2026 TURBOS Price Prediction: Expert Analysis and Market Forecast for the Next Bull Cycle

Introduction: TURBOS's Market Position and Investment Value

Turbos (TURBOS), as a non-custodial decentralized exchange operating on the Sui blockchain, has been establishing its presence in the DeFi landscape since its launch in 2023. As of February 2026, TURBOS maintains a market capitalization of approximately $852,656, with a circulating supply of around 6.62 billion tokens and a current trading price of $0.0001288. Backed by notable investors including Jump Crypto and Mysten Labs, this asset is playing a growing role in bridging liquidity gaps within the Sui ecosystem and facilitating efficient digital asset trading.

This article will comprehensively analyze TURBOS's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem development trends, and broader macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TURBOS Price History Review and Market Status

TURBOS Historical Price Evolution Trajectory

- 2023: TURBOS was launched in May with an initial price of $0.005, reaching a peak of $0.024 on May 15, 2023, representing a notable increase from its launch price. The token experienced significant volatility during its early trading period.

- 2023: By December 17, 2023, TURBOS recorded its lowest price point at $0.0000707, reflecting a substantial decline from its earlier highs as market conditions shifted.

- 2024-2026: The token has continued to trade within a lower range, with the current price as of February 4, 2026, at $0.0001288, showing a decline of approximately 97.42% from its initial offering price.

TURBOS Current Market Status

As of February 4, 2026, TURBOS is trading at $0.0001288, with a 24-hour trading range between $0.0001271 and $0.0001335. The token has experienced a price decline of 1.07% over the past 24 hours and 0.22% in the last hour.

Over longer timeframes, TURBOS has seen a decrease of 13.96% in the past 7 days and 22.41% over the past 30 days. The 1-year performance indicates a decline of 94.69%, reflecting sustained downward pressure on the token's valuation.

TURBOS currently holds a market ranking of 2624, with a circulating supply of 6.62 billion tokens out of a maximum supply of 10 billion tokens, representing a circulation ratio of 66.2%. The market capitalization stands at approximately $852,656, while the fully diluted valuation is approximately $1.288 million. The token's market dominance is 0.000048%, and the 24-hour trading volume is recorded at $26,831.74.

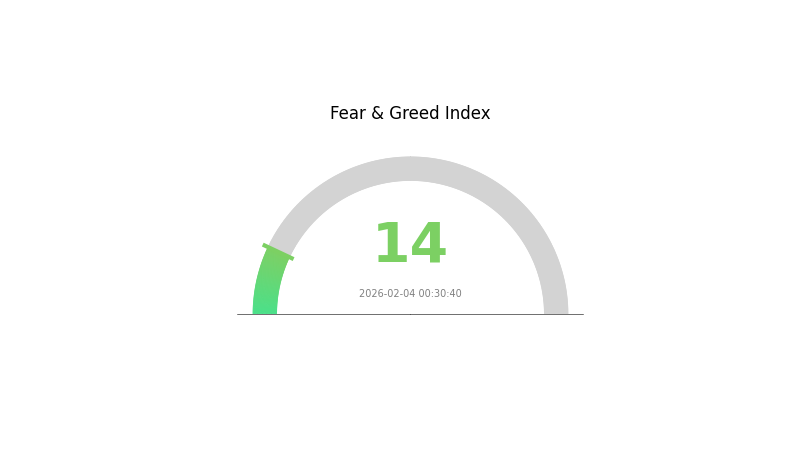

The token holder count stands at 6,208 addresses. The current market sentiment index registers at 14, indicating an "Extreme Fear" condition in the broader market environment.

Click to view the current TURBOS market price

TURBOS Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 14. This exceptionally low reading reflects significant market pessimism and investor anxiety. Such extreme fear levels historically present potential opportunities for contrarian investors, as markets often reach turning points during periods of maximum panic. However, traders should exercise caution and conduct thorough research before making investment decisions. Risk management remains crucial during volatile market conditions.

