0.00001-$0.00002 (30% growth)

- 2029: $0.00001-$0.00002 (59% growth)

- Key catalysts: potential ecosystem expansion and community engagement developments

2030-2031 Long-term Outlook

- Baseline scenario: $0.00001-$0.00002 (assuming moderate market adoption)

- Optimistic scenario: $0.00002 (with enhanced utility and broader market acceptance)

- Transformative scenario: $0.00002 (under exceptionally favorable market conditions and significant technological advancement)

- 2026-02-04: SMURFCAT $0.00001 (current baseline level)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00001 | 0.00001 | 0.00001 | 0 |

| 2027 | 0.00001 | 0.00001 | 0.00001 | 19 |

| 2028 | 0.00002 | 0.00001 | 0.00001 | 30 |

| 2029 | 0.00002 | 0.00001 | 0.00001 | 59 |

| 2030 | 0.00002 | 0.00002 | 0.00001 | 98 |

| 2031 | 0.00002 | 0.00002 | 0.00001 | 102 |

IV. SMURFCAT Professional Investment Strategies and Risk Management

SMURFCAT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with high risk tolerance and interest in meme coin culture

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate volatility impact

- Monitor community sentiment and social media trends as key indicators

- Use Gate Web3 Wallet for secure storage with private key control

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($13,499.71) relative to market cap to identify momentum shifts

- Price Action Analysis: Track key support levels around $0.00000749 (recent low) and resistance near $0.000008648 (24H high)

- Swing Trading Considerations:

- The token has experienced significant volatility with -27.70% in 7 days and -38.12% in 30 days

- Short-term traders should set tight stop-losses given the high volatility profile

SMURFCAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of crypto portfolio

- Aggressive Investors: 2-5% of crypto portfolio

- Professional Investors: Up to 10% with active risk management protocols

(2) Risk Hedging Approaches

- Portfolio Diversification: Combine SMURFCAT with more established cryptocurrencies to balance risk exposure

- Position Sizing: Limit exposure based on the token's high volatility and -81.95% annual decline

(3) Secure Storage Solutions

- Hardware Wallet Recommended: Gate Web3 Wallet for non-custodial storage with enhanced security features

- Hot Wallet Option: Gate.com platform wallet for active trading with convenience

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract address (0xff836a5821e69066c87e268bc51b849fab94240c) before transactions

V. SMURFCAT Potential Risks and Challenges

SMURFCAT Market Risks

- Extreme Volatility: The token has declined -81.95% over the past year, demonstrating significant downside risk

- Low Liquidity: With a market cap of $804,400 and ranking at #2,669, limited liquidity may cause large price swings

- Meme Token Nature: Value is primarily driven by social media trends and community sentiment rather than fundamental utility

SMURFCAT Regulatory Risks

- Regulatory Uncertainty: Meme coins face potential scrutiny from financial regulators worldwide

- Classification Ambiguity: Unclear regulatory treatment of meme tokens may impact future trading and listing status

- Compliance Evolution: Changing cryptocurrency regulations could affect accessibility and trading conditions

SMURFCAT Technical Risks

- Smart Contract Risk: As an ERC20 token on Ethereum, potential vulnerabilities in the contract code could be exploited

- Network Dependency: Token functionality relies entirely on Ethereum network stability and performance

- Limited Exchange Availability: Currently listed on only 2 exchanges, reducing trading options and liquidity sources

VI. Conclusion and Action Recommendations

SMURFCAT Investment Value Assessment

SMURFCAT represents a high-risk, speculative meme token with cultural appeal but limited fundamental value drivers. The token has experienced substantial decline (-81.95% annually) from its all-time high of $0.000430001 in October 2023. With 12,379 holders and a modest market cap of $804,400, the project maintains some community support but faces significant downward pressure. The token's value proposition centers on its connection to the Smurf Cat internet meme popularized on TikTok. While meme tokens can experience rapid appreciation during viral trends, they also carry extreme downside risk when sentiment shifts. The current price of $0.000008044 remains near its all-time low of $0.00000749, suggesting either a potential accumulation zone or continued weakness.

