2026 STORM Price Prediction: Expert Analysis and Market Forecasts for the Coming Year

Introduction: STORM's Market Position and Investment Value

Storm Trade (STORM), as a social-first derivatives platform operating on the TON blockchain within Telegram's ecosystem, has been facilitating trading of cryptocurrencies, forex, equities, and commodities since its launch in October 2024. As of February 2026, STORM maintains a market capitalization of approximately $337,991, with a circulating supply of around 46.62 million tokens, and the price hovering near $0.00725. This asset, deeply integrated with Telegram's @wallet infrastructure, is playing an increasingly important role in the social trading and decentralized derivatives sectors.

This article will comprehensively analyze STORM's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. STORM Price History Review and Market Status

STORM Historical Price Evolution Trajectory

- October 2024: Storm Trade launched on Gate.com at an initial price of $0.012, marking the project's entry into the broader cryptocurrency exchange market.

- December 2024: STORM reached a notable price level of $0.056522 on December 5, 2024, representing a significant appreciation from its launch price.

- February 2026: The token experienced a substantial decline, with prices falling to $0.006359 on February 6, 2026, reflecting broader market volatility and shifting sentiment in the derivatives trading sector.

STORM Current Market Situation

As of February 7, 2026, STORM is trading at $0.00725, showing a 3.46% increase over the past 24 hours. The token has demonstrated mixed short-term performance, with a 1.32% gain in the past hour but facing downward pressure over longer timeframes, including an 8.27% decline over the past week and an 11.02% decrease over the past month.

The trading volume over the past 24 hours stands at approximately $49,073.75, indicating moderate trading activity. The token's intraday range has fluctuated between $0.006359 and $0.007257, suggesting ongoing price discovery in the current market environment.

With a circulating supply of 46,619,408 STORM tokens out of a maximum supply of 1,000,000,000, the current circulation rate is approximately 4.66%. The market capitalization sits at around $337,990.71, while the fully diluted valuation reaches $7,250,000. The token holds a market share of 0.00028% within the broader cryptocurrency ecosystem.

Storm Trade operates as a social-first derivatives platform on Telegram, built on the TON blockchain, and offers deep integration with Telegram via @wallet. The platform facilitates trading across multiple asset classes, including cryptocurrencies, forex, equities, and commodities. The project has attracted approximately 25,906 holders, reflecting a growing community of users engaging with the platform's services.