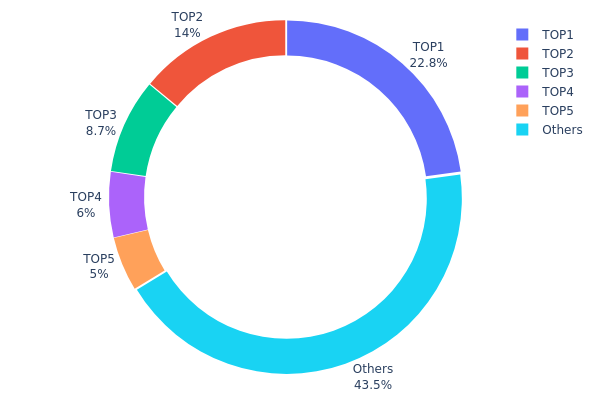

TURBOS Holding Distribution

The holding distribution chart reflects the allocation of TURBOS tokens across different wallet addresses on the blockchain, serving as a crucial metric for assessing token concentration and decentralization. By analyzing the percentage held by top addresses versus the broader community, investors can gauge potential centralization risks, market manipulation vulnerability, and overall network health.

Based on the current data, TURBOS exhibits a moderately concentrated distribution pattern. The top holder controls 22.80% of the total supply (2.28M tokens), while the top 5 addresses collectively hold 56.50% of all tokens in circulation. Notably, the second and third largest holders maintain 14.00% and 8.70% respectively, with the remaining top addresses holding between 5-6% each. The fragmented portion ("Others") accounts for 43.50%, representing over 4.3M tokens distributed among smaller holders.

This concentration level presents a mixed risk profile. While the dominant position of the largest holder creates potential price volatility risk through large-scale sell pressure, the relatively dispersed nature of the remaining 43.50% provides some market stability buffer. The presence of multiple whale addresses holding 5-14% each suggests institutional involvement or early investor positions that could influence short-term price movements. However, compared to extremely centralized projects where top 5 holders control 70-80%+ of supply, TURBOS maintains a moderate decentralization level that balances stakeholder influence with community participation.

Click to view current TURBOS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc43b...beb1f7 | 2280000.00K | 22.80% |

| 2 | 0xd6f2...bf4ba2 | 1400000.00K | 14.00% |

| 3 | 0xfd5b...90e8f7 | 870031.08K | 8.70% |

| 4 | 0x6e55...50d86a | 600000.00K | 6.00% |

| 5 | 0x15a4...1ea230 | 500000.00K | 5.00% |

| - | Others | 4349968.92K | 43.5% |

II. Core Factors Influencing TURBOS Future Price

Supply Mechanism

- Current Impact: The rapid development of the electric vehicle industry is directly driving TURBOS demand growth.

Institutional and Major Holder Dynamics

Data related to institutional holdings and enterprise adoption patterns was not available in the provided materials.

Macroeconomic Environment

- Market Volatility: The cryptocurrency market's inherent volatility requires investors to adopt a forward-looking approach, enabling them to anticipate potential price movements and position themselves strategically.

Technology Development and Ecosystem Building

- Technology Innovation: The future performance of TURBOS will depend on continuous technological innovation, market dynamics, and user adoption patterns.

- Ecosystem Expansion: Through collaboration with opinion leaders in the cryptocurrency field, TURBOS's influence has rapidly expanded.

III. 2026-2031 TURBOS Price Prediction

2026 Outlook

- Conservative estimate: $0.00008 - $0.00013

- Neutral estimate: $0.00013 average price level

- Optimistic estimate: $0.00016 (requires favorable market conditions and ecosystem development)

2027-2029 Mid-term Outlook

- Market stage expectation: Gradual growth phase with steady adoption and ecosystem expansion

- Price range predictions:

- 2027: $0.00013 - $0.00017

- 2028: $0.0001 - $0.0002

- 2029: $0.00017 - $0.00022

- Key catalysts: Platform development progress, user base expansion, and broader cryptocurrency market recovery