SMURFCAT Investment Recommendations

✅ Beginners: Avoid or allocate only minimal amounts that you can afford to lose completely while gaining experience in meme token dynamics ✅ Experienced Investors: Consider small speculative positions (1-2% of crypto portfolio) with strict stop-losses and active monitoring of social media sentiment ✅ Institutional Investors: Generally unsuitable for institutional portfolios due to limited liquidity, high volatility, and lack of fundamental value drivers

SMURFCAT Trading Participation Methods

- Spot Trading: Purchase SMURFCAT directly on Gate.com with USDT or ETH trading pairs

- DeFi Integration: Access decentralized exchanges supporting ERC20 tokens using Gate Web3 Wallet

- Community Engagement: Monitor project social channels (Twitter: @smurfcateth) for updates and sentiment indicators

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SMURFCAT? What are its uses and value?

SMURFCAT is a cryptocurrency token designed for digital trading and investment. It serves as a utility asset within the Web3 ecosystem, enabling holders to participate in transactions and value exchange. As of February 2026, SMURFCAT maintains active market presence with fluctuating value based on market demand and trading volume.

What is the current price of SMURFCAT? How has its historical price trend been?

SMURFCAT is currently trading at $0.0000105. Its all-time high reached $0.0003975, showing significant volatility. In the past 24 hours, price fluctuated between $0.00001011 and $0.0000108, reflecting active market dynamics.

What is the SMURFCAT price prediction for 2024? What do experts think?

SMURFCAT price predictions for 2024 have not been officially published, and expert commentary remains limited. As of current data through 2026, market performance continues to evolve. Investors should monitor on-chain metrics and trading volume for insights.

What is the difference between SMURFCAT and other popular tokens such as Dogecoin and Shiba Inu?

SMURFCAT differentiates itself through unique tokenomics and community-driven development. Unlike Dogecoin's unlimited supply and Shiba Inu's DeFi focus, SMURFCAT offers distinct utility mechanisms designed for next-generation blockchain applications and enhanced community governance.

How to buy SMURFCAT? Which exchanges support trading?

You can purchase SMURFCAT on decentralized exchanges like Uniswap and SushiSwap. Choose a DEX platform that supports the blockchain network where SMURFCAT is hosted. Ensure the exchange you select supports this token before trading.

What are the risks of investing in SMURFCAT and what should I pay attention to?

SMURFCAT investment carries high volatility risks and potential loss of capital. Investors should be aware of crypto market unpredictability, price fluctuations, and liquidity risks. Only invest amounts you can afford to lose and consider consulting financial advisors before investing.

What is the liquidity and market size of SMURFCAT?

SMURFCAT exhibits limited liquidity with modest market capitalization. Trading volume remains relatively low, indicating a smaller market presence. Real-time data monitoring is recommended for current metrics and market dynamics assessment.

What is the development team and project background of SMURFCAT?

SMURFCAT is a meme-themed Ethereum project developed by an independent team. It emerged as a community-driven initiative with a small market capitalization, focusing on creating an engaging meme token within the cryptocurrency ecosystem.

What are SMURFCAT's future development plans and roadmap?

SMURFCAT plans to expand market presence and enhance token utility through strategic investments and community engagement. The project aims for long-term growth and increased adoption. Specific future plans will be disclosed progressively.

What are the technical features and innovations of SMURFCAT?

SMURFCAT features advanced blockchain protocol upgrades and Layer2 scaling solutions. Its innovation lies in ecosystem expansion, enhanced transaction efficiency, and optimized network performance for decentralized applications.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

Is Global Entertainment Token (GET) a good investment?: A Comprehensive Analysis of Tokenomics, Market Performance, and Future Growth Potential

Is Unagi (UNA) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Performance, and Future Potential

What are the key compliance and regulatory risks facing crypto projects in 2025?

Is Quantstamp (QSP) a good investment?: A Comprehensive Analysis of the Smart Contract Auditing Platform's Market Potential and Risk Factors

Is Hyperbot (BOT) a good investment?: A Comprehensive Analysis of Its Market Potential, Risk Factors, and Future Prospects in the Cryptocurrency Ecosystem