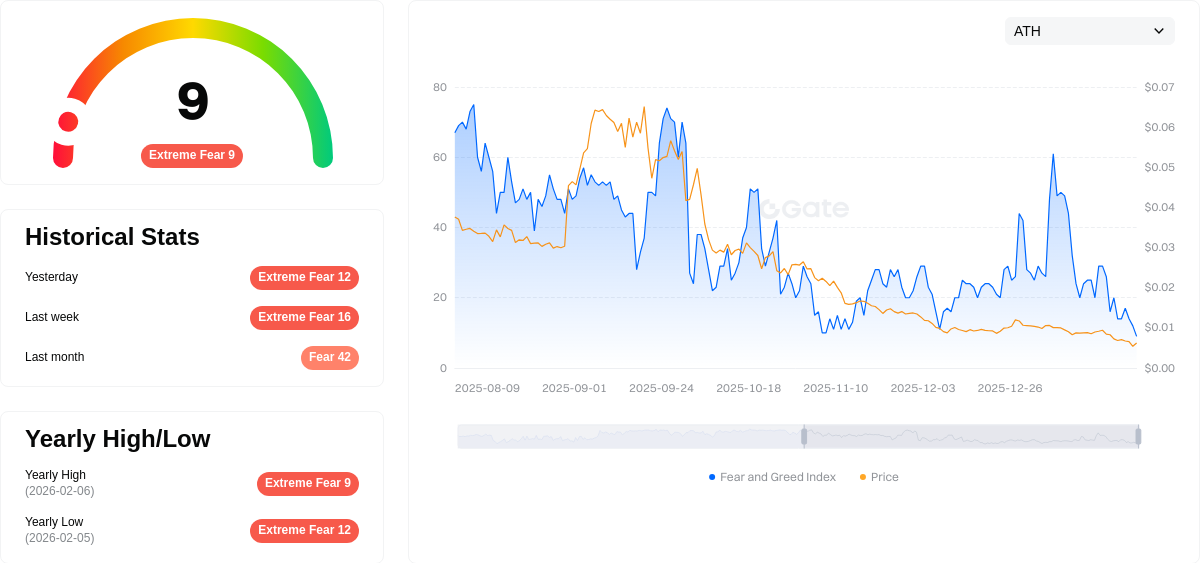

The current market sentiment index stands at 9, indicating an extreme fear environment, which may be influencing trading behaviors and price movements across the market.

Click to view current STORM market price

STORM Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index hitting a critically low level of 9. This indicates severe investor pessimism and heightened market anxiety. Such extreme readings often signal potential capitulation points where panic selling intensifies. Traders should exercise caution and consider that extreme fear environments can sometimes present contrarian opportunities for long-term investors. Monitor market developments closely and manage risk appropriately during this volatile period. Stay informed through Gate.com's comprehensive market data tools.

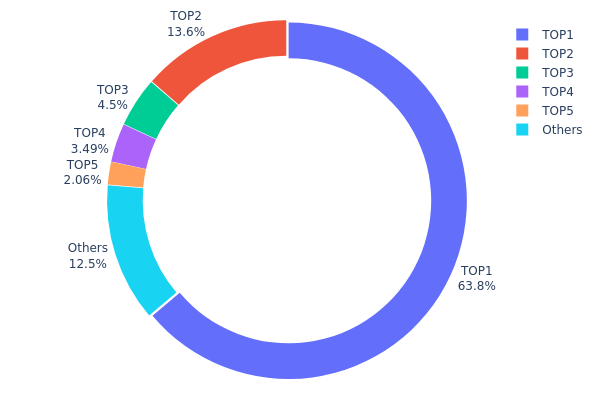

STORM Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a crucial indicator of decentralization and market structure health. For STORM, the current data reveals a notably concentrated ownership pattern that warrants careful examination.

The top wallet address holds approximately 638.34 million tokens, representing 63.83% of the total supply, while the second-largest holder controls 135.88 million tokens (13.58%). Combined with the third and fourth positions at 4.50% and 3.49% respectively, the top four addresses collectively account for over 85% of STORM's circulating supply. This concentration level significantly exceeds typical thresholds for healthy decentralization, suggesting potential vulnerabilities in market dynamics and price discovery mechanisms.

Such extreme concentration poses several market implications. The dominant position of the largest holder creates substantial sell pressure risk, where even modest portfolio rebalancing could trigger significant price volatility. Additionally, this distribution pattern may facilitate price manipulation scenarios and reduce organic market liquidity. The relatively small "Others" category at 12.55% indicates limited retail participation and ecosystem diversity. From a structural perspective, this concentration undermines the decentralization ethos typically associated with cryptocurrency projects and may deter institutional investors seeking more distributed ownership models.

Click to view current STORM Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQBDMz...0BasXR | 638338.62K | 63.83% |

| 2 | EQDaC-...VNUdik | 135875.51K | 13.58% |

| 3 | EQByAD...JNJGx6 | 45011.44K | 4.50% |

| 4 | UQC6mq...pvU4NC | 34900.00K | 3.49% |

| 5 | EQA82S...QODs0r | 20553.52K | 2.05% |

| - | Others | 125319.98K | 12.55% |

II. Core Factors Influencing STORM's Future Price

Supply Mechanism

- Mining Supply Dynamics: Silver mining output reached its peak in 2016 at 900.1 million ounces but has declined approximately 7% to around 835 million ounces in 2025, despite prices more than doubling during this period.

- Historical Patterns: Silver supply exhibits limited responsiveness to price signals, as 70-80% of production comes as a by-product of copper, lead-zinc, and gold mining. This structural characteristic means supply adjustments lag significantly behind price movements.

- Current Impact: Even with prices potentially reaching the $120-180 range, supply expansion faces constraints from declining ore grades, requiring 1.5 times more ore processing than a decade ago, and new mine development cycles averaging 7-10 years from exploration to production.

Institutional and Major Holder Dynamics

- Institutional Positions: Major technology corporations including Samsung and Tesla have shifted from exchange-based purchasing to direct mine supply agreements. Samsung secured $7 million in prepaid financing for the La Parrilla mine restart, while Tesla reportedly initiated an 85 million ounce physical silver procurement.

- Corporate Adoption: Technology giants are pursuing vertical integration strategies, with companies directly locking in long-term supply contracts with Latin American mining enterprises. Apple's internal procurement contingency planning indicates willingness to accept prices around $500 per ounce under extreme supply disruption scenarios to maintain production continuity.

- State-Level Policies: China's export control measures on silver, combined with central bank de-dollarization purchasing activity, have contributed to fundamental market restructuring and price reassessment.

Macroeconomic Environment

- Monetary Policy Influence: The Federal Reserve's January 2026 decision to maintain unchanged interest rates, accompanied by hawkish policy guidance, created direct downward pressure on precious metal prices, contributing to market volatility.

- Inflation Hedge Attributes: Following the sharp correction in late January and early February 2026, silver demonstrated recovery capacity, with prices rebounding as risk appetite declined and the U.S. dollar index softened, suggesting continued safe-haven appeal.

- Geopolitical Factors: Market dynamics reflect intensifying competition for strategic resources, with supply chain security concerns driving corporate procurement behavior and contributing to price volatility in international precious metals markets.

Technical Development and Ecosystem Construction

- Battery Technology Advancement: Samsung's solid-state battery development requires silver-carbon composite anode layers where silver substitution remains technically unfeasible. Large-scale production deployment would generate exponential growth in silver demand.

- Industrial Application Expansion: Industrial demand reached 680 million ounces in 2025, representing approximately 60% of total demand. Key sectors include photovoltaic applications consuming 200-250 million ounces, electric vehicles requiring 40-60 million ounces, and rapidly growing demand from data centers, 5G infrastructure, and semiconductor manufacturing.

- Ecosystem Applications: Core industrial applications demonstrate price-inelastic characteristics, with silver comprising only 3-5% of solar panel costs. This structural demand rigidity suggests that consumption patterns will not significantly contract even with substantial price increases, as production shutdowns would generate losses far exceeding elevated procurement costs.

III. 2026-2031 STORM Price Prediction

2026 Outlook

- Conservative Prediction: $0.00636 - $0.00723

- Neutral Prediction: $0.00723 (average level)

- Optimistic Prediction: Up to $0.00997 (requires favorable market sentiment and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: STORM may enter a gradual growth phase as the token potentially expands its ecosystem and user base. The market could experience moderate volatility with steady upward momentum if broader crypto market conditions remain supportive.

- Price Range Predictions:

- 2027: $0.00456 - $0.01247, representing an 18% increase from 2026 baseline

- 2028: $0.00822 - $0.0117, showing a 45% cumulative change

- 2029: $0.00667 - $0.01156, reaching a 53% overall increase

- Key Catalysts: Expansion of platform utility, strategic partnerships, and general cryptocurrency market recovery cycles could serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00998 - $0.01134 (assuming steady ecosystem development and stable market conditions)

- Optimistic Scenario: $0.01338 - $0.01542 (requires enhanced adoption rates and favorable regulatory environment)

- Transformative Scenario: Approaching $0.01806 (contingent upon significant technological breakthroughs, mass adoption, and sustained bull market conditions)

- 2026-02-07: STORM trading within the early-year range as market participants assess long-term growth potential

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00997 | 0.00723 | 0.00636 | 0 |

| 2027 | 0.01247 | 0.0086 | 0.00456 | 18 |

| 2028 | 0.0117 | 0.01054 | 0.00822 | 45 |

| 2029 | 0.01156 | 0.01112 | 0.00667 | 53 |

| 2030 | 0.01542 | 0.01134 | 0.00998 | 56 |

| 2031 | 0.01806 | 0.01338 | 0.0107 | 84 |

IV. STORM Professional Investment Strategy and Risk Management

STORM Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Cryptocurrency enthusiasts interested in derivatives trading and TON blockchain ecosystem believers

- Operational recommendations:

- Consider accumulating STORM during market downturns, given the token's current price is significantly below its historical peak from December 2024

- Monitor the development progress of Storm Trade platform and its integration with Telegram ecosystem

- Implement dollar-cost averaging (DCA) to mitigate volatility risk, particularly important given the token's 71.71% decline over the past year

- Storage solution: Utilize Gate Web3 Wallet for secure custody, which offers compatibility with TON blockchain assets and provides user-friendly management features

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Current price around $0.00725 shows potential support near the all-time low of $0.006359, with resistance at recent 24H high of $0.007257

- Volume analysis: Monitor the 24-hour trading volume of approximately $49,073 to gauge market interest and liquidity conditions

- Swing trading considerations:

- Pay attention to short-term price movements, as STORM showed a 3.46% increase in 24 hours despite broader negative trends

- Set clear profit targets and stop-loss levels, particularly given the token's high volatility and limited exchange availability (currently listed on 2 exchanges)

STORM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Aggressive investors: 3-5% of crypto portfolio allocation

- Professional investors: 5-10% of crypto portfolio allocation, with active position management

(2) Risk Hedging Approaches

- Diversification strategy: Balance STORM holdings with more established cryptocurrencies and stablecoins to reduce portfolio volatility

- Position sizing discipline: Limit individual position size to prevent overexposure to this low-cap token (current market cap approximately $338,000)

(3) Secure Storage Solutions

- Web3 wallet recommendation: Gate Web3 Wallet supports TON blockchain assets and provides secure custody with user-controlled private keys

- Hardware wallet consideration: For larger holdings, consider cold storage solutions compatible with TON ecosystem

- Security precautions: Enable two-factor authentication, regularly backup wallet recovery phrases, and verify contract address (EQBsosmcZrD6FHijA7qWGLw5wo_aH8UN435hi935jJ_STORM) before transactions

V. STORM Potential Risks and Challenges

STORM Market Risks

- Limited liquidity: With only 2 exchanges listing STORM and relatively low 24-hour trading volume, investors may face challenges executing large orders without significant price impact

- Price volatility: The token has experienced a 71.71% decline over the past year, demonstrating substantial downside risk and market uncertainty

- Low market capitalization: With a circulating market cap of approximately $338,000 and ranking at 3404, STORM remains highly susceptible to market manipulation and dramatic price swings

STORM Regulatory Risks

- Derivatives platform scrutiny: As Storm Trade facilitates trading of cryptocurrencies, forex, equities, and commodities, it may face increased regulatory attention from financial authorities in various jurisdictions

- Telegram integration concerns: The platform's deep integration with Telegram and @wallet may encounter regulatory challenges as authorities scrutinize messaging app-based financial services

- Cross-border compliance: Operating a derivatives platform with multiple asset classes across different regions presents complex compliance requirements that could impact operations

STORM Technical Risks

- Smart contract vulnerabilities: As a Jetton token on TON blockchain, STORM relies on smart contract security; any undiscovered vulnerabilities could result in asset losses

- Platform dependency: The project's reliance on Telegram and TON blockchain infrastructure means technical issues or policy changes affecting these platforms could directly impact STORM's functionality

- Low circulation rate: With only 4.66% of total supply in circulation (46.6 million out of 1 billion tokens), significant token unlocks could create substantial selling pressure

VI. Conclusion and Action Recommendations

STORM Investment Value Assessment

STORM represents a specialized opportunity within the TON ecosystem, offering exposure to social-first derivatives trading on Telegram. The platform's unique positioning at the intersection of messaging apps and decentralized finance presents innovative potential. However, the token faces significant challenges including limited liquidity, low market capitalization, and substantial price depreciation over the past year. The current price near all-time lows may attract risk-tolerant investors, but the small holder base (25,906) and limited exchange listings suggest limited market maturity. Long-term value depends heavily on Storm Trade's ability to grow its user base, expand trading volume, and establish sustainable tokenomics.

STORM Investment Recommendations

✅ Beginners: Avoid STORM until gaining more cryptocurrency market experience. If interested, limit exposure to no more than 1% of portfolio and thoroughly research derivatives trading mechanics and TON ecosystem fundamentals

✅ Experienced investors: Consider small speculative positions (2-3% of crypto portfolio) with strict risk management protocols. Monitor platform development milestones and trading volume growth as key indicators for position adjustment

✅ Institutional investors: Conduct comprehensive due diligence on Storm Trade's business model, regulatory compliance status, and tokenomics structure before considering allocation. Focus on platform metrics, user acquisition costs, and competitive positioning within decentralized derivatives landscape

STORM Trading Participation Methods

- Spot trading: Purchase STORM through Gate.com with USDT or other supported trading pairs, taking advantage of Gate's deep liquidity and advanced trading tools

- DCA strategy: Implement systematic dollar-cost averaging to accumulate positions gradually, reducing timing risk in volatile market conditions

- Portfolio integration: Incorporate STORM as part of a diversified TON ecosystem portfolio, balancing exposure with other Telegram-native projects and established cryptocurrencies

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price performance of STORM tokens?

STORM reached an all-time high of $0.04468 on December 5, 2024, and an all-time low of $0.008816 on October 10, 2025. The token has demonstrated significant volatility throughout its trading history with notable price swings between these levels.

What are the main factors affecting STORM price?

STORM price is primarily influenced by market demand, ecosystem development, investor sentiment, institutional capital inflows, and ETF potential. Trading volume and broader crypto market trends also play significant roles in price movements.

How to predict and analyze the future price of STORM?

Analyze STORM's price using technical analysis,fundamental analysis,and market sentiment. Technical analysis examines price charts and trading volume trends. Fundamental analysis evaluates project development and adoption. Sentiment analysis tracks community and market mood. Combining these methods helps assess market trends and potential value movements.

What are the advantages and risks of STORM compared to other cryptocurrencies?

STORM offers fast, low-cost transactions and strong interoperability features. However, it faces regulatory uncertainty and potential market fragmentation risks similar to emerging crypto assets.

What is the price prediction target for STORM in 2024-2025?

STORM's price prediction for 2024-2025 ranges between $0.008968 and $0.044198, based on market trends and technical analysis. Actual prices may vary due to market volatility.

How to Make Money on TikTok: 10 Real Ways to Earn in 2025

How does SocialFi empower creators: monetization, tokens, and community governance

What is SocialFi? Explore the future of decentralized social media in the field of crypto assets

Top 5 SocialFi projects to watch in 2025: the intersection of crypto assets and social interaction

What Is the Correlation Between Bitcoin's Social Media Followers and Its Environmental Impact?

DDD Token: Challenging medical insurance injustice with blockchain technology

Anonymity vs. Pseudonymity: Key Differences Explained

Cryptocurrency staking: What is it and how can you earn profits from it

Money-Making Games: Top 23 Projects for Earning

Can quantum computers break Bitcoin?

What is MEPAD: A Comprehensive Guide to Mobile Electronic Personal Assistant Devices