2030-2031 Long-term Outlook

- Baseline scenario: $0.00012 - $0.00028 (assuming continued platform development and stable market conditions)

- Optimistic scenario: $0.00022 - $0.00027 (assuming accelerated ecosystem growth and increased adoption)

- Transformative scenario: approaching $0.00028 levels (under exceptionally favorable conditions including significant protocol upgrades and market-wide bull cycle)

- 2026-02-04: TURBOS currently trading within early-stage development phase, with projected growth potential of up to 87% by 2031 compared to 2026 baseline levels

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00016 | 0.00013 | 0.00008 | 0 |

| 2027 | 0.00017 | 0.00014 | 0.00013 | 10 |

| 2028 | 0.0002 | 0.00016 | 0.0001 | 22 |

| 2029 | 0.00022 | 0.00018 | 0.00017 | 40 |

| 2030 | 0.00028 | 0.0002 | 0.00012 | 54 |

| 2031 | 0.00027 | 0.00024 | 0.00022 | 87 |

IV. TURBOS Professional Investment Strategies and Risk Management

TURBOS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to DeFi infrastructure on the Sui ecosystem with a long-term perspective

- Operational Recommendations:

- Consider accumulating positions during periods of reduced volatility or market corrections

- Monitor the development progress of Turbos Finance's DEX platform and ecosystem adoption metrics

- Storage Solution: Utilize Gate Web3 Wallet for secure storage with support for Sui-based assets

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $26,831 to identify liquidity trends and potential breakout opportunities

- Price Action Analysis: Track key support levels around $0.0001271 and resistance levels near $0.0001335 based on recent 24-hour range

- Swing Trading Considerations:

- Given the recent 7-day decline of 13.96%, traders may wait for stabilization signals before establishing positions

- Short-term traders should be aware of the token's significant price volatility, with a 94.69% decline from its initial offering price

TURBOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Moderate Investors: 3-5% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation, with close monitoring of market conditions

(2) Risk Hedging Approaches

- Diversification Strategy: Balance TURBOS holdings with other Sui ecosystem tokens and established DeFi assets

- Position Sizing: Implement gradual accumulation rather than lump-sum investments given recent downward price trends

(3) Secure Storage Solutions

- Primary Recommendation: Gate Web3 Wallet for comprehensive support of Sui-based assets including TURBOS

- Backup Solution: Maintain proper backup of seed phrases and private keys in secure, offline locations

- Security Considerations: Enable multi-factor authentication, regularly verify contract addresses (0x5d1f47ea69bb0de31c313d7acf89b890dbb8991ea8e03c6c355171f84bb1ba4a::turbos::TURBOS), and avoid sharing wallet credentials

V. TURBOS Potential Risks and Challenges

TURBOS Market Risks

- Price Volatility: TURBOS has experienced substantial price fluctuations, currently trading at $0.0001288, representing a 99.46% decline from its initial offering price of $0.005

- Liquidity Concerns: With a relatively modest 24-hour trading volume of approximately $26,831 and availability on limited exchanges, liquidity may be constrained during market stress

- Market Capitalization Position: Ranked #2624 with a market cap of approximately $852,656, TURBOS represents a micro-cap cryptocurrency with associated higher volatility risks

TURBOS Regulatory Risks

- DeFi Protocol Oversight: As an unmanaged decentralized exchange protocol, Turbos Finance may face evolving regulatory scrutiny regarding DeFi operations and compliance requirements

- Jurisdictional Uncertainties: The regulatory landscape for decentralized finance platforms continues to evolve across different jurisdictions, potentially impacting protocol operations

- Compliance Requirements: Future regulatory frameworks may impose additional compliance obligations on DeFi protocols and their native tokens

TURBOS Technical Risks

- Smart Contract Security: As a DEX protocol on the Sui blockchain, TURBOS is subject to potential smart contract vulnerabilities or exploitation risks

- Platform Dependency: The project's success is closely tied to the broader adoption and technical stability of the Sui blockchain ecosystem

- Competition Pressure: Turbos Finance operates in a highly competitive DeFi landscape with numerous established DEX protocols across various blockchain networks

VI. Conclusion and Action Recommendations

TURBOS Investment Value Assessment

Turbos Finance positions itself as a non-custodial DEX infrastructure within the Sui ecosystem, backed by notable investors including Jump Crypto and Mysten Labs. With 66.2% of tokens in circulation (6.62 billion out of 10 billion maximum supply) and approximately 6,208 holders, the project demonstrates moderate distribution. However, the substantial price decline of 94.69% over the past year and current micro-cap status suggest significant risk factors. Long-term value proposition depends heavily on the successful adoption of both the Sui blockchain and Turbos' DeFi offerings, while short-term risks include continued price volatility and limited liquidity conditions.

TURBOS Investment Recommendations

✅ Beginners: Exercise extreme caution; consider allocating only 0.5-1% of total crypto portfolio if interested in Sui ecosystem exposure. Focus on education regarding DeFi protocols and the Sui blockchain before investing.

✅ Experienced Investors: May consider small speculative positions (1-3% of crypto portfolio) as part of a diversified DeFi strategy. Closely monitor platform development metrics, total value locked, and trading volume trends on Turbos Finance.

✅ Institutional Investors: Conduct thorough due diligence on protocol security audits, team credentials, and ecosystem partnerships. Consider TURBOS only as a minor component of specialized DeFi or Sui ecosystem investment strategies, with appropriate risk controls.

TURBOS Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and trading of TURBOS tokens with comprehensive trading tools and market analysis resources

- DeFi Interaction: Participate directly in the Turbos Finance protocol on the Sui blockchain for liquidity provision or token swaps

- Portfolio Integration: Incorporate TURBOS as part of a broader Sui ecosystem investment thesis alongside other Sui-based DeFi protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TURBOS? What are its uses?

TURBOS is the native token of Turbos Finance, designed to attract liquidity and enhance the activity of decentralized trading. It plays a key role in the ecosystem by incentivizing participation and strengthening the platform's trading environment.

What is the current price of TURBOS and how has its historical price trend been?

TURBOS is currently trading at US$0.0001458, down 2.31% in the past 24 hours and down 7.13% over the past 7 days, showing a recent bearish trend in the market.

How to conduct TURBOS price prediction? What are the analysis methods?

TURBOS price prediction uses technical analysis with indicators like moving averages and RSI. Identify trends, support/resistance levels, and chart patterns. Monitor trading volume, market sentiment, and on-chain data for comprehensive forecasting.

What are the main factors affecting TURBOS price?

TURBOS price is influenced by market demand, trading volume, Sui ecosystem developments, community sentiment, and overall cryptocurrency market trends. Supply dynamics and investor interest also play significant roles in price movements.

What are the advantages and differences of TURBOS compared to similar projects?

TURBOS stands out through fair token distribution and decentralized ecosystem. It combines AI-driven development with community-focused governance, preventing single entity control and promoting a more equitable and transparent environment compared to traditional projects.

What are the main risks to pay attention to when investing in TURBOS?

Main risks include market volatility, price manipulation potential, regulatory uncertainties across jurisdictions, and technical vulnerabilities. Manage risk through diversification and position sizing to protect your investment capital.

How do professional analysts predict TURBOS future price?

Professional analysts predict TURBOS price to range between $0.0017 and $0.0032 in 2025, with potential for short-term spikes driven by market sentiment and community engagement. Predictions vary based on different analytical approaches and market conditions.

What is the liquidity and trading volume of TURBOS?

TURBOS maintains solid liquidity with a 24-hour trading volume of $106,996.19 and a liquidity market cap of $988,000.19. With 6.62 billion circulating tokens out of 10 billion total supply, TURBOS demonstrates stable market presence and adequate trading depth for participants.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Bitcoin Dominance and Market Analysis: A Comprehensive Guide

Comprehensive Guide to Crypto Branding

Top-Ranked Cryptocurrencies with Growth Potential and Key Indicators for Identification

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems